DEF 14A: Definitive proxy statements

Published on April 7, 2023

Table of Contents

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2))

|

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

April 7, 2023

NeoGenomics, Inc.

9490 NeoGenomics Way

Fort Myers, Florida 33912

Fellow Stockholders,

On behalf of the Board of Directors, it is my pleasure to invite you to attend our 2023 Annual Meeting of Stockholders of NeoGenomics, Inc., which will be held on Thursday, May 25, 2023, at 10:00 a.m., Eastern Time. The 2023 Annual Meeting will be a completely virtual meeting conducted via live webcast.

Details regarding the meeting and the business to be conducted are described in the accompanying Proxy Statement. In addition to considering the matters described in the Proxy Statement, we will report on matters of interest to our stockholders.

We are pleased to inform you that instead of a paper copy of our proxy materials, most of our stockholders will be mailed a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) on April 7, 2023. The Notice of Internet Availability contains instructions on how to access proxy materials and how to submit your proxy over the internet. The Notice of Internet Availability also contains instructions on how to request a paper copy of our proxy materials, if desired. All stockholders who do not receive a Notice of Internet Availability will be mailed a paper copy of the proxy materials. Furnishing proxy materials over the internet allows us to provide our stockholders with the information they need in a timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whether or not you plan to attend the live webcast of the 2023 Annual Meeting. Please vote electronically over the internet, by telephone, or, if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. You may also vote your shares online during the 2023 Annual Meeting. Instructions on how to vote while participating at the meeting live via the internet are posted at www.virtualshareholdermeeting.com/NEO2023.

On behalf of the Board of Directors and management, we thank you for your continued support and confidence in NeoGenomics.

Sincerely,

Lynn Tetrault

Non-Executive Chair of the Board of Directors

Table of Contents

Notice of 2023 Annual Meeting of Stockholders

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of NeoGenomics, Inc., will be held on Thursday, May 25, 2023, at 10:00 a.m., Eastern Time. The 2023 Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the 2023 Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/NEO2023. For instructions on how to attend and vote your shares at the 2023 Annual Meeting, see the information in the accompanying Proxy Statement.

ITEMS OF BUSINESS:

1. To elect eight directors from the nominees named in the attached Proxy Statement.

2. To approve, on a non-binding advisory basis, executive compensation.

3. To approve the NeoGenomics, Inc. 2023 Equity Incentive Plan.

4. To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for the year ending December 31, 2023.

5. To consider any other business properly brought before the 2023 Annual Meeting.

RECORD DATE:

You can vote if you were a stockholder of record as of the close of business on March 27, 2023.

PROXY VOTING:

It is important that your shares be represented at the 2023 Annual Meeting regardless of the number of shares you hold. Whether or not you expect to virtually attend, please complete, date, sign and return the accompanying proxy card in the enclosed envelope or use the telephone or internet method of voting as described on your proxy card to ensure the presence of a quorum at the meeting. Even if you have voted by proxy and you virtually attend the meeting, you may, if you prefer, revoke your proxy and vote your shares virtually.

By Order of the Board of Directors

Alicia Olivo

General Counsel and Corporate Secretary

Important notice regarding the availability of proxy materials for the 2023 Annual Meeting of Stockholders to be held on Thursday, May 25, 2023. Our 2023 Proxy Statement and 2022 Annual Report to Stockholders are available at www.proxyvote.com.

Table of Contents

Table of Contents

Table of Contents

Index of Frequently Requested Information

| 27 | ||||

| 6 | ||||

| 66 | ||||

| 20 | ||||

| 39 | ||||

| 42 | ||||

| 14 | ||||

| 6 | ||||

| 9 | ||||

| 44 | ||||

| 9 | ||||

| 68 | ||||

| 7 | ||||

| 45 | ||||

| 45 | ||||

| 55 | ||||

| 43 |

Table of Contents

NEOGENOMICS, INC.

PROXY STATEMENT FOR THE

2023 ANNUAL MEETING OF STOCKHOLDERS

NeoGenomics, Inc. (“we,” “us,” “our,” “NeoGenomics,” or the “Company”), having its principal executive offices at 9490 NeoGenomics Way, Fort Myers, Florida 33912, is providing these proxy materials in connection with the 2023 Annual Meeting of Stockholders of NeoGenomics, Inc. (the “2023 Annual Meeting”). This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the 2023 Annual Meeting.

The following is a summary of certain key disclosures in our Proxy Statement. This is only a summary and may not contain all the information that is important to you. For more complete information, please review the full Proxy Statement as well as our 2022 Annual Report, which includes our Annual Report on Form 10-K, as filed with the SEC on February 24, 2023.

1

Table of Contents

| Proposal 1 - Election of Directors | ||

| • As of March 2023, seven of our eight Director nominees are independent and all represent a diverse background of qualifications and experience.

• Our Director nominees are 38% female and 25% racial/ethnic diversity.

• All four Board Committees are comprised solely of independent Directors. |

|

|

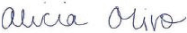

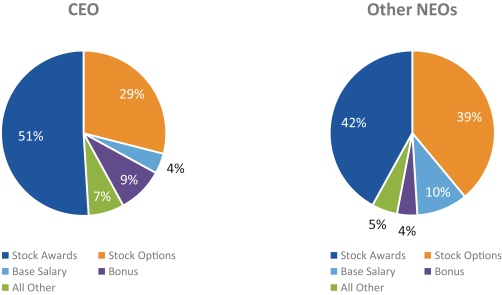

| Proposal 2 - Advisory Vote on Executive Compensation | ||

| • We strive for pay-for-performance and believe that performance objectives should align with our strategy over the long-term.

• Our compensation philosophy is focused on providing compensation and benefits that are competitive and meet our goals of attracting, retaining and motivating highly skilled management. |

|

|

| Proposal 3 - To Approve the NeoGenomics, Inc. 2023 Equity Incentive Plan |

||

| • To approve the NeoGenomics, Inc. 2023 Equity Incentive Plan. |

|

|

| Proposal 4 - Ratification of Independent Registered Accounting Firm | ||

| • The Audit and Finance Committee of the Board has appointed Deloitte & Touche LLP to act as our independent registered public accounting firm for the fiscal year ending December 31, 2023. |

|

|

Corporate Governance

Transforming Patient Care by Living our Values

We believe that strong corporate governance practices provide a framework for the Board of Directors’ (the “Board”) oversight of the short-term and long-term health, strategy and overall success of NeoGenomics. We have established Corporate Governance Guidelines and a Code of Business Conduct and Ethics that provide the foundation for our values of quality, integrity, accountability, teamwork and innovation. Our commitment to integrity and ethics starts at the top with our Board and senior management and extends to every NeoGenomics employee.

2

Table of Contents

We recognize that the Board’s role and oversight extends to sustainability, human capital management, and environmental impact. We continue to have meaningful internal and external conversations about environmental, social and governance (“ESG”) policies and initiatives and are increasing our focus on related efforts. We believe that progress on these objectives aligns with our vision and further supports our progress towards our near and long-term strategic objectives.

Environmental, Social and Governance

We are passionate about promoting a World-Class Culture through employee engagement, training and development, wellness, work-life balance, and communication initiatives. We believe that a diverse and inclusive workforce, where all perspectives are recognized and respected, positively impacts our performance and strengthens our culture. We strive to promote a workplace in which people of diverse race, ethnicity, veteran status, marital status, socio-economic level, national origin, religious belief, physical ability, sexual orientation, age, class, political ideology, and gender identity and expression participate in, contribute to, and benefit equally.

| Diversity, Equity, Inclusion & Belonging Vision |

| Cancer doesn’t discriminate, and neither do we.

While placing the value of people at the heart of our organization, we challenge ourselves every day to be more inclusive with our teams, clients, and community. We create an environment where culture engenders growth and innovation. We are champions of diversity and inclusion and take action to create an equitable culture where everyone belongs. |

Our commitment to maintaining an excellent workplace includes investing in ongoing opportunities for employee development in a diverse and inclusive environment. We have worked to reflect gender and ethnic diversity and inclusion on our Board and diversity in gender and ethnicity is well-established within our workforce. As of March 2023, women make up 58% of our global workforce, 16% of our workforce is in supervisory or higher positions, and of that 16%, 52% are female. With regard to the Company’s top two management tiers, 37%1 of our executive team and our vice presidents are women and 38% of our Board of Directors are women. Ethnicity is also strongly represented: 52% of our workforce and 25% of our Board of Directors are ethnically diverse. Diversity is an active conversation at NeoGenomics including through employee initiated and led employee resource groups (“ERGs”) such as LGBTQ@Neo, Women@Neo, Veterans@Neo, We S.T.A.N.D@Neo (Standing Together Against Negativity and Discrimination), and Wellness@Neo. These ERGs reinforce our commitment to diversity by fostering community, providing education and support across the business, and facilitating dialogue on relevant and critical employee topics. We regularly seek the input of all of our employees through both in-person roundtables and anonymous weekly surveys. It is important to us that each of our employees has a voice, equal opportunity and a method to communicate their views in a way that they feel comfortable.

In addition, in recognition that health and wellness extends beyond only the physical aspects, we have established a number of broad health-focused measures for our employees. Our Wellness@Neo ERG has a mission to support the financial, physical, emotional, and social wellness of our employees. The Wellness@Neo ERG sponsors education on a variety of topics including investing, student loan debt, mental support initiatives, meditation, and yoga. We continually assess the benefits offered to our employees and in addition to competitive health plans, 401(k) matching and our Employee Stock Purchase Plan (“ESPP”), we offer contributions towards our employees’ student loan debt, tuition reimbursement, gym and fitness studio credits, and an employee assistance program that provides health, family, legal, and financial assistance.

| 1 | Inadvertently reported as 68% in our Annual Report on Form 10-K for the year ended December 31, 2022. |

3

Table of Contents

We also encourage and support community involvement and corporate philanthropy. As part of our social wellness program, we partner with VolunteerMatch Virtual Volunteer Opportunities and with Project Helping, a mental wellness organization that creates meaningful social and accessible volunteer experience to help people improve their mental wellness through service. Each year we also provide corporate giving to organizations that are aligned with our purposes and values. During 2022 we made a variety of charitable donations, education grants, sponsorship programs, and research grants. In September 2022, Hurricane Ian devastated the town of Fort Myers, Florida, where our Company’s headquarters is located. In response, the Company assisted with cleanup efforts and created a fund to provide financial assistance to employees affected by the storm with remaining funds being donated to the American Red Cross. The totals donated to NeoGenomics’ employees and The American Red Cross were approximately $55,000 and $200,000, respectively.

| NeoGREEN Vision |

| NeoGenomics is committed to seeking and upholding sustainable solutions that build trust with our employees, clients and stakeholders. |

We believe our corporate responsibility includes a commitment to our environment, which we support through our NeoGREEN initiative. In 2021 we opened a new headquarters in Fort Myers, FL, which includes a new laboratory, warehouse and administrative facilities. We completed the design and construction of our new headquarters in accordance with the Sustainable SITE initiative that ensures that a project’s natural environment is valued and respected throughout every step of the building process. Additionally, we utilize low-emitting materials, energy and water efficient design, and utilize GS-42 certified janitorial and sustainable pest services. As a result, we are proud of NeoGenomics’ achievement of Leadership in Energy and Environmental Design (“LEED”) certification for this facility. Developed by the U.S. Green Building Counsel, LEED is the most widely used green building rating system in the world and an international symbol of sustainability excellence. Our environmental efforts also focus on improvements in our waste, water and energy management.

4

Table of Contents

| Corporate Governance Highlights | ||

| Independent Board Chair | • As of March 2023, Lynn Tetrault, NeoGenomics’ independent non-executive Chair of the Board has eight years’ tenure on the Board and extensive healthcare leadership experience |

|

| Independent and diverse director nominees | • As of March 2023, seven of our eight directors are independent • All Board committees are comprised of independent directors • Five of our eight directors, representing 63% of our directors are diverse (either gender or race/ethnicity) • Directors have a broad range of experience, skills and qualifications (see ‘Director Diversity and Expertise’ on page 13) |

|

| Executive sessions of independent directors |

• Independent directors meet regularly without management |

|

| Active board refreshment | • Balanced mix of short and long-tenured directors • Three of our seven independent directors joined the Board within the last three years • Annual election of all directors |

|

| Continual assessments | • Board and Committees complete annual self-evaluation surveys • Annual Chief Executive Officer and executive management evaluation in alignment with corporate goals and objectives, including achievement of business and strategic objectives • Continuously evaluate director capacity, including updating corporate governance guidelines to limit the number of public boards our directors can sit on from five to four |

|

| Stock ownership guidelines | • No hedging or pledging of NeoGenomics stock • Minimum holding requirements for directors and executive officers |

|

Director Nominations. Our Board has a standing Nominating and Corporate Governance Committee (the “Nominating and Governance Committee”). The Nominating and Governance Committee considers and recommends candidates for election to the Board and nominees for committee memberships and committee chairs, and focuses on ensuring that the Board is composed of members with varied skill sets to support the Company’s key initiatives.

Director candidates are considered based upon a variety of criteria, including demonstrated business and professional skills and experiences relevant to our business and strategic direction, concern for long-term stockholder interests, personal integrity, and sound business judgment. The Nominating and Governance Committee seeks individuals from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise as set forth in the Strategic Competencies Matrix. The Nominating and Governance Committee also emphasizes the importance of diversity, equity and inclusion with respect to age, gender, race and ethnicity, sexual orientation, and gender identity and believes that an inclusive environment offers the Company and our stockholders’ diversity of opinion and insight in the areas most important to us and our corporate mission. All director candidates must have time available to devote to the activities of the Board. We also consider the independence of director candidates, including the appearance of any conflict in serving as a director. A director who does not meet all of these criteria may still be considered for nomination to the Board if our independent directors believe that the candidate will make an exceptional contribution to us and our stockholders.

5

Table of Contents

Generally, when evaluating and recommending candidates for election to the Board, the Nominating and Governance Committee will conduct candidate interviews, evaluate biographical information and background material, and assess the skills and experience of candidates against selection criteria set forth in the Strategic Competencies Matrix in the context of the then-current needs of the Company. In identifying potential director candidates, the Board may also seek input from the executive officers and may also consider recommendations by employees, community leaders, business contacts, third-party search firms, and any other sources deemed appropriate by the Nominating and Governance Committee. The Nominating and Governance Committee will also consider director candidates recommended by stockholders to stand for election at the annual meeting of stockholders so long as such recommendations are submitted in accordance with the procedures described below under “Stockholder Recommendations for Board Candidates.”

Board Leadership Structure. Consistent with the Company’s Corporate Governance Guidelines our Board has a policy that allows the Chair of the Board and Chief Executive Officer positions to be separate or combined and, if they are to be separate, allows the Chair of the Board role to be either selected from among the independent directors or an executive officer. Our Board believes that it should have the flexibility to make these determinations at any given time in the way that it believes best to provide appropriate leadership for the Company. Our Board has reviewed the current Board leadership structure in light of the composition of the Board, the Company’s size, the nature of the Company’s business, the regulatory framework under which the Company operates, and other relevant factors.

On July 15, 2020, Ms. Lynn Tetrault was appointed Lead Independent Director. On October 7, 2021, Ms. Tetrault was appointed as non-executive Chair of the Board. Effective March 28, 2022, in connection with Mr. Mallon’s termination as Chief Executive Officer and resignation from the Board, Ms. Tetrault was appointed Executive Chair of the Board, and as such functioned as the Company’s principal executive officer. Effective May 12, 2022, Ms. Tetrault was appointed Interim Chief Executive Officer and continued in her role as Chair of the Board. Effective August 15, 2022, upon the appointment of Mr. Smith as Chief Executive Officer, Ms. Tetrault resumed the position of non-executive Chair of the Board. Mr. Michael Kelly, an independent director on the Board for the duration of 2022, served as the Board’s Lead Independent Director for the duration of Ms. Tetrault’s service as Executive Chair of the Board and Interim Chief Executive Officer in 2022.

Director Independence. Our Corporate Governance Guidelines provide that our Board will consist of a majority of independent directors and in making independence determinations, the Board will observe all applicable requirements, including the applicable corporate governance listing standards of the Nasdaq Stock Market LLC (“Nasdaq”). Under Nasdaq rules, the Board has a responsibility to make an affirmative determination that those members of its Board that serve as independent directors do not have any relationships with the Company and its businesses that would impair their independence. In connection with these determinations the Board reviews information regarding transactions, relationships, and arrangements involving the Company and its businesses and each director that it deems relevant to independence, including those required by Nasdaq rules.

The Board has determined that each of the directors, with the exception of Ms. Tetrault and Mr. Smith, were independent for the duration of their service in 2022. Upon Ms. Tetrault’s appointment to Executive Chair of the Board on March 28, 2022 she was deemed no longer independent. Upon resuming the role of non-executive Chair of the Board, effective August 15, 2022, Ms. Tetrault was once again deemed independent. Mr. Michael Kelly was appointed Lead Independent Director during the time in which Ms. Tetrault was no longer independent. The Audit and Finance Committee, the Compliance Committee, the Culture and Compensation Committee, and the Nominating and Corporate Governance Committee are each composed entirely of directors who are independent under Nasdaq rules and the applicable rules of the United States Securities and Exchange Commission (the “SEC”).

6

Table of Contents

Board Role in Risk Oversight. The Board administers its enterprise risk oversight function directly and through its Committees. The Board and the Audit and Finance Committee have primary oversight over enterprise risks and regularly discuss with management major risk exposures, including cybersecurity, their potential financial impact on the Company, and the steps taken to monitor, control and mitigate those risks. The Nominating and Governance Committee has primary oversight over ESG matters, the Culture and Compensation Committee has primary oversight over risks associated with compensation policies and practices and the Compliance Committee has primary oversight over the Corporate Compliance Program and Code of Business Conduct and Ethics. Please refer to the section “Information Regarding Meetings and Committees of the Board” below for a full description of the responsibilities of each Committee and their role in overseeing the Company’s major risk exposures.

| Board of Directors | ||||||||||||

| • Stay informed of our risk profile and oversee Enterprise Risk Management program

• Consider risk in connection with strategic planning and other matters |

||||||||||||

| Audit & Finance | Nominating & Corporate Governance | Culture & Compensation | Compliance | |||||||||

| • Enterprise risks, including but not limited to risks relating to IT use and protection, data governance, privacy, and cybersecurity

• Independent auditor’s qualifications and independence

• Financial reporting and processes, including Internal Controls over Financial Reporting |

• Environmental, Social and Governance matters

• Investor engagement and communications

• Review Board size, composition, function and duties

• Develop and recommend to the Board the Corporate Governance Guidelines and oversee compliance with the Guidelines |

• Review the risks associated with the Corporation’s compensation policies and practices

• Oversee an annual review of the Corporation’s risk assessment of its compensation policies and practices for its employees

• Diversity, equity, inclusion & belonging

• Confirmation of zero conflict of interests related to members of the Board of Director, Named Executive Officers and external consultants engaged by the Board |

• Assess management’s implementation of the Corporate Compliance Program elements

• Assess adequacy and effectiveness of policies and programs to ensure compliance with laws and regulation

• Monitor significant external and internal investigations

• Implementation of Code of Conduct |

|||||||||

| NeoGenomics Management |

| NeoGenomics Management advises the Board and its Committees of key risks and the status of ongoing efforts to address these risks. |

Stockholder Outreach. It is our practice to have ongoing and robust engagement with our stockholders throughout the year and seek their direct feedback to continuously improve our performance, programs and reporting. Our outreach is supplemented by our year-round investor relations engagement that includes post-earnings communications, one-on-one conferences, individual meetings and general availability to respond to investor inquiries. We also periodically engage proxy advisory firms for their viewpoints. The multifaceted nature of this program allows us to maintain meaningful engagement with a broad audience including institutional and retail stockholders.

7

Table of Contents

In 2022, we received approximately 31% support for our annual say-on-pay proposal. Following our say-on-pay vote in 2022, we widened our governance outreach and engagement even further to ensure we understood stockholders’ concerns to inform and guide our actions in response. We take the outcome of this vote seriously and have been highly focused on understanding and responding to our stockholders’ feedback reflected in this vote. Through the company’s engagement efforts, the committee sought to elicit and consider a full range of stockholders’ perspectives related to NeoGenomics’ executive compensation program, program design elements and specific actions, to inform appropriate responses to the say-on-pay vote.

We engaged with stockholders representing 54% of outstanding shares with our integrated engagement team consisting of finance, legal, and investor relations and met with representatives capturing 26.59% of outstanding shares. One independent director participated in engagement with a stockholder representing 17.29% of outstanding shares. Our engagements also included representatives from our Legal, People & Culture and Investor Relations teams. We are planning further enhanced stockholder outreach efforts for the 2023 fiscal year.

As part of these engagements, many stockholders favorably acknowledged changes and enhancements that we discussed we will be making related to executive compensation in 2023. This supported our understanding that many stockholders were generally comfortable with the fundamental aspects of our compensation program design, but voted against say-on-pay in 2022 based on specific compensation actions taken in 2021. As a result, we are taking certain steps in 2023 to ensure we are addressing the concerns of the stockholders while also attracting and retaining talented executives who are motivated to achieve our annual and long-term strategic goals. Our goal is to continue to refine our programs further beyond 2023 while leveraging ongoing stockholder feedback and effective performance-based awards.

For more on our response to our stockholder engagement related to the 2022 say-on-pay vote, see page 45.

8

Table of Contents

PROPOSAL 1—ELECTION OF DIRECTORS

At the 2023 Annual Meeting, a board of eight directors will be elected, each to hold office until the next succeeding annual meeting of stockholders or until such director’s successor shall have been duly elected and qualified (or, if earlier, such director’s death, resignation or removal). Information concerning all director nominees appears below. Although management does not anticipate that any of the persons named below will be unable or unwilling to stand for election, in the event of such an occurrence, proxies may be voted for a substitute designated by the Board, or the Board may reduce the number of directors to be elected at the 2023 Annual Meeting.

Information as to Nominees and Other Director Information

Background information, as of the date of this proxy statement, about the Board’s nominees for election, as well as information regarding additional experience, qualifications, attributes or skills that led the Board to conclude that the nominees should serve on the Board, is set forth below.

Lynn Tetrault, age 60, non-executive Chair of the Board. Effective March 28, 2022, Ms. Tetrault was appointed Executive Chair of the Board, and as such functioned as the Company’s principal executive officer. Effective May 12, 2022, Ms. Tetrault was appointed as Interim Chief Executive Officer and continued in her role as Chair of the Board. Effective August 15, 2022, upon the appointment of Mr. Smith as Chief Executive Officer, Ms. Tetrault resumed the position of non-executive Chair of the Board. Prior to her appointment as Executive Chair of the Board, Ms. Tetrault served as non-executive Chair of the Board since October 2021, as Lead Independent Director of the Company from July 2020 to October 2021 and as a director since June 2015. Since 2020, she has also served as a director of Rhythm Pharmaceuticals, Inc. Ms. Tetrault has more than 25 years of experience in the healthcare sector. She worked from 1993 to 2014 with AstraZeneca PLC, most recently as Executive Vice President of Human Resources and Corporate Affairs from 2007 to 2014. Ms. Tetrault was responsible for all human resources strategy, talent management, executive compensation and related activities, internal and external communications, government affairs, corporate reputation, and corporate social responsibility for AstraZeneca. Prior to AstraZeneca Ms. Tetrault practiced healthcare and corporate law at Choate, Hall and Stewart in Boston. She is a Fellow and member of the Advisory Board of Simmons University’s Institute for Inclusive Leadership. She is also a member of the board of Paradigm for Parity, a non-profit organization focused on closing the gender parity gap in corporate leadership. Ms. Tetrault has a BA from Princeton University and a JD from the University of Virginia Law School.

Skills and Qualifications: Ms. Tetrault is a dynamic, seasoned executive in the pharmaceutical industry. Having progressed through numerous senior management roles at AstraZeneca, she acquired extensive human resource and corporate governance experience at the highest level of that company. As the Company continues to grow, Ms. Tetrault’s experience is helping to shape human resource policies and operations as well as the make-up of the Board and its governance policies, and therefore we believe that Ms. Tetrault is well qualified to serve on our Board.

Christopher Smith, age 60, Board Member and Chief Executive Officer. Mr. Smith was appointed Chief Executive Officer and a director in August 2022. Prior to joining NeoGenomics, from 2019 to 2022, Mr. Smith served as Chief Executive Officer of Ortho Clinical Diagnostics (“Ortho Clinical”). Under his leadership, Ortho Clinical raised $1.45 billion in funding for a 2021 initial public offering and achieved accelerated revenue growth while simultaneously improving profitability. Mr. Smith successfully guided the company through a combination with Quidel that closed in May 2022. Prior to Ortho Clinical, from 2004 to 2018, Mr. Smith served in key executive leadership positions, including CEO of Cochlear Limited (“Cochlear”), a global market leader in implantable hearing

9

Table of Contents

solutions. Having initially joined Cochlear as President of Cochlear Americas in 2004, Mr. Smith helped grow division revenue from $80 million to over $400 million before being named CEO in 2015. Before joining Cochlear, Mr. Smith served as a Chief Executive Officer in residence at global private equity firm Warburg Pincus and Global Group President at Gyrus Group Plc., a surgical products company. Prior to that he served in a variety of leadership roles at Abbott, KCI, Prism and Cardinal Health. Since May 2022, Mr. Smith has served as a member of the board of directors at QuidelOrtho, a global provider of innovative in vitro diagnostic technologies. In addition, since March 2022, Mr. Smith has served as Chair of the board of directors of Osler Diagnostics, a UK-based diagnostics company. Mr. Smith has a BS from Texas A&M University.

Skills and Qualifications: Mr. Smith is a dynamic leader with strong cultural values, vast diagnostic industry experience, and an extensive history of proven operating success. Because of Mr. Smith’s extensive industry knowledge and his experience serving on the boards of directors of other public companies, we believe Mr. Smith is well qualified to serve on our Board.

Bruce Crowther, age 71, Board Member and Chair of the Culture and Compensation Committee. Mr. Crowther has served as a director since October 2014. Mr. Crowther served as President and Chief Executive Officer of Northwest Community Healthcare for 23 years, before retiring in 2013. Northwest Community Healthcare is an award-winning hospital offering a complete system of care. Since 2019, Mr. Crowther has been a director of Methode Electronics, Inc., a leading global supplier of custom-engineered solutions. Mr. Crowther has also served on the board of directors of Gray Matter Analytics, Inc., a privately-owned company that provides analytical tools to health systems, since 2018. Mr. Crowther previously served on the board of directors of Wintrust Financial Corporation, a public financial holding company and was previously the chair and a director of the Max McGraw Wildlife Foundation, a not for profit organization committed to conservation education and research. Mr. Crowther has a BS in Biology and an MBA from Virginia Commonwealth University.

Skills and Qualifications: Mr. Crowther has experience in the healthcare industry and a strong knowledge of the hospital market, having served as Chief Executive Officer of a healthcare system for 23 years. We believe Mr. Crowther’s experience in this role allows him to provide insight into how the Company should manage the hospital market. Because of Mr. Crowther’s extensive industry knowledge and his experience serving on the boards of directors of other public companies, we believe Mr. Crowther is well qualified to serve on our Board.

Dr. Alison Hannah, age 62, Board Member and Chair of the Compliance Committee. Dr. Hannah has served as a director since June 2015. Dr. Hannah has over 30 years’ experience in the development of investigational cancer chemotherapies. She currently serves as a consultant to the pharmaceutical industry, working with over 30 companies over 20 years with a focus on molecularly targeted anti-cancer therapy. Dr. Hannah previously served as Senior Vice President and Chief Medical Officer at CytomX Therapeutics, an oncology-focused biopharmaceutical company. Previously, Dr. Hannah worked as Senior Medical Director at SUGEN (working on Sutent and other tyrokine kinase inhibitors) and Quintiles, a global contract research organization. Dr. Hannah has also served on the board of directors of Rigel Pharmaceuticals since 2021. Dr. Hannah specializes in clinical development strategy and has filed over 30 Investigational New Drug applications for new molecular entities and seven successful New Drug Applications (including talazoparib, enzalutamide, defibrotide, carfilzomib, and others). Dr. Hannah received her BA in biochemistry and immunology from Harvard University and her MD from the University of Saint Andrews. She is a member of ASCO, AACR, ASH, ESMO, SITC, and a Fellow with the Royal Society of Medicine.

Skills and Qualifications: Dr. Hannah has significant healthcare knowledge having spent over 20 years as a consultant in the field of oncology drug development and has over 30 years of experience working with biopharmaceutical companies. Dr. Hannah has extensive knowledge of the clinical trials

10

Table of Contents

marketplace and we believe she will continue to offer valuable guidance on how the Company should position itself to obtain clinical trials diagnostic testing volumes as the Company continues to grow its revenue in that area. Because of this experience and knowledge, we believe Dr. Hannah is well qualified to serve on our Board.

Stephen Kanovsky, age 60, Board Member and Chair of the Nominating and Corporate Governance Committee. Mr. Kanovsky has served as a director since July 2017. Mr. Kanovsky is Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, which provides medical technologies and solutions to the global healthcare industry and supports customers throughout the world with a broad range of services and systems, from diagnostic imaging and healthcare IT to molecular diagnostics and life sciences. Prior to his service at GE HealthCare, Mr. Kanovsky held numerous legal, compliance, and research roles in several global pharmaceutical companies. Mr. Kanovsky earned his bachelor’s degree from the University of Pennsylvania. He subsequently graduated from Temple University’s School of Pharmacy with a master’s degree in Pharmacology and Temple University’s School of Law with a juris doctorate degree. Mr. Kanovsky also holds an MBA from Saint Joseph’s University’s Haub School of Business.

Skills and Qualifications: Mr. Kanovsky has over 25 years of legal experience in the global life sciences and pharmaceutical industry. Through his work as Deputy General Counsel and Chief Commercial Counsel of GE HealthCare, Mr. Kanovsky is able to provide continued knowledge of the life sciences space. He also brings valuable experience to our Board through his prior involvement with Clarient, Inc. (“Clarient”), prior to its acquisition by NeoGenomics in December 2015. Because of Mr. Kanovsky’s extensive legal and compliance background and long-term service to the Board, we believe Mr. Kanovsky is well qualified to serve on our Board.

Michael Kelly, age 66, Board Member and Chair of the Audit and Finance Committee. Mr. Kelly has served as a director since July 2020 and served as the Board’s Lead Independent Director for the duration of Ms. Tetrault’s service as Chair of the Board and Interim Chief Executive Officer in 2022. Mr. Kelly is a former senior executive of Amgen, Inc. and is currently acting as Founder & President of Sentry Hill Partners, LLC, a global life sciences transformation and management consulting business he founded in 2018. Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions at Amgen Inc. from 2003 to 2017, most recently as Senior Vice President, Global Business Services and Vice President & CFO, International Commercial Operations. Mr. Kelly has also held positions at Biogen, Tanox and Monsanto Life Sciences. Mr. Kelly currently serves as a director for Amicus Therapeutics, DMC Global, Inc., and Prime Medicine, Inc. Mr. Kelly serves on the Council of Advisors and was the former audit committee chair for Direct Relief, a humanitarian aid organization focused on health outcomes and disaster relief. Mr. Kelly holds a BS in business administration from Florida A&M University, concentrating in Finance and Industrial Relations.

Skills and Qualifications: Mr. Kelly has more than two decades of executive experience as a senior leader in the life sciences industry serving in various strategic finance and operations positions. We believe Mr. Kelly’s extensive experience managing and growing domestic and international organizations, as well as his track record in finance, operations and building differentiated product companies is highly valuable as we continue our long-term growth strategy, and therefore Mr. Kelly is well qualified to serve on our Board. In addition, we believe Mr. Kelly’s extensive knowledge and background in finance qualifies him to serve as a financial expert on the Audit and Finance Committee.

David Perez, age 63, Board Member. Mr. Perez has 40 years of global executive leadership experience, leading the growth and operations of several businesses, growing and scaling organically through research & development and innovation as well as through mergers and acquisitions. In March 2019, he retired from his position as president and CEO of Terumo BCT, a company dedicated to

11

Table of Contents

blood banking, transfusion medicine and cell-based therapies, following a comprehensive two-year succession and transition plan and now serves as an independent board member for public, private equity and non-profit organizations. During his nearly 20-year tenure, Mr. Perez guided Terumo BCT through several foreign ownership structures, leveraging his extensive experience leading complex, multinational businesses and diverse, cross-cultural organizations. Under his leadership, the company transformed from a single manufacturing and R&D site to a multi-national biomedical organization with five R&D centers and six manufacturing plants, as he helped drive global revenue growth from $160 million to $1 billion. Mr. Perez holds a BA in Political Science from Texas Tech University.

Skills and Qualifications: Mr. Perez has 40 years of executive leadership in medical device and health care services, He serves as an independent board member and advisor to several corporations and non-profit organizations. His expertise encompasses growing and scaling highly regulated global businesses organically through R&D and innovation and inorganically through M&A, leading within a variety of foreign, public and private equity ownership structures, strategic planning, culture and talent development, succession planning, enterprise risk management, operations, compliance, and corporate governance. We believe Mr. Perez’s extensive knowledge and background as a chief executive and director qualifies him to service on our board.

Rachel Stahler, age 47, Board Member. Ms. Stahler has served as a director since May 2020. Ms. Stahler is the Chief Information Officer at Organon, a pharmaceutical company created in 2021 through the spin-off of Merck’s women’s health, legacy brands, and biosimilars businesses. Ms. Stahler has nearly two decades of global technology experience in the pharmaceutical industry. From 2019 to 2020 Ms. Stahler was the Chief Information Officer for Allergan, a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical, device, biologic, surgical, and regenerative medicine products for patients around the world. Prior to Allergan, from 2017 to 2019, Ms. Stahler served as Chief Information and Digital Officer at Syneos Health, a leading CRO / CCO, where she was responsible for designing clinical and commercial systems for customers as an outsourcing leader. Ms. Stahler was also the Chief Information Officer at Optimer Pharmaceuticals and held various senior technology roles at Pfizer. Ms. Stahler holds a BA from the University of Pennsylvania and an MBA from Columbia Business School.

Skills and Qualifications: Ms. Stahler is an experienced Chief Information Officer, having held several executive positions in the pharmaceutical industry, including at Allergan, a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical, device, biologic, surgical, and regenerative medicine products for patients around the world. We believe Ms. Stahler’s experience in designing clinical and commercial systems and prior senior technology roles will continue to enhance the Company’s information technology policies and operations, as well as the composition and governance of the Board, and therefore we believe Ms. Stahler is well qualified to serve on our Board.

12

Table of Contents

Director Diversity and Expertise

We seek to have a Board that represents diversity, equity and inclusion as to experience, gender, race and ethnicity, but we do not have a formal policy with respect to diversity. We also seek to have a Board that reflects a range of talents, ages, skills, character and expertise, particularly in the areas of leadership, operations, risk management, accounting and finance, strategic planning and the areas most important to us and our corporate mission, sufficient to provide sound and prudent guidance with respect to our operations and interests. To augment our Board’s strategic competencies, we also consult with experts in specialized areas such as ESG and executive compensation, to provide the relevant skills to support the Company’s long-term strategy.

| Average Tenure of Directors

4.4 years

|

Average Age of Directors

62 years |

% of Diverse Directors (Gender, Racial/Ethnic)

63% |

||||||

| Board Diversity Matrix (as of April 7, 2023) |

||||||||

| Total Number of Directors | 8 | |||||||

|

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

||||

| Part I: Gender Identity | ||||||||

| Directors | 3 | 5 | 0 | 0 | ||||

| Part II: Demographic Background | ||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||

| Asian | 0 | 0 | 0 | 0 | ||||

| Hispanic or Latinx | 0 | 1 | 0 | 0 | ||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

| White | 3 | 3 | 0 | 0 | ||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

| LGBTQ+ | 0 | 0 | 0 | 0 | ||||

| Did not Disclose Demographic Background | 0 | 0 | 0 | 0 | ||||

13

Table of Contents

| Strategic Competencies Matrix | ||||||||||||||||||||||||||||||||

| Competencies / Attributes |

|

Lynn Tetrault |

|

Bruce Crowther |

|

Dr. Alison Hannah |

|

Stephen Kanovsky |

|

Michael Kelly |

|

David Perez |

|

Rachel Stahler |

|

Chris Smith | ||||||||||||||||

| Financial (Reporting, Auditing, Internal Controls) |

|

X |

|

X |

|

|

|

|

|

X |

|

X |

|

X |

|

X |

||||||||||||||||

| Strategy/Business Development / M&A |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

||||||||||||||||

| Human Resources / Organizational Development |

|

X |

|

X |

|

|

|

|

|

X |

|

X |

|

|

|

X |

||||||||||||||||

| Legal / Governance / Business Conduct |

|

X |

|

X |

|

|

|

X |

|

|

|

X |

|

|

|

|

||||||||||||||||

| Sales / Marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

X | ||||||||||||||||

| Risk Management |

|

X |

|

X |

|

|

|

X |

|

X |

|

X |

|

X |

|

X | ||||||||||||||||

| Information Technology |

|

|

|

X |

|

|

|

|

|

X |

|

X |

|

X |

|

|

||||||||||||||||

| Public Policy / Regulatory Affairs |

|

X |

|

X |

|

X |

|

X |

|

|

|

|

|

|

|

X | ||||||||||||||||

Information Regarding Meetings and Committees of the Board

The Board. The Board met four times for regular meetings during 2022. All of such meetings were regularly scheduled meetings and telephonic calls were held as needed. In addition, the Board held twelve special meetings during 2022. During 2022, each incumbent director attended 75% or more of the Board and applicable committee meetings for the periods during which each director served. Although not required, directors are invited to attend the annual meeting of our stockholders. We held an annual meeting of stockholders on June 2, 2022, which was attended by six of the directors then serving on the Board.

The Board currently has four standing committees: the Audit and Finance Committee, the Compliance Committee, the Culture and Compensation Committee, and the Nominating and Corporate Governance Committee. The following table provides the composition of the committees as of December 31, 2022, and the number of times each committee met in 2022:

| Director Name |

|

Audit and Committee |

|

Compliance Committee |

|

Culture and Compensation Committee |

|

Nominating and Corporate Governance Committee |

||||||||

| Lynn Tetrault (non-executive Chair of the Board) |

|

|

|

|

|

X |

|

X | ||||||||

| Bruce Crowther |

|

X |

|

|

|

Chair |

|

|

||||||||

| David Daly (1) |

|

|

|

X |

|

X |

|

|

||||||||

| Dr. Alison Hannah |

|

|

|

Chair |

|

|

|

X | ||||||||

| Stephen Kanovsky |

|

|

|

X |

|

|

|

Chair | ||||||||

| Michael Kelly |

|

Chair |

|

|

|

X |

|

|

||||||||

| David Perez |

|

X |

|

X |

|

|

|

|

||||||||

| Rachel Stahler |

|

X |

|

|

|

|

|

X | ||||||||

| Number of Meetings Held in 2022 |

|

8 |

|

4 |

|

8 |

|

6 | ||||||||

| (1) | Mr. Daly resigned from the Board effective January 19, 2023. |

14

Table of Contents

Audit and Finance Committee. The Audit and Finance Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading “Investors”. The Audit and Finance Committee is appointed by the Board to assist with a variety of matters described in its charter, which include monitoring (1) the quality and integrity of our financial statements, (2) the effectiveness of our internal controls over financial reporting, (3) the Company’s compliance with legal and regulatory requirements, (4) the Company’s enterprise risks, including but not limited to risks relating to the Company’s information technology use and protection, data governance, privacy, and cybersecurity, and the Company’s strategy to mitigate such risks, (5) the independent auditor’s qualifications and independence, (6) the performance of our independent registered public accounting firm, and (7) working in coordination with the Compliance Committee of the Board, the implementation and effectiveness of the Company’s ethics and compliance program. The formal report of the Audit and Finance Committee is set forth beginning on page 28 of this Proxy Statement.

The Board has determined that Mr. Michael Kelly, who served as the Audit and Finance Committee Chair through 2022, was independent and an “audit and finance committee financial expert” as such term is defined under applicable SEC rules.

Compliance Committee. The Compliance Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading Investors. The Compliance Committee is responsible for overseeing the Company’s activities in the area of corporate compliance with applicable laws and regulations related to our provision of medical-related services and assessing management’s implementation of the Company’s Corporate Compliance Program, including but not limited to the (1) adequacy and effectiveness of policies and procedures to ensure the Company’s compliance with applicable laws and regulations, (2) organization, responsibilities, plans, results, budget, staffing, and performance of the Company’s Compliance Department, including its independence, authority and reporting obligations, (3) appointment, replacement, reassignment, or dismissal of the Chief Compliance Officer and review of compliance policies, practices, procedures and programs, and management’s responses thereto, (4) monitoring of significant internal and external investigations, (5) monitoring of the Company’s actions in response to applicable legislative, regulatory and legal developments, (6) Company’s Code of Conduct and policies and procedures that guide the Company and employees, (7) appropriate mechanisms for employees to seek guidance to report concerns, including anonymously through the Company’s compliance hotline, and (8) Company’s compliance risk assessment activities and efforts to promote an ethical culture.

Culture and Compensation Committee. The Culture and Compensation Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading Investors. The Culture and Compensation Committee is responsible for discharging the Board’s responsibilities relating to compensation of our Chief Executive Officer, other executive officers, and our directors and has overall responsibility for approving and evaluating all of our compensation plans, policies and programs as they affect our executive officers. All committee members are independent directors within the meaning of the applicable Nasdaq rules. Specifically, the Culture and Compensation Committee is responsible for (1) setting compensation for Company executive officers and directors, (2) monitoring the Company’s incentive and equity-based compensation plans, (3) succession planning, and (4) organizational culture programs and practices to ensure that such programs are fair and appropriate and designed to attract, retain and motivate employees. Such programs include the Company’s diversity, equity and inclusion initiatives and Human Resources policies as such practices relate to organizational engagement and effectiveness, employee development programs, fair pay and benefit programs, and equal employment and equal opportunity. The Culture and Compensation Committee may delegate any or all of its responsibilities to a subcommittee or to one or more directors as it deems appropriate, provided that the Culture and Compensation Committee may not delegate any power or authority required by law, regulation or Nasdaq rule to be exercised by the committee as a whole. In addition, the Culture and Compensation Committee engaged independent compensation consulting firm Willis Towers Watson (“WTW”) in 2022

15

Table of Contents

to advise the Culture and Compensation Committee on peer development, market practices, industry trends, investor views, and benchmark compensation data. In addition, WTW reviewed and provided the Culture and Compensation Committee with an independent perspective of management recommendations. These duties were consistent with those performed in prior years. For the year ending December 31, 2022, aggregate fees for WTW’s consulting services provided to the Culture and Compensation Committee were approximately $440,000. Approximately $270,000 of this aggregate amount was related to review of executive compensation.

The decision to engage this firm as a consultant was made by the Culture and Compensation Committee.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee functions pursuant to a written charter adopted by the Board, a copy of which may be found at our website www.neogenomics.com under the heading Investors. Our Nominating and Corporate Governance Committee is responsible for (1) reviewing and evaluating the size, composition, function, and duties of the Board consistent with its needs; (2) establishing criteria for the selection of candidates to the Board and its committees and identifying individuals qualified to become Board members consistent with such criteria, including the consideration of nominees submitted by stockholders; (3) recommending to the Board, director nominees for election at the next annual or special meeting of stockholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; (4) recommending directors for appointment to Board committees; (5) making recommendations to the Board as to determinations of director independence; (6) overseeing the evaluation of the Board; (7) developing and recommending to the Board the Corporate Governance Guidelines for the Company and overseeing compliance with such Guidelines; and (8) monitoring significant developments in the law and practice of corporate governance and of the duties and responsibilities of directors of public companies, including but not limited to overseeing the Company’s environmental, social and governance initiatives and investor engagement and communications. The Nominating and Corporate Governance Committee identifies and evaluates nominee candidates as described above under “Director Nominations”.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serve as a member of a board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or the Culture and Compensation Committee.

Code of Ethics

Our Board adopted the Code of Ethics, which is applicable to all of our executives, directors, and employees. The Code of Ethics is available in print to any stockholder that requests a copy by contacting Investor Relations at our corporate headquarters. Our Code of Ethics is also available in the Investors section of our website at www.neogenomics.com. We intend to make any disclosures regarding amendments to, or waivers from, the Code of Ethics required under Form 8-K by posting such information on our website.

Policy Against Hedging of Stock

Our insider trading policy prohibits our directors, officers and employees from entering into hedging transactions, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars, and exchange funds, because such transactions may permit a director, officer or employee to continue to own securities obtained through our employee benefit plans or otherwise, but without the full risks and rewards of ownership. When that occurs the individual may no longer have the same objectives as our other stockholders.

16

Table of Contents

Stockholder Recommendations for Board Candidates

The Board will consider qualified candidates for director that are recommended and properly submitted by stockholders in accordance with our Amended and Restated Bylaws (“Bylaws”). Any stockholder may submit in writing a candidate for consideration for each stockholder meeting at which directors are to be elected by no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the anniversary date of the prior year’s annual meeting, except that if the annual meeting is set for a date that is not within 30 days of such anniversary date, we must receive the notice no later than the close of business on the tenth day following the day on which the date of the annual meeting is first disclosed in a public announcement. Any stockholder recommendations for consideration by the Nominating and Corporate Governance Committee should include the candidate’s name, biographical information and the information required by Section 1.10(e) of our Bylaws. Submissions that meet the current criteria for Board membership are forwarded to the Nominating and Corporate Governance Committee for further review and consideration. The Committee will consider a recommendation only if appropriate biographical information and background material is provided on a timely basis, accompanied by a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than five percent of our common stock for at least one year as of the date that the recommendation is made. To submit a recommendation for a nomination, a stockholder may write to the Board at our principal executive office, Attention: Alicia Olivo, Corporate Secretary.

The Committee will evaluate any such candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members, assuming that appropriate biographical and background material is provided for candidates recommended by stockholders and the process for submitting the recommendation is followed.

Stockholder Communications with the Board

Stockholders may, at any time, communicate with any of our directors by mailing a written communication to NeoGenomics, Inc., 9490 NeoGenomics Way, Fort Myers, Florida 33912, Attention: Alicia Olivo, Corporate Secretary. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.” All such letters must identify the author as a stockholder, provide evidence of the sender’s stock ownership and clearly state whether the intended recipients are all members of the Board or a particular director or directors. The Corporate Secretary will then forward such correspondence, without editing or alteration, to the Board or to the specified director(s) on or prior to the next scheduled meeting of the Board. The Board will determine the method by which such submission will be reviewed and considered. The Board may also request the submitting stockholder to furnish additional information it may reasonably require or deem necessary to sufficiently review and consider the submission of such stockholder.

Vote Required for Approval

The eight nominees receiving the majority of votes cast “FOR” by stockholders virtually or by proxy will be elected. Proposal 1 is a “non-discretionary” or “non-routine” item, meaning that brokerage firms cannot vote shares in their discretion on behalf of a client if the client has not given voting instructions. Accordingly, if you hold your shares in street name and fail to instruct your broker to vote your shares, your shares will not be counted as votes cast and will have no effect on the outcome of Proposal 1.

Board Recommendation

The Board unanimously recommends a vote “FOR” the election of each of the nominees as director in Proposal 1.

17

Table of Contents

PROPOSAL 2—ADVISORY VOTE ON THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS

We are providing our stockholders with the opportunity to express their views on our named executive officers’ compensation as set forth under “Executive and Director Compensation” by casting their vote on Proposal 2. This non-binding, advisory vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers as described in this Proxy Statement.

The Board believes our executive compensation program, which is described in detail in the “Executive and Director Compensation” section, is designed to balance the goals of attracting and retaining talented executives who are motivated to achieve our annual and long-term strategic goals, while keeping the program affordable and appropriately aligned with stockholder interests. We believe that our executive compensation program accomplishes these goals in a way that is consistent with our purpose and core values, and the long-term interests of the Company and its stockholders. Our equity compensation (which is primarily awarded in the form of stock option awards and restricted stock) is designed to build executive ownership and align the incentives of our named executives with those of our stockholders and to focus them on achieving our long-term strategic goals (both financial and non-financial).

Although the vote on Proposal 2 regarding the compensation of our named executive officers is not binding, the Board and the Culture and Compensation Committee value the opinions of our stockholders and will consider the result of the vote when determining future executive compensation arrangements.

If this proposal is approved, our stockholders will be approving the following resolution:

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K in the Company’s Proxy Statement for the 2023 Annual Meeting of Stockholders, is hereby approved.

Vote Required for Approval

The compensation paid to our named executive officers will be considered approved if a majority of the votes cast by stockholders virtually or via proxy with respect to this matter are cast in favor of the proposal.

Board Recommendation

The Board unanimously recommends a vote “FOR” Proposal 2.

18

Table of Contents

PROPOSAL 3—TO APPROVE THE NEOGENOMICS, INC. 2023 EQUITY INCENTIVE PLAN

The Company currently maintains the NeoGenomics, Inc. Amended and Restated Equity Incentive Plan, as most recently amended and subsequently approved by a majority of stockholders on May 25, 2017 (the “Prior Plan”). The Board believes that the Prior Plan has been effective in attracting and retaining highly-qualified employees and other key contributors to the Company’s business, and that the awards granted under the Prior Plan have provided an incentive that aligns the economic interests of Plan participants with those of our stockholders. The Board is now seeking the approval of our stockholders of a new equity incentive plan, the NeoGenomics, Inc. 2023 Equity Incentive Plan (the “2023 Equity Incentive Plan”). Based on the Culture and Compensation Committee’s recommendation, our Board adopted the 2023 Equity Incentive Plan on March 28, 2023, subject to approval from stockholders at our 2023 annual meeting. The 2023 Equity Incentive Plan is intended to supersede and replace the Prior Plan, and no new awards will be granted under the Prior Plan. Shares available for issuance under the Prior Plan as of the Effective Date will be made available under the 2023 Equity Incentive Plan. Any awards outstanding under the Prior Plan on the date of stockholder approval of the 2023 Equity Incentive Plan remain subject to and will be paid under the Prior Plan, and any shares subject to outstanding awards under the Prior Plan that subsequently expire, terminate, or are surrendered or forfeited for any reason without issuance of shares automatically become available for issuance under the 2023 Equity Incentive Plan.

The Board recommends that stockholders approve the 2023 Equity Incentive Plan. The purposes of the 2023 Equity Incentive Plan are to enhance our ability to attract and retain highly qualified officers, non-employee directors, key employees and consultants, and to motivate eligible service providers to serve the Company and to expend maximum effort to improve our business results and earnings, by providing to eligible service providers an opportunity to acquire or increase a direct proprietary interest in our operations and future success of the company.

The Board seeks approval for an aggregate share reserve of (a) 3,975,000 shares under the 2023 Equity Incentive Plan and (b) any shares which remain available for issuance under the Prior Plan as of the Effective Date, initially equating to approximately 6.93% and 5.83% percent of our weighted-average common shares outstanding on a basic and diluted basis, respectively, as of March 27, 2023 (the “Record Date”). When including the options and stock awards outstanding, the aggregate share reserve equates to 10.48% and 8.81% of our weighted-average common shares outstanding on a basic and diluted basis, respectively, as of the Record Date. 3,975,000 shares will be available for issuance under the 2023 Equity Incentive Plan as Incentive Stock Options.

The Board considered various factors when determining the number of shares to ask stockholders to approve under the 2023 Equity Incentive Plan, including the replacement of the Prior Plan, “overhang”, “burn rate”, dilution, historical grant practices and our forecasted equity award grants.

At December 31, 2022, the Equity Incentive Plan had 4,868,198 shares remaining available for future issuance. In addition, a total of 4,529,837 options and stock awards in aggregate were outstanding, comprised of the following:

| • | 3,271,004 stock options (weighted average exercise price of $17.67, and weighted average remaining term of 2.0 years) |

| • | 1,258,833 stock awards |

Over the past three years, the Company has used options and stock awards judiciously, with a value-adjusted burn rate average of approximately 2.09% (of weighted average basic common shares outstanding) as compared to the Health Care Equipment & Services industry benchmark of 3.76%.

19

Table of Contents

The Company has granted awards as follows:

| Fiscal Year |

|

Stock Options Granted |

|

Stock Awards Granted |

||||

| 2022 |

|

4,494,333 |

|

2,865,727 | ||||

| 2021 |

|

1,232,056 |

|

936,648 | ||||

| 2020 |

|

845,120 |

|

149,012 | ||||

Based on its review, the Culture and Compensation Committee recommended the reserve of (a) 3,975,000 shares under the 2023 Equity Incentive Plan and (b) any shares which remain available for issuance under the Prior Plan as of the Effective Date, to ensure the 2023 Equity Incentive Plan has an adequate number of shares available. Accordingly, the Board approved, and is recommending that the Company’s stockholders approve a share reserve of (a) 3,975,000 shares under the 2023 Equity Incentive Plan and (b) any shares which remain available for issuance under the Prior Plan as of the Effective Date under the 2023 Equity Incentive Plan, with 3,975,000 shares available for issuance as Incentive Stock Options.

Our Board believes that this reserve will provide sufficient shares for the equity-based compensation needs of the Company under the 2023 Equity Incentive Plan.

The material features of the 2023 Equity Incentive Plan are summarized below. The summary is qualified in its entirety by reference to the specific provisions of the 2023 Equity Incentive Plan, the full text of which is set forth as Annex A to this Proxy Statement.

Description of the Plan

Corporate Governance Aspects of the Plan

The 2023 Equity Incentive Plan has been designed to include a number of provisions that promote best practices by reinforcing the alignment between equity compensation arrangements for eligible service providers and stockholders’ interests. These provisions include, but are not limited to, the following:

| • | Clawback Policy. In the event of a restatement of our financials due to material noncompliance with any financial reporting requirements under the law, participants will be required to reimburse us for any amounts earned or payable in connection with an award under the 2023 Equity Incentive Plan to the extent required by law and any applicable Company policies. |

| • | No Evergreen Provision. The 2023 Equity Incentive Plan does not contain an “evergreen” feature pursuant to which the shares authorized for issuance under the Plan will be automatically replenished. |

| • | Conservative Change in Control Provision. The 2023 Equity Incentive Plan does not provide for automatic vesting of awards solely upon a change in control of the Company. |

| • | No Discounted Stock Options or Stock Appreciation Rights. Stock options and stock appreciation rights may not be granted under the 2023 Equity Incentive Plan with exercise prices lower than the market value of the underlying shares on the grant date. |

| • | No Transferability. 2023 Equity Incentive Plan awards generally may not be transferred, except by will or the laws of descent and distribution, unless approved by the Culture and Compensation Committee of the Board. |

| • | No Automatic Grants. The 2023 Equity Incentive Plan does not provide for automatic grants to any participant. |

20

Table of Contents

| • | No Repricings Without Stockholder Approval. The 2023 Equity Incentive Plan prohibits the repricing of stock options and SARs without prior stockholder approval, with customary exceptions for certain changes in capitalization. This provision applies to both direct repricings (lowering the exercise price or strike price of a stock option or stock appreciation right) as well as indirect repricings (canceling an outstanding stock option or stock appreciation right and granting a replacement stock option or stock appreciation right with a lower exercise price or exchanges or other substitutions for cash or other forms of awards). |

| • | No Tax Gross-Ups. The 2023 Equity Incentive Plan does not provide for any tax gross-ups. |

| • | Multiple Award Types. The 2023 Equity Incentive Plan permits the issuance of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock units, restricted stock awards and other types of equity grants, subject to the share limits of the 2023 Equity Incentive Plan. This breadth of award types will enable the Culture and Compensation Committee to tailor awards in light of the accounting, tax and other standards applicable at the time of grant. Historically, these standards have changed over time. |

| • | Independent Oversight. The 2023 Equity Incentive Plan is administered by the Culture and Compensation Committee, which is comprised of independent Board members. |

Administration

The 2023 Equity Incentive Plan is administered by the Culture and Compensation Committee. Subject to the express provisions of the 2023 Equity Incentive Plan, the Culture and Compensation Committee has the authority, in its discretion, to interpret the 2023 Equity Incentive Plan, establish rules and regulations for the Plan’s operation, select eligible individuals to receive awards and determine the form and amount and other terms and conditions of such awards.

Summary of Award Terms and Conditions

Awards under the 2023 Equity Incentive Plan may include nonqualified and incentive stock options, stock appreciation rights, restricted shares, restricted stock units and other stock-based awards. Any of these awards may (but need not) be made as performance incentives to reward attainment of performance goals.

Stock Options. The Culture and Compensation Committee may grant to a 2023 Equity Incentive Plan participant options to purchase our common stock that qualify as incentive stock options for purposes of Code Section 422, options that do not qualify as incentive stock options, or a combination thereof. The terms and conditions of stock option grants, including the quantity, exercise price, vesting periods and other conditions on exercise will be determined by the Committee and will be reflected in a written award agreement.

The exercise price of each option (except those that constitute substitute awards) will be determined by the Culture and Compensation Committee, but will be at least the fair market value of a share of common stock on the date the stock option is granted; provided, however, in the case of incentive stock options granted to a holder of more than 10% of the total combined voting power of all classes of our stock on the date of grant, the exercise price shall be not less than 110% of the fair market value of one share of common stock on the date the stock option is granted.

Stock options must be exercised within a period fixed by the Culture and Compensation Committee that may not exceed 10 years from the date of grant, except that in the case of incentive stock options granted to a holder of more than 10% of the total combined voting power of all classes of our stock on the date of grant, the exercise period may not exceed five years. The 2023 Equity Incentive Plan

21

Table of Contents

provides for earlier termination of stock options upon the participant’s termination of service, unless extended by the Culture and Compensation Committee, but in no event may the options be exercised after the scheduled expiration date of the options.

At the Culture and Compensation Committee’s discretion, payment for shares of common stock on the exercise of stock options may be made in cash, shares of our common stock held by the participant or in any other form of consideration acceptable to the Culture and Compensation Committee (including one or more forms of “cashless” or “net” exercise).

Stock Appreciation Rights. The Culture and Compensation Committee may grant to a 2023 Equity Incentive Plan participant an award of stock appreciation rights, which entitles the participant to receive, upon its exercise, a payment equal to (a) the excess of the fair market value of a share of common stock on the exercise date over the stock appreciation right exercise price, multiplied by (b) the number of shares of common stock with respect to which the stock appreciation right is exercised. The terms and conditions of awards of stock appreciation rights, including the quantity, exercise price, vesting periods and other conditions on exercise will be determined by the Culture and Compensation Committee and will be reflected in a written award agreement.