EX-99.1

Published on January 5, 2021

NeoGenomics Investor Presentation January 2021 1 Exhibit 99.1

Forward Looking Statements 2 only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. expressions or words, identify forward looking statements. Although the Company believes the expectations reflected in such forward looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Com looking statements due to numerous known and unknown risks and uncertainties. All forward looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Non GAAP Adjusted EBITDA tion and amortization expense, (iv) non cash stock based compensation expense, and, if applicable in a reporting period, (v) acquisition and integration related expenses, (vi) non cash impairments of intangible assets, (vii) and other significant non recurring or non operating (income) or expenses, including any debt financing costs.

We save lives by improving patient care. By providing uncompromising quality, exceptional service and innovative solutions, we strive to be the leading cancer testing and information company. Quality, integrity, accountability, teamwork, innovation. NeoGenomics We are Focused and Genuine Our Common Purpose Our Values Our Vision 3

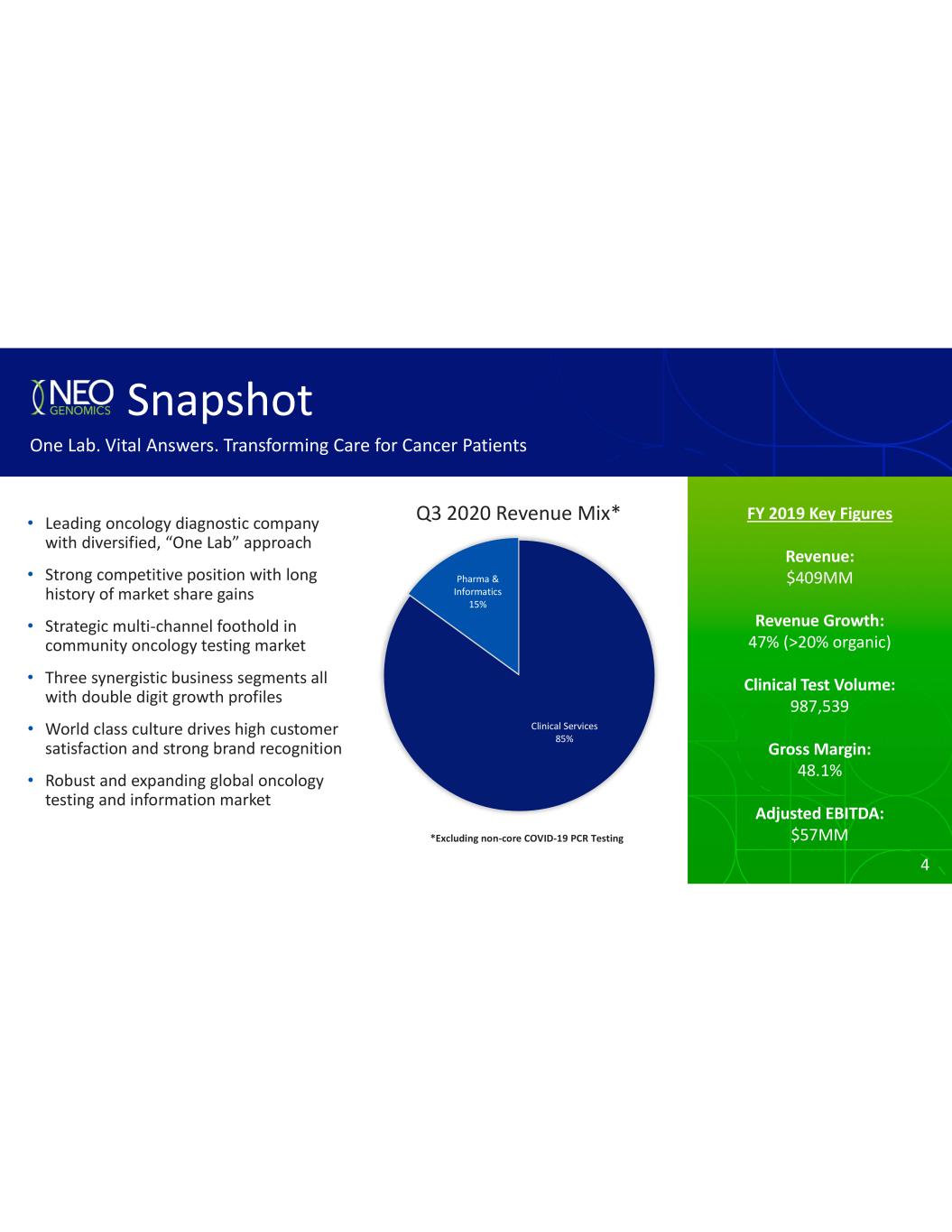

4 FY 2019 Key Figures Revenue: $409MM Revenue Growth: 47% (>20% organic) Clinical Test Volume: 987,539 Gross Margin: 48.1% Adjusted EBITDA: $57MM Q3 2020 Revenue Mix* Snapshot One Lab. Vital Answers. Transforming Care for Cancer Patients Leading oncology diagnostic company with diversified, approach Strong competitive position with long history of market share gains Strategic multi channel foothold in community oncology testing market Three synergistic business segments all with double digit growth profiles World class culture drives high customer satisfaction and strong brand recognition Robust and expanding global oncology testing and information market Clinical Services 85% Pharma & Informatics 15% *Excluding non core COVID 19 PCR Testing 4

Informatics Division One Lab. Vital Answers. 5 Leading Oncology Diagnostics Company, Designed to Provide Innovative Diagnostic and Data Solutions That Bridge Oncologists, Pathologists, and Therapeutic Development Leading oncology reference lab market share for oncologists, pathologists and hospitals Comprehensive oncology test menu including all major testing modalities Direct national commercial team of ~100 people A longstanding reputation for service and quality in the community oncology market Leading provider of oncology focused research and clinical trials services Comprehensive support from pre clinical and research discovery through FDA filing, approval and launch Global footprint (U.S., Switzerland, Singapore, China) Greater than $185MM(1) in backlog (signed contracts) Pharma Services DivisionClinical Services Division Formed in 2020 to utilize clinical testing data to address real world problems for patients and other stakeholders Our information platform includes one of the largest cancer testing databases, covering the complete spectrum of oncology testing modalities for over 1.6 million patients and growing NOTE: 1. As of September 30, 2020

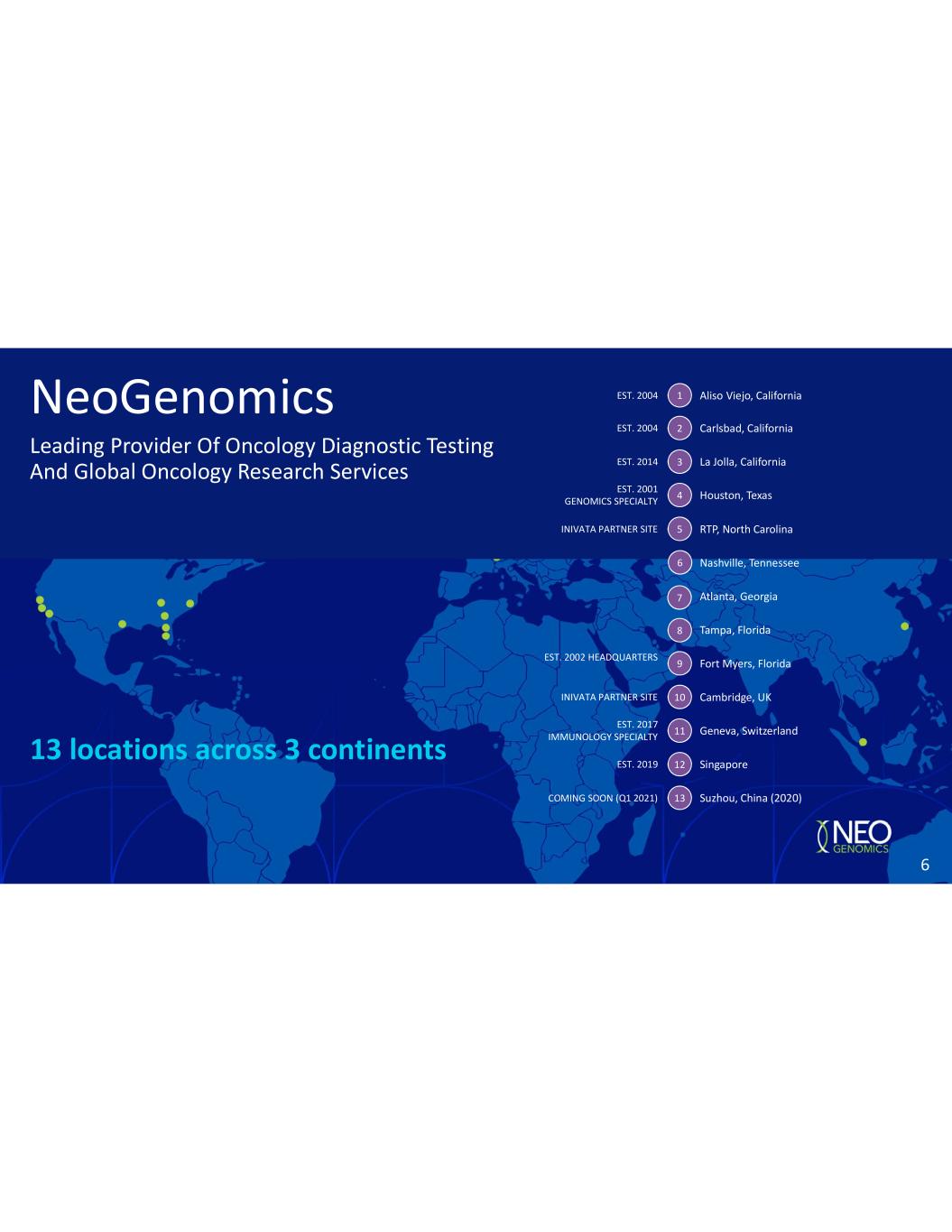

13 locations across 3 continents Leading Provider Of Oncology Diagnostic Testing And Global Oncology Research Services NeoGenomics Carlsbad, California Houston, Texas La Jolla, California Fort Myers, Florida Tampa, Florida Atlanta, Georgia Nashville, Tennessee RTP, North Carolina Cambridge, UK Geneva, Switzerland Singapore Suzhou, China (2020) EST. 2004 EST. 2014 EST. 2001 GENOMICS SPECIALTY EST. 2002 HEADQUARTERS EST. 2017 IMMUNOLOGY SPECIALTY EST. 2019 COMING SOON (Q1 2021) 2 3 4 5 9 10 11 12 13 INIVATA PARTNER SITE INIVATA PARTNER SITE 6 7 8 Aliso Viejo, CaliforniaEST. 2004 1 6

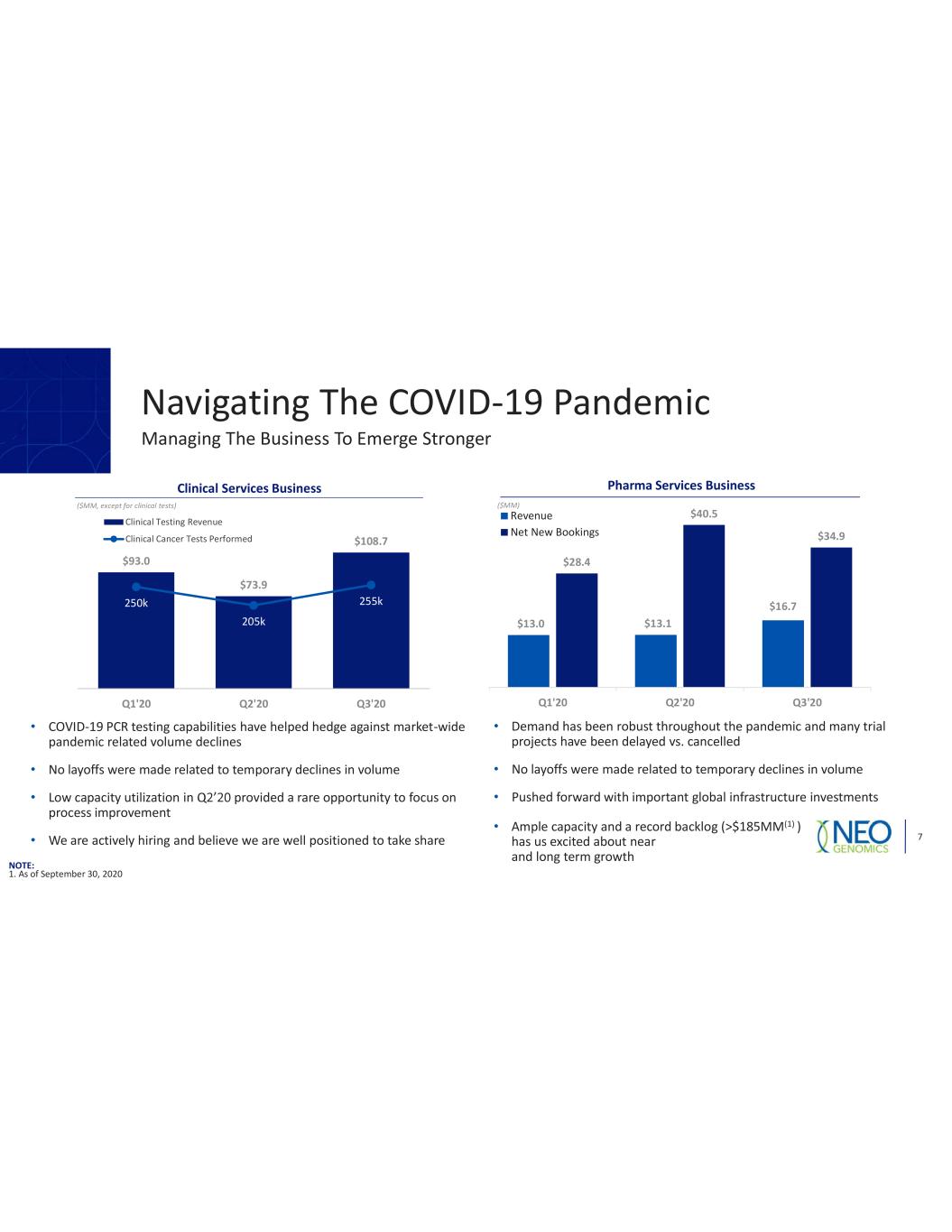

Navigating The COVID 19 Pandemic 7 Managing The Business To Emerge Stronger $93.0 $73.9 $108.7 250k 205k 255k 0k 50k 100k 150k 200k 250k 300k 350k 400k 0 20 40 60 80 100 120 Q1'20 Q2'20 Q3'20 Clinical Testing Revenue Clinical Cancer Tests Performed $13.0 $13.1 $16.7 $28.4 $40.5 $34.9 Q1'20 Q2'20 Q3'20 Revenue Net New Bookings Clinical Services Business ($MM, except for clinical tests) Pharma Services Business ($MM) COVID 19 PCR testing capabilities have helped hedge against market wide pandemic related volume declines No layoffs were made related to temporary declines in volume Low capacity utilization in provided a rare opportunity to focus on process improvement We are actively hiring and believe we are well positioned to take share Ample capacity and a record backlog (>$185MM(1) ) has us excited about near and long term growth Demand has been robust throughout the pandemic and many trial projects have been delayed vs. cancelled No layoffs were made related to temporary declines in volume Pushed forward with important global infrastructure investments NOTE: 1. As of September 30, 2020

The Oncology Test Market Is Poised For Growth 8 Demographics An aging population is resulting in higher cancer incidence Increased cancer survival rates leading to more follow on testing Precision Medicine & Drug Development Proliferation and complexity of therapeutic options driving more testing Burgeoning oncology drug pipeline underlying current Pharma Services demand and likely to drive demand for future clinical testing New platforms and tests (NGS, TMB, MSI, liquid biopsy, etc.) creating more test options for diagnosis, prognosis, and therapy selection Upside Potential: Emerging Opportunities Promising minimal residual disease tests in development such as strategic partner could create a compelling recurrence monitoring opportunity We expect to develop a number of innovative value add data offerings in our growing Informatics division

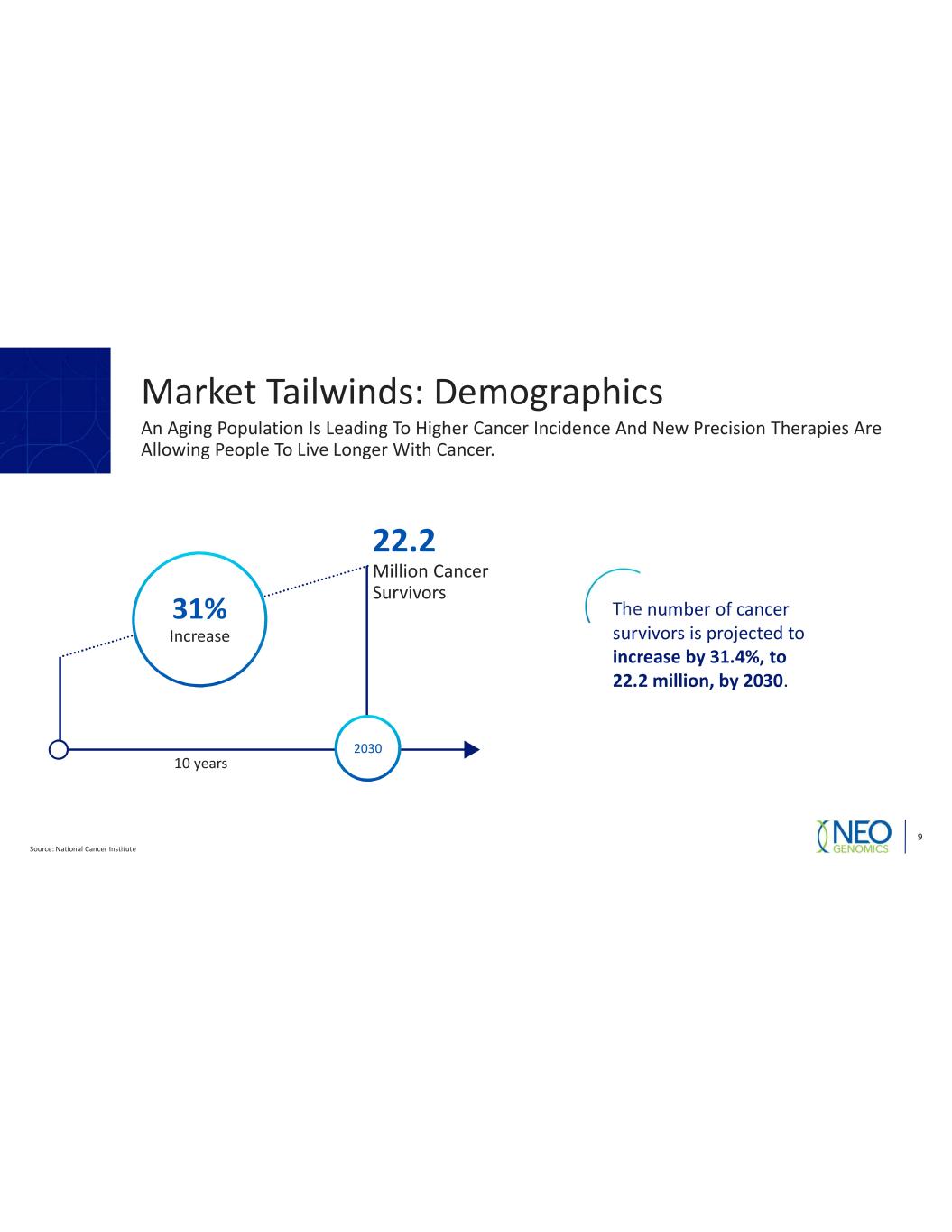

Source: National Cancer Institute 9 The number of cancer survivors is projected to increase by 31.4%, to 22.2 million, by 2030. 2030 22.2 Million Cancer Survivors 10 years 31% Increase An Aging Population Is Leading To Higher Cancer Incidence And New Precision Therapies Are Allowing People To Live Longer With Cancer. Market Tailwinds: Demographics

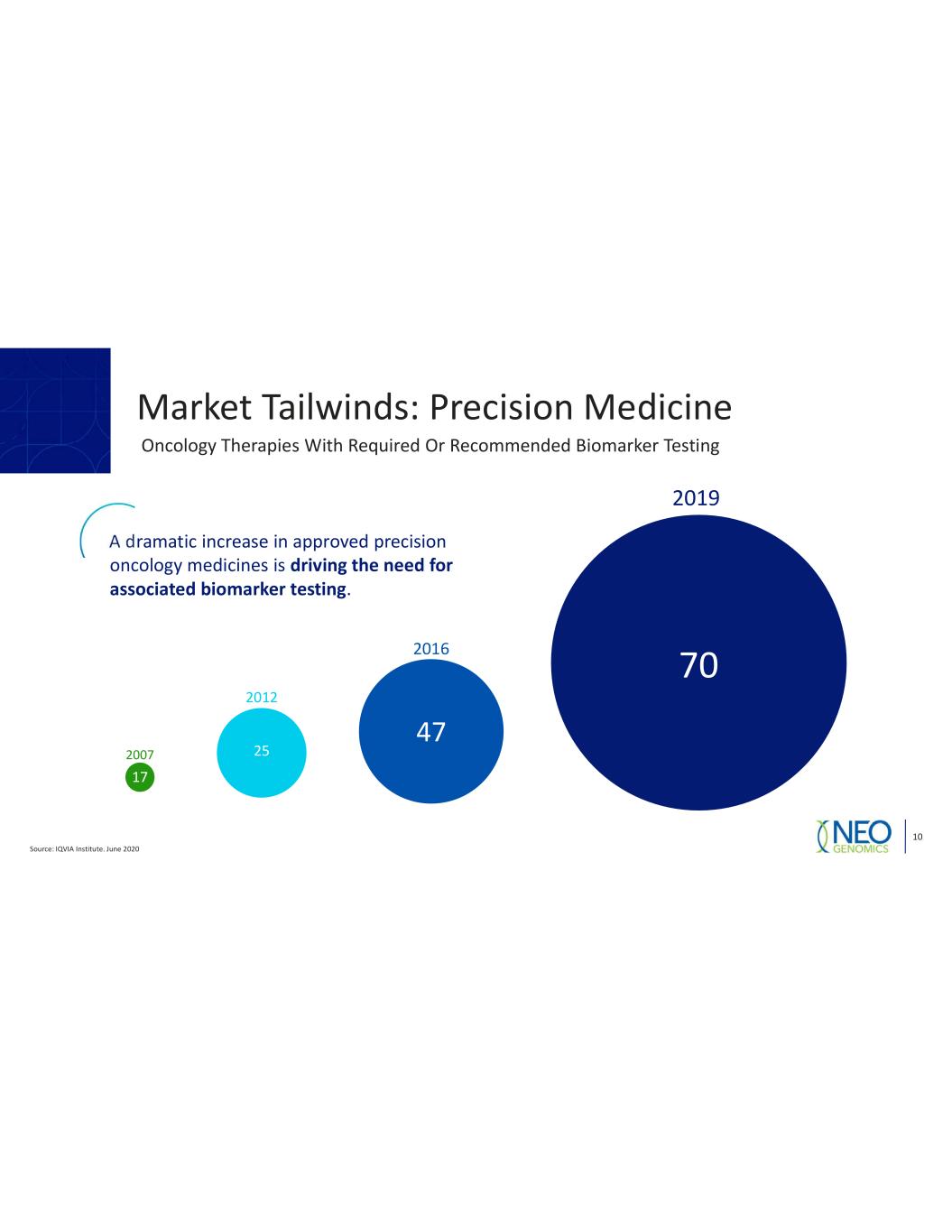

Source: IQVIA Institute. June 2020 10 2007 2012 2016 2019 70 47 25 17 A dramatic increase in approved precision oncology medicines is driving the need for associated biomarker testing. Oncology Therapies With Required Or Recommended Biomarker Testing Market Tailwinds: Precision Medicine

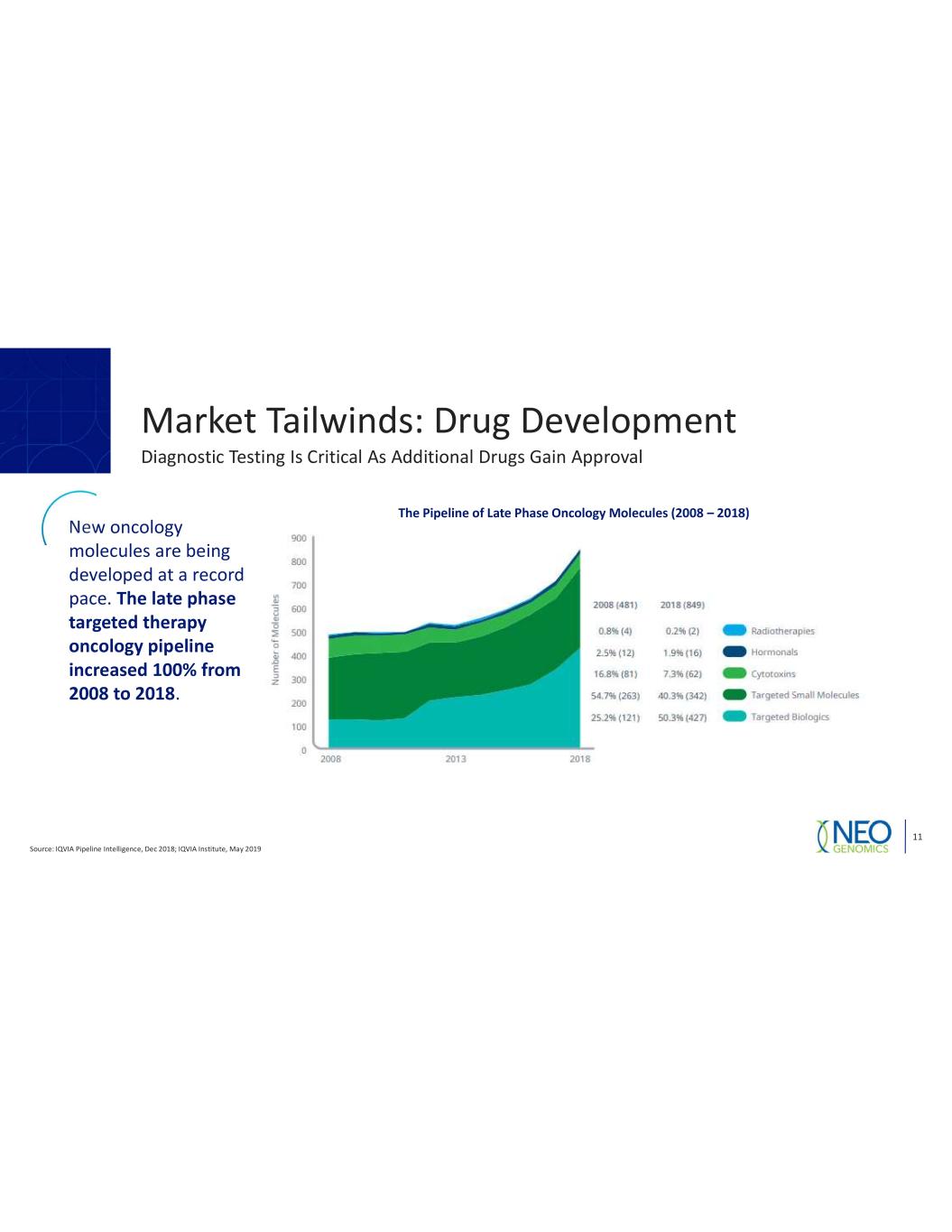

Market Tailwinds: Drug Development 11 Diagnostic Testing Is Critical As Additional Drugs Gain Approval New oncology molecules are being developed at a record pace. The late phase targeted therapy oncology pipeline increased 100% from 2008 to 2018. The Pipeline of Late Phase Oncology Molecules (2008 Source: IQVIA Pipeline Intelligence, Dec 2018; IQVIA Institute, May 2019

We Endeavor To Outgrow The Market 12 Significant Company Specific Growth Drivers 1 One of the most comprehensive test menus in oncology Dx including advanced NGS capabilities such as liquid biopsy 2 Uncompromising customer service with exceptional turn around time on testing 3 4 5 Over 120 MDs and PhDs on Staff including internationally renown experts 6 7 8Many years of market share gains validate the power of our competitive differentiation. Strong synergies with Pharma Services and Informatics Divisions A tenured and oncology focused best in class sales force Hundreds of contracts with managed care, IDNs, hospital systems, oncology practices and GPOs History of strong M&A Execution To complement organic growth Significant reach into the community channel positions us well for partnerships and strategic relationships

$32 $40 $56 $63 $79 $88 $203 $210 $242 $361 57k 76k 112k 136k 176k 223k 563k 657k 750k 988k 0 200 400 600 800 1,000 1,200 0 50 100 150 200 250 300 350 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Clinical Testing Revenue ($MM) Clinical Tests Performed Clinical Testing Annual Revenue / Clinical Tests Performed(1) 2 82 Acquired Growth MarketsReimbursement challenges NeoGenomics has the flexibility to pivot with the environment History of Organic and Inorganic Success 13 An Ability To Succeed In Varied Market Environments Acquired Dec 2015 (1)Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. (2)Base NEO Clinical includes organic clinical revenue and test volume growth and incorporates inorganic contributions from the 2015 acquisition of Clarient (closed Dec. 30th) and the 2018 acquisition of Genoptix (closed Dec. 10th). Base NEO Clinical excludes the impact from Pharma Services and PathLogic (divested on August 1st, 2017). Dec 2018

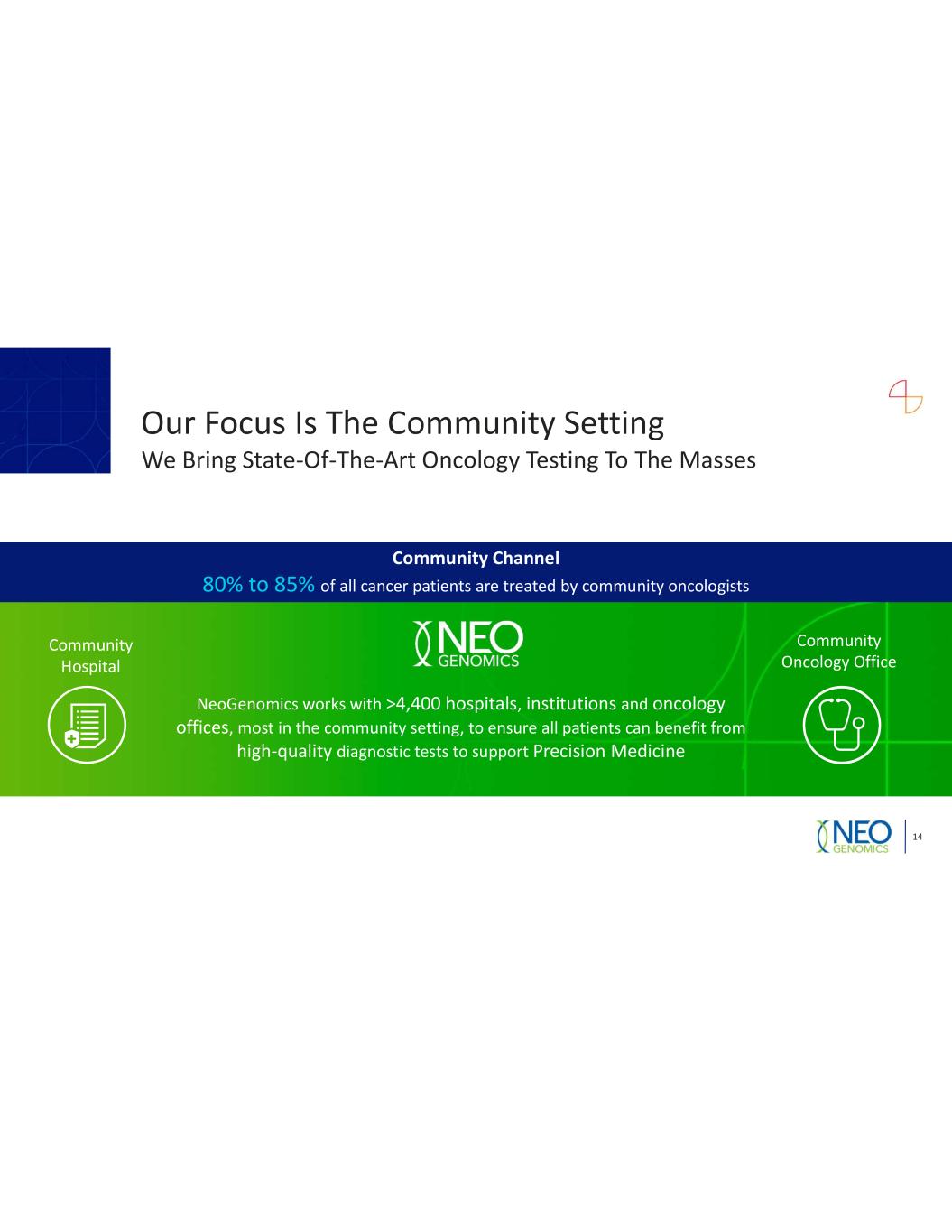

Our Focus Is The Community Setting 14 We Bring State Of The Art Oncology Testing To The Masses Community Hospital Community Oncology Office Community Channel 80% to 85% of all cancer patients are treated by community oncologists NeoGenomics works with >4,400 hospitals, institutions and oncology offices, most in the community setting, to ensure all patients can benefit from high quality diagnostic tests to support Precision Medicine

15 Consultation pathology Immunochemistry Immunohistochemistry Digital imaging Automated quantitative IHC Global and tech only service 10 color flow MRD detection Global and tech only service Extensive automation for high quality/low cost Robust Library of validated probes Global and tech only service FISH Next gen sequencing Liquid biopsy Whole exome sequencing Sanger sequencing Real time qPCR SNPmicroarray MolecularAnatomic Pathology Flow Cytometry Cytogenetics Comprehensive Oncology Test Menu A Low Beta approach To A Massive High Growth End Market Right Test Right Patient Right Time Flexible AppropriateTechnology Agnostic

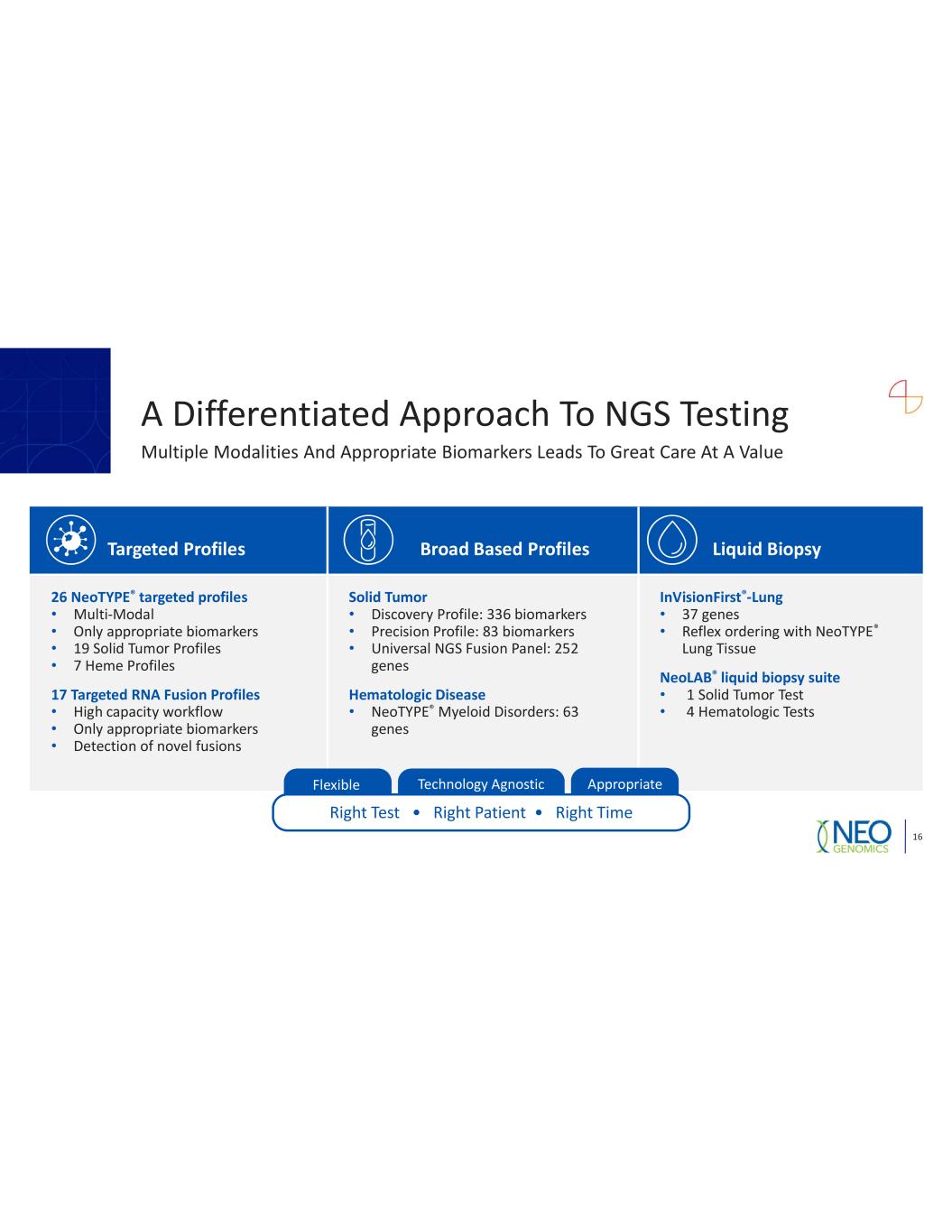

Targeted Profiles Broad Based Profiles Liquid Biopsy 26 NeoTYPE® targeted profiles Multi Modal Only appropriate biomarkers 19 Solid Tumor Profiles 7 Heme Profiles 17 Targeted RNA Fusion Profiles High capacity workflow Only appropriate biomarkers Detection of novel fusions Solid Tumor Discovery Profile: 336 biomarkers Precision Profile: 83 biomarkers Universal NGS Fusion Panel: 252 genes Hematologic Disease NeoTYPE® Myeloid Disorders: 63 genes InVisionFirst® Lung 37 genes Reflex ordering with NeoTYPE® Lung Tissue NeoLAB® liquid biopsy suite 1 Solid Tumor Test 4 Hematologic Tests 16 Right Test Right Patient Right Time Flexible AppropriateTechnology Agnostic A Differentiated Approach To NGS Testing Multiple Modalities And Appropriate Biomarkers Leads To Great Care At A Value

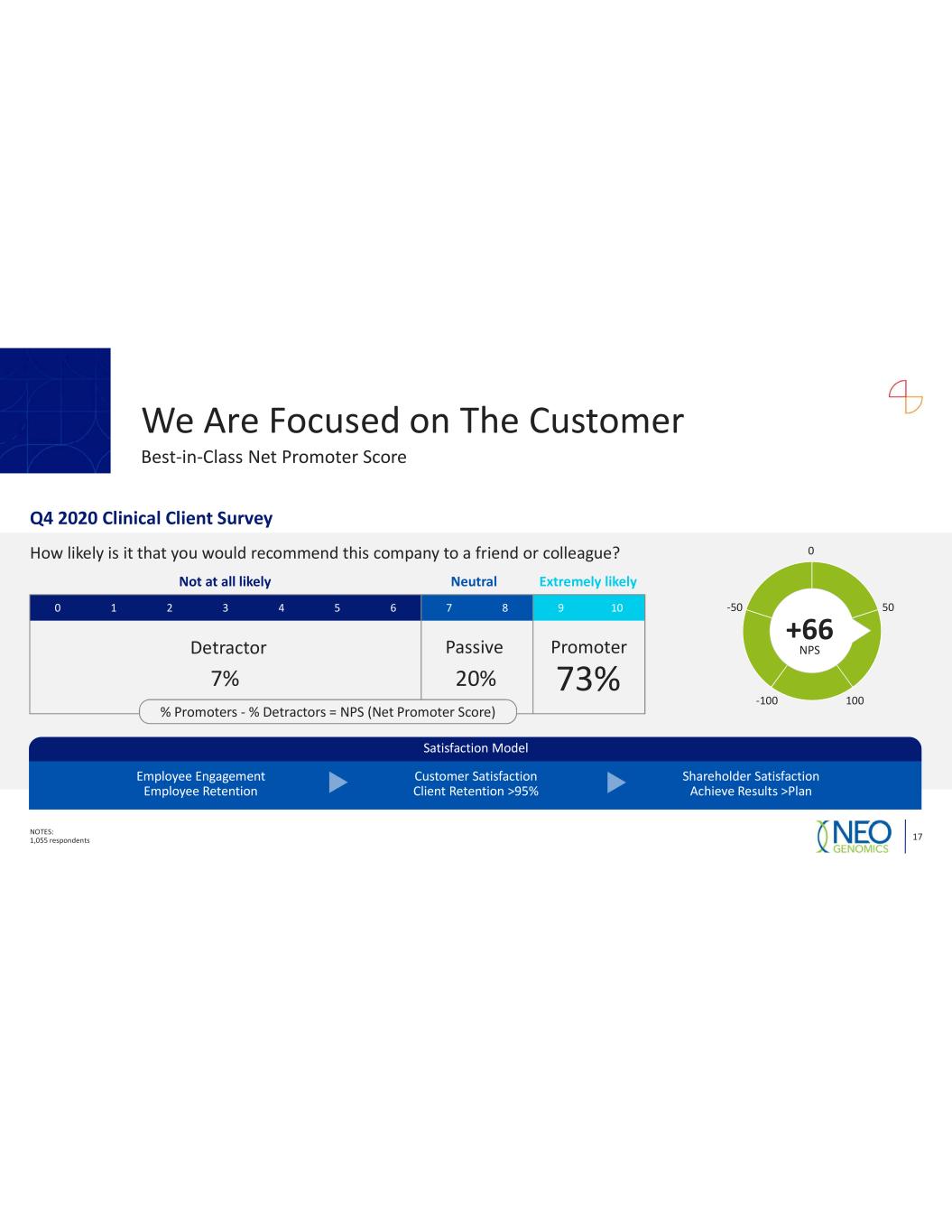

We Are Focused on The Customer NOTES: 1,055 respondents 17 Best in Class Net Promoter Score Q4 2020 Clinical Client Survey How likely is it that you would recommend this company to a friend or colleague? 0 1 2 3 4 5 6 7 8 9 10 Not at all likely Neutral Extremely likely Detractor Passive Promoter 7% 20% 73% 0 50 100100 50 +66 NPS Satisfaction Model Employee Engagement Employee Retention Customer Satisfaction Client Retention >95% Shareholder Satisfaction Achieve Results >Plan % Promoters % Detractors = NPS (Net Promoter Score)

Clinical Reference Labs with Oncology Divisions Niche Oncology Players High R&D investment and limited test menus 18 Diversified Focus Leading Share in U.S. Clinical Oncology Market Comprehensive, multi modality position Large and advanced somatic cancer test menu Significant reach into all customer segments National footprint and extensive payer contracts Outstanding client service and partnership models Synergistic Pharma, Clinical and Informatics businesses Pure Play Oncology Diagnostic Lab Comprehensive Test Menu + Sustainable Growth Competing Through Focus, Scale and Scope We Enjoy A Unique Position In The Clinical Market /

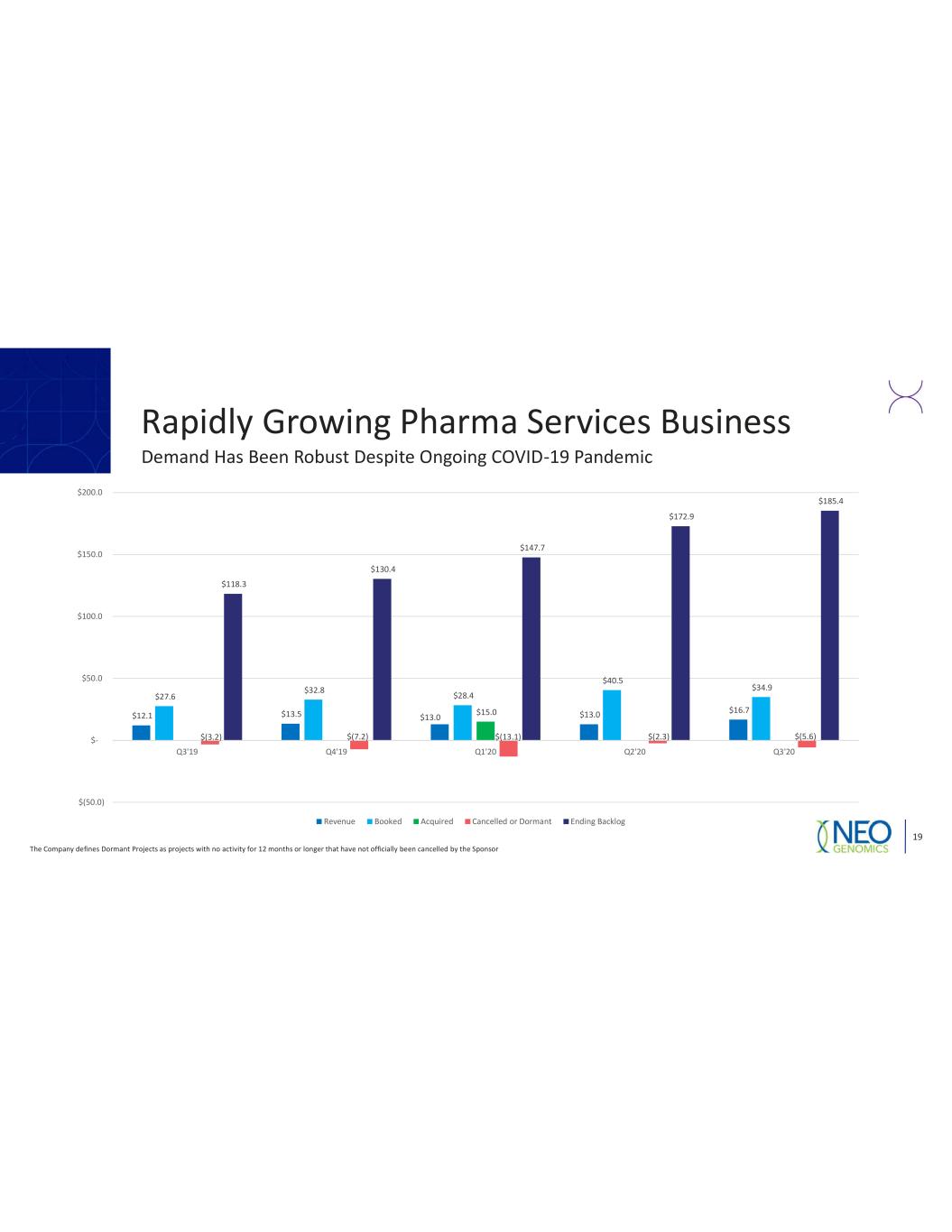

Rapidly Growing Pharma Services Business The Company defines Dormant Projects as projects with no activity for 12 months or longer that have not officially been cancelled by the Sponsor 19 Demand Has Been Robust Despite Ongoing COVID 19 Pandemic $12.1 $13.5 $13.0 $13.0 $16.7 $27.6 $32.8 $28.4 $40.5 $34.9 $15.0 $(3.2) $(7.2) $(13.1) $(2.3) $(5.6) $118.3 $130.4 $147.7 $172.9 $185.4 $(50.0) $ $50.0 $100.0 $150.0 $200.0 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Revenue Booked Acquired Cancelled or Dormant Ending Backlog

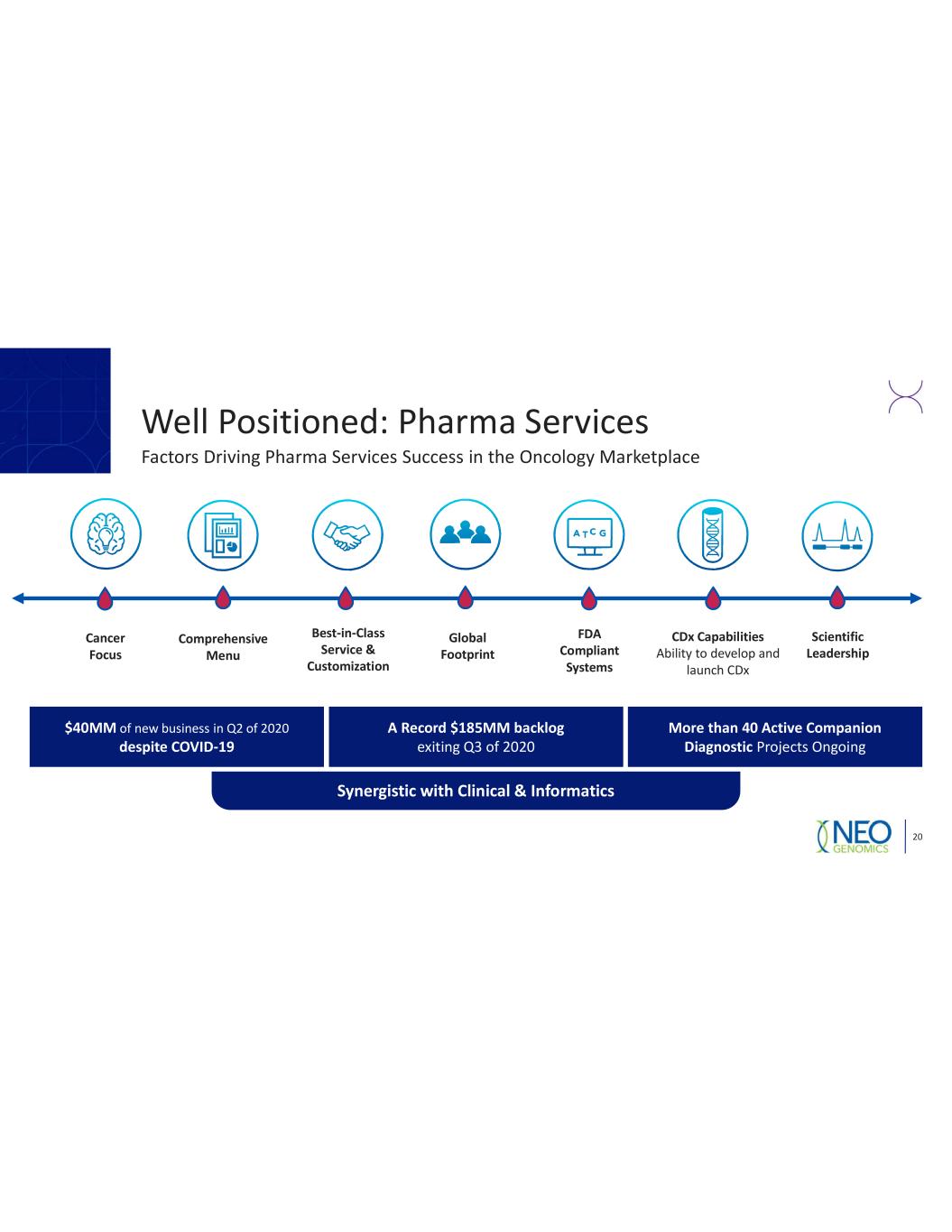

20 Comprehensive Menu Scientific Leadership CDx Capabilities Ability to develop and launch CDx Best in Class Service & Customization Cancer Focus Global Footprint FDA Compliant Systems $40MM of new business in Q2 of 2020 despite COVID 19 More than 40 Active Companion Diagnostic Projects Ongoing A Record $185MM backlog exiting Q3 of 2020 Synergistic with Clinical & Informatics Well Positioned: Pharma Services Factors Driving Pharma Services Success in the Oncology Marketplace

21 Companion diagnostics are part of the precision medicine that is driving the future of oncology Ability to take test across continuum from development, through clinical trials, and into the market CDx capabilities translating into customer wins Wide scale and scope across Pharma and Clinical markets Broad reach to oncologists and pathologists Access to data across massive quantity of oncology specific test results Well Positioned: Companion Diagnostics

Proving The Point: KEYTRUDA® 22 Selected by Merck due to IHC expertise Participated in Early Validation Program for Keytruda One of only 3 labs to offer PD L1 testing on Day 1 We remain an industry leader in clinical PD L1 testing

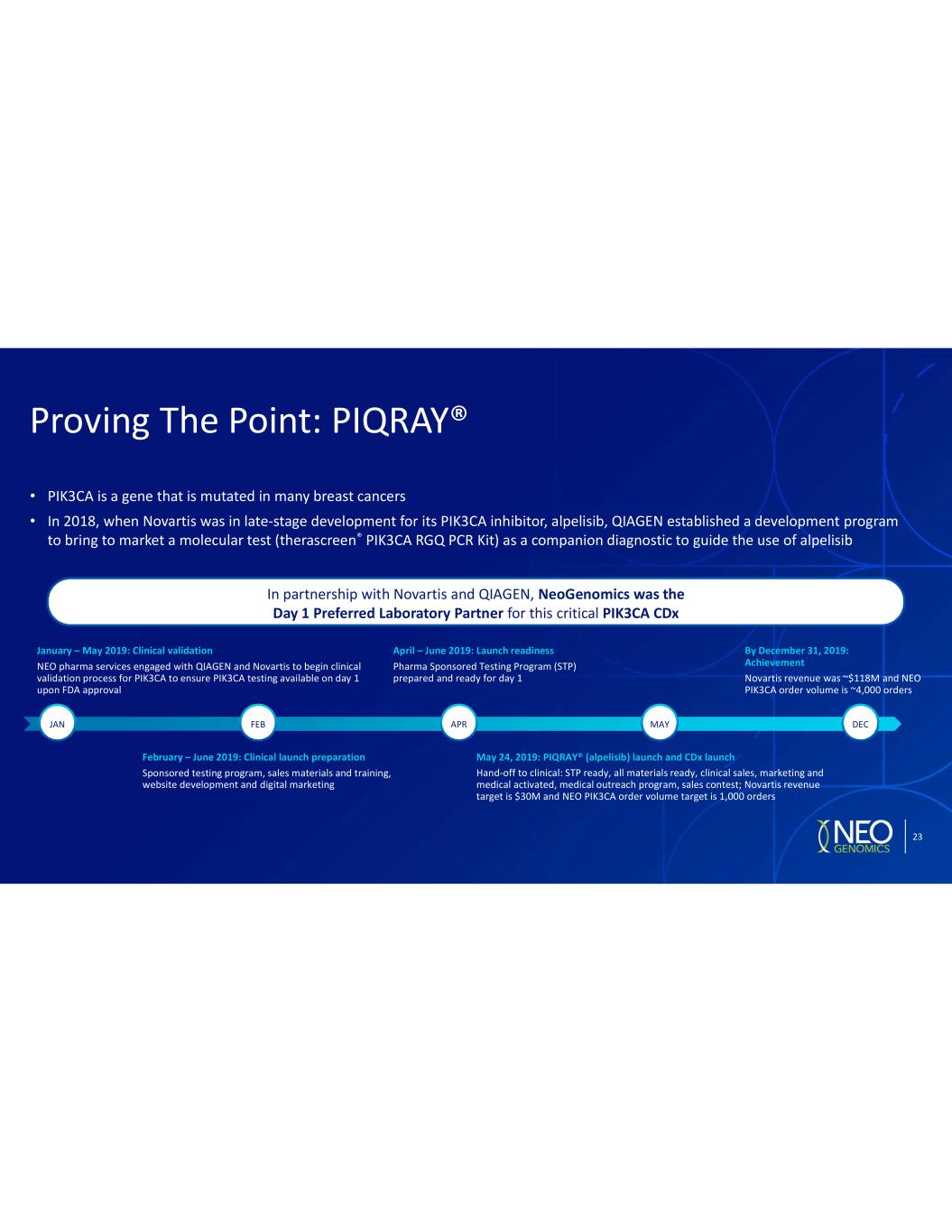

PIK3CA is a gene that is mutated in many breast cancers In 2018, when Novartis was in late stage development for its PIK3CA inhibitor, alpelisib, QIAGEN established a development program to bring to market a molecular test (therascreen® PIK3CA RGQ PCR Kit) as a companion diagnostic to guide the use of alpelisib Proving The Point: PIQRAY® JAN FEB DEC By December 31, 2019: Achievement Novartis revenue was ~$118M and NEO PIK3CA order volume is ~4,000 orders APR MAY May 24, 2019: PIQRAY® (alpelisib) launch and CDx launch Hand off to clinical: STP ready, all materials ready, clinical sales, marketing and medical activated, medical outreach program, sales contest; Novartis revenue target is $30M and NEO PIK3CA order volume target is 1,000 orders April 2019: Launch readiness Pharma Sponsored Testing Program (STP) prepared and ready for day 1 February 2019: Clinical launch preparation Sponsored testing program, sales materials and training, website development and digital marketing January 2019: Clinical validation NEO pharma services engaged with QIAGEN and Novartis to begin clinical validation process for PIK3CA to ensure PIK3CA testing available on day 1 upon FDA approval 23 In partnership with Novartis and QIAGEN, NeoGenomics was the Day 1 Preferred Laboratory Partner for this critical PIK3CA CDx

Informatics 24 Patient Focused. Data driven. We formed the Informatics Division in 2020 to utilize our market leading clinical data to help address the needs of Patients, Pharma companies, Providers, and Payors. NeoGenomics is committed to connecting patients with life altering therapies and trials. We believe that, with our partners, we can help the cancer patients of today and tomorrow.

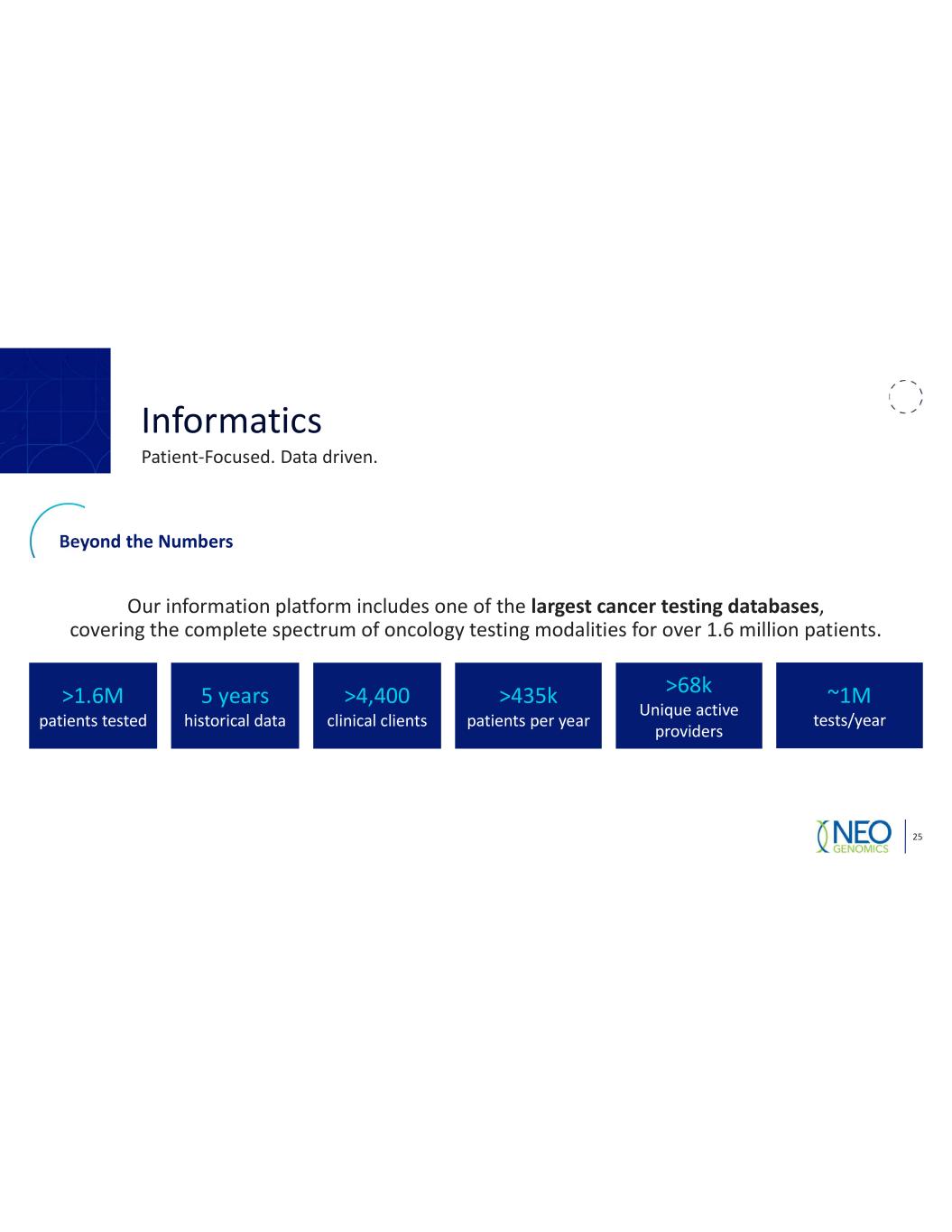

Informatics 25 Patient Focused. Data driven. Our information platform includes one of the largest cancer testing databases, covering the complete spectrum of oncology testing modalities for over 1.6 million patients. >1.6M patients tested 5 years historical data >4,400 clinical clients >435k patients per year >68k Unique active providers ~1M tests/year Beyond the Numbers

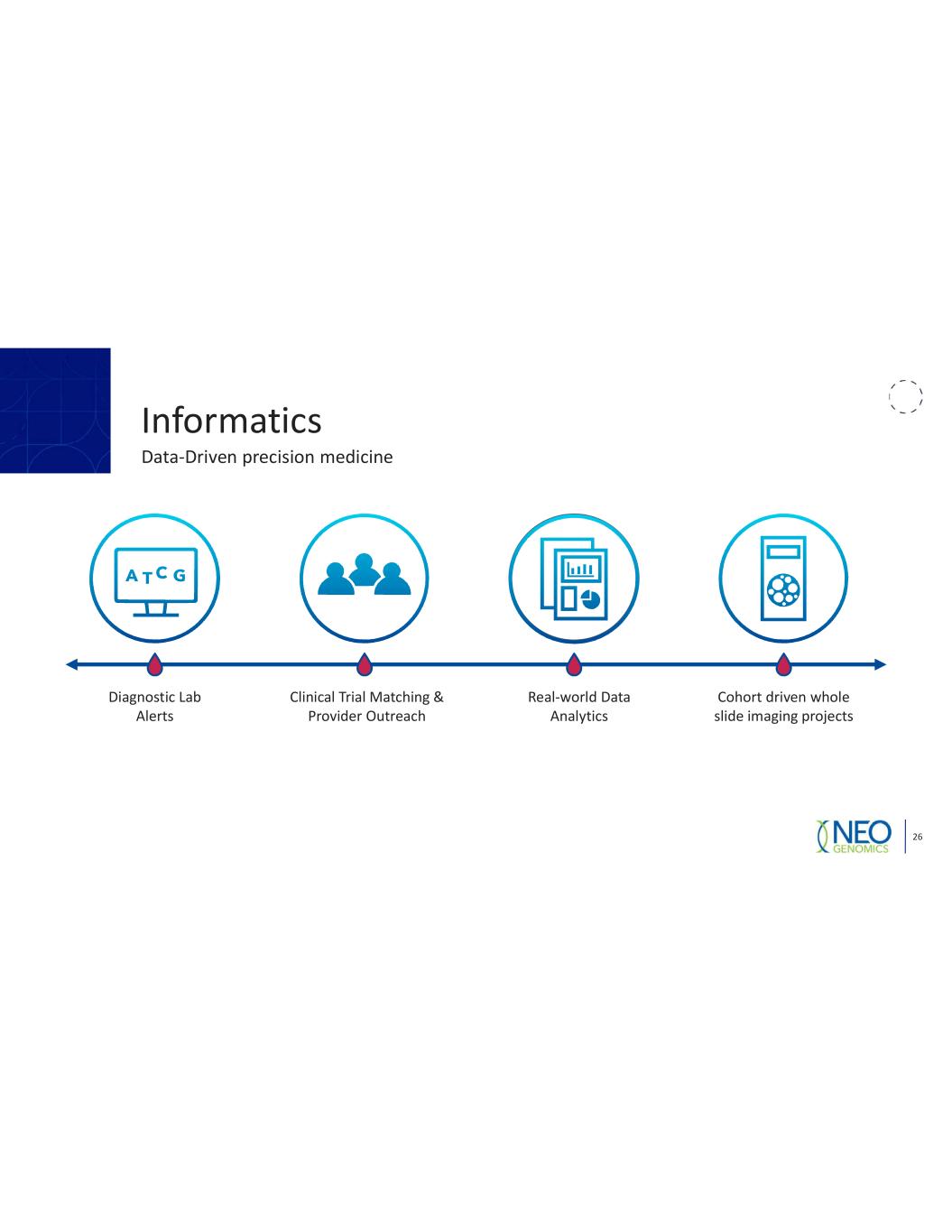

Informatics 26 Data Driven precision medicine Diagnostic Lab Alerts Clinical Trial Matching & Provider Outreach Real world Data Analytics Cohort driven whole slide imaging projects

Leading Oncology Diagnostics Company 27 Guided By Science And Passion For Patient Care We are a leader in the field of diagnostic testing with a significant share of patient test volume in the US Our extensive patient database allows us to optimize the pairing of patients with clinical trials We act as a collaborative partner to pathologists, oncologists and biopharma to deliver best in class services for all By helping the community oncology field, we improve lives Our work is founded in science, driven by data, and upheld to the highest standards We are oncology experts focused on developing foundational and innovative oncology laboratory diagnostic services

28

Appendix 29

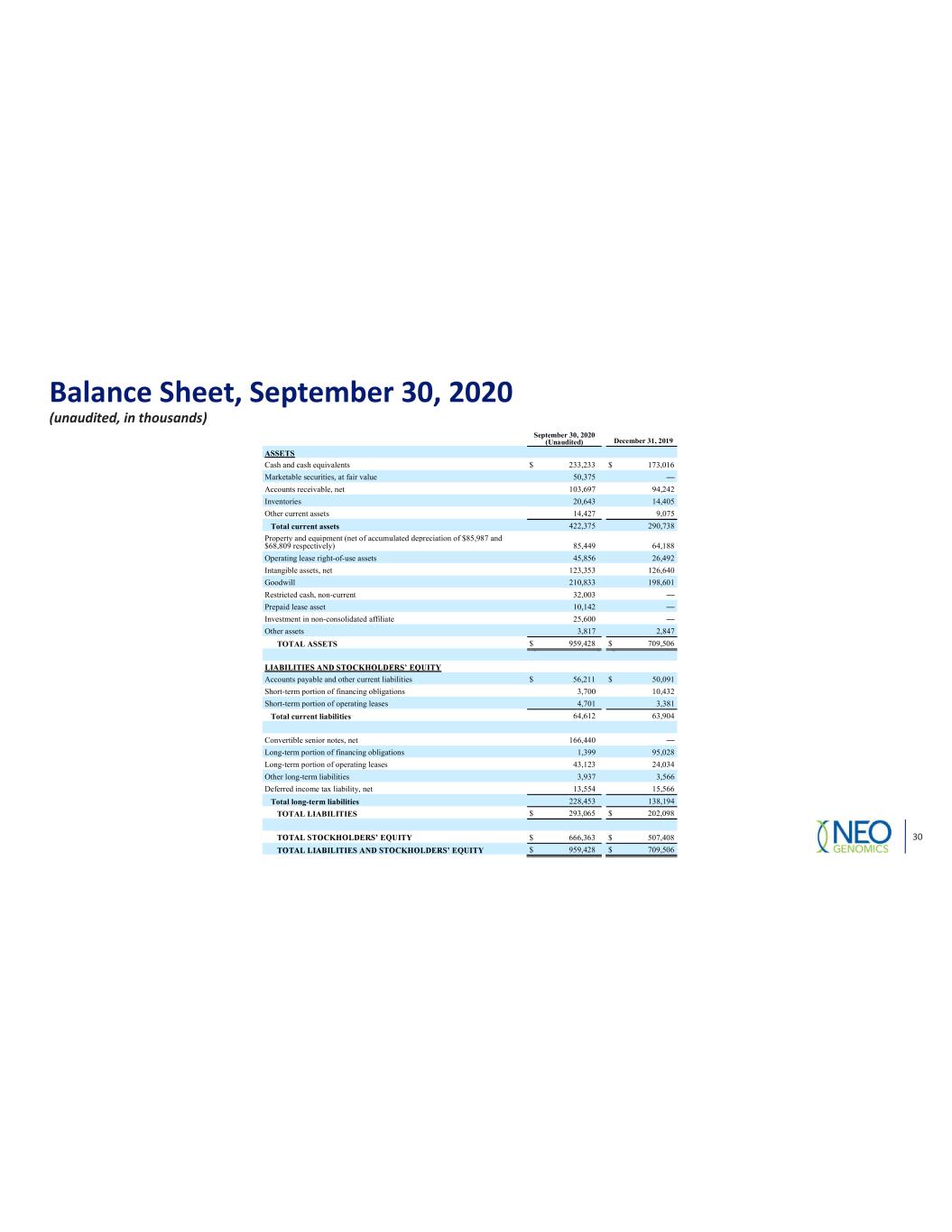

Balance Sheet, September 30, 2020 (unaudited, in thousands) September 30, 2020 (Unaudited) December 31, 2019 ASSETS Cash and cash equivalents $ 233,233 $ 173,016 Marketable securities, at fair value 50,375 Accounts receivable, net 103,697 94,242 Inventories 20,643 14,405 Other current assets 14,427 9,075 Total current assets 422,375 290,738 Property and equipment (net of accumulated depreciation of $85,987 and $68,809 respectively) 85,449 64,188 Operating lease right-of-use assets 45,856 26,492 Intangible assets, net 123,353 126,640 Goodwill 210,833 198,601 Restricted cash, non-current 32,003 Prepaid lease asset 10,142 Investment in non-consolidated affiliate 25,600 Other assets 3,817 2,847 TOTAL ASSETS $ 959,428 $ 709,506 Accounts payable and other current liabilities $ 56,211 $ 50,091 Short-term portion of financing obligations 3,700 10,432 Short-term portion of operating leases 4,701 3,381 Total current liabilities 64,612 63,904 Convertible senior notes, net 166,440 Long-term portion of financing obligations 1,399 95,028 Long-term portion of operating leases 43,123 24,034 Other long-term liabilities 3,937 3,566 Deferred income tax liability, net 13,554 15,566 Total long-term liabilities 228,453 138,194 TOTAL LIABILITIES $ 293,065 $ 202,098 $ 666,363 $ 507,408 $ 959,428 $ 709,506 30

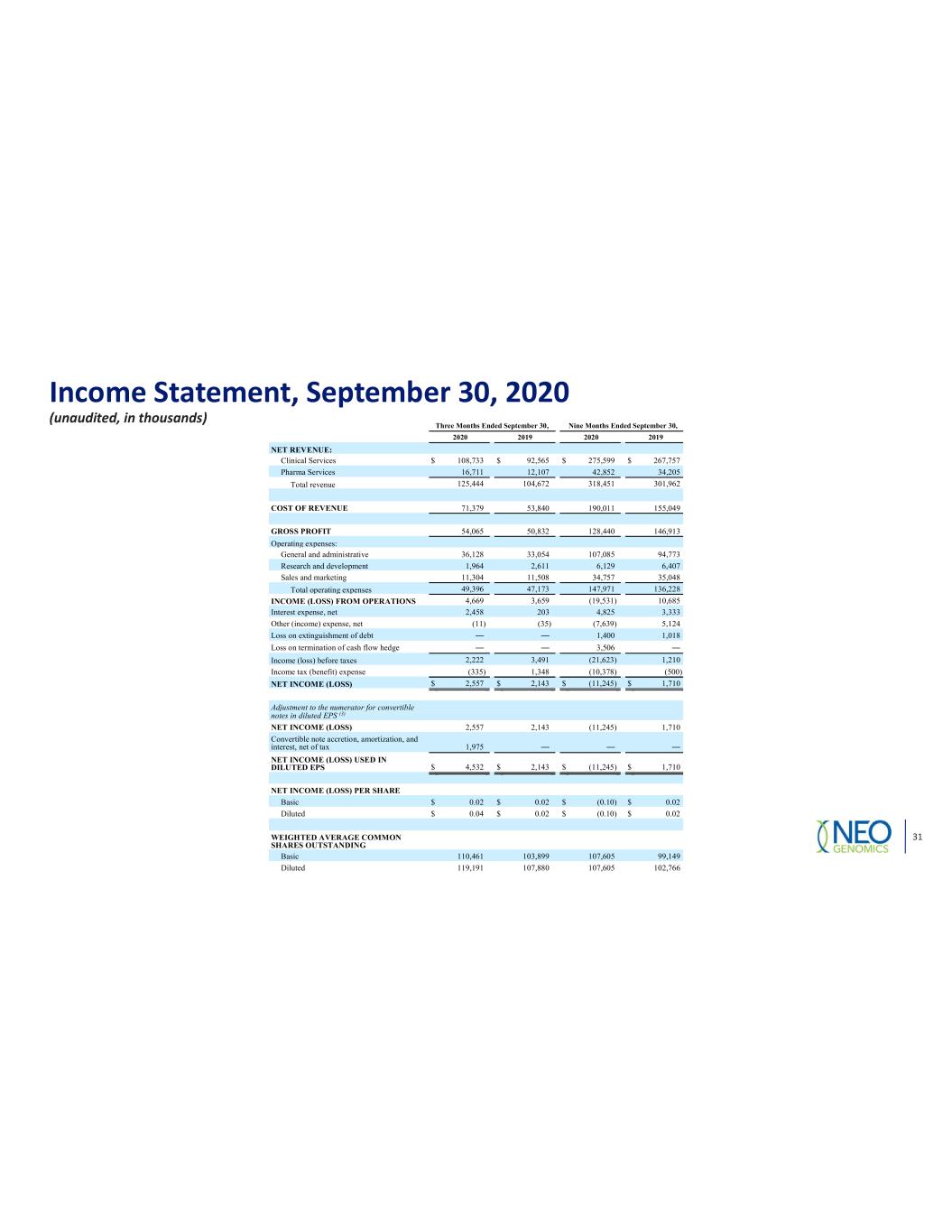

Income Statement, September 30, 2020 (unaudited, in thousands) 31 Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 NET REVENUE: Clinical Services $ 108,733 $ 92,565 $ 275,599 $ 267,757 Pharma Services 16,711 12,107 42,852 34,205 Total revenue 125,444 104,672 318,451 301,962 COST OF REVENUE 71,379 53,840 190,011 155,049 GROSS PROFIT 54,065 50,832 128,440 146,913 Operating expenses: General and administrative 36,128 33,054 107,085 94,773 Research and development 1,964 2,611 6,129 6,407 Sales and marketing 11,304 11,508 34,757 35,048 Total operating expenses 49,396 47,173 147,971 136,228 INCOME (LOSS) FROM OPERATIONS 4,669 3,659 (19,531) 10,685 Interest expense, net 2,458 203 4,825 3,333 Other (income) expense, net (11) (35) (7,639) 5,124 Loss on extinguishment of debt 1,400 1,018 Loss on termination of cash flow hedge 3,506 Income (loss) before taxes 2,222 3,491 (21,623) 1,210 Income tax (benefit) expense (335) 1,348 (10,378) (500) NET INCOME (LOSS) $ 2,557 $ 2,143 $ (11,245) $ 1,710 Adjustment to the numerator for convertible notes in diluted EPS (3) NET INCOME (LOSS) 2,557 2,143 (11,245) 1,710 Convertible note accretion, amortization, and interest, net of tax 1,975 NET INCOME (LOSS) USED IN DILUTED EPS $ 4,532 $ 2,143 $ (11,245) $ 1,710 NET INCOME (LOSS) PER SHARE Basic $ 0.02 $ 0.02 $ (0.10) $ 0.02 Diluted $ 0.04 $ 0.02 $ (0.10) $ 0.02 WEIGHTED AVERAGE COMMON SHARES OUTSTANDING Basic 110,461 103,899 107,605 99,149 Diluted 119,191 107,880 107,605 102,766

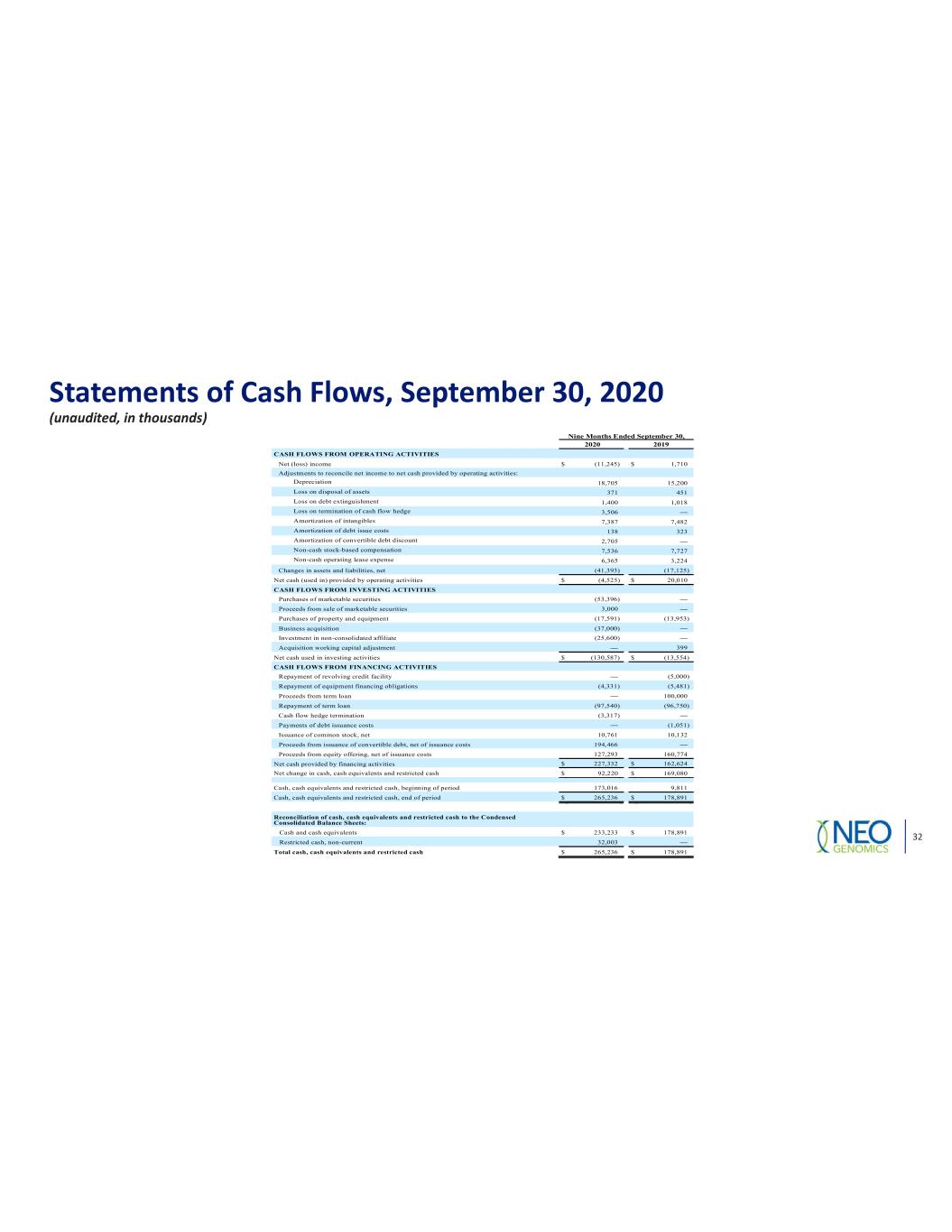

Statements of Cash Flows, September 30, 2020 (unaudited, in thousands) Nine Months Ended September 30, 2020 2019 CASH FLOWS FROM OPERATING ACTIVITIES Net (loss) income $ (11,245) $ 1,710 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 18,705 15,200 Loss on disposal of assets 371 451 Loss on debt extinguishment 1,400 1,018 Loss on termination of cash flow hedge 3,506 Amortization of intangibles 7,387 7,482 Amortization of debt issue costs 138 323 Amortization of convertible debt discount 2,705 Non-cash stock-based compensation 7,536 7,727 Non-cash operating lease expense 6,365 3,224 Changes in assets and liabilities, net (41,393) (17,125) Net cash (used in) provided by operating activities $ (4,525) $ 20,010 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of marketable securities (53,396) Proceeds from sale of marketable securities 3,000 Purchases of property and equipment (17,591) (13,953) Business acquisition (37,000) Investment in non-consolidated affiliate (25,600) Acquisition working capital adjustment 399 Net cash used in investing activities $ (130,587) $ (13,554) CASH FLOWS FROM FINANCING ACTIVITIES Repayment of revolving credit facility (5,000) Repayment of equipment financing obligations (4,331) (5,481) Proceeds from term loan 100,000 Repayment of term loan (97,540) (96,750) Cash flow hedge termination (3,317) Payments of debt issuance costs (1,051) Issuance of common stock, net 10,761 10,132 Proceeds from issuance of convertible debt, net of issuance costs 194,466 Proceeds from equity offering, net of issuance costs 127,293 160,774 Net cash provided by financing activities $ 227,332 $ 162,624 Net change in cash, cash equivalents and restricted cash $ 92,220 $ 169,080 Cash, cash equivalents and restricted cash, beginning of period 173,016 9,811 Cash, cash equivalents and restricted cash, end of period $ 265,236 $ 178,891 Reconciliation of cash, cash equivalents and restricted cash to the Condensed Consolidated Balance Sheets: Cash and cash equivalents $ 233,233 $ 178,891 Restricted cash, non-current 32,003 Total cash, cash equivalents and restricted cash $ 265,236 $ 178,891 32

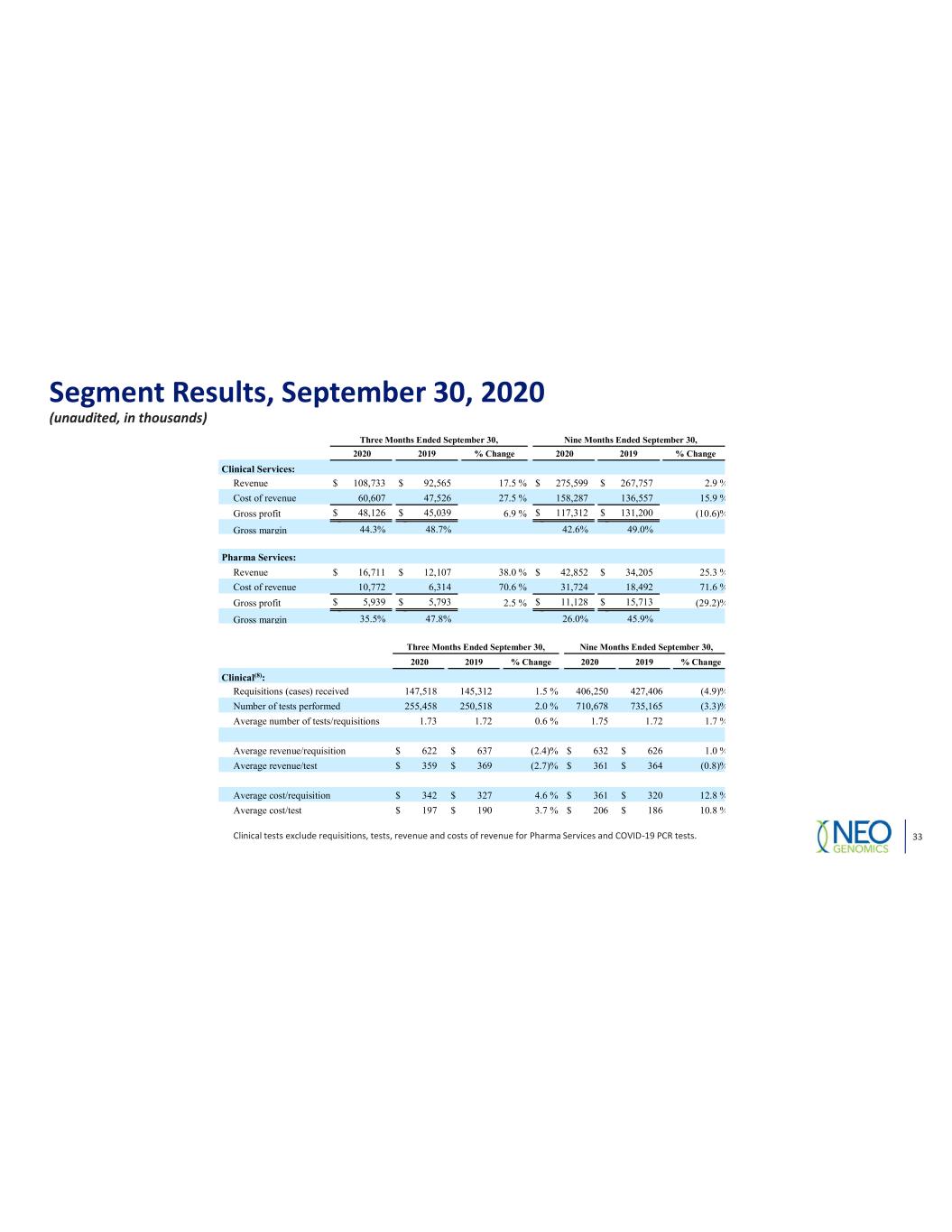

Segment Results, September 30, 2020 (unaudited, in thousands) Clinical tests exclude requisitions, tests, revenue and costs of revenue for Pharma Services and COVID 19 PCR tests. Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 % Change 2020 2019 % Change Clinical Services: Revenue $ 108,733 $ 92,565 17.5 % $ 275,599 $ 267,757 2.9 % Cost of revenue 60,607 47,526 27.5 % 158,287 136,557 15.9 % Gross profit $ 48,126 $ 45,039 6.9 % $ 117,312 $ 131,200 (10.6)% Gross margin 44.3% 48.7% 42.6% 49.0% Pharma Services: Revenue $ 16,711 $ 12,107 38.0 % $ 42,852 $ 34,205 25.3 % Cost of revenue 10,772 6,314 70.6 % 31,724 18,492 71.6 % Gross profit $ 5,939 $ 5,793 2.5 % $ 11,128 $ 15,713 (29.2)% Gross margin 35.5% 47.8% 26.0% 45.9% Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 % Change 2020 2019 % Change Clinical(8): Requisitions (cases) received 147,518 145,312 1.5 % 406,250 427,406 (4.9)% Number of tests performed 255,458 250,518 2.0 % 710,678 735,165 (3.3)% Average number of tests/requisitions 1.73 1.72 0.6 % 1.75 1.72 1.7 % Average revenue/requisition $ 622 $ 637 (2.4)% $ 632 $ 626 1.0 % Average revenue/test $ 359 $ 369 (2.7)% $ 361 $ 364 (0.8)% Average cost/requisition $ 342 $ 327 4.6 % $ 361 $ 320 12.8 % Average cost/test $ 197 $ 190 3.7 % $ 206 $ 186 10.8 % 33

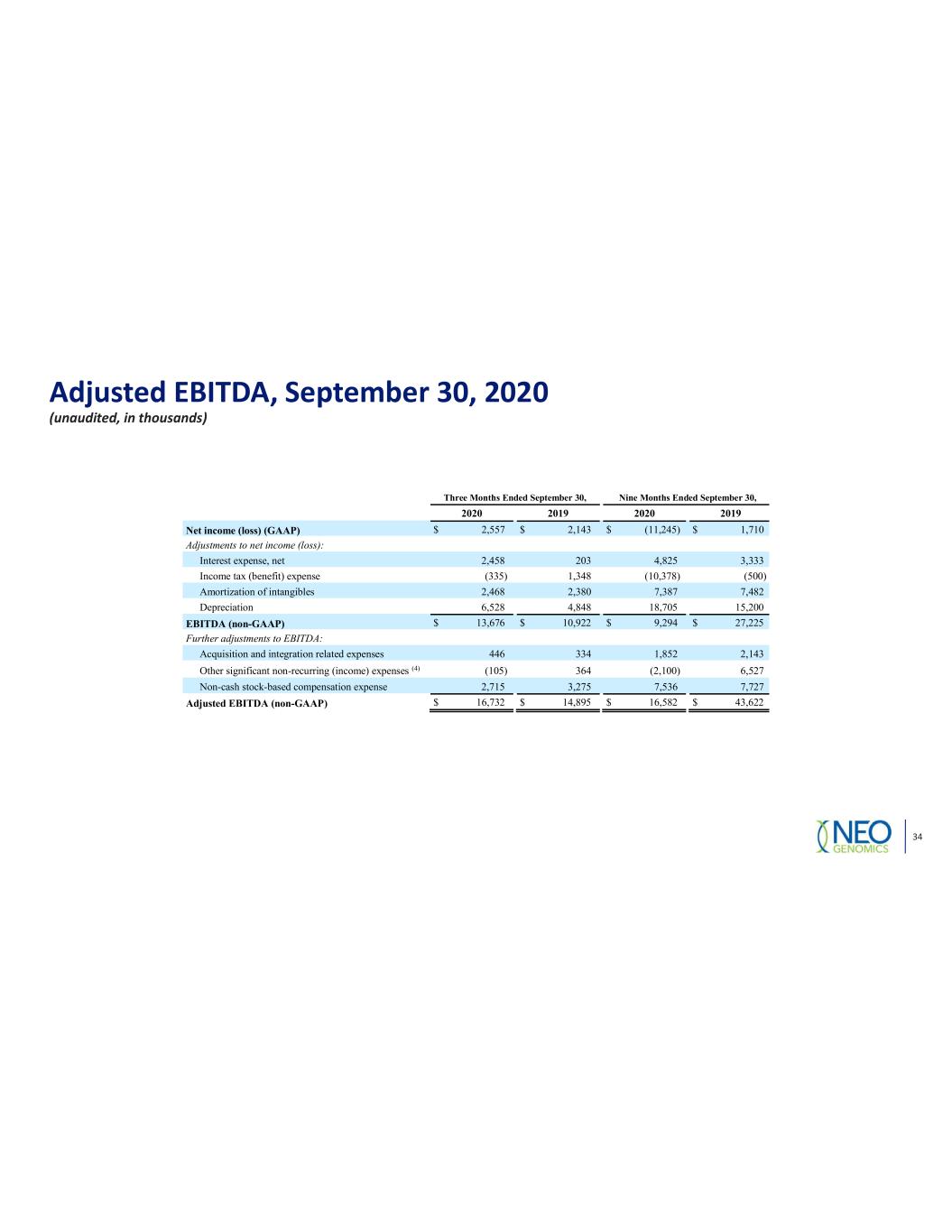

Adjusted EBITDA, September 30, 2020 (unaudited, in thousands) Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Net income (loss) (GAAP) $ 2,557 $ 2,143 $ (11,245) $ 1,710 Adjustments to net income (loss): Interest expense, net 2,458 203 4,825 3,333 Income tax (benefit) expense (335) 1,348 (10,378) (500) Amortization of intangibles 2,468 2,380 7,387 7,482 Depreciation 6,528 4,848 18,705 15,200 EBITDA (non-GAAP) $ 13,676 $ 10,922 $ 9,294 $ 27,225 Further adjustments to EBITDA: Acquisition and integration related expenses 446 334 1,852 2,143 Other significant non-recurring (income) expenses (4) (105) 364 (2,100) 6,527 Non-cash stock-based compensation expense 2,715 3,275 7,536 7,727 Adjusted EBITDA (non-GAAP) $ 16,732 $ 14,895 $ 16,582 $ 43,622 34