DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on October 21, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| x | Soliciting Material under §240.14a-12 | |

NeoGenomics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

| (5) | Total fee paid:

|

|||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

|

|||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

| (3) | Filing Party:

|

|||

| (4) | Date Filed:

|

|||

Filed by NeoGenomics, Inc.

Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: NeoGenomics, Inc.

Commission File No.: 001-35756

On October 21, 2015, the following three communications were made by NeoGenomics, Inc.:

NeoGenomics, Inc. issued the following press release:

NeoGenomics signs Definitive Agreement to acquire Clarient, Inc.

GE Healthcare retains significant stake in NeoGenomics and Parties agree to collaborate on

Bioinformatics Initiative

Fort Myers, FL October 21, 2015 NeoGenomics, Inc. (NASDAQ: NEO), a leading provider of cancer-focused genetic testing services, announced today that it has reached an agreement to acquire Clarient, Inc., and its wholly-owned subsidiary Clarient Diagnostic Services, Inc., a provider of comprehensive cancer diagnostic testing to hospitals, physicians and the pharmaceutical industry (together Clarient). Clarient, a unit of GE Healthcares Life Sciences business, is based in Aliso Viejo, California and Houston, Texas and has approximately 415 employees. Clarient had 2014 revenue of $127 million and Adjusted EBITDA(1) of approximately $13 million.

The acquisition will allow NeoGenomics to broaden its offering of innovative cancer diagnostic tests to hospitals and physicians across the country, and to accelerate its growth in the fast-growing worldwide market for pharmaceutical clinical trials and research. The complementary product offerings and expanded geographical reach of the combined companies are expected to provide customers with substantial benefits and create a significantly larger and more diversified provider of precision oncology diagnostics.

Clarients outstanding pathology services and capabilities in the analysis of solid tumor cancers of the breast, colon and lung are highly complementary to NeoGenomics industry-leading molecular testing services and extensive expertise in testing for hematologic cancers. Hospital, physician, and pharmaceutical industry clients will benefit from the combined companys ability to offer a wider range of world-class tests, closer geographical access to services, and enhanced service capabilities. The acquisition will allow the combined company to further leverage its existing laboratory facilities and infrastructure to drive productivity and lower operating costs.

The transaction purchase price includes $80 million in cash, $110 million in Preferred Stock, and 15 million shares of NeoGenomics Common Stock, subject to customary adjustments for working capital at close. The Preferred Stock will be issued at $7.50 per share and is redeemable at the option of NeoGenomics at any time over its ten year term along with any accrued dividends(2) at the original issue price with certain incentives for early redemption(3). After three years, GE Healthcare will have the option to convert the Preferred Stock and any accrued dividends to NeoGenomics Common Stock at $7.50 per share if the volume weighted average price of NeoGenomics Common Stock is above $8.00 per share for thirty consecutive trading days. If still outstanding on the tenth anniversary, the Preferred Stock and any accrued dividends will automatically convert into common stock at $7.50 per share.

The transaction is subject to approval by the relevant anti-trust authorities and NeoGenomics shareholders and is anticipated to close in Quarter 4, 2015. On a fully diluted basis, assuming full conversion of the preferred stock, GE Healthcare will beneficially own approximately 32% of NeoGenomics. As part of the transaction, the NeoGenomics Board of Directors will be expanded with the appointment of a new director from GE Healthcare. In addition, NeoGenomics and GE Healthcare have agreed to collaborate on a new bioinformatics initiative that combines their shared interest in precision oncology.

NeoGenomics Chairman and CEO, Mr. Douglas VanOort, commented, Our vision is to become Americas premier cancer testing laboratory, and this acquisition is a major step forward in achieving that vision. We have always respected Clarients outstanding capabilities, and are very pleased to be able to combine them with our own outstanding service offering. Hospital, physician, and pathology clients will benefit from our ability to offer the best of the best products and services available from each company. We are particularly pleased to add Clarients sizable and fast-growing clinical trial support business to further strengthen our own initiatives in this area.

Mr. VanOort continued, Providing there are no unexpected changes to reimbursement in 2016, we expect our revenue to more than double to approximately $240 - $250 million and our Adjusted EBITDA to more than triple to between $33 and $38 million on a pro forma basis in 2016. This will be a deliberately executed integration, and we expect synergy realization to begin modestly with approximately $4-6 million of realized synergies in 2016. However, by the end of year 3, we expect $20-$30 million per year of realized synergies as we strive to be the high-quality and low-cost provider in cancer genetic testing. Our increased scale will also enhance our ability to innovate in new areas of precision medicine. Of all the possible acquisition candidates we have reviewed, Clarient is by far the best fit for NeoGenomics.

Mr. VanOort concluded, In addition, NeoGenomics and GE Healthcare have agreed to collaborate on a new bioinformatics initiative that combines their shared interest in precision oncology. The collaboration will explore the potential for new products that combine genomic and imaging data, with the aim of helping reduce healthcare costs and improving the care of patients with cancer.

Ms. Cindy Collins, CEO of Clarient Diagnostic Services, said, Were proud of the highly talented and dedicated people at Clarient, who deliver an outstanding level of service to physicians and to leading players in the pharmaceutical industry, helping guide patient treatment and supporting the discovery and development of new medicines. We believe the business will benefit from the focus that will come from being part of NeoGenomics, while allowing GE Healthcare Life Sciences to focus on its core long-term growth areas in bioprocessing, cell therapy and disease imaging.

| (1) | Adjusted EBITDA is a non-GAAP measure and is defined as earnings before interest, taxes, depreciation, amortization, non-recurring charges and non-cash stock-based compensation expenses. Clarients historical Adjusted EBITDA also includes certain other adjustments to make Clarients historical financials consistent with the business and operations being acquired by NeoGenomics. The full details of such adjustments will be included in the Proxy Statement for this transaction. |

| (2) | Beginning one year after issuance, the Preferred Stock will start to accrue payment-in-kind (PIK) dividends at the rate of 4% per annum. To the extent such Preferred Stock has not been redeemed by NeoGenomics prior to the 4th anniversary of issuance, the dividend rate will be increased to 5% per annum in year 5 and increased by an additional 1% per annum per year thereafter until reaching 10% in year 10. |

| (3) | As an incentive to redeem the Preferred Stock in a timely manner, the redemption provisions provide for the following discounts if redemption occurs in the first four years. Partial redemptions will include an equivalent percentage discount of the amounts indicated below. |

| Redemption Period on or Before |

Discount on Full Redemption | |||

| The first anniversary of issuance: |

$ | 10.0 million | ||

| The second anniversary of issuance: |

$ | 7.5 million | ||

| The third anniversary of issuance: |

$ | 5.0 million | ||

| The fourth anniversary of issuance: |

$ | 2.5 million | ||

Conference Call

NeoGenomics has scheduled a web-cast and conference call to discuss this acquisition with research analysts and investors today at 11:00 AM EDT. Interested investors should dial (877) 407-0782 (domestic) and (201) 689-8567 (international) at least five minutes prior to the call and ask for Conference ID Number 13623193. A replay of the conference call will be available until 11:59 PM on November 3, 2015 and can be accessed by dialing (877) 660-6853 (domestic) and (201) 612-7415 (international). The playback conference ID Number is 13623193. The web-cast may be accessed visiting the link https://www.webcaster4.com/Webcast/Page/1219/11294 and can be viewed after the web-cast under the Investor Relations section of our website at www.neogenomics.com. An archive of the web-cast will be available until 11:59 PM on January 20, 2016.

About NeoGenomics, Inc.

NeoGenomics, Inc. is a high-complexity CLIAcertified clinical laboratory that specializes in cancer genetics diagnostic testing, the fastest growing segment of the laboratory industry. The companys testing services include cytogenetics, fluorescence in-situ hybridization (FISH), flow cytometry, immunohistochemistry, anatomic pathology and molecular genetic testing.

Headquartered in Fort Myers, FL, NeoGenomics has laboratories in Nashville, TN, Irvine, Fresno and West Sacramento CA, Tampa and Fort Myers, FL. NeoGenomics services the needs of pathologists, oncologists, other clinicians and hospitals throughout the United States. For additional information about NeoGenomics, visit http://www.neogenomics.com.

Forward Looking Statements

Except for historical information, all of the statements, expectations and assumptions contained in the foregoing are forward-looking statements. These forward looking statements involve a number of risks and uncertainties that could cause actual future results to differ materially from those anticipated in the forward looking statements, Actual results could differ materially from such statements expressed or implied herein. Factors that might cause such a difference include, among others, the companys ability to continue gaining new customers, offer new types of tests, and otherwise implement its business plan. As a result, this press release should be read in conjunction with the companys periodic filings with the SEC.

Additional Information

NeoGenomics will solicit the required approval of its stockholders by means of a proxy statement, which will be mailed to stockholders upon completion of the required Securities and Exchange Commission (SEC) filing and review process. The proxy statement will contain information about NeoGenomics, Clarient, the proposed transaction and related matters. NeoGenomics stockholders are urged to read the proxy statement carefully when it is available, as it will contain important information that stockholders should consider before making a decision about the transaction. In addition to receiving the proxy statement from NeoGenomics in the mail, stockholders will also be able to obtain the proxy statement, as well as other filings containing information about NeoGenomics, without charge, at the SECs web site, www.sec.gov, or from NeoGenomics at its website, www.neogenomics.com, or by mailing NeoGenomics, Inc., 12701 Commonwealth Drive, Suite 9, Fort Myers, Florida 33913 Attention: Fred Weidig, Corporate Secretary.

Participants in Solicitation

NeoGenomics and its executive officers and directors may be deemed to be participants in the solicitation of proxies from NeoGenomics stockholders with respect to the proposed transaction. Information regarding any interests that NeoGenomics executive officers and directors may have in the transaction will be set forth in the proxy statement.

For further information, please contact:

| NeoGenomics, Inc. | Hawk Associates, Inc. | |||

| Steven C. Jones | Ms. Julie Marshall | |||

| Director of Investor Relations | (305) 451-1888 | |||

| (239) 325-2001 | neogenomics@hawkassociates.com | |||

| sjones@neogenomics.com |

Transcript of October 21, 2015 NeoGenomics, Inc. Acquisition of Clarient, Inc. Conference Call and Webcast:

NeoGenomics Special Investor Meeting/Webinar

2015 Conference Call Script

Opening Remarks

The conference call operator announces the Special Meeting for Investors conference call for NeoGenomics, Inc. and turns it over to Douglas VanOort, the Chairman and Chief Executive Officer of NeoGenomics.

Doug VanOort

Good morning. Id like to welcome everyone to NeoGenomics Special Investor webinar and conference call. Our objective this morning is to provide additional information about todays announcement that NeoGenomics signed a Definitive Agreement to acquire Clarient Inc.

Joining me in our Irvine Lab this morning are Steve Jones, our Executive Vice President for Finance, and George Cardoza, our Chief Financial Officer.

Also joining us this morning by telephone from Moscow is Kieran Murphy, CEO of GE Healthcare Life Sciences, and from London is Kevin ONeil, Chief Financial Officer for GE Healthcare Life Sciences.

Before we begin our prepared remarks, Steve Jones will read the standard language about Forward-Looking Statements.

Steve Jones

This conference call may contain forward looking statements, which represent our current expectations and beliefs about our operations, performance, financial condition and growth opportunities. Any statements made on this call that are not statements of historical fact are forward-looking statements. These statements by their nature involve substantial risks and uncertainties, certain of which are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements. Any forward-looking statement speaks only as of today, and we undertake no obligation to update any such statements to reflect events or circumstances after today.

Dougs Comments

Thanks Steve. And wed like to thank everyone who has joined this meeting on short notice.

For those of you who have not joined our webinar, weve posted the presentation that we will now review on our website in the Investor Relations Section under NeoGenomics-Clarient acquisition. You may refer to it and well indicate the page numbers as we go through the presentation.

Id first like to say how very pleased we are to have announced this transaction. This is a transformative acquisition for NeoGenomics, and the two companies are the most complementary companies in our industry. This combination creates enormous potential for us.

NeoGenomics acquisition of Clarient is something weve actively discussed with GE for over a year, and both the NeoGenomics and GE teams have been working very hard to complete this transaction since the beginning of this year.

Transaction Background page 3

Referring to page 3 of our presentation now, we want to give you some background for context.

Weve discussed broadly, and believe most investors in NeoGenomics have known for some time about, NeoGenomics Vision and key strategic objectives.

Our Vision has been to become Americas premier cancer testing laboratory.

Our key strategic goals have been to be a low-cost and high-quality provider, to grow by being a One-stop-Shop for our clients, to aggressively innovate to lead in the field of Precision Medicine, and to diversify our product line and particularly to grow in the area of clinical trials testing to support the BioPharmaceutical industry.

Very simply, our acquisition of Clarient significantly accelerates our ability to achieve that Vision, and to achieve each of those strategies. In that sense, this acquisition is truly transformational.

As we conducted our analysis of acquisition candidates, and targeting strategies, Clarient always rose to the top of the list as clearly the best one for NeoGenomics. The businesses are highly complimentary, and we are very excited to combine the companies into one very powerful cancer genetics company.

Clarient Background page 4

Page 4 provides an overview of Clarient. Its largest Lab in Aliso Viejo, California is almost 80,000 square feet, and is right down the road from our Irvine Lab. I drove between the labs yesterday and it took me less than 15 minutes.

Interestingly, their lab uses a lot of the same equipment as our lab, it uses many of the same processes, and even the same fundamental LIS system.

Clarient serves the same clinical clients as NeoGenomics. They provide the very same services in IHC, Flow cytometry, FISH, Cytogenetics and Molecular testing. In fact, many of their clients are also our clients.

One of the very attractive elements of Clarient is their BioPharma clinical trial support business. This is many times larger than our own, has been growing nicely, and will be a wonderful platform for future growth.

2

In terms of product lines, this is a marriage made in heaven. The two companies offer the same testing services, but Clarients mix is more heavily weighted in IHC and Digital Pathology, while NeoGenomics mix is heavier in FISH and Molecular testing.

Combining Clarients product mix with our own, NeoGenomics will be a much more balanced competitor with the ability to offer the best services in virtually every major testing discipline available in precision oncology testing.

Achieving better balance and the ability to add to our product mix has always been an important part of our acquisition targeting strategy.

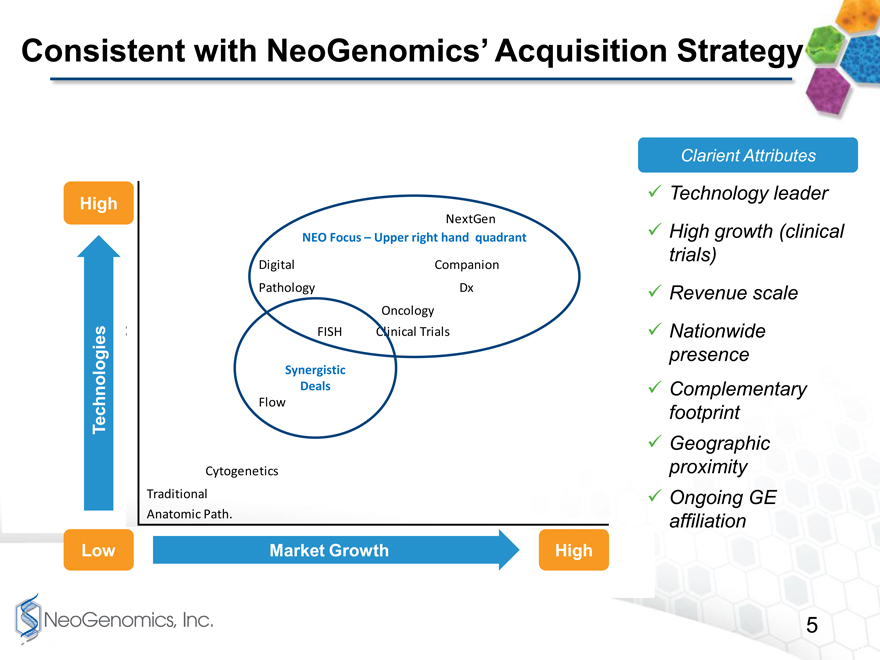

Consistent with Acquisition Strategy page 5

You may find it helpful to understand a bit about our general targeting strategy. This simple chart on page 5 is something weve used with our Board of Directors at each meeting for the past few years. It indicates our acquisition focus has been for companies operating with more advanced technology and in markets with higher growth rates. Companies offering such services as Next Generation sequencing, companion Diagnostics, Clinical trials, FISH, digital pathology, and similar services have been our targets.

Clarient operates squarely in the sweet spot here with their product mix. They are leaders in digital pathology and have been working hard in the area of companion diagnostics. In addition to being a technology leader and having developed their high-growth clinical trial support business, the acquisition also satisfies many other important attributes of our targeting process.

It gives us revenue scale and their main facility is geographically well-positioned for integration with NeoGenomics.

Another important attribute of this deal is our partnership and ongoing affiliation with GE. As part of this agreement, we announced a collaboration around bioinformatics, and I know Kieran will want to comment on that later in the presentation. \

The strategic rationale for this acquisition is fairly obvious.

Strategic Rationale page 6

Page 6 shows 8 key reasons for the deal. Both GE and our Board and advisors all believe these are compelling.

Clearly, by combining these businesses we create an opportunity to be the low-cost provider in each and every one of our key testing disciplines. And we all know that being a low cost provider is very important in our industry.

Weve discussed the benefits of having a comprehensive and well balanced product portfolio and the benefits of having a much larger clinical trials business to be able to build a very meaningful platform for future growth.

We also want to emphasize that larger scale also has important economies of scale benefits for Administrative functions, such as Regulatory, Compliance and Billing, as well as in Sales and

3

Marketing and Information Technology. Well have the opportunity to be more efficient and more effective.

A larger client base also allows us to take fuller advantage of innovation by each organization, and provides a more comprehensive national presence and geographic footprint for our clients and managed care organizations.

As with the obvious strategic rationale, the benefits of this transaction should also be obvious.

Key Benefits page 7

Page 7 shows a brief summary of some Key benefits of the deal. As a result of the similar service offering and other features, we believe there is $20 to $30 million of annual synergies realizable within 3-5 years. We are conservatively estimating that the bulk of those synergies are realized in 2017, but we estimate at least $6mm will be recognized in 2016. These synergies are real and are already fairly well defined. They include cost reductions in the Laboratory area, and in many Administrative and functional areas. Well discuss more about some of these synergies in a couple of minutes.

The combined company will also offer both East Coast and West Coast operations, and this will be a big benefit for clients and prospective clients. Also, the ability to combine our Irvine facility with Clarients Alsio Viejo facility will be terrific. We have already outgrown our Irvine Lab, and there is capacity in the Aliso Viejo Lab. Since those facilities are about 8 miles from one another, we have the opportunity to combine locations while keeping our highly trained people in the process.

This acquisition also positions NeoGenomics to be a leading industry consolidator. We know the industry has been hurt significantly by reimbursement pressure and other changes. As this acquisition is successfully integrated, we believe that other acquisition opportunities will open up for us.

In addition to the other key benefits shown here which weve discussed, I must say that we are also very excited about having GE as a long-term investor in NeoGenomics.

Weve been incredibly impressed with the people and capabilities of GE. GE Health Care is a fantastic company, and NeoGenomics will benefit from GEs presence on our Board and by our pursuit of joint initiatives in precision oncology.

Were particularly pleased to have agreed with GE to pursue a joint collaboration in precision oncology through the combination of genomic and imaging bioinformatics. Our prostate cancer liquid biopsy test is a good first candidate for this, and both companies are excited about this initiative.

Kieran Murphy

Id like to interject with a comment here. This is Kieran Murphy. Weve been in strategic dialogue with NeoGenomics now since almost the beginning of the year, and we are very supportive of NeoGenomics and of this transaction. We are going to be a significant shareholder

4

in the company and are optimistic about the potential of this combination of Clarient and NeoGenomics.

We will have a seat on the NeoGenomics Board of Directors, and will try to help the company achieve all its initiatives including growth in the Pharmaceutical clinical trials business, and in the bioinformatics area.

We see many benefits from the combination of the two Companies, particularly in terms of market opportunities.

The cancer genetics testing business has tremendous potential as new and exciting treatments and therapies are being developed. Much has been written about the future potential of precision medicine. At the core of the process is the testing that provides the key information needed by physicians to select the right treatment.

We believe NeoGenomics will be very well positioned for the future, and as a significant owners, we are excited to be a part of that.

Doug

Thank you Kieran. Were certainly looking forward to working with you and to our affiliation with GEHC.

In fact, we will plan to work closely with GEHC in the area of Pharmaceutical and clinical trial business development.

Clinical Trials BioPharma page 8

Particularly interesting to NeoGenomics is Clarients strong clinical trials support business as shown on page 8. With over $20 million in revenue and strong relationships with Pharmaceutical and Device companies, Clarient is well positioned to grow in clinical trials and in companion diagnostic testing. The recent approval of Mercks Keytruda drug with its companion PDL1 test is a prime example of the potential here.

Clarient has a strong pipeline of growth opportunities here, and we are very excited about advancing our strategy to grow in clinical trials by combining forces with Clarient for the benefit of BioPharmaceutical and research customers.

Kieran, perhaps youd like to add a comment on this?

Sure thanks, Doug.

Needless to say this is an issue which is taking up a lot of discussion among the major pharma companies at the moment. Clarient is formally represented on the advisory boards of companies like Merck / BMS / Roche Genentech / Ventana and in the course of those conversations we hear a lot about increasing demand for companion diagnostic tests alongside new drug launches.

The FDA in particular is keen to ensure that when new drugs are given to a patient they match the genetic signature of that individual patient, to make sure that they work. Some biologic

5

drugs will only be effective for patients of a specific genotype. It goes without saying that healthcare providers dont want to spend money on drugs that wont work and obviously patients dont want to have to go through drug treatments that are going to be ineffective, or potentially even harmful.

Clarient will often partner with pharmaceutical companies to support their clinical trials as they build a body of clinical data to help secure FDA approval for their new drugs. It also partners with IVD companies to develop robust new diagnostic tests used to support first the clinical trials, and ultimately through to clinical practice when and if the new drug is approved. This is now a $20MM+ business growing at 20%.

As I mentioned, GE Healthcare has long-established partnerships with the biopharma industry and we have built on those relationships to grow this part of the Clarient business. Those relationships will obviously be important in helping this part of the business continue to grow as part of NeoGenomics.

Back to you, Doug.

Thanks, Kieran. One of the other revenue growth areas we are excited about is in the area of cross selling.

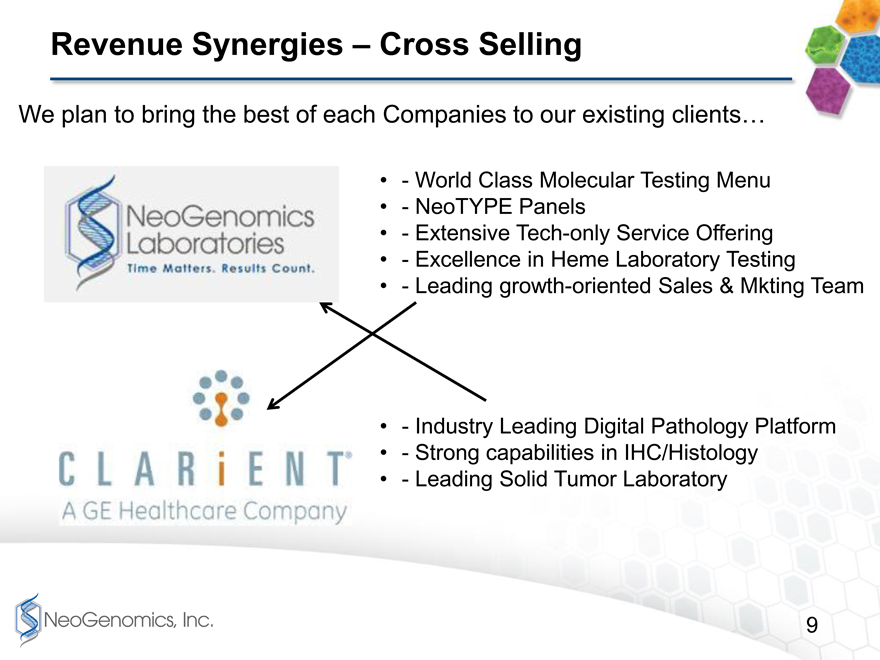

Revenue Synergies Cross-Selling page 9

A low-hanging opportunity for synergy is in cross-selling our services to each others clients. Page 9 shows the opportunity for NeoGenomics world class molecular services, for example, to be sold to existing Clarient accounts.

NeoGenomics has also been fortunate to have developed one of the best growth-oriented Sales and Marketing teams in the Industry, and we believe this organizational strength can be leveraged in this combination.

And that team will be very excited to sell Clarients world-class digital pathology and IHC products. Frankly, weve been working hard to develop a digital pathology and IHC capability to compete with Clarients services in this area for several years, and we know our clients love their services. Bringing the best of the best to all our clients will allow us to solidify our position as a one-stop shop, and will offer a compelling service package to new customers across the country.

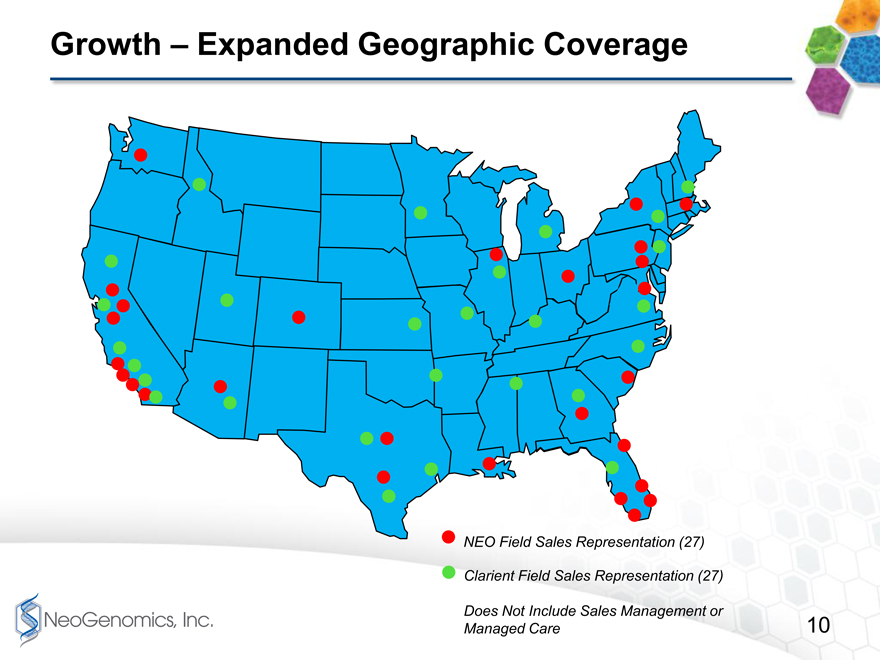

Growth Expanded geographic coverage page 10

Page 10 shows a map indicating the combined companies sales organization. Each company has 27 Sales Representatives. While there is some overlap, there also are areas where the combined company will fill in important gaps in sales coverage. We are very excited about the idea of combining the teams, and developing one highly productive sales team with extensive coverage throughout the country.

To summarize how this deal accelerates our strategies, we would bring your attention to page 11.

6

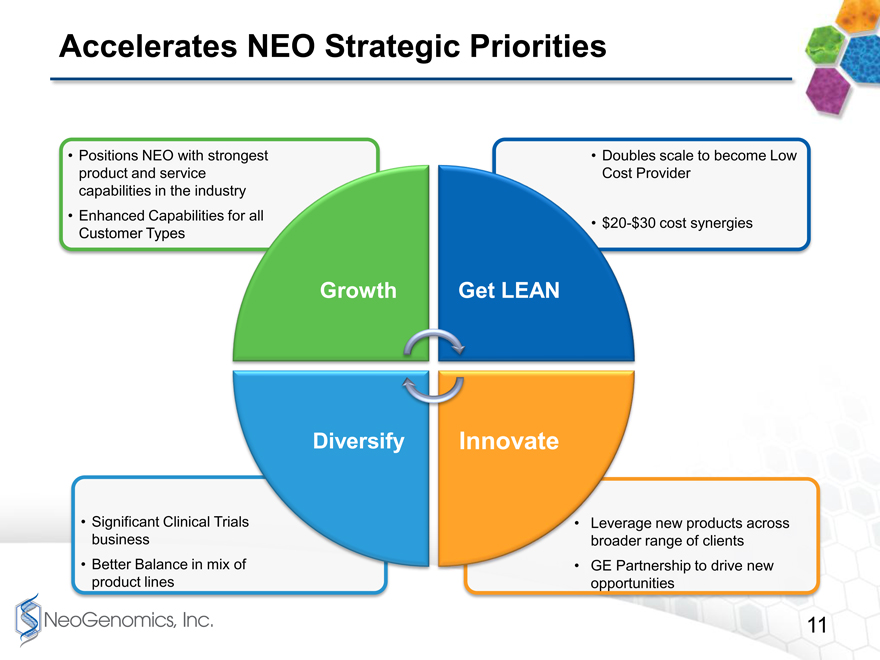

Accelerates NEO Strategic Priorities page 11

Weve shown this page 11 chart in our Investor Presentations for a few years now. Clearly, the acquisition of Clarient accelerates our strategies to grow, to get lean, to innovate more efficiently, and to diversify.

Ill turn it over to Steve to discuss the key components of the purchase price.

Steve Jones

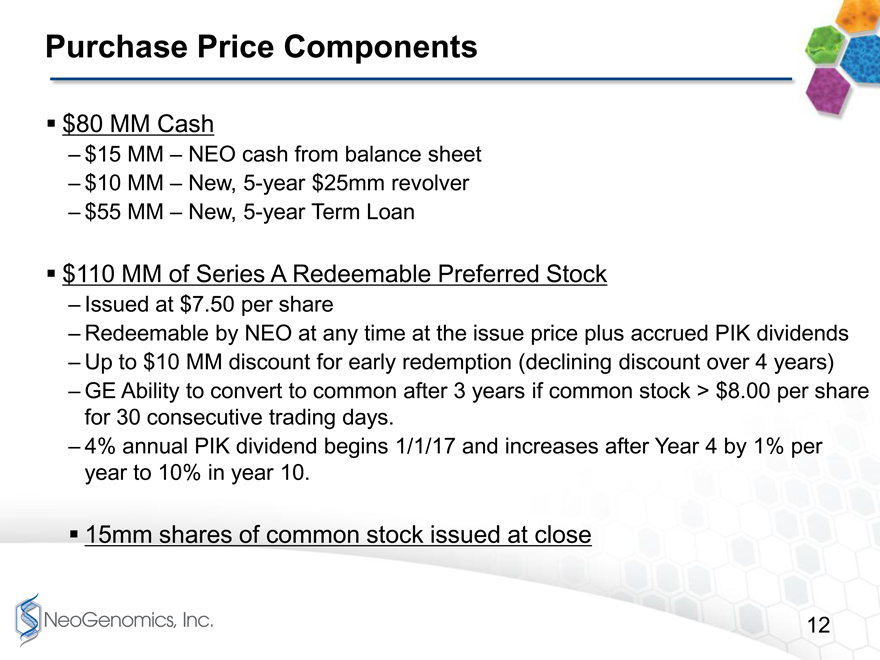

Purchase Price Components page 12

Purchase Price page 12

We are making this acquisition for $80 million of Cash, 15 million shares of NeoGenomics Common Stock and $110 million of NeoGenomics Series A Redeemable Preferred Stock.

With respect to the cash portion of the consideration, we plan to use $15 MM of the cash on our balance sheet and borrow another $65 MM of bank debt. AB Private Credit Investors, which is the middle market direct lending arm of AB, previously branded as Alliance Bernstein, will be providing a $55 MM Term Loan. In addition, Wells Fargo Capital Finance will be providing a $25 Million Revolving Credit Facility, from which we will draw $10 MM at close.

The Preferred Stock is being issued at $7.50 per share and it is redeemable at any time at the issue price plus accrued dividends, which will be paid in kind with additional shares of Series A Preferred. The PIK dividend rate is 0% in the first year, and then it jumps to 4% in years 2-4. Then beginning in year 5 it will increase 1% per year and will reach 10% in year 10 if it has not otherwise been redeemed first.

GE has also built in a substantial incentive for us to redeem this preferred stock early by providing discounts to the redemption price in the first four year. The discount starts at $10 million if a full redemption is completed in year 1, but will decrease by $2.5 million per year each year over the first 4 years.

GE will also have the ability to convert this Preferred Stock into common stock the $7.50 per share issue price after year 3 if the underlying price of our common stock trades above $8 per share for thirty consecutive trading days.

Based on yesterdays closing price of $5.68, the value of the common stock we will issue would be about $85 million, and the total consideration would be approximately $275 million.

George will give you some financial information

George Cardoza

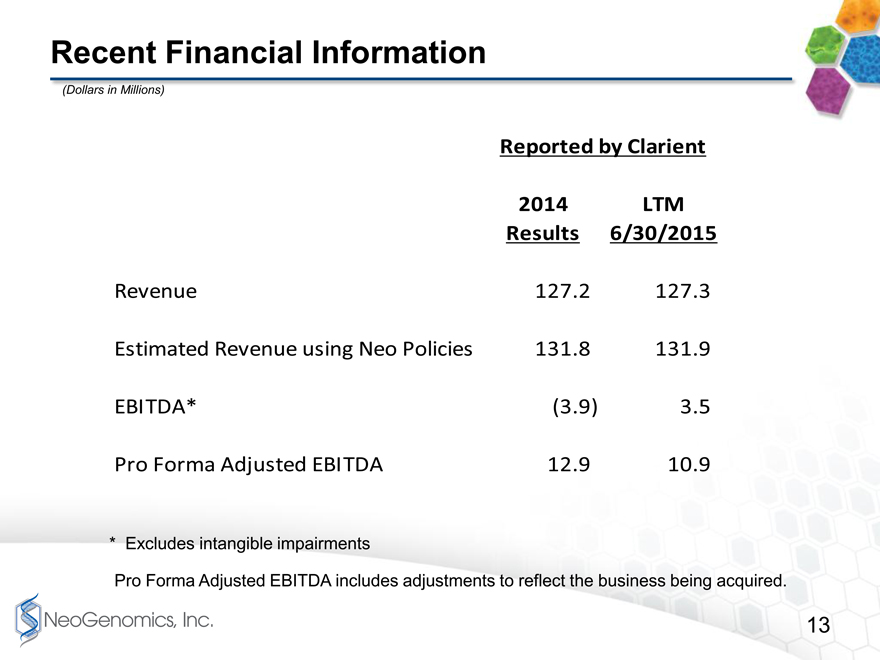

Recent Financial Information page 13

7

GE recently completed an audit of the carved out financial statements for the years ended 2012, 2013 and 2014. Shown here are the 2014 results as well as trailing 12 month numbers as of 6/30/15.

There are a number of adjustments required to bridge the Clarient results into pro forma NEO results, and the proxy will contain details of these adjustments. After all adjustments and conformance with NEO policies, we estimate that pro forma revenue will be approximately $132 million, and pro forma adjusted EBITDA will be approximately $11 million on a trailing 12 month basis. [George, explain the difference in bad debt reporting here]

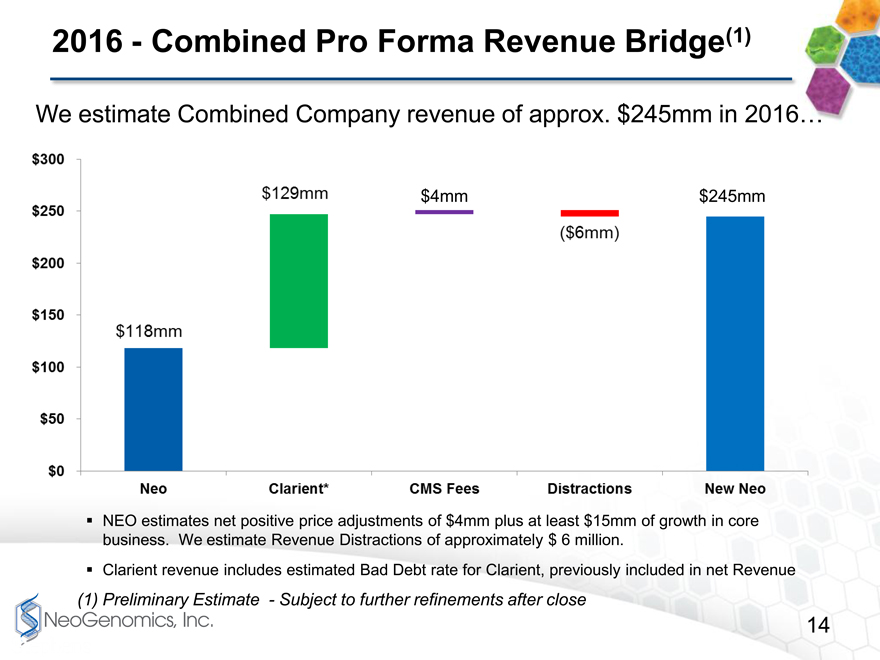

2016 Combined Pro Forma Revenue Bridge page 14

Assuming the acquisition closes at year end 2015, the first full year of combined performance should result in approximately $240 to 250 million in revenue as seen on page 14. For purposes of this analysis, weve assumed the 2016 CMS reimbursement levels proposed this past July are finalized without any material changes. We are also assuming approximately $6 million in negative synergy caused by integration-related distractions for our clients and sales team.

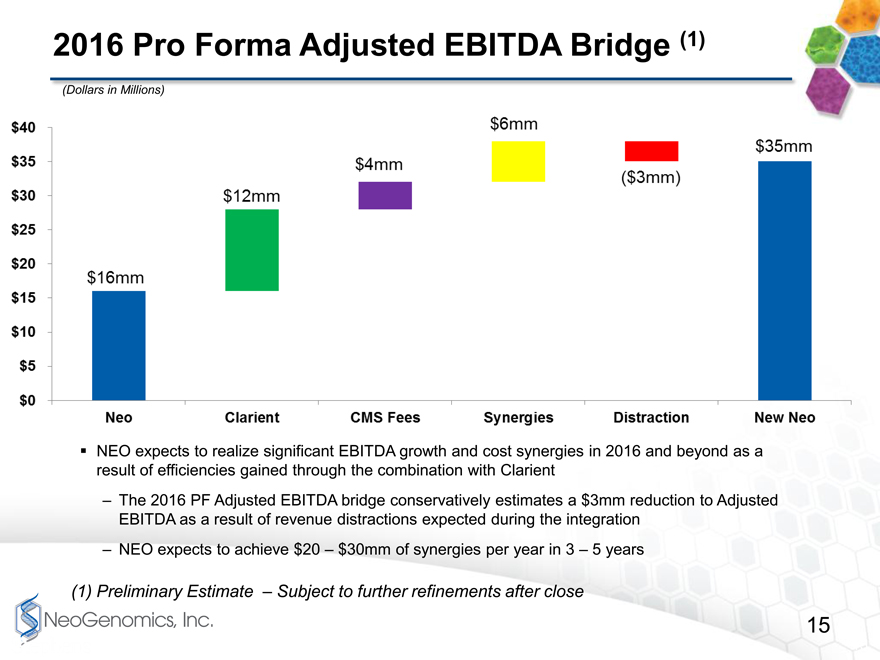

2016 Pro Forma Adjusted EBITDA Bridge page 15

The chart on page 15 shows our estimate of 2016 Adjusted EBITDA using those same assumptions. We are assuming here that we can generate adjusted EBITDA in 2016 of approximately $35 million with about $6 million of cost synergies realized in Year 1.

We do expect total cost synergies in the long-run to be in the range of $20 million to $30 million, and 2017 Adjusted EBITDA will obviously benefit significantly from that realization.

Im going to turn it back over to Steve to review the Implied Transaction Multiples with you.

Steve Jones

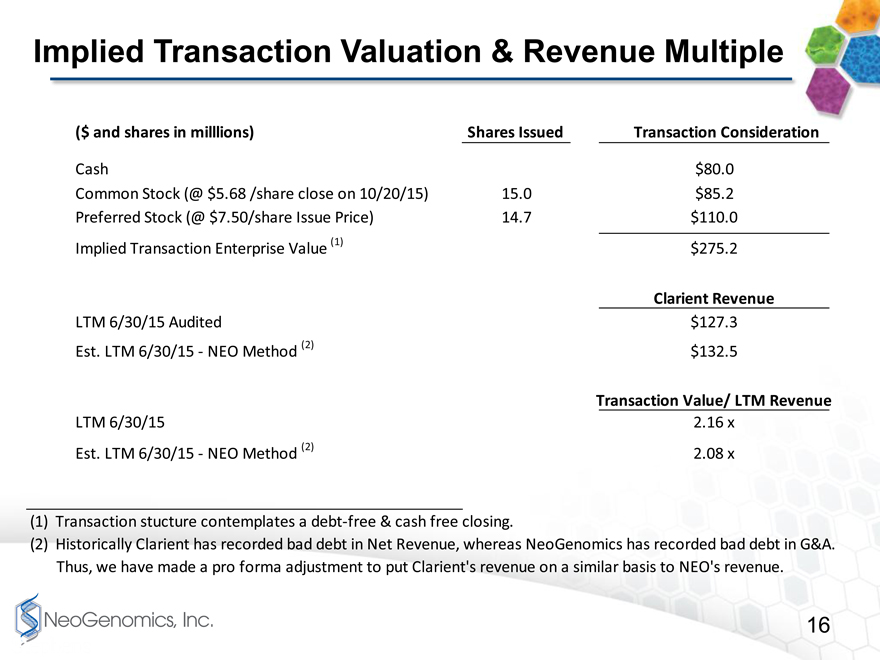

Implied Transaction Value Multiples page 16

Many of you will be trying to analyze the purchase price multiples, so we are trying to help you by analyzing it for you on page 19. For purposes of this analysis, we assumed a value of the common stock we will issue using yesterdays closing price of $5.68/share, which would result in about $85 million of common stock. On this basis, and counting the Preferred Stock at its $110 million liquidation preference value, the total transaction value is from approximately $275 million.

Given Clarients revenue as we just described, the purchase price multiples based on last 12 months revenue as of June 30, 2015, is approximately 2.1 to 2.2 times depending on whether you us Clarients historical method for reporting bad debt or the NeoGenomics method for reporting bad debt.

8

We commissioned a fairness opinion from Houlihan Lokey for this transaction. They compared both trading multiples and transaction multiples for selected peer companies in our industry and did extensive scenarios using Discounted Cash Flows. For transactions over $50 million for comparable laboratory companies, the mean and median transaction values expressed as a multiple of LTM revenue was 2.2 2.4 times.

We would like to point out however, that the value of synergies is quite sizable. On a present value basis, using a weighted average cost of capital of approximately 9%, the present value of synergies ranges from approximately $180 million to $215 million depending on what terminal value assumptions your use. Clearly this is a very compelling proposition for our shareholders.

Doug VanOort

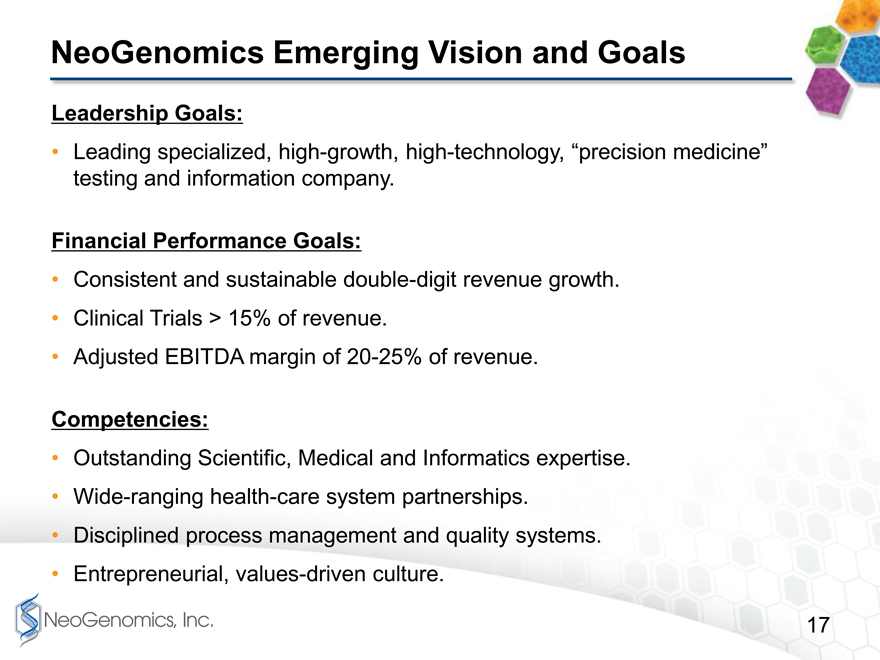

NEO Emerging Vision and Goals page 17

Well summarize this presentation by emphasizing how transformative this acquisition is for NeoGenomics.

Our Vision is to be a specialized high-growth, high-technology, precision oncology information and testing company. The company will be unique in America. From an Investment perspective, NeoGenomics will be one of the only pure specialized oncology testing companies in the country.

We believe our growth can be sustainably in the double-digit area, with a significant portion of that revenue coming from research and clinical trials.

We believe that Adjusted EBITDA margins will be in the 20-25% range.

With the key core competencies in genomic science, medicine, and bioinformatics, and with the high-quality and low cost platforms which result from large economies of scale, and with our driven and entrepreneurial culture, NeoGenomics is very well positioned with this acquisition to be a leader in Precision Oncology for many years to come.

On a personal note, Ive watched NeoGenomics grow from about $25 million in revenue when I came aboard about 6 years ago, to about $100 million in revenue today.

I believe this acquisition will drive tremendous value for our Company. We have built a great Company at NeoGenomics, and along with the talented team at Clarient, we are going to be even better than we are today.

Our vision that we set forth when I came aboard was To be Americas premier cancer testing laboratory. While that vision seemed pretty far away six years ago, it looks very different today. With Clarient, I believe we are going to become Americas premier cancer testing laboratory. Im extremely excited about what the future holds for NeoGenomics.

Steve Jones

9

At this point, I would like to close down our formal remarks and open it up for questions. Incidentally, if you are listening to this conference call via webcast only and would like to submit a question, please feel free to email us at sjones@neogenomics.com during the Q&A session and we will address your questions at the end if the subject matter hasnt already been addressed by our call-in listeners.

Operator, you may now open up the call for questions.

Expected Questions and Answers

Closing Remarks

As we end the call, I would like to recognize the wonderful team members and colleagues at GE Healthcare and GE Corporate as well as our NeoGenomics team members for their dedication and commitment to this important strategic initiative for Clarient and for NeoGenomics.

For those of you listening that are investors or are considering an investment in NeoGenomics, we thank you for your interest in our Company.

Good bye.

10

* * *

Additional Information

NeoGenomics will solicit the required approval of its stockholders by means of a proxy statement, which will be mailed to stockholders upon completion of the required Securities and Exchange Commission (SEC) filing and review process. The proxy statement will contain information about NeoGenomics, Clarient, the proposed transaction and related matters. NeoGenomics stockholders are urged to read the proxy statement carefully when it is available, as it will contain important information that stockholders should consider before making a decision about the transaction. In addition to receiving the proxy statement from NeoGenomics in the mail, stockholders will also be able to obtain the proxy statement, as well as other filings containing information about NeoGenomics, without charge, at the SECs web site, www.sec.gov, or from NeoGenomics at its website, www.neogenomics.com, or by mailing NeoGenomics, Inc., 12701 Commonwealth Drive, Suite 9, Fort Myers, Florida 33913 Attention: Fred Weidig, Corporate Secretary.

Participants in Solicitation

NeoGenomics and its executive officers and directors may be deemed to be participants in the solicitation of proxies from NeoGenomics stockholders with respect to the proposed transaction. Information regarding any interests that NeoGenomics executive officers and directors may have in the transaction will be set forth in the proxy statement.

NeoGenomics, Inc. made the following investor presentation available:

|

|

Acquisition of

Special Investor Presentation

October 21, 2015

|

|

Forward-looking Statements

This presentation contains statements which constitute forward-looking statements within the meaning of Section 27A of the Securities Act, as amended; Section 21E of the Securities Exchange Act of 1934; and the Private Securities Litigation Reform Act of 1995. The words may, would, could, will, expect, estimate, anticipate, believe, intend, plan, goal, and similar expressions and variations thereof are intended to specifically identify forward-looking statements. All statements that are not statements of historical fact are forward-looking statements.

Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. The risks that might cause such differences are identified in our filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise the forward looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events.

2

|

|

Transaction Background

NeoGenomics long-standing Vision and Strategy:

Vision: to become Americas premier cancer testing laboratory

Key Strategic Elements

High-quality and low-cost provider.

Growth by market share gains as one-stop-shop for cancer genetic testing.

Innovate aggressively to advance precision medicine

Diversify product line and enter BioPharma market.

Communicated desire to accelerate achievement of Vision and Strategies through M&A.

Clarient is a transformational acquisition for NEO creates ability to transform NEO quickly into industry leader.

Weve been in a strategic dialogue with GE for almost a year, and are extremely pleased with the outcome.

3

|

|

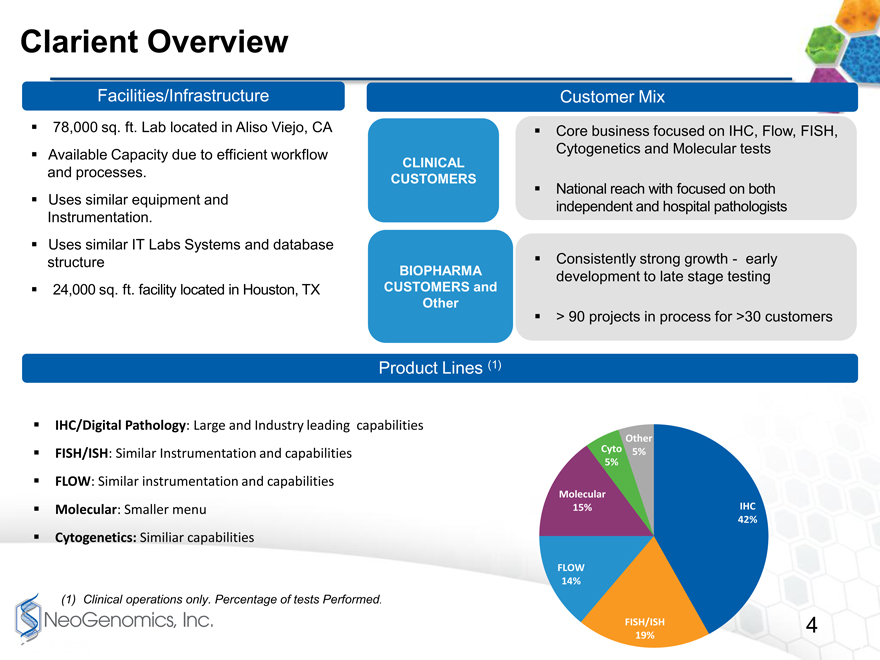

Clarient Overview

Facilities/Infrastructure

78,000 sq. ft. Lab located in Aliso Viejo, CA

Available Capacity due to efficient workflow CLINICAL

and processes. CUSTOMERS

Uses similar equipment and

Instrumentation.

Uses similar IT Labs Systems and database

structure BIOPHARMA

24,000 sq. ft. facility located in Houston, TX CUSTOMERS and

Other

Product Lines (1)

IHC/Digital Pathology: Large and Industry leading capabilities FISH/ISH: Similar Instrumentation and capabilities FLOW: Similar instrumentation and capabilities Molecular: Smaller menu

Cytogenetics: Similiar capabilities

(1) Clinical operations only. Percentage of tests Performed.

Customer Mix

Core business focused on IHC, Flow, FISH, Cytogenetics and Molecular tests

National reach with focused on both independent and hospital pathologists

Consistently strong growthearly development to late stage testing

> 90 projects in process for >30 customers

Other

Cyto 5%

5%

Molecular

15% IHC

42%

FLOW

14%

FISH/ISH 4

19%

4

|

|

Consistent with NeoGenomics Acquisition Strategy

High

NextGen

NEO Focus Upper right hand quadrant

Digital Companion

Pathology Dx

Oncology

FISH Clinical Trials

Synergistic

Deals

Technologies Flow

Cytogenetics

Traditional

Anatomic Path.

Low Market Growth High

Clarient Attributes

Technology leader

High growth (clinical trials)

Revenue scale

Nationwide presence

Complementary footprint

Geographic proximity

Ongoing GE affiliation

5

Confidential

5

|

|

Strategic Rationale

1. Opportunity to be the low-cost provider in each key laboratory discipline.

2. Ability to better balance clinical product portfolio and reduce risk profile from concentration in any one particular product line.

3. Enhance capability to develop a meaningful business in clinical trials.

4. Create greater economies of scale in Administrative/Corporate functions, including Information Technology, Regulatory, Billing, Compliance, etc.

5. Ability to leverage and optimize the Sales and Marketing function across a broader revenue base, and to provide better geographic coverage.

6. Ability to leverage innovation efforts/new product development across broader client base.

7. Create greater ability to serve Managed Care organizations and Large Buyers in a more significant way.

8. Ability to provide better one-stop-shop capability and service to existing and new clients.

6

|

|

Key Benefits

Synergy potential of $20mm$30mm/year within 3-5 year

Laboratory, Purchasing, Cross-selling, etc.

East Coast/West Coast labs

Combine Irvine and Aliso Viejo

Low cost position in every testing discipline

FISH, Flow, Cytogenetics, IHC, Digital Pathology, Molecular

Leadership in hematological and solid tumor cancers

One-stop-shop for clients with broad geographical coverage

Significant clinical trials business

Combined business approximates $25mm revenue

Potential to be a leading consolidator going forward

GE as significant long-term Investor

Collaboration in Bioinformatics in Precision Oncology

7

|

|

Clinical TrialsBioPharma

A rapidly growing part of Clarients business and a fantastic opportunity . . .

Over $20mm/yr in current business

Strong relationships with several leading Pharmaceutical firms

PDL1 22C3 FDA Approved companion diagnostic for Keytruda

Continued push into Companion Dx and personalized medicine

Approved vendor with top firms

On several firms advisory boards

Solid pipeline and future growth opportunities

8

|

|

Revenue Synergies Cross Selling

We plan to bring the best of each Companies to our existing clients

World Class Molecular Testing Menu

NeoTYPE Panels

Extensive Tech-only Service Offering

Excellence in Heme Laboratory Testing

Leading growth-oriented Sales & Mkting Team

Industry Leading Digital Pathology Platform

Strong capabilities in IHC/Histology

Leading Solid Tumor Laboratory

9

|

|

Growth Expanded Geographic Coverage

NEO Field Sales Representation (27)

Clarient Field Sales Representation (27)

Does Not Include Sales Management or

Managed Care 10

|

|

Accelerates NEO Strategic Priorities

Positions NEO with strongest product and service capabilities in the indu

Enhanced Capabilities Customer Types

Significant Clinical Tri business

Better Balance in mix product lines

Growth

Doubles scale to become Low

Provider

30 cost synergies

Get LEAN

Diversify

Innovate

e new products across

range of clients

rtnership to drive new

opportunities

11

|

|

Purchase Price Components

$80 MM Cash

$15 MM NEO cash from balance sheet

$10 MM New, 5-year $25mm revolver

$55 MM New, 5-year Term Loan

$110 MM of Series A Redeemable Preferred Stock

Issued at $7.50 per share

Redeemable by NEO at any time at the issue price plus accrued PIK dividends

Up to $10 MM discount for early redemption (declining discount over 4 years)

GE Ability to convert to common after 3 years if common stock > $8.00 per share for 30 consecutive trading days.

4% annual PIK dividend begins 1/1/17 and increases after Year 4 by 1% per year to 10% in year 10.

15mm shares of common stock issued at close

12

|

|

Recent Financial Information

(Dollars in Millions)

Reported by Clarient

2014 LTM

Results 6/30/2015

Revenue 127.2 127.3

Estimated Revenue using Neo Policies 131.8 131.9

EBITDA* (3.9) 3.5

Pro Forma Adjusted EBITDA 12.9 10.9

* Excludes intangible impairments

Pro Forma Adjusted EBITDA includes adjustments to reflect the business being acquired.

13

|

|

2016Combined Pro Forma Revenue Bridge(1)

We estimate Combined Company revenue of approx. $245mm in 2016

$4mm $245mm

NEO estimates net positive price adjustments of $4mm plus at least $15mm of growth in core business. We estimate Revenue Distractions of approximately $ 6 million.

Clarient revenue includes estimated Bad Debt rate for Clarient, previously included in net Revenue

(1) Preliminary Estimate Subject to further refinements after close

Confidential

14

|

|

2016 Pro Forma Adjusted EBITDA Bridge (1)

(Dollars in Millions)

NEO expects to realize significant EBITDA growth and cost synergies in 2016 and beyond as a result of efficiencies gained through the combination with Clarient

The 2016 PF Adjusted EBITDA bridge conservatively estimates a $3mm reduction to Adjusted EBITDA as a result of revenue distractions expected during the integration

NEO expects to achieve $20 $30mm of synergies per year in 3 5 years

(1) Preliminary Estimate Subject to further refinements after close

15

Confidential

15

|

|

Implied Transaction Valuation & Revenue Multiple

($ and shares in milllions) Shares Issued Transaction Consideration

Cash $80.0

Common Stock (@ $5.68 /share close on 10/20/15) 15.0 $85.2

Preferred Stock (@ $7.50/share Issue Price) 14.7 $110.0

Implied Transaction Enterprise Value (1) $275.2

Clarient Revenue

LTM 6/30/15 Audited $127.3

Est. LTM 6/30/15 NEO Method (2) $132.5

Transaction Value/ LTM Revenue

LTM 6/30/15 2.16 x

Est. LTM 6/30/15 NEO Method (2) 2.08 x

(1) Transaction stucture contemplates a debt-free & cash free closing.

(2) Historically Clarient has recorded bad debt in Net Revenue, whereas NeoGenomics has recorded bad debt in G&A. Thus, we have made a pro forma adjustment to put Clarients revenue on a similar basis to NEOs revenue.

16

|

|

Confidential

NeoGenomics Emerging Vision and Goals

Leadership Goals:

Leading specialized, high-growth, high-technology, precision medicine testing and information company.

Financial Performance Goals:

Consistent and sustainable double-digit revenue growth.

Clinical Trials > 15% of revenue.

Adjusted EBITDA margin of 20-25% of revenue.

Competencies:

Outstanding Scientific, Medical and Informatics expertise.

Wide-ranging health-care system partnerships.

Disciplined process management and quality systems.

Entrepreneurial, values-driven culture.

17

|

|

Appendix

Appendix

18

|

|

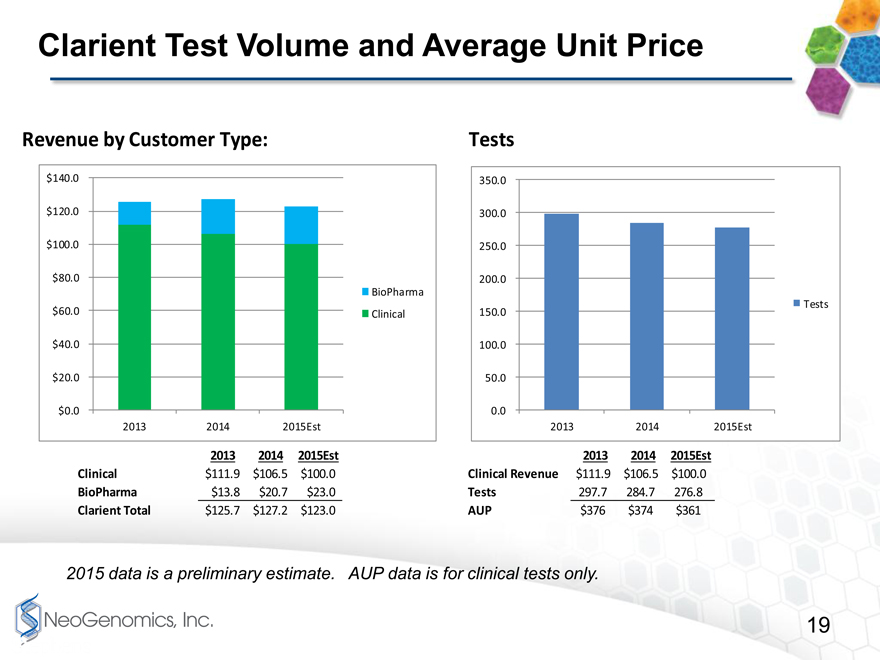

Clarient Test Volume and Average Unit Price

Revenue by Customer Type:

$140.0

$120.0

$100.0

$80.0

BioPharma

$60.0 Clinical

$40.0

$20.0

$0.0

2013 2014 2015Est

Tests

350.0

300.0

250.0

200.0

Tests

150.0

100.0

50.0

0.0

2013 2014 2015Est

2013 2014 2015Est 2013 2014 2015Est

Clinical $111.9 $106.5 $100.0 Clinical Revenue $111.9 $106.5 $100.0

BioPharma $13.8 $20.7 $23.0 Tests 297.7 284.7 276.8

Clarient Total $125.7 $127.2 $123.0 AUP $376 $374 $361

2015 data is a preliminary estimate. AUP data is for clinical tests only.

19

|

|

Confidential

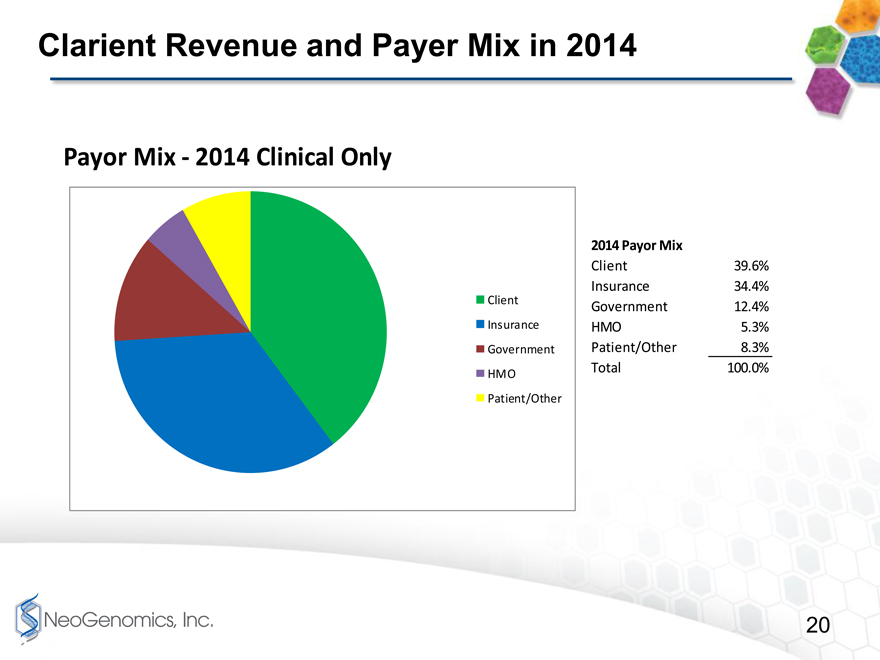

Clarient Revenue and Payer Mix in 2014

2014 Payor Mix

Client 39.6%

Insurance 34.4%

Client Government 12.4%

Insurance HMO 5.3%

Government Patient/Other 8.3%

HMO Total 100.0%

Patient/Other

20

Confidential

Payor Mix2014 Clinical Only