EX-99.1

Published on August 2, 2019

Exhibit 99.1 INVESTOR PRESENTATION July 2019

Exhibit 99.1 Forward-Looking Statements This presentation has been prepared by NeoGenomics, Inc. (“we,” ”us,” “our,” “NeoGenomics” or the “Company”) and is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward-looking statements. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward-looking statements due to numerous known and unknown risks and uncertainties. All forward-looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Non-GAAP Adjusted EBITDA "Adjusted EBITDA" is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, non-cash stock-based compensation expense, and if applicable in a reporting period, acquisition-related transaction expenses (vi) non-cash impairments of intangible assets (vii) debt financing costs (viii) and other significant non-recurring or non-operating (income) or expenses. 2

Exhibit 99.1 Investment Highlights Leading pure-play oncology testing company Significant market growth tailwinds Extensive molecular/oncology test menu Leader in immuno-oncology testing Market share gains driven by customer satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 3

Exhibit 99.1 Who We Are COMMON PURPOSE We save lives by improving patient care. VISION By providing uncompromising quality, exceptional service and innovative solutions, we will be the World’s leading cancer testing and information company. VALUES − Quality − Integrity − Accountability − Teamwork − Innovation We are Focused and Genuine 4

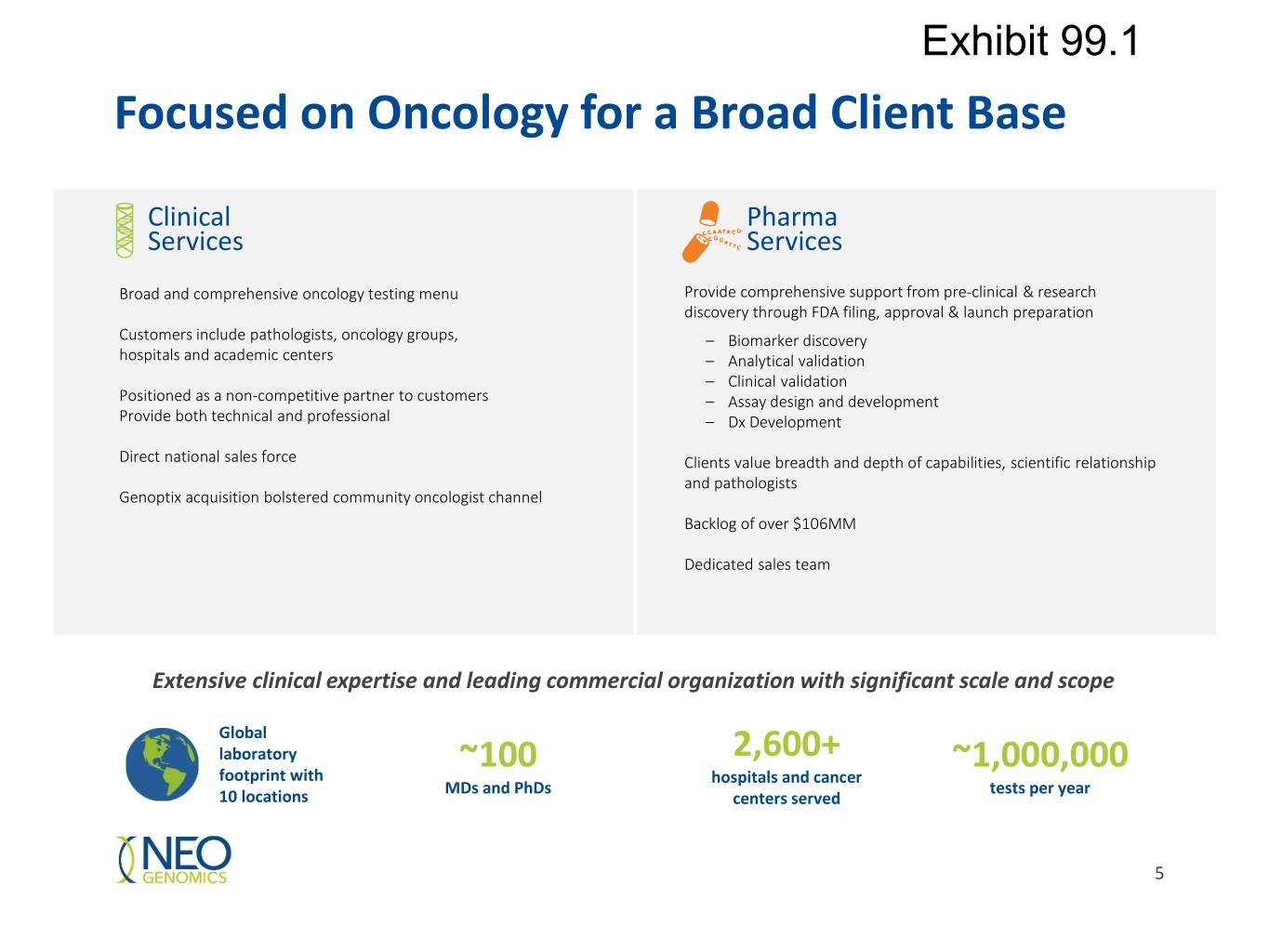

Exhibit 99.1 Focused on Oncology for a Broad Client Base Clinical Pharma Services Services Broad and comprehensive oncology testing menu Provide comprehensive support from pre-clinical & research discovery through FDA filing, approval & launch preparation Customers include pathologists, oncology groups, – Biomarker discovery hospitals and academic centers – Analytical validation – Clinical validation Positioned as a non-competitive partner to customers – Assay design and development Provide both technical and professional – Dx Development Direct national sales force Clients value breadth and depth of capabilities, scientific relationship and pathologists Genoptix acquisition bolstered community oncologist channel Backlog of over $106MM Dedicated sales team Extensive clinical expertise and leading commercial organization with significant scale and scope Global laboratory 2,600+ footprint with ~100 hospitals and cancer ~1,000,000 MDs and PhDs tests per year 10 locations centers served 5

Exhibit 99.1 Oncology Market Tailwinds Aging population driving cancer incidence Increased survival driving follow-on testing Growing number of therapeutic options Increased therapeutic complexity Burgeoning oncology drug pipeline Emerging platforms and tests (NGS, TMB, MSI, etc.) 6

Exhibit 99.1 US Oncology Lab Industry Clinical Reference Labs Pure Play Oncology Reference Labs Niche Oncology Players (with oncology divisions) (comprehensive test menus) (limited test menus) 7

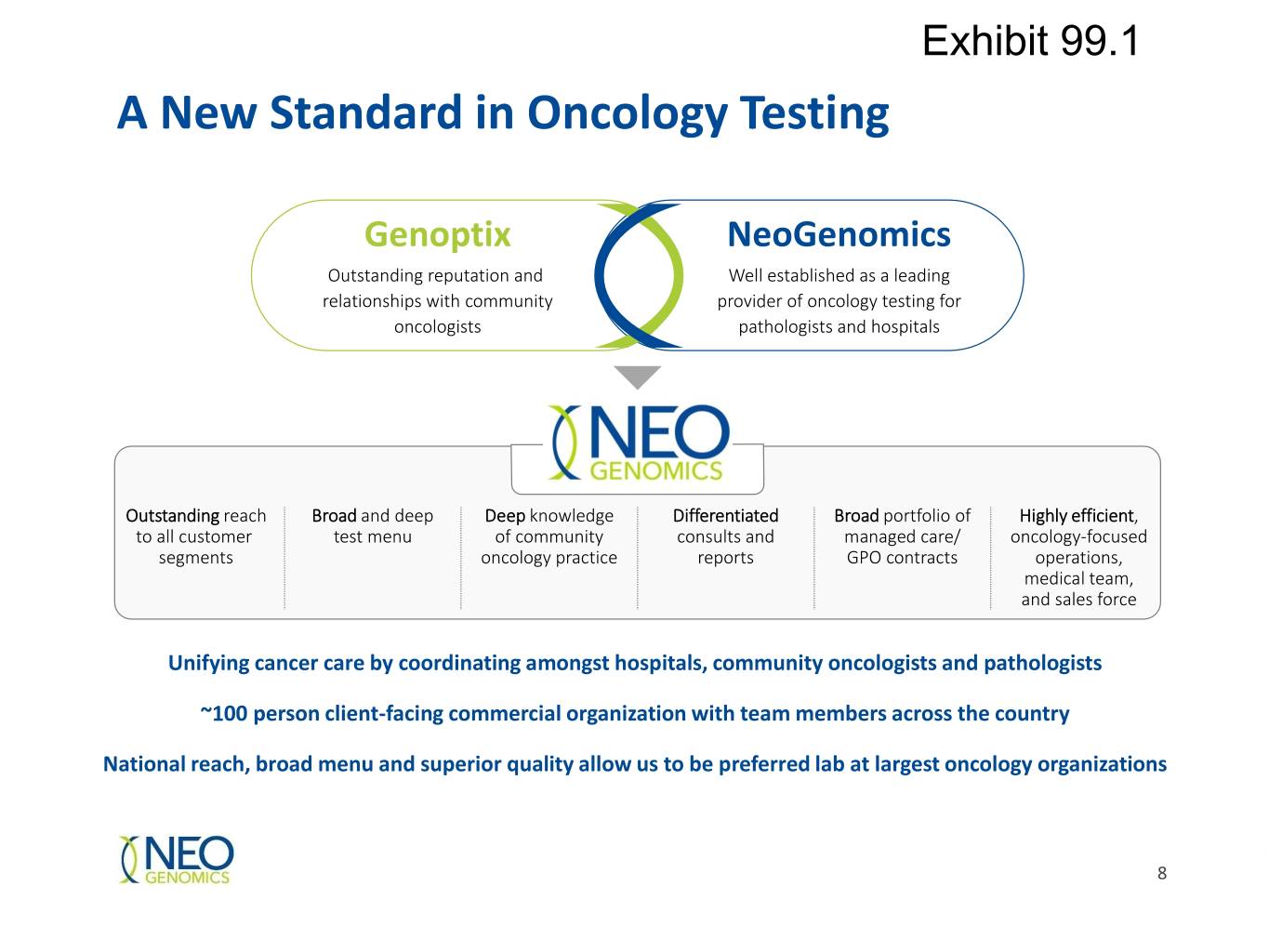

Exhibit 99.1 A New Standard in Oncology Testing Genoptix NeoGenomics Outstanding reputation and Well established as a leading relationships with community provider of oncology testing for oncologists pathologists and hospitals Outstanding reach Broad and deep Deep knowledge Differentiated Broad portfolio of Highly efficient, to all customer test menu of community consults and managed care/ oncology-focused segments oncology practice reports GPO contracts operations, medical team, and sales force Unifying cancer care by coordinating amongst hospitals, community oncologists and pathologists ~100 person client-facing commercial organization with team members across the country National reach, broad menu and superior quality allow us to be preferred lab at largest oncology organizations 8

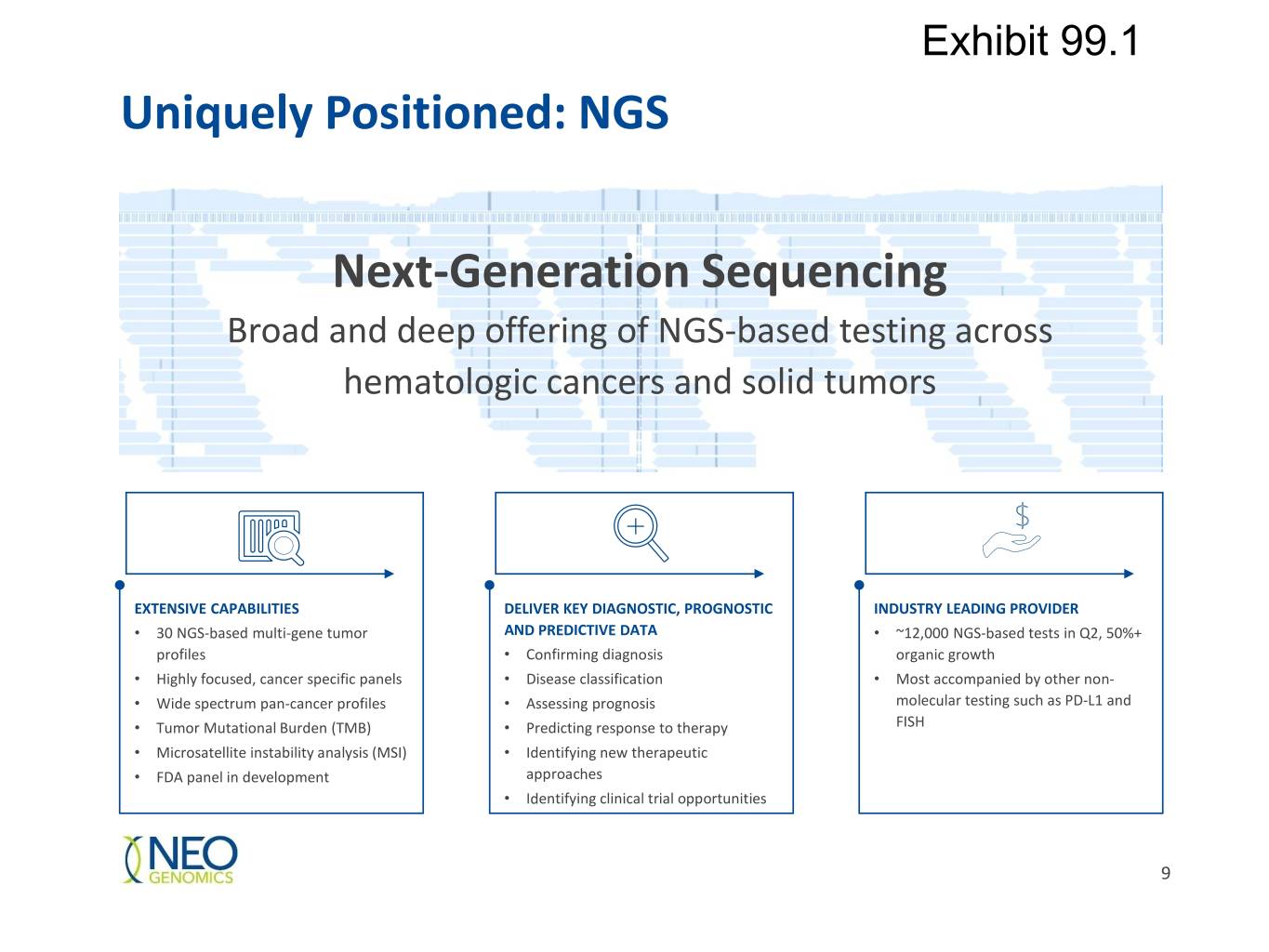

Exhibit 99.1 Uniquely Positioned: NGS Next-Generation Sequencing Broad and deep offering of NGS-based testing across hematologic cancers and solid tumors EXTENSIVE CAPABILITIES DELIVER KEY DIAGNOSTIC, PROGNOSTIC INDUSTRY LEADING PROVIDER • 30 NGS-based multi-gene tumor AND PREDICTIVE DATA • ~12,000 NGS-based tests in Q2, 50%+ profiles • Confirming diagnosis organic growth • Highly focused, cancer specific panels • Disease classification • Most accompanied by other non- • Wide spectrum pan-cancer profiles • Assessing prognosis molecular testing such as PD-L1 and • Tumor Mutational Burden (TMB) • Predicting response to therapy FISH • Microsatellite instability analysis (MSI) • Identifying new therapeutic • FDA panel in development approaches • Identifying clinical trial opportunities 9

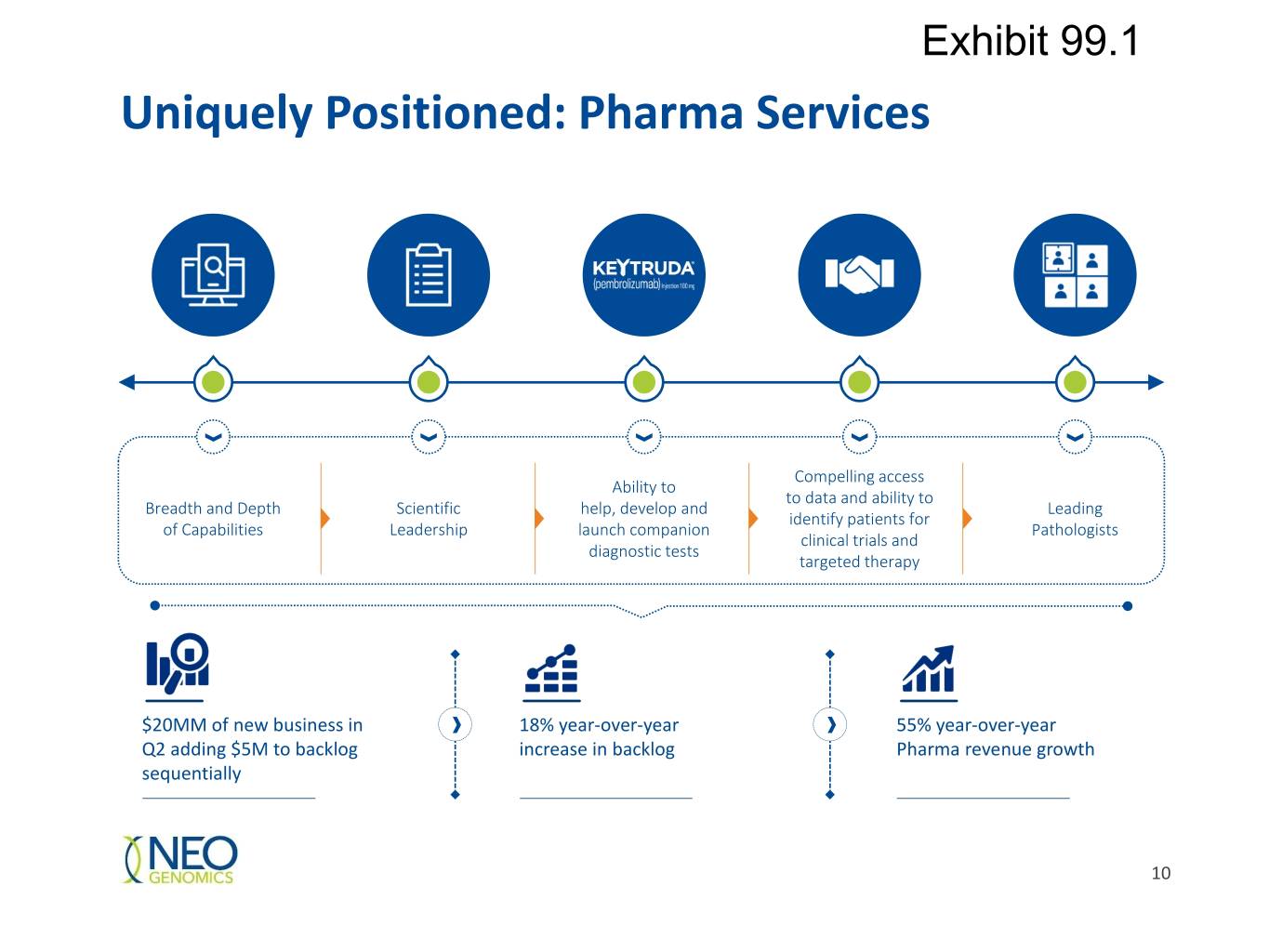

Exhibit 99.1 Uniquely Positioned: Pharma Services Compelling access Ability to to data and ability to Breadth and Depth Scientific help, develop and Leading identify patients for of Capabilities Leadership launch companion Pathologists clinical trials and diagnostic tests targeted therapy $20MM of new business in 18% year-over-year 55% year-over-year Q2 adding $5M to backlog increase in backlog Pharma revenue growth sequentially 10

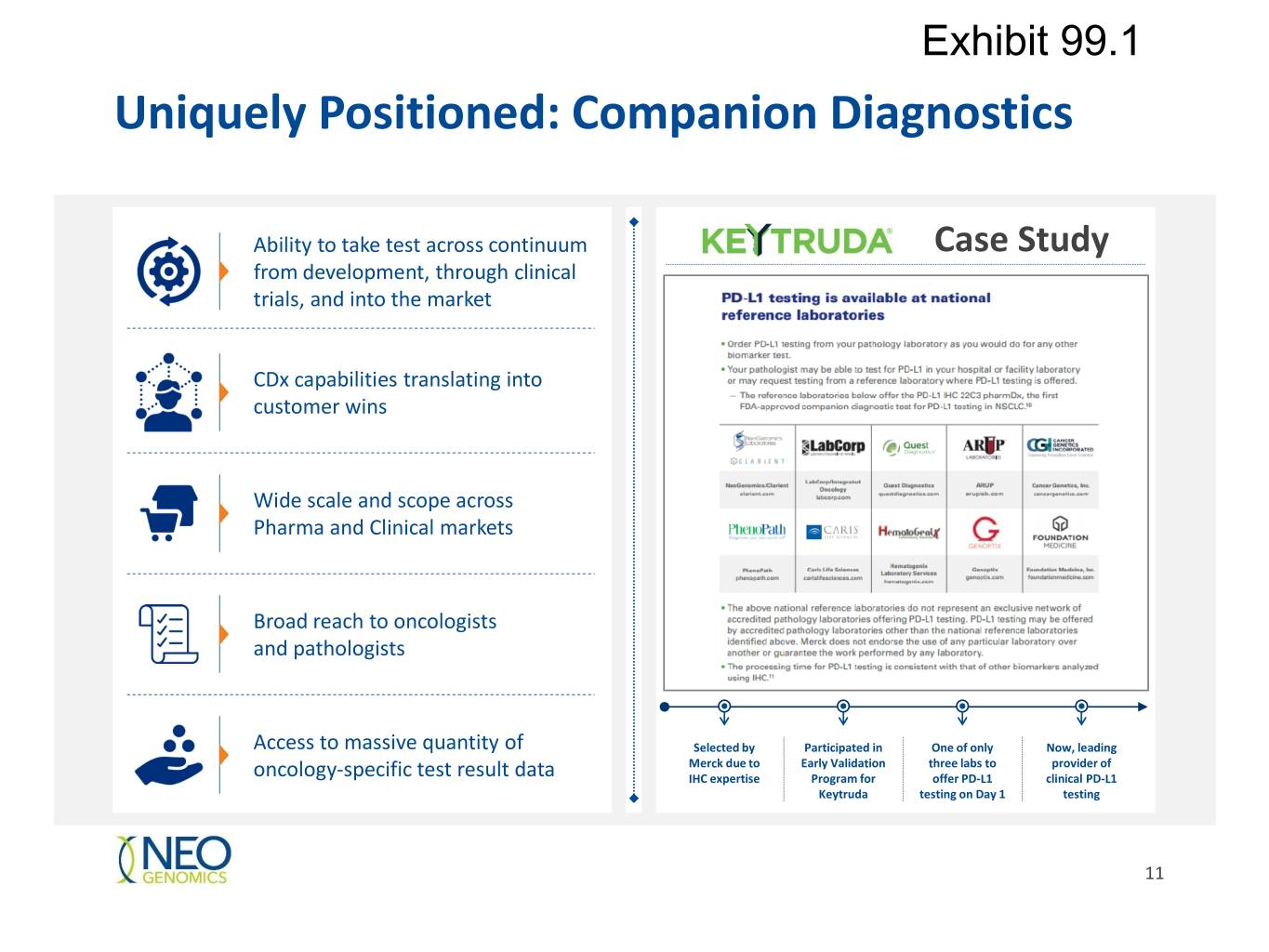

Exhibit 99.1 Uniquely Positioned: Companion Diagnostics Ability to take test across continuum Case Study from development, through clinical trials, and into the market CDx capabilities translating into customer wins Wide scale and scope across Pharma and Clinical markets Broad reach to oncologists and pathologists Access to massive quantity of Selected by Participated in One of only Now, leading Merck due to Early Validation three labs to provider of oncology-specific test result data IHC expertise Program for offer PD-L1 clinical PD-L1 Keytruda testing on Day 1 testing 11

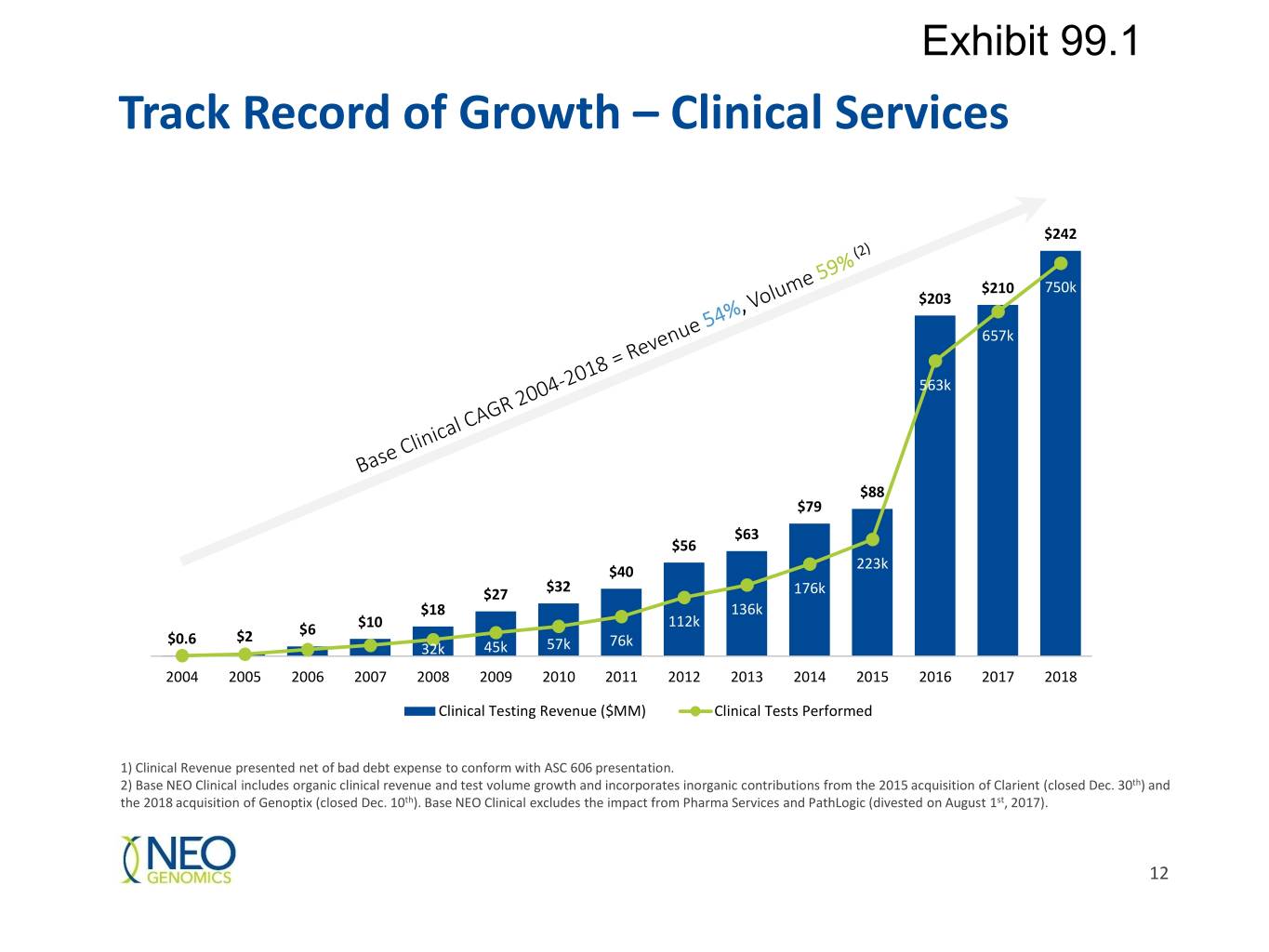

Exhibit 99.1 Track Record of Growth – Clinical Services 250 $242 800 $210 750k 700 $203 200 657k 600 563k 500 150 400 100 $88 300 $79 $63 $56 200 223k 50 $40 $27 $32 176k $18 136k 100 $10 112k $2 $6 $0.6 45k 57k 76k 0 32k 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Clinical Testing Revenue ($MM) Clinical Tests Performed 1) Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. 2) Base NEO Clinical includes organic clinical revenue and test volume growth and incorporates inorganic contributions from the 2015 acquisition of Clarient (closed Dec. 30th) and the 2018 acquisition of Genoptix (closed Dec. 10th). Base NEO Clinical excludes the impact from Pharma Services and PathLogic (divested on August 1st, 2017). 12

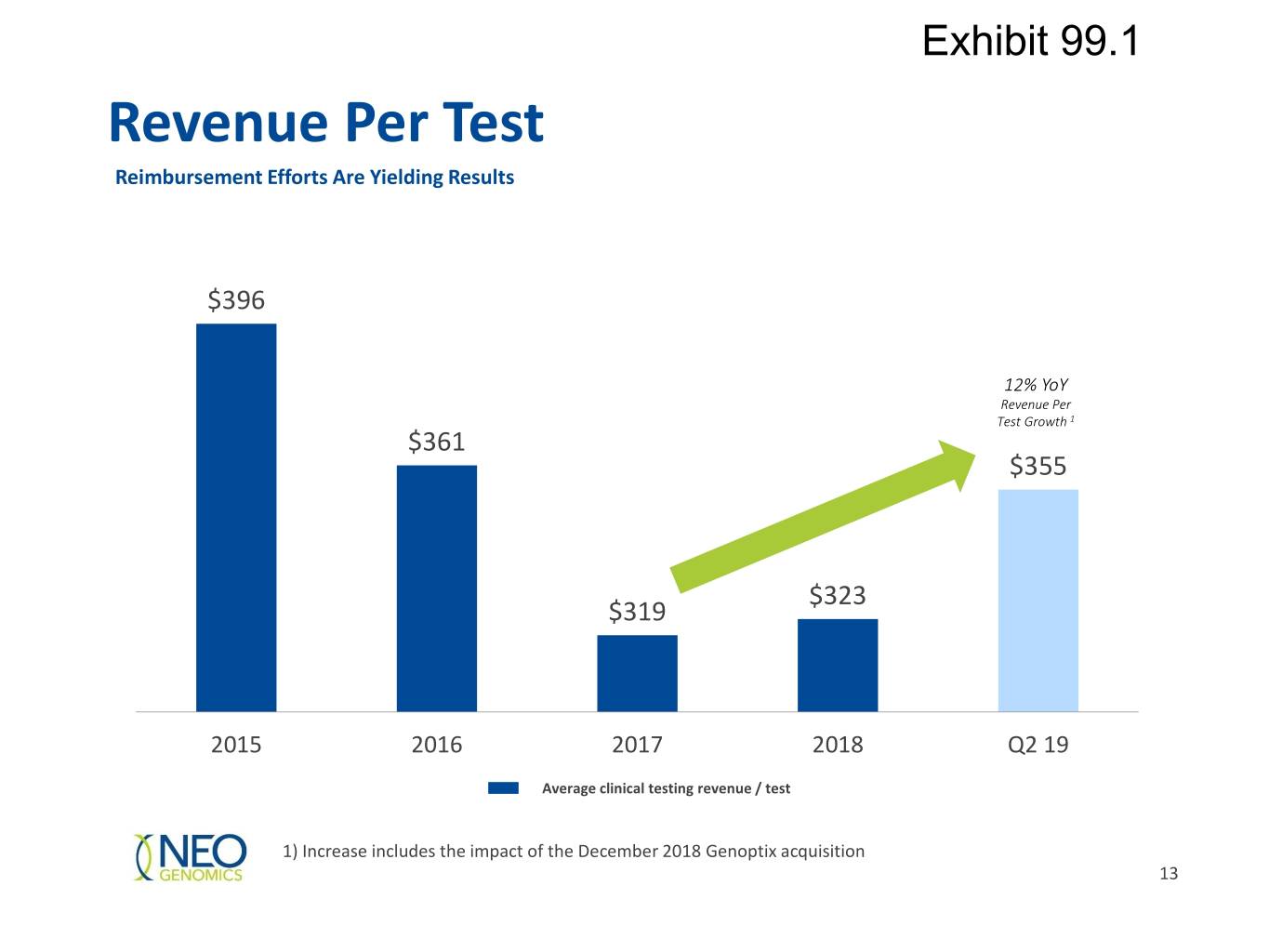

Exhibit 99.1 Revenue Per Test Reimbursement Efforts Are Yielding Results $396 12% YoY Revenue Per Test Growth 1 $361 $355 $323 $319 2015 2016 2017 2018 Q2 19 Average clinical testing revenue / test 1) Increase includes the impact of the December 2018 Genoptix acquisition 13

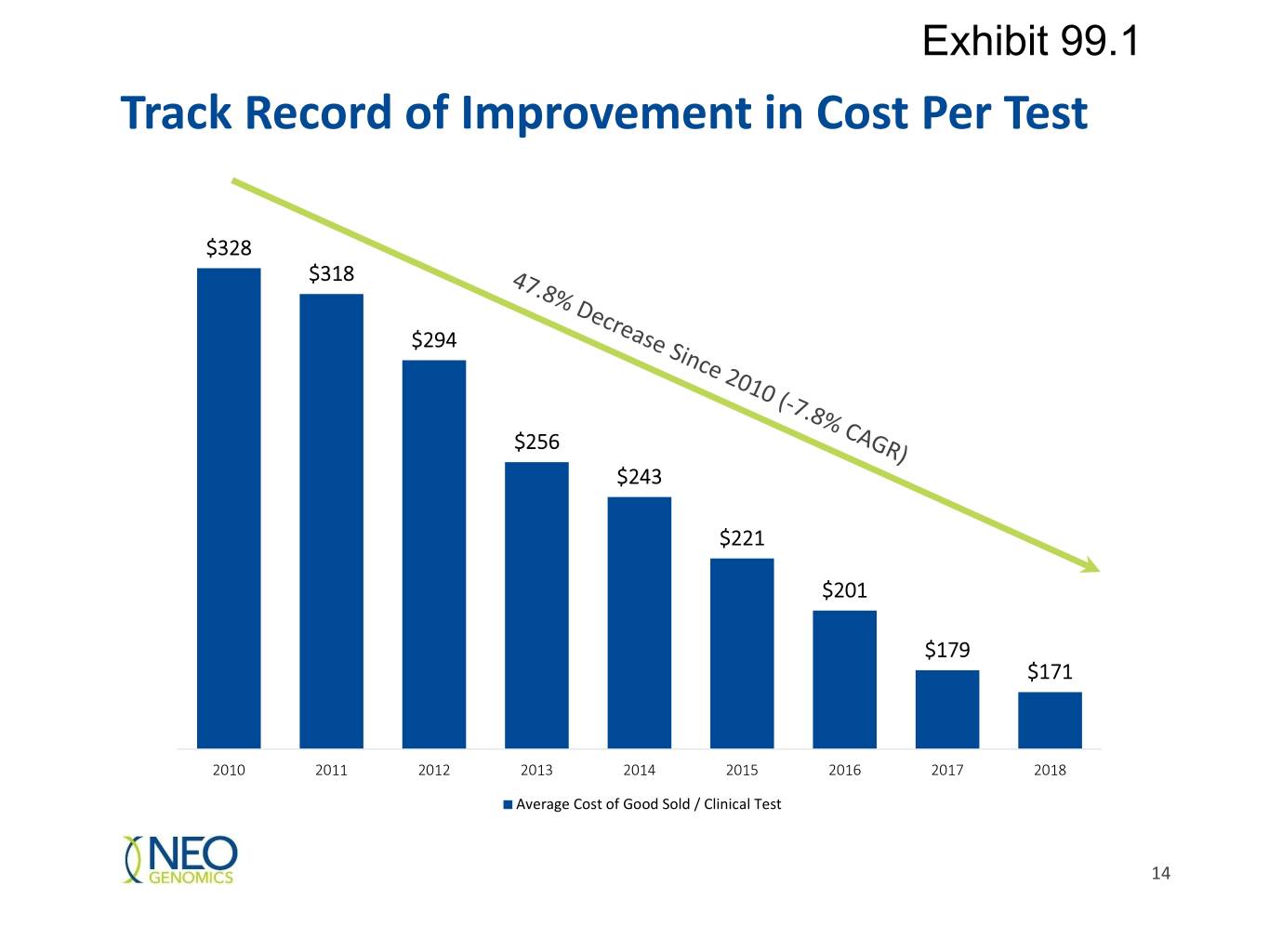

Exhibit 99.1 Track Record of Improvement in Cost Per Test $328 $318 $294 $256 $243 $221 $201 $179 $171 2010 2011 2012 2013 2014 2015 2016 2017 2018 Average Cost of Good Sold / Clinical Test 14

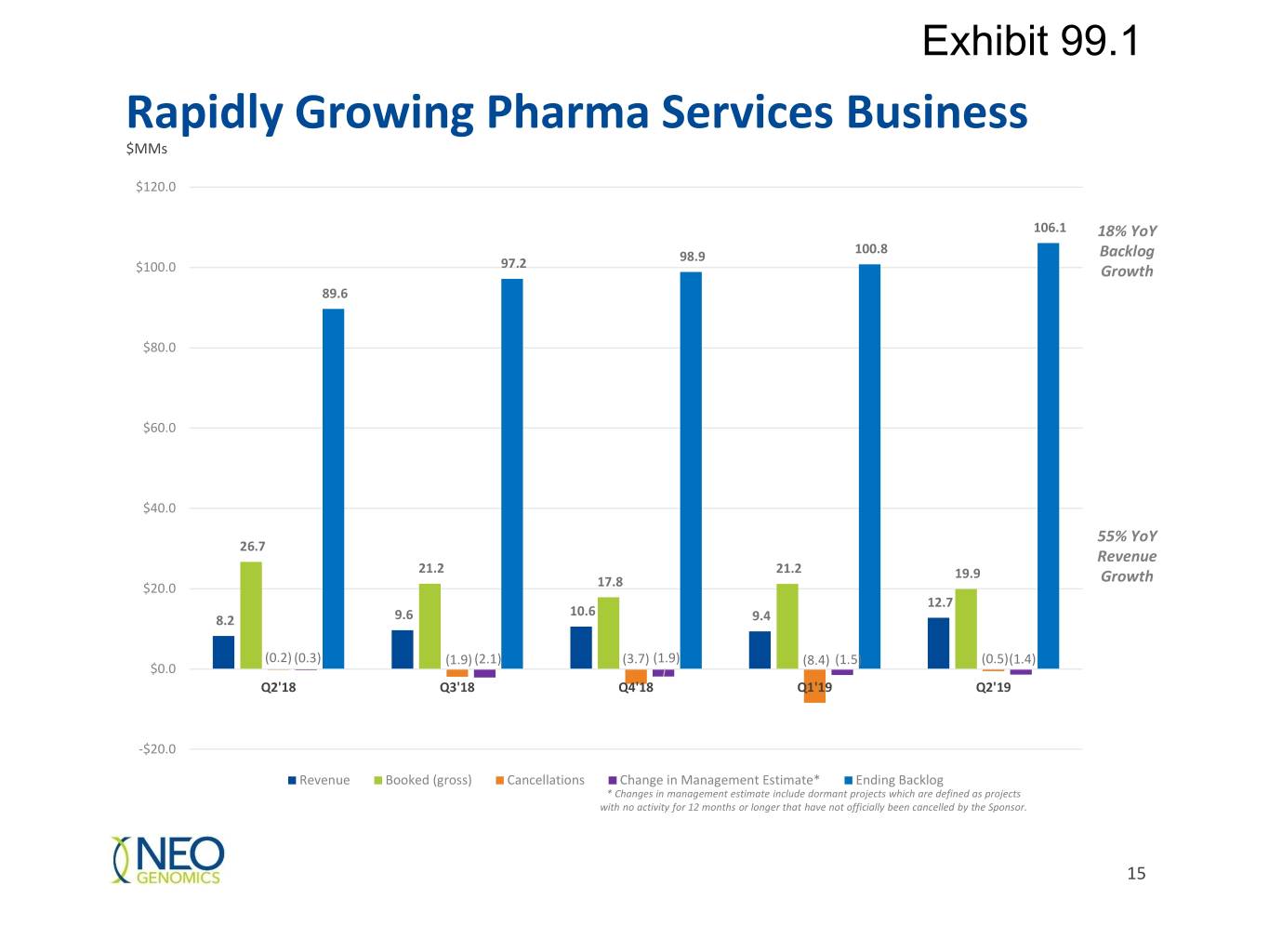

Exhibit 99.1 Rapidly Growing Pharma Services Business $MMs $120.0 106.1 18% YoY 100.8 98.9 Backlog $100.0 97.2 Growth 89.6 $80.0 $60.0 $40.0 55% YoY 26.7 Revenue 21.2 21.2 19.9 Growth $20.0 17.8 12.7 10.6 8.2 9.6 9.4 (0.2) (0.3) (1.9) (2.1) (3.7) (1.9) (8.4) (1.5) (0.5)(1.4) $0.0 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 -$20.0 Revenue Booked (gross) Cancellations Change in Management Estimate* Ending Backlog * Changes in management estimate include dormant projects which are defined as projects with no activity for 12 months or longer that have not officially been cancelled by the Sponsor. 15

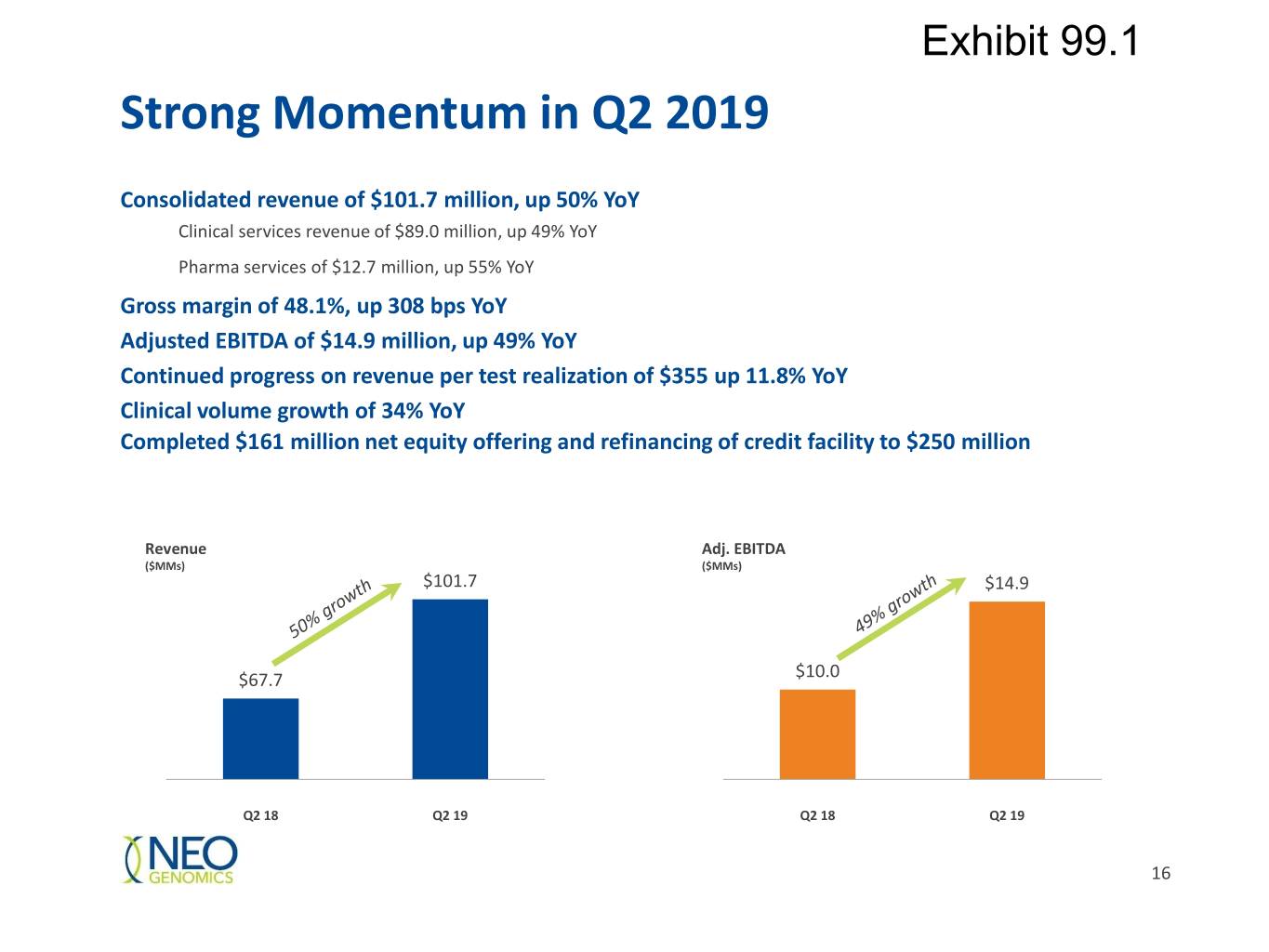

Exhibit 99.1 Strong Momentum in Q2 2019 Consolidated revenue of $101.7 million, up 50% YoY Clinical services revenue of $89.0 million, up 49% YoY Pharma services of $12.7 million, up 55% YoY Gross margin of 48.1%, up 308 bps YoY Adjusted EBITDA of $14.9 million, up 49% YoY Continued progress on revenue per test realization of $355 up 11.8% YoY Clinical volume growth of 34% YoY Completed $161 million net equity offering and refinancing of credit facility to $250 million Revenue Adj. EBITDA ($MMs) ($MMs) $101.7 $14.9 $67.7 $10.0 Q2 18 Q2 19 Q2 18 Q2 19 16

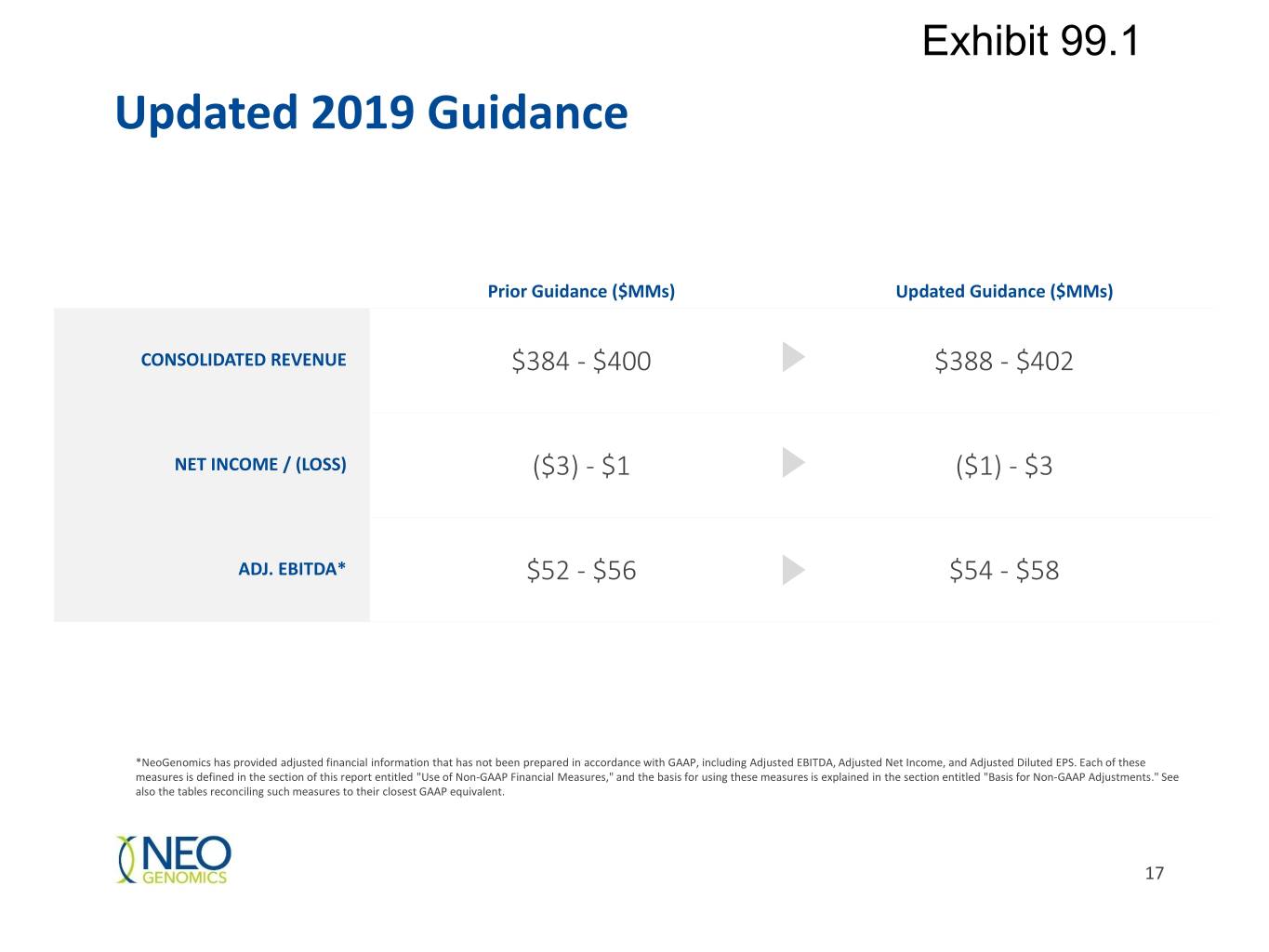

Exhibit 99.1 Updated 2019 Guidance Prior Guidance ($MMs) Updated Guidance ($MMs) CONSOLIDATED REVENUE $384 - $400 $388 - $402 NET INCOME / (LOSS) ($3) - $1 ($1) - $3 ADJ. EBITDA* $52 - $56 $54 - $58 *NeoGenomics has provided adjusted financial information that has not been prepared in accordance with GAAP, including Adjusted EBITDA, Adjusted Net Income, and Adjusted Diluted EPS. Each of these measures is defined in the section of this report entitled "Use of Non-GAAP Financial Measures," and the basis for using these measures is explained in the section entitled "Basis for Non-GAAP Adjustments." See also the tables reconciling such measures to their closest GAAP equivalent. 17

Exhibit 99.1 Key Strategic and Investment Initiatives Investing in our informatics capabilities Pharma customers driving demand for deeper informatics - Prospective identification of patients for clinical trials - Informing treatment selection Strategic acquisitions or partnerships Focused on targeted rather than transformational deals Continue to grow the capability and reach of our pharma services business Disciplined capital allocation with prior acquisitions - Genoptix (2018) - Clarient (2015) Focused innovation and investment To drive growth and shareholder returns across technology, facilities, portfolio of FDA approved tests and liquid biopsy capabilities 18

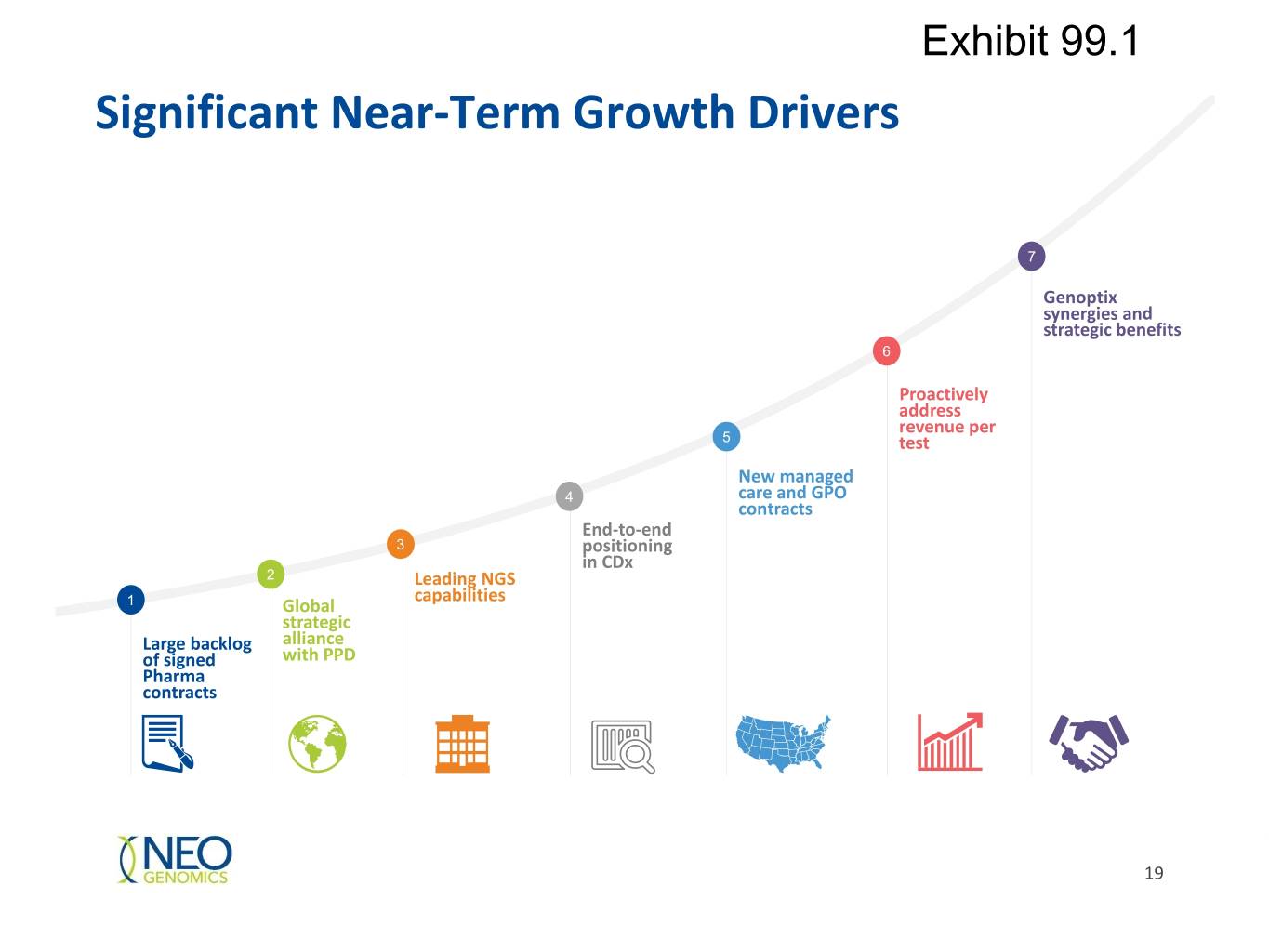

Exhibit 99.1 Significant Near-Term Growth Drivers 7 Genoptix synergies and strategic benefits 6 Proactively address revenue per 5 test New managed 4 care and GPO contracts End-to-end 3 positioning in CDx 2 Leading NGS capabilities 1 Global strategic Large backlog alliance of signed with PPD Pharma contracts 19

Exhibit 99.1 Investment Highlights Leading pure-play oncology testing company Significant market growth tailwinds Extensive molecular/oncology test menu Leader in immuno-oncology testing Market share gains driven by customer satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 20

Exhibit 99.1 Appendix 21

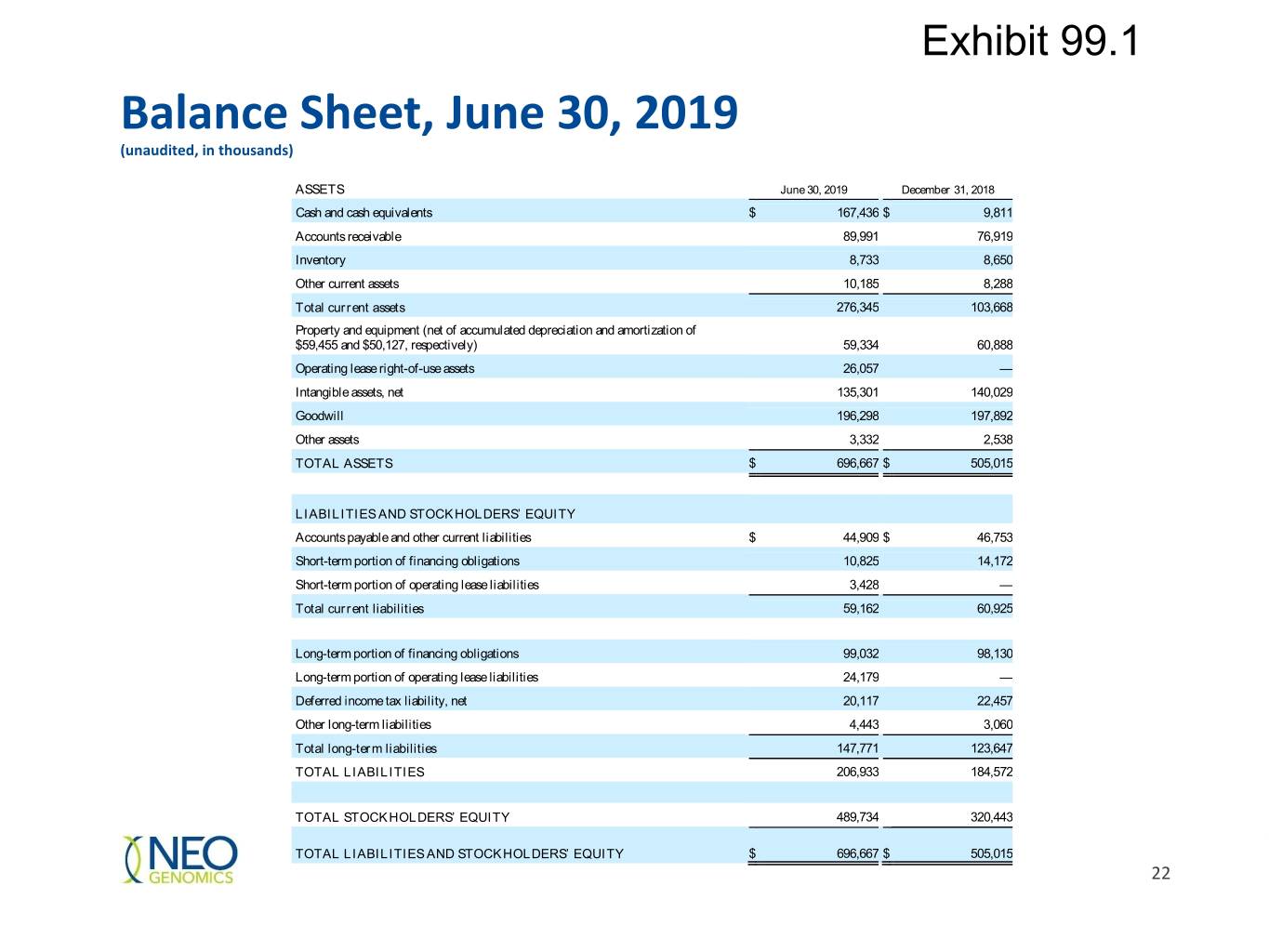

Exhibit 99.1 Balance Sheet, June 30, 2019 (unaudited, in thousands) ASSETS June 30, 2019 December 31, 2018 Cash and cash equivalents $ 167,436 $ 9,811 Accounts receivable 89,991 76,919 Inventory 8,733 8,650 Other current assets 10,185 8,288 Total current assets 276,345 103,668 Property and equipment (net of accumulated depreciation and amortization of $59,455 and $50,127, respectively) 59,334 60,888 Operating lease right-of-use assets 26,057 — Intangible assets, net 135,301 140,029 Goodwill 196,298 197,892 Other assets 3,332 2,538 TOTAL ASSETS $ 696,667 $ 505,015 LIABILITIES AND STOCKHOLDERS’ EQUITY Accounts payable and other current liabilities $ 44,909 $ 46,753 Short-term portion of financing obligations 10,825 14,172 Short-term portion of operating lease liabilities 3,428 — Total current liabilities 59,162 60,925 Long-term portion of financing obligations 99,032 98,130 Long-term portion of operating lease liabilities 24,179 — Deferred income tax liability, net 20,117 22,457 Other long-term liabilities 4,443 3,060 Total long-term liabilities 147,771 123,647 TOTAL LIABILITIES 206,933 184,572 TOTAL STOCKHOLDERS’ EQUITY 489,734 320,443 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 696,667 $ 505,015 22

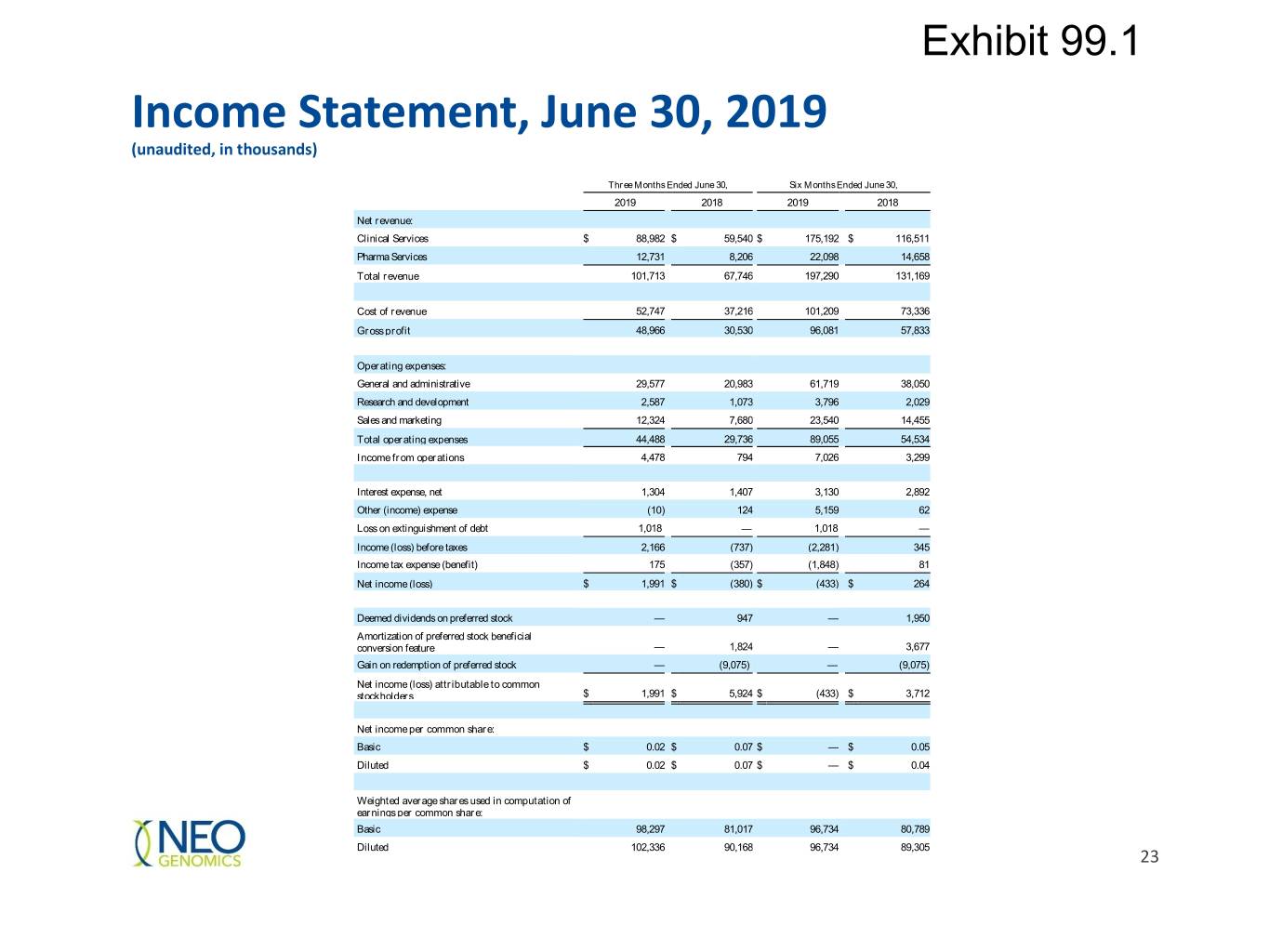

Exhibit 99.1 Income Statement, June 30, 2019 (unaudited, in thousands) Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 Net revenue: Clinical Services $ 88,982 $ 59,540 $ 175,192 $ 116,511 Pharma Services 12,731 8,206 22,098 14,658 Total revenue 101,713 67,746 197,290 131,169 Cost of revenue 52,747 37,216 101,209 73,336 Gross profit 48,966 30,530 96,081 57,833 Operating expenses: General and administrative 29,577 20,983 61,719 38,050 Research and development 2,587 1,073 3,796 2,029 Sales and marketing 12,324 7,680 23,540 14,455 Total operating expenses 44,488 29,736 89,055 54,534 Income from operations 4,478 794 7,026 3,299 Interest expense, net 1,304 1,407 3,130 2,892 Other (income) expense (10) 124 5,159 62 Loss on extinguishment of debt 1,018 — 1,018 — Income (loss) before taxes 2,166 (737) (2,281) 345 Income tax expense (benefit) 175 (357) (1,848) 81 Net income (loss) $ 1,991 $ (380) $ (433) $ 264 Deemed dividends on preferred stock — 947 — 1,950 Amortization of preferred stock beneficial conversion feature — 1,824 — 3,677 Gain on redemption of preferred stock — (9,075) — (9,075) Net income (loss) attributable to common stockholders $ 1,991 $ 5,924 $ (433) $ 3,712 Net income per common share: Basic $ 0.02 $ 0.07 $ — $ 0.05 Diluted $ 0.02 $ 0.07 $ — $ 0.04 Weighted average shares used in computation of earnings per common share: Basic 98,297 81,017 96,734 80,789 Diluted 102,336 90,168 96,734 89,305 23

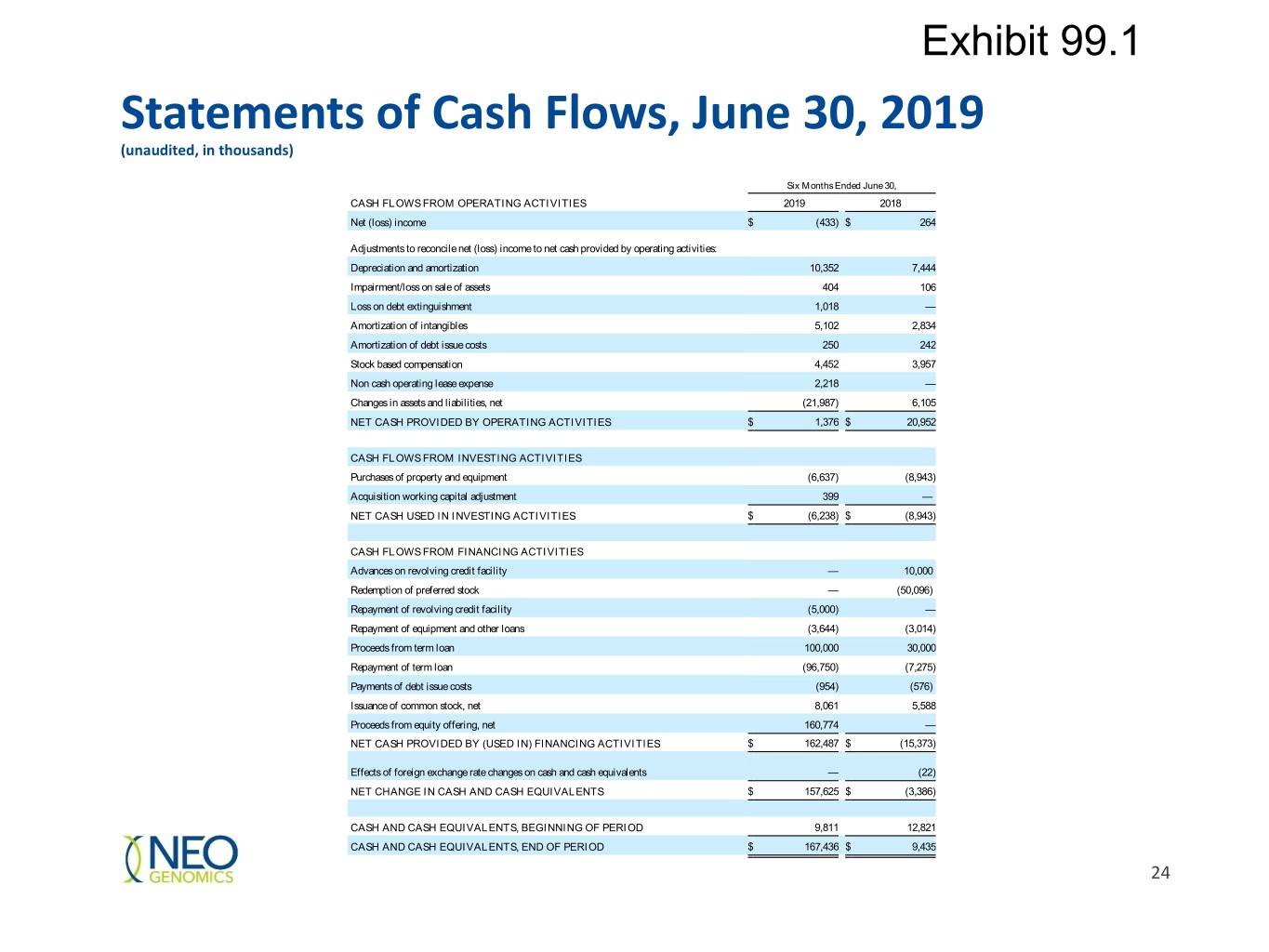

Exhibit 99.1 Statements of Cash Flows, June 30, 2019 (unaudited, in thousands) Six Months Ended June 30, CASH FLOWS FROM OPERATING ACTIVITIES 2019 2018 Net (loss) income $ (433) $ 264 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization 10,352 7,444 Impairment/loss on sale of assets 404 106 Loss on debt extinguishment 1,018 — Amortization of intangibles 5,102 2,834 Amortization of debt issue costs 250 242 Stock based compensation 4,452 3,957 Non cash operating lease expense 2,218 — Changes in assets and liabilities, net (21,987) 6,105 NET CASH PROVIDED BY OPERATING ACTIVITIES $ 1,376 $ 20,952 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (6,637) (8,943) Acquisition working capital adjustment 399 — NET CASH USED IN INVESTING ACTIVITIES $ (6,238) $ (8,943) CASH FLOWS FROM FINANCING ACTIVITIES Advances on revolving credit facility — 10,000 Redemption of preferred stock — (50,096) Repayment of revolving credit facility (5,000) — Repayment of equipment and other loans (3,644) (3,014) Proceeds from term loan 100,000 30,000 Repayment of term loan (96,750) (7,275) Payments of debt issue costs (954) (576) Issuance of common stock, net 8,061 5,588 Proceeds from equity offering, net 160,774 — NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES $ 162,487 $ (15,373) Effects of foreign exchange rate changes on cash and cash equivalents — (22) NET CHANGE IN CASH AND CASH EQUIVALENTS $ 157,625 $ (3,386) CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 9,811 12,821 CASH AND CASH EQUIVALENTS, END OF PERIOD $ 167,436 $ 9,435 24

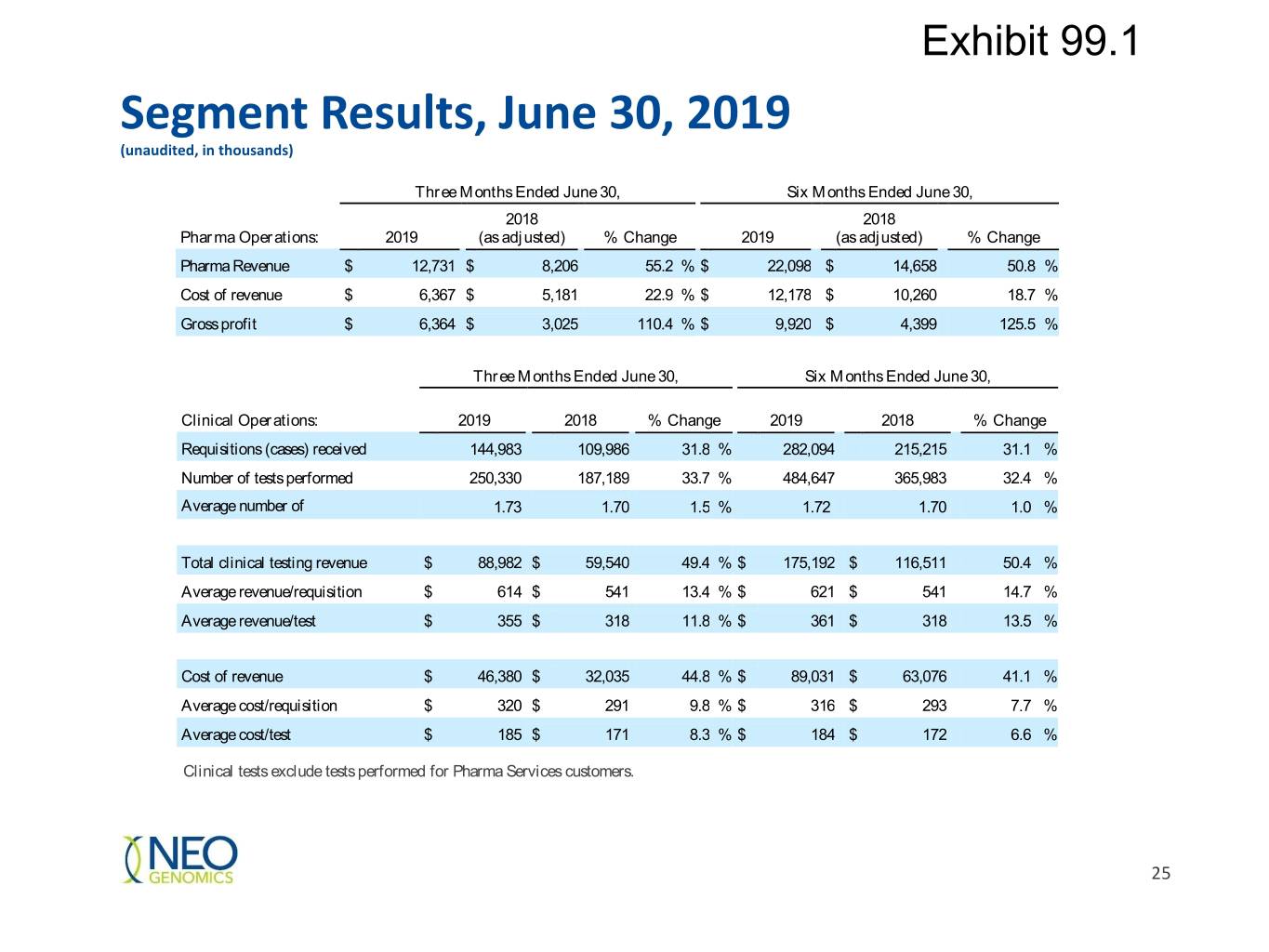

Exhibit 99.1 Segment Results, June 30, 2019 (unaudited, in thousands) Three Months Ended June 30, Six Months Ended June 30, 2018 2018 Pharma Operations: 2019 (as adjusted) % Change 2019 (as adjusted) % Change Pharma Revenue $ 12,731 $ 8,206 55.2 % $ 22,098 $ 14,658 50.8 % Cost of revenue $ 6,367 $ 5,181 22.9 % $ 12,178 $ 10,260 18.7 % Gross profit $ 6,364 $ 3,025 110.4 % $ 9,920 $ 4,399 125.5 % Three Months Ended June 30, Six Months Ended June 30, Clinical Operations: 2019 2018 % Change 2019 2018 % Change Requisitions (cases) received 144,983 109,986 31.8 % 282,094 215,215 31.1 % Number of tests performed 250,330 187,189 33.7 % 484,647 365,983 32.4 % Average number of 1.73 1.70 1.5 % 1.72 1.70 1.0 % Total clinical testing revenue $ 88,982 $ 59,540 49.4 % $ 175,192 $ 116,511 50.4 % Average revenue/requisition $ 614 $ 541 13.4 % $ 621 $ 541 14.7 % Average revenue/test $ 355 $ 318 11.8 % $ 361 $ 318 13.5 % Cost of revenue $ 46,380 $ 32,035 44.8 % $ 89,031 $ 63,076 41.1 % Average cost/requisition $ 320 $ 291 9.8 % $ 316 $ 293 7.7 % Average cost/test $ 185 $ 171 8.3 % $ 184 $ 172 6.6 % Clinical tests exclude tests performed for Pharma Services customers. 25

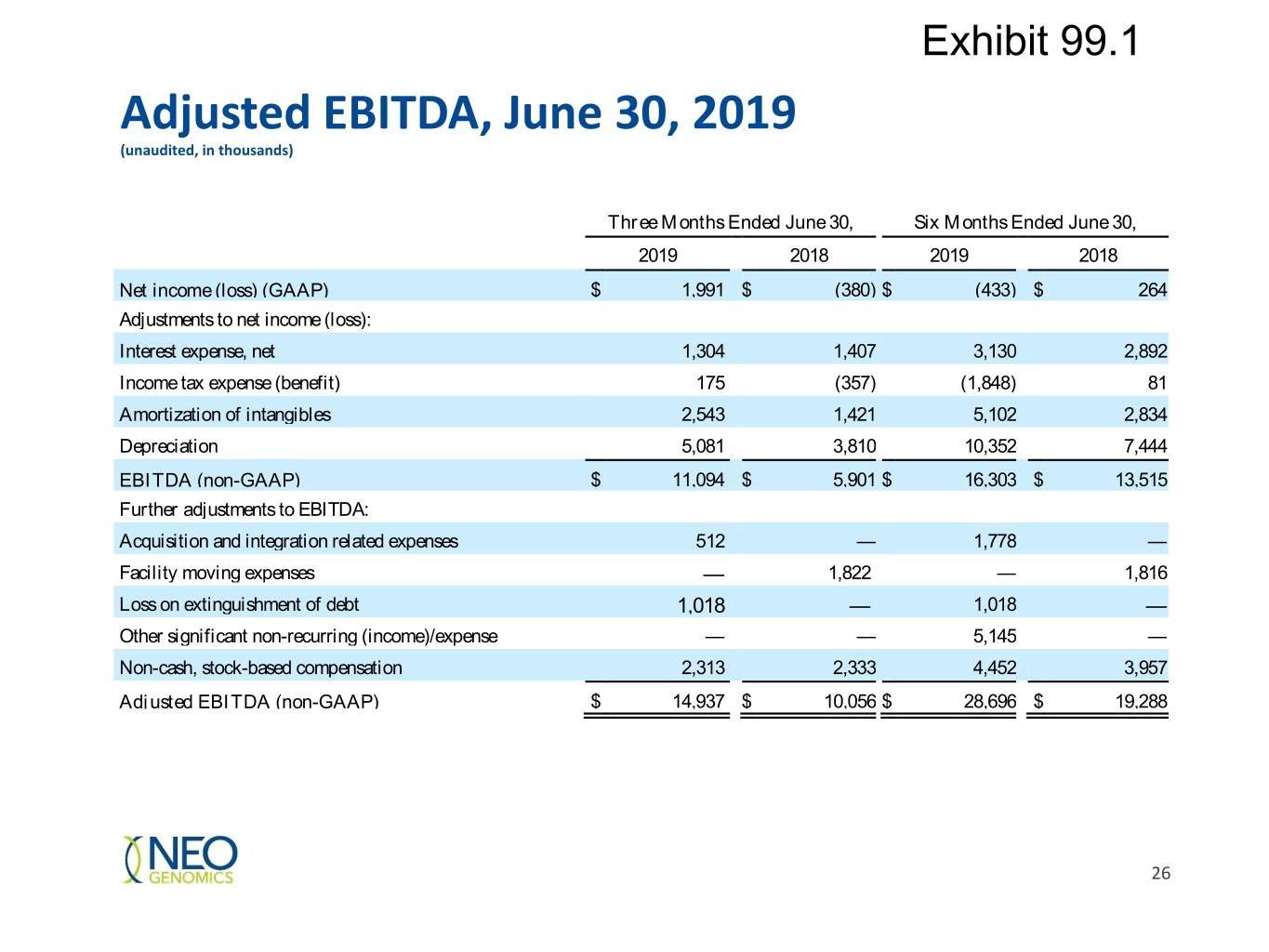

Exhibit 99.1 Adjusted EBITDA, June 30, 2019 (unaudited, in thousands) Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 Net income (loss) (GAAP) $ 1,991 $ (380) $ (433) $ 264 Adjustments to net income (loss): Interest expense, net 1,304 1,407 3,130 2,892 Income tax expense (benefit) 175 (357) (1,848) 81 Amortization of intangibles 2,543 1,421 5,102 2,834 Depreciation 5,081 3,810 10,352 7,444 EBITDA (non-GAAP) $ 11,094 $ 5,901 $ 16,303 $ 13,515 Further adjustments to EBITDA: Acquisition and integration related expenses 512 — 1,778 — Facility moving expenses — 1,822 — 1,816 Loss on extinguishment of debt 1,018 — 1,018 — Other significant non-recurring (income)/expense — — 5,145 — Non-cash, stock-based compensation 2,313 2,333 4,452 3,957 Adjusted EBITDA (non-GAAP) $ 14,937 $ 10,056 $ 28,696 $ 19,288 26

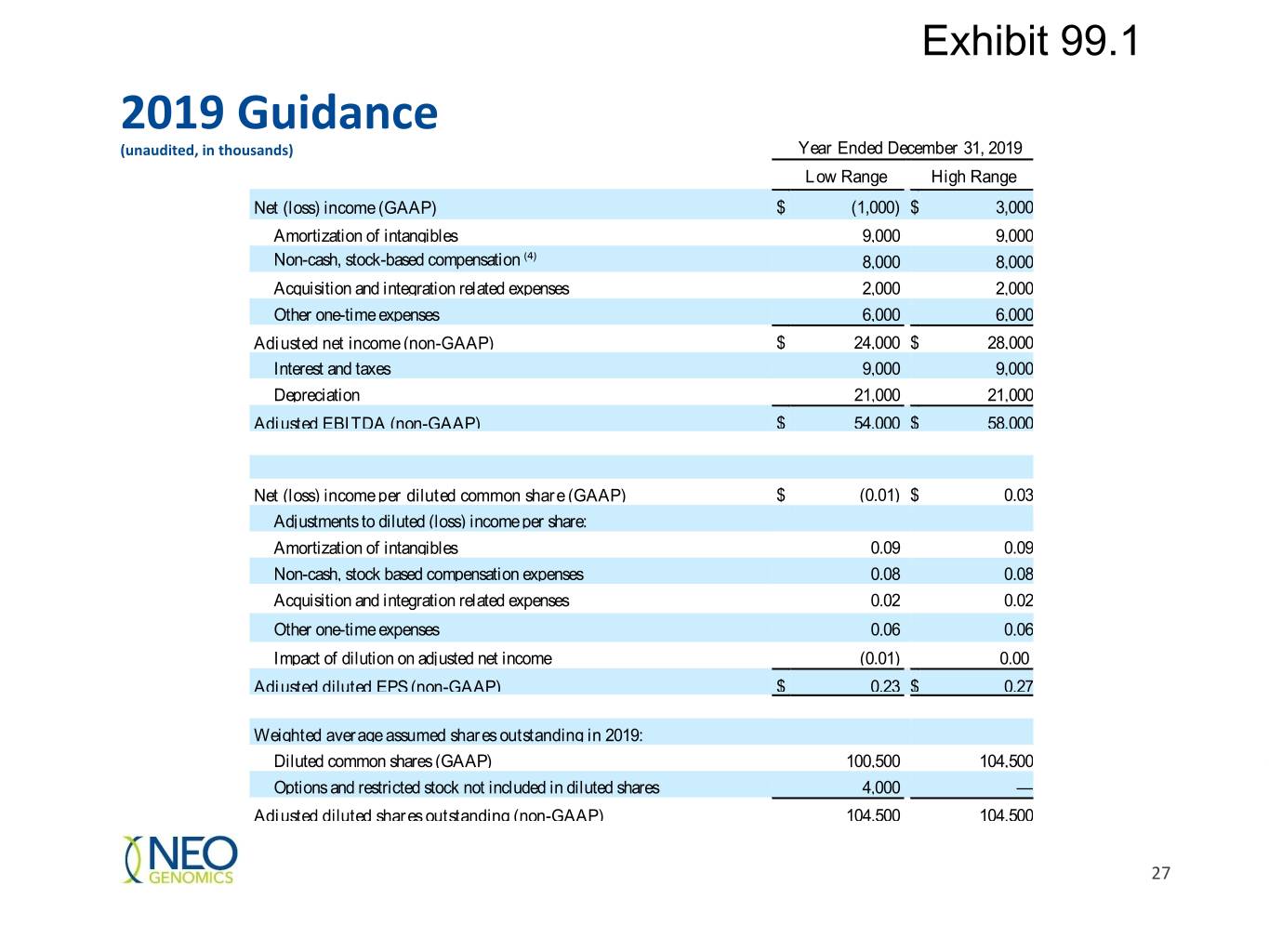

Exhibit 99.1 2019 Guidance (unaudited, in thousands) Year Ended December 31, 2019 Low Range High Range Net (loss) income (GAAP) $ (1,000) $ 3,000 Amortization of intangibles 9,000 9,000 Non-cash, stock-based compensation (4) 8,000 8,000 Acquisition and integration related expenses 2,000 2,000 Other one-time expenses 6,000 6,000 Adjusted net income (non-GAAP) $ 24,000 $ 28,000 Interest and taxes 9,000 9,000 Depreciation 21,000 21,000 Adjusted EBITDA (non-GAAP) $ 54,000 $ 58,000 Net (loss) income per diluted common share (GAAP) $ (0.01) $ 0.03 Adjustments to diluted (loss) income per share: Amortization of intangibles 0.09 0.09 Non-cash, stock based compensation expenses 0.08 0.08 Acquisition and integration related expenses 0.02 0.02 Other one-time expenses 0.06 0.06 Impact of dilution on adjusted net income (0.01) 0.00 Adjusted diluted EPS (non-GAAP) $ 0.23 $ 0.27 Weighted average assumed shares outstanding in 2019: Diluted common shares (GAAP) 100,500 104,500 Options and restricted stock not included in diluted shares 4,000 — Adjusted diluted shares outstanding (non-GAAP) 104,500 104,500 27

Exhibit 99.1 Focused on Customer Satisfaction Net Promoter Score Q2 2019 Clinical Client Survey How likely is it that you would recommend this company to a friend or colleague? Not at all likely Neutral Extremely likely 0 0 1 2 3 4 5 6 7 8 9 10 -50 50 Detractor Passive Promoter +63 NPS 6.2% 24.2% 69.6% -100 100 % Promoters - % Detractors = NPS ( Net Promoter Score) NOTES: Survey Period: June 12th to June 30th 1,223 NeoGenomics and Genoptix respondents 24 questions + comments 2,947+ comments received 28

Exhibit 99.1 COMPASS® and CHART® COMPASS: comprehensive, hematopathologist-directed, integrated assessment report • Customized workflow on each patient case to provide a disease-specific evaluation based on up-to-date guidelines • Actionable diagnosis in a one-page correlation report • Consultation with assigned hematopathologist available on every case • Notification of acute cases and unexpected diagnoses within 24 hours • Real -time electronic reporting with Genoptix Online, powered by eCOMPASS™ • Review of challenging cases and presentation of tumor conferences with a Genoptix Hematopathologist through eRounds CHART: a longitudinal report including a consultative review and correlation with relevant prior findings by a Genoptix Hematopathologist, used to: • Monitor response to therapy • Determine disease progression • Evaluate clonal evolution • Assess residual disease 29

Exhibit 99.1