EXHIBIT 99.2

Published on August 6, 2018

Exhibit 99.2 NeoGenomics Investor Presentation August 2018

Disclaimers The Company has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Copies of these documents may also be obtained by contacting William Blair & Company L.L.C., The William Blair Building, 150 North Riverside Plaza, Chicago, IL 60606. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward-looking statements. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward- looking statements due to numerous known and unknown risks and uncertainties. All forward-looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. For additional information with respect to risks and other factors which could occur, see the Company’s Annual Report on Form 10-K, including Part I, Item 1A, “Risk Factors” therein, Quarterly Reports on Form 10-Q, Current Reports on 8-K and other filings made with the Securities and Exchange Commission (the “SEC”) that are available at the SEC’s website at www.sec.gov. 2

Offering Summary Issuer NeoGenomics, Inc. Exchange: Ticker NASDAQCM: NEO Base Deal Size Approximately $125 million (100% primary) Overallotment 15% (100% primary) Offering Type Fully marketed follow-on of common stock Lock-up 90 days To fund the growth of the business, including the acquisition of and investment in businesses that the company believes will enhance its value, although the company has no current commitments or agreements with Use of Proceeds respect to any such transactions as of the date of this prospectus. Net proceeds may also be used for working capital and for general corporate purposes including the repayment of existing indebtedness. Bookrunners William Blair, Leerink Partners Craig-Hallum Capital Group, Stephens Inc., First Analysis Securities Corp., and Co-Managers Janney Montgomery Scott Expected Pricing August 9, 2018 (Post-Market Close) 3

Company Overview A leading pure-play oncology testing company Significant near-term growth drivers Extensive molecular/oncology test menu A leader in immuno-oncology testing Market share gains driven by customer satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 4

Substantial Industry Tailwinds • Aging population driving cancer incidence • Increased survival driving follow-on testing • Growing number of therapeutic options • Increased therapeutic complexity • Burgeoning oncology drug pipeline • Emerging platforms and tests (NGS, TMB, MSI, etc.) 5

Our Competitive Advantage • Comprehensive, multi-modality “one-stop-shop” • Large and advanced somatic cancer test menu • National footprint and extensive payer contracts • Outstanding client service and partnership models • Leader in test development immuno-oncology • Synergistic Pharma and Clinical businesses 6

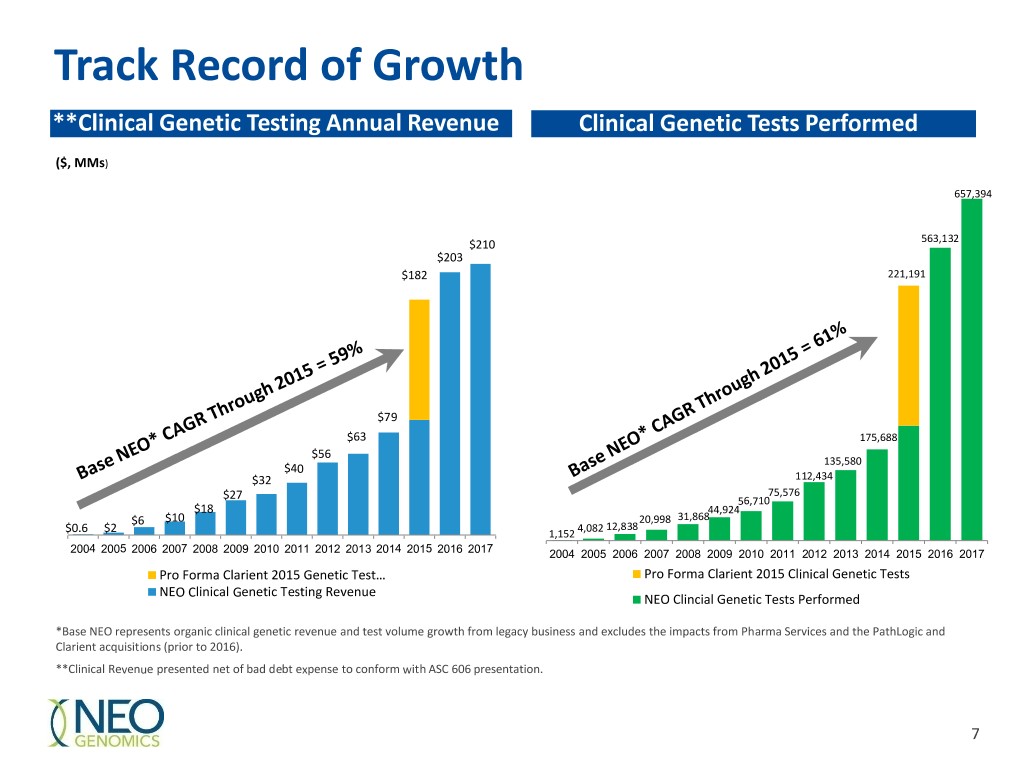

Track Record of Growth **Clinical Genetic Testing Annual Revenue Clinical Genetic Tests Performed ($, MMs) 657,394 $210 563,132 $203 $182 221,191 $79 $63 175,688 $56 135,580 $40 $32 112,434 75,576 $27 56,710 $18 44,924 $6 $10 20,998 31,868 4,082 12,838 $0.6 $2 1,152 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Pro Forma Clarient 2015 Genetic Test… Pro Forma Clarient 2015 Clinical Genetic Tests NEO Clinical Genetic Testing Revenue NEO Clincial Genetic Tests Performed *Base NEO represents organic clinical genetic revenue and test volume growth from legacy business and excludes the impacts from Pharma Services and the PathLogic and Clarient acquisitions (prior to 2016). **Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. 7

Significant Near-term Growth Drivers 6 Pursue accelerated growth through 5 strategic acquisitions New GPO (expand technical relationships capabilities, acquire 4 complimentary tests, New, national, in- broaden geographic network contract reach, deepen 3 with Cigna customer base) New labs in Geneva, Houston 2 and Atlanta Global strategic alliance with PPD 1 Large backlog of signed Pharma contracts 8

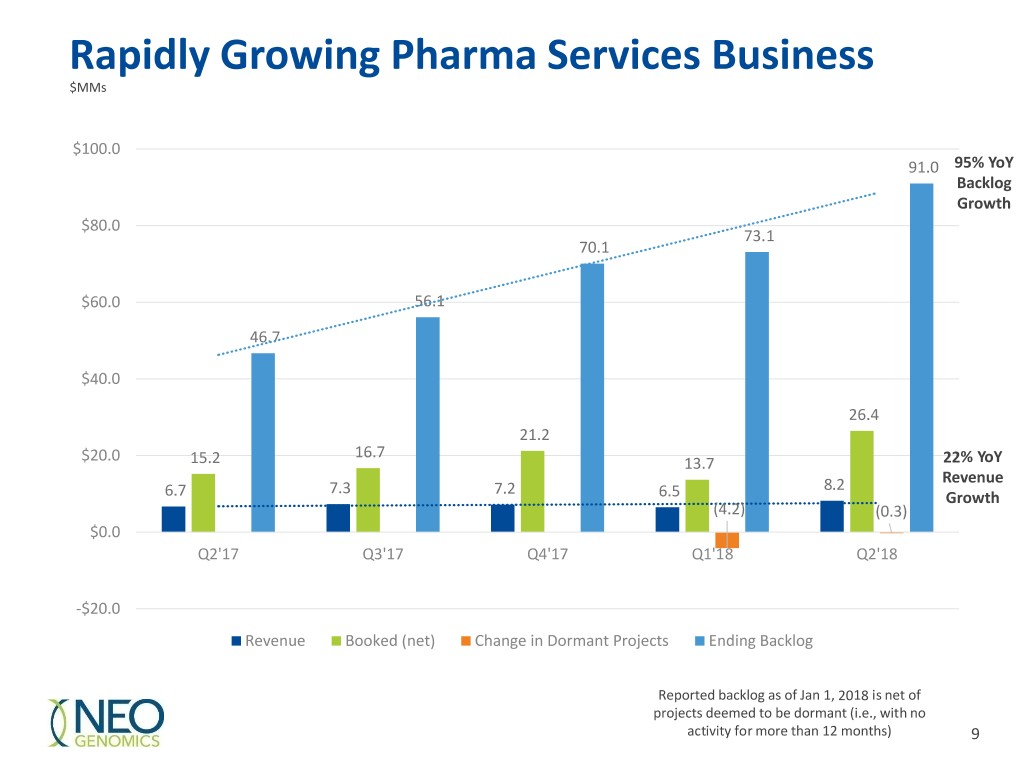

Rapidly Growing Pharma Services Business $MMs $100.0 91.0 95% YoY Backlog Growth $80.0 73.1 70.1 $60.0 56.1 46.7 $40.0 26.4 21.2 16.7 $20.0 15.2 13.7 22% YoY Revenue 7.3 7.2 8.2 6.7 6.5 Growth (4.2) (0.3) $0.0 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 -$20.0 Revenue Booked (net) Change in Dormant Projects Ending Backlog Reported backlog as of Jan 1, 2018 is net of projects deemed to be dormant (i.e., with no activity for more than 12 months) 9

Global Strategic Alliance With PPD • PPD’s preferred lab for oncology testing • Significant revenue opportunity • Expands global client base • Expansion into Asia • Collaborations for companion diagnostics • Opportunities to leverage laboratory data for trials 10

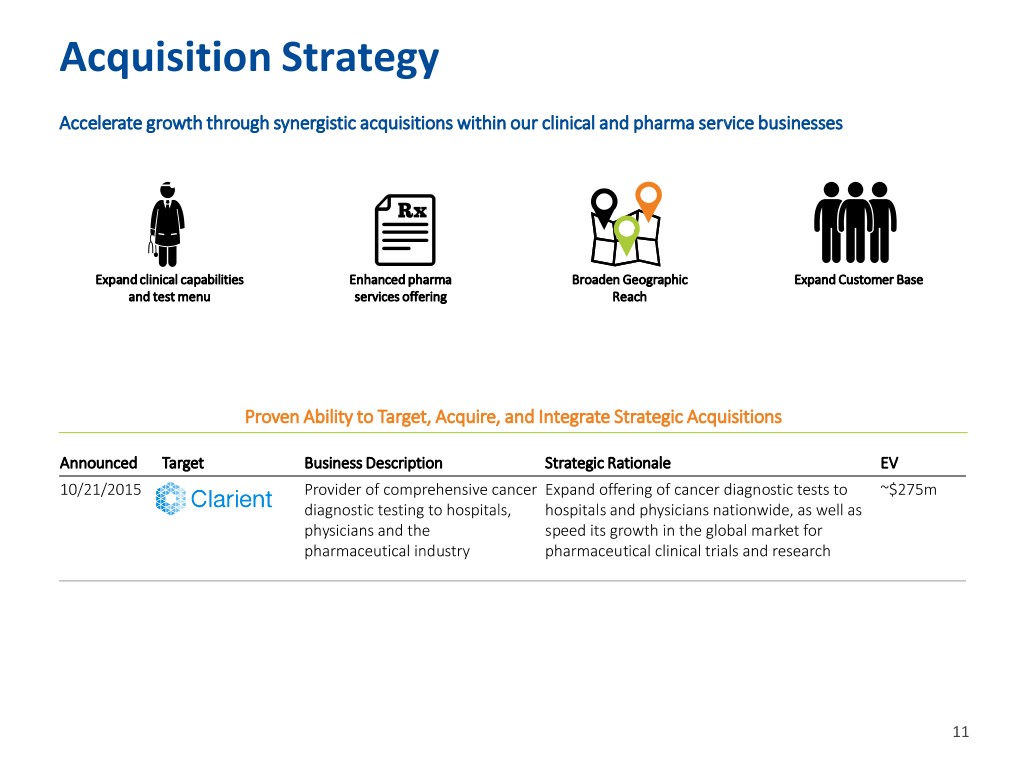

Acquisition Strategy Accelerate growth through synergistic acquisitions within our clinical and pharma service businesses Expand clinical capabilities Enhanced pharma Broaden Geographic Expand Customer Base and test menu services offering Reach Proven Ability to Target, Acquire, and Integrate Strategic Acquisitions Announced Target Business Description Strategic Rationale EV 10/21/2015 Provider of comprehensive cancer Expand offering of cancer diagnostic tests to ~$275m diagnostic testing to hospitals, hospitals and physicians nationwide, as well as physicians and the speed its growth in the global market for pharmaceutical industry pharmaceutical clinical trials and research 11

Industry and Company Overview 12

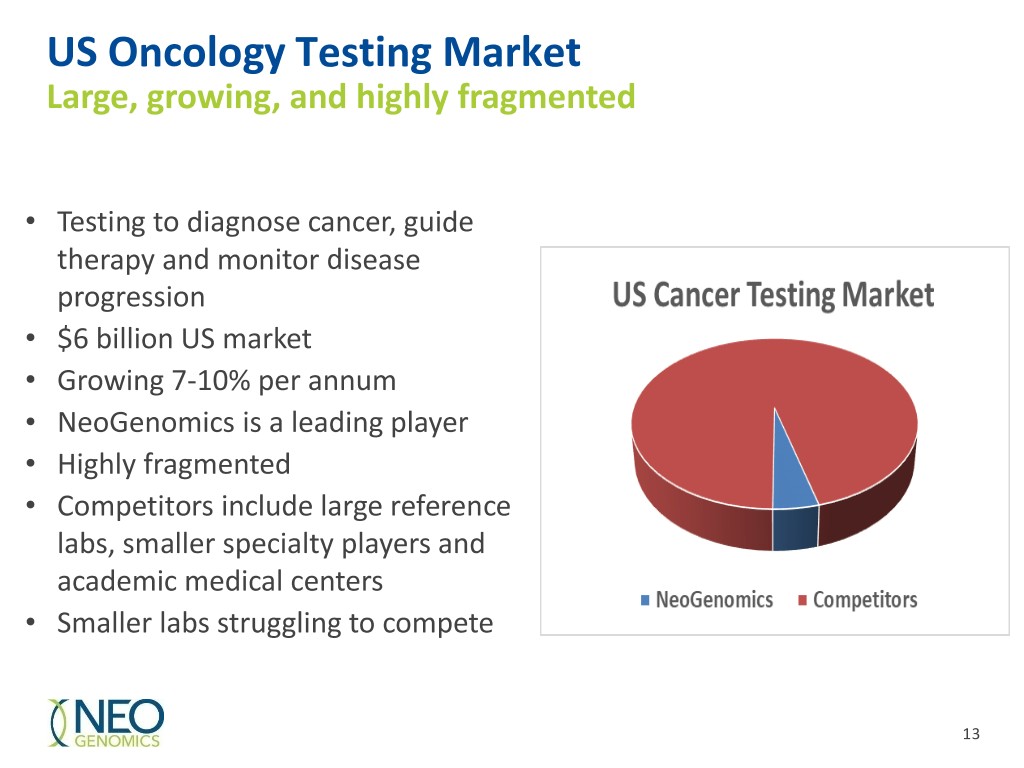

US Oncology Testing Market Large, growing, and highly fragmented • Testing to diagnose cancer, guide therapy and monitor disease progression • $6 billion US market • Growing 7-10% per annum • NeoGenomics is a leading player • Highly fragmented • Competitors include large reference labs, smaller specialty players and academic medical centers • Smaller labs struggling to compete 13

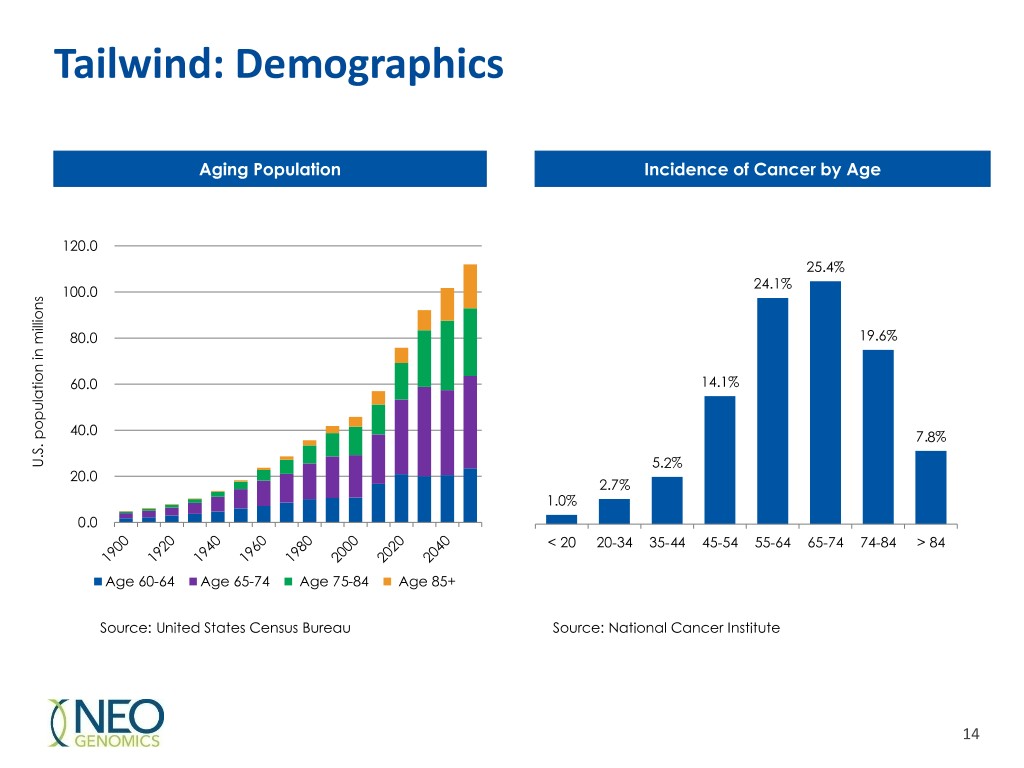

Tailwind: Demographics Aging Population Incidence of Cancer by Age 120.0 25.4% 24.1% 100.0 80.0 19.6% 60.0 14.1% 40.0 7.8% U.S. U.S. populationin millions 5.2% 20.0 2.7% 1.0% 0.0 < 20 20-34 35-44 45-54 55-64 65-74 74-84 > 84 Age 60-64 Age 65-74 Age 75-84 Age 85+ Source: United States Census Bureau Source: National Cancer Institute 14

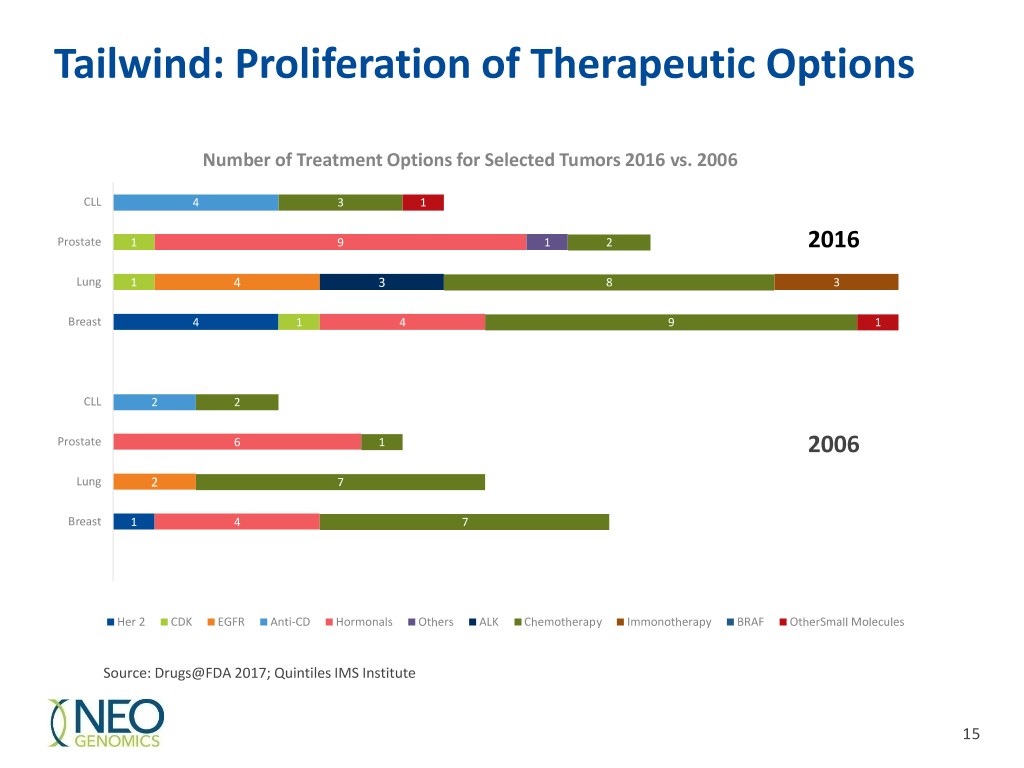

Tailwind: Proliferation of Therapeutic Options Number of Treatment Options for Selected Tumors 2016 vs. 2006 CLL 4 3 1 Prostate 1 9 1 2 2016 Lung 1 4 3 8 3 Breast 4 1 4 9 1 CLL 2 2 Prostate 6 1 2006 Lung 2 7 Breast 1 4 7 Her 2 CDK EGFR Anti-CD Hormonals Others ALK Chemotherapy Immonotherapy BRAF OtherSmall Molecules Source: Drugs@FDA 2017; Quintiles IMS Institute 15

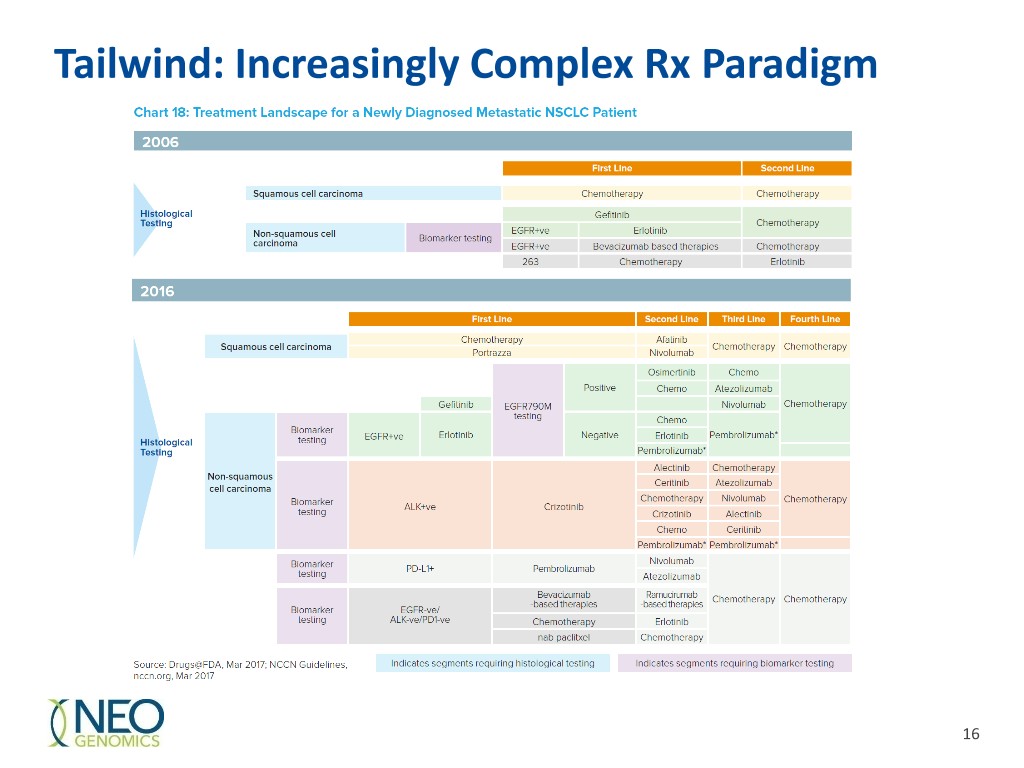

Tailwind: Increasingly Complex Rx Paradigm 16

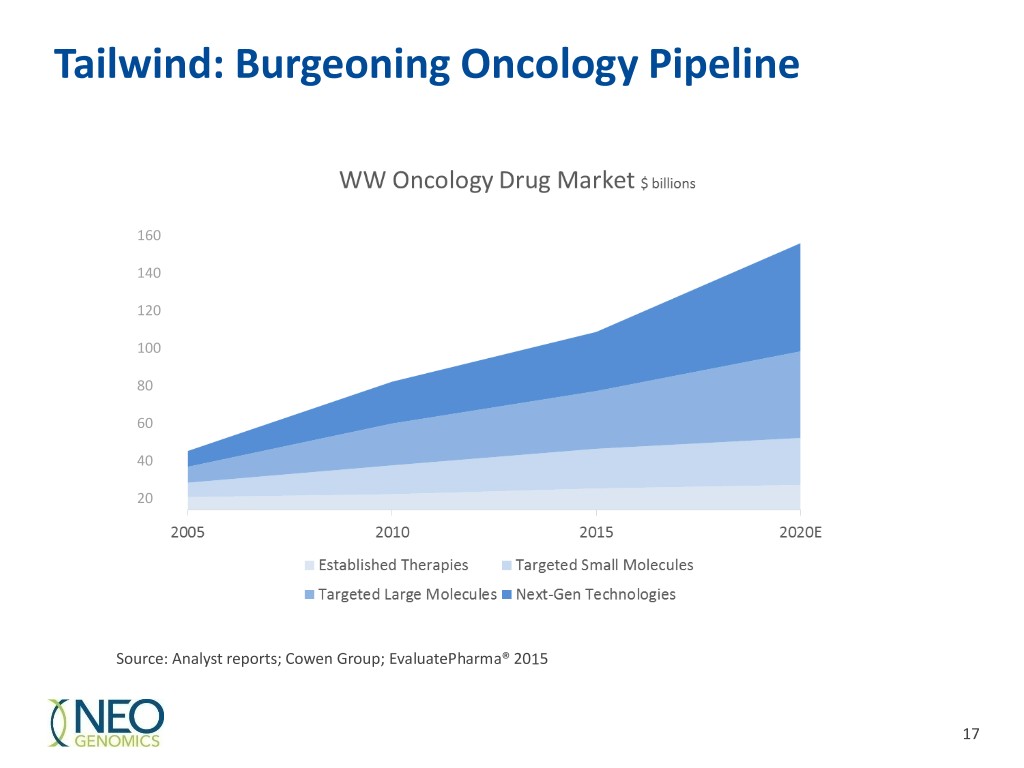

Tailwind: Burgeoning Oncology Pipeline 160 140 120 100 80 60 40 20 Source: Analyst reports; Cowen Group; EvaluatePharma® 2015 17

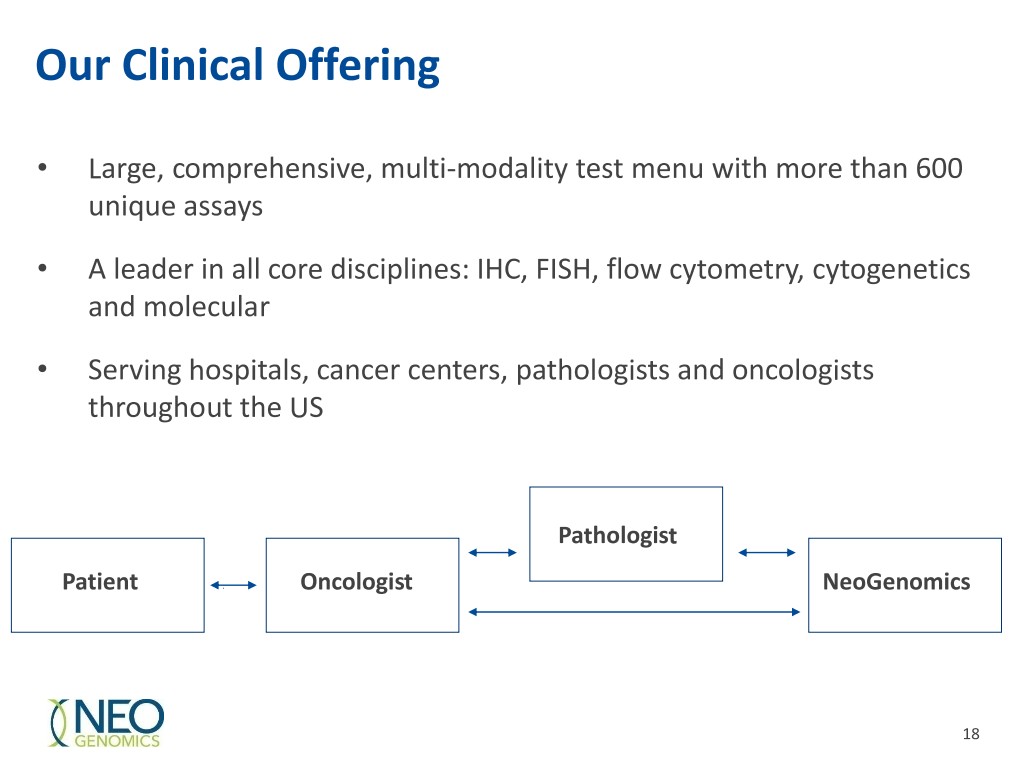

Our Clinical Offering • Large, comprehensive, multi-modality test menu with more than 600 unique assays • A leader in all core disciplines: IHC, FISH, flow cytometry, cytogenetics and molecular • Serving hospitals, cancer centers, pathologists and oncologists throughout the US Pathologist Patient Oncologist NeoGenomics 18

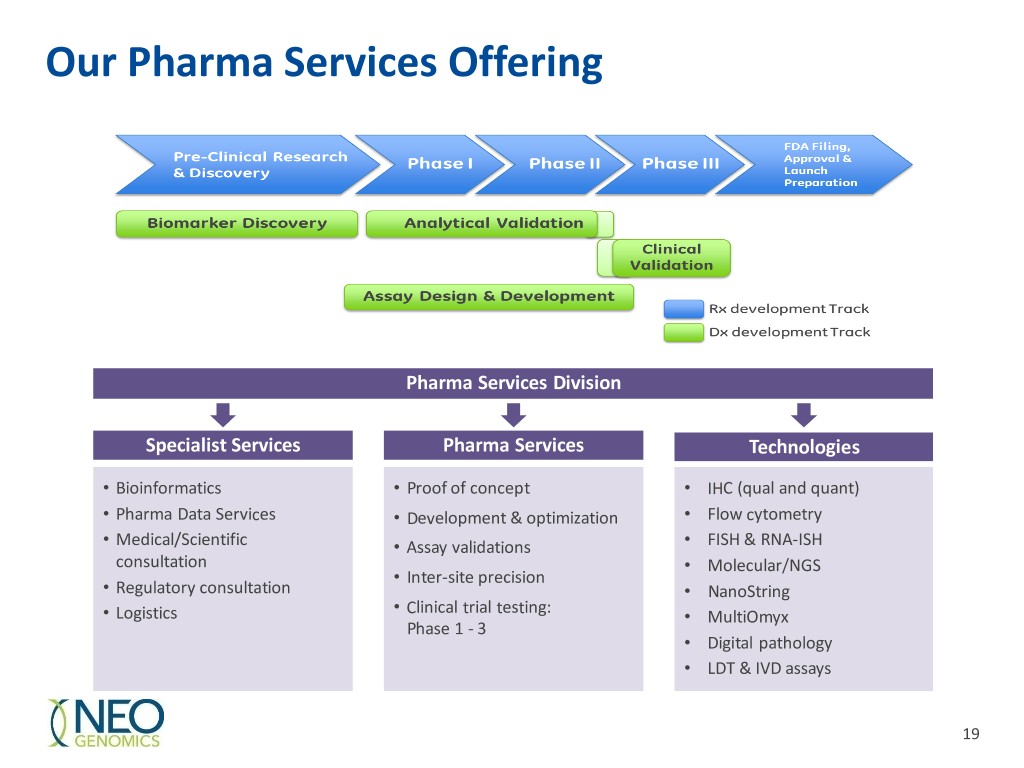

Our Pharma Services Offering Pharma Services Division Specialist Services Pharma Services Technologies • Bioinformatics • Proof of concept • IHC (qual and quant) • Pharma Data Services • Development & optimization • Flow cytometry • Medical/Scientific • Assay validations • FISH & RNA-ISH consultation • Molecular/NGS • Inter-site precision • Regulatory consultation • NanoString • Clinical trial testing: • Logistics • MultiOmyx Phase 1 - 3 • Digital pathology • LDT & IVD assays 19

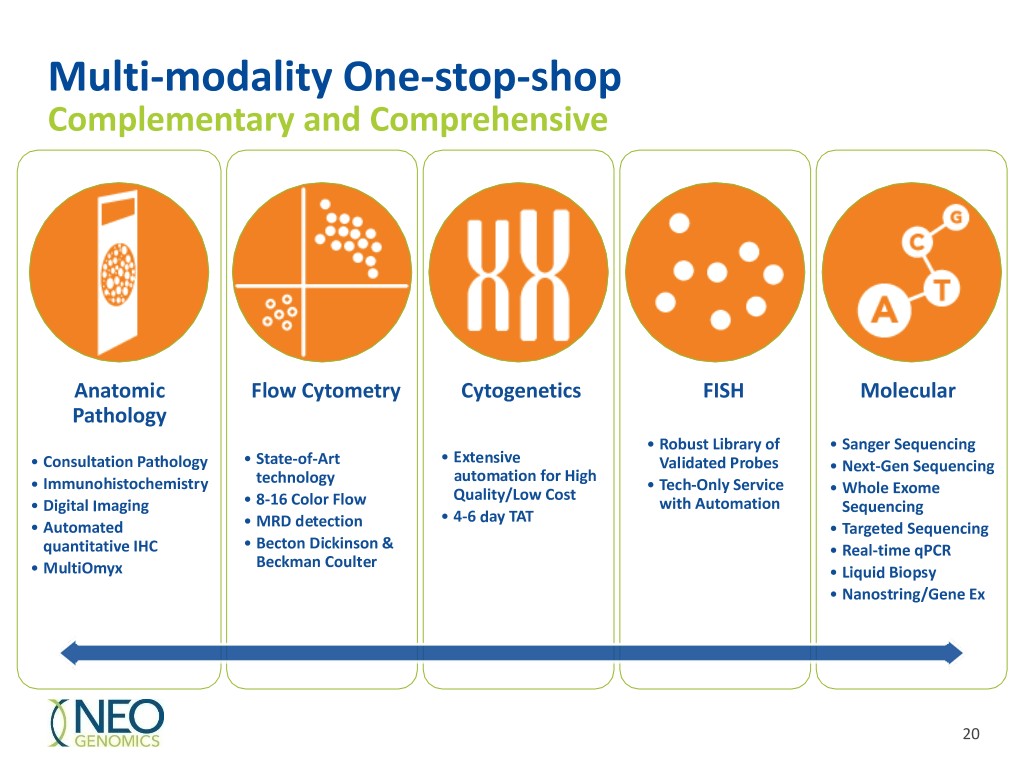

Multi-modality One-stop-shop Complementary and Comprehensive Anatomic Flow Cytometry Cytogenetics FISH Molecular Pathology • Robust Library of • Sanger Sequencing • Extensive • Consultation Pathology • State-of-Art Validated Probes • Next-Gen Sequencing automation for High • Immunohistochemistry technology • Tech-Only Service Quality/Low Cost • Whole Exome • Digital Imaging • 8-16 Color Flow with Automation Sequencing • 4-6 day TAT • Automated • MRD detection • Targeted Sequencing quantitative IHC • Becton Dickinson & • Real-time qPCR Beckman Coulter • MultiOmyx • Liquid Biopsy • Nanostring/Gene Ex 20

Track Record of Innovation New Tests Launched 2013-2017 2017 Locations: • Opening of first international laboratory in Rolle, Switzerland Papers Published: • Wild-type Blocking PCR Combined with Direct Sequencing as a Highly Sensitive Method for Detection of Low-Frequency 2016 Somatic Mutations. J Vis Exp. 2017 Mar. • Prevalence and relative proportions of CLL and non-CLL monoclonal B-cell lymphocytosis phenotypes in the Middle 50 new/revised tests, include: Eastern population. Hematol Oncol Stem Cell Ther. 2017 Mar. • Comprehensive PD-L1 Testing (three • Using high-sensitivity sequencing for the detection of mutations 2015 FDA-cleared and one LDT) in BTK and PLCγ2 genes in cellular and cell-free DNA and • 1,385 genes RNA-Based Pan Cancer correlation with progression in patients treated with BTK NGS Fusion, Mutation and Expression inhibitors. Oncotarget. 2017 Mar. 2014 70 new/revised tests, include: Profiling. • A Multi-Center Prospective Study to Validate an Algorithm Using TM • Smart Flow Cytometry data analysis Urine and Plasma Biomarkers for Predicting Gleason ≥3+4 NeoLAB Liquid Biopsies platform Prostate Cancer on Biopsy. Journal of Cancer - 2017 Aug 2017 • MDS/CMML Profile 60 new/revised tests, include: • Aug. • AML Profile Pediatric Hereditary Susceptibility • Acquired RhD mosaicism identifies fibrotic transformation of • 24 new NeoTYPE Next Generation • FLT3 Mutation Analysis • Hereditary DNA Panel (prostate) thrombopoietin receptor-mutated essential thrombocythemia. Sequencing Profiles • NPM1 Mutation Analysis 2013 • Inherited Bone Marrow Failure Transfusion. 2017 Sep. • PML-RARA Translocation • 26 new IHC/ISH tests • MET Exon 14 Deletion Analysis • • Significant Improvement in Detecting BRAF, KRAS, and EGFR • Additional NeoLAB Prostate clinical RUNX1-RNX1T1Transloc • • NRAS Exon 4 Mutation Analysis Mutations Using Next-Generation Sequencing as Compared with studies INV16 Translocation 40 new Molecular tests, include: • c-kit Mutation Analysis • NGS ALK, NTRK, RET, ROS1 Fusion FDA-Cleared Kits. Mol Diagn Ther. 2017 Oct. • AML Extended FISH Panel • IDH1 Mutation Analysis • Add’l NeoTYPE® Panels Invited Speaking Events: • AML Favorable-Risk FISH Panel • IDH2 Mutation Analysis NeoLAB Liquid Biopsies • Next Generation Sequencing (48 • American Society of Hematology 2017 – 2 oral presentations • MDS Extended FISH Panel • NRAS Mutation Analysis • NeoLAB Myeloid Disorders Profile genes) • KRAS Mutation Analysis • Plasma Cell Myeloma Risk • EGFR T790M New Tests • ROS1 FISH • BTK Inhibitor Resistance Stratification FISH Panel Molecular • NeoSITE® Melanoma FISH • Solid Tumor Monitoring NeoTYPE Multi Modality Profiles IHC • RET FISH • NPM1 MRD Analysis • Plasma/Urine-based Prostate Test • AITL/Peripheral T-Cell Lymphoma • ATRX • MET FISH Germline MolDx Testing • Oncomine™ Dx Target Test (Patent App) • BRCA1 & BRCA2 • Thyroid Profile • MAL • ALL Adult & Pediatric FISH Panels • Tumor Mutation Burden • SVM-based Cytogenetics Analysis • Lynch Syndrome (colon) • Brain Tumor Profile • PD-L1 22C3 FDA • HER2 Breast Equivocal FISH Panel • Universal Fusion/Expression Profile System • 73 Gene Comprehensive • Melanoma Profile (KEYTRUDA®) for • BRAF Translocation FISH Predisposition Panel Gastric/GEA • SVM-based Automated FISH • Liposarcoma Fusion Profile NeoTYPE • PD-L1 SP263 FDA Analysis System v2 • Chromosome 1 POC Ploidy Other • NeoTYPE GI Predictive Profile • Head & Neck Tumor Profile (IMFINZI™) • Began development of NeoLAB • Launched robotic FISH-Cyto • ALK, ROS1, RET Fusion FISH (Liquid Alternative to Biopsy) processing platform • Sarcoma gene Fusion FISH & IHC • RRM1 • Prostate Cx test • NeoSITE Cervical FISH • FISH Testing for EWSR1, SS18, DDIT3, CDKN2A (p16) Deletion for • TOPO1 • Expanded IHC Menu STAT 6, BCL2, & TCL1 Mesothelioma • Smart Flow Cytometry Other • IHC Testing for CXCL13, BAP1, INI1, New Platforms: • HPV RNA ISH MUC4 Launch of New BD Fortessa X-20 services for Pharma Services flow • PD-L1 cytometry 21

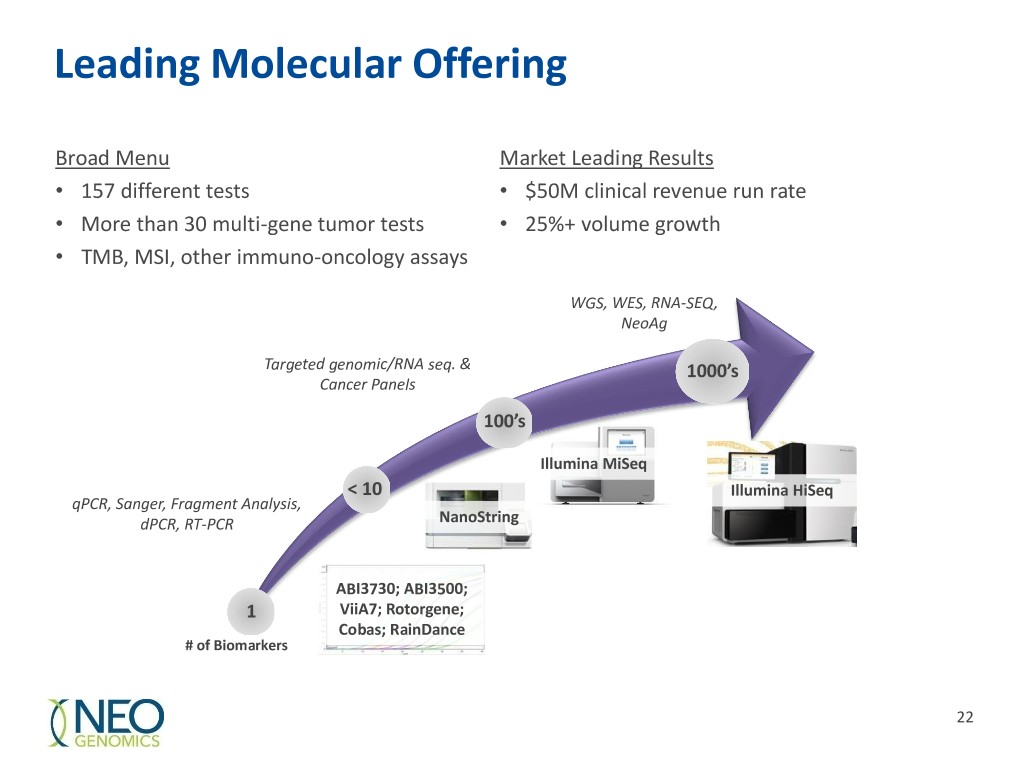

Leading Molecular Offering Broad Menu Market Leading Results • 157 different tests • $50M clinical revenue run rate • More than 30 multi-gene tumor tests • 25%+ volume growth • TMB, MSI, other immuno-oncology assays WGS, WES, RNA-SEQ, NeoAg Targeted genomic/RNA seq. & 1000’s Cancer Panels 100’s Illumina MiSeq < 10 Illumina HiSeq qPCR, Sanger, Fragment Analysis, dPCR, RT-PCR NanoString ABI3730; ABI3500; 1 ViiA7; Rotorgene; Cobas; RainDance # of Biomarkers 22

National Footprint Dots reflect individual customers; colors reflect sales territories 23

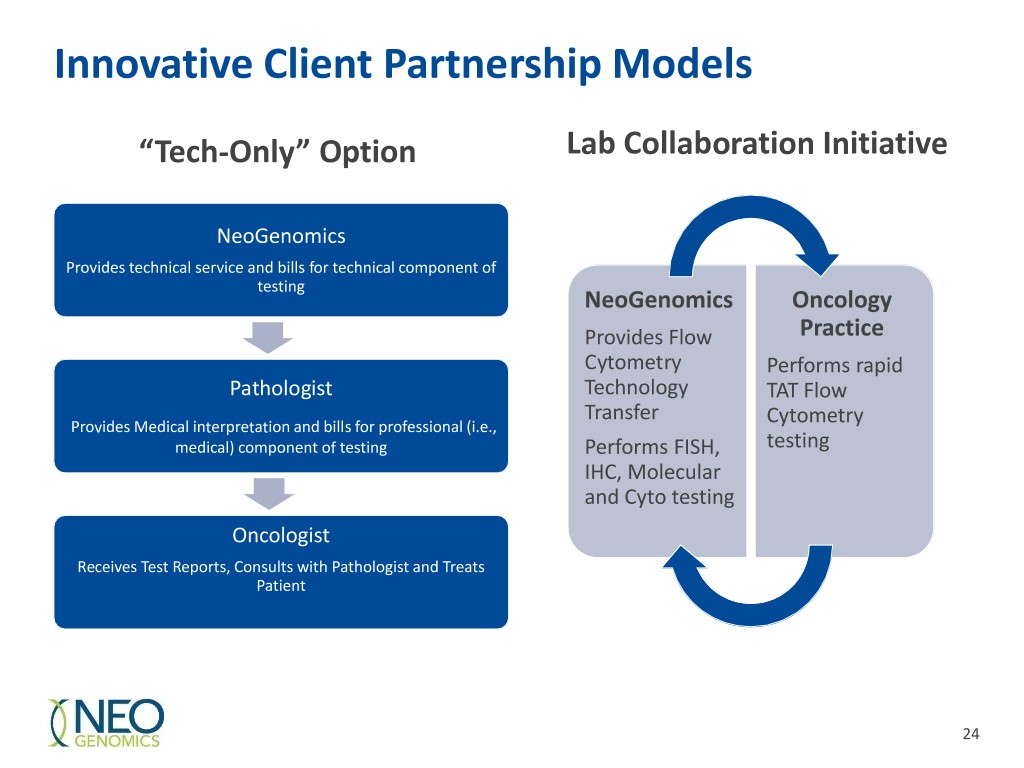

Innovative Client Partnership Models “Tech-Only” Option Lab Collaboration Initiative NeoGenomics Provides technical service and bills for technical component of testing NeoGenomics Oncology Provides Flow Practice Cytometry Performs rapid Pathologist Technology TAT Flow Transfer Provides Medical interpretation and bills for professional (i.e., Cytometry medical) component of testing Performs FISH, testing IHC, Molecular and Cyto testing Oncologist Receives Test Reports, Consults with Pathologist and Treats Patient 24

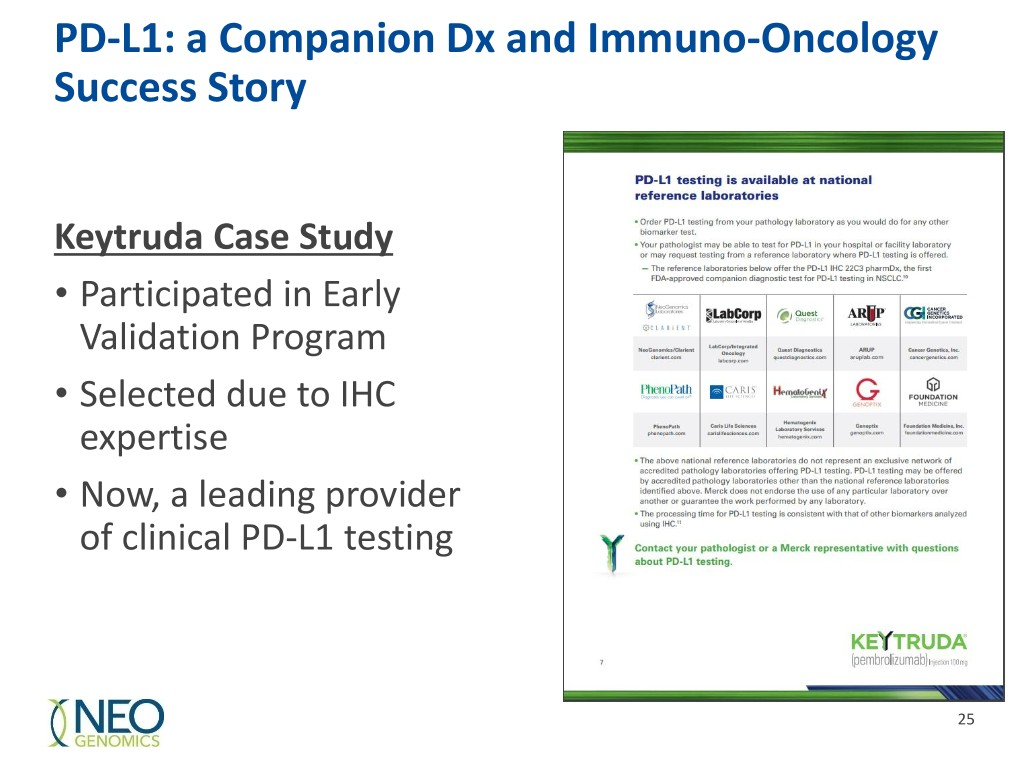

PD-L1: a Companion Dx and Immuno-Oncology Success Story Keytruda Case Study • Participated in Early Validation Program • Selected due to IHC expertise • Now, a leading provider of clinical PD-L1 testing 25

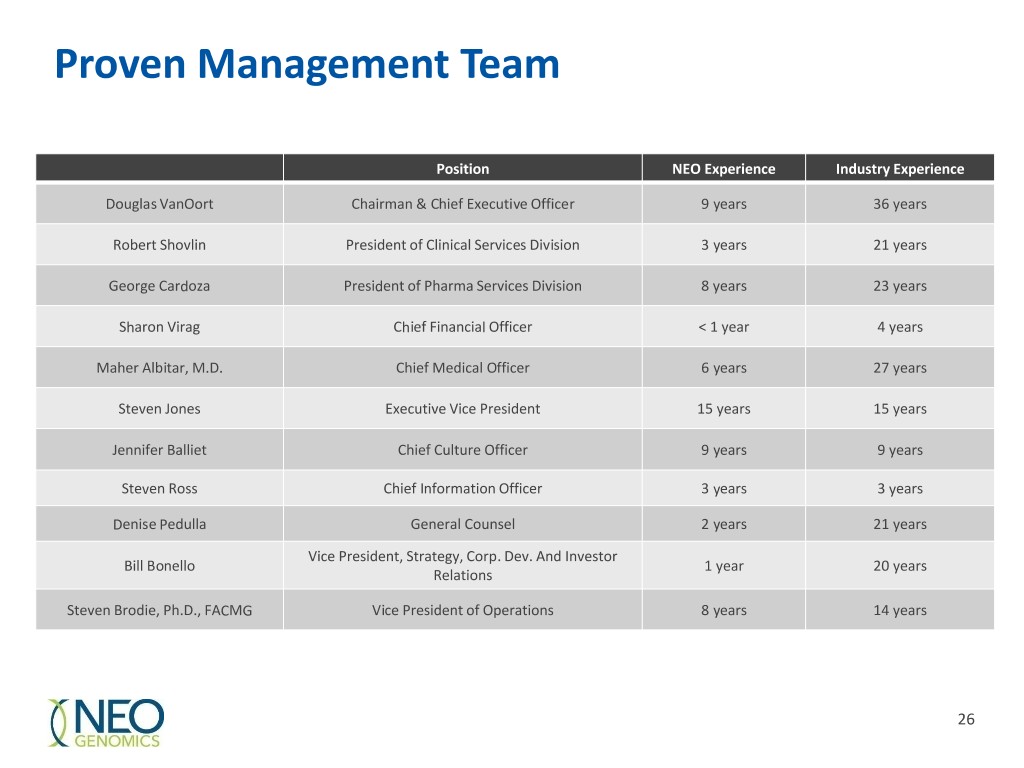

Proven Management Team Position NEO Experience Industry Experience Douglas VanOort Chairman & Chief Executive Officer 9 years 36 years Robert Shovlin President of Clinical Services Division 3 years 21 years George Cardoza President of Pharma Services Division 8 years 23 years Sharon Virag Chief Financial Officer < 1 year 4 years Maher Albitar, M.D. Chief Medical Officer 6 years 27 years Steven Jones Executive Vice President 15 years 15 years Jennifer Balliet Chief Culture Officer 9 years 9 years Steven Ross Chief Information Officer 3 years 3 years Denise Pedulla General Counsel 2 years 21 years Vice President, Strategy, Corp. Dev. And Investor Bill Bonello 1 year 20 years Relations Steven Brodie, Ph.D., FACMG Vice President of Operations 8 years 14 years 26

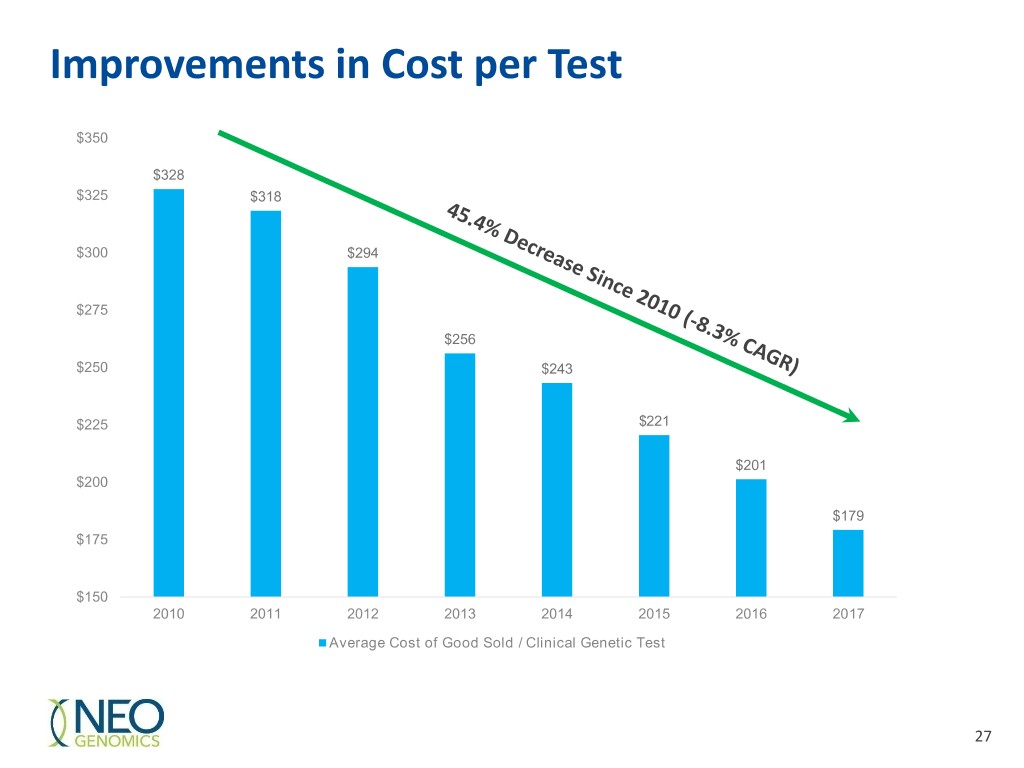

Improvements in Cost per Test $350 $328 $325 $318 $300 $294 $275 $256 $250 $243 $225 $221 $201 $200 $179 $175 $150 2010 2011 2012 2013 2014 2015 2016 2017 Average Cost of Good Sold / Clinical Genetic Test 27

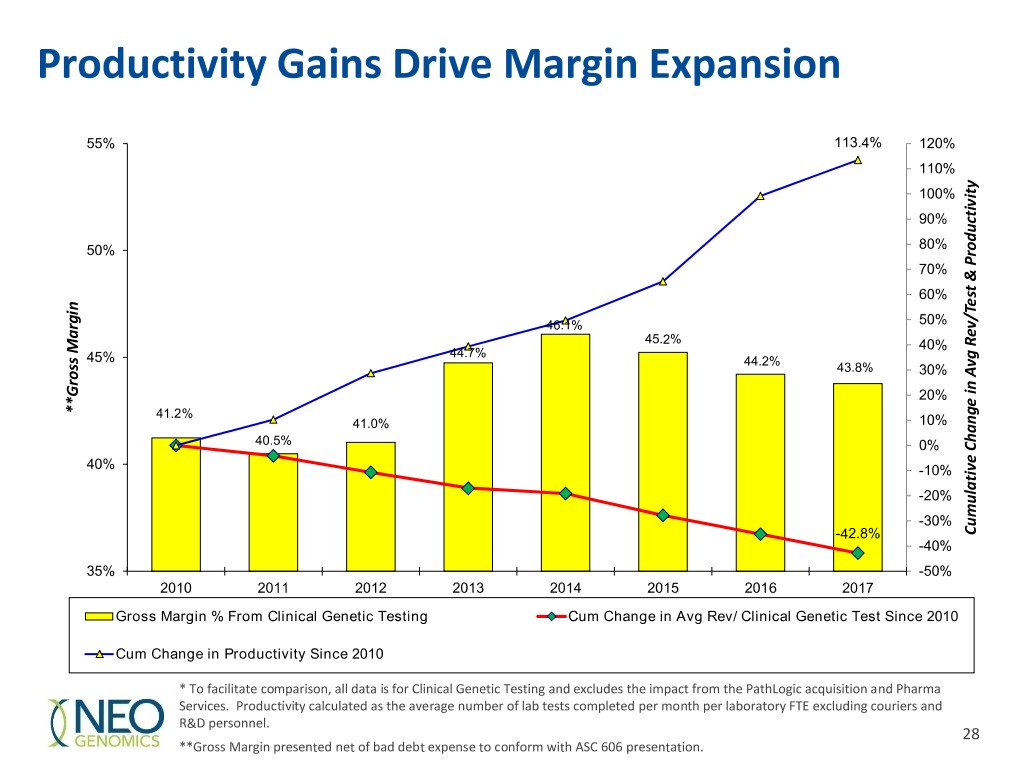

Productivity Gains Drive Margin Expansion 55% 113.4% 120% 110% 100% 90% 50% 80% 70% 60% 46.1% 50% 45.2% 40% Margin 44.7% 45% 44.2% 43.8% 30% 20% **Gross **Gross 41.2% 41.0% 10% 40.5% 0% 40% -10% -20% -30% -42.8% Productivity& Rev/Test ChangeAvg inCumulative -40% 35% -50% 2010 2011 2012 2013 2014 2015 2016 2017 Gross Margin % From Clinical Genetic Testing Cum Change in Avg Rev/ Clinical Genetic Test Since 2010 Cum Change in Productivity Since 2010 * To facilitate comparison, all data is for Clinical Genetic Testing and excludes the impact from the PathLogic acquisition and Pharma Services. Productivity calculated as the average number of lab tests completed per month per laboratory FTE excluding couriers and R&D personnel. 28 **Gross Margin presented net of bad debt expense to conform with ASC 606 presentation.

Investment Highlights Leading pure-play oncology testing company Significant Market Growth Tailwinds Extensive molecular/oncology test menu Leader in immuno-oncology testing Market share gains driven by Customer Satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 29

Appendix 30

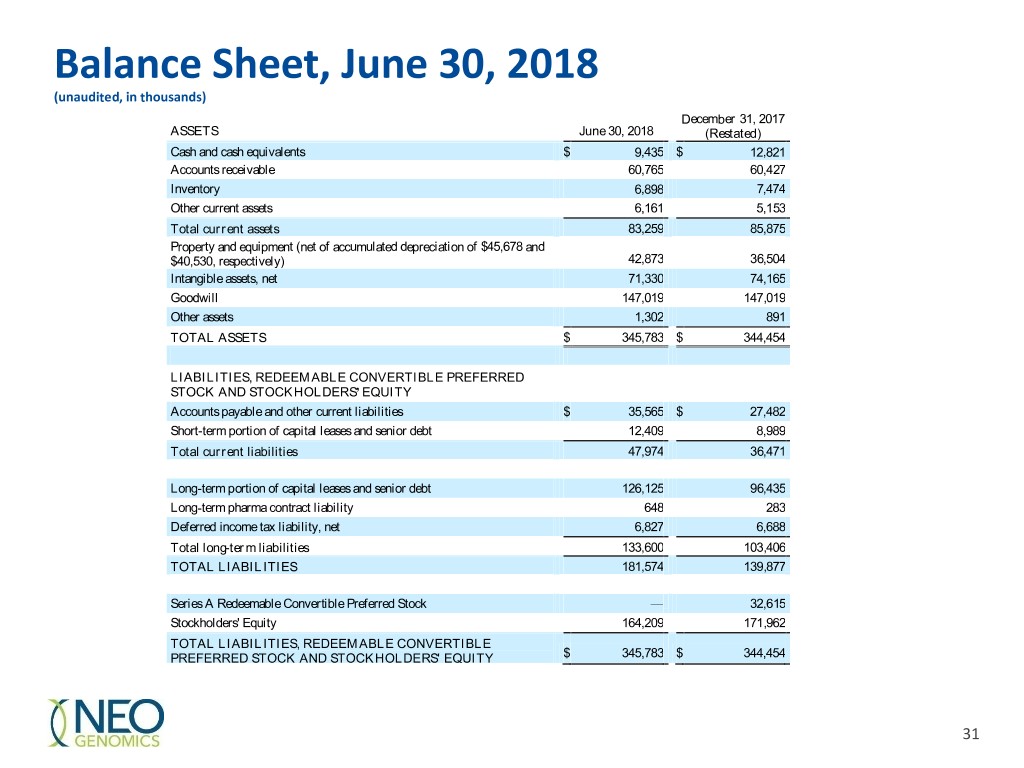

Balance Sheet, June 30, 2018 (unaudited, in thousands) December 31, 2017 ASSETS June 30, 2018 (Restated) Cash and cash equivalents $ 9,435 $ 12,821 Accounts receivable 60,765 60,427 Inventory 6,898 7,474 Other current assets 6,161 5,153 Total current assets 83,259 85,875 Property and equipment (net of accumulated depreciation of $45,678 and $40,530, respectively) 42,873 36,504 Intangible assets, net 71,330 74,165 Goodwill 147,019 147,019 Other assets 1,302 891 TOTAL ASSETS $ 345,783 $ 344,454 LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY Accounts payable and other current liabilities $ 35,565 $ 27,482 Short-term portion of capital leases and senior debt 12,409 8,989 Total current liabilities 47,974 36,471 Long-term portion of capital leases and senior debt 126,125 96,435 Long-term pharma contract liability 648 283 Deferred income tax liability, net 6,827 6,688 Total long-term liabilities 133,600 103,406 TOTAL LIABILITIES 181,574 139,877 Series A Redeemable Convertible Preferred Stock — 32,615 Stockholders' Equity 164,209 171,962 TOTAL LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY $ 345,783 $ 344,454 31

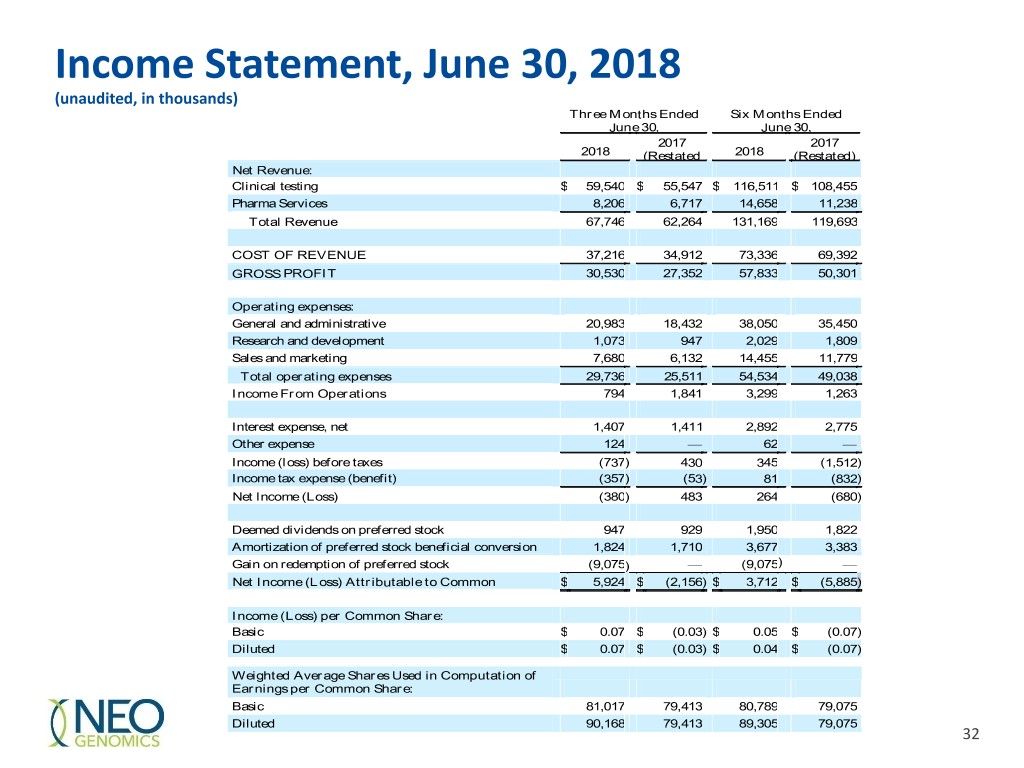

Income Statement, June 30, 2018 (unaudited, in thousands) Three Months Ended Six Months Ended June 30, June 30, 2017 2017 2018 (Restated 2018 (Restated) Net Revenue: ) Clinical testing $ 59,540 $ 55,547 $ 116,511 $ 108,455 Pharma Services 8,206 6,717 14,658 11,238 Total Revenue 67,746 62,264 131,169 119,693 COST OF REVENUE 37,216 34,912 73,336 69,392 GROSS PROFIT 30,530 27,352 57,833 50,301 Operating expenses: General and administrative 20,983 18,432 38,050 35,450 Research and development 1,073 947 2,029 1,809 Sales and marketing 7,680 6,132 14,455 11,779 Total operating expenses 29,736 25,511 54,534 49,038 Income From Operations 794 1,841 3,299 1,263 Interest expense, net 1,407 1,411 2,892 2,775 Other expense 124 — 62 — Income (loss) before taxes (737 ) 430 345 (1,512 ) Income tax expense (benefit) (357 ) (53 ) 81 (832 ) Net Income (Loss) (380 ) 483 264 (680 ) Deemed dividends on preferred stock 947 929 1,950 1,822 Amortization of preferred stock beneficial conversion 1,824 1,710 3,677 3,383 Gainfeature on redemption of preferred stock (9,075 ) — (9,075) — Net Income (Loss) Attributable to Common $ 5,924 $ (2,156 ) $ 3,712 $ (5,885 ) Stockholders Income (Loss) per Common Share: Basic $ 0.07 $ (0.03 ) $ 0.05 $ (0.07 ) Diluted $ 0.07 $ (0.03 ) $ 0.04 $ (0.07 ) Weighted Average Shares Used in Computation of Earnings per Common Share: Basic 81,017 79,413 80,789 79,075 Diluted 90,168 79,413 89,305 79,075 32

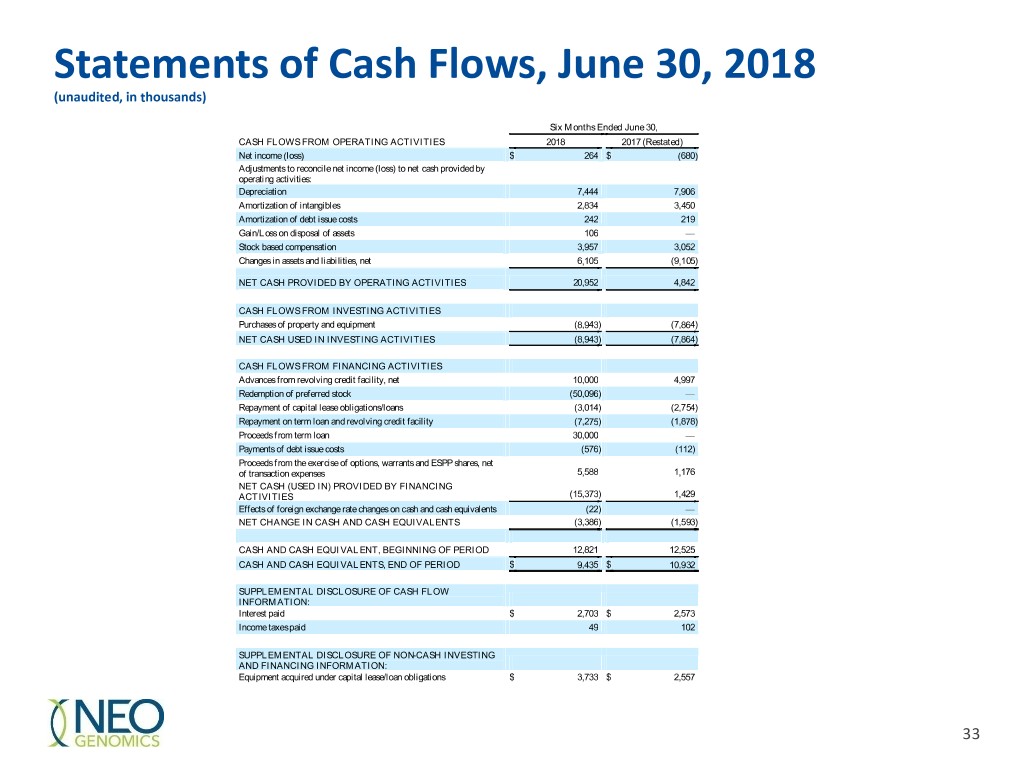

Statements of Cash Flows, June 30, 2018 (unaudited, in thousands) Six Months Ended June 30, CASH FLOWS FROM OPERATING ACTIVITIES 2018 2017 (Restated) Net income (loss) $ 264 $ (680 ) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation 7,444 7,906 Amortization of intangibles 2,834 3,450 Amortization of debt issue costs 242 219 Gain/Loss on disposal of assets 106 — Stock based compensation 3,957 3,052 Changes in assets and liabilities, net 6,105 (9,105 ) NET CASH PROVIDED BY OPERATING ACTIVITIES 20,952 4,842 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (8,943 ) (7,864 ) NET CASH USED IN INVESTING ACTIVITIES (8,943 ) (7,864 ) CASH FLOWS FROM FINANCING ACTIVITIES Advances from revolving credit facility, net 10,000 4,997 Redemption of preferred stock (50,096 ) — Repayment of capital lease obligations/loans (3,014 ) (2,754 ) Repayment on term loan and revolving credit facility (7,275 ) (1,878 ) Proceeds from term loan 30,000 — Payments of debt issue costs (576 ) (112) Proceeds from the exercise of options, warrants and ESPP shares, net of transaction expenses 5,588 1,176 NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES (15,373 ) 1,429 Effects of foreign exchange rate changes on cash and cash equivalents (22 ) — NET CHANGE IN CASH AND CASH EQUIVALENTS (3,386 ) (1,593 ) CASH AND CASH EQUIVALENT, BEGINNING OF PERIOD 12,821 12,525 CASH AND CASH EQUIVALENTS, END OF PERIOD $ 9,435 $ 10,932 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Interest paid $ 2,703 $ 2,573 Income taxes paid 49 102 SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING INFORMATION: Equipment acquired under capital lease/loan obligations $ 3,733 $ 2,557 33