EX-99.1

Published on February 25, 2021

NeoGenomics Investor Presentation January 2021 1 Exhibit 99.1

Forward-Looking Statements 2 This presentation has been prepared by NeoGenomics, Inc. (“we,” ”us,” “our,” “NeoGenomics” or the “Company”) and is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward-looking statements. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward-looking statements due to numerous known and unknown risks and uncertainties. All forward-looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Non-GAAP Adjusted EBITDA “Adjusted EBITDA” is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, (iv) non-cash stock-based compensation expense, and, if applicable in a reporting period, (v) acquisition and integration related expenses, (vi) non-cash impairments of intangible assets, (vii) and other significant non-recurring or non-operating (income) or expenses, including any debt financing costs. Exhibit 99.1

We save lives by improving patient care. By providing uncompromising quality, exceptional service and innovative solutions, we are becoming the world’s leading cancer testing and information company. Quality, integrity, accountability, teamwork, innovation. NeoGenomics We are Focused and Genuine Our Common Purpose Our Values Our Vision 3 Exhibit 99.1

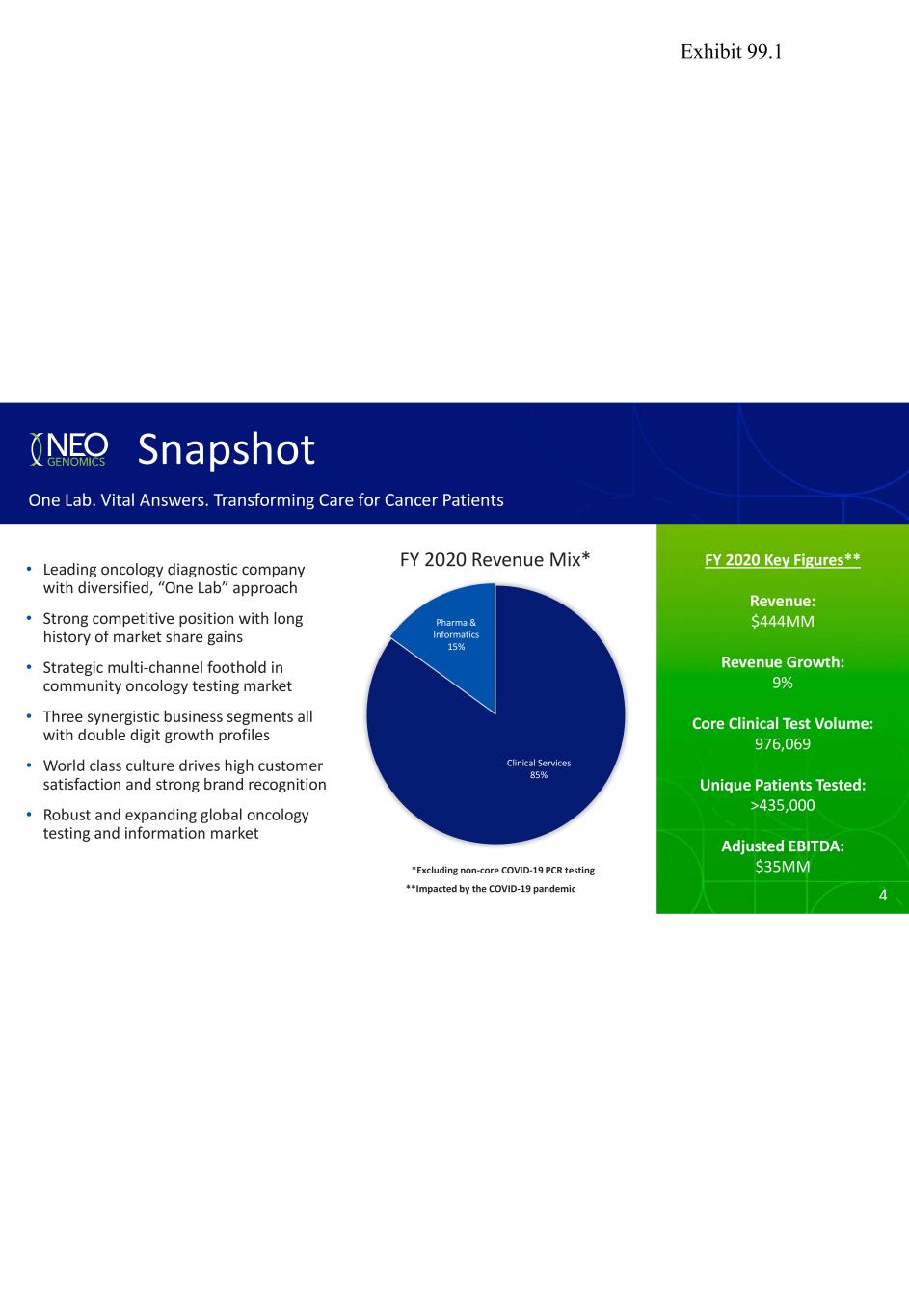

4 FY 2020 Key Figures** Revenue: $444MM Revenue Growth: 9% Core Clinical Test Volume: 976,069 Unique Patients Tested: >435,000 Adjusted EBITDA: $35MM FY 2020 Revenue Mix* Snapshot One Lab. Vital Answers. Transforming Care for Cancer Patients • Leading oncology diagnostic company with diversified, “One Lab” approach • Strong competitive position with long history of market share gains • Strategic multi-channel foothold in community oncology testing market • Three synergistic business segments all with double digit growth profiles • World class culture drives high customer satisfaction and strong brand recognition • Robust and expanding global oncology testing and information market Clinical Services 85% Pharma & Informatics 15% *Excluding non-core COVID-19 PCR testing 4**Impacted by the COVID-19 pandemic Exhibit 99.1

Informatics Division One Lab. Vital Answers. 5 Leading oncology diagnostics company, designed to provide innovative diagnostic and data solutions that bridge oncologists, pathologists, and therapeutic development • Leading oncology reference lab market share for oncologists, pathologists and hospitals • Comprehensive oncology test menu including all major testing modalities • Direct national commercial team of ~100 people • A longstanding reputation for service and quality in the community oncology market • Leading provider of oncology-focused research and clinical trials services • Comprehensive support from pre-clinical and research discovery through FDA filing, approval and launch • Global footprint (U.S., Switzerland, Singapore, China) • Approximately $209MM(1) in backlog (signed contracts) Pharma Services DivisionClinical Services Division • Formed in 2020 to utilize clinical testing data to address real world problems for Patients and other stakeholders • Our information platform includes one of the largest cancer testing database, covering the complete spectrum of oncology testing modalities for over 1.6 million patients and growing NOTE: 1. As of December 31, 2020 Exhibit 99.1

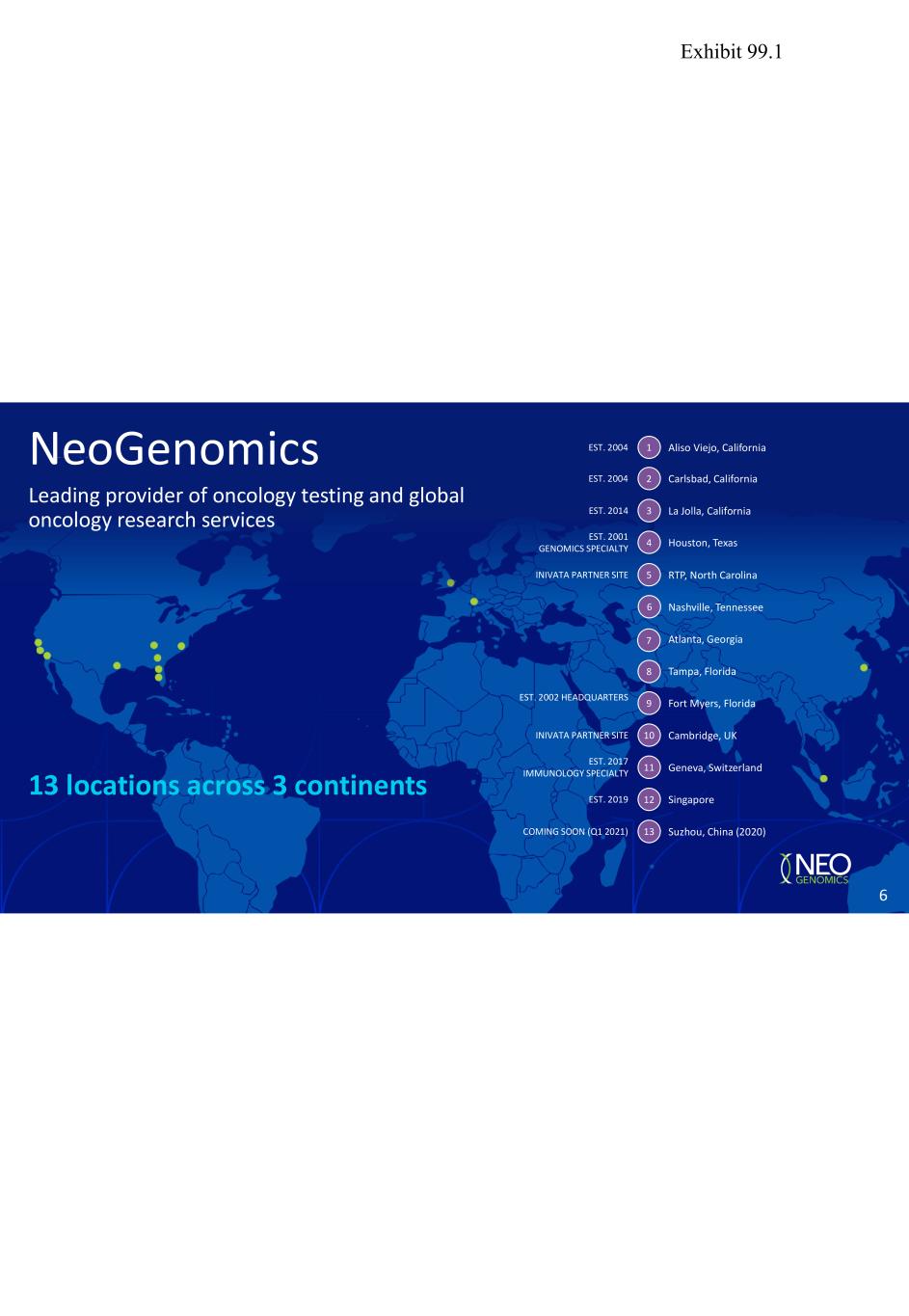

13 locations across 3 continents Leading provider of oncology testing and global oncology research services NeoGenomics Carlsbad, California Houston, Texas La Jolla, California Fort Myers, Florida Tampa, Florida Atlanta, Georgia Nashville, Tennessee RTP, North Carolina Cambridge, UK Geneva, Switzerland Singapore Suzhou, China (2020) EST. 2004 EST. 2014 EST. 2001 GENOMICS SPECIALTY EST. 2002 HEADQUARTERS EST. 2017 IMMUNOLOGY SPECIALTY EST. 2019 COMING SOON (Q1 2021) 2 3 4 5 9 10 11 12 13 INIVATA PARTNER SITE INIVATA PARTNER SITE 6 7 8 Aliso Viejo, CaliforniaEST. 2004 1 6 Exhibit 99.1

Oncology Testing Market Tailwinds Estimated 6% to 8% annual market growth with upside potential Demographics An aging population is resulting in higher cancer incidence Increased cancer survival rates leading to more follow-on testing Precision Medicine & Drug Development Proliferation and complexity of therapeutic options driving more testing Burgeoning oncology drug pipeline underlying current Pharma Services demand and likely to drive demand for future clinical testing New platforms and tests (NGS, TMB, MSI, liquid biopsy, etc.) creating more test options for diagnosis, prognosis, and therapy selection Upside Potential: Emerging Opportunities Promising minimal residual disease tests in development such as strategic partner Inivata’s RaDaR assay could create a compelling recurrence monitoring opportunity We expect to develop a number of innovative value-add data offerings in our growing Informatics division 7 Exhibit 99.1

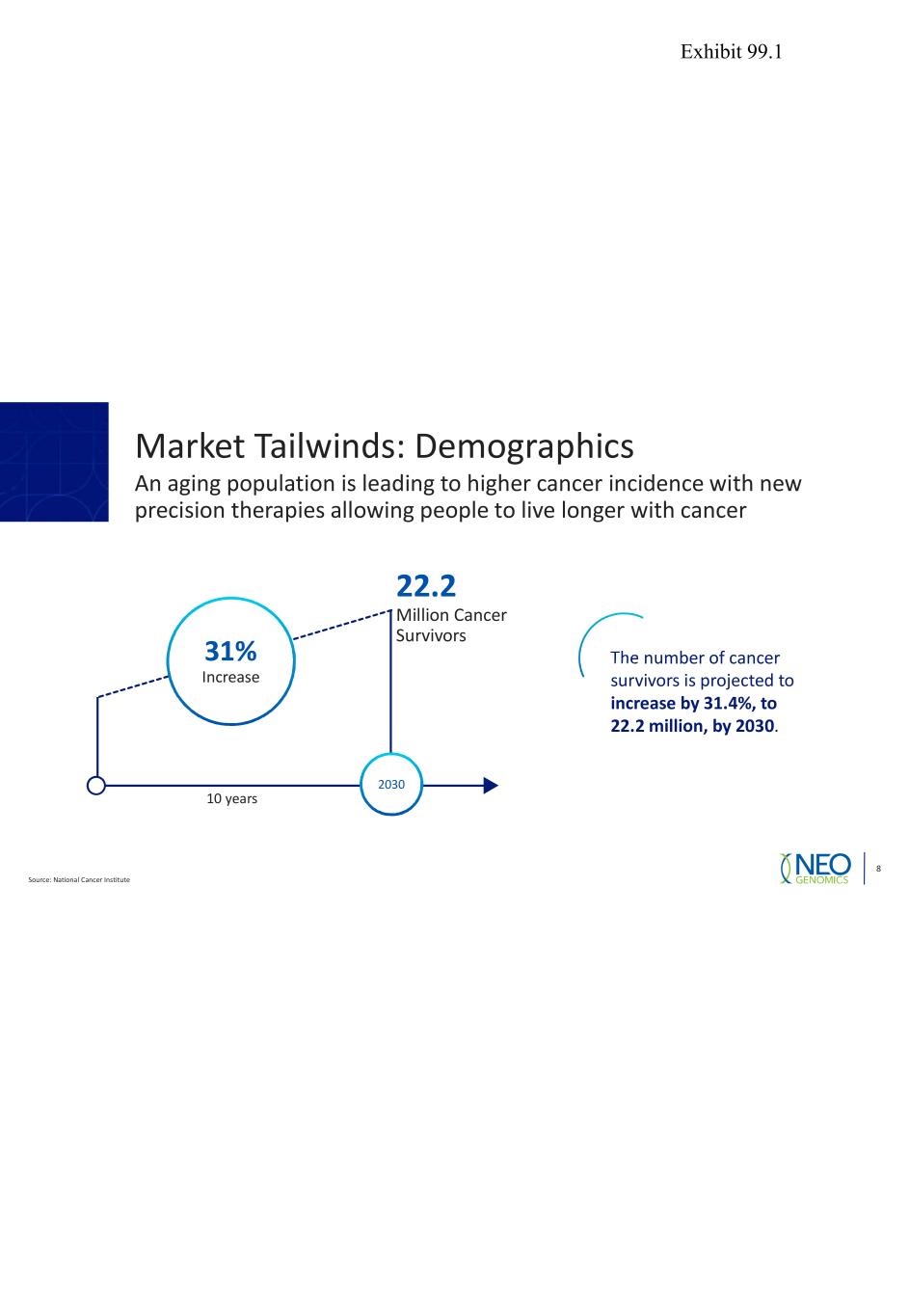

Market Tailwinds: Demographics An aging population is leading to higher cancer incidence with new precision therapies allowing people to live longer with cancer Source: National Cancer Institute 8 2030 22.2 Million Cancer Survivors 10 years 31% Increase The number of cancer survivors is projected to increase by 31.4%, to 22.2 million, by 2030. Exhibit 99.1

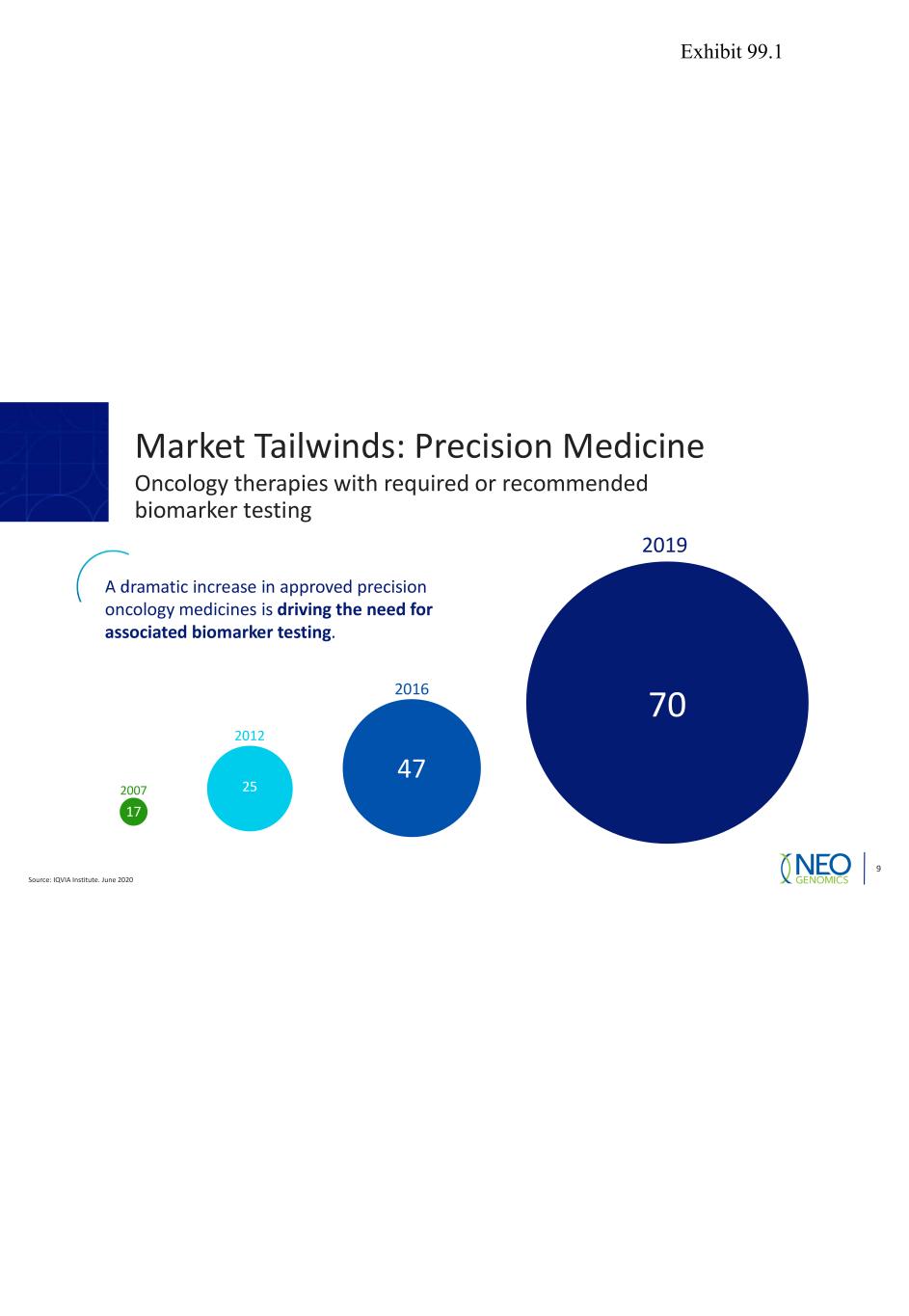

Source: IQVIA Institute. June 2020 9 2007 2012 2016 2019 70 47 25 17 A dramatic increase in approved precision oncology medicines is driving the need for associated biomarker testing. Market Tailwinds: Precision Medicine Oncology therapies with required or recommended biomarker testing Exhibit 99.1

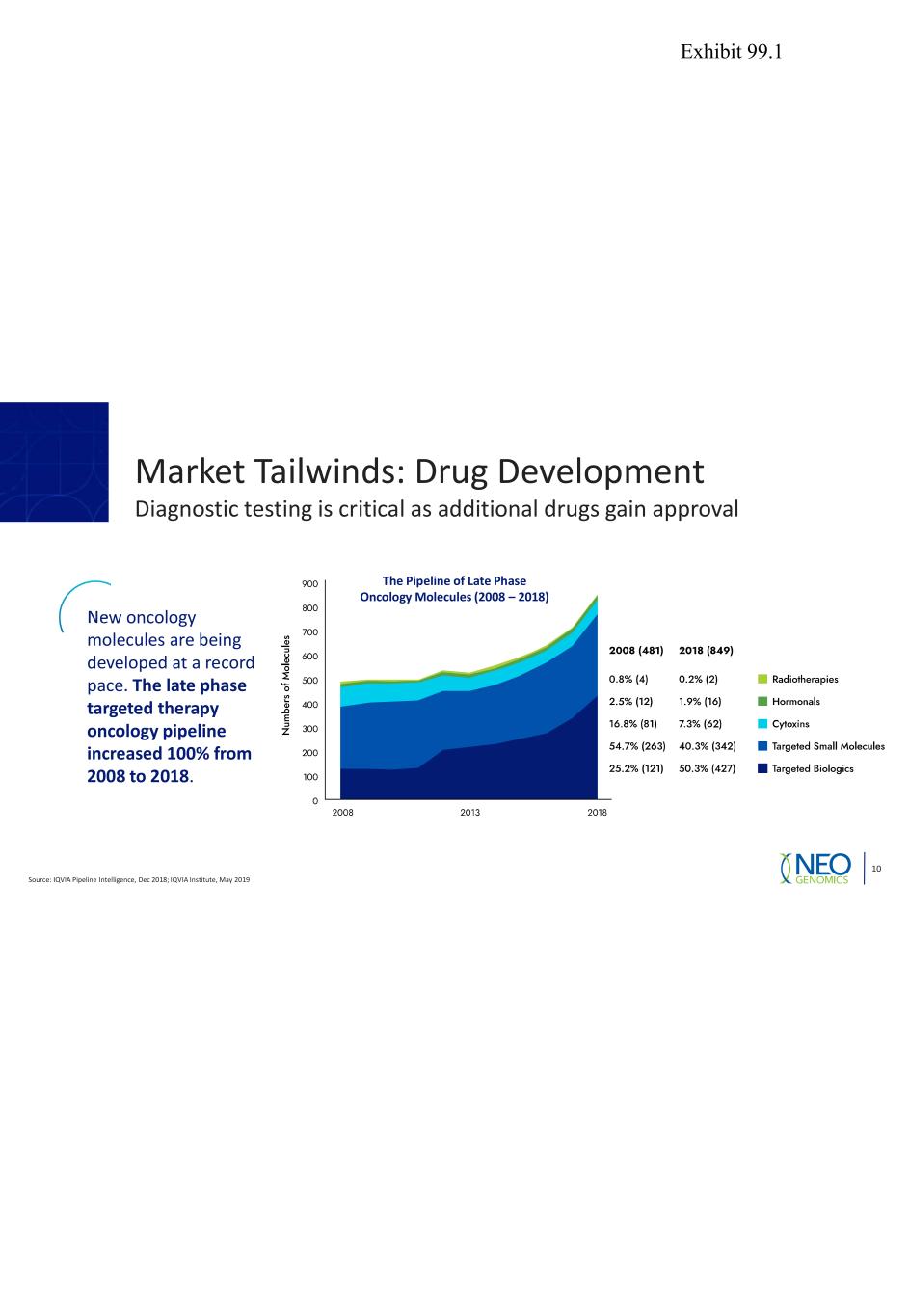

Market Tailwinds: Drug Development Diagnostic testing is critical as additional drugs gain approval Source: IQVIA Pipeline Intelligence, Dec 2018; IQVIA Institute, May 2019 10 New oncology molecules are being developed at a record pace. The late phase targeted therapy oncology pipeline increased 100% from 2008 to 2018. The Pipeline of Late Phase Oncology Molecules (2008 – 2018) Exhibit 99.1

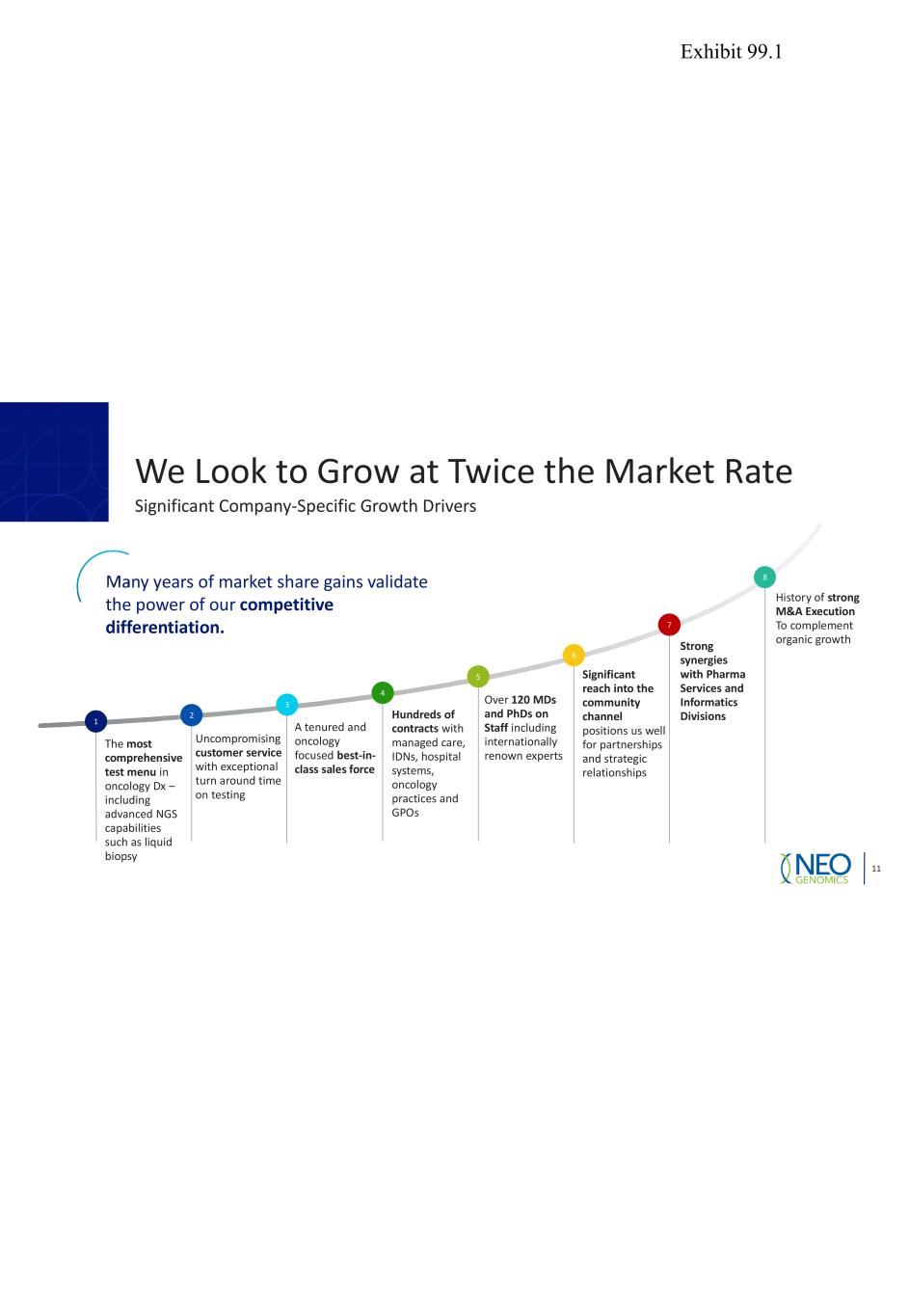

We Look to Grow at Twice the Market Rate 11 Significant Company-Specific Growth Drivers 1 The most comprehensive test menu in oncology Dx – including advanced NGS capabilities such as liquid biopsy 2 Uncompromising customer service with exceptional turn around time on testing 3 4 5 Over 120 MDs and PhDs on Staff including internationally renown experts 6 7 8Many years of market share gains validate the power of our competitive differentiation. Strong synergies with Pharma Services and Informatics Divisions A tenured and oncology focused best-in- class sales force Hundreds of contracts with managed care, IDNs, hospital systems, oncology practices and GPOs History of strong M&A Execution To complement organic growth Significant reach into the community channel positions us well for partnerships and strategic relationships Exhibit 99.1

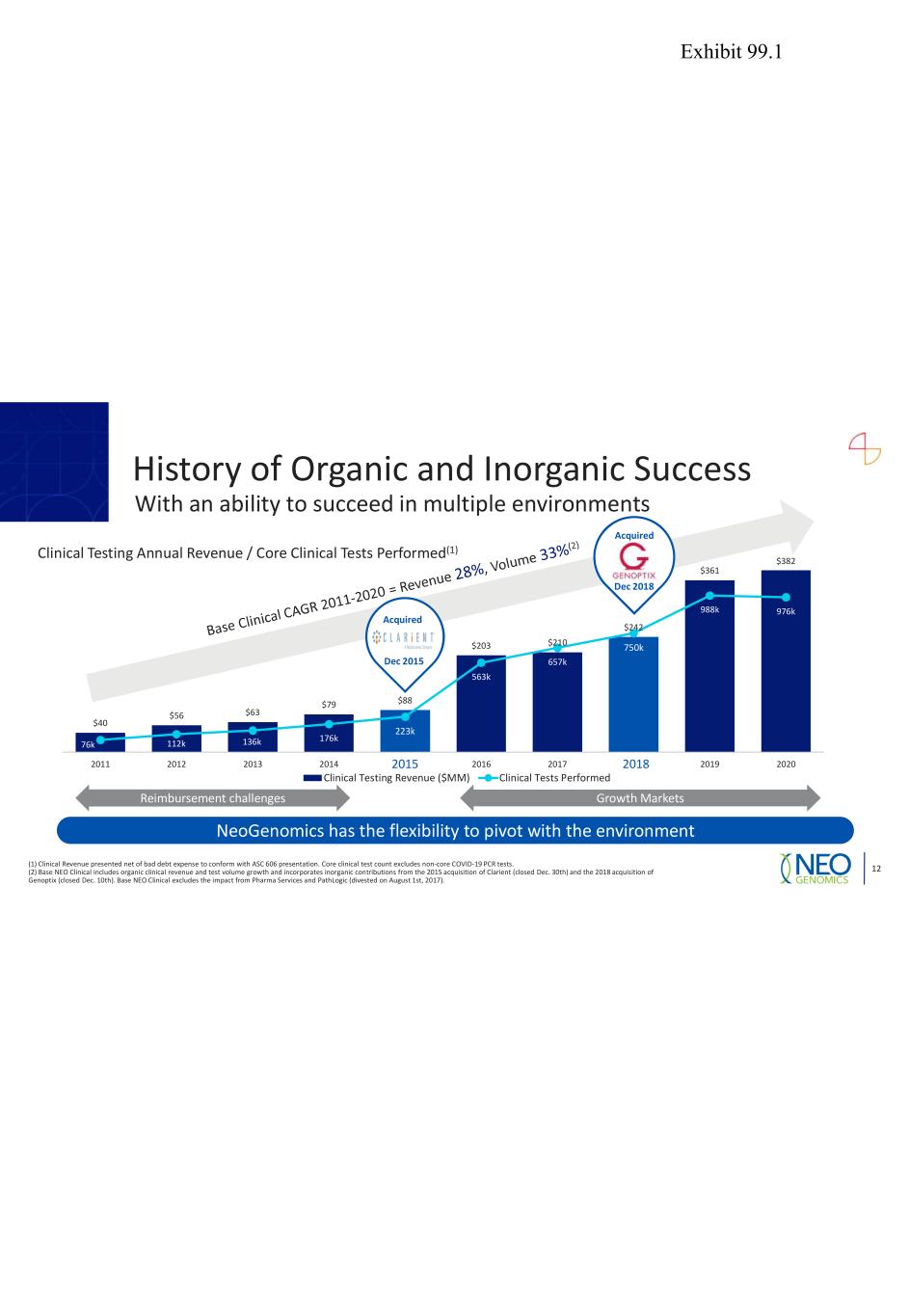

$40 $56 $63 $79 $88 $203 $210 $242 $361 $382 76k 112k 136k 176k 223k 563k 657k 750k 988k 976k 0 200 400 600 800 1,000 1,200 0 50 100 150 200 250 300 350 400 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Clinical Testing Revenue ($MM) Clinical Tests Performed Clinical Testing Annual Revenue / Core Clinical Tests Performed(1) 82 Acquired Growth MarketsReimbursement challenges NeoGenomics has the flexibility to pivot with the environment History of Organic and Inorganic Success With an ability to succeed in multiple environments 12 Acquired Dec 2015 (1) Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. Core clinical test count excludes non-core COVID-19 PCR tests. (2) Base NEO Clinical includes organic clinical revenue and test volume growth and incorporates inorganic contributions from the 2015 acquisition of Clarient (closed Dec. 30th) and the 2018 acquisition of Genoptix (closed Dec. 10th). Base NEO Clinical excludes the impact from Pharma Services and PathLogic (divested on August 1st, 2017). Dec 2018 Exhibit 99.1

Our Focus Is The Community Setting We bring state-of-the-art oncology testing to the masses 13 NeoGenomics works with >4,400 hospitals, institutions and oncology offices, most in the community setting, to ensure all patients can benefit from high-quality diagnostic tests to support Precision Medicine Community Hospital Community Oncology Office Community Channel 80% to 85% of all cancer patients are treated by community oncologists Exhibit 99.1

Comprehensive Oncology Test Menu A low Beta approach to a massive high growth end market 14 • Consultation pathology • Immunochemistry • Immunohistochemistry • Digital imaging • Automated quantitative IHC • Global and tech-only service • 10-color flow • MRD detection • Global and tech-only service • Extensive automation for high quality/low cost • Robust Library of validated probes • Global and tech-only service FISH • Next-gen sequencing • Liquid biopsy • Whole exome sequencing • Sanger sequencing • Real time qPCR • SNP microarray MolecularAnatomic Pathology Flow Cytometry Cytogenetics Right Test • Right Patient • Right Time Flexible AppropriateTechnology Agnostic Exhibit 99.1

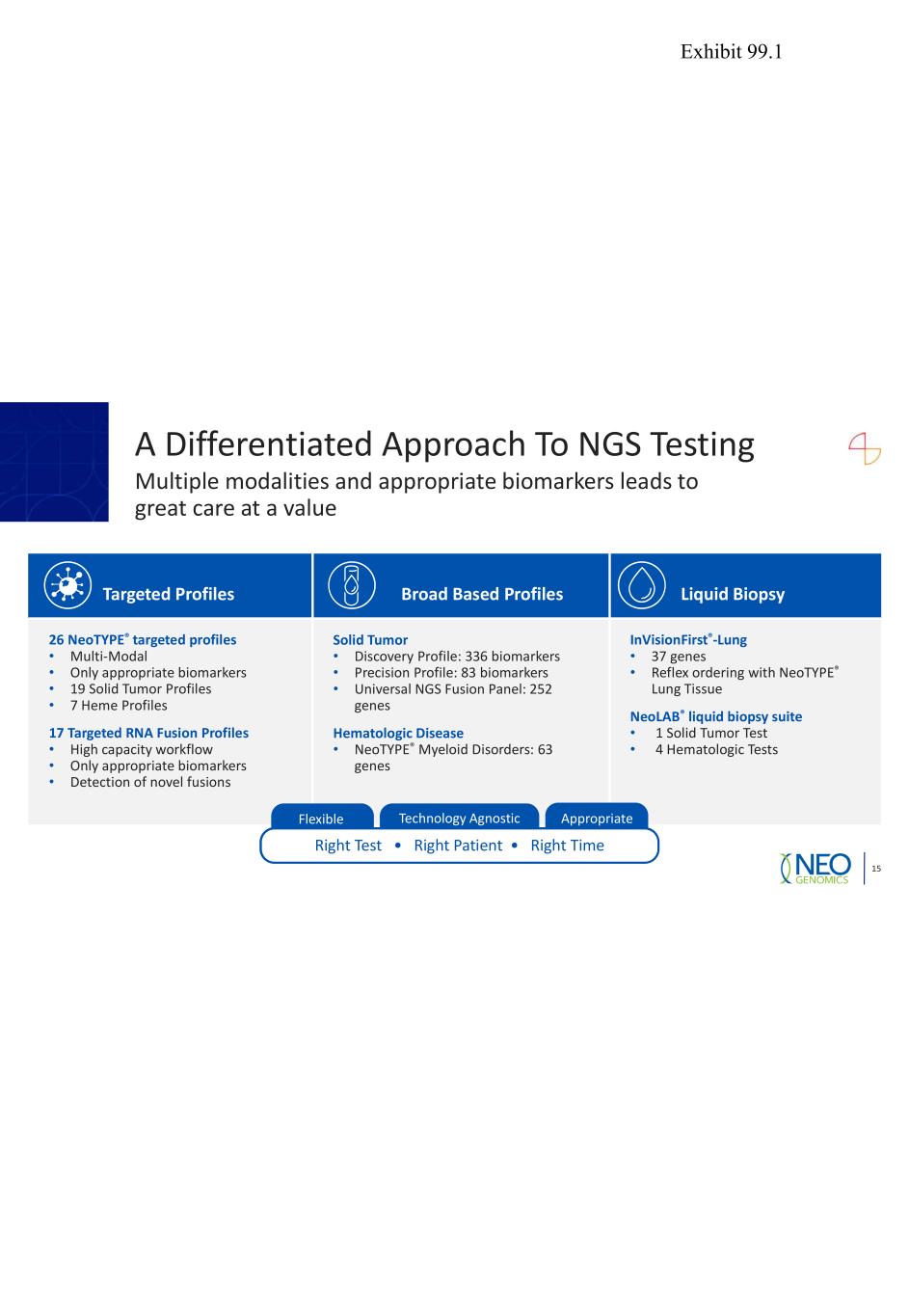

Targeted Profiles Broad Based Profiles Liquid Biopsy 26 NeoTYPE® targeted profiles • Multi-Modal • Only appropriate biomarkers • 19 Solid Tumor Profiles • 7 Heme Profiles 17 Targeted RNA Fusion Profiles • High capacity workflow • Only appropriate biomarkers • Detection of novel fusions Solid Tumor • Discovery Profile: 336 biomarkers • Precision Profile: 83 biomarkers • Universal NGS Fusion Panel: 252 genes Hematologic Disease • NeoTYPE® Myeloid Disorders: 63 genes InVisionFirst®-Lung • 37 genes • Reflex ordering with NeoTYPE® Lung Tissue NeoLAB® liquid biopsy suite • 1 Solid Tumor Test • 4 Hematologic Tests 15 Right Test • Right Patient • Right Time Flexible AppropriateTechnology Agnostic A Differentiated Approach To NGS Testing Multiple modalities and appropriate biomarkers leads to great care at a value Exhibit 99.1

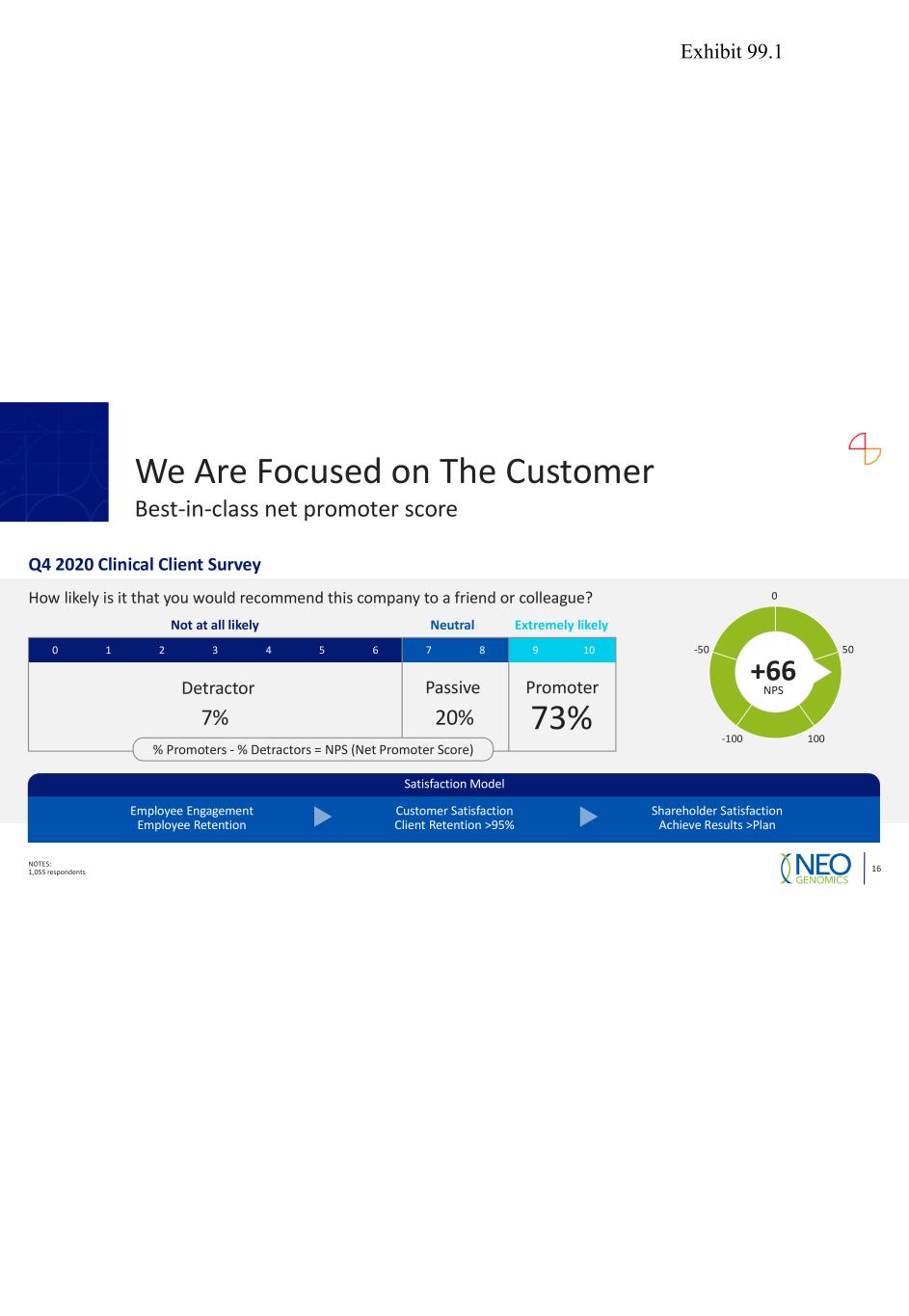

We Are Focused on The Customer NOTES: 1,055 respondents 16 Best-in-class net promoter score Q4 2020 Clinical Client Survey How likely is it that you would recommend this company to a friend or colleague? 0 1 2 3 4 5 6 7 8 9 10 Not at all likely Neutral Extremely likely Detractor Passive Promoter 7% 20% 73% 0 50 100-100 -50 +66 NPS Satisfaction Model Employee Engagement Employee Retention Customer Satisfaction Client Retention >95% Shareholder Satisfaction Achieve Results >Plan % Promoters - % Detractors = NPS (Net Promoter Score) Exhibit 99.1

Clinical Reference Labs with Oncology Divisions Niche Oncology Players High R&D investment and limited test menus 17 Diversified Focus Leading Share in U.S. Clinical Oncology Market Comprehensive, multi-modality “One Lab” position Large and advanced somatic cancer test menu Significant reach into all customer segments National footprint and extensive payer contracts Outstanding client service and partnership models Synergistic Pharma, Clinical and Informatics businesses Pure Play Oncology Diagnostic Lab Comprehensive Test Menu + Sustainable Growth Competing Through Focus, Scale and Scope We enjoy a unique position in the clinical market / Exhibit 99.1

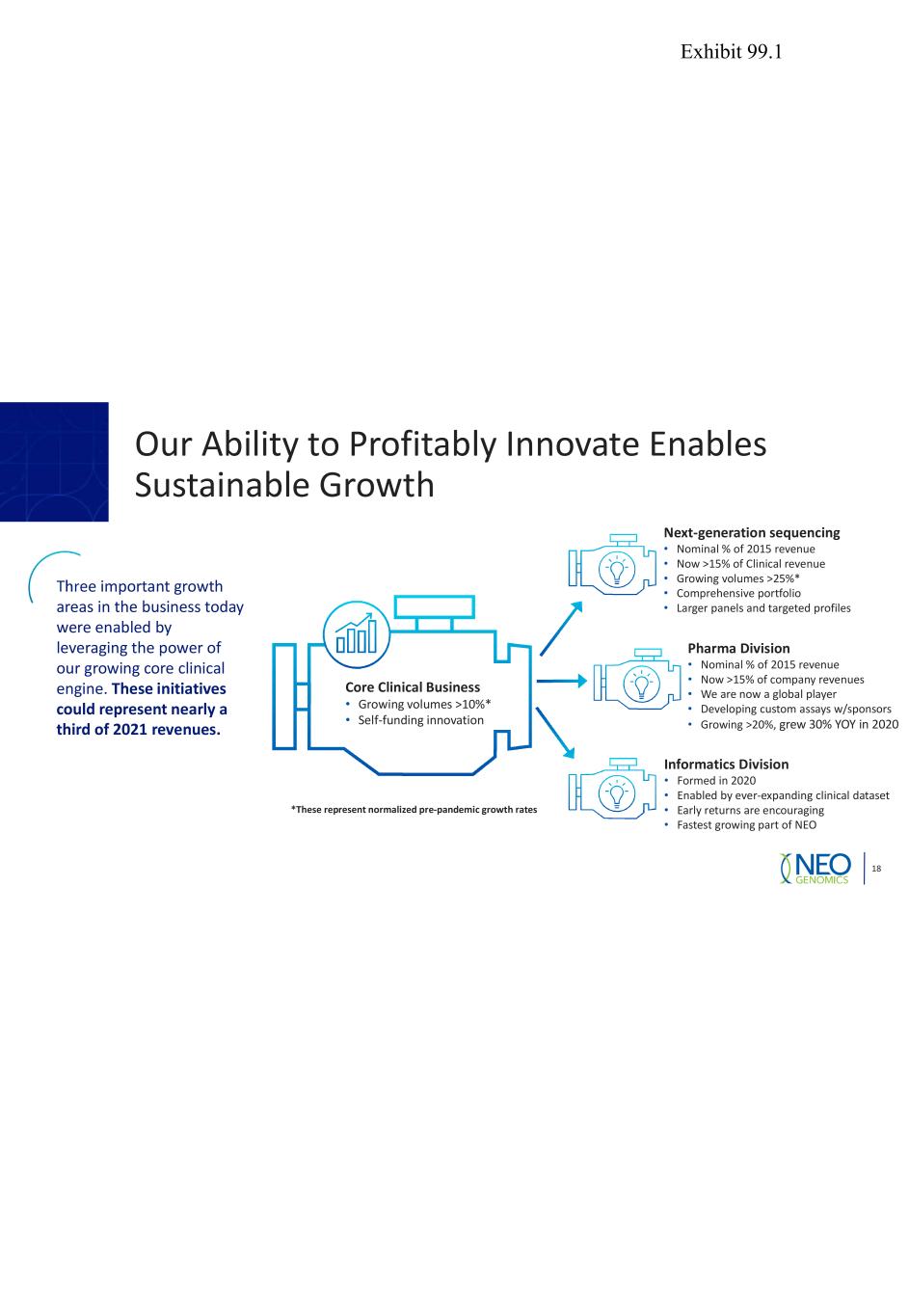

Our Ability to Profitably Innovate Enables Sustainable Growth 18 Core Clinical Business • Growing volumes >10%* • Self-funding innovation Three important growth areas in the business today were enabled by leveraging the power of our growing core clinical engine. These initiatives could represent nearly a third of 2021 revenues. Next-generation sequencing • Nominal % of 2015 revenue • Now >15% of Clinical revenue • Growing volumes >25%* • Comprehensive portfolio • Larger panels and targeted profiles Pharma Division • Nominal % of 2015 revenue • Now >15% of company revenues • We are now a global player • Developing custom assays w/sponsors • Growing >20%, grew 30% YOY in 2020 Informatics Division • Formed in 2020 • Enabled by ever-expanding clinical dataset • Early returns are encouraging • Fastest growing part of NEO *These represent normalized pre-pandemic growth rates Exhibit 99.1

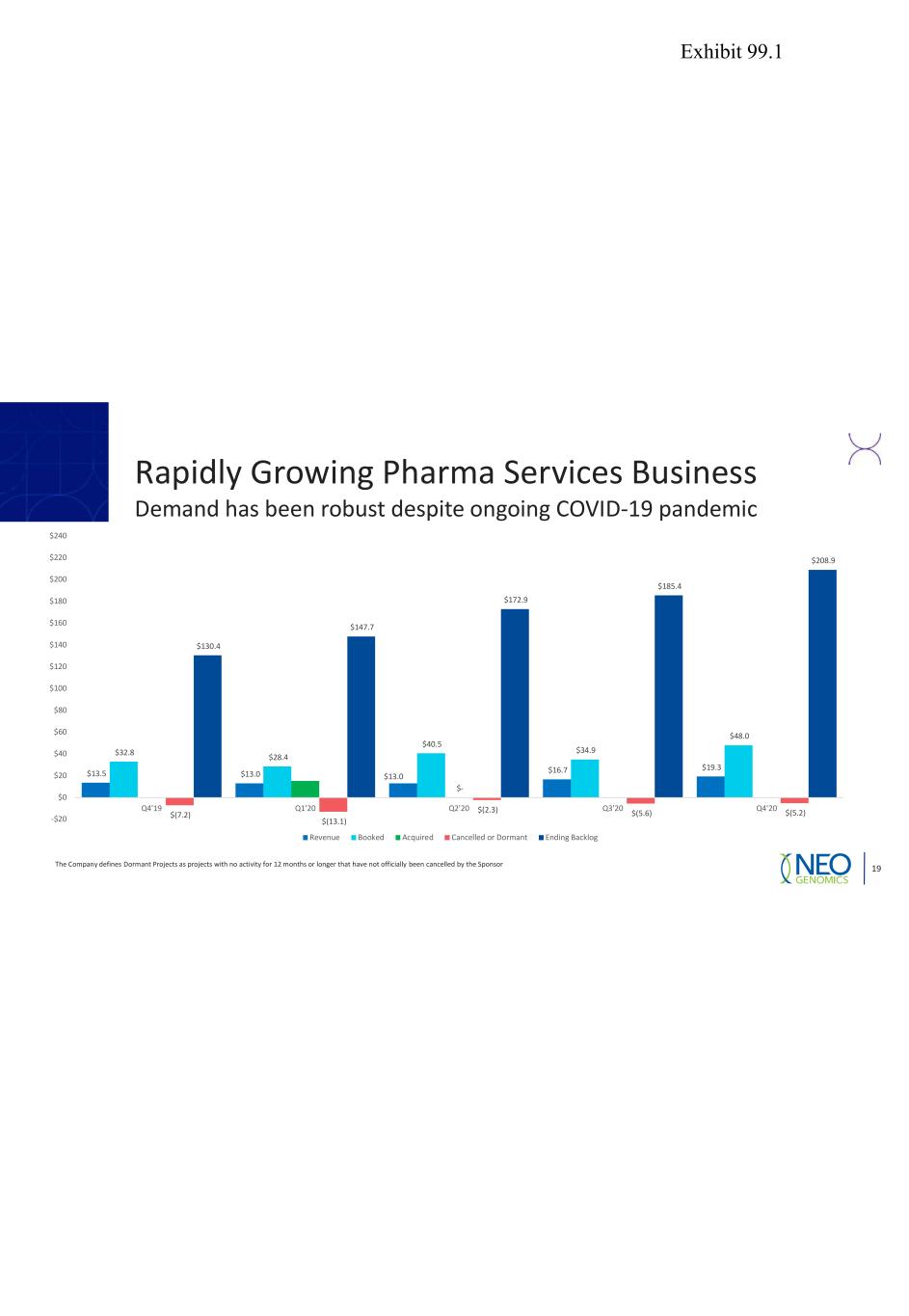

Rapidly Growing Pharma Services Business Demand has been robust despite ongoing COVID-19 pandemic The Company defines Dormant Projects as projects with no activity for 12 months or longer that have not officially been cancelled by the Sponsor 19 $13.5 $13.0 $13.0 $16.7 $19.3 $32.8 $28.4 $40.5 $34.9 $48.0 $- $(7.2) $(13.1) $(2.3) $(5.6) $(5.2) $130.4 $147.7 $172.9 $185.4 $208.9 -$20 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Revenue Booked Acquired Cancelled or Dormant Ending Backlog Exhibit 99.1

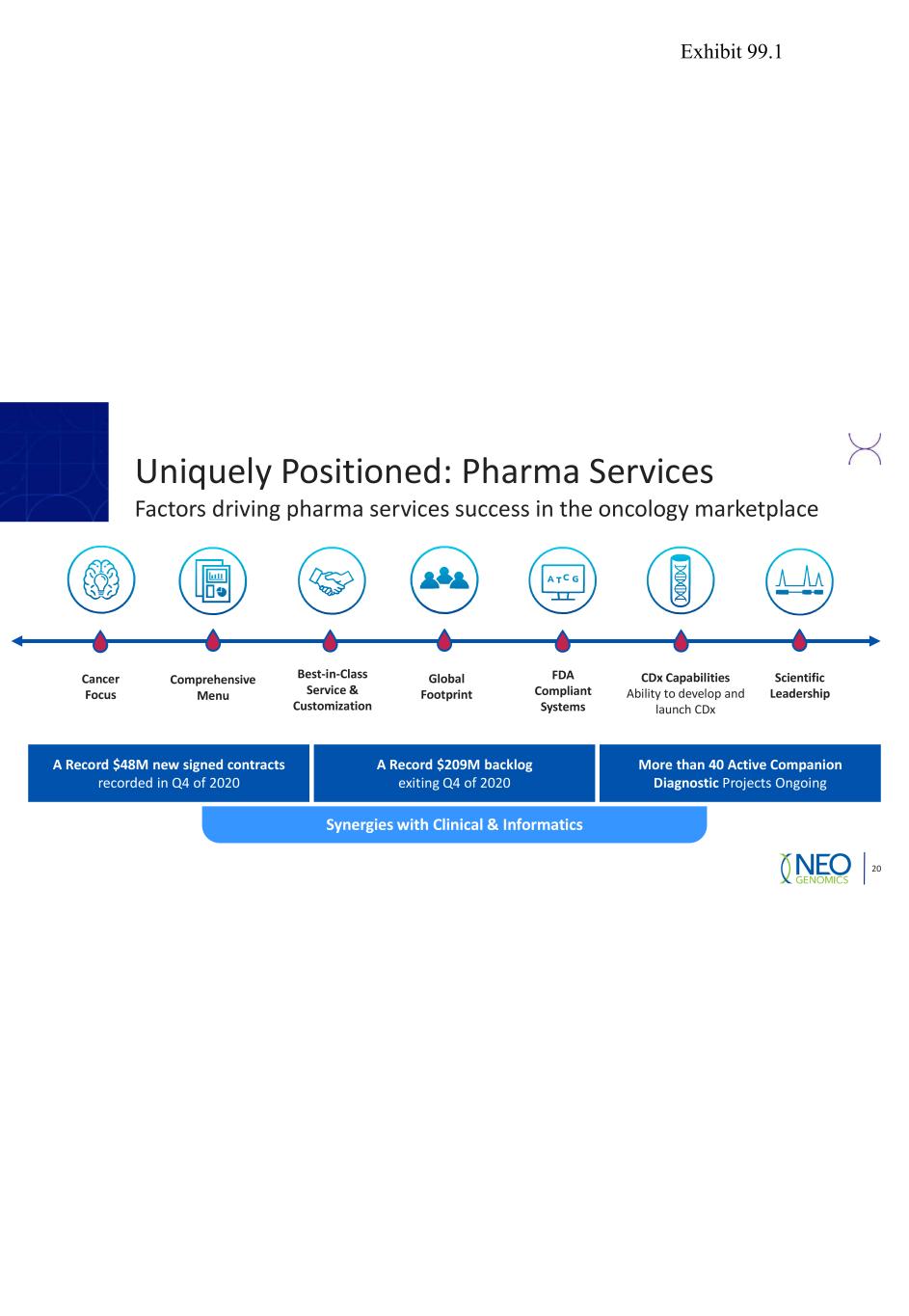

Uniquely Positioned: Pharma Services Factors driving pharma services success in the oncology marketplace 20 A Record $48M new signed contracts recorded in Q4 of 2020 Synergies with Clinical & Informatics More than 40 Active Companion Diagnostic Projects Ongoing A Record $209M backlog exiting Q4 of 2020 Comprehensive Menu Scientific Leadership CDx Capabilities Ability to develop and launch CDx Best-in-Class Service & Customization Cancer Focus Global Footprint FDA Compliant Systems Exhibit 99.1

Informatics Patient-focused. Data driven. 21 Our information platform includes one of the largest cancer testing databases, covering the complete spectrum of oncology testing modalities for over 1.6 million patients. >1.6M patients tested 5 years historical data >4,400 clinical clients >435k patients per year >68k Unique active providers ~1M tests/year Exhibit 99.1

Informatics Primary offerings today 22 Diagnostic lab alerts and commercial analytics Clinical trial matching and provider outreach Exhibit 99.1

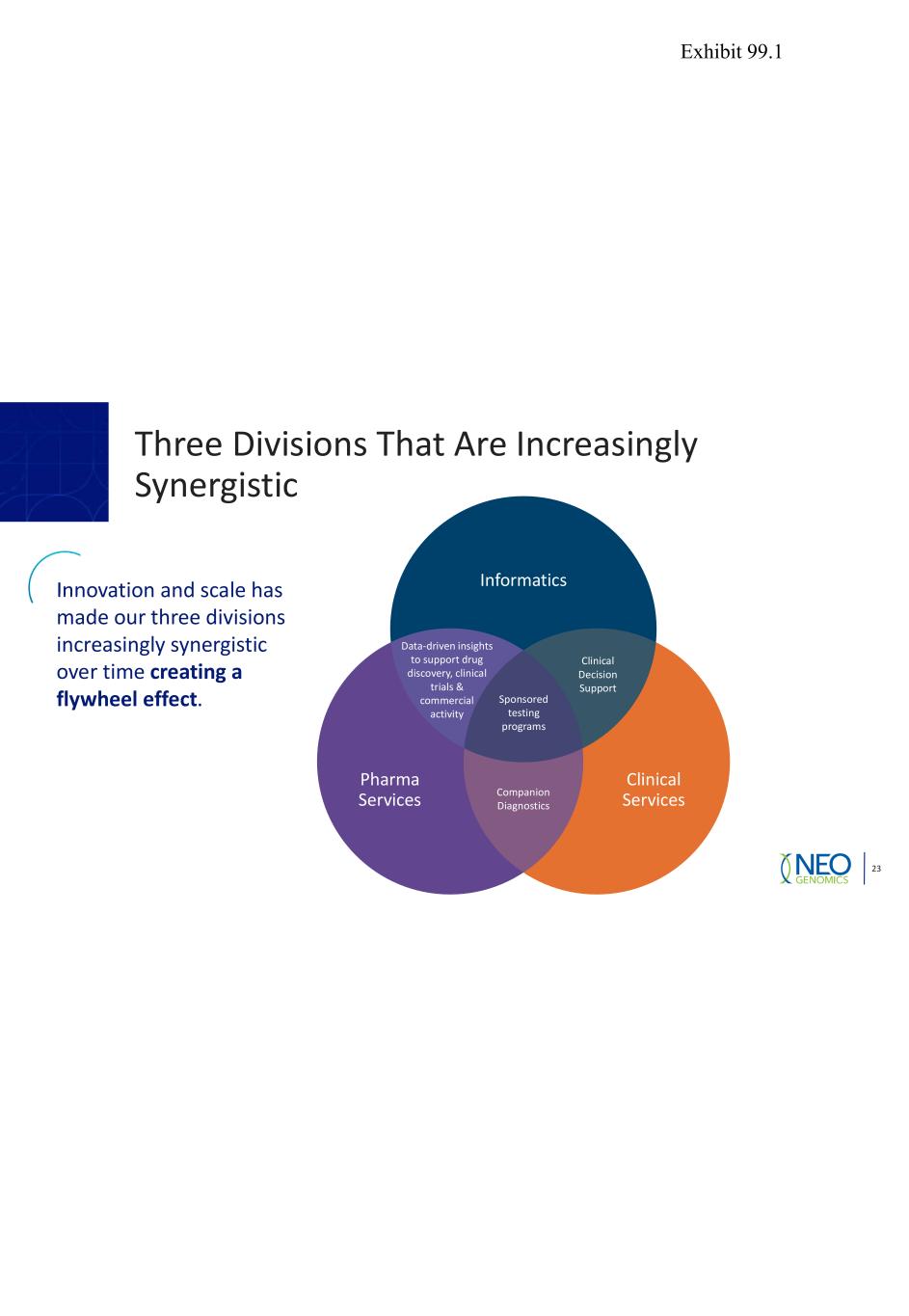

Three Divisions That Are Increasingly Synergistic 23 Innovation and scale has made our three divisions increasingly synergistic over time creating a flywheel effect. Data-driven insights to support drug discovery, clinical trials & commercial activity Clinical Decision Support Sponsored testing programs Clinical Services Pharma Services Informatics Companion Diagnostics Exhibit 99.1

Leading Oncology Diagnostics Company 24 Guided By Science And Passion For Patient Care We are a leader in the field of diagnostic testing with a significant share of patient test volume in the US Our extensive patient database allows us to optimize the pairing of patients with clinical trials We act as a collaborative partner to pathologists, oncologists and biopharma to deliver best-in-class services for all By helping the community oncology field, we improve lives Our work is founded in science, driven by data, and upheld to the highest standards We are oncology experts focused on developing foundational and innovative oncology laboratory diagnostic services When you invest in NeoGenomics, you invest in all of oncology Exhibit 99.1

Exhibit 99.1

Appendix Exhibit 99.1

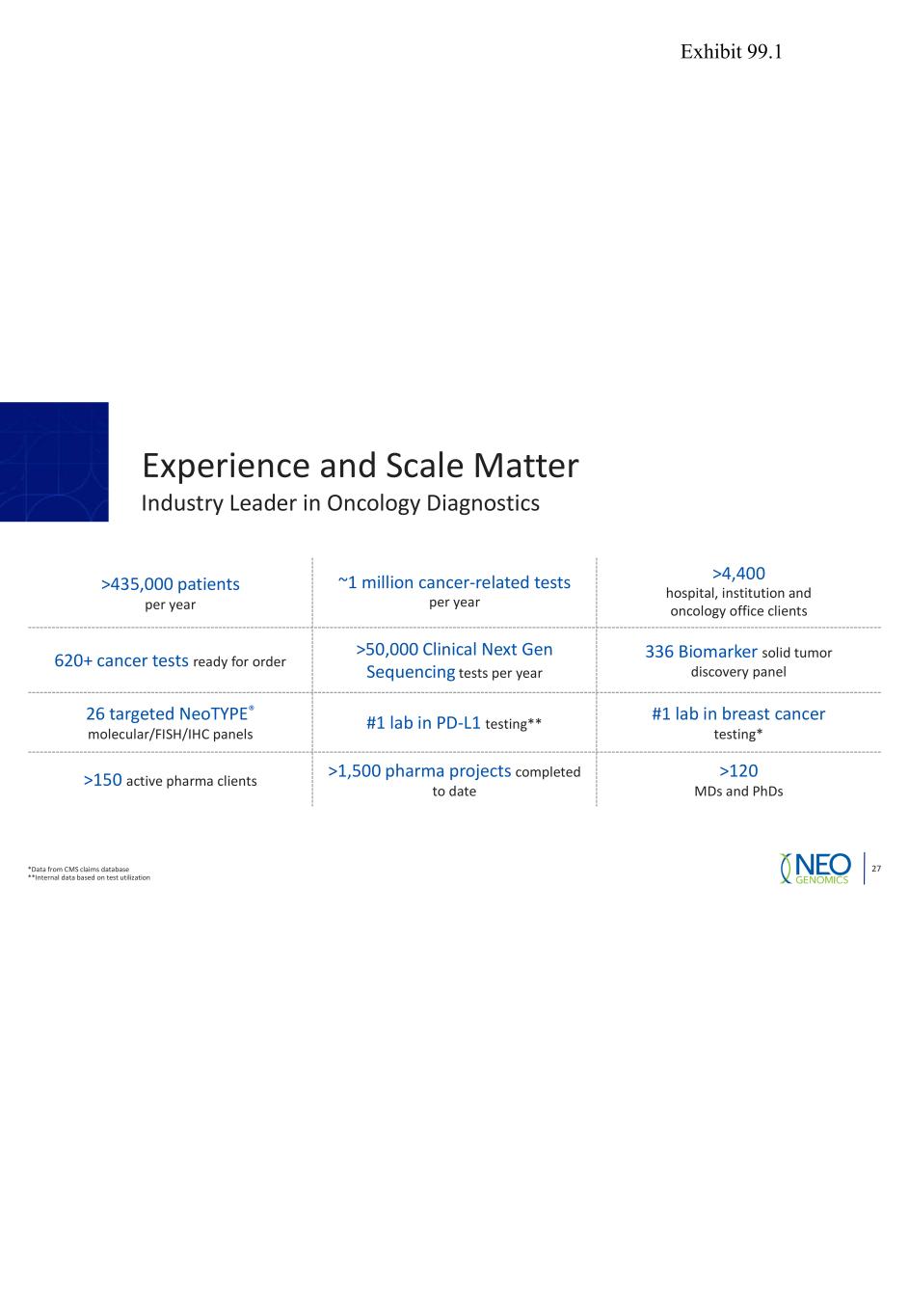

27 Experience and Scale Matter >435,000 patients per year ~1 million cancer-related tests per year >4,400 hospital, institution and oncology office clients 620+ cancer tests ready for order >50,000 Clinical Next Gen Sequencing tests per year 336 Biomarker solid tumor discovery panel 26 targeted NeoTYPE® molecular/FISH/IHC panels #1 lab in PD-L1 testing** #1 lab in breast cancer testing* >150 active pharma clients >1,500 pharma projects completed to date >120 MDs and PhDs *Data from CMS claims database **Internal data based on test utilization Industry Leader in Oncology Diagnostics Exhibit 99.1

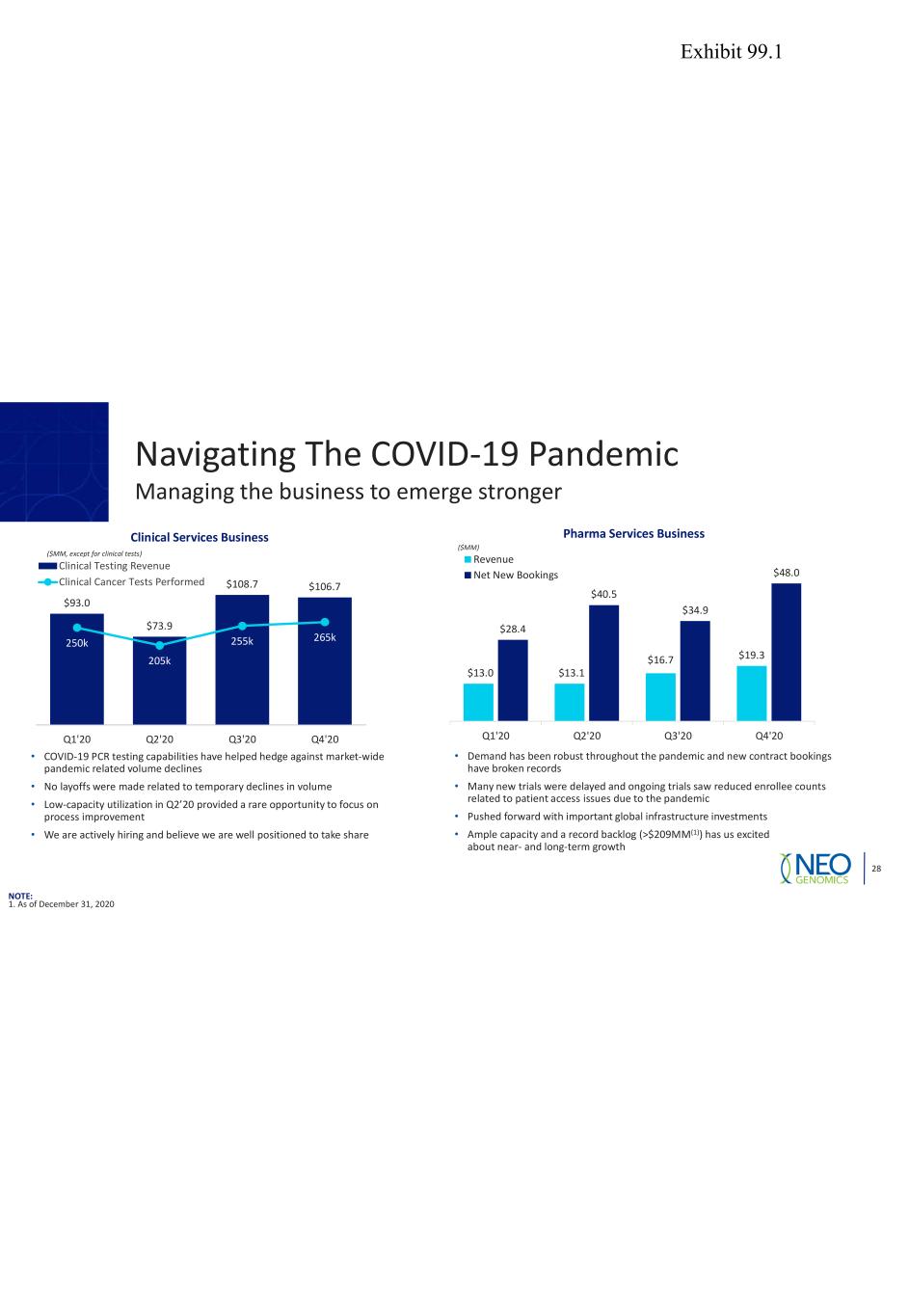

28 $93.0 $73.9 $108.7 $106.7 250k 205k 255k 265k 0k 50k 100k 150k 200k 250k 300k 350k 400k 0 20 40 60 80 100 120 Q1'20 Q2'20 Q3'20 Q4'20 Clinical Testing Revenue Clinical Cancer Tests Performed $13.0 $13.1 $16.7 $19.3 $28.4 $40.5 $34.9 $48.0 Q1'20 Q2'20 Q3'20 Q4'20 Revenue Net New Bookings Clinical Services Business ($MM, except for clinical tests) Pharma Services Business ($MM) • COVID-19 PCR testing capabilities have helped hedge against market-wide pandemic related volume declines • No layoffs were made related to temporary declines in volume • Low-capacity utilization in Q2’20 provided a rare opportunity to focus on process improvement • We are actively hiring and believe we are well positioned to take share • Demand has been robust throughout the pandemic and new contract bookings have broken records • Many new trials were delayed and ongoing trials saw reduced enrollee counts related to patient access issues due to the pandemic • Pushed forward with important global infrastructure investments • Ample capacity and a record backlog (>$209MM(1)) has us excited about near- and long-term growth Navigating The COVID-19 Pandemic Managing the business to emerge stronger NOTE: 1. As of December 31, 2020 Exhibit 99.1

29 Companion diagnostics are part of the precision medicine that is driving the future of oncology Ability to take test across continuum from development, through clinical trials, and into the market CDx capabilities translating into customer wins Wide scale and scope across Pharma and Clinical markets Broad reach to oncologists and pathologists Access to data across massive quantity of oncology-specific test results Well Positioned: Companion Diagnostics Exhibit 99.1

Proving the Point: KEYTRUDA® • Selected by Merck due to IHC expertise • Participated in Early Validation Program for Keytruda • One of only 3 labs to offer PD-L1 testing on Day 1 30 We remain an industry leader in clinical PD-L1 testing Exhibit 99.1

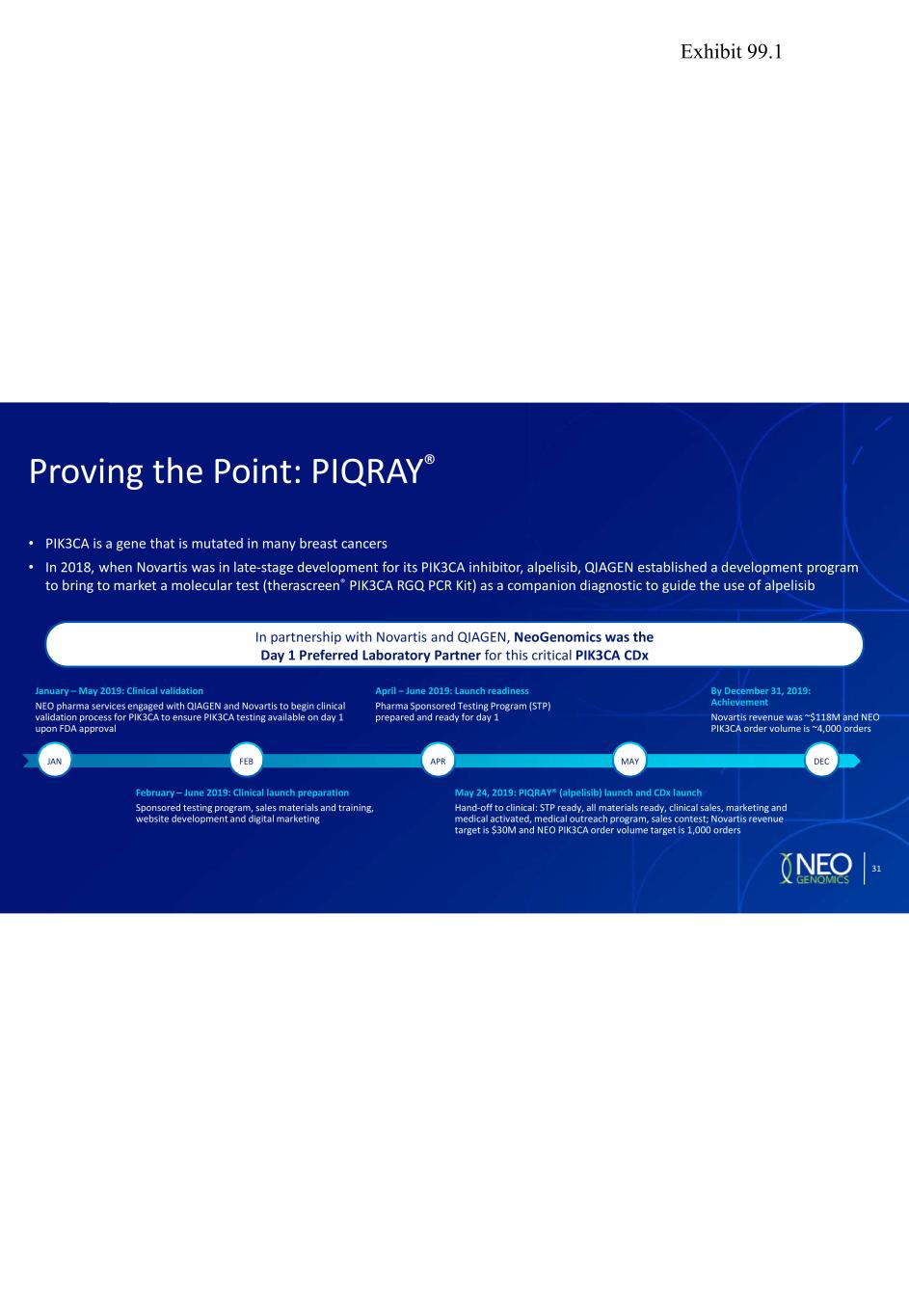

• PIK3CA is a gene that is mutated in many breast cancers • In 2018, when Novartis was in late-stage development for its PIK3CA inhibitor, alpelisib, QIAGEN established a development program to bring to market a molecular test (therascreen® PIK3CA RGQ PCR Kit) as a companion diagnostic to guide the use of alpelisib Proving the Point: PIQRAY® JAN FEB DEC By December 31, 2019: Achievement Novartis revenue was ~$118M and NEO PIK3CA order volume is ~4,000 orders APR MAY May 24, 2019: PIQRAY® (alpelisib) launch and CDx launch Hand-off to clinical: STP ready, all materials ready, clinical sales, marketing and medical activated, medical outreach program, sales contest; Novartis revenue target is $30M and NEO PIK3CA order volume target is 1,000 orders April – June 2019: Launch readiness Pharma Sponsored Testing Program (STP) prepared and ready for day 1 February – June 2019: Clinical launch preparation Sponsored testing program, sales materials and training, website development and digital marketing January – May 2019: Clinical validation NEO pharma services engaged with QIAGEN and Novartis to begin clinical validation process for PIK3CA to ensure PIK3CA testing available on day 1 upon FDA approval 31 In partnership with Novartis and QIAGEN, NeoGenomics was the Day 1 Preferred Laboratory Partner for this critical PIK3CA CDx Exhibit 99.1

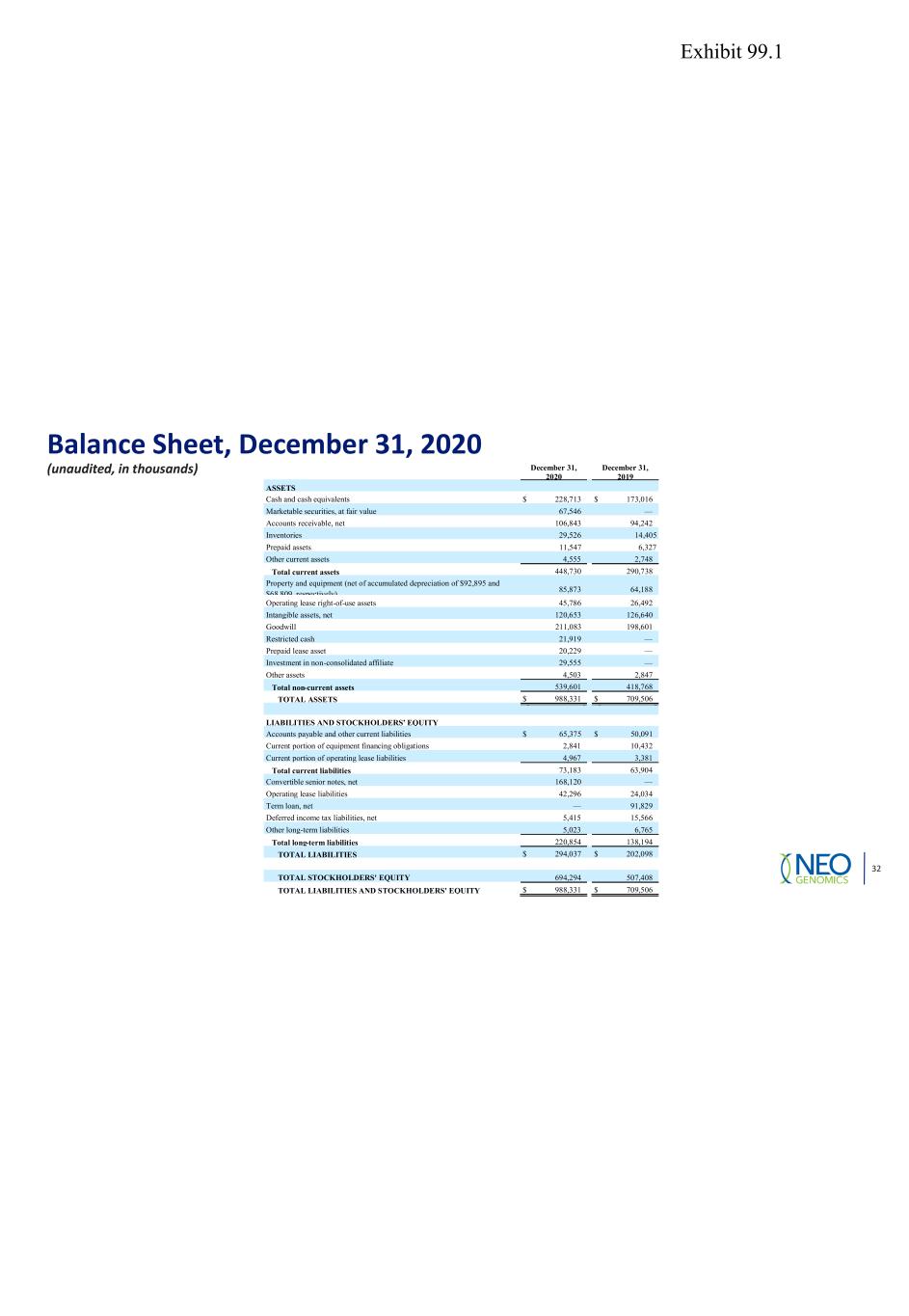

Balance Sheet, December 31, 2020 (unaudited, in thousands) 32 December 31, 2020 December 31, 2019 ASSETS Cash and cash equivalents $ 228,713 $ 173,016 Marketable securities, at fair value 67,546 — Accounts receivable, net 106,843 94,242 Inventories 29,526 14,405 Prepaid assets 11,547 6,327 Other current assets 4,555 2,748 Total current assets 448,730 290,738 Property and equipment (net of accumulated depreciation of $92,895 and $68 809 respectively) 85,873 64,188 Operating lease right-of-use assets 45,786 26,492 Intangible assets, net 120,653 126,640 Goodwill 211,083 198,601 Restricted cash 21,919 — Prepaid lease asset 20,229 — Investment in non-consolidated affiliate 29,555 — Other assets 4,503 2,847 Total non-current assets 539,601 418,768 TOTAL ASSETS $ 988,331 $ 709,506 LIABILITIES AND STOCKHOLDERS’ EQUITY Accounts payable and other current liabilities $ 65,375 $ 50,091 Current portion of equipment financing obligations 2,841 10,432 Current portion of operating lease liabilities 4,967 3,381 Total current liabilities 73,183 63,904 Convertible senior notes, net 168,120 — Operating lease liabilities 42,296 24,034 Term loan, net — 91,829 Deferred income tax liabilities, net 5,415 15,566 Other long-term liabilities 5,023 6,765 Total long-term liabilities 220,854 138,194 TOTAL LIABILITIES $ 294,037 $ 202,098 TOTAL STOCKHOLDERS' EQUITY 694,294 507,408 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 988,331 $ 709,506 Exhibit 99.1

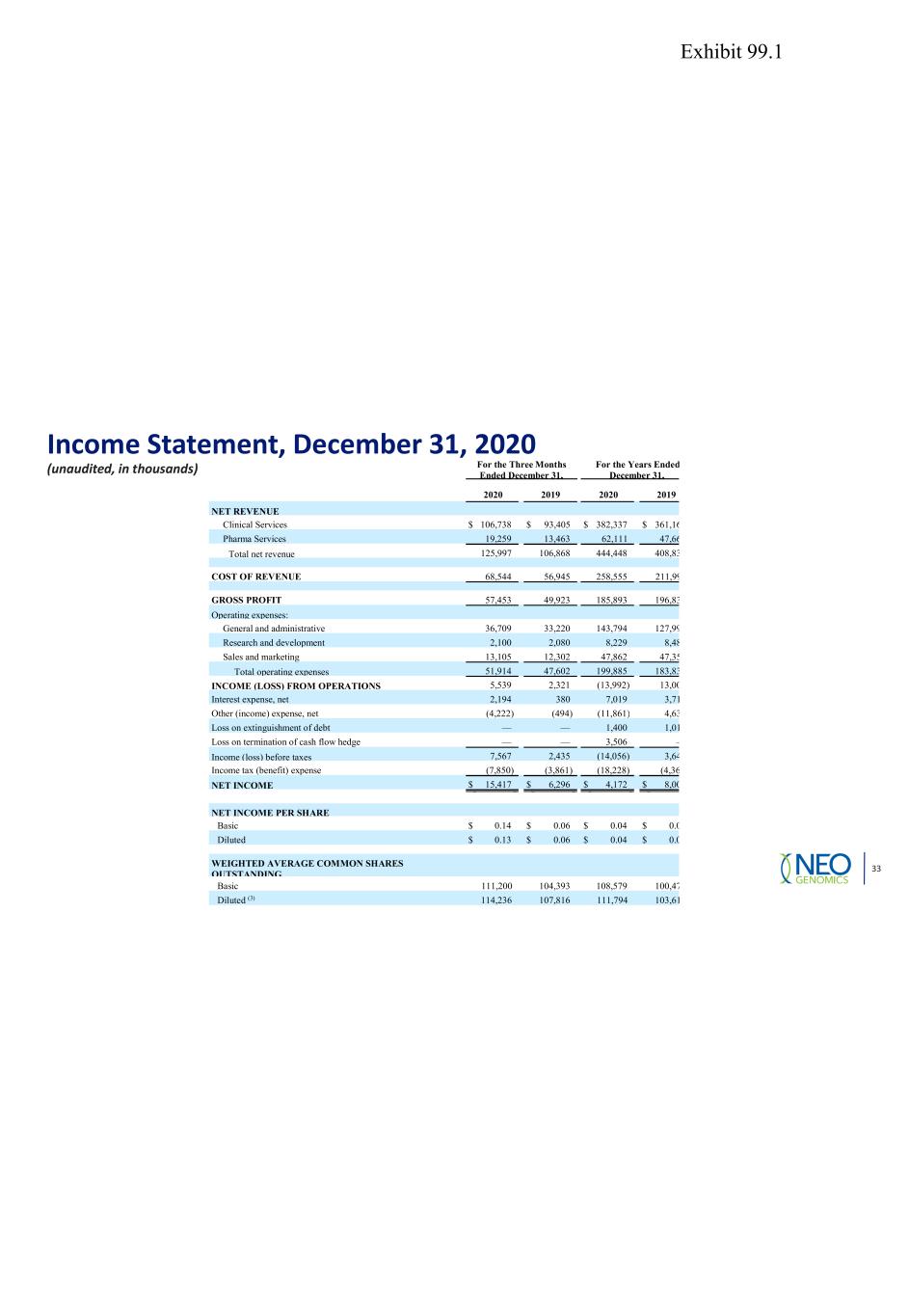

Income Statement, December 31, 2020 (unaudited, in thousands) 33 For the Three Months Ended December 31, For the Years Ended December 31, 2020 2019 2020 2019 NET REVENUE Clinical Services $ 106,738 $ 93,405 $ 382,337 $ 361,16 Pharma Services 19,259 13,463 62,111 47,66 Total net revenue 125,997 106,868 444,448 408,83 COST OF REVENUE 68,544 56,945 258,555 211,99 GROSS PROFIT 57,453 49,923 185,893 196,83 Operating expenses: General and administrative 36,709 33,220 143,794 127,99 Research and development 2,100 2,080 8,229 8,48 Sales and marketing 13,105 12,302 47,862 47,35 Total operating expenses 51,914 47,602 199,885 183,83 INCOME (LOSS) FROM OPERATIONS 5,539 2,321 (13,992) 13,00 Interest expense, net 2,194 380 7,019 3,71 Other (income) expense, net (4,222) (494) (11,861) 4,63 Loss on extinguishment of debt — — 1,400 1,01 Loss on termination of cash flow hedge — — 3,506 — Income (loss) before taxes 7,567 2,435 (14,056) 3,64 Income tax (benefit) expense (7,850) (3,861) (18,228) (4,36 NET INCOME $ 15,417 $ 6,296 $ 4,172 $ 8,00 NET INCOME PER SHARE Basic $ 0.14 $ 0.06 $ 0.04 $ 0.0 Diluted $ 0.13 $ 0.06 $ 0.04 $ 0.0 WEIGHTED AVERAGE COMMON SHARES OUTSTANDING Basic 111,200 104,393 108,579 100,47 Diluted (3) 114,236 107,816 111,794 103,61 Exhibit 99.1

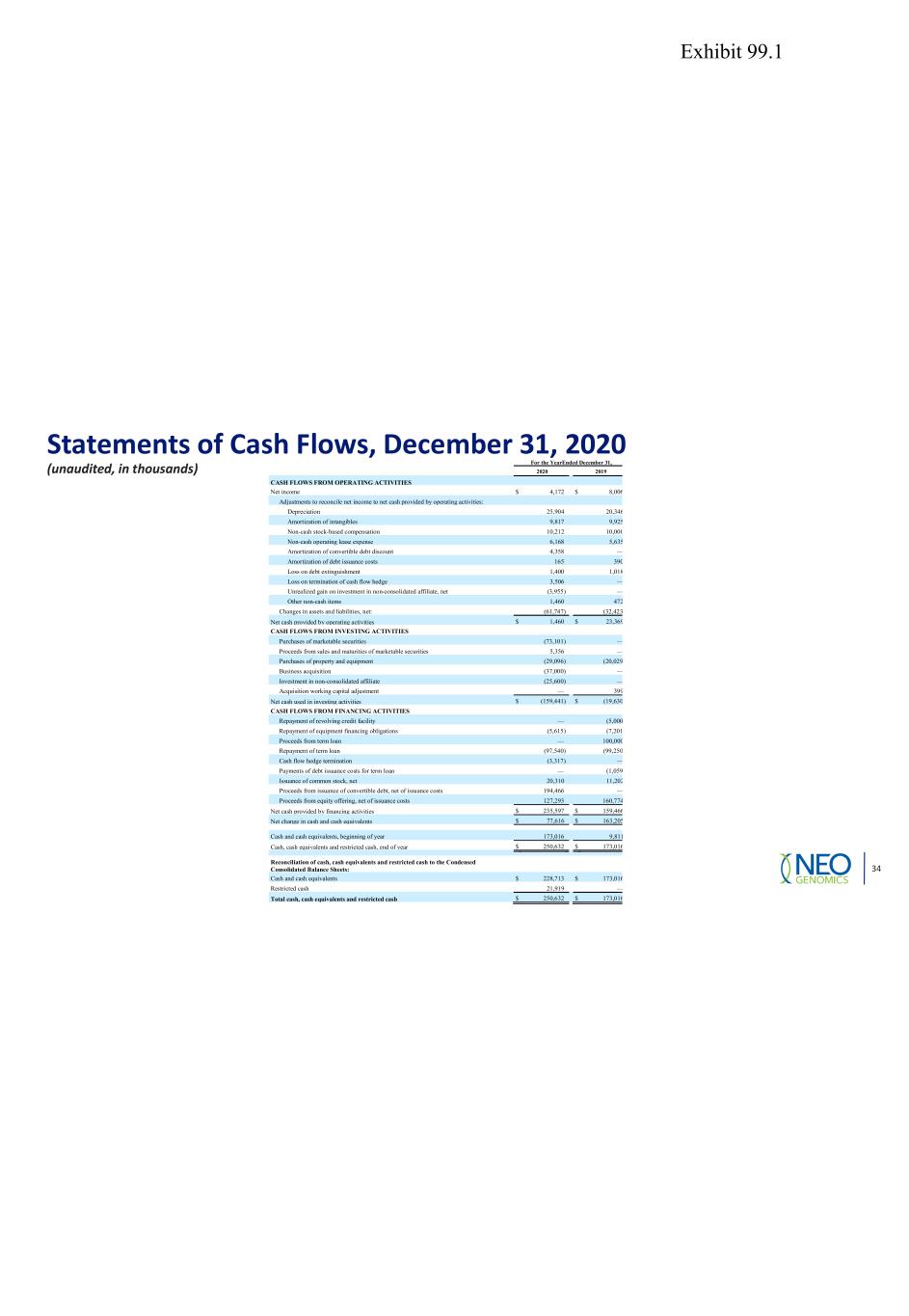

Statements of Cash Flows, December 31, 2020 (unaudited, in thousands) 34 For the Year Ended December 31, 2020 2019 CASH FLOWS FROM OPERATING ACTIVITIES Net income $ 4,172 $ 8,006 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 25,904 20,346 Amortization of intangibles 9,817 9,925 Non-cash stock-based compensation 10,212 10,000 Non-cash operating lease expense 6,168 5,635 Amortization of convertible debt discount 4,358 — Amortization of debt issuance costs 165 390 Loss on debt extinguishment 1,400 1,018 Loss on termination of cash flow hedge 3,506 — Unrealized gain on investment in non-consolidated affiliate, net (3,955) — Other non-cash items 1,460 472 Changes in assets and liabilities, net: (61,747) (32,423 Net cash provided by operating activities $ 1,460 $ 23,369 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of marketable securities (73,101) — Proceeds from sales and maturities of marketable securities 5,356 — Purchases of property and equipment (29,096) (20,029 Business acquisition (37,000) — Investment in non-consolidated affiliate (25,600) — Acquisition working capital adjustment — 399 Net cash used in investing activities $ (159,441) $ (19,630 CASH FLOWS FROM FINANCING ACTIVITIES Repayment of revolving credit facility — (5,000 Repayment of equipment financing obligations (5,615) (7,201 Proceeds from term loan — 100,000 Repayment of term loan (97,540) (99,250 Cash flow hedge termination (3,317) — Payments of debt issuance costs for term loan — (1,059 Issuance of common stock, net 20,310 11,202 Proceeds from issuance of convertible debt, net of issuance costs 194,466 — Proceeds from equity offering, net of issuance costs 127,293 160,774 Net cash provided by financing activities $ 235,597 $ 159,466 Net change in cash and cash equivalents $ 77,616 $ 163,205 Cash and cash equivalents, beginning of year 173,016 9,811 Cash, cash equivalents and restricted cash, end of year $ 250,632 $ 173,016 Reconciliation of cash, cash equivalents and restricted cash to the Condensed Consolidated Balance Sheets: Cash and cash equivalents $ 228,713 $ 173,016 Restricted cash 21,919 — Total cash, cash equivalents and restricted cash $ 250,632 $ 173,016 Exhibit 99.1

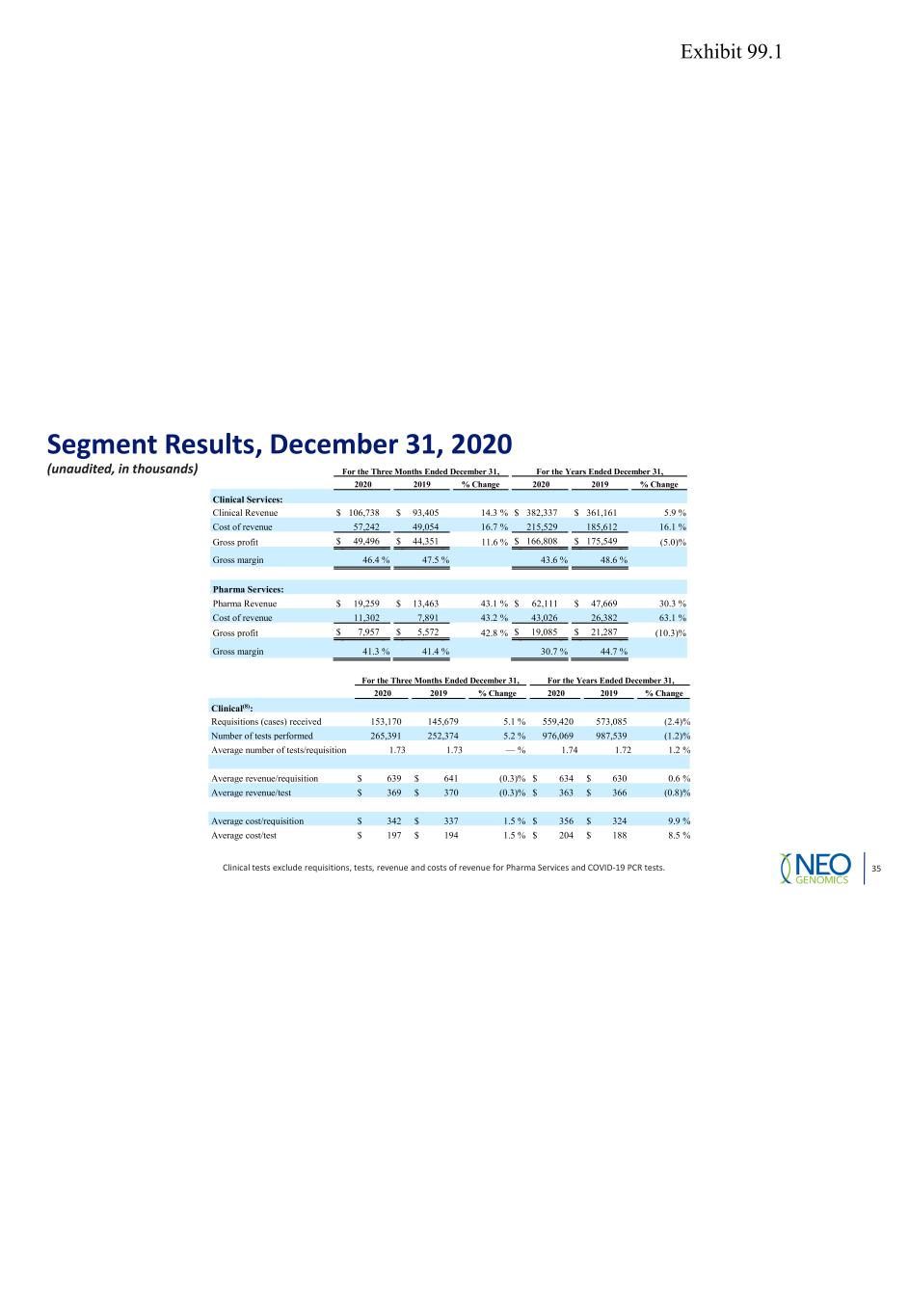

Segment Results, December 31, 2020 (unaudited, in thousands) Clinical tests exclude requisitions, tests, revenue and costs of revenue for Pharma Services and COVID-19 PCR tests. 35 For the Three Months Ended December 31, For the Years Ended December 31, 2020 2019 % Change 2020 2019 % Change Clinical(8): Requisitions (cases) received 153,170 145,679 5.1 % 559,420 573,085 (2.4) % Number of tests performed 265,391 252,374 5.2 % 976,069 987,539 (1.2) % Average number of tests/requisition 1.73 1.73 — % 1.74 1.72 1.2 % Average revenue/requisition $ 639 $ 641 (0.3) % $ 634 $ 630 0.6 % Average revenue/test $ 369 $ 370 (0.3) % $ 363 $ 366 (0.8) % Average cost/requisition $ 342 $ 337 1.5 % $ 356 $ 324 9.9 % Average cost/test $ 197 $ 194 1.5 % $ 204 $ 188 8.5 % For the Three Months Ended December 31, For the Years Ended December 31, 2020 2019 % Change 2020 2019 % Change Clinical Services: Clinical Revenue $ 106,738 $ 93,405 14.3 % $ 382,337 $ 361,161 5.9 % Cost of revenue 57,242 49,054 16.7 % 215,529 185,612 16.1 % Gross profit $ 49,496 $ 44,351 11.6 % $ 166,808 $ 175,549 (5.0) % Gross margin 46.4 % 47.5 % 43.6 % 48.6 % Pharma Services: Pharma Revenue $ 19,259 $ 13,463 43.1 % $ 62,111 $ 47,669 30.3 % Cost of revenue 11,302 7,891 43.2 % 43,026 26,382 63.1 % Gross profit $ 7,957 $ 5,572 42.8 % $ 19,085 $ 21,287 (10.3) % Gross margin 41.3 % 41.4 % 30.7 % 44.7 % Exhibit 99.1

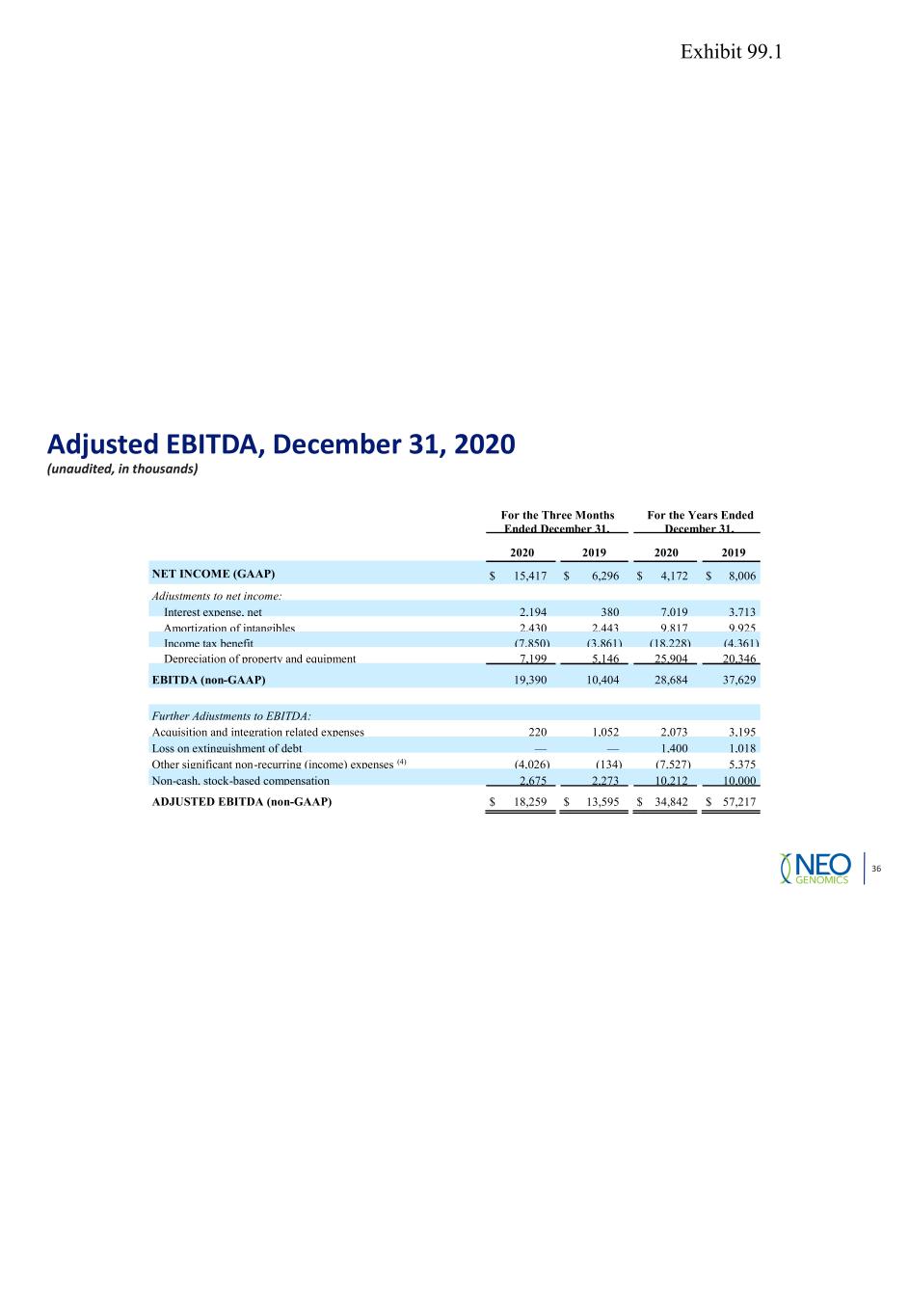

Adjusted EBITDA, December 31, 2020 (unaudited, in thousands) 36 For the Three Months Ended December 31, For the Years Ended December 31, 2020 2019 2020 2019 NET INCOME (GAAP) $ 15,417 $ 6,296 $ 4,172 $ 8,006 Adjustments to net income: Interest expense, net 2,194 380 7,019 3,713 Amortization of intangibles 2,430 2,443 9,817 9,925 Income tax benefit (7,850) (3,861) (18,228) (4,361) Depreciation of property and equipment 7,199 5,146 25,904 20,346 EBITDA (non-GAAP) 19,390 10,404 28,684 37,629 Further Adjustments to EBITDA: Acquisition and integration related expenses 220 1,052 2,073 3,195 Loss on extinguishment of debt — — 1,400 1,018 Other significant non-recurring (income) expenses (4) (4,026) (134) (7,527) 5,375 Non-cash, stock-based compensation 2,675 2,273 10,212 10,000 ADJUSTED EBITDA (non-GAAP) $ 18,259 $ 13,595 $ 34,842 $ 57,217 Exhibit 99.1