EXHIBIT 99.2

Published on October 23, 2018

NeoGenomics Acquisition of Genoptix October 23, 2018

Forward‐Looking Statements This presentation has been prepared by NeoGenomics, Inc. (“we,” ”us,” “our,” “NeoGenomics” or the “Company”) and is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains “forward‐looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward‐looking statements. Although the Company believes the expectations reflected in such forward‐looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward‐looking statements due to numerous known and unknown risks and uncertainties. All forward‐looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Non‐GAAP Adjusted EBITDA "Adjusted EBITDA" is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, non‐cash stock‐based compensation expense, and if applicable in a reporting period, acquisition‐related transaction expenses (vi) non‐cash impairments of intangible assets (vii) debt financing costs (viii) and other significant non‐recurring or non‐operating (income) or expenses.

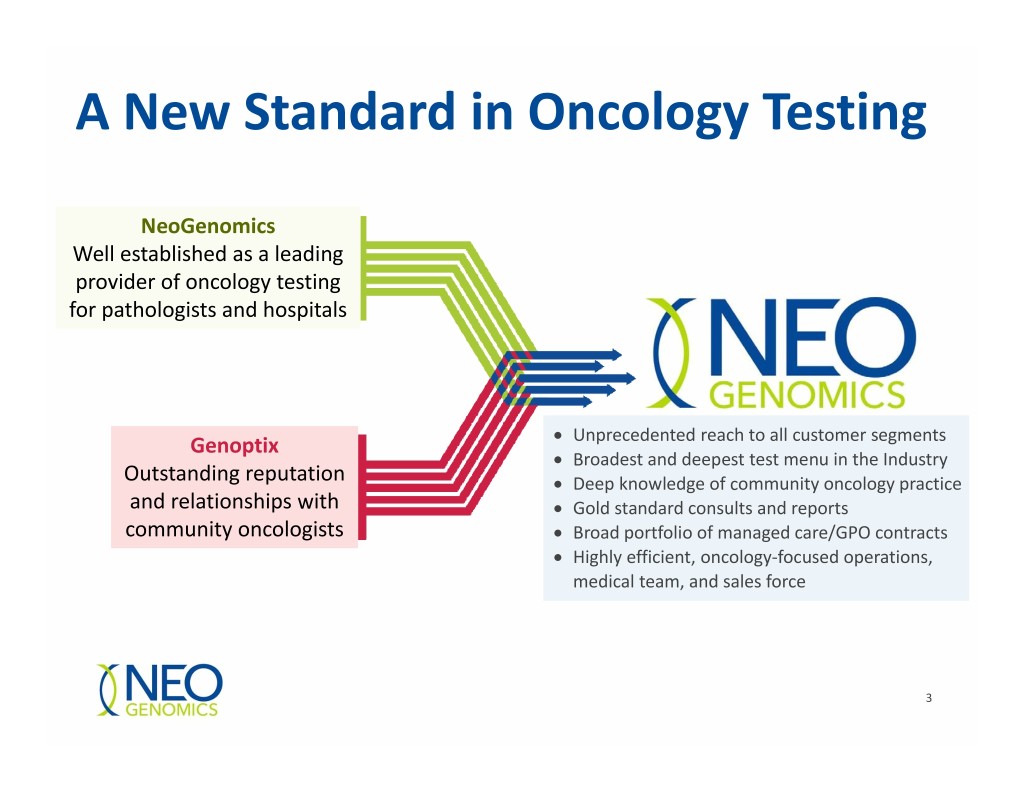

A New Standard in Oncology Testing NeoGenomics Well established as a leading provider of oncology testing for pathologists and hospitals Genoptix Unprecedented reach to all customer segments Broadest and deepest test menu in the Industry Outstanding reputation Deep knowledge of community oncology practice and relationships with Gold standard consults and reports community oncologists Broad portfolio of managed care/GPO contracts Highly efficient, oncology‐focused operations, medical team, and sales force 3

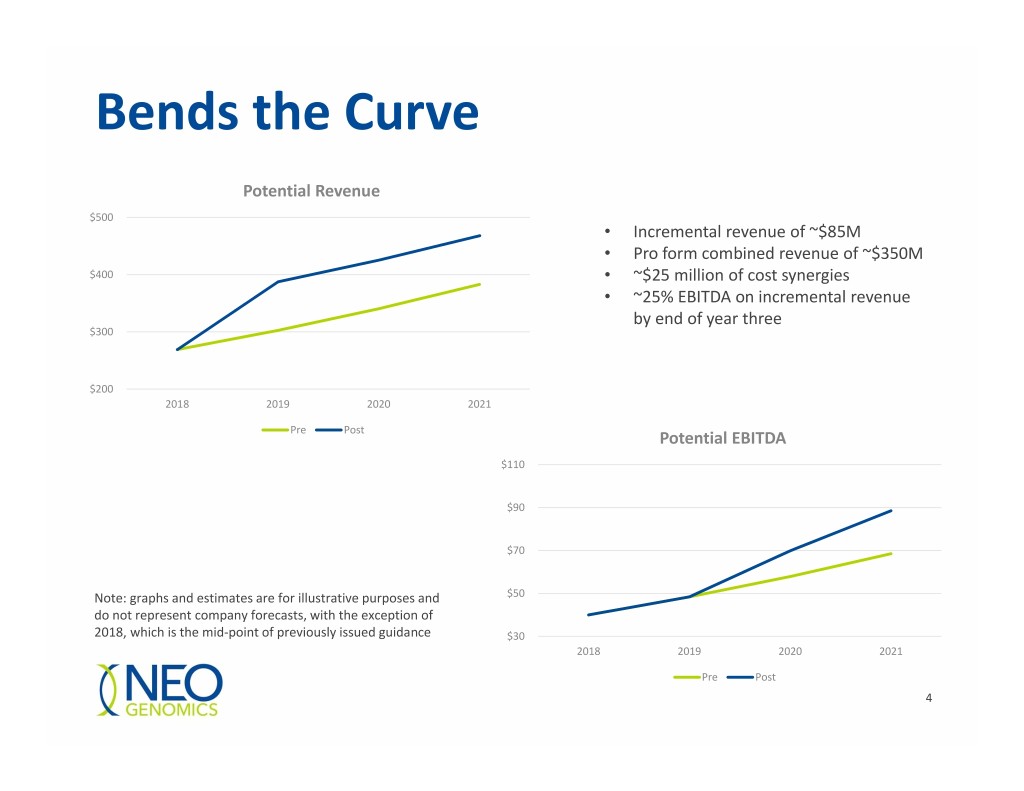

Bends the Curve Potential Revenue $500 • Incremental revenue of ~$85M • Pro form combined revenue of ~$350M $400 • ~$25 million of cost synergies • ~25% EBITDA on incremental revenue by end of year three $300 $200 2018 2019 2020 2021 Pre Post Potential EBITDA $110 $90 $70 Note: graphs and estimates are for illustrative purposes and $50 do not represent company forecasts, with the exception of 2018, which is the mid‐point of previously issued guidance $30 2018 2019 2020 2021 Pre Post 4

Genoptix Overview • Leading oncology‐focused lab • Outstanding reputation and relationship with community oncology practices • Cases managed by specialized pathologists and hematopathologists • Experience with complex and challenging disease states • 170,000 test reports issued in 2017 • Located in Carlsbad, CA • Founded in 1999; IPO 2007; Acquired by Novartis 2011; Acquired by Ampersand Capital, 1315 Capital and management in March of 2017 5

Expands Reach into Oncology Practices Significant opportunity Genoptix is well established in for growth this market segment $2.5 billion revenue 40 person oncologist‐focused sales opportunity force (5x larger than NeoGenomics’ current oncology team) >2,000 independent, Customized reports specifically community oncology tailored for the oncologist practices community Important channel for fastest Specialized pathologists with years growing tests (e.g., NGS and of experience working directly with Liquid Biopsy) oncologists 6

Leverages Best Offerings MANAGED CARE CUSTOMIZED EXTENSIVE PHARMA NATIONAL AND GPO REPORTING TEST MENU SERVICES FOOTPRINT CONTRACTS NeoGenomics’ test Synergistic With operations on NeoGenomics Genoptix has a menu includes many pharma services both coasts, has a broad suite of tests that Genoptix business drives NeoGenomics will portfolio of customized does not currently be able to improve access to contracts in reporting tools offer to its customers turn‐around time • Broader portfolio companion for Genoptix which that are of NGS tests diagnostics customers Genoptix does considered the • 10‐color flow not participate gold standard • Greater number of among IHC tests oncologists • Solid tumor pathology 7

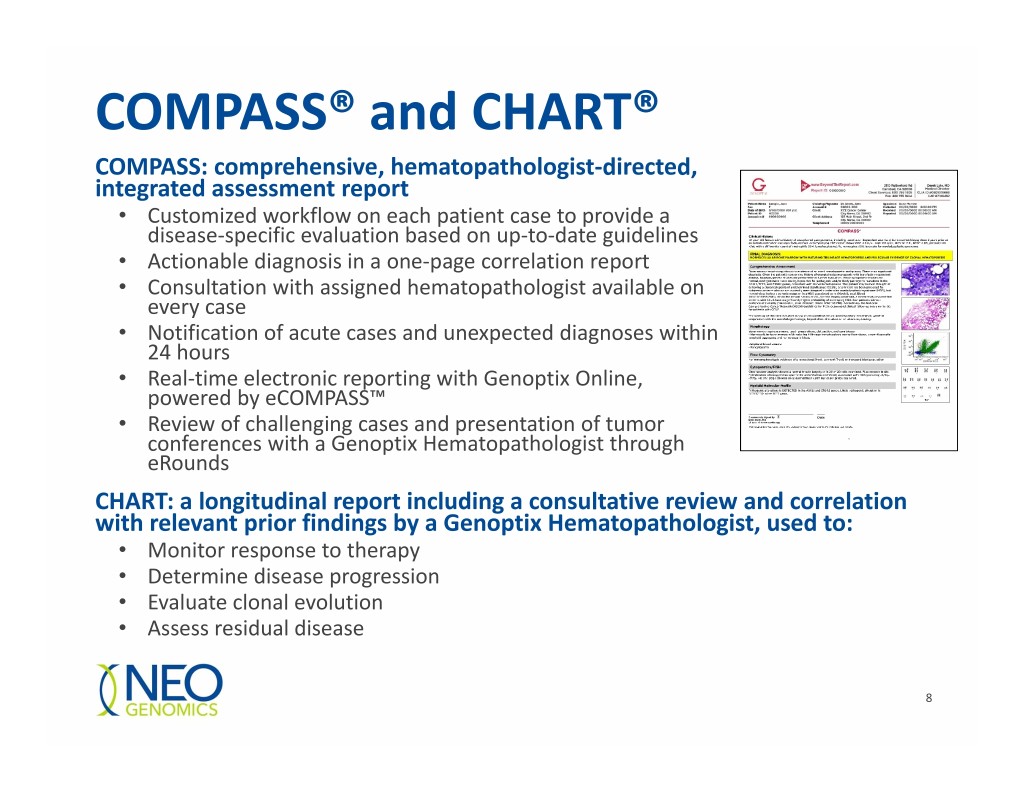

COMPASS® and CHART® COMPASS: comprehensive, hematopathologist‐directed, integrated assessment report • Customized workflow on each patient case to provide a disease‐specific evaluation based on up‐to‐date guidelines • Actionable diagnosis in a one‐page correlation report • Consultation with assigned hematopathologist available on every case • Notification of acute cases and unexpected diagnoses within 24 hours • Real‐time electronic reporting with Genoptix Online, powered by eCOMPASS™ • Review of challenging cases and presentation of tumor conferences with a Genoptix Hematopathologist through eRounds CHART: a longitudinal report including a consultative review and correlation with relevant prior findings by a Genoptix Hematopathologist, used to: • Monitor response to therapy • Determine disease progression • Evaluate clonal evolution • Assess residual disease 8

Creates Innovative Value Proposition NEOGENOMICS • Can provide both technical and professional services (including customized consults and reports) to oncologist, when preferred • ONCOLOGIST Can provide “tech‐only” services to pathologist when Expanded referral preferred by oncologist options with access to both NeoGenomics and affiliated community‐ PATHOLOGIST based pathologists Opportunity for increased referrals from community oncologists leveraging NeoGenomics’ “tech‐only” offering 9

Raises the Bar • Significantly expands reach into oncology practices • Creates unique value proposition for oncologists, pathologists, hospitals, payors and patients • Enhances and leverages combined product offering • Increases opportunity for coordination between oncologists and pathologists within the community • Accelerates revenue and profit trajectory 10

© 2018 NeoGenomics Laboratories, Inc. All rights reserved. All other trademarks are the property of their respective owners.