EXHIBIT 99.1

Published on June 12, 2018

Exhibit 99.1 NeoGenomics Investor Presentation June 2018

This presentation has been prepared by NeoGenomics, Inc. (“we,” ”us,” “our,” “NeoGenomics” or the “Company”) and is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward-looking statements. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward-looking statements due to numerous known and unknown risks and uncertainties. All forward-looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. 2

Company Overview A leading pure-play oncology testing company Significant market growth tailwinds Extensive molecular/oncology test menu A leader in immuno-oncology testing Market share gains driven by customer satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 3

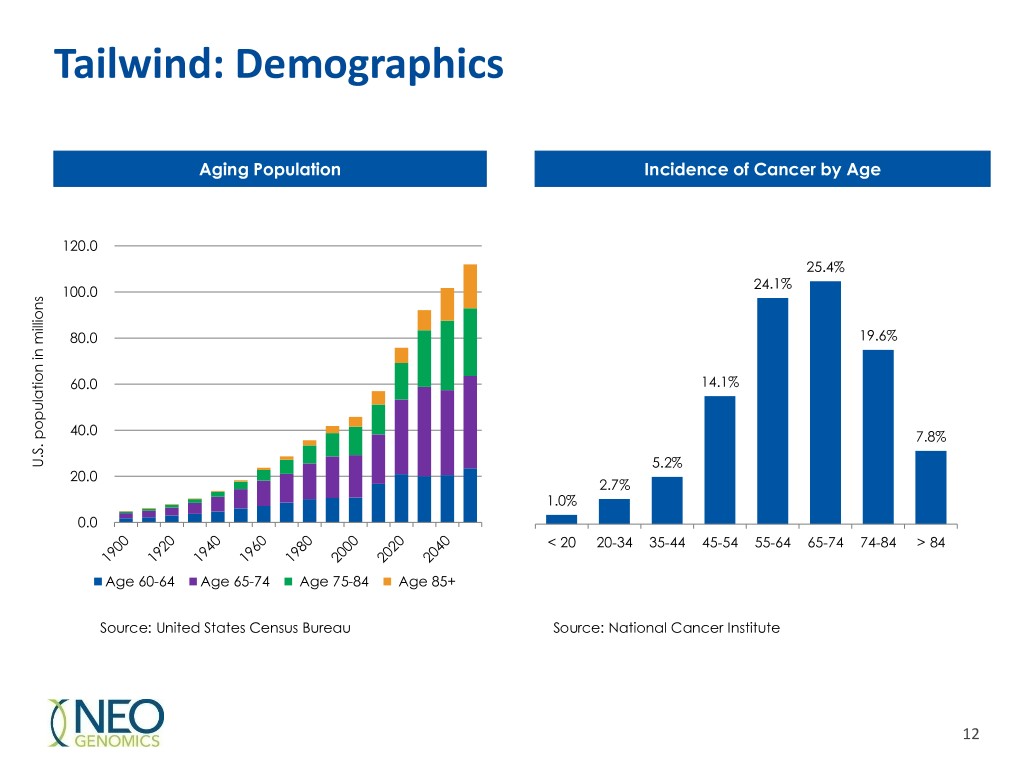

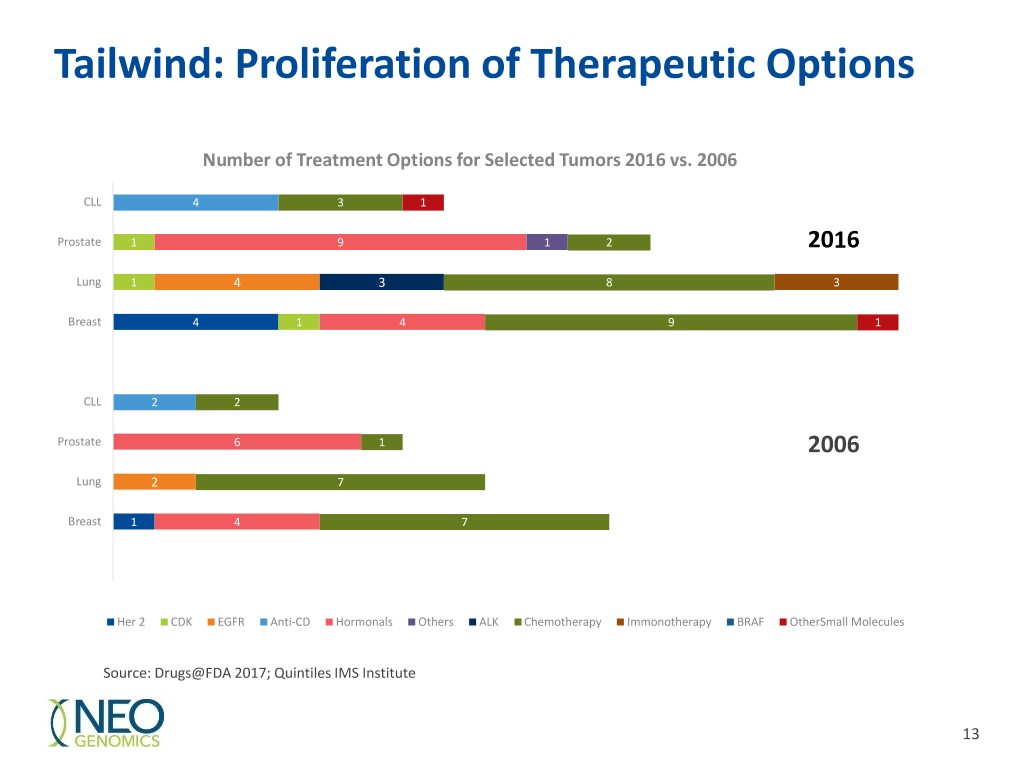

Substantial Industry Tailwinds • Aging population driving cancer incidence • Increased survival driving follow-on testing • Growing number of therapeutic options • Increased therapeutic complexity • Burgeoning oncology drug pipeline • Emerging platforms and tests (NGS, TMB, MSI, etc.) 4

Our Competitive Advantage • Comprehensive, multi-modality “one-stop-shop” • Large and advanced somatic cancer test menu • National footprint and extensive payer contracts • Outstanding client service and partnership models • Leader in test development immuno-oncology • Synergistic Pharma and Clinical businesses 5

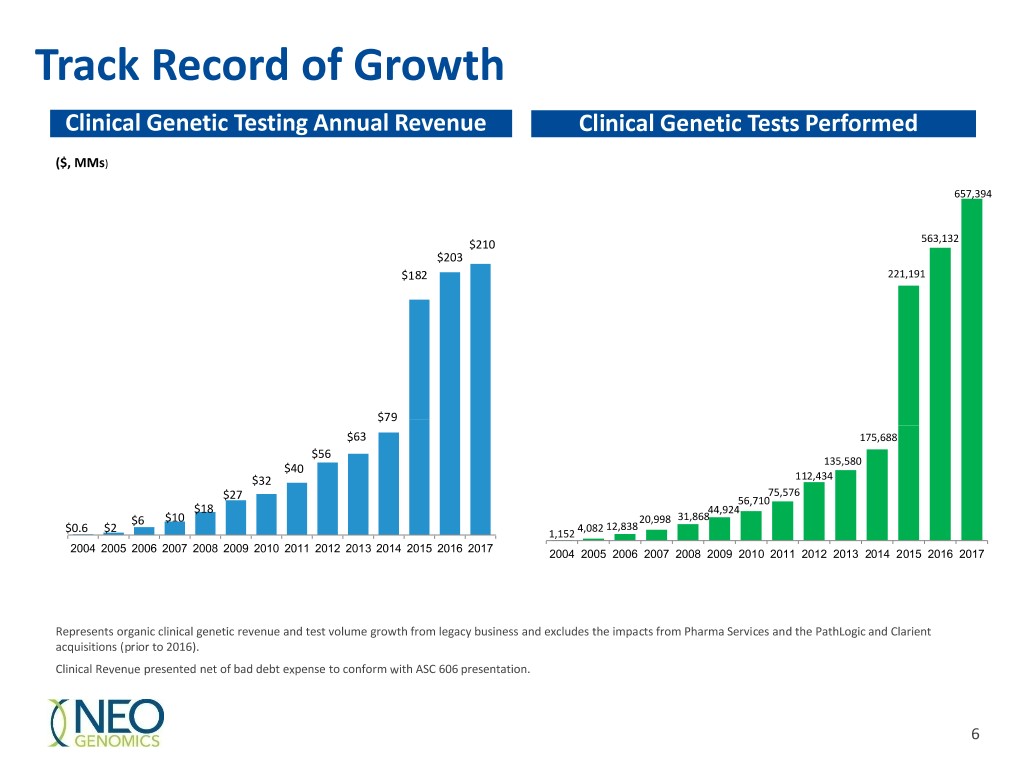

Track Record of Growth Clinical Genetic Testing Annual Revenue Clinical Genetic Tests Performed ($, MMs) 657,394 $210 563,132 $203 $182 221,191 $79 $63 175,688 $56 135,580 $40 $32 112,434 75,576 $27 56,710 $18 44,924 $6 $10 20,998 31,868 4,082 12,838 $0.6 $2 1,152 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Represents organic clinical genetic revenue and test volume growth from legacy business and excludes the impacts from Pharma Services and the PathLogic and Clarient acquisitions (prior to 2016). Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. 6

Significant Near-term Growth Drivers • Large backlog of signed Pharma contracts • Global strategic alliance with PPD • New labs in Geneva, Houston and Atlanta • New commercial payor contracts • New GPO relationships 7

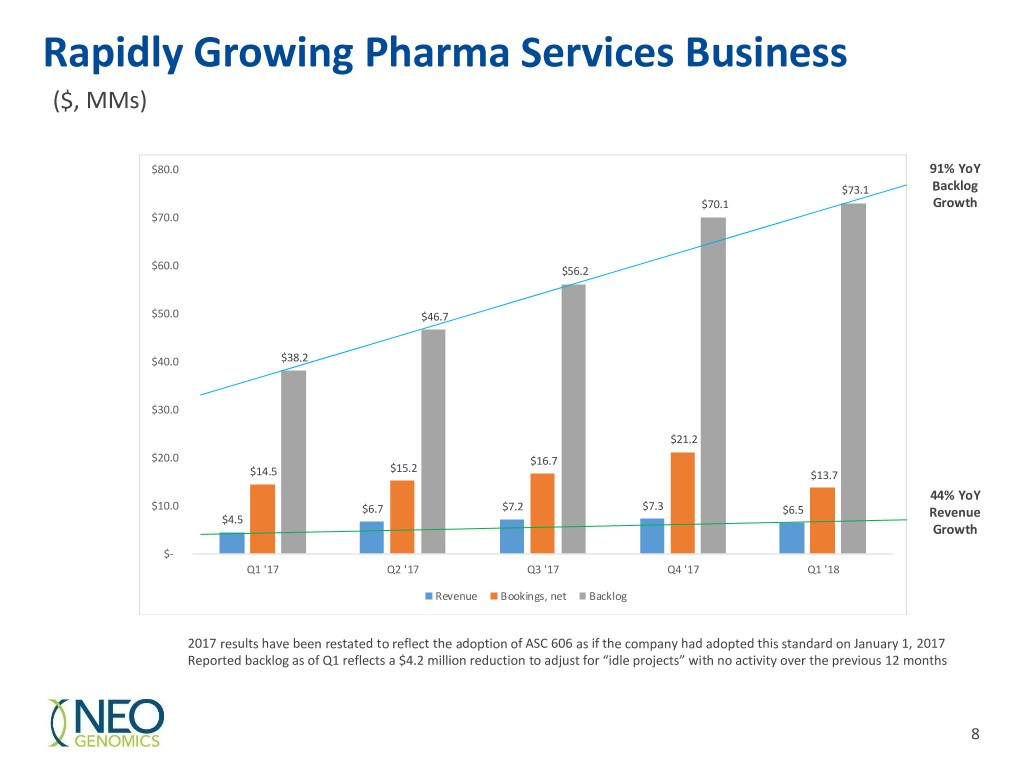

Rapidly Growing Pharma Services Business ($, MMs) $80.0 91% YoY $73.1 Backlog $70.1 Growth $70.0 $60.0 $56.2 $50.0 $46.7 $40.0 $38.2 $30.0 $21.2 $20.0 $16.7 $15.2 $14.5 $13.7 44% YoY $10.0 $6.7 $7.2 $7.3 $6.5 $4.5 Revenue Growth $- Q1 '17 Q2 '17 Q3 '17 Q4 '17 Q1 '18 Revenue Bookings, net Backlog 2017 results have been restated to reflect the adoption of ASC 606 as if the company had adopted this standard on January 1, 2017 Reported backlog as of Q1 reflects a $4.2 million reduction to adjust for “idle projects” with no activity over the previous 12 months 8

Global Strategic Alliance With PPD • PPD’s preferred lab for oncology testing • Significant revenue opportunity • Expands global client base • Expansion into Asia • Collaborations for companion diagnostics • Opportunities to leverage laboratory data for trials 9

Industry and Company Overview 10

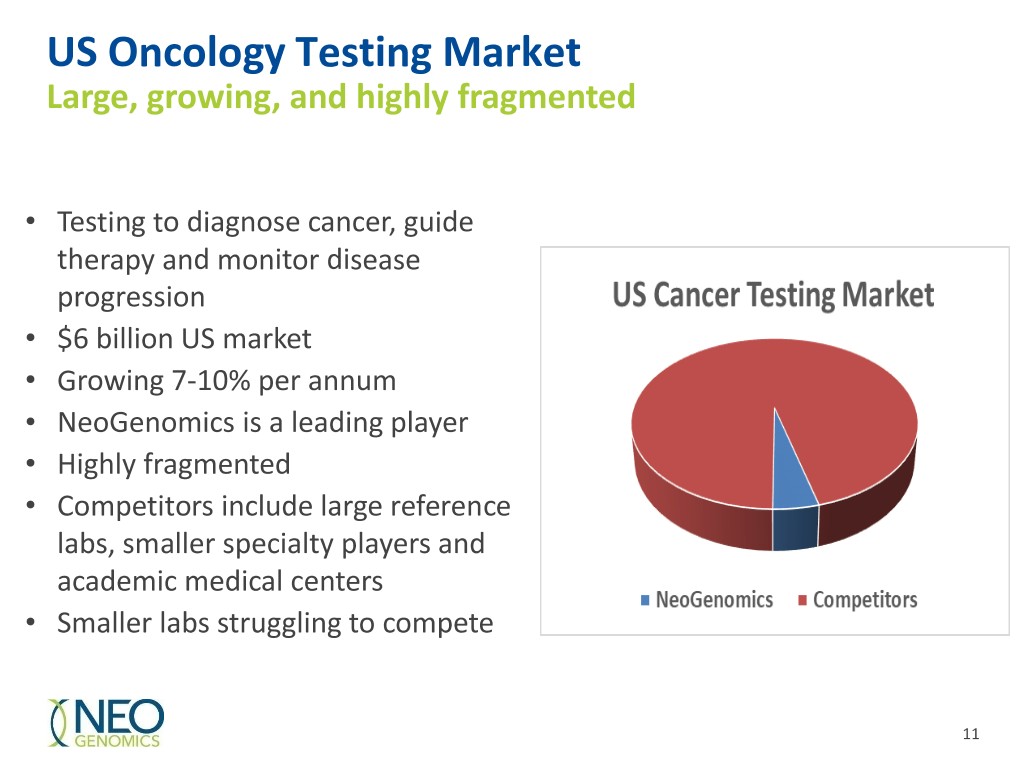

US Oncology Testing Market Large, growing, and highly fragmented • Testing to diagnose cancer, guide therapy and monitor disease progression • $6 billion US market • Growing 7-10% per annum • NeoGenomics is a leading player • Highly fragmented • Competitors include large reference labs, smaller specialty players and academic medical centers • Smaller labs struggling to compete 11

Tailwind: Demographics Aging Population Incidence of Cancer by Age 120.0 25.4% 24.1% 100.0 80.0 19.6% 60.0 14.1% 40.0 7.8% U.S. U.S. populationin millions 5.2% 20.0 2.7% 1.0% 0.0 < 20 20-34 35-44 45-54 55-64 65-74 74-84 > 84 Age 60-64 Age 65-74 Age 75-84 Age 85+ Source: United States Census Bureau Source: National Cancer Institute 12

Tailwind: Proliferation of Therapeutic Options Number of Treatment Options for Selected Tumors 2016 vs. 2006 CLL 4 3 1 Prostate 1 9 1 2 2016 Lung 1 4 3 8 3 Breast 4 1 4 9 1 CLL 2 2 Prostate 6 1 2006 Lung 2 7 Breast 1 4 7 Her 2 CDK EGFR Anti-CD Hormonals Others ALK Chemotherapy Immonotherapy BRAF OtherSmall Molecules Source: Drugs@FDA 2017; Quintiles IMS Institute 13

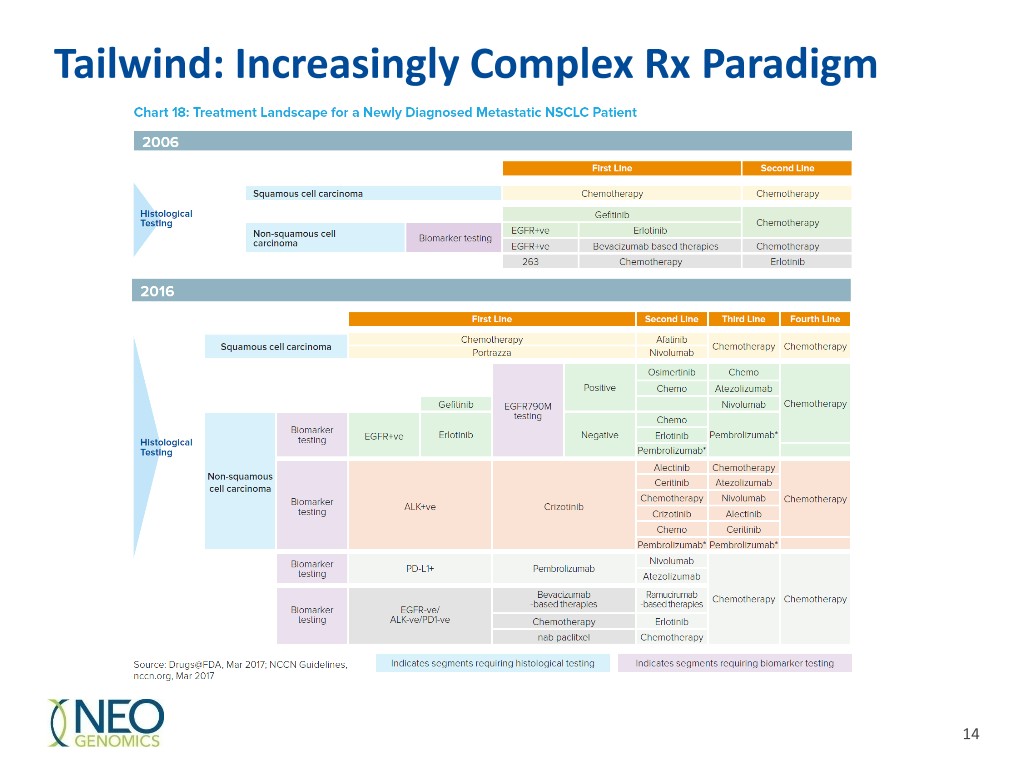

Tailwind: Increasingly Complex Rx Paradigm 14

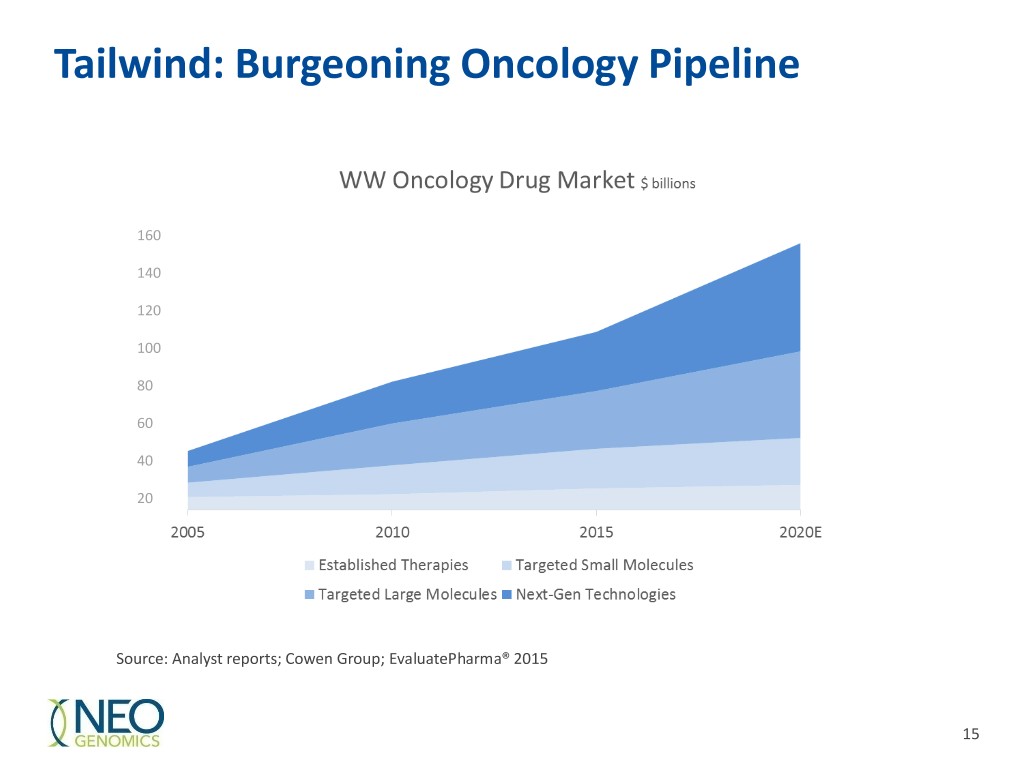

Tailwind: Burgeoning Oncology Pipeline 160 140 120 100 80 60 40 20 Source: Analyst reports; Cowen Group; EvaluatePharma® 2015 15

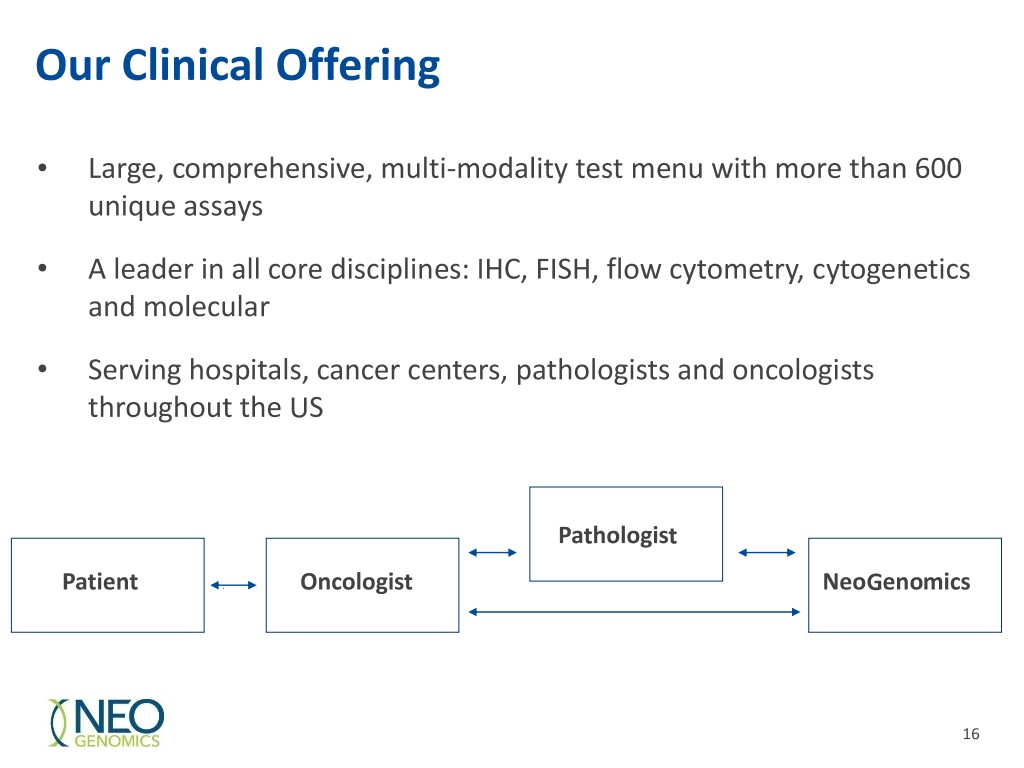

Our Clinical Offering • Large, comprehensive, multi-modality test menu with more than 600 unique assays • A leader in all core disciplines: IHC, FISH, flow cytometry, cytogenetics and molecular • Serving hospitals, cancer centers, pathologists and oncologists throughout the US Pathologist Patient Oncologist NeoGenomics 16

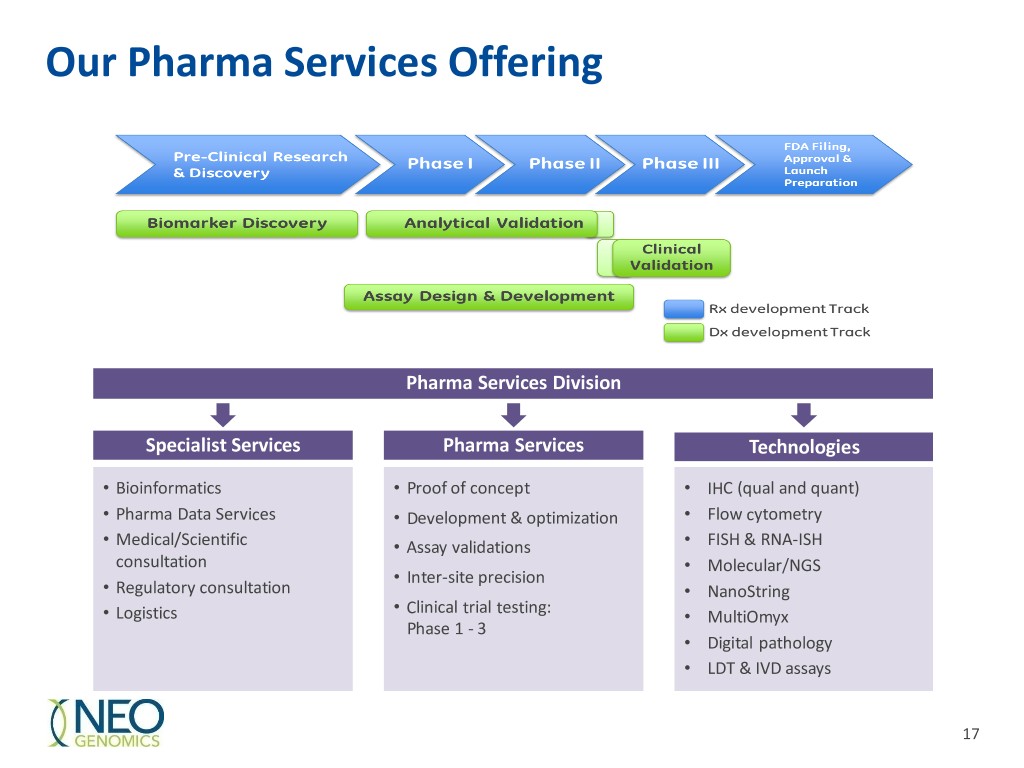

Our Pharma Services Offering Pharma Services Division Specialist Services Pharma Services Technologies • Bioinformatics • Proof of concept • IHC (qual and quant) • Pharma Data Services • Development & optimization • Flow cytometry • Medical/Scientific • Assay validations • FISH & RNA-ISH consultation • Molecular/NGS • Inter-site precision • Regulatory consultation • NanoString • Clinical trial testing: • Logistics • MultiOmyx Phase 1 - 3 • Digital pathology • LDT & IVD assays 17

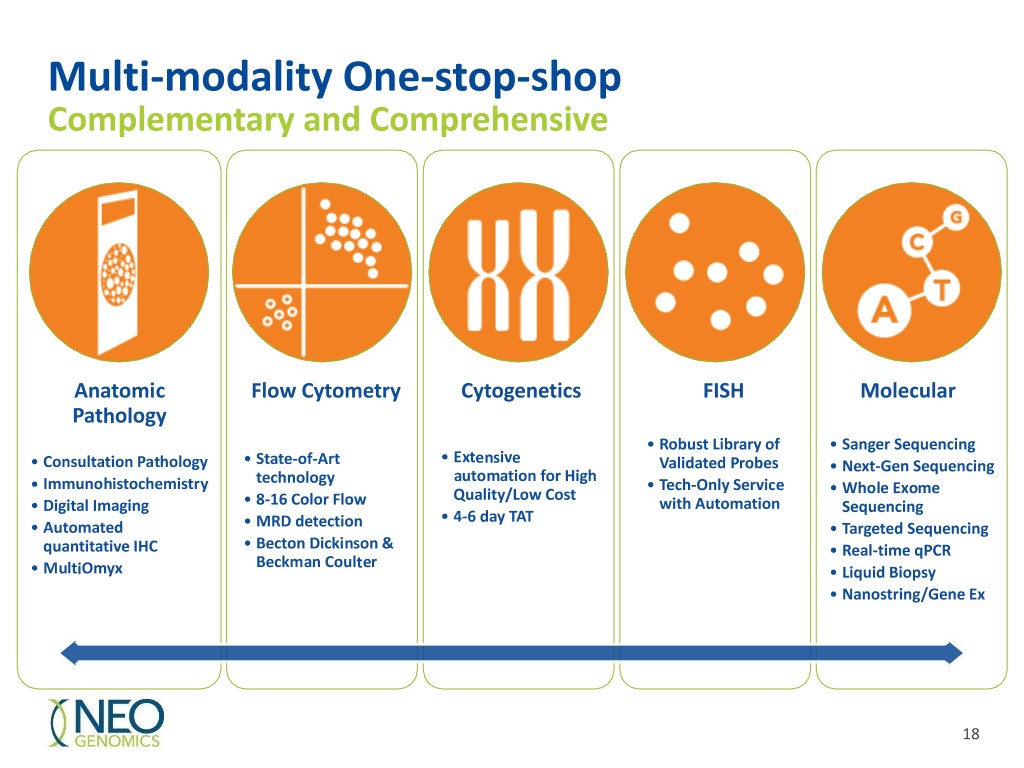

Multi-modality One-stop-shop Complementary and Comprehensive Anatomic Flow Cytometry Cytogenetics FISH Molecular Pathology • Robust Library of • Sanger Sequencing • Extensive • Consultation Pathology • State-of-Art Validated Probes • Next-Gen Sequencing automation for High • Immunohistochemistry technology • Tech-Only Service Quality/Low Cost • Whole Exome • Digital Imaging • 8-16 Color Flow with Automation Sequencing • 4-6 day TAT • Automated • MRD detection • Targeted Sequencing quantitative IHC • Becton Dickinson & • Real-time qPCR Beckman Coulter • MultiOmyx • Liquid Biopsy • Nanostring/Gene Ex 18

Track Record of Innovation New Tests Launched 2013-2017 2017 Locations: • Opening of first international laboratory in Rolle, Switzerland Papers Published: • Wild-type Blocking PCR Combined with Direct Sequencing as a Highly Sensitive Method for Detection of Low-Frequency 2016 Somatic Mutations. J Vis Exp. 2017 Mar. • Prevalence and relative proportions of CLL and non-CLL monoclonal B-cell lymphocytosis phenotypes in the Middle 50 new/revised tests, include: Eastern population. Hematol Oncol Stem Cell Ther. 2017 Mar. • Comprehensive PD-L1 Testing (three • Using high-sensitivity sequencing for the detection of mutations 2015 FDA-cleared and one LDT) in BTK and PLCγ2 genes in cellular and cell-free DNA and • 1,385 genes RNA-Based Pan Cancer correlation with progression in patients treated with BTK NGS Fusion, Mutation and Expression inhibitors. Oncotarget. 2017 Mar. 2014 70 new/revised tests, include: Profiling. • A Multi-Center Prospective Study to Validate an Algorithm Using TM • Smart Flow Cytometry data analysis Urine and Plasma Biomarkers for Predicting Gleason ≥3+4 NeoLAB Liquid Biopsies platform Prostate Cancer on Biopsy. Journal of Cancer - 2017 Aug 2017 • MDS/CMML Profile 60 new/revised tests, include: • Aug. • AML Profile Pediatric Hereditary Susceptibility • Acquired RhD mosaicism identifies fibrotic transformation of • 24 new NeoTYPE Next Generation • FLT3 Mutation Analysis • Hereditary DNA Panel (prostate) thrombopoietin receptor-mutated essential thrombocythemia. Sequencing Profiles • NPM1 Mutation Analysis 2013 • Inherited Bone Marrow Failure Transfusion. 2017 Sep. • PML-RARA Translocation • 26 new IHC/ISH tests • MET Exon 14 Deletion Analysis • • Significant Improvement in Detecting BRAF, KRAS, and EGFR • Additional NeoLAB Prostate clinical RUNX1-RNX1T1Transloc • • NRAS Exon 4 Mutation Analysis Mutations Using Next-Generation Sequencing as Compared with studies INV16 Translocation 40 new Molecular tests, include: • c-kit Mutation Analysis • NGS ALK, NTRK, RET, ROS1 Fusion FDA-Cleared Kits. Mol Diagn Ther. 2017 Oct. • AML Extended FISH Panel • IDH1 Mutation Analysis • Add’l NeoTYPE® Panels Invited Speaking Events: • AML Favorable-Risk FISH Panel • IDH2 Mutation Analysis NeoLAB Liquid Biopsies • Next Generation Sequencing (48 • American Society of Hematology 2017 – 2 oral presentations • MDS Extended FISH Panel • NRAS Mutation Analysis • NeoLAB Myeloid Disorders Profile genes) • KRAS Mutation Analysis • Plasma Cell Myeloma Risk • EGFR T790M New Tests • ROS1 FISH • BTK Inhibitor Resistance Stratification FISH Panel Molecular • NeoSITE® Melanoma FISH • Solid Tumor Monitoring NeoTYPE Multi Modality Profiles IHC • RET FISH • NPM1 MRD Analysis • Plasma/Urine-based Prostate Test • AITL/Peripheral T-Cell Lymphoma • ATRX • MET FISH Germline MolDx Testing • Oncomine™ Dx Target Test (Patent App) • BRCA1 & BRCA2 • Thyroid Profile • MAL • ALL Adult & Pediatric FISH Panels • Tumor Mutation Burden • SVM-based Cytogenetics Analysis • Lynch Syndrome (colon) • Brain Tumor Profile • PD-L1 22C3 FDA • HER2 Breast Equivocal FISH Panel • Universal Fusion/Expression Profile System • 73 Gene Comprehensive • Melanoma Profile (KEYTRUDA®) for • BRAF Translocation FISH Predisposition Panel Gastric/GEA • SVM-based Automated FISH • Liposarcoma Fusion Profile NeoTYPE • PD-L1 SP263 FDA Analysis System v2 • Chromosome 1 POC Ploidy Other • NeoTYPE GI Predictive Profile • Head & Neck Tumor Profile (IMFINZI™) • Began development of NeoLAB • Launched robotic FISH-Cyto • ALK, ROS1, RET Fusion FISH (Liquid Alternative to Biopsy) processing platform • Sarcoma gene Fusion FISH & IHC • RRM1 • Prostate Cx test • NeoSITE Cervical FISH • FISH Testing for EWSR1, SS18, DDIT3, CDKN2A (p16) Deletion for • TOPO1 • Expanded IHC Menu STAT 6, BCL2, & TCL1 Mesothelioma • Smart Flow Cytometry Other • IHC Testing for CXCL13, BAP1, INI1, New Platforms: • HPV RNA ISH MUC4 Launch of New BD Fortessa X-20 services for Pharma Services flow • PD-L1 cytometry 19

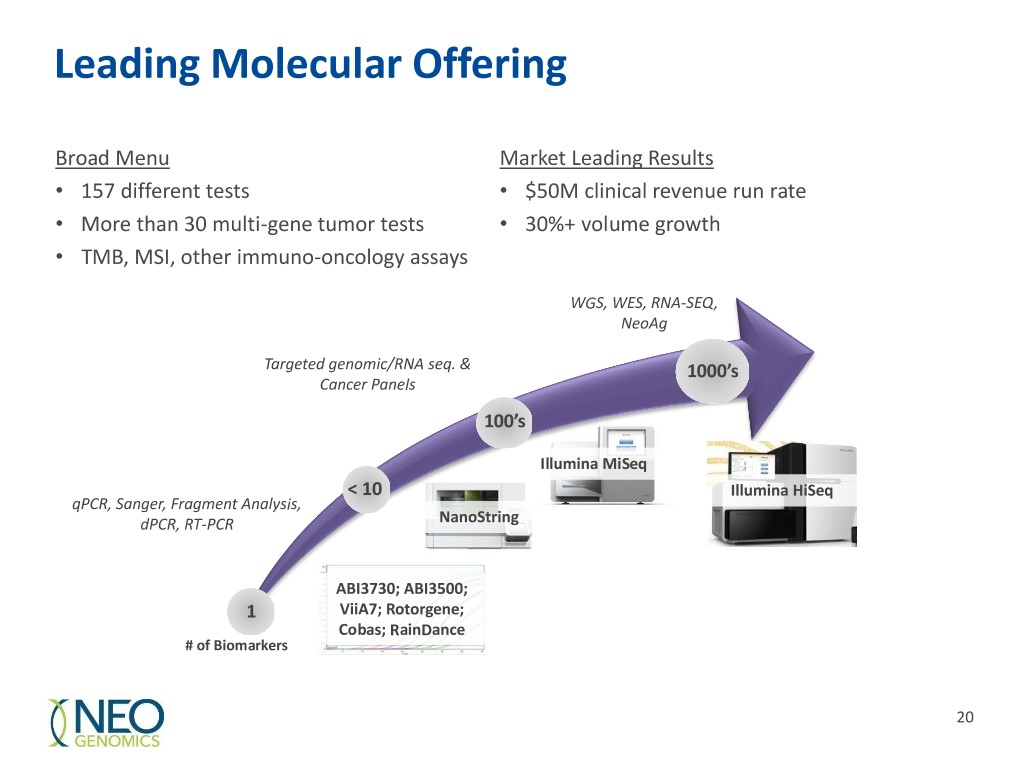

Leading Molecular Offering Broad Menu Market Leading Results • 157 different tests • $50M clinical revenue run rate • More than 30 multi-gene tumor tests • 30%+ volume growth • TMB, MSI, other immuno-oncology assays WGS, WES, RNA-SEQ, NeoAg Targeted genomic/RNA seq. & 1000’s Cancer Panels 100’s Illumina MiSeq < 10 Illumina HiSeq qPCR, Sanger, Fragment Analysis, dPCR, RT-PCR NanoString ABI3730; ABI3500; 1 ViiA7; Rotorgene; Cobas; RainDance # of Biomarkers 20

National Footprint Dots reflect individual customers; colors reflect sales territories 21

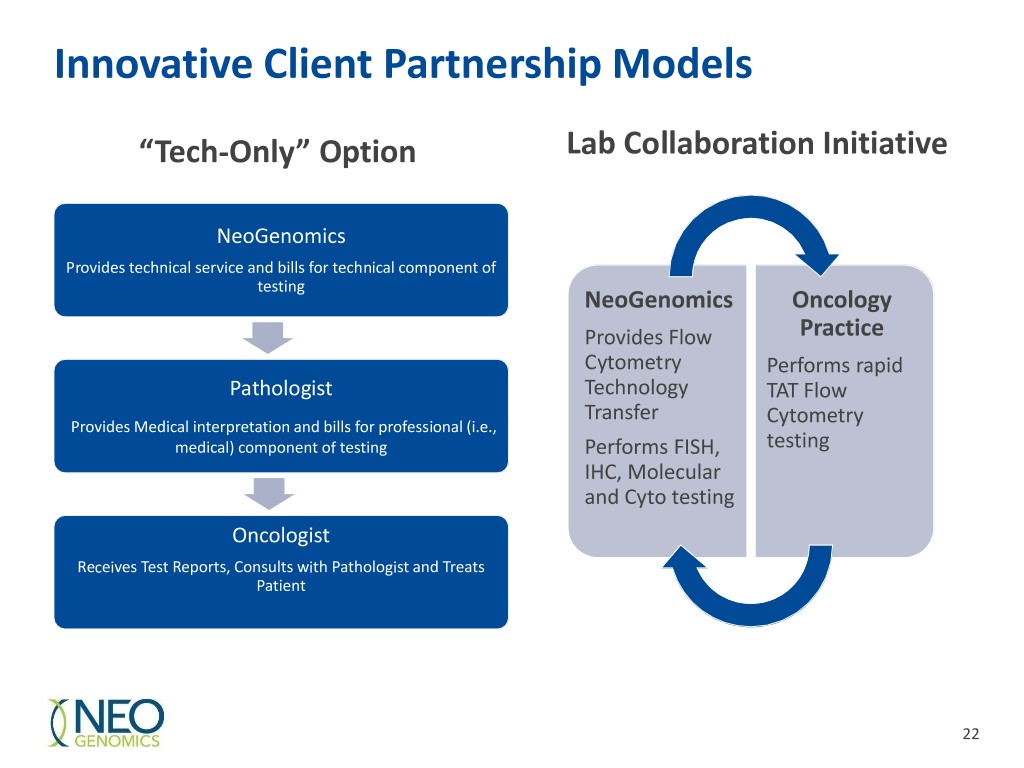

Innovative Client Partnership Models “Tech-Only” Option Lab Collaboration Initiative NeoGenomics Provides technical service and bills for technical component of testing NeoGenomics Oncology Provides Flow Practice Cytometry Performs rapid Pathologist Technology TAT Flow Transfer Provides Medical interpretation and bills for professional (i.e., Cytometry medical) component of testing Performs FISH, testing IHC, Molecular and Cyto testing Oncologist Receives Test Reports, Consults with Pathologist and Treats Patient 22

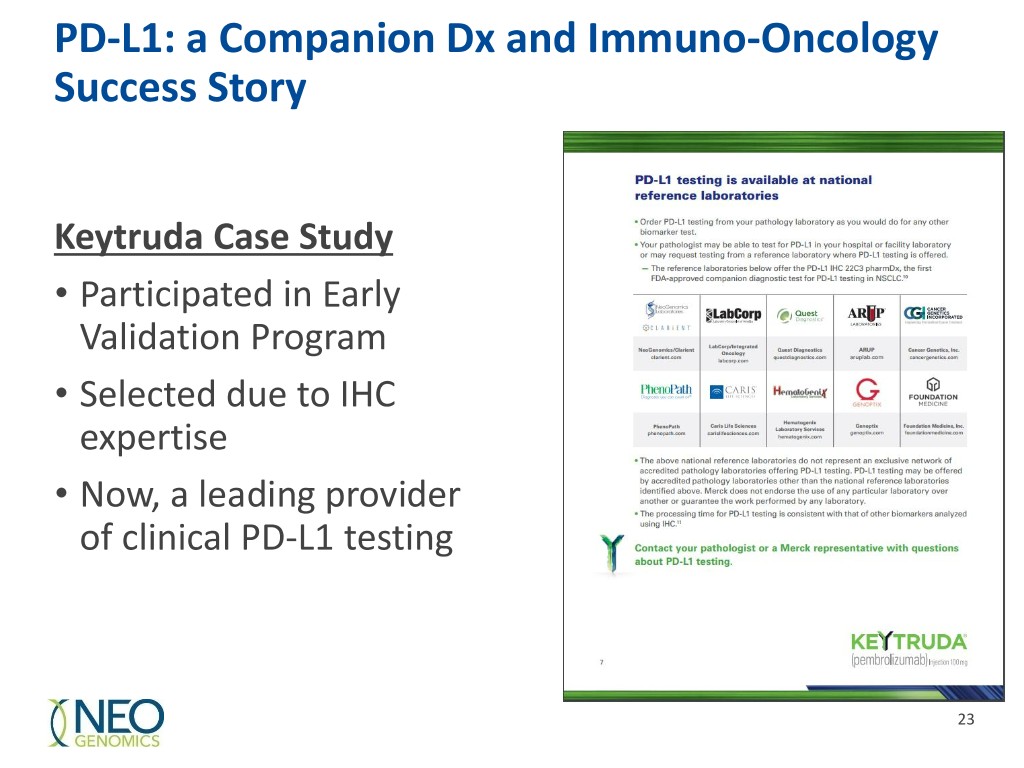

PD-L1: a Companion Dx and Immuno-Oncology Success Story Keytruda Case Study • Participated in Early Validation Program • Selected due to IHC expertise • Now, a leading provider of clinical PD-L1 testing 23

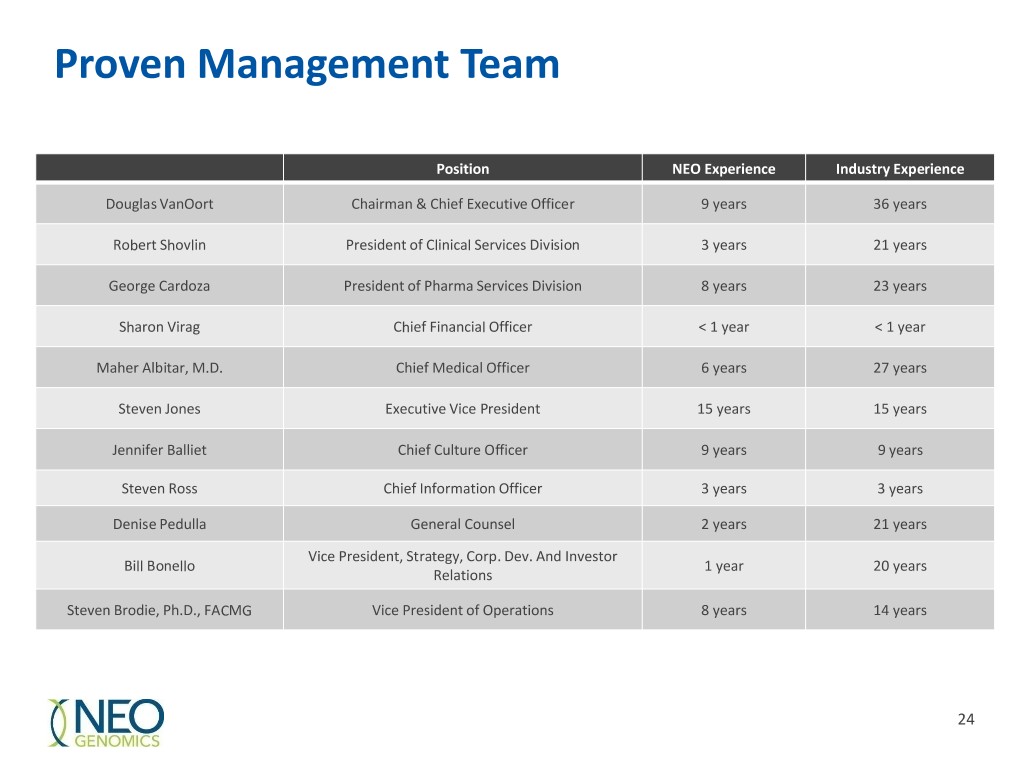

Proven Management Team Position NEO Experience Industry Experience Douglas VanOort Chairman & Chief Executive Officer 9 years 36 years Robert Shovlin President of Clinical Services Division 3 years 21 years George Cardoza President of Pharma Services Division 8 years 23 years Sharon Virag Chief Financial Officer < 1 year < 1 year Maher Albitar, M.D. Chief Medical Officer 6 years 27 years Steven Jones Executive Vice President 15 years 15 years Jennifer Balliet Chief Culture Officer 9 years 9 years Steven Ross Chief Information Officer 3 years 3 years Denise Pedulla General Counsel 2 years 21 years Vice President, Strategy, Corp. Dev. And Investor Bill Bonello 1 year 20 years Relations Steven Brodie, Ph.D., FACMG Vice President of Operations 8 years 14 years 24

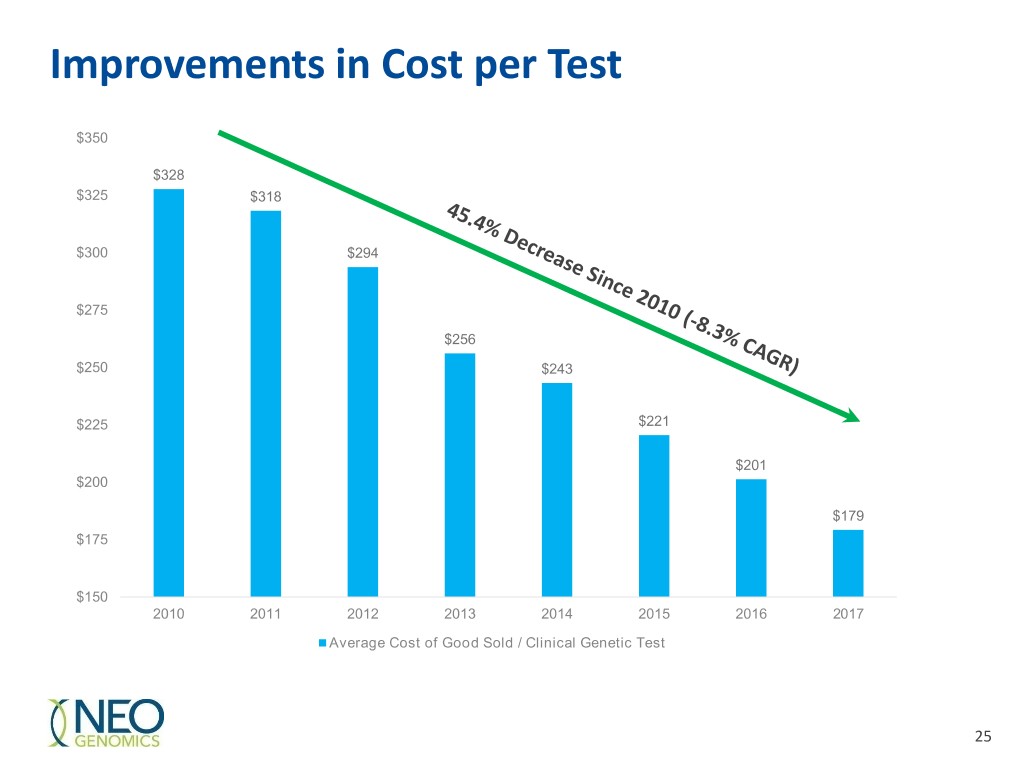

Improvements in Cost per Test $350 $328 $325 $318 $300 $294 $275 $256 $250 $243 $225 $221 $201 $200 $179 $175 $150 2010 2011 2012 2013 2014 2015 2016 2017 Average Cost of Good Sold / Clinical Genetic Test 25

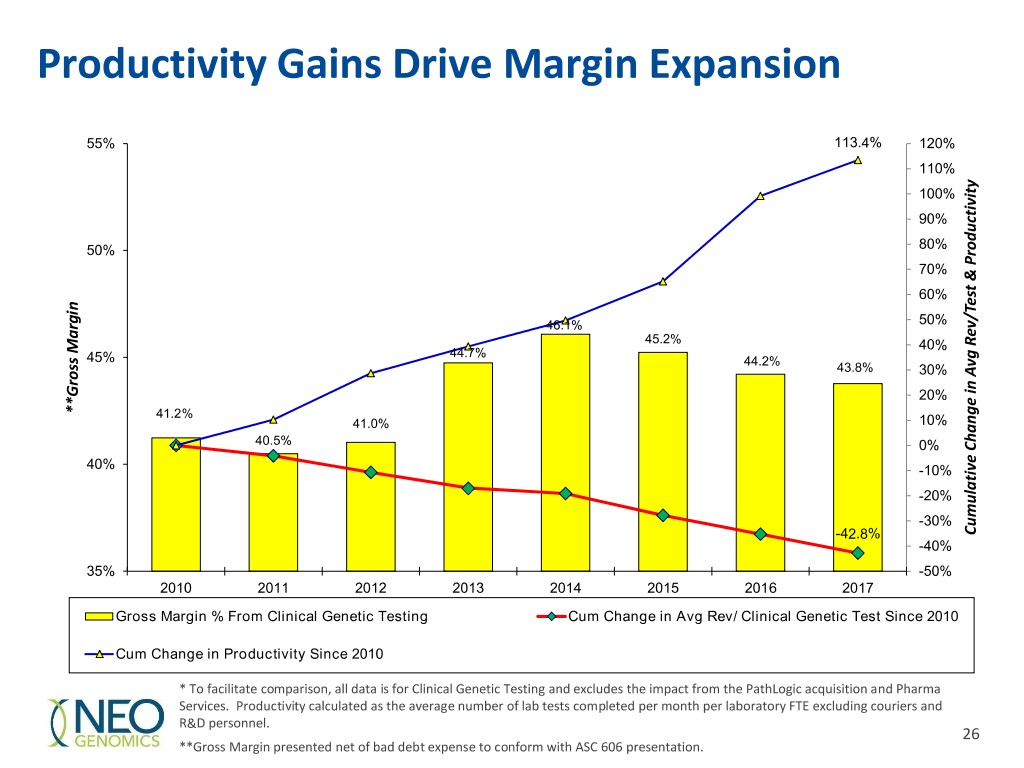

Productivity Gains Drive Margin Expansion 55% 113.4% 120% 110% 100% 90% 50% 80% 70% 60% 46.1% 50% 45.2% 40% Margin 44.7% 45% 44.2% 43.8% 30% 20% **Gross **Gross 41.2% 41.0% 10% 40.5% 0% 40% -10% -20% -30% -42.8% Productivity& Rev/Test CumulativeChangeinAvg -40% 35% -50% 2010 2011 2012 2013 2014 2015 2016 2017 Gross Margin % From Clinical Genetic Testing Cum Change in Avg Rev/ Clinical Genetic Test Since 2010 Cum Change in Productivity Since 2010 * To facilitate comparison, all data is for Clinical Genetic Testing and excludes the impact from the PathLogic acquisition and Pharma Services. Productivity calculated as the average number of lab tests completed per month per laboratory FTE excluding couriers and R&D personnel. 26 **Gross Margin presented net of bad debt expense to conform with ASC 606 presentation.

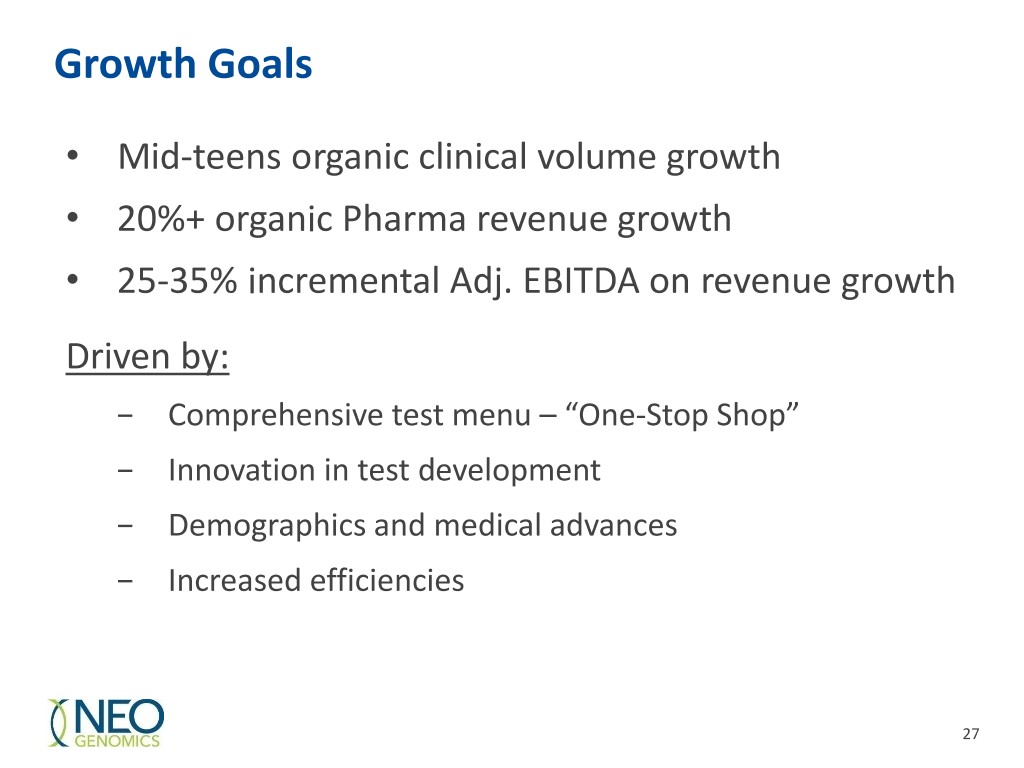

Growth Goals • Mid-teens organic clinical volume growth • 20%+ organic Pharma revenue growth • 25-35% incremental Adj. EBITDA on revenue growth Driven by: − Comprehensive test menu – “One-Stop Shop” − Innovation in test development − Demographics and medical advances − Increased efficiencies 27

Investment Highlights Leading pure-play oncology testing company Significant Market Growth Tailwinds Extensive molecular/oncology test menu Leader in immuno-oncology testing Market share gains driven by Customer Satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 28

Appendix 29

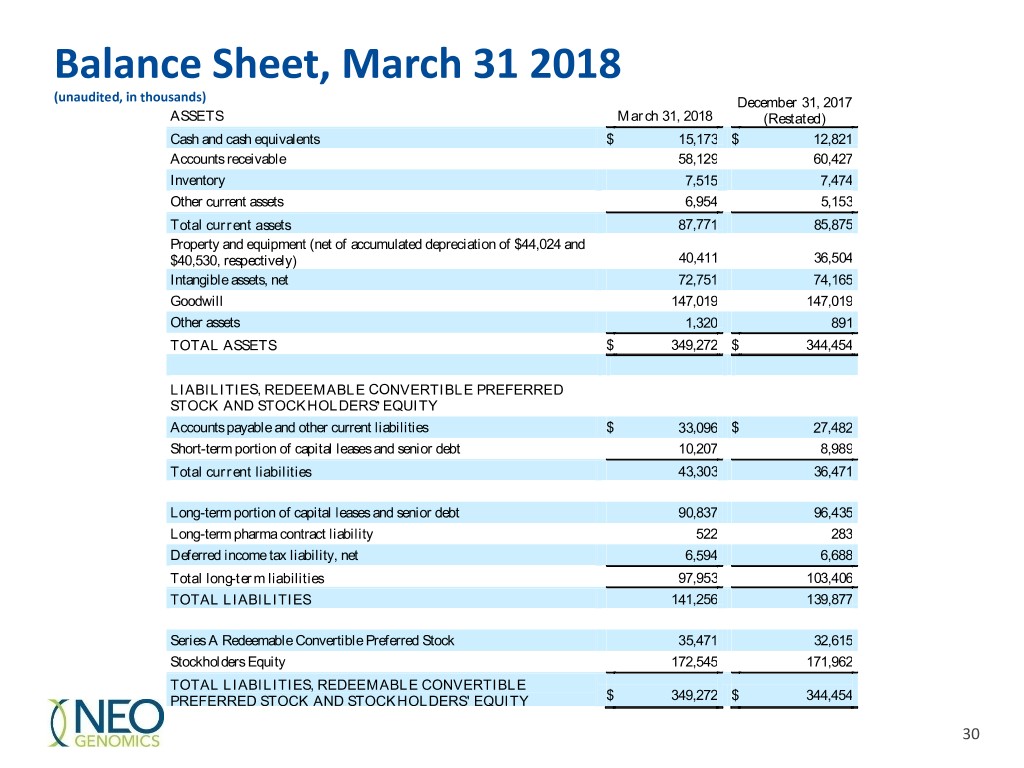

Balance Sheet, March 31 2018 (unaudited, in thousands) December 31, 2017 ASSETS March 31, 2018 (Restated) Cash and cash equivalents $ 15,173 $ 12,821 Accounts receivable 58,129 60,427 Inventory 7,515 7,474 Other current assets 6,954 5,153 Total current assets 87,771 85,875 Property and equipment (net of accumulated depreciation of $44,024 and $40,530, respectively) 40,411 36,504 Intangible assets, net 72,751 74,165 Goodwill 147,019 147,019 Other assets 1,320 891 TOTAL ASSETS $ 349,272 $ 344,454 LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY Accounts payable and other current liabilities $ 33,096 $ 27,482 Short-term portion of capital leases and senior debt 10,207 8,989 Total current liabilities 43,303 36,471 Long-term portion of capital leases and senior debt 90,837 96,435 Long-term pharma contract liability 522 283 Deferred income tax liability, net 6,594 6,688 Total long-term liabilities 97,953 103,406 TOTAL LIABILITIES 141,256 139,877 Series A Redeemable Convertible Preferred Stock 35,471 32,615 Stockholders Equity 172,545 171,962 TOTAL LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY $ 349,272 $ 344,454 30

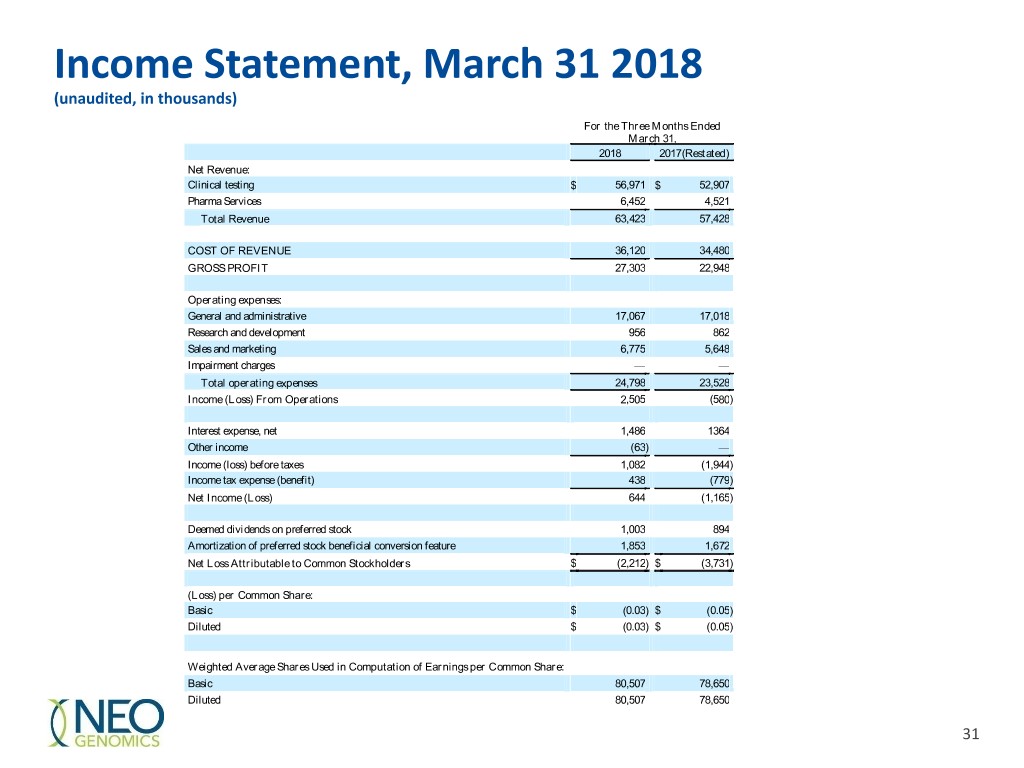

Income Statement, March 31 2018 (unaudited, in thousands) For the Three Months Ended March 31, 2018 2017(Restated) Net Revenue: Clinical testing $ 56,971 $ 52,907 Pharma Services 6,452 4,521 Total Revenue 63,423 57,428 COST OF REVENUE 36,120 34,480 GROSS PROFIT 27,303 22,948 Operating expenses: General and administrative 17,067 17,018 Research and development 956 862 Sales and marketing 6,775 5,648 Impairment charges — — Total operating expenses 24,798 23,528 Income (Loss) From Operations 2,505 (580 ) Interest expense, net 1,486 1364 Other income (63 ) — Income (loss) before taxes 1,082 (1,944 ) Income tax expense (benefit) 438 (779 ) Net Income (Loss) 644 (1,165 ) Deemed dividends on preferred stock 1,003 894 Amortization of preferred stock beneficial conversion feature 1,853 1,672 Net Loss Attributable to Common Stockholders $ (2,212 ) $ (3,731 ) (Loss) per Common Share: Basic $ (0.03 ) $ (0.05 ) Diluted $ (0.03 ) $ (0.05 ) Weighted Average Shares Used in Computation of Earnings per Common Share: Basic 80,507 78,650 Diluted 80,507 78,650 31

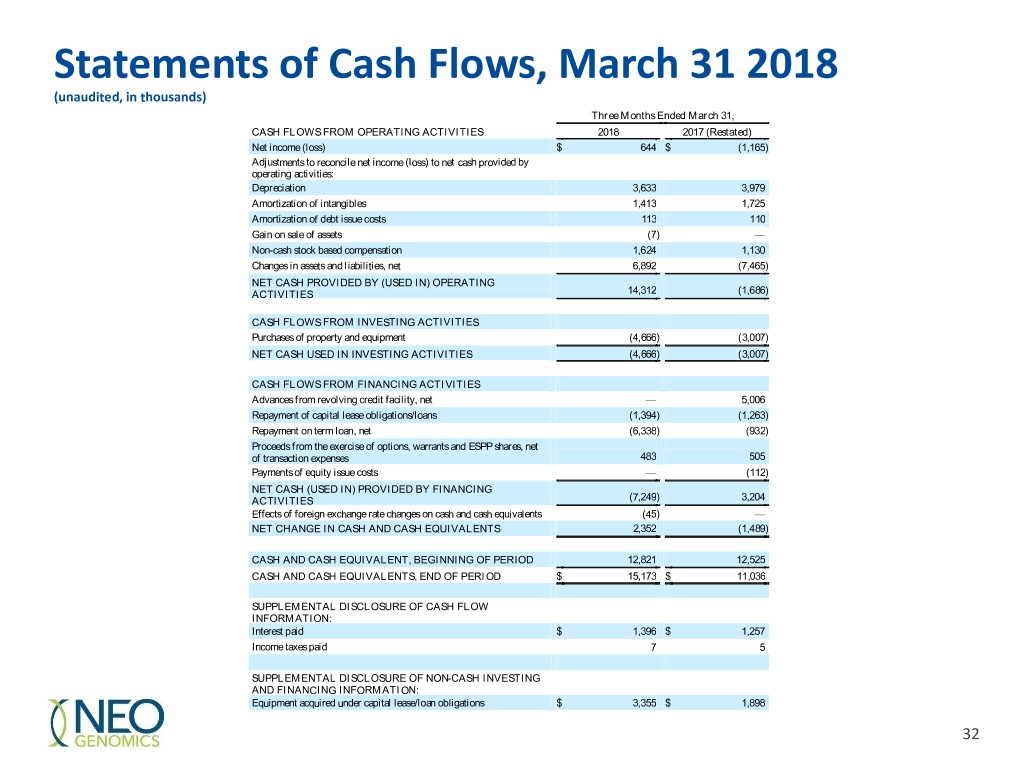

Statements of Cash Flows, March 31 2018 (unaudited, in thousands) Three Months Ended March 31, CASH FLOWS FROM OPERATING ACTIVITIES 2018 2017 (Restated) Net income (loss) $ 644 $ (1,165 ) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation 3,633 3,979 Amortization of intangibles 1,413 1,725 Amortization of debt issue costs 113 110 Gain on sale of assets (7 ) — Non-cash stock based compensation 1,624 1,130 Changes in assets and liabilities, net 6,892 (7,465 ) NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES 14,312 (1,686 ) CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (4,666 ) (3,007 ) NET CASH USED IN INVESTING ACTIVITIES (4,666 ) (3,007 ) CASH FLOWS FROM FINANCING ACTIVITIES Advances from revolving credit facility, net — 5,006 Repayment of capital lease obligations/loans (1,394 ) (1,263 ) Repayment on term loan, net (6,338 ) (932 ) Proceeds from the exercise of options, warrants and ESPP shares, net of transaction expenses 483 505 Payments of equity issue costs — (112 ) NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES (7,249 ) 3,204 Effects of foreign exchange rate changes on cash and cash equivalents (45 ) — NET CHANGE IN CASH AND CASH EQUIVALENTS 2,352 (1,489 ) CASH AND CASH EQUIVALENT, BEGINNING OF PERIOD 12,821 12,525 CASH AND CASH EQUIVALENTS, END OF PERIOD $ 15,173 $ 11,036 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Interest paid $ 1,396 $ 1,257 Income taxes paid 7 5 SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING INFORMATION: Equipment acquired under capital lease/loan obligations $ 3,355 $ 1,898 32

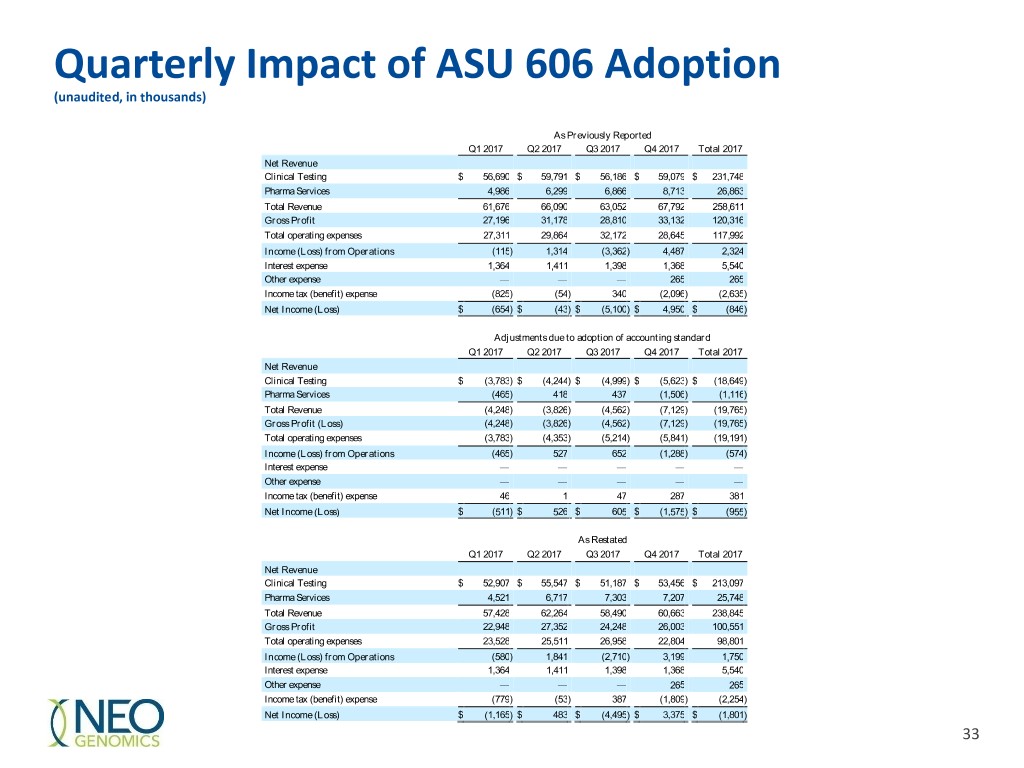

Quarterly Impact of ASU 606 Adoption (unaudited, in thousands) As Previously Reported Q1 2017 Q2 2017 Q3 2017 Q4 2017 Total 2017 Net Revenue Clinical Testing $ 56,690 $ 59,791 $ 56,186 $ 59,079 $ 231,748 Pharma Services 4,986 6,299 6,866 8,713 26,863 Total Revenue 61,676 66,090 63,052 67,792 258,611 Gross Profit 27,196 31,178 28,810 33,132 120,316 Total operating expenses 27,311 29,864 32,172 28,645 117,992 Income (Loss) from Operations (115 ) 1,314 (3,362 ) 4,487 2,324 Interest expense 1,364 1,411 1,398 1,368 5,540 Other expense — — — 265 265 Income tax (benefit) expense (825 ) (54 ) 340 (2,096) (2,635 ) Net Income (Loss) $ (654 ) $ (43 ) $ (5,100 ) $ 4,950 $ (846 ) Adjustments due to adoption of accounting standard Q1 2017 Q2 2017 Q3 2017 Q4 2017 Total 2017 Net Revenue Clinical Testing $ (3,783 ) $ (4,244 ) $ (4,999 ) $ (5,623) $ (18,649 ) Pharma Services (465 ) 418 437 (1,506) (1,116 ) Total Revenue (4,248 ) (3,826 ) (4,562 ) (7,129) (19,765 ) Gross Profit (Loss) (4,248 ) (3,826 ) (4,562 ) (7,129) (19,765 ) Total operating expenses (3,783 ) (4,353 ) (5,214 ) (5,841) (19,191 ) Income (Loss) from Operations (465 ) 527 652 (1,288) (574 ) Interest expense — — — — — Other expense — — — — — Income tax (benefit) expense 46 1 47 287 381 Net Income (Loss) $ (511 ) $ 526 $ 605 $ (1,575) $ (955 ) As Restated Q1 2017 Q2 2017 Q3 2017 Q4 2017 Total 2017 Net Revenue Clinical Testing $ 52,907 $ 55,547 $ 51,187 $ 53,456 $ 213,097 Pharma Services 4,521 6,717 7,303 7,207 25,748 Total Revenue 57,428 62,264 58,490 60,663 238,845 Gross Profit 22,948 27,352 24,248 26,003 100,551 Total operating expenses 23,528 25,511 26,958 22,804 98,801 Income (Loss) from Operations (580 ) 1,841 (2,710 ) 3,199 1,750 Interest expense 1,364 1,411 1,398 1,368 5,540 Other expense — — — 265 265 Income tax (benefit) expense (779 ) (53 ) 387 (1,809) (2,254 ) Net Income (Loss) $ (1,165 ) $ 483 $ (4,495 ) $ 3,375 $ (1,801 ) 33

Reconciliation of GAAP to Adjusted Non-GAAP Non-GAAP Adjusted EBITDA "Adjusted EBITDA" is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, non-cash stock-based compensation expense, and if applicable in a reporting period, acquisition-related transaction expenses (vi) non-cash impairments of intangible assets (vii) debt financing costs (viii) and other significant non-recurring or non-operating (income) or expenses. Non-GAAP Adjusted Net Income "Adjusted Net Income" is defined by NeoGenomics as net income available to common shareholders from continuing operations plus: (i) non-cash amortization of customer lists and other intangible assets, (ii) non-cash stock-based compensation expense, (iii) non- cash deemed dividends on preferred stock, (iv) non-cash amortization of preferred stock beneficial conversion feature, and if applicable in a reporting period (v) acquisition related transaction expenses (vi) non-cash impairments of intangible assets (vii) debt financing costs (viii) and other significant non-recurring or non-operating (income) or expenses. Non-GAAP Adjusted Diluted EPS "Adjusted Diluted EPS" is defined by NeoGenomics as Adjusted Net Income divided by Adjusted Diluted Shares outstanding. Adjusted Diluted Shares outstanding is the sum of Diluted shares outstanding and the weighted average number of common shares that would be outstanding if the preferred stock were converted into common stock on the original issue date based on the number of days such common shares would have been outstanding in the reporting period. In addition, if GAAP Net Income is negative and Adjusted Net Income is positive, Adjusted Diluted Shares will also include any options or warrants that would be outstanding as dilutive instruments using the treasury stock method. 34

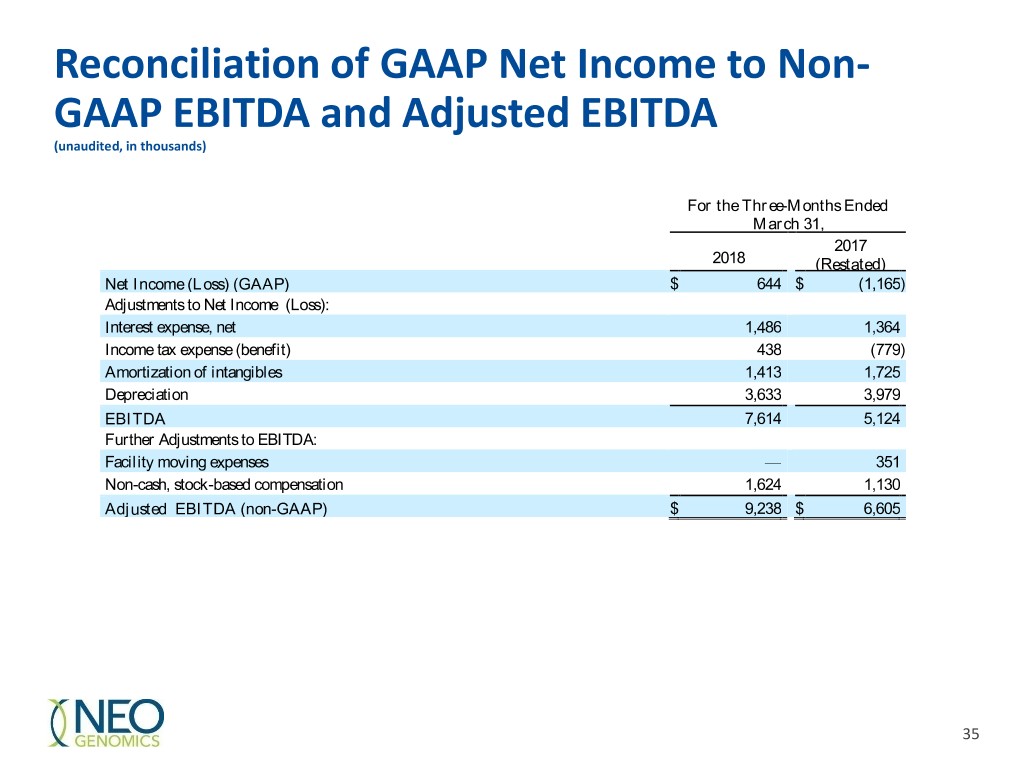

Reconciliation of GAAP Net Income to Non- GAAP EBITDA and Adjusted EBITDA (unaudited, in thousands) For the Three-Months Ended March 31, 2017 2018 (Restated) Net Income (Loss) (GAAP) $ 644 $ (1,165 ) Adjustments to Net Income (Loss): Interest expense, net 1,486 1,364 Income tax expense (benefit) 438 (779 ) Amortization of intangibles 1,413 1,725 Depreciation 3,633 3,979 EBITDA 7,614 5,124 Further Adjustments to EBITDA: Facility moving expenses — 351 Non-cash, stock-based compensation 1,624 1,130 Adjusted EBITDA (non-GAAP) $ 9,238 $ 6,605 35

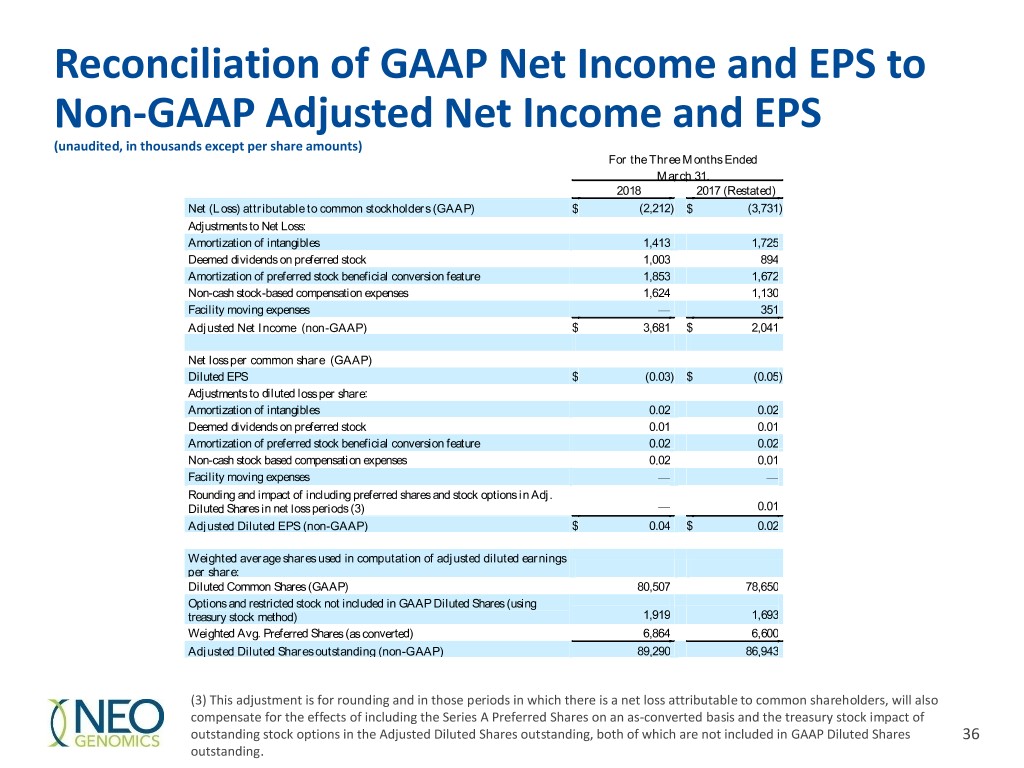

Reconciliation of GAAP Net Income and EPS to Non-GAAP Adjusted Net Income and EPS (unaudited, in thousands except per share amounts) For the Three Months Ended March 31, 2018 2017 (Restated) Net (Loss) attributable to common stockholders (GAAP) $ (2,212) $ (3,731 ) Adjustments to Net Loss: Amortization of intangibles 1,413 1,725 Deemed dividends on preferred stock 1,003 894 Amortization of preferred stock beneficial conversion feature 1,853 1,672 Non-cash stock-based compensation expenses 1,624 1,130 Facility moving expenses — 351 Adjusted Net Income (non-GAAP) $ 3,681 $ 2,041 Net loss per common share (GAAP) Diluted EPS $ (0.03) $ (0.05 ) Adjustments to diluted loss per share: Amortization of intangibles 0.02 0.02 Deemed dividends on preferred stock 0.01 0.01 Amortization of preferred stock beneficial conversion feature 0.02 0.02 Non-cash stock based compensation expenses 0.02 0.01 Facility moving expenses — — Rounding and impact of including preferred shares and stock options in Adj. Diluted Shares in net loss periods (3) — 0.01 Adjusted Diluted EPS (non-GAAP) $ 0.04 $ 0.02 Weighted average shares used in computation of adjusted diluted earnings per share: Diluted Common Shares (GAAP) 80,507 78,650 Options and restricted stock not included in GAAP Diluted Shares (using treasury stock method) 1,919 1,693 Weighted Avg. Preferred Shares (as converted) 6,864 6,600 Adjusted Diluted Shares outstanding (non-GAAP) 89,290 86,943 (3) This adjustment is for rounding and in those periods in which there is a net loss attributable to common shareholders, will also compensate for the effects of including the Series A Preferred Shares on an as-converted basis and the treasury stock impact of outstanding stock options in the Adjusted Diluted Shares outstanding, both of which are not included in GAAP Diluted Shares 36 outstanding.

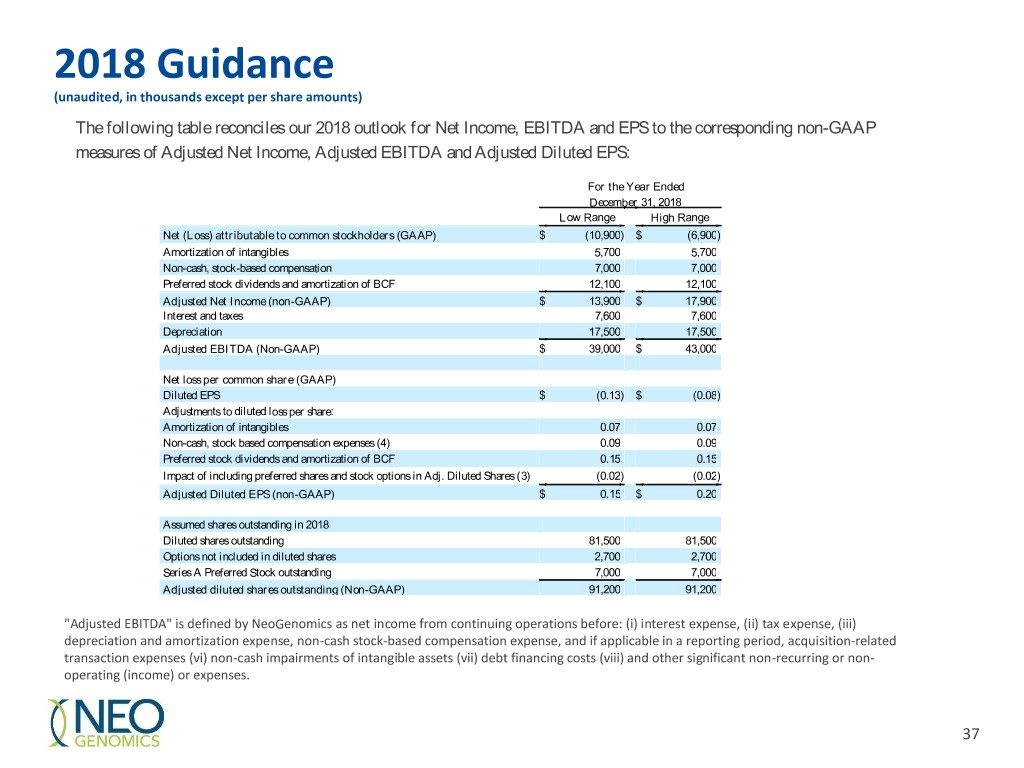

2018 Guidance (unaudited, in thousands except per share amounts) The following table reconciles our 2018 outlook for Net Income, EBITDA and EPS to the corresponding non-GAAP measures of Adjusted Net Income, Adjusted EBITDA and Adjusted Diluted EPS: For the Year Ended December 31, 2018 Low Range High Range Net (Loss) attributable to common stockholders (GAAP) $ (10,900 ) $ (6,900 ) Amortization of intangibles 5,700 5,700 Non-cash, stock-based compensation 7,000 7,000 Preferred stock dividends and amortization of BCF 12,100 12,100 Adjusted Net Income (non-GAAP) $ 13,900 $ 17,900 Interest and taxes 7,600 7,600 Depreciation 17,500 17,500 Adjusted EBITDA (Non-GAAP) $ 39,000 $ 43,000 Net loss per common share (GAAP) Diluted EPS $ (0.13 ) $ (0.08 ) Adjustments to diluted loss per share: Amortization of intangibles 0.07 0.07 Non-cash, stock based compensation expenses (4) 0.09 0.09 Preferred stock dividends and amortization of BCF 0.15 0.15 Impact of including preferred shares and stock options in Adj. Diluted Shares (3) (0.02 ) (0.02 ) Adjusted Diluted EPS (non-GAAP) $ 0.15 $ 0.20 Assumed shares outstanding in 2018 Diluted shares outstanding 81,500 81,500 Options not included in diluted shares 2,700 2,700 Series A Preferred Stock outstanding 7,000 7,000 Adjusted diluted shares outstanding (Non-GAAP) 91,200 91,200 "Adjusted EBITDA" is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, non-cash stock-based compensation expense, and if applicable in a reporting period, acquisition-related transaction expenses (vi) non-cash impairments of intangible assets (vii) debt financing costs (viii) and other significant non-recurring or non- operating (income) or expenses. 37

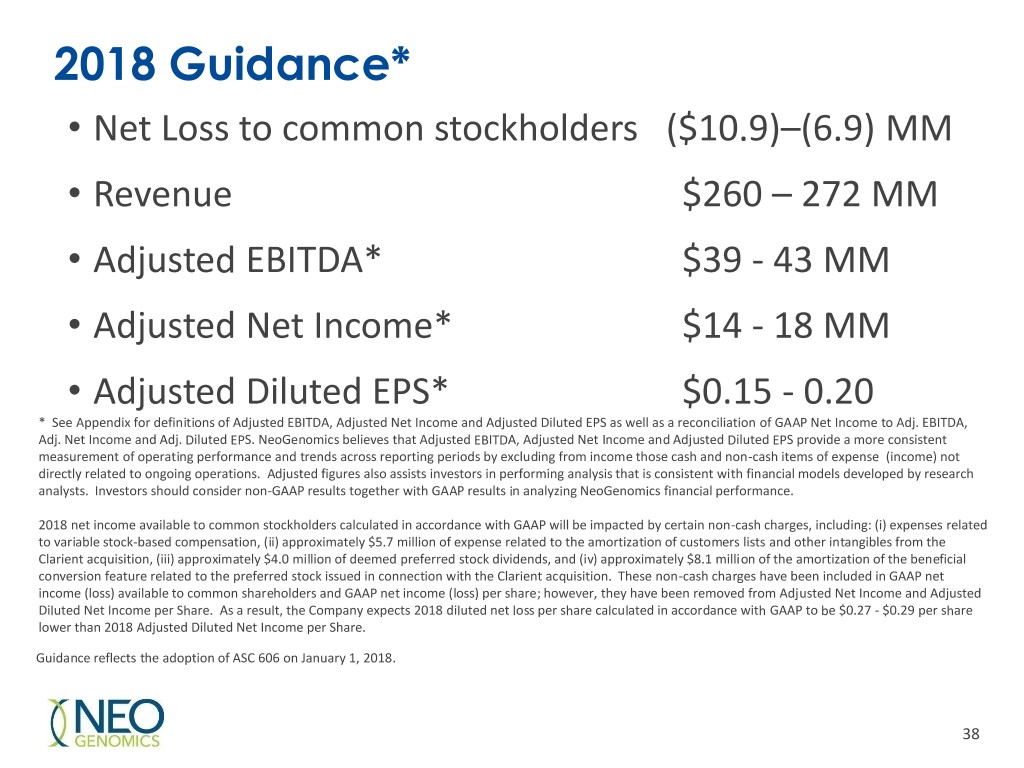

2018 Guidance* • Net Loss to common stockholders ($10.9)–(6.9) MM • Revenue $260 – 272 MM • Adjusted EBITDA* $39 - 43 MM • Adjusted Net Income* $14 - 18 MM • Adjusted Diluted EPS* $0.15 - 0.20 * See Appendix for definitions of Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS as well as a reconciliation of GAAP Net Income to Adj. EBITDA, Adj. Net Income and Adj. Diluted EPS. NeoGenomics believes that Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS provide a more consistent measurement of operating performance and trends across reporting periods by excluding from income those cash and non-cash items of expense (income) not directly related to ongoing operations. Adjusted figures also assists investors in performing analysis that is consistent with financial models developed by research analysts. Investors should consider non-GAAP results together with GAAP results in analyzing NeoGenomics financial performance. 2018 net income available to common stockholders calculated in accordance with GAAP will be impacted by certain non-cash charges, including: (i) expenses related to variable stock-based compensation, (ii) approximately $5.7 million of expense related to the amortization of customers lists and other intangibles from the Clarient acquisition, (iii) approximately $4.0 million of deemed preferred stock dividends, and (iv) approximately $8.1 million of the amortization of the beneficial conversion feature related to the preferred stock issued in connection with the Clarient acquisition. These non-cash charges have been included in GAAP net income (loss) available to common shareholders and GAAP net income (loss) per share; however, they have been removed from Adjusted Net Income and Adjusted Diluted Net Income per Share. As a result, the Company expects 2018 diluted net loss per share calculated in accordance with GAAP to be $0.27 - $0.29 per share lower than 2018 Adjusted Diluted Net Income per Share. Guidance reflects the adoption of ASC 606 on January 1, 2018. 38