CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on September 11, 2007

NEOGENOMICS,

INC.

12701

COMMONWEALTH DRIVE, SUITE 9

FORT

MYERS, FLORIDA 33913

September

11, 2007

Ms.

Tia

Jenkins

Senior

Assistant Chief Accountant

Securities

and Exchange Commission

100

F

Street, N.E.

Mail

Stop

3561

Washington,

D.C. 20549

Re: NeoGenomics,

Inc. (the

“Company”)

Form

10-KSB for the Fiscal Year Ended

December 31, 2006

Filed

April 2,

2007

File

No.

333-72097

Dear

Ms.

Jenkins:

We

are

providing this letter in response to the comments included in the Staff’s letter

dated August 23, 2007 regarding the Company’s Annual Report on Form 10-KSB for

the Fiscal Year Ended December 31, 2006, as filed with the Commission on April

2, 2007.

Form

10-KSB for the Year Ended December 31, 2006

Item

6. Management’s Discussion and Analysis or Plan of

Operation

Critical

Accounting Policies, page 26

|

COMMENT

1:

|

We

note that your revenue and accounts receivable are recorded net of

a

contractual allowance. Please expand your disclosures to

include the following:

|

|

·

|

For

each period presented, quantify and disclose the amount of changes

in

estimates of prior period contractual adjustments that you recorded

during

the current period. For example for 2006, this amount would

represent the amount of the difference between estimates of contractual

adjustments for services provided in 2005 and the amount of the new

estimate or settlement amount that was recorded during

2006.

|

|

·

|

Quantify

and disclose the reasonably possible effects that a change in estimate

of

unsettled amount from 3rd party payers as of the latest balance sheet

date

could have on your financial position and

operations.

|

|

·

|

Disclose

in a comparative tabular format, the payor mix concentrations and

related

aging of accounts receivable. The aging schedule may be based

on management's own reporting criteria (i.e, unbilled, less than

30 days,

30 to 60 days etc.) or some other reasonable presentation. At a

minimum, the disclosure should indicate the past due amounts and

a

breakdown by payor classification (i.e., Medicare, Medicaid, Managed

care

and other, and Self- pay). We would expect Self-pay to be

separately classified from any other grouping. If your billing

system does not have the capacity to provide an aging schedule of

your

receivables, disclose that fact and clarify how this affects your

ability

to estimate your allowance for bad

debts.

|

|

·

|

If

you have amounts that are pending approval from third party payers

(i.e.

Medicaid Pending), please disclose the balances of such amounts,

where

they have been classified in your aging buckets, and what payor

classification they have been grouped with. If amounts are

classified outside of self'-pay, tell us why this classification

is

appropriate, and disclose the historical percentage of amounts that

get

reclassified into self pay.

|

|

RESPONSE:

|

In

response to the Staff’s comments above, the Company will do the following

and/or has the following

clarifications:

|

|

·

|

In

response to your fist question, we would propose that we amend the

MD&A section of the filing to disclose the following in the

description of Critical Accounting

Policies:

|

|

|

“While

we use all available information in the estimation of our net revenues,

including our contractual status and historical collection experience

with

payors, by their nature, adjustments to previously recorded estimated

net

revenue amounts arise from time-to-time, and are recorded as an adjustment

to current period net revenue when such amounts are both probable

and

estimable. In almost all cases, such adjustments are not made

until the time of final settlement because, until that point, we

usually

do not have sufficient information that would indicate that an adjustment

is warranted. We continually refine our estimated discounts and

contractual allowances on a prospective basis to take new information

and/or new payment experiences into consideration in order to make

our

prospective estimated net revenue as accurate as possible. As a

result, current period adjustments to prior period revenue estimates

are

not material to the Company’s results of operations or our financial

condition in any period

presented.”

|

|

·

|

It

is not our policy to retrospectively change our estimates of prior

period net revenue in future periods until we receive final payment

because, until that point, we do not have sufficient information

that

would indicate that an adjustment is warranted. However, we

emphasize that we use all available information in developing our

prospective estimates and refine this information

frequently. Therefore, as we discussed in our response above,

these amounts are not material to our financial statements. In

fact, our net total estimate change amount arising from 2006 collections

of 2005 recorded revenue represented less than 1% of the net revenue

recorded in FY 2006 and less than 3% of the net revenue recorded

in FY

2005. We believe the proposed wording changes in the response

above address this

concern.

|

|

·

|

We

will amend our filing to disclose our accounts receivable aging table

as

of the balance sheet date for receivables <30 days old, 31-60 days old,

61-90 days old, 91-120 days old, and> 120 days old. We will

also include a qualitative statement at the end of such aging table

that

states that accounts receivable from “self-pay” clients were not material

in any period presented. As background, please note that as of

December 31, 2006 and December 31, 2005, accounts receivable from

“self-pay” clients represented approximately 0.2% and 1.2% of the total

accounts receivable,

respectively.

|

|

·

|

Our

systems are unable to make a distinction between accounts receivable

which

have been approved and are unpaid and accounts receivable that have

not

yet been approved. Thus, from our perspective, all of our

accounts receivable are pending approval until we actually receive

payment. As noted above, approximately 1% of our accounts

receivable are from “self-pay” accounts and approximately 99% of our

revenue and accounts receivable are from third party payors or client

relationships . Our billing system classifies each account

receivable according to the Medicare, insurance or other information

we

have at the time the original invoice is processed. The only

time adjustments are made to this are in the case of errors (which

are

seldom) where we find that a patient’s insurance is no longer in force or

a patient is not Medicare eligible for some reason. We do not

have any way to discern what percentage of accounts receivable get

reclassified into “self-pay” from a third party payor, but we believe this

is an immaterial amount.

|

Notes

to Consolidated Financial Statements

Note

E - Incentive Stock Options and Awards, page 61

|

COMMENT

2:

|

It

appears you are determining future volatility based on a three months

period prior to the grant date and not historical or implied information

over the expected term of the option. The does not appear to be

consistent with the guidance in paragraph (A32) of SFAS NO. 123(R)

and SAB Topic 14D. Please advise or

revise.

|

|

RESPONSE:

|

We

have considered the guidance provided in SFAS123(R) and SAB107 in

developing assumptions underlying the fair value measurements of

our

share-based payment arrangements. In response to your inquiry, we

noted

that SAB 107, Topic 14C, states in the third sentence of the Staff’s

Interpretive Response to Question

#1:

|

“The

estimate of fair value should reflect the assumptions marketplace participants

would use in determining how much to pay for an instrument on the date of the

measurement (generally the grant date for equity

awards).”

We

also noted that the Staff reiterated this objective of fair value measurement

in

Topic 14D in the opening lines of the Interpretive Response to Question #1,

as

follows:

“Statement

123R does not specify a particular method of estimating expected

volatility. However, the Statement does clarify that the objective in

estimating expected volatility is to ascertain the assumption about expected

volatility that marketplace participants would likely use in determining an

exchange price for an option.”

Since

NeoGenomics does not have any publicly-traded options on its stock available

to

“market participants” which we can directly observe, we have estimated the fair

value of our employee stock options on the date of grant using other means

and widely-available market indicators. With respect to estimating

the expected volatility assumption used in the Black-Scholes model, as per

the

guidance in SAB 107, Topic D, we considered historical volatility over a period

generally commensurate with the expected term of our options, but we

disqualified this as a meaningful approach because the resulting measures of

historical volatility are significantly in excess of what we believe a willing

“marketplace participants” would use to value options on our stock if such

options were available to purchase.

Among

other problems, historical volatilities over long sweeps of time for micro-cap

companies, are especially inappropriate because such companies tend to have

much

higher bid-ask spreads (in percentage terms) than larger companies which

artificially inflates their volatilities. Furthermore, the outlook

and prospects for a micro-cap company can change dramatically in a short period

of time, and when any marketplace participant is valuing an exchange traded

option, they are really just concerned with the recent past and what impact

that

might have on the future volatility of the Company.

Prior

to working at NeoGenomics, our Chief Financial Officer, Mr. Steven Jones, worked

as the Chief Financial Officer of Peak 6 Investments, LLC, which is one of

the

largest over-the-counter options market makers in the United

States. As a result of such experience, he is intimately familiar

with what professional market participants are willing to pay for options

contracts since PEAK 6 monitored, on a daily basis, the implied volatilities

of

thousands of options contracts in which it was making a

market. Except in the most unusual circumstances, professional

options traders are not willing to pay a price for an exchange traded option

contract that has more than a 35-45% implied volatility.

The

above range of volatilities can be corroborated for smaller companies by looking

to the volatility available from the Russell 2000 index (the RVX index

– See Exhibit A). The RVX 2000 index is the only index of smaller

companies on which volatility is calculated. As can be seen from the

Exhibit A Chart, the volatility of the Russell 2000 index has ranged from

approximately 15% -34% since data began to be tracked 18 months ago, and only

once just recently spiked up to 45% for a brief period. We have

concluded that this widely-available market indicator supports our conclusion

that no options trader would pay for more than 35-45% volatility under usual

circumstances for even smaller companies.

Since

there are no option contracts on smaller publicly-traded micro-cap companies

that are similar in size and scope to NeoGenomics and since historical

volatilities over long sweeps of time of individual micro-cap companies are

not

an appropriate indicator of what a marketplace participant would pay for a

similar option, we look at the implied volatilities of the much larger companies

in our industry that do have exchange-traded options as a place to

start. Exhibits B and C show the implied volatilities for options on

the common stock of Laboratory Corporation of America and Quest

Diagnostics. As you can see, the 52 week range of implied

volatilities for Lab Corp has been 12%-32% and the 52 week range for Quest

has

been 15-45%. Just as important, however, is the fact that the implied

volatilities are considerably lower than the historical calculated volatilities

of the stock price movements. This can be seen by comparing the

circled ranges on the attached exhibits to the numbers just above the circled

ranges, which represent the historical volatilities.

However,

since the implied volatilities of both of these companies do not have any

correlation to company specific events happening at NeoGenomics, we generally

just use them as a reference range of appropriate volatilities between which

our

estimates of expected volatility should fall. We then determined that

we needed to incorporate some measure of expected volatility for NeoGenomics

that would change over time as the events and circumstances of NeoGenomics

changed. We believe the best way to do that is to use a historical

volatility over the previous three months prior to the grant date of any options

as a proxy for the expected volatility of NeoGenomics at that point in time

so

long as such measure falls within the appropriate reference

range. This is consistent with the practice of marketplace

participants who use recent events and recent volatility in determining how

much

to pay for an exchange traded option.

In

addition, since the vast majority of our employee stock options are granted

to

new employees on their start date and such employees were evaluating the

prospects of the Company and whether or not to join, based on the information

they had available to them at such time, we believe using three month

volatilities for the period preceding the grant date is the most relevant place

to start when estimating future volatilities. Using this methodology,

resulted in NeoGenomics using estimates of future volatilities at the time

of

option grants in FY 2006 which ranged from 12.3% - 44.7%. Such range

is consistent with all of the data above.

Since

we are a smaller company and are likely to have greater volatility than the

larger companies, beginning with FY 2007 we have recently set a minimum for

our

expected volatility estimates of 20%. We have also set a maximum

future volatility estimate of 50%, which we believe is conservative in light

of

observable trading patterns of professional “market participants” as well as the

52 week experience of the larger companies in our

industry. Furthermore, since estimates of future volatility are at

best an inexact science, we have recently started rounding our volatility

estimates to the nearest 5%.

When

one considers that employee stock options are non-transferable options to

purchase shares only after they have vested either due to time passing or

certain milestones having been met, we believe that if “market participants”

were to adjust for these restrictions, they would significantly reduce the

value

that they would be willing to pay, which further supports limiting the

volatility estimates used at any given time since there is no other input into

the Black Scholes model which could be used to factor this consideration into

the valuation estimate. Thus, for all of the above reasons, we

believe our approach to estimating future volatility is consistent with the

tenets of SFAS 123(R) and SAB 107.

In

response to your concern, we will amend the disclosure in the option footnote

to

clarify this practice as follows:

“We

calculate expected volatility for our employee stock options by first looking

at

the range of implied volatilities embedded within the option contracts of the

larger companies in our industry that have listed, exchange-traded option

contracts outstanding on their common stock. We believe this range of

implied volatilities comprises the upper and lower limits of what a marketplace

participant would use in valuing our employee stock options if such options

were

transferable and not subject to the vesting requirements of employee stock

options. Then, in order to factor in developments that are specific

to NeoGenomics, we measure the recent volatility of our own stock price over

the

3 month period preceding the option grant date by taking the standard deviation

of the stock price for such period and dividing it by the average stock price

for the same period to arrive at a measure of recent volatility. If

this measure of volatility is within the reference range, we use it as our

estimate of future volatility in the Black-Scholes option pricing

model. If it is below or above the reference range, we use the

minimum or the maximum of the reference range, accordingly, as our estimate

of

future volatility.”

Note

G - Other Related Party Transactions, page_66

|

COMMENT

3:

|

We

note in March 2005 you refinanced the existing revolving credit facility

with Aspen to increase the credit facility from $740,000 to $1.5

million. As part of this transaction you issued a warrant to

purchase 2,500,000 shares of common stock to Aspen which was recorded

as a

$131,337 discount to the credit facility. Please provide a detailed

discussion of how the value of the warrants was determined (including

the

assumptions utilized). Please note that when equity instruments

are issued to secure borrowing capacity (i.e., revolving note, line

of

credit) the full fair value of the equity instruments should be charged

to

debt issue costs and amortized over the term of the

loan.

|

|

RESPONSE:

|

The

fair value of the warrants issued to Aspen was determined using the

Black-Scholes option valuation model, based on the following factors,

which were present on the date on which we reached agreement on the

principal terms:

|

Strike

price

$0.50

Market

price

$0.35

Term

5 years

Volatility

22.7%

Risk-free

rate

4.50%

Dividend

yield

0%

Warrant

value $0.0525347

#

of

warrants 2,500,000

Total

value $131,337

The

total value of the warrants of $131,337 was recorded as deferred financing

costs

and was being amortized on a straight-line basis over the life of the credit

facility. This credit facility was paid off early on June 7, 2007,

and all remaining unamortized amounts were expensed to interest expense at

that

time. We will add the following disclosure to the paragraphs

discussing this warrant in our amended Form 10-K.

“We

estimated the fair value of this warrant to be $131,337 as of the original

commitment date by using the Black-Scholes pricing model using the following

approximate assumptions: spot price of $0.35/share, dividend yield of 0 %,

expected volatility of 22.7%, risk-free interest rate of 4.5%, and a term of

5

years.”

|

COMMENT

4:

|

We

note that in January 2006 you entered into a binding letter agreement

with

Aspen which extended the maturity date of the credit facility, increased

the credit facility by $200,000 and allowed Aspen to purchase an

additional $200,000 of restricted common shares. As

compensation for each of these modifications you issued Aspen a total

of

900,000 additional warrants to purchase shares of your common

stock. Please tell us how you accounted for the modification to

the credit facility and cite the specific authoritative literature

you

utilized to support your accounting

treatment.

|

|

RESPONSE:

|

In

accordance with paragraph 4a of EITF Issue 98-14 “Debtor’s Accounting for

Changes in Line-of-Credit or Revolving-Debt Arrangements”, because the

borrowing capacity of the new arrangement was greater than the borrowing

capacity of the old arrangement, the a) unamortized deferred costs

from

the original agreement (see response 3 above), together with b) the

fair

value of the additional warrants issued to Aspen issued in connection

with

increasing the credit facility and c) the change in the fair value

of the

original 2,500,000 warrants previously issued to Aspen as a result

of the

reduction in the exercise price (see response 5 below), were associated

with the new arrangement. Thus the sum of these three

components were deferred and amortized over the remaining term of

the new

arrangement.

|

|

COMMENT

5:

|

It

appears that the exercise price of the 2,500,000 warrants issued

in March

2005 was modified from $0.50 to $0.31 in January 2006. Please

provide a detailed discussion of how this modification was accounted

for

in accordance with the guidance of paragraph (51) of SFAS

NO. 123(R).

|

|

RESPONSE:

|

The

difference, as of the date of modification, between the value of

the

warrants at an exercise price of $0.50, and their value at an exercise

price of $0.31, amounting to $2,365, was credited to additional paid-in

capital and included in deferred financing fees and amortized over

the

remaining term of the new arrangement (see response 4

above).

|

|

COMMENT

6:

|

We

noted several issuances of warrants as compensation for the modification

of existing agreements. Please expand your disclosure here to

describe all of the material terms of the warrants, including who

has the

rights to convert (i.e. the holder or the Company), the exercise

feature

(i.e. physical, net cash, or net share settlement, etc.), and any

redemption features. Please provide a description of the method

and significant assumptions used to determine the fair value of the

warrants issued.

|

|

RESPONSE:

|

We

will expand our disclosure in the Liquidity and Capital Resources

Section

on page 30 and the Related Party Transactions Section on Page 65

of our FY

2006 10-KSB to include a new subparagraph g) which

states:

|

|

|

|

All

Waiver Warrants, the Existing Warrants and all warrants issued to

Aspen

and SKL in connection with the purchase of equity or debt securities

are

exercisable at the option of the holder and each such warrant contains

provisions that allow for a physical exercise, a net cash exercise

or a

net share settlement. We used the Black-Scholes pricing model

to estimate the fair value of all such warrants as of the commitment

date

for each, using the following assumptions: dividend yield of 0 %,

expected

volatility of 14.6 – 19.3%, risk-free interest rate of 4.5%,

and a term of 3 - 5

years.”

|

Note

H -Equity Financing Transactions, page 68

|

COMMENT

7:

|

It

appears that the fees associated with Standby Equity Distribution

Agreement with Cornell Capital Partners were paid with equity

instruments. Please provide a detailed discussion of how you

determined the fair value of the equity instruments. In

addition, it does not appear that these fees paid with shares of

common

stock were shown as a non-cash financing activity in your consolidated

statement of cash flows on page 48. Please clarify and

revise.

|

|

RESPONSE:

|

The

fees paid with equity instruments were recorded based on the fair

value of

the common stock issued on the date of issue. The Supplemental

Disclosure Of Non-Cash Investing And Financing Activities at the

bottom of

the Consolidated Statement of Cash Flows will be amended to include

disclosure of the value of common stock issued in settlement of financing

fees of $50,000 and $143,208, respectively in FY 2006 and FY 2005,

respectively.

|

Note

I - Subsequent Events, page 70

|

COMMENT

8:

|

We

noted that in April 2007 you entered an agreement regarding the formation

of a joint venture Contract Research Organization. Please

provide a detailed discussion on how you have accounted for this

transaction and cite the specific authoritative literature you utilized

to

support your accounting treatment.

|

|

RESPONSE:

|

The

Joint Venture Agreement for the Contract Research Organization (“CRO”) has

not yet been written and the CRO has not yet been formed. To clarify,

we

disclosed that we entered into an agreement regarding the formation

of a

prospective joint venture. At the bottom of the paragraph which

discusses the CRO joint venture in our Form 10-KSB, we have already

disclosed that “Subject to final negotiation, we will own a minimum of 60%

and up to 80% of the new CRO venture which is anticipated to be launched

in the third or fourth quarter of FY 2007”. Upon its formation,

we currently anticipate consolidating its results of operations,

unless,

ultimately, the final joint venture agreement embodies terms and

conditions (such as, minority veto rights) that would suggest an

alternative accounting treatment is more

appropriate.

|

The

Company understands and asserts the following:

|

·

|

The

Company is responsible for the adequacy and accuracy of the disclosure

in

the filing;

|

|

·

|

Staff

comments or changes to disclosure in response to staff comments

do not

foreclose the Commission from taking action with respect to the

filing;

and

|

|

·

|

The

Company may not assert staff comments as a defense in any proceeding

initiated by the Commission or any person under the federal security

laws

of the United States.

|

We

trust

that this response satisfactorily responds to your comments. We have

filed an amended Form 10-KSB/A and have federal express a marked version

of the

amendment for your review. Should you require further information,

please contact Clayton Parker, Esq. at (305) 539-3300 or Steven Jones, our

Acting Chief Financial Officer at (239) 325-2001, or myself at (239)

768-0600.

Thank

you

very much for your consideration of this response.

Very

truly yours,

/s/

Robert P.

Gasparini

Robert

P. Gasparini

President

and Chief Executive

Officer

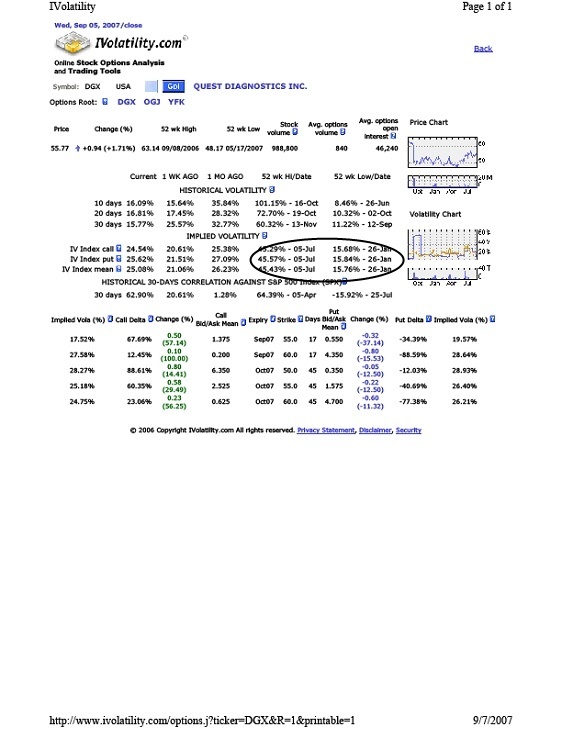

Exhibit

A

Russell

2000 Volatility Index Since Inception (May 2006)

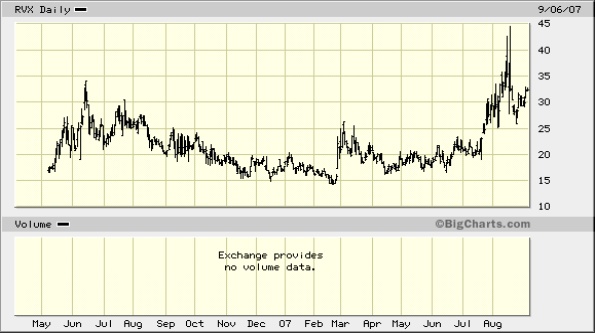

Exhibit

B

Implied

Volatilities of Exchange Traded Options on

Laboratory

Corporation of American (Lab Corp)

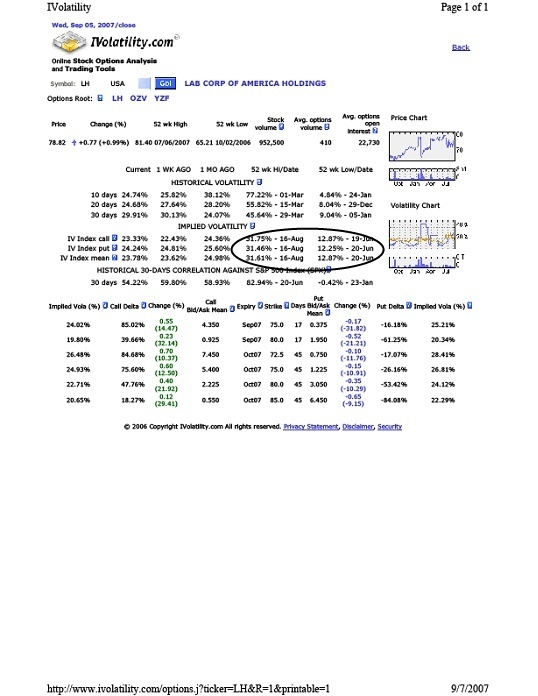

Exhibit

C

Implied

Volatilities of Exchange Traded Options on

Quest

Diagnostics