EX-99.1

Published on March 2, 2020

INVESTOR PRESENTATION February 2020

Forward-Looking Statements This presentation has been prepared by NeoGenomics, Inc. (“we,” ”us,” “our,” “NeoGenomics” or the “Company”) and is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward-looking statements. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward-looking statements due to numerous known and unknown risks and uncertainties. All forward-looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Non-GAAP Adjusted EBITDA "Adjusted EBITDA" is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, non-cash stock-based compensation expense, and if applicable in a reporting period, acquisition-related transaction expenses (vi) non-cash impairments of intangible assets (vii) debt financing costs (viii) and other significant non-recurring or non-operating (income) or expenses. 2

We Are The Leading Oncology Testing Company Extensive clinical expertise and leading commercial organization with significant scale and scope Global 2,600+ laboratory ~500,000 100+ hospitals and cancer footprint with ~1,000,000 MDs and PhDs tests per year patients served each year centers served 11 locations Clinical Pharma Services Services Leading oncology reference lab for oncologists, Provide comprehensive support from pre-clinical & research pathologists, and hospitals discovery through FDA filing, approval & launch preparation – Biomarker discovery Provide both technical and professional laboratory – Analytical validation services – Clinical validation – Assay design and development Comprehensive oncology test menu including all major – Dx Development testing modalities Backlog of ~$145MM Non-competitive partner to customers Dedicated global sales team Direct national sales force Labs in USA, Europe, and Asia 3

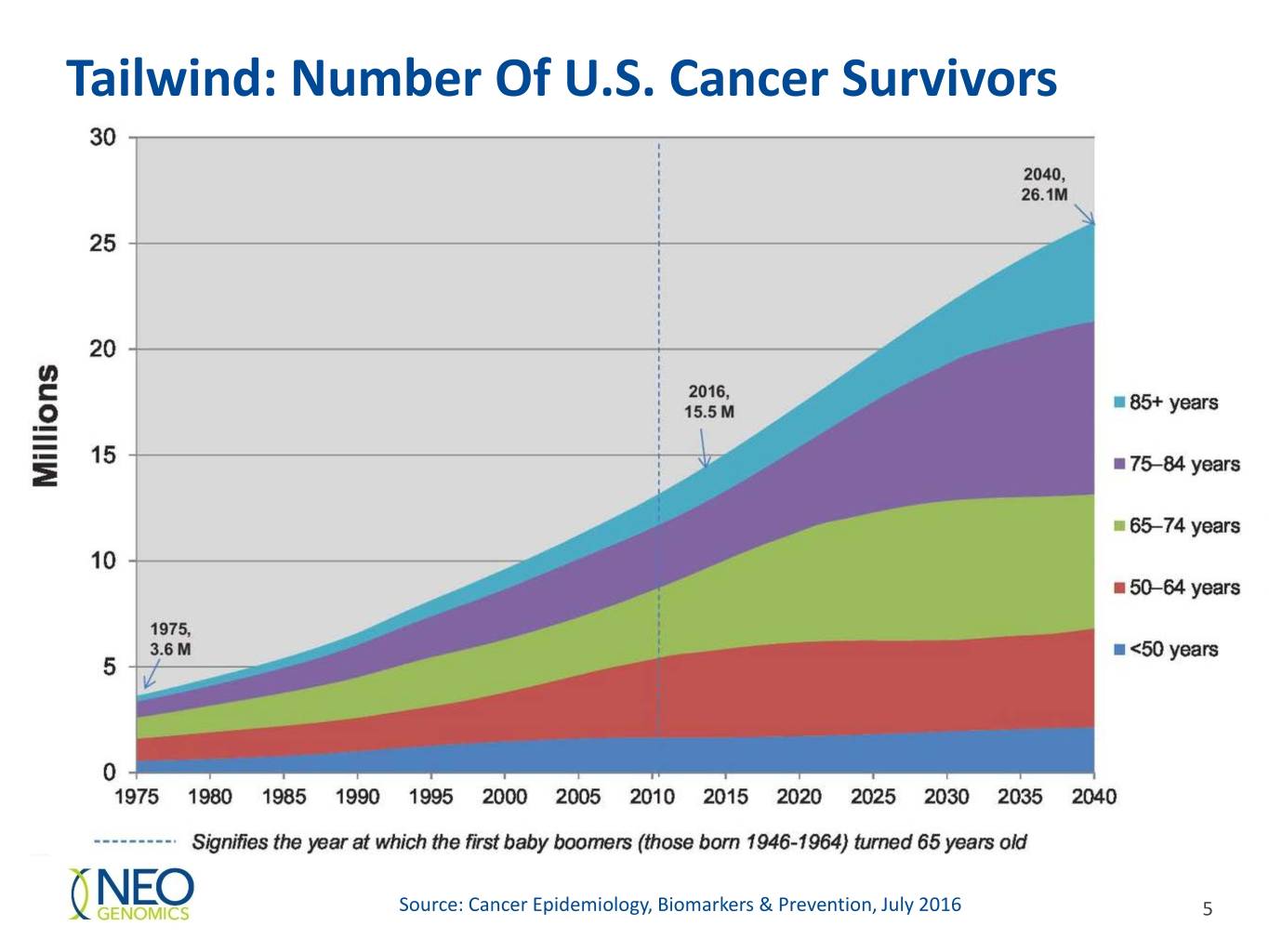

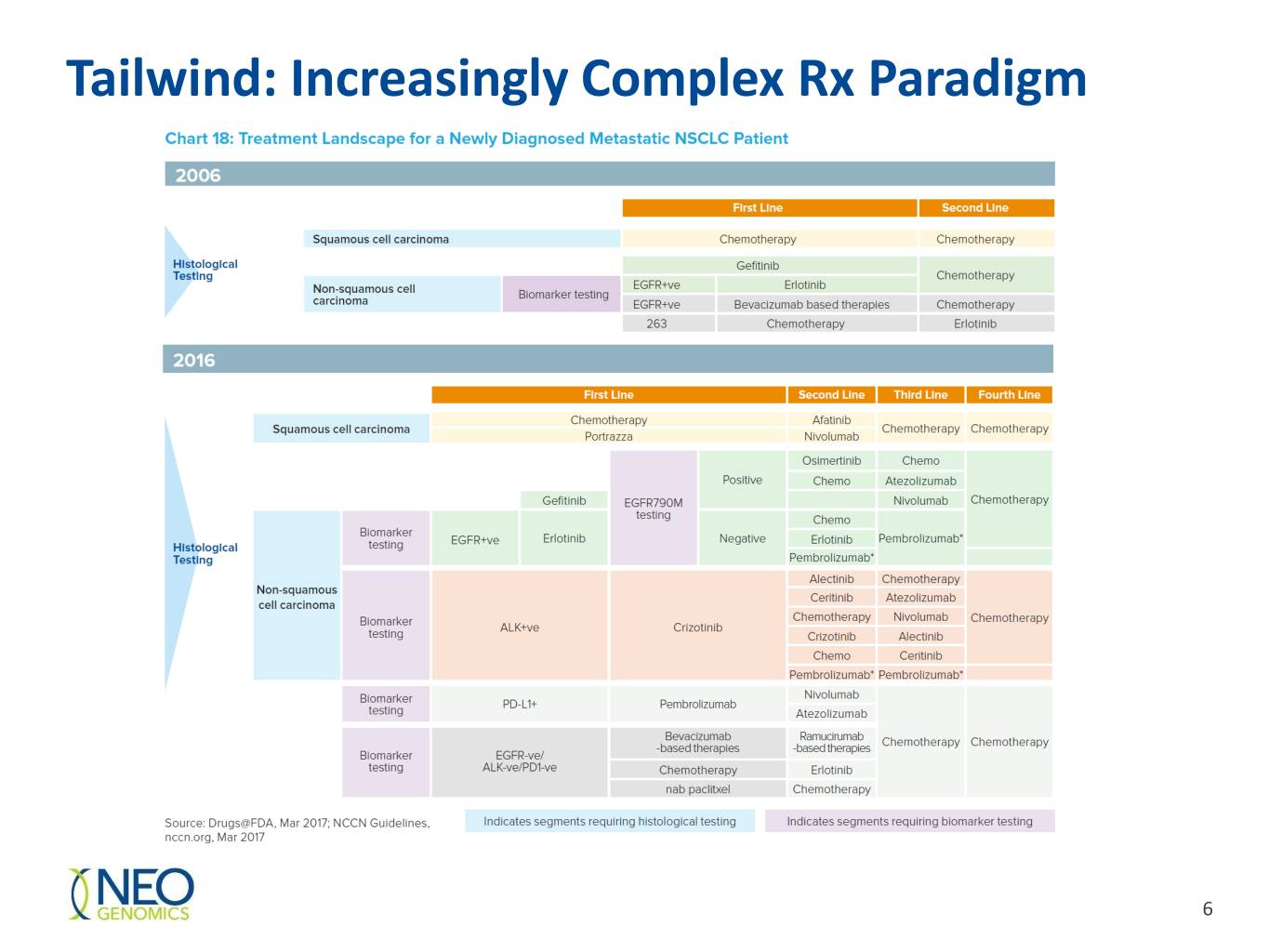

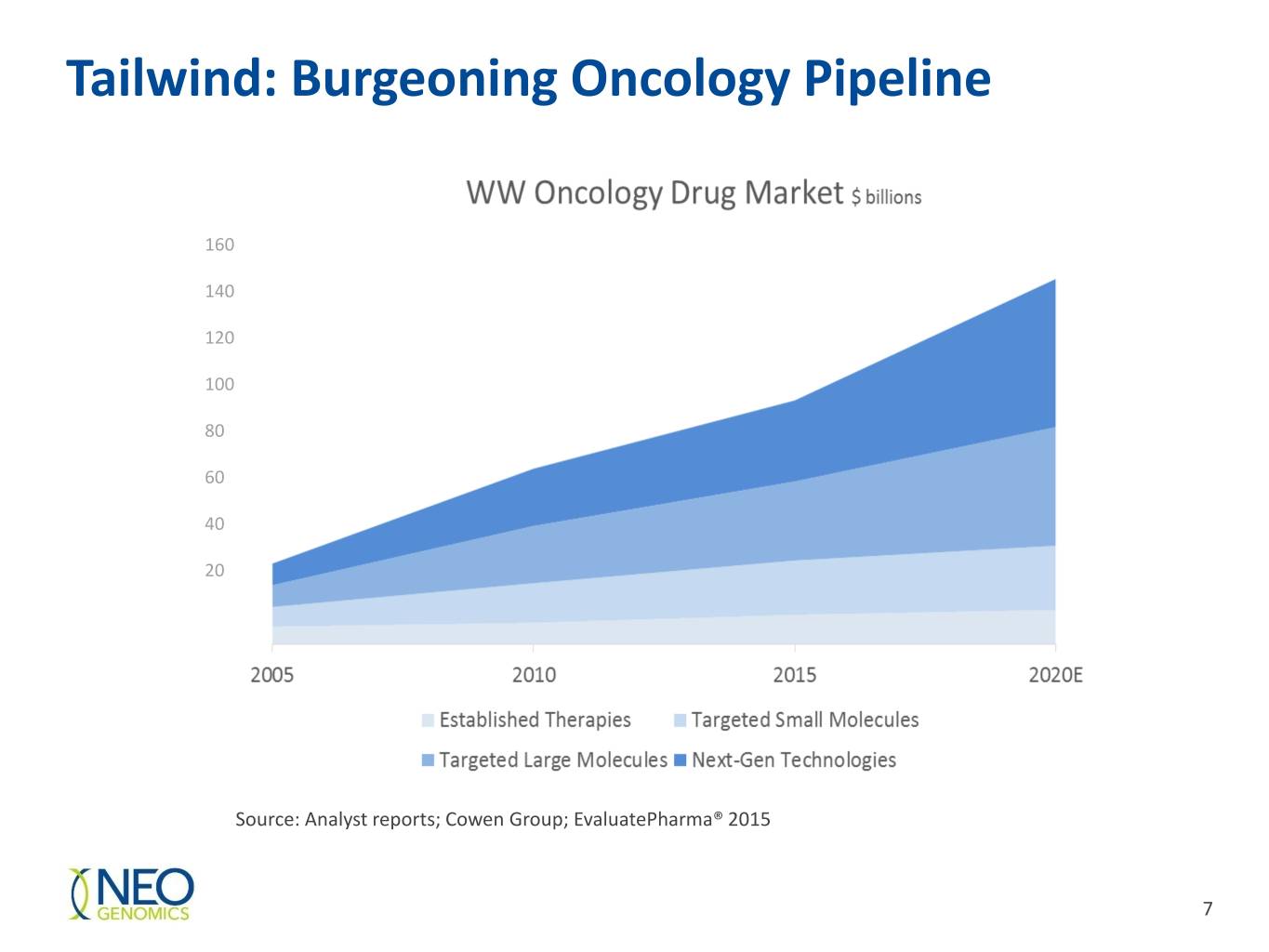

The Oncology Test Market Is Poised For Growth Estimated 6% to 8% Market Growth Aging population driving cancer incidence Increased survival driving follow-on testing Proliferation and complexity of therapeutic options driving more testing Emerging platforms and tests (NGS, TMB, MSI, MRD, Liquid Biopsy, etc.) driving more test options Burgeoning oncology drug pipeline driving current Pharma Services demand and likely to drive future clinical testing as well 4

Tailwind: Number Of U.S. Cancer Survivors Source: Cancer Epidemiology, Biomarkers & Prevention, July 2016 5

Tailwind: Increasingly Complex Rx Paradigm 6

Tailwind: Burgeoning Oncology Pipeline 160 140 120 100 80 60 40 20 Source: Analyst reports; Cowen Group; EvaluatePharma® 2015 7

We Look To Grow Twice The Market Rate Significant Company Specific Growth Drivers; Guide to Mid-Teens Organic Volume Growth 7 Acquisition synergies and strategic benefits 6 Revenue per test initiatives 5 Large, new 4 managed care, IDN, Hospital End-to-end System, 3 positioning Oncology in CDx Practice and 2 Enhanced GPO contracts 1 NGS Global capabilities strategic Large backlog alliance of signed with PPD Pharma contracts 8

We Compete Through Focus, Scale and Scope ~$6 Billion Oncology Lab Testing Industry Clinical Reference Labs Pure Play Oncology Reference Labs Niche Oncology Players (with oncology divisions) (comprehensive test menus) (limited test menus) •Comprehensive, multi-modality “one-stop-shop” •Large and advanced somatic cancer test menu •Unparalleled reach into all customer segments •National footprint and extensive payer contracts •Outstanding client service and partnership models •Synergistic Pharma and Clinical businesses 9

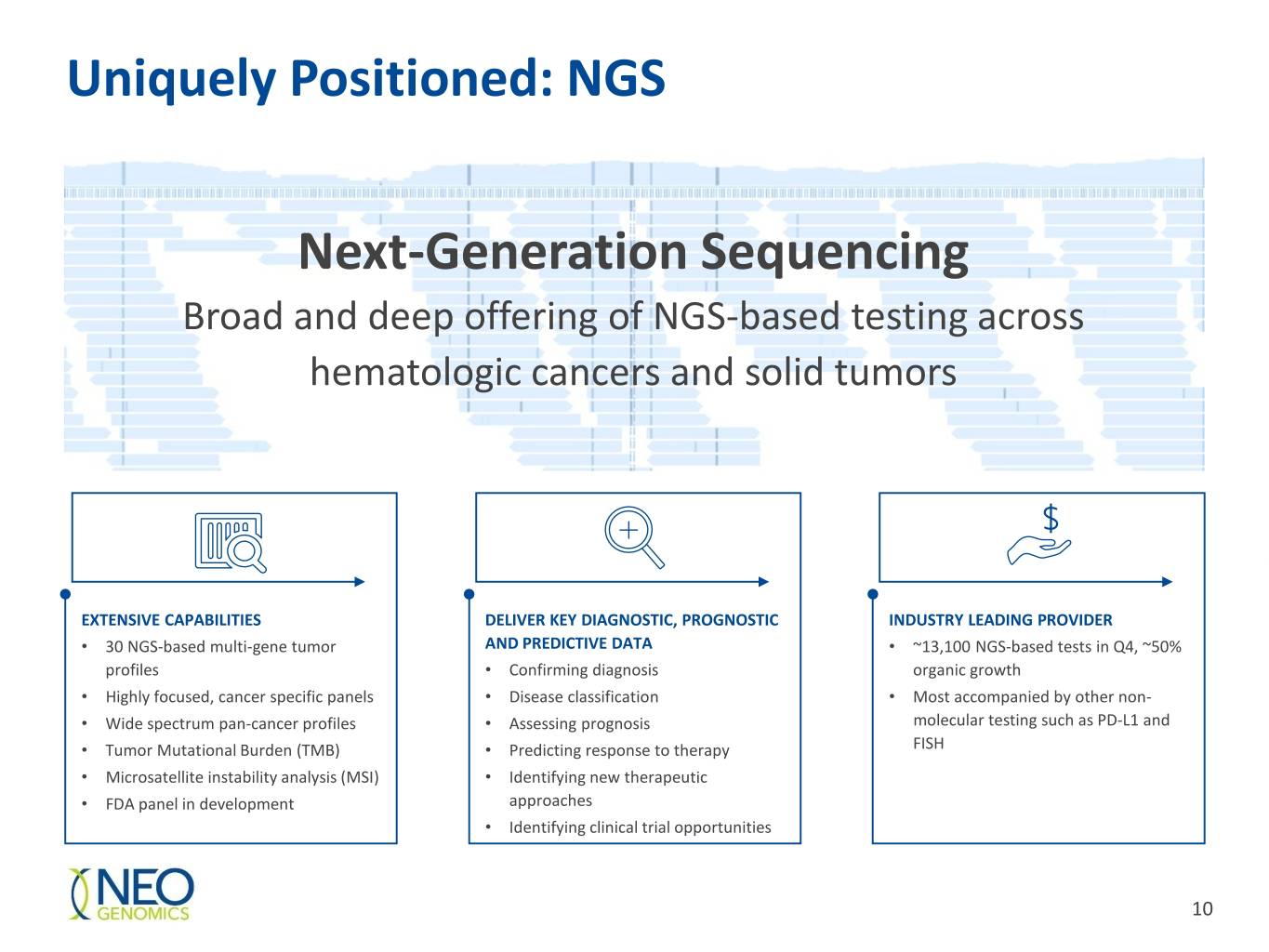

Uniquely Positioned: NGS Next-Generation Sequencing Broad and deep offering of NGS-based testing across hematologic cancers and solid tumors EXTENSIVE CAPABILITIES DELIVER KEY DIAGNOSTIC, PROGNOSTIC INDUSTRY LEADING PROVIDER • 30 NGS-based multi-gene tumor AND PREDICTIVE DATA • ~13,100 NGS-based tests in Q4, ~50% profiles • Confirming diagnosis organic growth • Highly focused, cancer specific panels • Disease classification • Most accompanied by other non- • Wide spectrum pan-cancer profiles • Assessing prognosis molecular testing such as PD-L1 and • Tumor Mutational Burden (TMB) • Predicting response to therapy FISH • Microsatellite instability analysis (MSI) • Identifying new therapeutic • FDA panel in development approaches • Identifying clinical trial opportunities 10

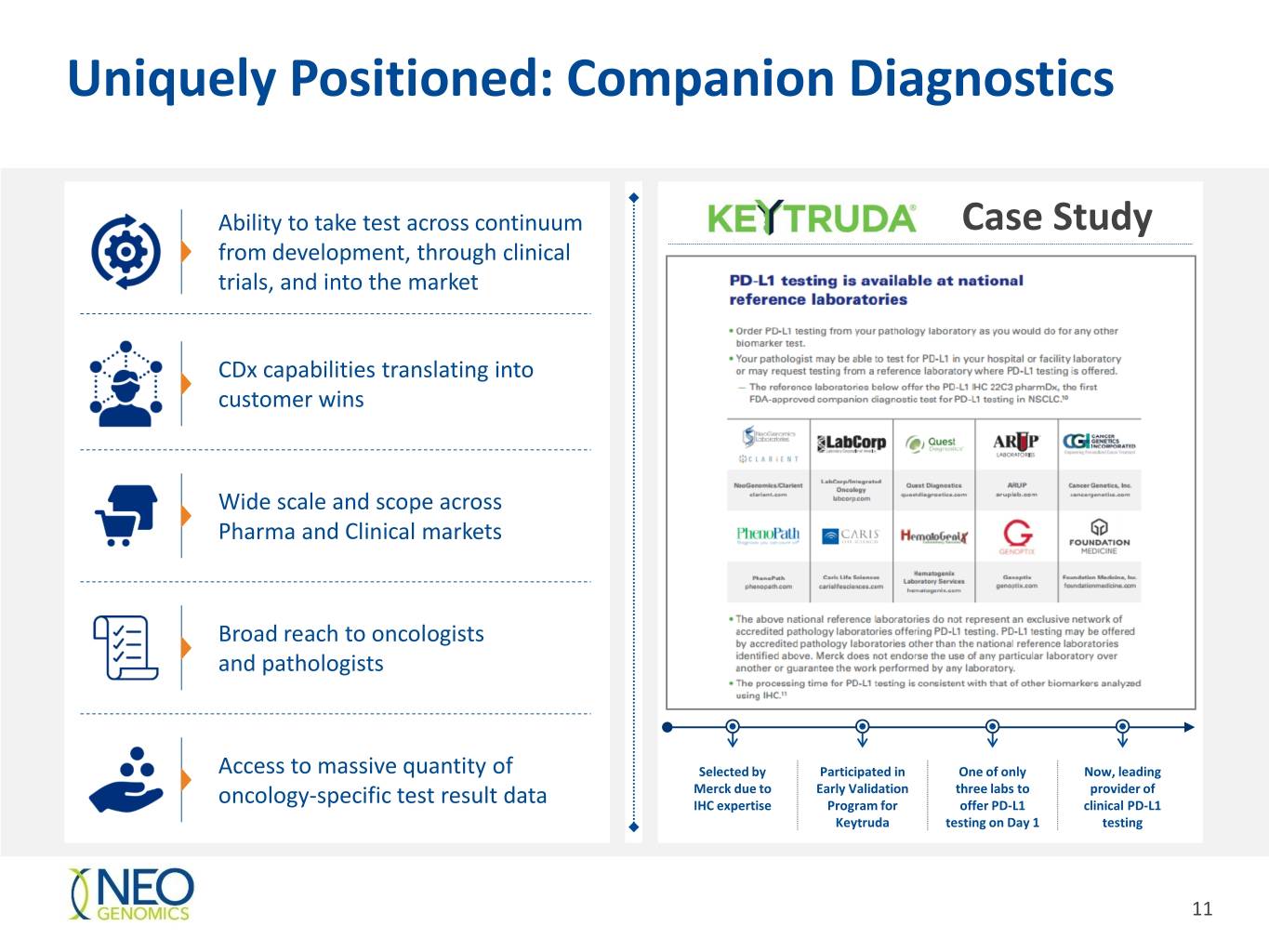

Uniquely Positioned: Companion Diagnostics Ability to take test across continuum Case Study from development, through clinical trials, and into the market CDx capabilities translating into customer wins Wide scale and scope across Pharma and Clinical markets Broad reach to oncologists and pathologists Access to massive quantity of Selected by Participated in One of only Now, leading Merck due to Early Validation three labs to provider of oncology-specific test result data IHC expertise Program for offer PD-L1 clinical PD-L1 Keytruda testing on Day 1 testing 11

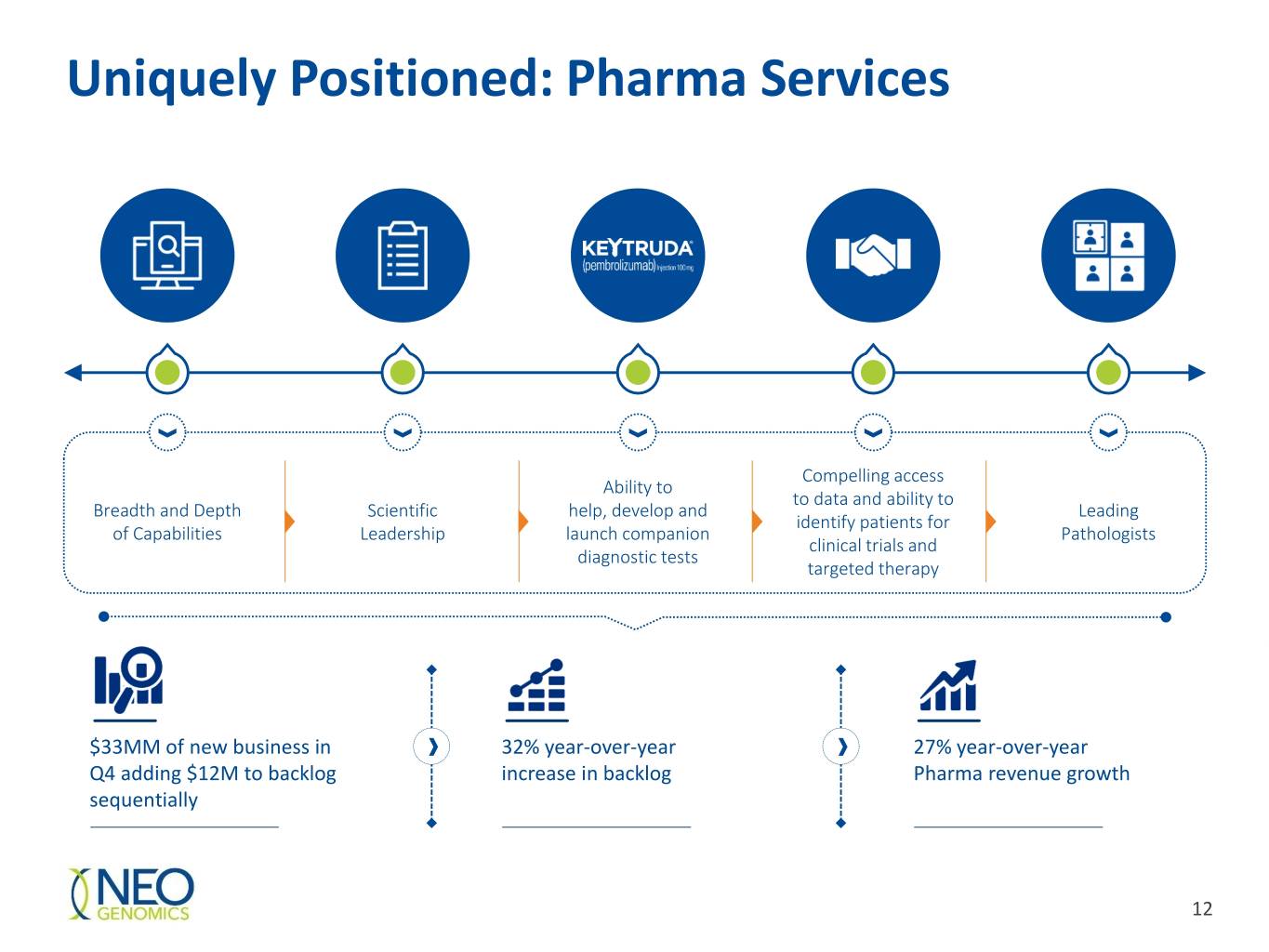

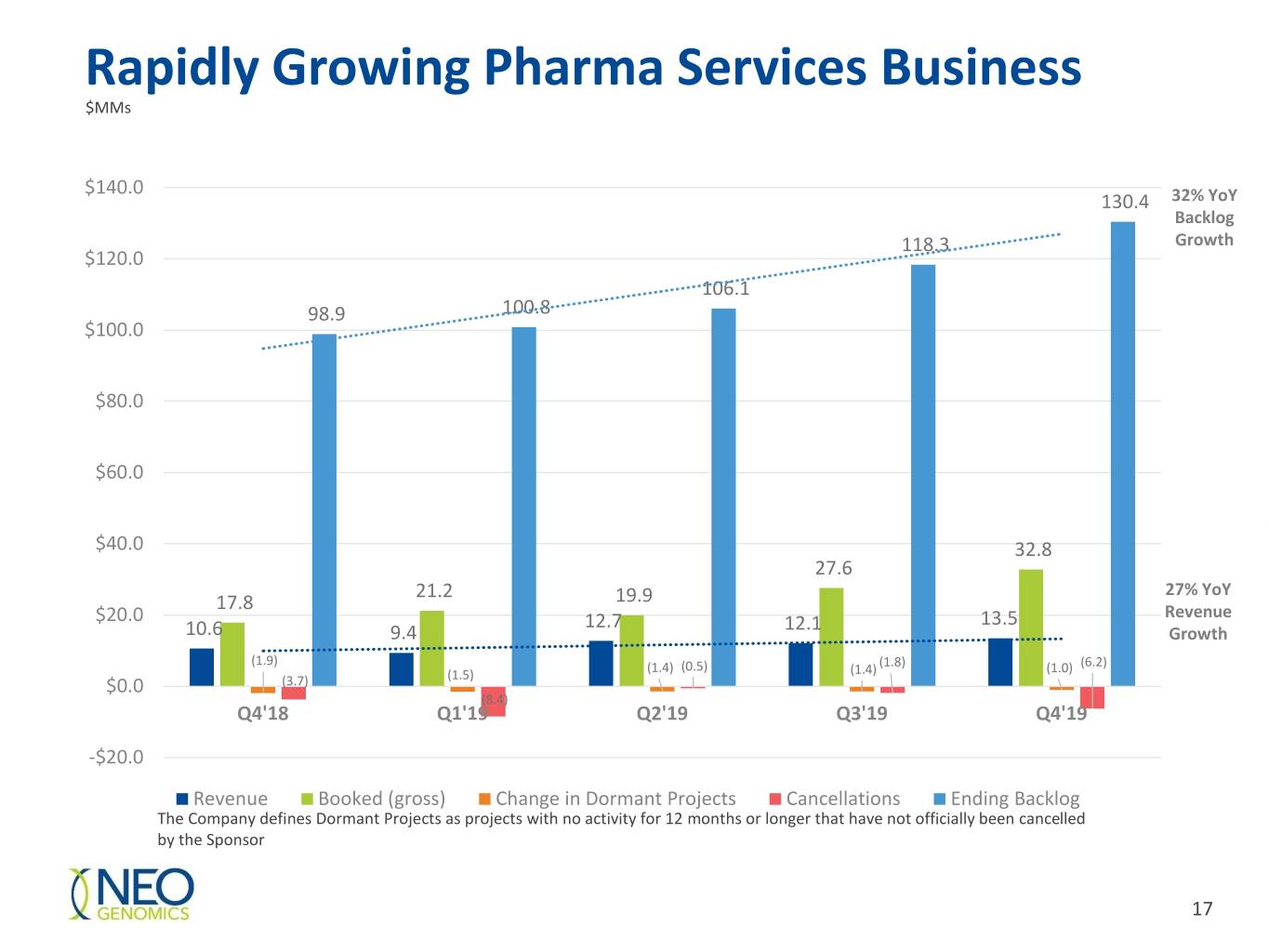

Uniquely Positioned: Pharma Services Compelling access Ability to to data and ability to Breadth and Depth Scientific help, develop and Leading identify patients for of Capabilities Leadership launch companion Pathologists clinical trials and diagnostic tests targeted therapy $33MM of new business in 32% year-over-year 27% year-over-year Q4 adding $12M to backlog increase in backlog Pharma revenue growth sequentially 12

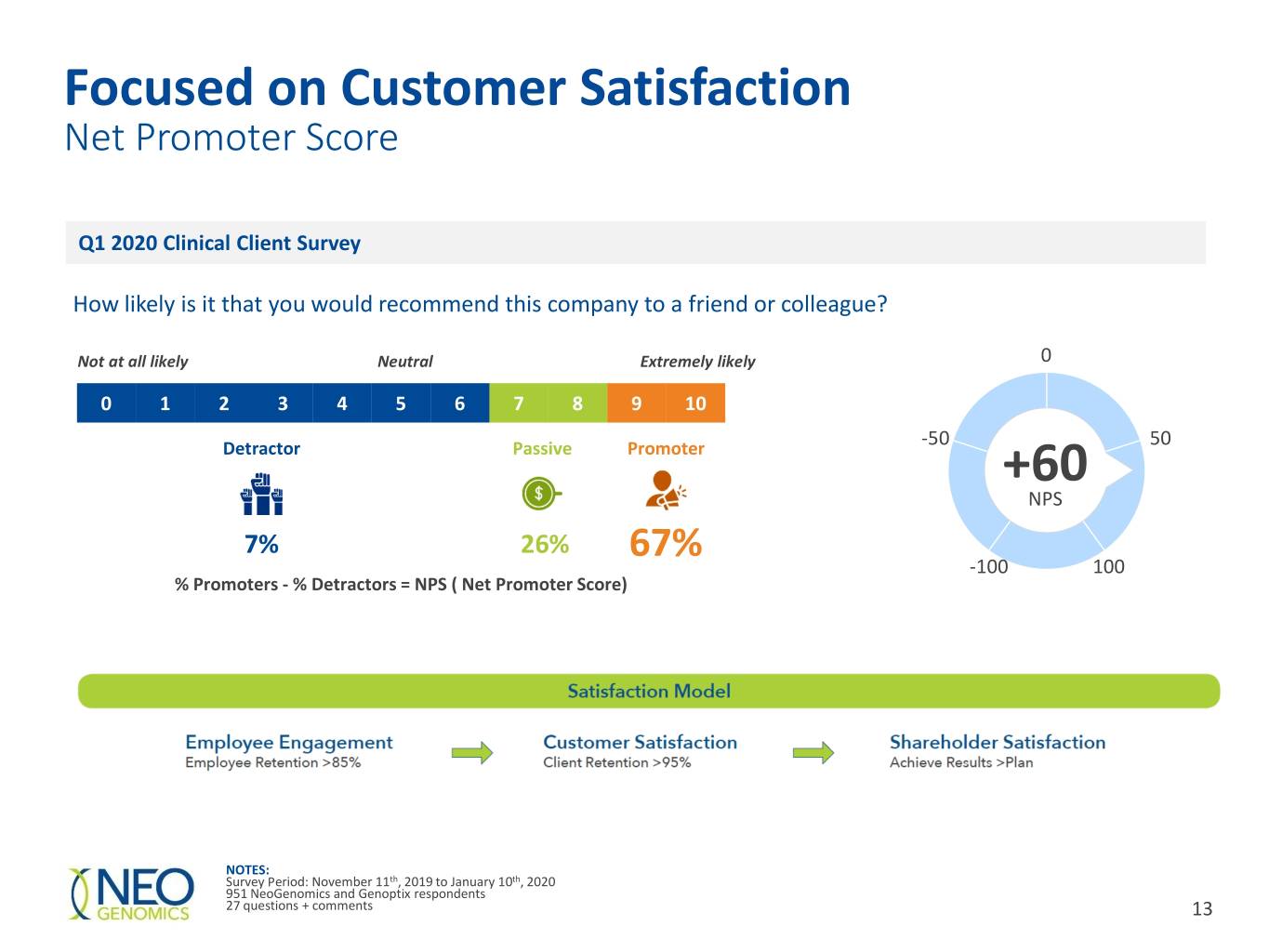

Focused on Customer Satisfaction Net Promoter Score Q1 2020 Clinical Client Survey How likely is it that you would recommend this company to a friend or colleague? Not at all likely Neutral Extremely likely 0 0 1 2 3 4 5 6 7 8 9 10 -50 50 Detractor Passive Promoter +60 NPS 7% 26% 67% -100 100 % Promoters - % Detractors = NPS ( Net Promoter Score) NOTES: Survey Period: November 11th, 2019 to January 10th, 2020 951 NeoGenomics and Genoptix respondents 27 questions + comments 13

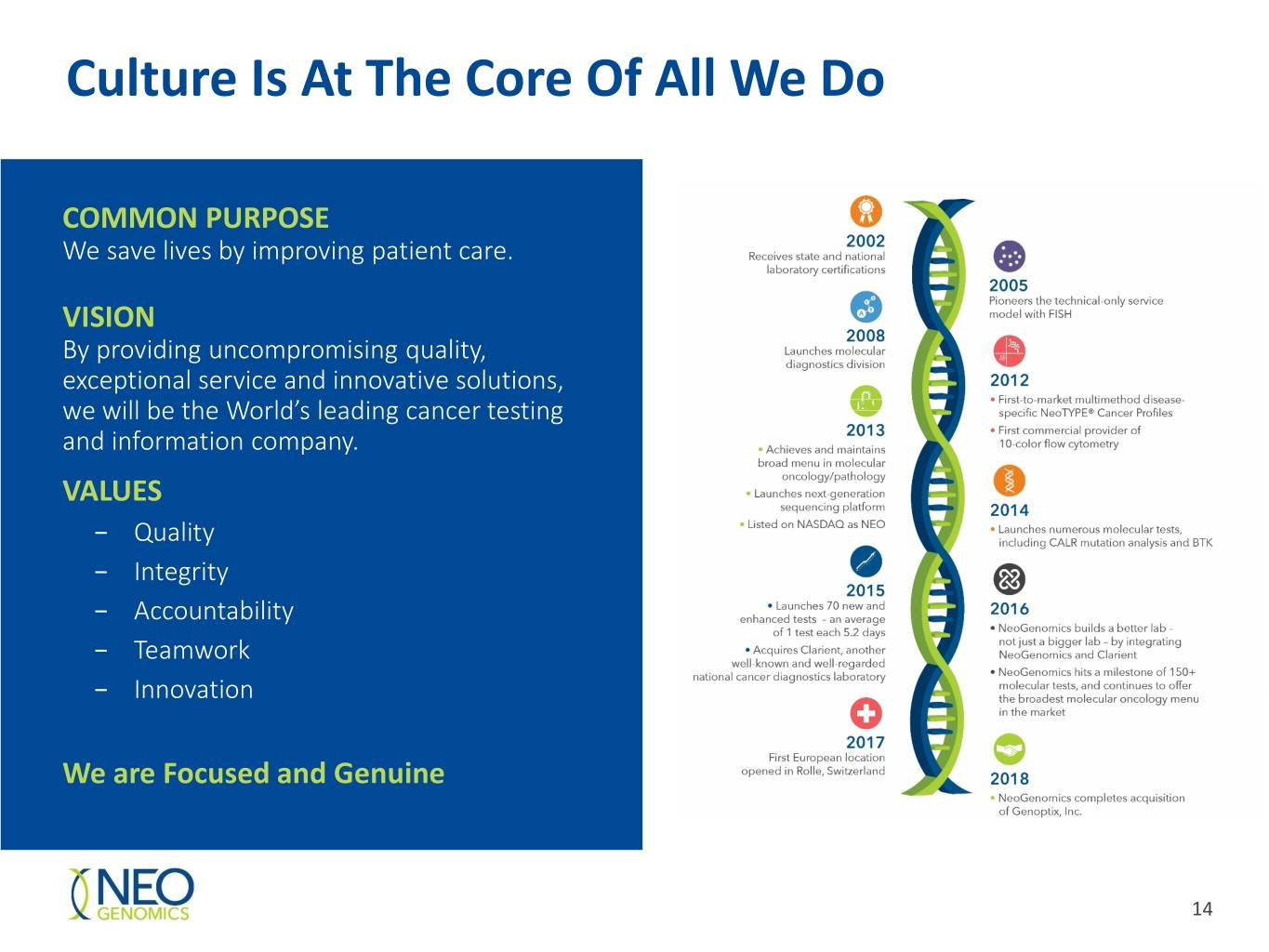

Culture Is At The Core Of All We Do COMMON PURPOSE We save lives by improving patient care. VISION By providing uncompromising quality, exceptional service and innovative solutions, we will be the World’s leading cancer testing and information company. VALUES − Quality − Integrity − Accountability − Teamwork − Innovation We are Focused and Genuine 14

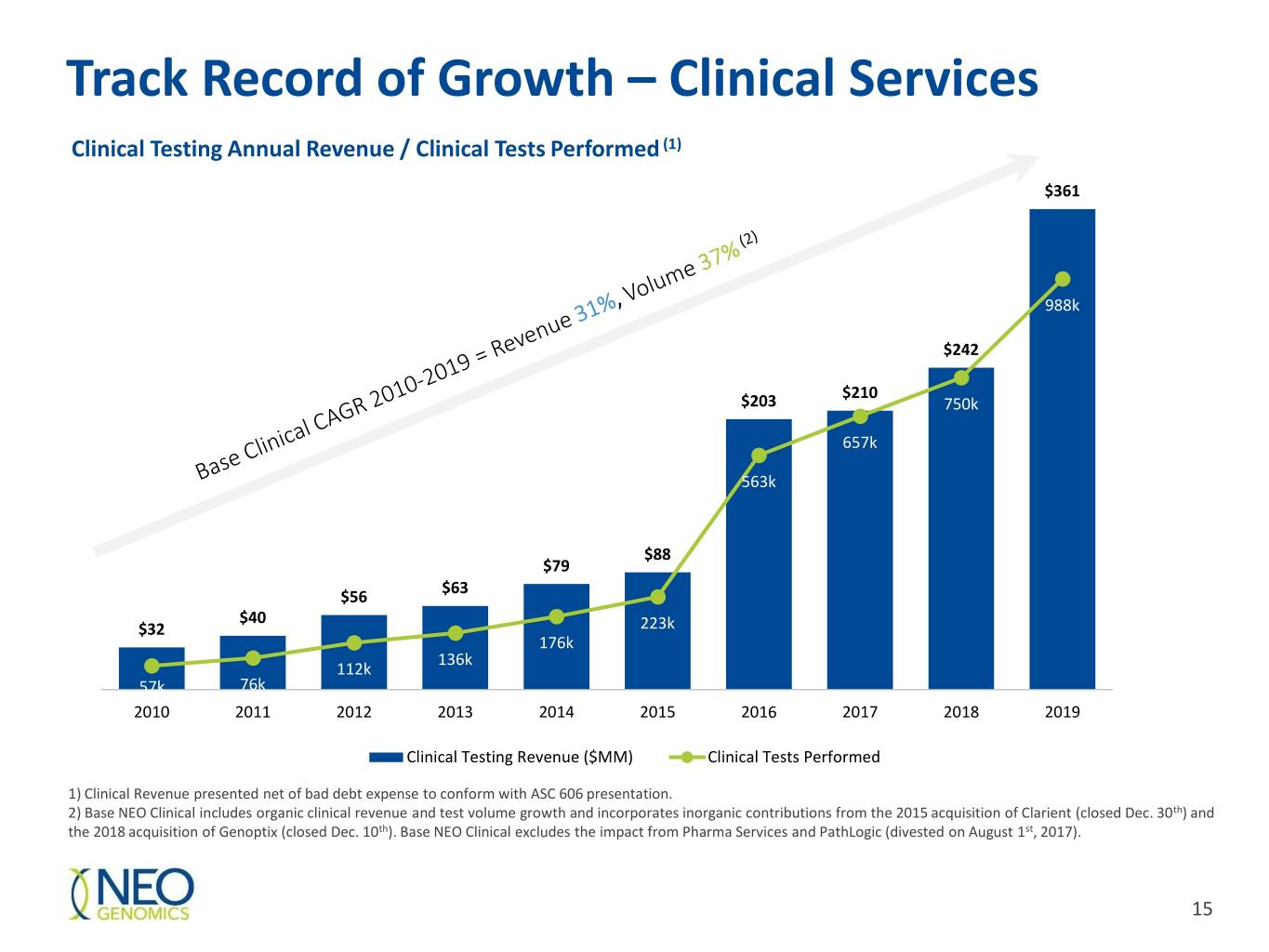

Track Record of Growth – Clinical Services Clinical Testing Annual Revenue / Clinical Tests Performed (1) $361 1,200 350 1,000 300 988k 250 $242 800 $210 $203 750k 200 657k 600 150 563k 400 100 $88 $79 $63 $56 200 $40 50 $32 223k 176k 136k 112k 0 57k 76k 0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Clinical Testing Revenue ($MM) Clinical Tests Performed 1) Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. 2) Base NEO Clinical includes organic clinical revenue and test volume growth and incorporates inorganic contributions from the 2015 acquisition of Clarient (closed Dec. 30th) and the 2018 acquisition of Genoptix (closed Dec. 10th). Base NEO Clinical excludes the impact from Pharma Services and PathLogic (divested on August 1st, 2017). 15

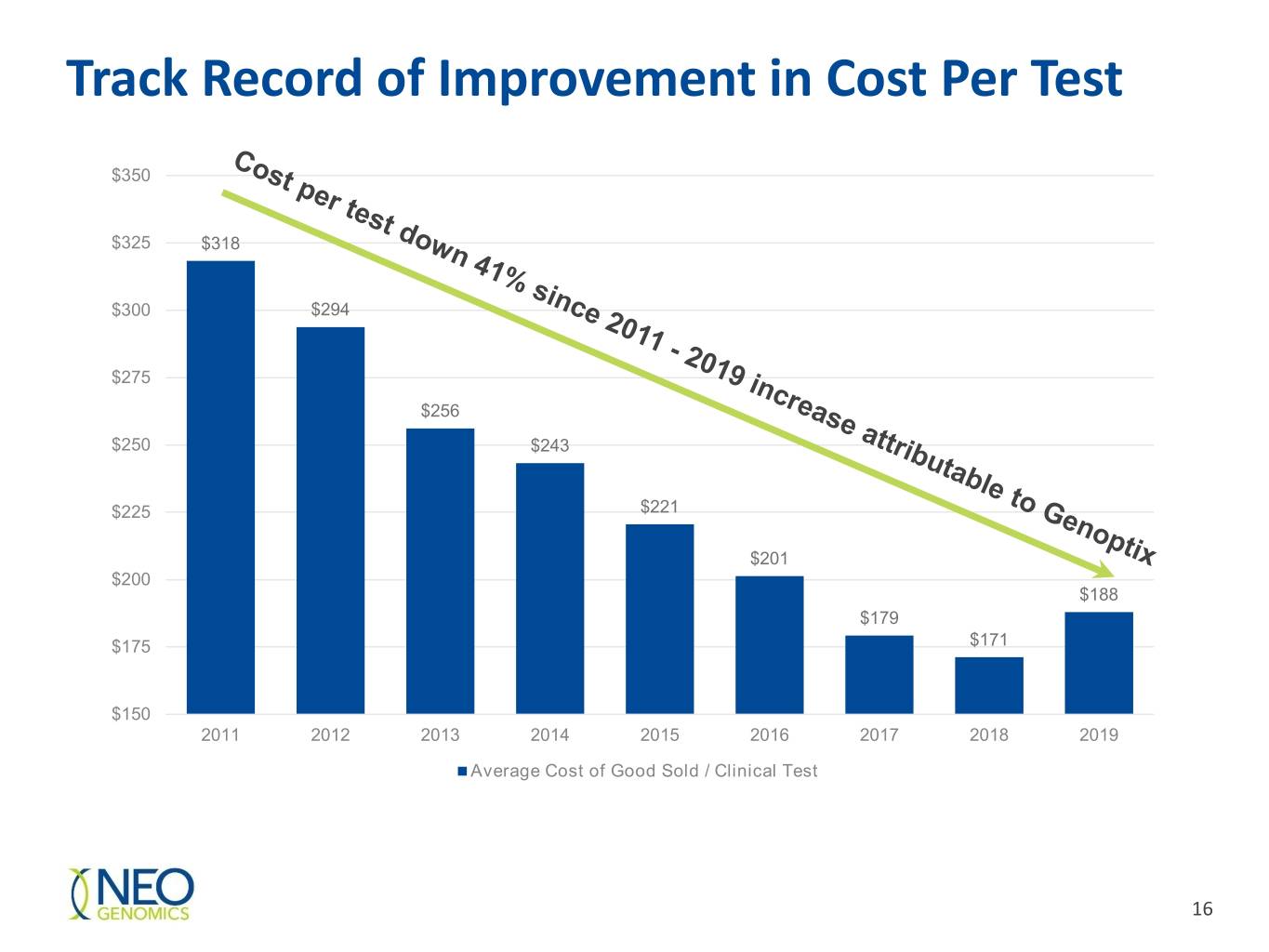

Track Record of Improvement in Cost Per Test $350 $325 $318 $300 $294 $275 $256 $250 $243 $225 $221 $201 $200 $188 $179 $175 $171 $150 2011 2012 2013 2014 2015 2016 2017 2018 2019 Average Cost of Good Sold / Clinical Test 16

Rapidly Growing Pharma Services Business $MMs $140.0 130.4 32% YoY Backlog 118.3 Growth $120.0 106.1 98.9 100.8 $100.0 $80.0 $60.0 $40.0 32.8 27.6 21.2 19.9 27% YoY 17.8 Revenue $20.0 12.7 12.1 13.5 10.6 9.4 Growth (1.9) (1.4) (0.5) (1.8) (6.2) (1.5) (1.4) (1.0) $0.0 (3.7) (8.4) Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 -$20.0 Revenue Booked (gross) Change in Dormant Projects Cancellations Ending Backlog The Company defines Dormant Projects as projects with no activity for 12 months or longer that have not officially been cancelled by the Sponsor 17

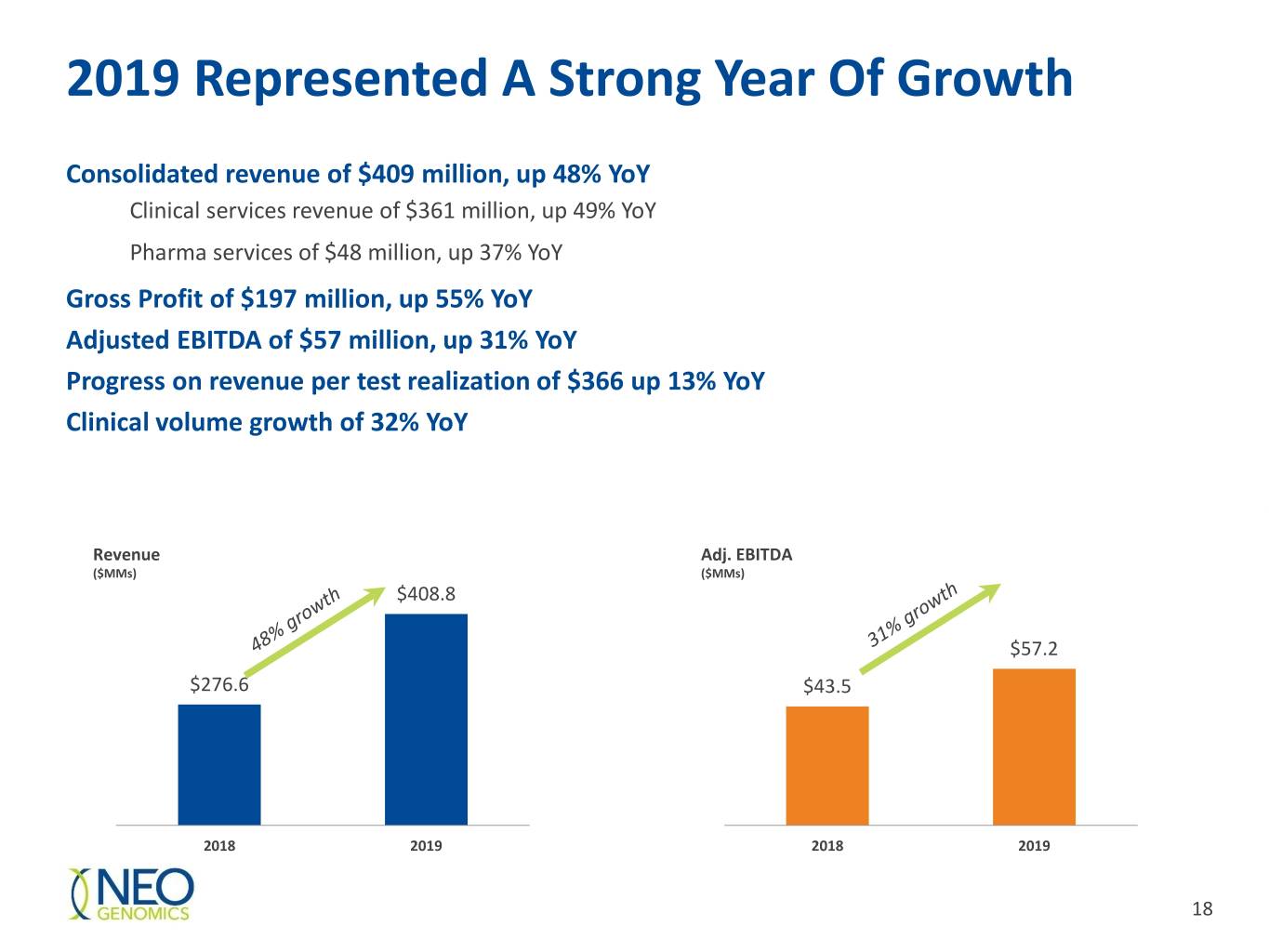

2019 Represented A Strong Year Of Growth Consolidated revenue of $409 million, up 48% YoY Clinical services revenue of $361 million, up 49% YoY Pharma services of $48 million, up 37% YoY Gross Profit of $197 million, up 55% YoY Adjusted EBITDA of $57 million, up 31% YoY Progress on revenue per test realization of $366 up 13% YoY Clinical volume growth of 32% YoY Revenue Adj. EBITDA ($MMs) ($MMs) $408.8 $57.2 $276.6 $43.5 2018 2019 2018 2019 18

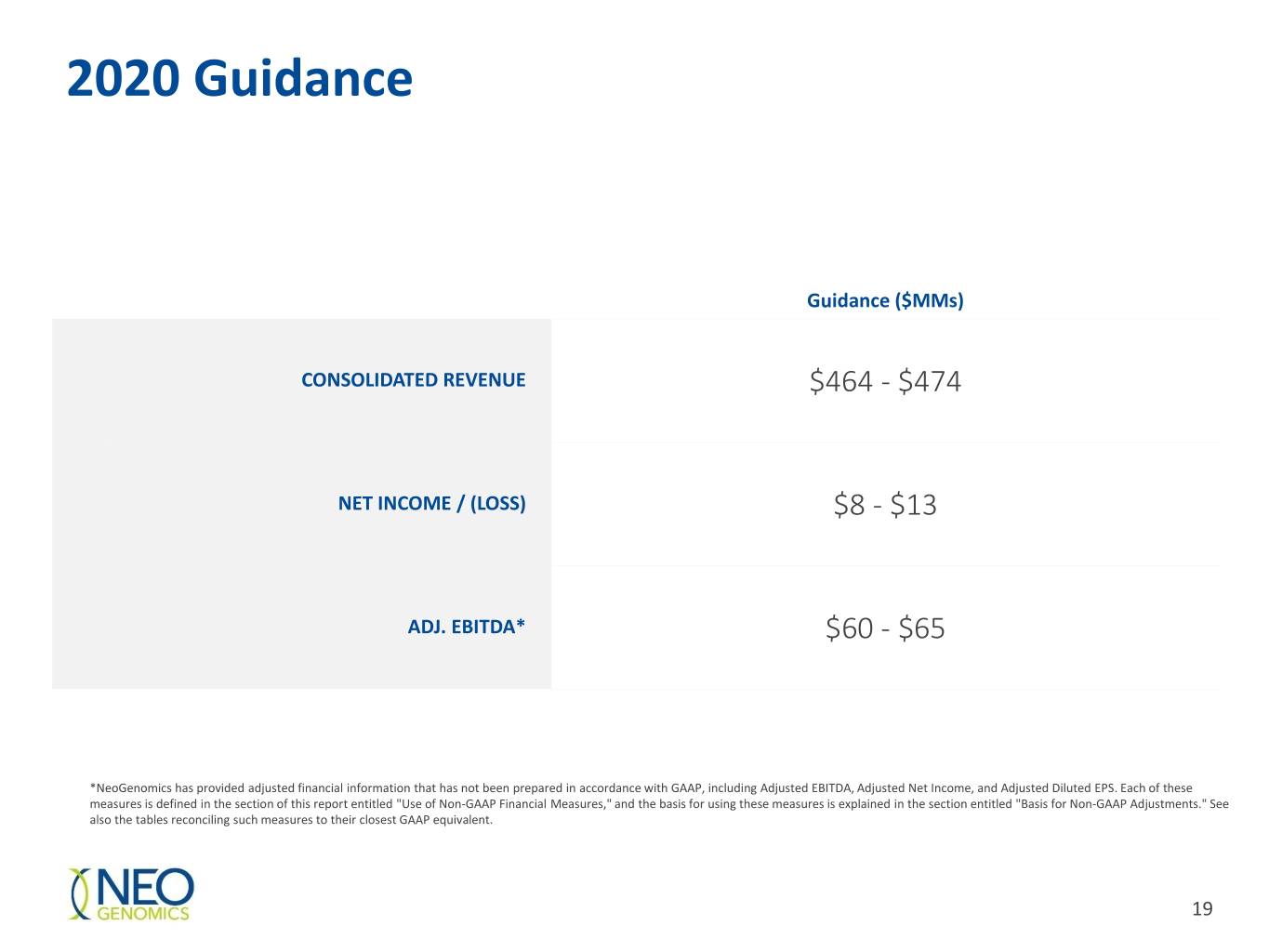

2020 Guidance Guidance ($MMs) CONSOLIDATED REVENUE $464 - $474 NET INCOME / (LOSS) $8 - $13 ADJ. EBITDA* $60 - $65 *NeoGenomics has provided adjusted financial information that has not been prepared in accordance with GAAP, including Adjusted EBITDA, Adjusted Net Income, and Adjusted Diluted EPS. Each of these measures is defined in the section of this report entitled "Use of Non-GAAP Financial Measures," and the basis for using these measures is explained in the section entitled "Basis for Non-GAAP Adjustments." See also the tables reconciling such measures to their closest GAAP equivalent. 19

Investment Highlights Leading pure-play oncology testing company Significant market growth tailwinds Extensive molecular/oncology test menu Leader in immuno-oncology testing Market share gains driven by customer satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 20

Appendix 21

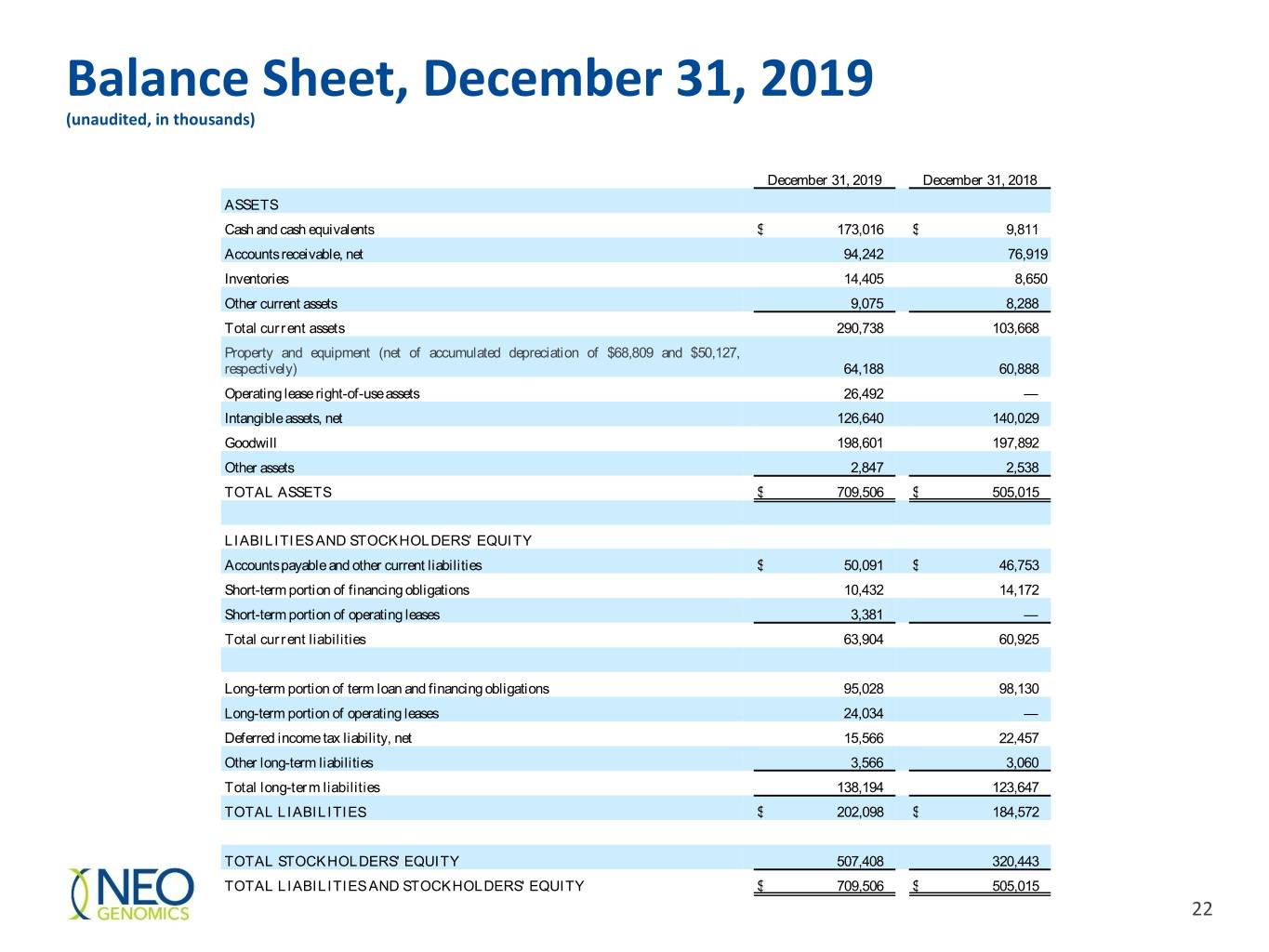

Balance Sheet, December 31, 2019 (unaudited, in thousands) December 31, 2019 December 31, 2018 ASSETS Cash and cash equivalents $ 173,016 $ 9,811 Accounts receivable, net 94,242 76,919 Inventories 14,405 8,650 Other current assets 9,075 8,288 Total current assets 290,738 103,668 Property and equipment (net of accumulated depreciation of $68,809 and $50,127, respectively) 64,188 60,888 Operating lease right-of-use assets 26,492 — Intangible assets, net 126,640 140,029 Goodwill 198,601 197,892 Other assets 2,847 2,538 TOTAL ASSETS $ 709,506 $ 505,015 LIABILITIES AND STOCKHOLDERS’ EQUITY Accounts payable and other current liabilities $ 50,091 $ 46,753 Short-term portion of financing obligations 10,432 14,172 Short-term portion of operating leases 3,381 — Total current liabilities 63,904 60,925 Long-term portion of term loan and financing obligations 95,028 98,130 Long-term portion of operating leases 24,034 — Deferred income tax liability, net 15,566 22,457 Other long-term liabilities 3,566 3,060 Total long-term liabilities 138,194 123,647 TOTAL LIABILITIES $ 202,098 $ 184,572 TOTAL STOCKHOLDERS' EQUITY 507,408 320,443 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 709,506 $ 505,015 22

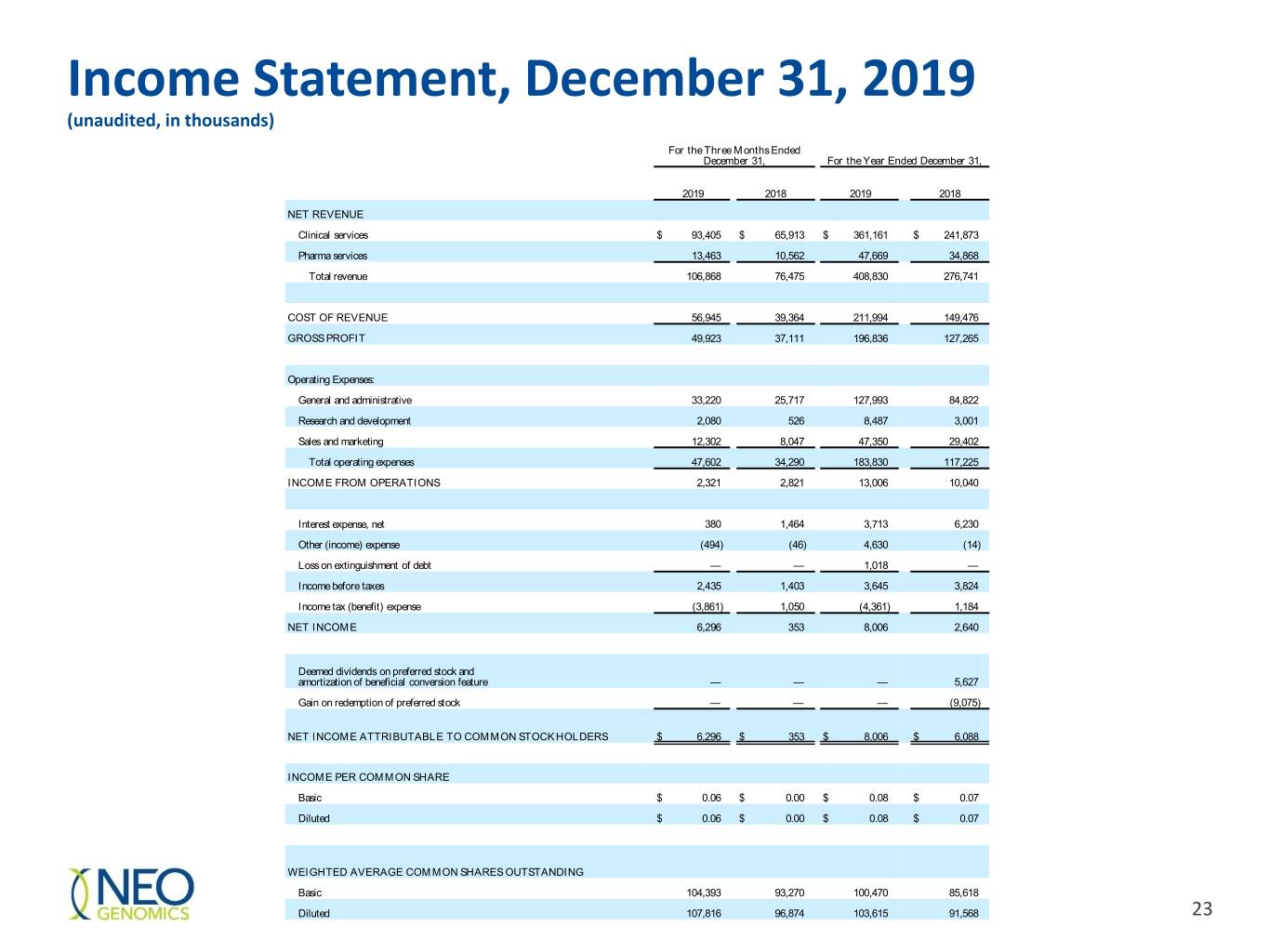

Income Statement, December 31, 2019 (unaudited, in thousands) For the Three Months Ended December 31, For the Year Ended December 31, 2019 2018 2019 2018 NET REVENUE Clinical services $ 93,405 $ 65,913 $ 361,161 $ 241,873 Pharma services 13,463 10,562 47,669 34,868 Total revenue 106,868 76,475 408,830 276,741 COST OF REVENUE 56,945 39,364 211,994 149,476 GROSS PROFIT 49,923 37,111 196,836 127,265 Operating Expenses: General and administrative 33,220 25,717 127,993 84,822 Research and development 2,080 526 8,487 3,001 Sales and marketing 12,302 8,047 47,350 29,402 Total operating expenses 47,602 34,290 183,830 117,225 INCOME FROM OPERATIONS 2,321 2,821 13,006 10,040 Interest expense, net 380 1,464 3,713 6,230 Other (income) expense (494) (46) 4,630 (14) Loss on extinguishment of debt — — 1,018 — Income before taxes 2,435 1,403 3,645 3,824 Income tax (benefit) expense (3,861) 1,050 (4,361) 1,184 NET INCOME 6,296 353 8,006 2,640 Deemed dividends on preferred stock and amortization of beneficial conversion feature — — — 5,627 Gain on redemption of preferred stock — — — (9,075) NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS $ 6,296 $ 353 $ 8,006 $ 6,088 INCOME PER COMMON SHARE Basic $ 0.06 $ 0.00 $ 0.08 $ 0.07 Diluted $ 0.06 $ 0.00 $ 0.08 $ 0.07 WEIGHTED AVERAGE COMMON SHARES OUTSTANDING Basic 104,393 93,270 100,470 85,618 Diluted 107,816 96,874 103,615 91,568 23

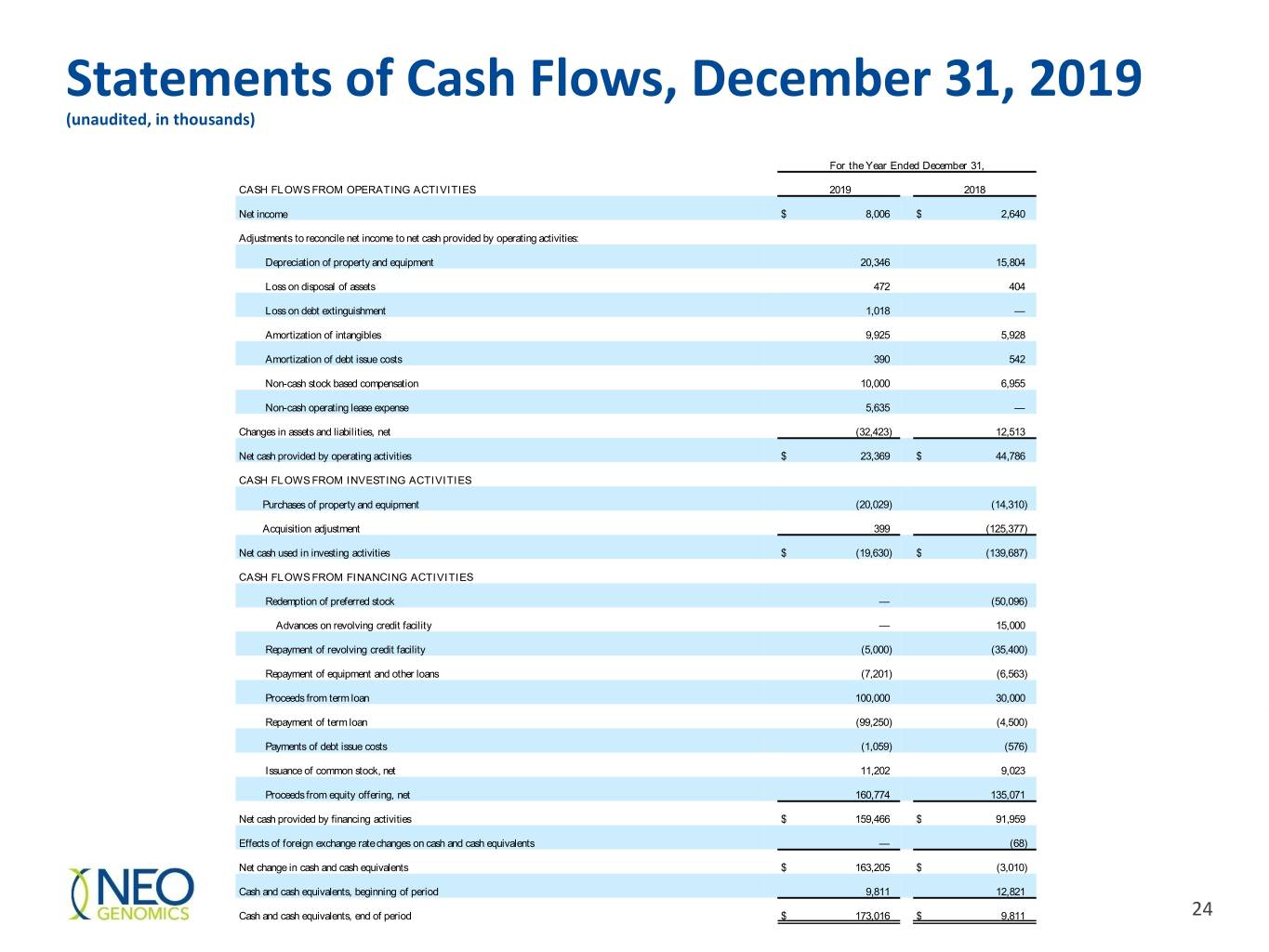

Statements of Cash Flows, December 31, 2019 (unaudited, in thousands) For the Year Ended December 31, CASH FLOWS FROM OPERATING ACTIVITIES 2019 2018 Net income $ 8,006 $ 2,640 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation of property and equipment 20,346 15,804 Loss on disposal of assets 472 404 Loss on debt extinguishment 1,018 — Amortization of intangibles 9,925 5,928 Amortization of debt issue costs 390 542 Non-cash stock based compensation 10,000 6,955 Non-cash operating lease expense 5,635 — Changes in assets and liabilities, net (32,423) 12,513 Net cash provided by operating activities $ 23,369 $ 44,786 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (20,029) (14,310) Acquisition adjustment 399 (125,377) Net cash used in investing activities $ (19,630) $ (139,687) CASH FLOWS FROM FINANCING ACTIVITIES Redemption of preferred stock — (50,096) Advances on revolving credit facility — 15,000 Repayment of revolving credit facility (5,000) (35,400) Repayment of equipment and other loans (7,201) (6,563) Proceeds from term loan 100,000 30,000 Repayment of term loan (99,250) (4,500) Payments of debt issue costs (1,059) (576) Issuance of common stock, net 11,202 9,023 Proceeds from equity offering, net 160,774 135,071 Net cash provided by financing activities $ 159,466 $ 91,959 Effects of foreign exchange rate changes on cash and cash equivalents — (68) Net change in cash and cash equivalents $ 163,205 $ (3,010) Cash and cash equivalents, beginning of period 9,811 12,821 Cash and cash equivalents, end of period $ 173,016 $ 9,811 24

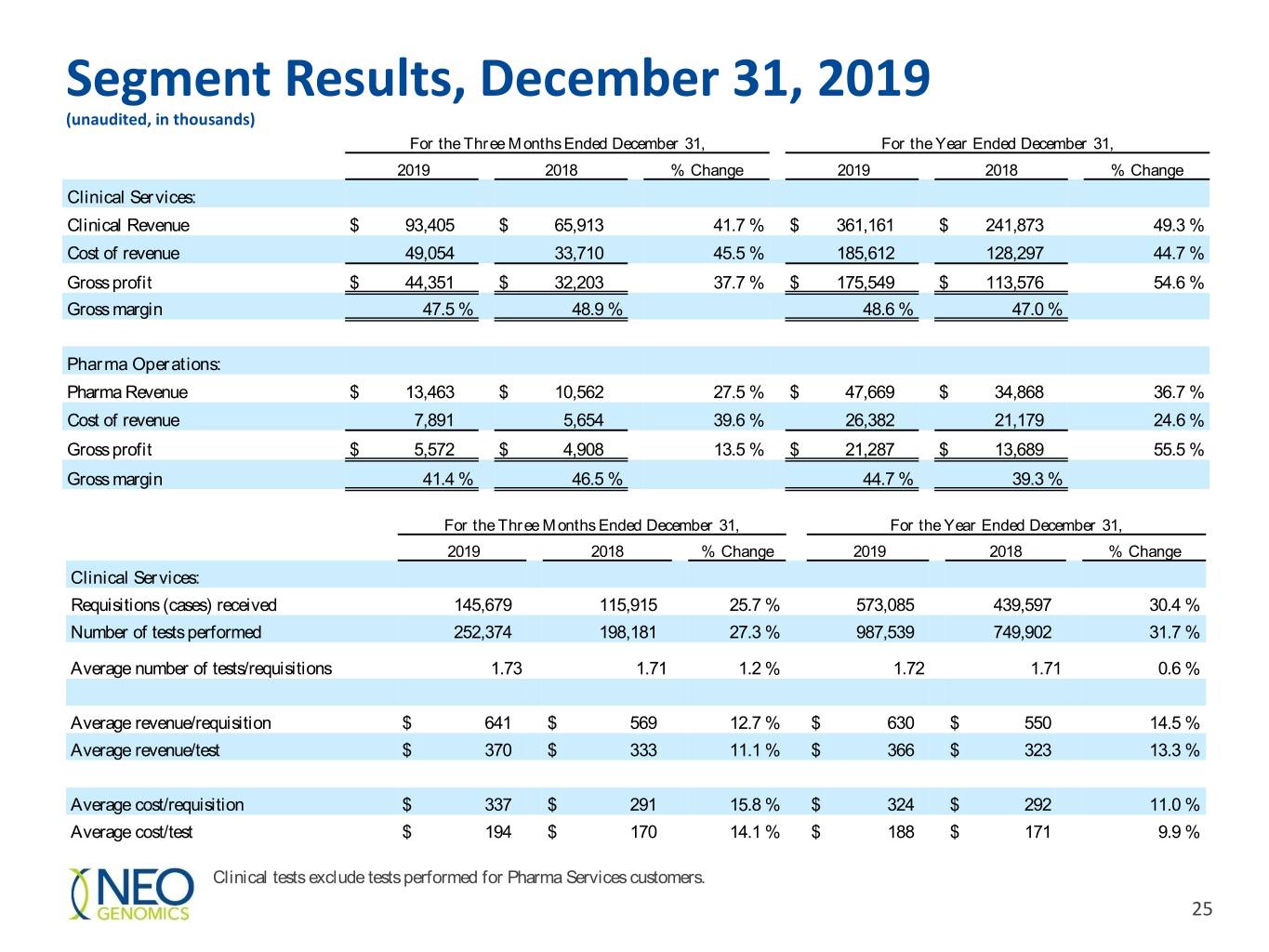

Segment Results, December 31, 2019 (unaudited, in thousands) For the Three Months Ended December 31, For the Year Ended December 31, 2019 2018 % Change 2019 2018 % Change Clinical Services: Clinical Revenue $ 93,405 $ 65,913 41.7 % $ 361,161 $ 241,873 49.3 % Cost of revenue 49,054 33,710 45.5 % 185,612 128,297 44.7 % Gross profit $ 44,351 $ 32,203 37.7 % $ 175,549 $ 113,576 54.6 % Gross margin 47.5 % 48.9 % 48.6 % 47.0 % Pharma Operations: Pharma Revenue $ 13,463 $ 10,562 27.5 % $ 47,669 $ 34,868 36.7 % Cost of revenue 7,891 5,654 39.6 % 26,382 21,179 24.6 % Gross profit $ 5,572 $ 4,908 13.5 % $ 21,287 $ 13,689 55.5 % Gross margin 41.4 % 46.5 % 44.7 % 39.3 % For the Three Months Ended December 31, For the Year Ended December 31, 2019 2018 % Change 2019 2018 % Change Clinical Services: Requisitions (cases) received 145,679 115,915 25.7 % 573,085 439,597 30.4 % Number of tests performed 252,374 198,181 27.3 % 987,539 749,902 31.7 % Average number of tests/requisitions 1.73 1.71 1.2 % 1.72 1.71 0.6 % Average revenue/requisition $ 641 $ 569 12.7 % $ 630 $ 550 14.5 % Average revenue/test $ 370 $ 333 11.1 % $ 366 $ 323 13.3 % Average cost/requisition $ 337 $ 291 15.8 % $ 324 $ 292 11.0 % Average cost/test $ 194 $ 170 14.1 % $ 188 $ 171 9.9 % Clinical tests exclude tests performed for Pharma Services customers. 25

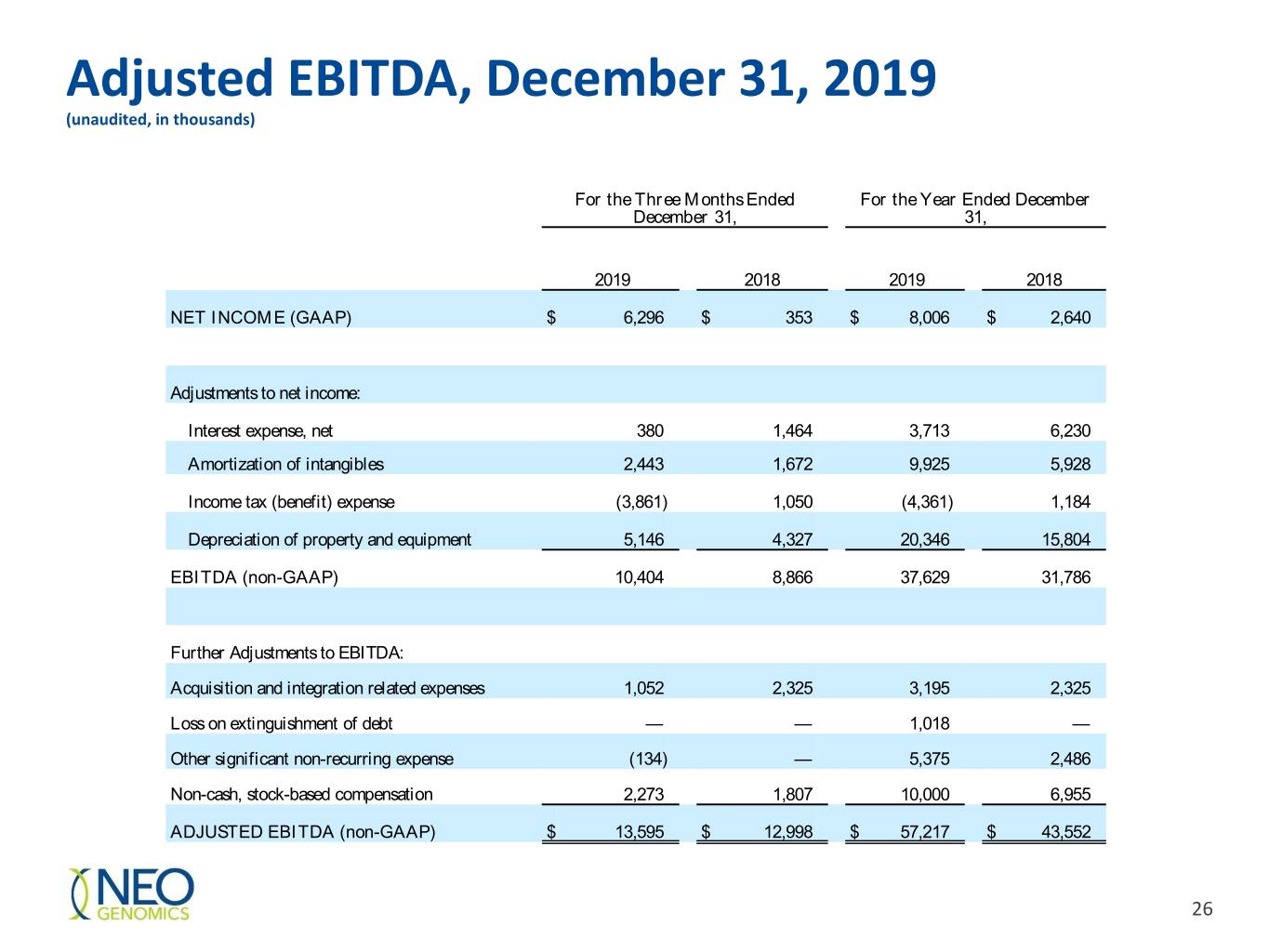

Adjusted EBITDA, December 31, 2019 (unaudited, in thousands) For the Three Months Ended For the Year Ended December December 31, 31, 2019 2018 2019 2018 NET INCOME (GAAP) $ 6,296 $ 353 $ 8,006 $ 2,640 Adjustments to net income: Interest expense, net 380 1,464 3,713 6,230 Amortization of intangibles 2,443 1,672 9,925 5,928 Income tax (benefit) expense (3,861) 1,050 (4,361) 1,184 Depreciation of property and equipment 5,146 4,327 20,346 15,804 EBITDA (non-GAAP) 10,404 8,866 37,629 31,786 Further Adjustments to EBITDA: Acquisition and integration related expenses 1,052 2,325 3,195 2,325 Loss on extinguishment of debt — — 1,018 — Other significant non-recurring expense (134) — 5,375 2,486 Non-cash, stock-based compensation 2,273 1,807 10,000 6,955 ADJUSTED EBITDA (non-GAAP) $ 13,595 $ 12,998 $ 57,217 $ 43,552 26

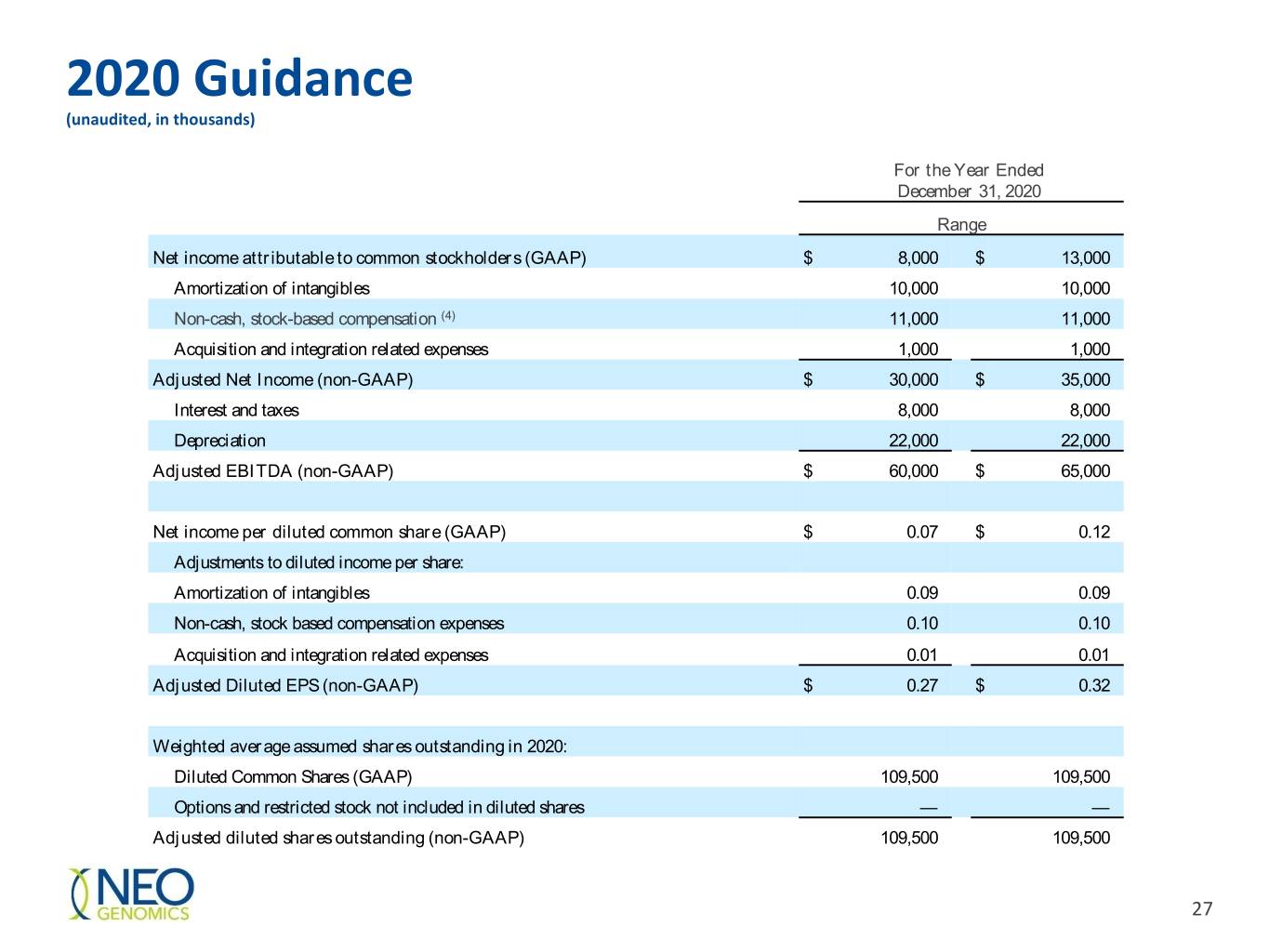

2020 Guidance (unaudited, in thousands) For the Year Ended December 31, 2020 Range Net income attributable to common stockholders (GAAP) $ 8,000 $ 13,000 Amortization of intangibles 10,000 10,000 Non-cash, stock-based compensation (4) 11,000 11,000 Acquisition and integration related expenses 1,000 1,000 Adjusted Net Income (non-GAAP) $ 30,000 $ 35,000 Interest and taxes 8,000 8,000 Depreciation 22,000 22,000 Adjusted EBITDA (non-GAAP) $ 60,000 $ 65,000 Net income per diluted common share (GAAP) $ 0.07 $ 0.12 Adjustments to diluted income per share: Amortization of intangibles 0.09 0.09 Non-cash, stock based compensation expenses 0.10 0.10 Acquisition and integration related expenses 0.01 0.01 Adjusted Diluted EPS (non-GAAP) $ 0.27 $ 0.32 Weighted average assumed shares outstanding in 2020: Diluted Common Shares (GAAP) 109,500 109,500 Options and restricted stock not included in diluted shares — — Adjusted diluted shares outstanding (non-GAAP) 109,500 109,500 27

COMPASS® and CHART® COMPASS: comprehensive, hematopathologist- directed, integrated assessment report • Customized workflow on each patient case to provide a disease-specific evaluation based on up- to-date guidelines • Actionable diagnosis in a one- page correlation report • Consultation with assigned hematopathologist available on every case • Notification of acute cases and unexpected diagnoses within 24 hours CHART: a longitudinal report including a consultative review and correlation with relevant prior findings by a NeoGenomics Hematopathologist, used to: • Monitor response to therapy • Determine disease progression • Evaluate clonal evolution • Assess residual disease 28