DEF 14A: Definitive proxy statements

Published on April 8, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| Check the appropriate box: | ||||||||

| ☐ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2)) | |||||||

| ☒ | Definitive Proxy Statement | |||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material under Rule 14a-12 | |||||||

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

Notice of 2024 Annual Meeting of

Stockholders and Proxy Statement

Stockholders and Proxy Statement

April 8, 2024

NeoGenomics, Inc.

9490 NeoGenomics Way

Fort Myers, Florida 33912

Fellow Stockholders,

On behalf of the Board of Directors, it is my pleasure to invite you to attend our 2024 Annual Meeting of Stockholders of NeoGenomics, Inc., which will be held on Thursday, May 23, 2024, at 10:00 a.m., Eastern Time (the "2024 Annual Meeting"). The 2024 Annual Meeting will be a completely virtual meeting conducted via live webcast.

Details regarding the 2024 Annual Meeting and the business to be conducted are described in the accompanying Proxy Statement. In addition to considering the matters described in the Proxy Statement, we will report on matters of interest to our stockholders.

We are pleased to inform you that instead of a paper or electronic copy of our proxy materials, most of our stockholders will be mailed a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) on or about April 8, 2024. The Notice of Internet Availability contains instructions on how to access proxy materials and how to submit your proxy over the Internet. The Notice of Internet Availability also contains instructions on how to request a paper copy of our proxy materials, if desired. All stockholders who do not receive a Notice of Internet Availability, or who have not consented to receive their proxy materials electronically by email, will be mailed a paper copy of the proxy materials. Furnishing proxy materials over the Internet allows us to provide our stockholders with the information they need in a timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the 2024 Annual Meeting whether or not you plan to attend the live webcast of the 2024 Annual Meeting. Please vote electronically over the Internet, by telephone, or, if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. You may also vote your shares online during the 2024 Annual Meeting. Instructions on how to vote while participating at the 2024 Annual Meeting live via the Internet are posted at www.virtualshareholdermeeting.com/NEO2024.

On behalf of the Board of Directors and management, we thank you for your continued support and confidence in NeoGenomics, Inc.

Sincerely,

| Lynn Tetrault | ||

| Non-Executive Chair of the Board of Directors | ||

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of NeoGenomics, Inc., will be held on Thursday, May 23, 2024, at 10:00 a.m., Eastern Time (the "2024 Annual Meeting"). The 2024 Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the 2024 Annual Meeting online and submit your questions during the 2024 Annual Meeting by visiting www.virtualshareholdermeeting.com/NEO2024. For instructions on how to attend and vote your shares at the 2024 Annual Meeting, see the information in the accompanying Proxy Statement.

Items of Business:

1.To elect nine directors from the nominees named in the attached Proxy Statement.

2.To approve, on a non-binding advisory basis, executive compensation.

3.To approve the Fourth Amendment of the Employee Stock Purchase Plan (as amended and restated).

4.To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for the year ending December 31, 2024.

5.To consider any other business properly brought before the 2024 Annual Meeting.

Record Date:

You can vote if you were a stockholder of record as of the close of business on March 25, 2024.

Proxy Voting:

|

|

|

||||||

| By Mail | By Phone | By Internet | ||||||

It is important that your shares be represented at the 2024 Annual Meeting regardless of the number of shares you hold. Whether or not you expect to virtually attend, please complete, date, sign and return the accompanying proxy card in the enclosed envelope or use the telephone or Internet method of voting as described on your proxy card to ensure the presence of a quorum at the meeting. Even if you have voted by proxy and you virtually attend the meeting, you may, if you prefer, revoke your proxy and vote your shares virtually.

By Order of the Board of Directors

Alicia Olivo

EVP, General Counsel & Business Development

Important notice regarding the availability of proxy materials for the 2024 Annual Meeting of Stockholders to be held on Thursday, May 23, 2024. Our 2024 Proxy Statement and 2023 Annual Report to Stockholders are available at www.proxyvote.com.

Table of Contents

Index of Frequently Requested Information

NEOGENOMICS, INC.

PROXY STATEMENT FOR THE

2024 ANNUAL MEETING OF STOCKHOLDERS

NeoGenomics, Inc. (“we,” “us,” “our,” “NeoGenomics,” or the “Company”), having its principal executive offices at 9490 NeoGenomics Way, Fort Myers, Florida 33912, is providing these proxy materials in connection with the 2024 Annual Meeting of Stockholders of NeoGenomics (the “2024 Annual Meeting”). This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the 2024 Annual Meeting. This Proxy Statement, including the notice of the 2024 Annual Meeting (the "Meeting Notice") and the proxy card, were first distributed to our stockholders on or about April 8, 2024.

The following is a summary of key disclosures in our Proxy Statement. This is only a summary and may not contain all the information that is important to you. For more complete information, please review the full Proxy Statement as well as our 2023 Annual Report, which includes our Annual Report on Form 10-K, as filed with the SEC on February 20, 2024.

| Proposal 1 - Election of Directors | ||||||||||||||

|

•As of March 2024, eight of our nine Director nominees are independent, and all represent a diverse background of qualifications and experience.

•Our Director nominees are 33% female and 22% racial/ethnic diverse.

•All Board Committees are comprised solely of independent Directors.

|

ü |

The Board recommends a vote FOR each Director nominee.

|

||||||||||||

| à | ||||||||||||||

| Proposal 2 - Advisory Vote on Executive Compensation | ||||||||||||||

|

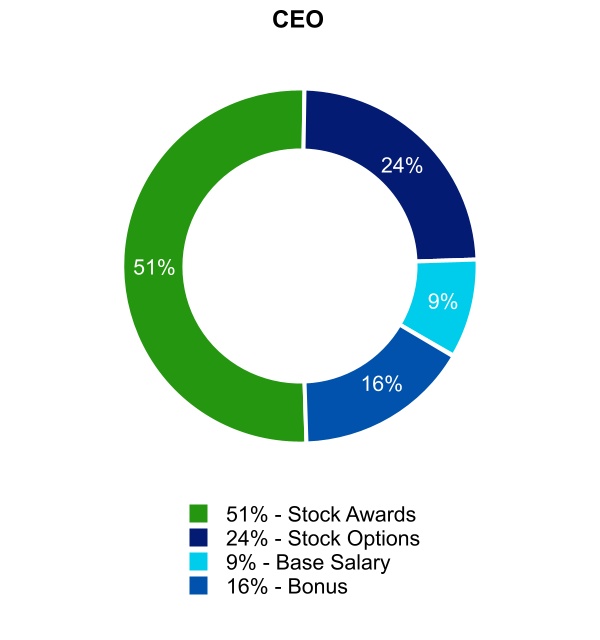

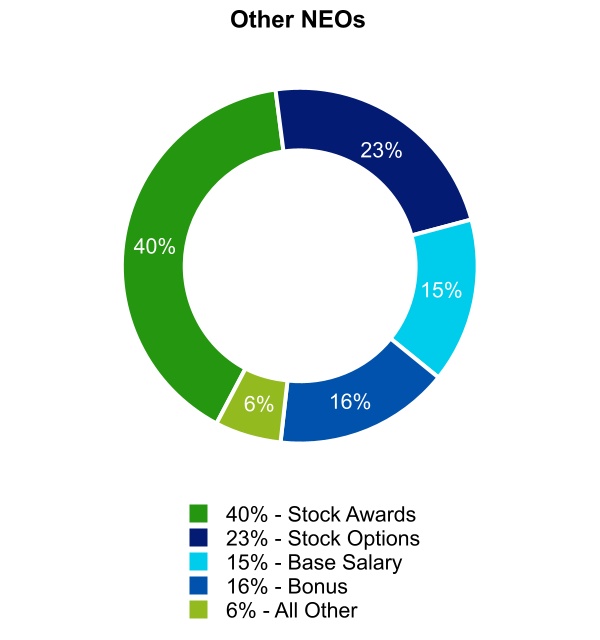

•We strive for pay-for-performance and believe that performance objectives should align with our strategy over the long term.

•Our compensation philosophy is focused on providing compensation and benefits that are competitive and meet our goals of attracting, retaining, and motivating highly skilled teammates and management.

|

ü |

The Board recommends a vote FOR this proposal.

|

||||||||||||

| à | ||||||||||||||

| Proposal 3 - To Approve the Fourth Amendment of the Employee Stock Purchase Plan (as amended and restated) | ||||||||||||||

•To approve the Fourth Amendment of the Employee Stock Purchase Plan (as amended and restated) will increase the number of shares of common stock reserved for issuance under the ESPP by 1,000,000 shares to 3,500,000 shares.

|

ü |

The Board recommends a vote FOR this proposal.

|

||||||||||||

| à | ||||||||||||||

| Proposal 4 - Ratification of Independent Registered Accounting Firm | ||||||||||||||

•The Audit and Finance Committee of the Board has appointed Deloitte & Touche LLP to act as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

|

ü |

The Board recommends a vote FOR this proposal.

|

||||||||||||

| à | ||||||||||||||

| NeoGenomics, Inc. | 1 |

2024 Proxy Statement | ||||||

CORPORATE GOVERNANCE

Transforming Patient Care by Living our Values

We believe that strong corporate governance practices provide a framework for our Board of Directors’ (the “Board”) oversight of the short-term and long-term health, strategy, and overall success of NeoGenomics. We have established Corporate Governance Guidelines and a Code of Business Conduct and Ethics that provide the foundation for our values of quality, integrity, accountability, teamwork, and innovation. Our commitment to integrity and ethics starts at the top with our Board and senior management and extends to every NeoGenomics employee.

We recognize that the Board’s role and oversight extends to sustainability, human capital management, and environmental impact. We continue to have meaningful internal and external conversations about environmental, social, and governance (“ESG”) policies and initiatives and are increasing our focus on related efforts. We believe that progress on these objectives aligns with our vision and further supports our progress towards our near and long-term strategic objectives.

Environmental, Social and Governance

We are passionate about promoting a World-Class Culture through employee engagement, training and development, wellness, work-life balance, and communication initiatives. We believe that a diverse and inclusive workforce, where diverse perspectives are recognized and respected, positively impacts our performance and strengthens our culture. We continually strive to promote a workplace in which people of diverse race, ethnicity, veteran status, marital status, socio-economic level, national origin, religious belief, physical ability, sexual orientation, age, class, political ideology, and gender identity and expression participate in, contribute to, and benefit equally.

To underscore our commitment to ESG, we issued our inaugural ESG report in March 2024. This report was informed by a materiality assessment completed in the second half of 2023 which identified six topics of significant importance to our stakeholders and our business. Our inaugural report serves as a baseline for our activity going forward.

| Diversity, Equity, Inclusion & Belonging Vision | ||||||||||||||||||||

|

Cancer doesn’t discriminate, and neither do we.

While placing the value of people at the heart of our organization, we challenge ourselves every day to be more inclusive with

our teams, clients, and community. We create an environment where culture engenders growth and innovation. We champion

diversity and inclusion and take action to create an equitable culture where everyone belongs.

| ||||||||||||||||||||

Our commitment to maintaining an excellent workplace includes investing in ongoing opportunities for employee development in a diverse and inclusive environment. We have worked to reflect gender and ethnic diversity and inclusion on our Board and diversity in gender and ethnicity is well-established within our workforce. As of December 31, 2023, women make up 59.9% of our global workforce, and 50.8% of the supervisory or higher positions are made up by females. With regard to the Company's top two management tiers, 44.4% of our executive team and our vice presidents are women and 33.3% of the Board are women. Ethnicity is also strongly represented: 53.5% of our workforce and 22.2% of the Board are ethnically diverse. Diversity is an active conversation at NeoGenomics including through employee-initiated and -led employee resource groups (“ERGs”) such as LGBTQ@Neo, Women&Allies@Neo, Generations@Neo, Veterans@Neo, We S.T.A.N.D@Neo (Standing Together Against Negativity and Discrimination), and Wellness@Neo. These ERGs reinforce our commitment to diversity, inclusion and belonging by fostering community, providing education and support across the business, and facilitating dialogue on relevant and critical employee topics. We regularly seek the input of our employees through both in-person roundtables and anonymous surveys. It is important that our employees have a voice, equal opportunities and a method to communicate their views in a way that they feel comfortable.

In addition, in recognition that health and wellness extend beyond the physical aspects, we have established a number of broad health-focused measures for our employees. Our Wellness@Neo ERG has a mission to support the financial, physical, emotional, and social wellness of our employees. The Wellness@Neo ERG sponsors education on a variety of topics including investing, student loan debt, mental support initiatives, meditation, and yoga. We continually assess the benefits offered to our employees and in addition to competitive health plans, 401(k) matching and our Employee Stock Purchase Plan (“ESPP”), we offer contributions towards our employees’ student loan debt, tuition reimbursement, gym and fitness studio credits, and an employee assistance program that provides health, family, legal, and financial assistance.

We also encourage and support community involvement and corporate philanthropy. As part of our social wellness program, we partner with VolunteerMatch Virtual Volunteer Opportunities and with Project Helping, a mental wellness organization that creates meaningful social and accessible volunteer experience to help people improve their mental wellness through service. Each year we also provide corporate giving to organizations that are aligned with our purposes and values.

| NeoGenomics, Inc. | 2 |

2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

| NeoGREEN Vision | ||||||||||||||||||||

| NeoGenomics is committed to seeking and upholding environmentally sustainable solutions that build trust with our employees, clients, and stakeholders. | ||||||||||||||||||||

We believe our corporate responsibility includes a commitment to our environment, which we support through our NeoGREEN initiative. In 2021 we opened a new headquarters in Fort Myers, FL, which includes a new laboratory, warehouse, and administrative facilities. We completed the design and construction of our new headquarters in accordance with the Sustainable SITE initiative that ensures that a project’s natural environment is valued and respected throughout the building process. Additionally, we utilize low-emitting materials, energy, and water efficient design, and utilize GS-42 certified janitorial and sustainable pest services. As a result, we are proud of NeoGenomics’ achievement of Leadership in Energy and Environmental Design (“LEED”) certification for this facility. Developed by the U.S. Green Building Counsel, LEED is the most widely used green building rating system in the world and an international symbol of sustainability achievement. Our environmental efforts also focus on improvements in our waste, water, and energy management.

| Corporate Governance Highlights | |||||

| Independent Board Chair |

•As of March 2024, Lynn Tetrault, NeoGenomics’ independent non-executive Chair of the Board, has nine years’ tenure on the Board and extensive healthcare leadership experience

|

||||

| Independent and diverse director nominees |

•As of March 2024, eight of our nine directors are independent

•All Board committees are entirely comprised of independent directors

•Five of our nine directors, representing 56% of our directors are diverse (either gender or race/ethnicity)

•Directors have a broad range of experience, skills, and qualifications (see "Director Diversity and Expertise"’ on page 12)

|

||||

| Executive sessions of independent directors |

•Independent directors meet regularly without management

|

||||

| Active board refreshment |

•Balanced mix of short and long-tenured directors

•Four of our eight independent directors joined the Board within the last twenty-four months

•Annual election of all directors

|

||||

| Continual assessments |

•Board and Committees complete annual self-evaluation surveys

•Annual Chief Executive Officer and executive management performance and potential evaluation in alignment with corporate goals and objectives, including achievement of business and strategic objectives

•Continuously evaluate director capacity

|

||||

| Stock ownership guidelines |

•No hedging or pledging of NeoGenomics stock

•Minimum stock holding requirements for directors and executive officers

|

||||

Share Ownership Guidelines and Share Retention Requirements

NeoGenomics has adopted share ownership guidelines for its independent directors and executive officers to further align the interests of our senior leaders and Board with those of our stockholders. The guidelines require independent directors to hold NeoGenomics stock worth a value expressed as a multiple of their annual compensation within five years of the guideline applying to them.

For the purposes of assessing compliance with share ownership guidelines, the following forms of equity interests are considered:

•shares owned directly (including vested restricted awards); and

•unvested restricted stock awards.

| NeoGenomics, Inc. | 3 |

2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

The table below summarizes the current share ownership guidelines as well as the current share ownership of our independent Board members as a multiple of base compensation for Board services as of December 31, 2023:

| Role | Share Ownership Guideline | Current Share Ownership | ||||||||||||

| Chair of the Board | 3.0 | 13.5 | ||||||||||||

Board Members(1)

|

3.0 | 15.6 | ||||||||||||

(1)Share ownership calculated as an average of all independent Board Members except the Chair of the Board who is shown separately.

Directors who are yet to achieve their share ownership amount are required to retain an amount equal to 25% of the net shares received as the result of the exercise, vesting, or payment of any equity awards. If a director’s required ownership level amount is not attained by the end of the initial five-year period (or at any time thereafter), they will be required to retain an amount equal to 100% of the net shares received as the result of the exercise, vesting, or payment of any equity awards granted, until the applicable guideline level is achieved. As of December 31, 2023, all Board members were either in compliance with the share ownership guidelines or not yet required to be in compliance due to their appointment date.

Director Nominations. Our Board has a standing Nominating and Corporate Governance Committee (the “Nominating and Governance Committee”). The Nominating and Governance Committee considers and recommends candidates for election to the Board and nominees for committee memberships and committee chairs and focuses on ensuring that the Board is composed of members with varied skill sets to support the Company’s key initiatives.

Director candidates are considered based upon a variety of criteria, including the director nominee's business judgment, professional integrity, character, experience, and understanding of the Company, while also taking into account the current Board members and the specific needs of the Company and the Board. The Nominating and Governance Committee seeks individuals from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise as set forth in the Strategic Competencies Matrix. The Nominating and Governance Committee also emphasizes the importance of diversity, equity, and inclusion with respect to age, gender, race and ethnicity, sexual orientation, and gender identity and believes that an inclusive environment offers the Company and our stockholders’ diversity of opinion and insight in the areas most important to us and our corporate mission. All director candidates must have time available to devote to the activities of the Board. In deciding whether to nominate a director candidate, our Board also considers the independence of director candidates, including the appearance of any conflict in serving as a director. A director who does not meet all of these criteria may still be considered for nomination to the Board if our independent directors believe that the candidate will make an exceptional contribution to us and our stockholders.

Generally, when evaluating and recommending candidates for election to the Board, the Nominating and Governance Committee will conduct candidate interviews, evaluate biographical information and background material, and assess the skills and experience of candidates against selection criteria set forth in the Strategic Competencies Matrix in the context of the then-current needs of the Company. In identifying potential director candidates, the Board may also seek input from the executive officers and may also consider recommendations by employees, community leaders, business contacts, third-party search firms, and any other sources deemed appropriate by the Nominating and Governance Committee. The Nominating and Governance Committee will also consider director candidates recommended by stockholders to stand for election at the annual meeting of stockholders so long as such recommendations are submitted in accordance with the procedures described below under “Stockholder Recommendations for Board Candidates.”

Board Leadership Structure. Consistent with the Company’s Corporate Governance Guidelines, our Board has a policy that allows the Chair of the Board and Chief Executive Officer positions to be separate or combined and, if they are to be separate, allows the Chair of the Board role to be either selected from among the independent directors or an executive officer. Our Board believes that it should have the flexibility to make these determinations at any given time in the way that it believes best to provide appropriate leadership for the Company. Our Board has reviewed the current Board leadership structure in light of the composition of the Board, the Company’s size, the nature of the Company’s business, the regulatory framework under which the Company operates, and other relevant factors. Under our current leadership structure, the roles of Chair of the Board and Chief Executive Officer are held by two different individuals. The board's independence from management is increased by having separate Chair of the Board and Chief Executive Officer roles, which helps lead to better monitoring and oversight.

| NeoGenomics, Inc. | 4 |

2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

Director Independence. Our Corporate Governance Guidelines provide that our Board will consist of a majority of independent directors and, in making independence determinations, the Board will observe all applicable requirements, including the applicable corporate governance listing standards of the Nasdaq Stock Market LLC (“Nasdaq”). Under Nasdaq rules, the Board has a responsibility to make an affirmative determination that those members of its Board that serve as independent directors do not have any relationships with the Company and its businesses that would impair their independence. In connection with these determinations the Board reviews information regarding transactions, relationships, and arrangements involving the Company and its businesses and each director that it deems relevant to independence, including those required by Nasdaq rules.

The Board has determined that each of the directors, except for Mr. Smith, was independent for the duration of the director's service in 2023. As of April 8, 2024, the Audit and Finance Committee, the Compliance Committee, the Culture and Compensation Committee, the Nominating and Corporate Governance Committee, and the Innovation, Pipeline & Technology Committee are each composed entirely of directors who are independent under Nasdaq rules and the applicable rules of the United States Securities and Exchange Commission (the “SEC”).

| NeoGenomics, Inc. | 5 |

2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

Board Role in Risk Oversight. The Board administers its enterprise risk oversight function directly and through its Committees. The Board and the Audit and Finance Committee have primary oversight over enterprise risks and regularly discuss with management major risk exposures, including cybersecurity, their likelihood of occurrence, their potential financial impact on the Company, and the steps taken to monitor, control, and mitigate those risks. The Nominating and Governance Committee has primary oversight over ESG matters, the Culture and Compensation Committee has primary oversight over risks associated with compensation policies and practices, the Compliance Committee has primary oversight over the Corporate Compliance Program and Code of Business Conduct and Ethics, and the Innovation, Pipeline & Technology Committee has primary oversight over the Company's R&D programs, its technology and relevant scientific advances overseeing technology developments. Please refer to the section “Information Regarding Meetings and Committees of the Board” below for a full description of the responsibilities of each Committee and its role in overseeing the Company’s major risk exposures.

| Board of Directors | ||||||||||||||||||||

|

•Stay informed of our risk profile and oversee our Enterprise Risk Management program

•Consider risk in connection with strategic planning and other matters

| ||||||||||||||||||||

|

Audit &

Finance

|

Nominating &

Corporate Governance

|

Culture &

Compensation

|

Compliance | Innovation, Pipeline & Technology | ||||||||||||||||||||||

|

•Enterprise risks, including but not limited to risks relating to IT use and protection, data governance, privacy, and cybersecurity

•Independent auditor’s qualifications and independence

•Financial reporting and processes, including internal control over financial reporting

|

•ESG matters

•Investor engagement and communications

•Review Board size, composition, function, duties, diversity, and Strategic Competencies

•Develop and recommend to the Board the Corporate Governance Guidelines and oversee compliance with these Guidelines

|

•Review the risks associated with the Company’s compensation policies and practices

•Oversee an annual review of the Company’s risk assessment of its compensation policies and practices for its employees

•Diversity, equity, inclusion and belonging

•Succession planning

|

•Assess management’s implementation of the Corporate Compliance Program elements

•Assess adequacy and effectiveness of policies and programs to monitor compliance with laws and regulations

•Monitor significant external and internal investigations

•Implementation of Code of Business Conduct and Ethics

•Confirmation of zero conflict of interests related to members of the Board of Directors and Named Executive Officers (as defined below under "Executive Compensation") and external consultants engaged by the Board

|

•Develop insights and recommendations regarding the Company's approach to product pipeline development and technical and commercial innovation

•Support recruitment and interactions with the Company's scientific advisory board

|

||||||||||||||||||||||

| NeoGenomics Management | ||

| NeoGenomics management advises the Board and its Committees of key risks and the status of ongoing efforts to address these risks. | ||

| NeoGenomics, Inc. | 6 |

2024 Proxy Statement | ||||||

| Corporate Governance | ||||||||

Stockholder Outreach. It is our practice to have ongoing and robust engagement with our stockholders throughout the year and seek their direct feedback to continuously improve our performance, programs, and reporting. Our outreach is supplemented by our year-round investor relations engagement that includes post-earnings communications, one-on-one conferences, individual meetings, and general availability to respond to investor inquiries. We also periodically engage proxy advisory firms for their viewpoints. The multifaceted nature of this program allows us to maintain meaningful engagement with a broad audience including institutional and retail stockholders.

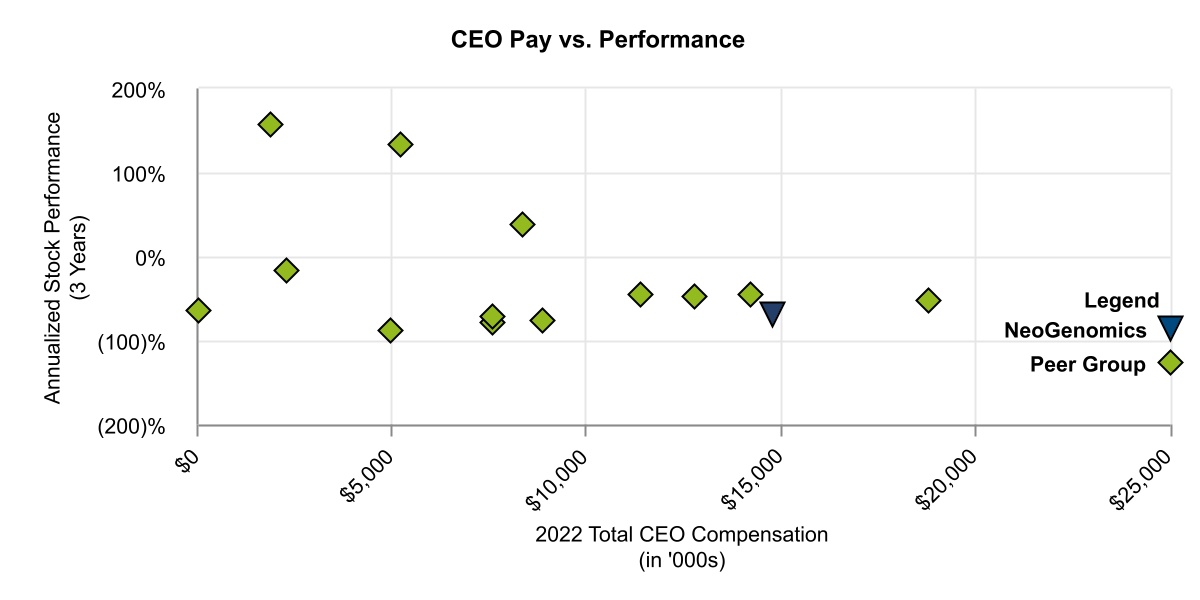

In 2023, we received approximately 52% support for our annual say-on-pay proposal. Following our say-on-pay vote in 2023, we widened our governance outreach and engagement even further to ensure we understood stockholders’ concerns and to inform and guide our actions in response. As evidenced by the actions taken already throughout 2023, we take the outcome of this vote seriously and have been highly focused on understanding and responding to our stockholders’ feedback. Through the Company’s engagement efforts, the Culture and Compensation Committee sought to elicit and consider a full range of stockholders’ perspectives related to NeoGenomics’ executive compensation program and design elements and ESG initiatives to inform specific actions and appropriate responses to the say-on-pay vote.

We engaged with stockholders representing 77% of outstanding shares with our integrated engagement team consisting of the Chair of the Culture & Compensation Committee, finance, legal, people & culture, and investor relations and met with representatives capturing 36% of outstanding shares. We will continue our stockholder outreach efforts throughout 2024.

As part of these engagements, many stockholders favorably acknowledged changes and enhancements that we introduced related to executive compensation in particular. This supported our understanding that many stockholders were generally comfortable with the fundamental aspects of our compensation program design but voted against say-on-pay in 2023 based on specific compensation actions taken in 2021 and 2022 - actions largely driven by significant changes in leadership and organizational structure. As a result, we took steps in 2023 and 2024 to address the concerns of many stockholders, while also ensuring our ability to attract and retain talented executives who are motivated to achieve our annual and long-term strategic goals. Our goal is to continue to refine our programs further beyond 2024 by leveraging ongoing stockholder feedback and maintaining effective linkage to company performance-based awards.

For more on our response to our stockholder engagement related to the 2023 say-on-pay vote, see page 34.

| NeoGenomics, Inc. | 7 |

2024 Proxy Statement | ||||||

PROPOSAL 1—ELECTION OF DIRECTORS

At the 2024 Annual Meeting, a board of nine directors will be elected, each to hold office until the next succeeding annual meeting of stockholders or until such director’s successor shall have been duly elected and qualified (or, if earlier, such director’s death, resignation, or removal). Information concerning all director nominees appears below. Although management does not anticipate that any of the persons named below will be unable or unwilling to stand for election, in the event of such an occurrence, proxies may be voted for a substitute designated by the Board, or the Board may reduce the number of directors to be elected at the 2024 Annual Meeting.

Information as to Nominees and Other Director Information

Background information, as of the date of this Proxy Statement, about the Board’s nominees for election, as well as information regarding additional experience, qualifications, attributes, or skills that led the Board to conclude that the nominees should serve on the Board, is set forth below.

| Lynn Tetrault | Age: 61 | Non-Executive Chair of the Board | ||||||||||||||||||||

|

Lynn Tetrault has served as the non-executive Chair of the Board since August 2022. Prior to her holding this position, from May 2022, Ms. Tetrault served as our Interim Chief Executive Officer and Chair of the Board. From March 2022 to May 2022, Ms. Tetrault served as our Executive Chair of the Board and functioned as the Company's principal executive officer. From October 2021 to March 2022, she served as our non-executive Chair and from July 2020 to October 2021 she served as our Lead Independent Director. Ms. Tetrault has been a director since June 2015. She has also served as a director of Rhythm Pharmaceuticals, Inc. since 2020 and as a director of Acelyrin, Inc. since December 2023. Ms. Tetrault has more than 30 years of experience in the healthcare sector. She worked from 1993 to 2014 with AstraZeneca PLC, most recently as Executive Vice President of Human Resources and Corporate Affairs from 2007 to 2014. Ms. Tetrault was responsible for human resources strategy, talent management, executive compensation and related activities, internal and external communications, government affairs, corporate reputation, and corporate social responsibility for AstraZeneca. Prior to AstraZeneca Ms. Tetrault practiced healthcare and corporate law at Choate, Hall and Stewart in Boston. Ms. Tetrault has a BA from Princeton University and a JD from the University of Virginia Law School.

Skills and Qualifications

Lynn Tetrault is a dynamic, seasoned executive in the pharmaceutical industry. Having progressed through numerous senior management roles at AstraZeneca, she acquired extensive human resource and corporate governance experience at the highest level of that company. As the Company continues to grow, Ms. Tetrault’s experience is helping to shape human resource policies and operations as well as the make-up of the Board and its governance policies, and therefore we believe that Ms. Tetrault is well qualified to serve on our Board.

| ||||||||||||||||||||

| Christopher Smith | Age: 61 | Board Member and Chief Executive Officer | ||||||||||||||||||||

|

Chris Smith was appointed Chief Executive Officer and a director in August 2022. Prior to joining NeoGenomics, from 2019 to 2022, Mr. Smith served as Chief Executive Officer of Ortho Clinical Diagnostics (“Ortho Clinical”). Under his leadership, Ortho Clinical raised $1.45 billion in funding for a 2021 initial public offering and achieved accelerated revenue growth while simultaneously improving profitability. Mr. Smith successfully guided the company through a combination with Quidel that closed in May 2022. Prior to Ortho Clinical, from 2004 to 2018, Mr. Smith served in key executive leadership positions, including CEO of Cochlear Limited (“Cochlear”), a global market leader in implantable hearing solutions. Having initially joined Cochlear as President of Cochlear Americas in 2004, Mr. Smith helped grow division revenue from $80 million to over $400 million before being named CEO in 2015. Before joining Cochlear, Mr. Smith served as a Chief Executive Officer in residence at global private equity firm Warburg Pincus and Global Group President at Gyrus Group Plc., a surgical products company. Prior to that he served in a variety of leadership roles at Abbott, KCI, Prism and Cardinal Health. Prior to 2023, Mr. Smith has served as a member of the board of directors at QuidelOrtho, a global provider of innovative in vitro diagnostic technologies, Akouos, Inc., Osler Diagnostics Limited and Results Physiotherapy. In addition, since mid-2023, Mr. Smith has served as a member of the board of directors of Laborie Medical Technologies Corp. Mr. Smith has a BS from Texas A&M University.

Skills and Qualifications

Mr. Smith is a dynamic leader with strong cultural values, vast diagnostic industry experience, and an extensive history of proven operating success. Because of Mr. Smith’s extensive industry knowledge and his experience serving on the boards of directors of other public companies, we believe Mr. Smith is well qualified to serve on our Board.

| ||||||||||||||||||||

| NeoGenomics, Inc. | 8 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

| Dr. Alison Hannah | Age: 63 | Board Member and Chair of the Compliance Committee | ||||||||||||||||||||

|

Dr. Hannah has served as a director since June 2015. Dr. Hannah has over 30 years’ experience in the development of investigational cancer chemotherapies. She currently serves as a consultant to the pharmaceutical industry, working with over 30 companies over 20 years with a focus on molecularly targeted anti-cancer therapy. From 2020 to 2022, Dr. Hannah served as Senior Vice President and Chief Medical Officer at CytomX Therapeutics, an oncology-focused biopharmaceutical company. Previously, Dr. Hannah worked as Senior Medical Director at SUGEN (working on Sutent and other tyrokine kinase inhibitors) and Quintiles, a global contract research organization. Dr. Hannah has also served on the board of directors of Rigel Pharmaceuticals since 2021. Dr. Hannah specializes in clinical development strategy and has filed over 30 Investigational New Drug applications for new molecular entities and seven successful New Drug Applications (including talazoparib, enzalutamide, defibrotide, carfilzomib, and others). Dr. Hannah received her BA in biochemistry and immunology from Harvard University and her MD from the University of Saint Andrews. She is a member of ASCO, AACR, ASH, ESMO, SITC, and a Fellow with the Royal Society of Medicine.

Skills and Qualifications

Dr. Hannah has significant healthcare knowledge having spent over 20 years as a consultant in the field of oncology drug development and has over 30 years of experience working with biopharmaceutical companies. Dr. Hannah has extensive knowledge of the clinical trials marketplace, and we believe she will continue to offer valuable guidance on how the Company should position itself to obtain clinical trials diagnostic testing volumes as the Company continues to grow its revenue in that area. Because of this experience and knowledge, we believe Dr. Hannah is well qualified to serve on our Board.

| ||||||||||||||||||||

| Stephen Kanovsky | Age: 61 | Board Member and Chair of the Nominating and Corporate Governance Committee | ||||||||||||||||||||

|

Mr. Kanovsky has served as a director since July 2017. Mr. Kanovsky is Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, where he has served since 2012, which provides medical technologies and solutions to the global healthcare industry and supports customers throughout the world with a broad range of services and systems, from diagnostic imaging and healthcare IT to molecular diagnostics and life sciences. Prior to his service at GE HealthCare, Mr. Kanovsky held numerous legal, compliance, and research roles in several global pharmaceutical companies. Mr. Kanovsky earned his bachelor’s degree from the University of Pennsylvania. He subsequently graduated from Temple University’s School of Pharmacy with a master’s degree in Pharmacology and Temple University’s School of Law with a juris doctorate degree. Mr. Kanovsky also holds an MBA from Saint Joseph’s University’s Haub School of Business.

Skills and Qualifications

Mr. Kanovsky has over 25 years of legal and compliance experience in the global life sciences and pharmaceutical industry. Through his work as Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, Mr. Kanovsky is able to provide continued knowledge of the life sciences space. He also brings valuable experience to our Board through his prior involvement with Clarient, Inc. (“Clarient”), prior to its acquisition by NeoGenomics in December 2015. Because of Mr. Kanovsky’s extensive legal and compliance background and long-term service to the Board, we believe Mr. Kanovsky is well qualified to serve on our Board.

| ||||||||||||||||||||

| NeoGenomics, Inc. | 9 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

| Michael Kelly | Age: 67 | Board Member and Chair of the Audit and Finance Committee | ||||||||||||||||||||

|

Mr. Kelly has served as a director since July 2020 and served as the Board’s Lead Independent Director for the duration of Ms. Tetrault’s service as Executive Chair of the Board and Interim Chief Executive Officer in 2022. Mr. Kelly is a former senior executive of Amgen, Inc. ("Amgen") and is currently acting as Founder & President of Sentry Hill Partners, LLC, a global life sciences transformation and management consulting business he founded in 2018. Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions at Amgen from 2003 to 2017, most recently as Senior Vice President, Global Business Services and Vice President & CFO, International Commercial Operations. Mr. Kelly has also held positions at Biogen, Tanox, and Monsanto Life Sciences. Mr. Kelly currently serves as a director for Amicus Therapeutics, DMC Global, Inc., and Prime Medicine, Inc. Mr. Kelly serves on the Council of Advisors and was the former audit committee chair for Direct Relief, a humanitarian aid organization focused on health outcomes and disaster relief. Mr. Kelly holds a BS in business administration from Florida A&M University, concentrating in Finance and Industrial Relations.

Skills and Qualifications

Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions. We believe Mr. Kelly’s extensive experience managing and growing domestic and international organizations, as well as his track record in finance, operations and building differentiated product companies is highly valuable as we continue our long-term growth strategy, and therefore Mr. Kelly is well qualified to serve on our Board. In addition, we believe Mr. Kelly’s extensive knowledge and background in finance qualifies him to serve as a financial expert on the Audit and Finance Committee.

| ||||||||||||||||||||

| David Perez | Age: 64 | Board Member | ||||||||||||||||||||

|

Mr. Perez has served as a director since November 2022. Mr. Perez has over 40 years of global executive leadership experience, leading the growth and operations of several businesses, growing and scaling organically through research and development and innovation, as well as through mergers and acquisitions. In March 2019, he retired from his position as president and CEO of Terumo BCT, a company dedicated to blood banking, transfusion medicine and cell-based therapies, following a comprehensive two-year succession and transition plan. Mr. Perez currently serves as a director on the following private company boards Laborie Medical Technologies Corp., Advanced Instruments, LLC and MoInlycke Health Care AB. During his nearly 20-year tenure, Mr. Perez guided Terumo BCT through several foreign ownership structures, leveraging his extensive experience leading complex, multinational businesses, and diverse, cross-cultural organizations. Under his leadership as CEO for 18.5 years, the company transformed from a single manufacturing and R&D site to a multi-national biomedical organization with five R&D centers and six manufacturing plants, as he helped drive global revenue growth from $160 million to $1 billion. Mr. Perez holds a BA in Political Science from Texas Tech University.

Skills and Qualifications

Mr. Perez has 40 years of executive leadership in medical device and health care services, He serves as an independent board member and advisor to several corporations and non-profit organizations. His expertise encompasses growing and scaling highly regulated global businesses organically through R&D and innovation and inorganically through M&A, leading within a variety of foreign, public, and private equity ownership structures, strategic planning, culture and talent development, succession planning, enterprise risk management, operations, compliance, and corporate governance. We believe Mr. Perez’s extensive knowledge and background as a chief executive and director qualifies him to service on our board.

| ||||||||||||||||||||

| NeoGenomics, Inc. | 10 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

| Anthony Zook | Age: 63 | Board Member and Chair of the Culture and Compensation Committee | ||||||||||||||||||||

|

Mr. Zook has served as a director since June 2023. Mr. Zook served as Chief Executive Officer of Innocoll Pharmaceuticals, and prior to that Mr. Zook was Executive Vice President, Commercial Operations of AstraZeneca (AZ) where he held global P&L responsibility for all of AZ's brands and markets. Under Mr. Zook's leadership, AZ commercialized ten brands, each in excess of $1 billion in sales. Mr. Zook was also responsible for MedImmune, AZ's global biologics business. He also chaired the Commercial Investment Board, which identified and approved critical investments company-wide, including investments in plants, markets, and technology. Earlier in his career at AZ, Mr. Zook held various positions including CEO of North America and VP of Sales, where he helped lead the integrations of Astra US, Astra Merck, and Zeneca. Prior to joining AZ, Mr. Zook spent 14 years with Berlex Laboratories in a variety of positions.

Skills and Qualifications

Mr. Zook has significant experience as a brand and marketing executive with a focus on managing the interface between commercial and research and development aspects of an organization. Mr. Zook has served as a Chief Executive Officer of a large pharmaceutical company with global responsibilities, has significant sales and marketing experience, as well as operational and oncology experience. Because of Mr. Zook's industry knowledge, we believe Mr. Zook is well qualified to serve on our Board.

| ||||||||||||||||||||

| Elizabeth Floegel | Age: 48 | Board Member | ||||||||||||||||||||

|

Ms. Floegel has served as a director since June 2023. Ms. Floegel is Chief Information & Digital Officer of Numotion and manages a significant digital and cybersecurity transformation with the strategic use of data and technology to drive value creation by creating efficient and compliant operations. Before joining Numotion, Ms. Floegel was the Global Vice President of Business Technology at Allergan (now part of Abbvie) where she led the technology portfolio across global commercial, retail, digital products, and marketing. Prior to Allergan, Ms. Floegel was Head of Commercial and Digital Technology for Regeneron Pharmaceuticals and Global Vice President of Commercial Technology for Baxter Healthcare. Ms. Floegel holds an MBA from Benedictine University.

Skills and Qualifications

Ms. Floegel has a track record for successfully leading technology and organizational transformation in highly matrixed environments. She has extensive experience in cybersecurity, data privacy, automation, compliance technology and digital technology transformation. Because of her experience and knowledge, we believe Ms. Floegel is well qualified to serve on our Board.

| ||||||||||||||||||||

| Dr. Neil Gunn | Age: 63 | Board Member and Chair of the Innovation, Pipeline & Technology Committee | ||||||||||||||||||||

|

Dr. Neil Gunn has served as a director since June 2023. Most recently, Dr. Gunn was the Chief Executive Officer of IDbyDNA, which was acquired by Illumina in 2022. Prior to that, Dr. Gunn was President of Roche Sequencing Solutions ("RSS"), where he grew the organization from early initial concepts to over 900 employees across three continents while integrating nine acquisitions into one with a common vision and strategy. Before RSS, Dr. Gunn was Head of Global Business for Roche Molecular Diagnostics and was responsible of the development and execution of strategic plan that launched over 140 major assay, instrument, and software launches over six years. Dr. Gunn’s earlier roles include Vice President Commercial Operations for CaridianBCT and Vice President of Commercial Operations - Americas for Novartis Diagnostics.

Skills and Qualifications

Dr. Gunn is a veteran diagnostics senior executive with expertise in company organization to maximize efficiencies with a focus on value generators to drive growth. Dr. Gunn has multi-year executive experience in multinational diagnostic companies and startups. He also has technical expertise in oncology diagnostics, next generation sequencing and other relevant technologies. Because of this experience and knowledge, we believe Dr. Gunn is well qualified to serve on our Board.

| ||||||||||||||||||||

| NeoGenomics, Inc. | 11 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

Director Diversity and Expertise

We seek to have a Board that represents diversity, equity, and inclusion as to experience, gender, race and ethnicity, though we do not have a formal policy with respect to diversity. We also seek to have a Board that reflects a range of talents, ages, skills, character, and expertise, particularly in the areas of leadership, operations, risk management, accounting and finance, strategic planning and the areas most important to us and our corporate mission, and that is qualified to provide sound and prudent guidance with respect to our operations and interests. To augment our Board’s strategic competencies, we also consult with experts in specialized areas such as ESG and executive compensation, to provide the relevant skills to support the Company’s long-term strategy.

| Average Tenure of Directors |

Average Age of Directors |

% of Diverse Directors (Gender, Racial/Ethnic) |

||||||||||||

3.5 years |

62 years |

56% |

||||||||||||

|

Board Diversity Matrix

(as of April 8, 2024)

| ||||||||||||||

| Total Number of Directors | 9 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender |

|||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 3 | 6 | 0 | 0 | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||||||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||||||||

| Asian | 0 | 0 | 0 | 0 | ||||||||||

| Hispanic or Latinx | 0 | 1 | 0 | 0 | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||

| White | 3 | 4 | 0 | 0 | ||||||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||||||

| LGBTQ+ | 0 | 0 | 0 | 0 | ||||||||||

| Did not Disclose Demographic Background | 0 | 0 | 0 | 0 | ||||||||||

| NeoGenomics, Inc. | 12 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

| Board Strategic Competencies Matrix | |||||||||||||||||||||||||||||

| Competencies / Attributes | Lynn Tetrault | Dr. Alison Hannah | Stephen Kanovsky | Michael Kelly | David Perez | Dr. Neil Gunn | Chris Smith | Tony Zook | Elizabeth Floegel | ||||||||||||||||||||

| Financial (Reporting, Auditing, Internal Controls) | X | X | X | X | X | ||||||||||||||||||||||||

| Strategy/Business Development / M&A | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||

| Human Resources / Organizational Development |

X | X | X | X | |||||||||||||||||||||||||

| Legal / Governance / Business Conduct | X | X | X | X | X | ||||||||||||||||||||||||

| Sales / Marketing | X | X | X | X | X | ||||||||||||||||||||||||

| Risk Management | X | X | X | X | X | X | X | ||||||||||||||||||||||

| Information Technology/Cybersecurity | X | X | |||||||||||||||||||||||||||

| Research & Development | X | X | X | ||||||||||||||||||||||||||

| Medical/Scientific Affairs | X | ||||||||||||||||||||||||||||

| Sustainability | X | X | |||||||||||||||||||||||||||

| Public Policy / Regulatory Affairs | X | X | X | X | X | X | |||||||||||||||||||||||

Information Regarding Meetings and Committees of the Board

The Board. The Board met four times for regular meetings during 2023. All such meetings were regularly scheduled meetings; and additional telephonic calls were held as needed. In addition, the Board held twelve special meetings during 2023. During 2023, each incumbent director attended 75% or more of the Board and applicable committee meetings for the periods during which each director served. Although not required, directors are invited to attend the annual meeting of our stockholders. We held an annual meeting of stockholders on May 25, 2023, which was attended by six of the directors then serving on the Board.

The Board currently has five standing committees: the Audit and Finance Committee, the Compliance Committee, the Culture and Compensation Committee, the Nominating and Corporate Governance Committee and the Innovation, Pipeline & Technology Committee. The following table provides the composition of the committees as of April 8, 2024, and the number of times each committee met in 2023:

| Director Name | Audit and Finance Committee |

Compliance Committee |

Culture and Compensation Committee |

Nominating and Corporate Governance Committee |

Innovation, Pipeline & Technology Committee | ||||||||||||

| Lynn Tetrault (non-executive Chair of the Board) | X | X | |||||||||||||||

Bruce Crowther(1)

|

X | X | |||||||||||||||

| Dr. Alison Hannah | Chair | X | X | ||||||||||||||

| Stephen Kanovsky | X | Chair | |||||||||||||||

| Michael Kelly | Chair | X | |||||||||||||||

| David Perez | X | X | X | ||||||||||||||

Tony Zook(2)

|

X | Chair | X | ||||||||||||||

| Elizabeth Floegel | X | X | |||||||||||||||

| Dr. Neil Gunn | X | X | Chair | ||||||||||||||

| Number of Meetings Held in 2023 | 8 | 4 | 8 | 6 |

0(3)

|

||||||||||||

(1)Mr. Crowther resigned as Chair of the Culture and Compensation Committee effective October 19, 2023.

(2)Mr. Zook became Chair of the Culture and Compensation Committee effective October 19, 2023.

(3)The Innovation, Pipeline & Technology Committee was established as of February 2024.

| NeoGenomics, Inc. | 13 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

Audit and Finance Committee. The Audit and Finance Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under “Investors - Governance - Board Committees.” All Committee members are independent directors within the meaning of the applicable Nasdaq rules. The Audit and Finance Committee is appointed by the Board to assist with a variety of matters described in its charter, which include oversight of (1) the quality and integrity of our financial statements, (2) the Company’s compliance with legal and regulatory requirements, (3) the Company’s enterprise risks, including but not limited to risks relating to the Company’s information technology use and protection, data governance, privacy, and cybersecurity, and the Company’s strategy to mitigate such risks, (4) the independent auditor’s qualifications and independence, (5) the performance of our internal audit function and independent auditors, and (6) working in coordination with the Compliance Committee of the Board, the implementation and effectiveness of the Company’s ethics and compliance program. The formal report of the Audit and Finance Committee is set forth beginning on page 22 of this Proxy Statement.

The Board has determined that Mr. Michael Kelly, who served as the Audit and Finance Committee Chair throughout 2023, was independent and an “audit and finance committee financial expert” as defined under applicable SEC rules.

Compliance Committee. The Compliance Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading "Investors - Governance - Board Committees." All committee members are independent directors within the meaning of the applicable Nasdaq rules. The Compliance Committee is responsible for overseeing the Company’s activities in the area of compliance with applicable laws and regulations related to our provision of medical-related services and assessing management’s implementation of the Company’s Corporate Compliance Program elements, including but not limited to the (1) adequacy and effectiveness of policies and procedures to ensure the Company’s compliance with applicable laws and regulations and all associated risk, (2) organization, responsibilities, plans, results, budget, staffing, and performance of the Company’s Compliance Department, including its independence, authority and reporting obligations, (3) reviewing and concurring in the appointment, replacement, reassignment, or dismissal of the Chief Compliance Officer and review of significant reports to management or summaries thereof regarding the Company's compliance policies, practices, procedures and programs, and management’s responses thereto, (4) monitoring of significant internal and external investigations of the Company's business, (5) monitoring of the Company’s implementation of actions in response to applicable legislative, regulatory, and legal developments, (6) Company’s Code of Conduct and written compliance policies and procedures that guide the Company and the conduct of its staff, (7) appropriate mechanisms for employees to seek guidance to report concerns, and (8) Company’s systems and processes designed to periodically assess the Company's compliance obligation and associated risks and efforts to promote an ethical culture.

Culture and Compensation Committee. The Culture and Compensation Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading "Investors - Governance - Board Committees." All committee members are independent directors within the meaning of the applicable Nasdaq rules. The Culture and Compensation Committee is responsible for discharging the Board’s responsibilities relating to compensation of our Chief Executive Officer, other executive officers, and our directors and has responsibility for approving, recommending and/or evaluating all our compensation plans, policies and programs as they affect our executive officers. Specifically, the Culture and Compensation Committee is responsible for (1) reviewing and recommending to the full Board, or approving, compensation for Company executive officers and reviewing and recommending to the full Board compensation for Company directors, (2) monitoring and administering the Company’s compensation plans and other employee benefit plans, including incentive-based and equity-based plans and recommending amendments to these plans to the full Board, (3) reviewing and overseeing the Company's succession planning process for the Chief Executive Officer and other executive officers, and (4) reviewing key organizational culture and human capital management strategies to include employee development, diversity and inclusion, equal employment opportunity, and fair pay and benefit programs, workforce recruitment and retention initiatives, and related Human Resources policies, procedures and metrics. The Culture and Compensation Committee may delegate any or all responsibilities to a subcommittee or to one or more directors as it deems appropriate, provided that the Culture and Compensation Committee may not delegate any power or authority required by law, regulation or Nasdaq rule to be exercised by the committee as a whole. In addition, the Culture and Compensation Committee engaged an independent compensation consulting firm Willis Towers Watson (“WTW”), in 2023 to advise the Culture and Compensation Committee on peer development, market practices, industry trends, investor views, and benchmark compensation data related to executive officer and director compensation. In addition, WTW reviewed and provided the Culture and Compensation Committee with an independent perspective of management recommendations. These duties were consistent with those performed in prior years. For the year ending December 31, 2023, aggregate fees for WTW’s consulting services provided to the Culture and Compensation Committee were approximately $547,000, of which approximately $384,000 was related to review of executive compensation.

The decision to engage WTW as a consultant was made by the Culture and Compensation Committee.

| NeoGenomics, Inc. | 14 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading "Investors - Governance - Board Committees." All committee members are independent directors within the meaning of the applicable Nasdaq rules. Our Nominating and Corporate Governance Committee is responsible for (1) reviewing and evaluating the size, composition, function, and duties of the Board consistent with its needs; (2) establishing criteria for the selection of candidates to the Board and its committees and identifying individuals qualified to become Board members consistent with such criteria, including the consideration of nominees submitted by stockholders; (3) recommending to the Board director nominees for election at the next annual or special meeting of stockholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; (4) recommending directors for appointment to Board committees; (5) making recommendations to the Board as to determinations of director independence; (6) overseeing the evaluation of the Board and its committees; (7) developing and recommending to the Board the Corporate Governance Guidelines for the Company and overseeing compliance with such Guidelines; and (8) overseeing the Company’s activities pertaining to ESG matters and investor engagement and communications. The Nominating and Corporate Governance Committee identifies and evaluates nominee candidates as described above under “Director Nominations.”

Innovation, Pipeline & Technology Committee. Formed in 2024, the Innovation, Pipeline & Technology Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading "Investors - Governance - Board Committees." The Information, Pipeline & Technology Committee is appointed to assist the Board in overseeing technology development to ensure that the Company’s technology supports the Company’s business objectives and strategies, providing counsel to the Company’s senior management on strategic innovation and technology matters, including pipeline product development and related personnel development. Specifically, the Information, Pipeline & Technology Committee is responsible for (1) interacting with management and external advisors to develop insights and recommendations regarding the Company’s approach to pipeline development and technical and commercial innovation, including: (a) provide feedback and input to management to gain alignment between strategic commercial objectives and the Company’s product development pipeline, new technology innovations consistent with the strategic direction of the Company, (b) provide feedback and input to management in the identification, evaluation, and oversight of appropriate pipeline, technology, and product development investments; (c) provide feedback and input to management to prioritize medical, clinical innovative technology needs that can effectively be addressed by the Company; (d) provide feedback and input into the development of measurement and tracking methods for significant pipeline, product development and other innovation projects; (e) provide feedback and input to practices and procedures to ensure that the Company's existing and new product technologies are developed and commercialized according to proper safety, health and regulatory compliance principles; and (f) provide feedback and input into the assessment of new and existing intellectual property assets and risks; (2) supporting the recruitment and interacting with the Company's scientific advisory board; and (3) providing feedback and input regarding the Company's development of innovative new business models, strategies and tactics, especially in light of potential competitive products that are being developed or marketed by others in this field.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serve as a member of a board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or the Culture and Compensation Committee.

Code of Business Conduct and Ethics

Our Board adopted the Code of Business Conduct and Ethics, which is applicable to all executives, directors, and employees. The Code of Business Conduct and Ethics is available in print to any stockholder that requests a copy by contacting Investor Relations at our corporate headquarters. Our Code of Business Conduct and Ethics is also available in the Investors section of our website at www.neogenomics.com. We intend to make any disclosures regarding amendments to, or waivers from, the Code of Business Conduct and Ethics required under Form 8-K by posting such information on our website.

Policy Against Hedging of Stock

Our insider trading policy prohibits our directors, officers, and employees from entering into hedging transactions, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars, and exchange funds, because such transactions may permit a director, officer or employee to continue to own securities obtained through our employee benefit plans or otherwise, but without the full risks and rewards of ownership. When that occurs, the individual may no longer have the same objectives as our other stockholders.

Stockholder Recommendations for Board Candidates

Under its charter, the Nominating and Corporate Governance Committee is responsible for considering potential director nominees submitted by stockholders. The Nominating and Corporate Governance Committee does not have a formal policy with respect to the consideration of director candidates recommended by stockholders from other sources. Such recommendations should be

| NeoGenomics, Inc. | 15 |

2024 Proxy Statement | ||||||

| Proposal 1 | ||||||||

submitted to the Corporate Secretary of the Company and should include information about the background and qualifications of the candidate, as well as any other information required by our Amended and Restated Bylaws. (the "Bylaws").

Stockholder Communications with the Board

Stockholders may, at any time, communicate with the full Board or any individual member of the Board by mailing a written communication to NeoGenomics, Inc., 9490 NeoGenomics Way, Fort Myers, Florida 33912, Attention: Alicia Olivo, Corporate Secretary. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.” All such letters must identify the author as a stockholder, provide evidence of the sender’s stock ownership and clearly state whether the intended recipients are all members of the Board or a particular director or directors. The Corporate Secretary will then forward such correspondence, without editing or alteration, to the Board or to the specified director(s) on or prior to the next scheduled meeting of the Board. The Board will determine the method by which such submission will be reviewed and considered. The Board may also request the submitting stockholder to furnish additional information it may reasonably require or deem necessary to sufficiently review and consider the submission of such stockholder. The Corporate Secretary's Office generally does not forward communications from stockholders that are not related to the duties and responsibilities of the Board, including junk mail, service complaints, employment issues, business suggestions, job inquiries, opinion surveys, and business solicitations.

Vote Required for Approval

The nine nominees receiving the majority of votes cast “FOR” their election by stockholders virtually or by proxy will be elected. Proposal 1 is a “non-discretionary” or “non-routine” item, meaning that brokerage firms cannot vote shares in their discretion on behalf of a client if the client has not given voting instructions. Accordingly, if you hold your shares in street name and fail to instruct your broker to vote your shares, your shares will not be counted as votes cast and will have no effect on the outcome of Proposal 1.

Board Recommendation

The Board unanimously recommends a vote “FOR” the election of each of the nominees as director in Proposal 1.

| NeoGenomics, Inc. | 16 |

2024 Proxy Statement | ||||||

PROPOSAL 2—ADVISORY VOTE ON THE COMPENSATION PAID

TO OUR NAMED EXECUTIVE OFFICERS

TO OUR NAMED EXECUTIVE OFFICERS

We are providing our stockholders with the opportunity to express their views on our Named Executive Officers’ compensation as set forth under “Executive Compensation” by casting their vote on Proposal 2. This non-binding, advisory vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers as described in this Proxy Statement.

The Board believes our executive compensation program, which is described in detail in the “Executive Compensation” section, is designed to balance the goals of attracting and retaining talented executives who are motivated to achieve our annual and long-term strategic goals, while keeping the program affordable and appropriately aligned with stockholder interests and business results. We believe that our executive compensation program accomplishes these goals in a way that is consistent with our purpose and core values, and the long-term interests of the Company and its stockholders. Our equity compensation (which is primarily awarded in the form of stock option awards, restricted stock, and performance-based restricted stock with stock price growth and 3-year revenue growth vesting criteria) is designed to build executive ownership, align the incentives of our Named Executive Officers with those of our stockholders, and focus them on achieving our long-term strategic goals (both financial and non-financial).

Although the vote on Proposal 2 regarding the compensation of our Named Executive Officers is not binding, the Board and the Culture and Compensation Committee value the opinions of our stockholders and will consider the result of the vote when determining future executive compensation arrangements.

If this proposal is approved, our stockholders will be approving the following resolution:

RESOLVED, that the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K in the Company’s Proxy Statement for the 2024 Annual Meeting of Stockholders, is hereby approved.

Vote Required for Approval

The compensation paid to our Named Executive Officers will be considered approved if a majority of the votes cast by stockholders virtually or via proxy with respect to this matter are cast in favor of this Proposal 2.

Board Recommendation

The Board unanimously recommends a vote “FOR” Proposal 2.

| NeoGenomics, Inc. | 17 |

2024 Proxy Statement | ||||||

PROPOSAL 3—FOURTH AMENDMENT OF THE EMPLOYEE STOCK PURCHASE PLAN

The Company currently maintains the NeoGenomics, Inc. Employee Stock Purchase Plan, most recently amended on April 14, 2022 and effective on June 2, 2022 (the “ESPP”).

The ESPP provides employees of the Company and its subsidiaries the opportunity to acquire an ownership interest in the Company through the purchase of Company common stock at a price below current market prices.

The Board approved and is recommending that the Company’s stockholders approve the Fourth Amendment of the ESPP (the “ESPP Amendment”) to increase the number of shares of common stock reserved for issuance under the ESPP by 1,000,000 shares to 3,500,000 shares. As of March 31, 2024, there were 2,500,000 shares of the Company’s common stock reserved under the ESPP, of which approximately 315,000 shares were available for future purchases. Accordingly, if the ESPP Amendment is approved, approximately 1,315,000 shares would be available for future purchases.

Other than the increase in reserved shares described above, the ESPP as amended by the ESPP Amendment continues to provide essentially the same substantive terms and provisions as the existing ESPP.

Description of the Plan

Administration of the ESPP

Our Board has authority to administer, interpret and implement the terms of the ESPP. The Board may delegate its powers under the ESPP to a committee of the Board composed of at least two members, each of whom may qualify as a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act, and/or an “outside director” in accordance with Section 162(m) of the Code. References to the Board herein will mean the committee as well. The Board will have the discretion to set the terms of each offering in accordance with the provisions of the ESPP, to designate any subsidiaries of the Company to participate in the ESPP, to make all determinations regarding the ESPP, including eligibility, and otherwise administer the ESPP. Our Board has delegated administration of the ESPP to the Culture and Compensation Committee. In this summary, we use the term “our Board” to refer to the administrator of the ESPP.

Number of Authorized Shares

If the ESPP Amendment is approved, a total of 3,500,000 shares of our common stock will be reserved under the amended ESPP, of which approximately 1,315,000 shares would be available for future purchases under the ESPP, subject to adjustment in the event of any significant change in our capitalization, such as a stock split, a combination or exchange of shares, or a stock dividend or other distribution. If any option under the ESPP is terminated without having been exercised, the shares of common stock subject to such option will again become available under the ESPP.

Eligibility and Participation

All our employees are generally eligible to participate in the ESPP. However, the Board may provide with respect to any offering that employees will not be eligible to participate in the offering if they are customarily employed by us or any participating subsidiary for less than 20 hours per week or less than five months in any calendar year. As of March 31, 2024, approximately 2,000 employees were eligible to participate in the ESPP. The Board also may exclude from an offering period highly compensated employees or employees who have not satisfied a minimum period of employment with us, which may not exceed a period of two years. In addition, an employee may not be granted rights to purchase stock under our ESPP if such employee would:

•immediately after any grant of purchase rights, own stock possessing five percent or more of the total combined voting power or value of all classes of our capital stock; or

•hold rights to purchase stock under all our employee stock purchase plans that would accrue at a rate that exceeds $25,000 worth of our stock for each calendar year.

Offering Periods

The ESPP provides for offering periods as short as one month or as long as 27 months. The Board may specify a maximum number of shares of common stock that any participant may purchase during an offering period. During each offering period, participants authorize payroll deductions on an after-tax basis from the participants’ base pay, subject to certain limits.

| NeoGenomics, Inc. | 18 |

2024 Proxy Statement | ||||||

| Proposal 3 | ||||||||

Exercise of Purchase Rights

Amounts deducted and accumulated by the participant are used to purchase shares of our common stock at the end of each offering period. The purchase price of the shares will not be less than 85% of the fair market value of our common stock on the first trading day of the offering period or on the last day of the offering period, whichever is lower. The fair market value of our common stock as of March 28, 2024, was $15.72 per share. Participants may withdraw from participation in the ESPP at any time during an offering period and will be paid their accrued payroll deductions that have not yet been used to purchase shares of common stock. Participation ends automatically upon termination of employment with us.

Corporate Transactions

In the event of a sale of all or substantially all the assets of the Company or a merger or consolidation or other corporate transaction, the surviving or acquiring corporation shall assume outstanding rights under the ESPP or, in the event any surviving or acquiring corporation refuses to assume such rights, then as determined by the Board, such rights may continue in full force and effect, the applicable offering may be terminated and accumulated payroll deductions refunded to the participants or the participants’ accumulated payroll deductions may be used to purchase shares prior to such transaction.

Amendment and Termination