EX-99.1

Published on August 10, 2021

NeoGenomics Investor Presentation August 2021 1 Exhibit 99.1

Forward-Looking Statements 2 This presentation has been prepared by NeoGenomics, Inc. (“we,” ”us,” “our,” “NeoGenomics” or the “Company”) and is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward-looking statements. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward-looking statements due to numerous known and unknown risks and uncertainties. All forward-looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Non-GAAP Adjusted EBITDA “Adjusted EBITDA” is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, (iv) non-cash stock-based compensation expense, and, if applicable in a reporting period, (v) acquisition and integration related expenses, (vi) non-cash impairments of intangible assets, (vii) and other significant non-recurring or non-operating (income) or expenses, including any debt financing costs.

We save lives by improving patient care. By providing uncompromising quality, exceptional service and innovative solutions, we are becoming the world’s leading cancer testing and information company. Quality, integrity, accountability, teamwork, innovation. NeoGenomics We are Focused and Genuine Our Common Purpose Our Values Our Vision 3

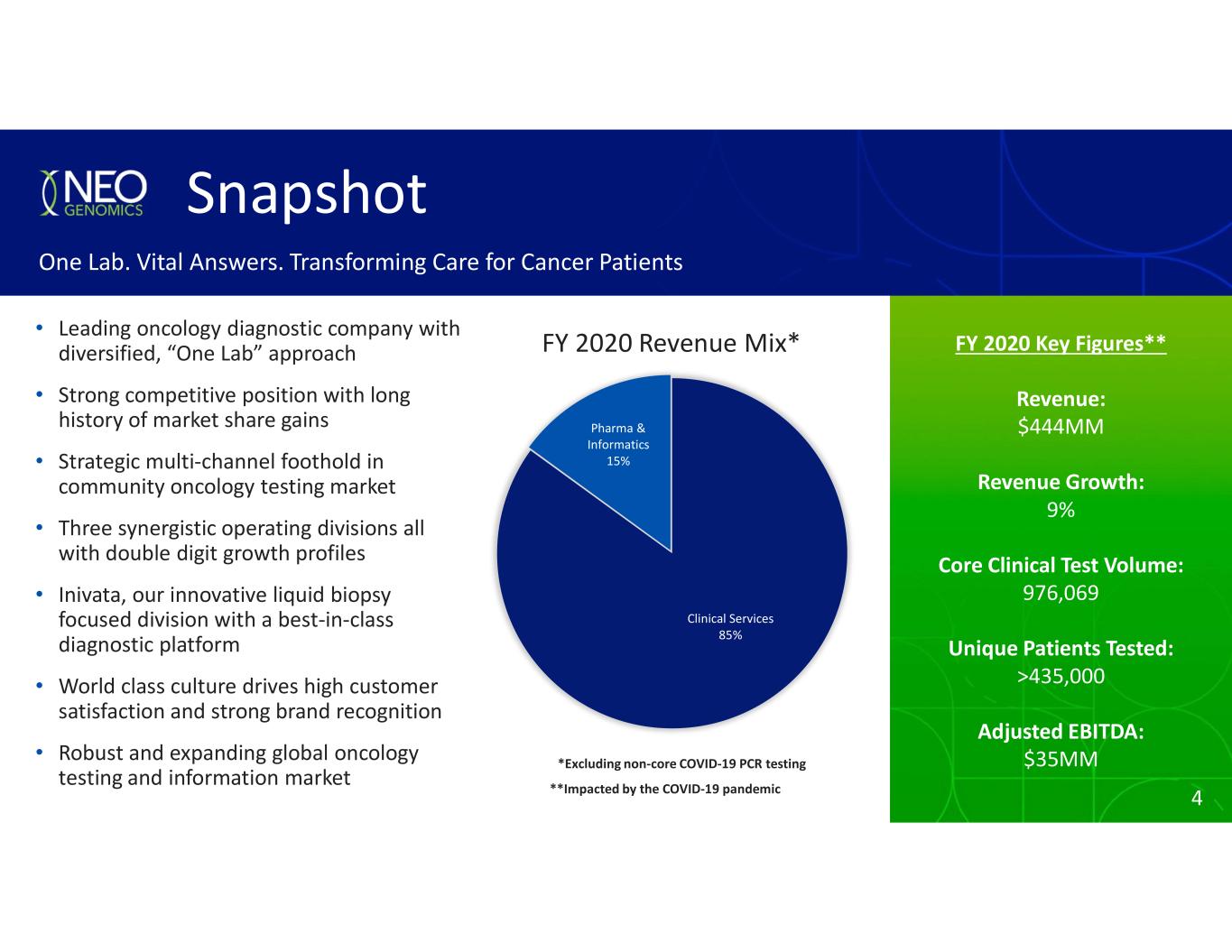

4 FY 2020 Key Figures** Revenue: $444MM Revenue Growth: 9% Core Clinical Test Volume: 976,069 Unique Patients Tested: >435,000 Adjusted EBITDA: $35MM FY 2020 Revenue Mix* Snapshot One Lab. Vital Answers. Transforming Care for Cancer Patients • Leading oncology diagnostic company with diversified, “One Lab” approach • Strong competitive position with long history of market share gains • Strategic multi-channel foothold in community oncology testing market • Three synergistic operating divisions all with double digit growth profiles • Inivata, our innovative liquid biopsy focused division with a best-in-class diagnostic platform • World class culture drives high customer satisfaction and strong brand recognition • Robust and expanding global oncology testing and information market Clinical Services 85% Pharma & Informatics 15% *Excluding non-core COVID-19 PCR testing 4**Impacted by the COVID-19 pandemic

Informatics Division One Lab. Vital Answers. 5 Leading oncology diagnostics company, designed to provide innovative diagnostic and data solutions that bridge oncologists, pathologists, and therapeutic development • Leading oncology reference lab market share for oncologists, pathologists and hospitals • Comprehensive oncology test menu including all major testing modalities • Direct national commercial team of ~100 people • A longstanding reputation for service and quality in the community oncology market • Leading provider of oncology-focused research and clinical trials services • Comprehensive support from pre-clinical and research discovery through FDA filing, approval and launch • Global footprint (U.S., Switzerland, Singapore, China) • Approximately $238MM(1) in backlog (signed contracts) Pharma Services DivisionClinical Services Division • Formed in 2020 to utilize clinical testing data to address real world problems for Patients and other stakeholders • Our information platform includes one of the largest cancer testing database, covering the complete spectrum of oncology testing modalities for over 1.6 million patients and growing NOTE: 1. As of June 30, 2021

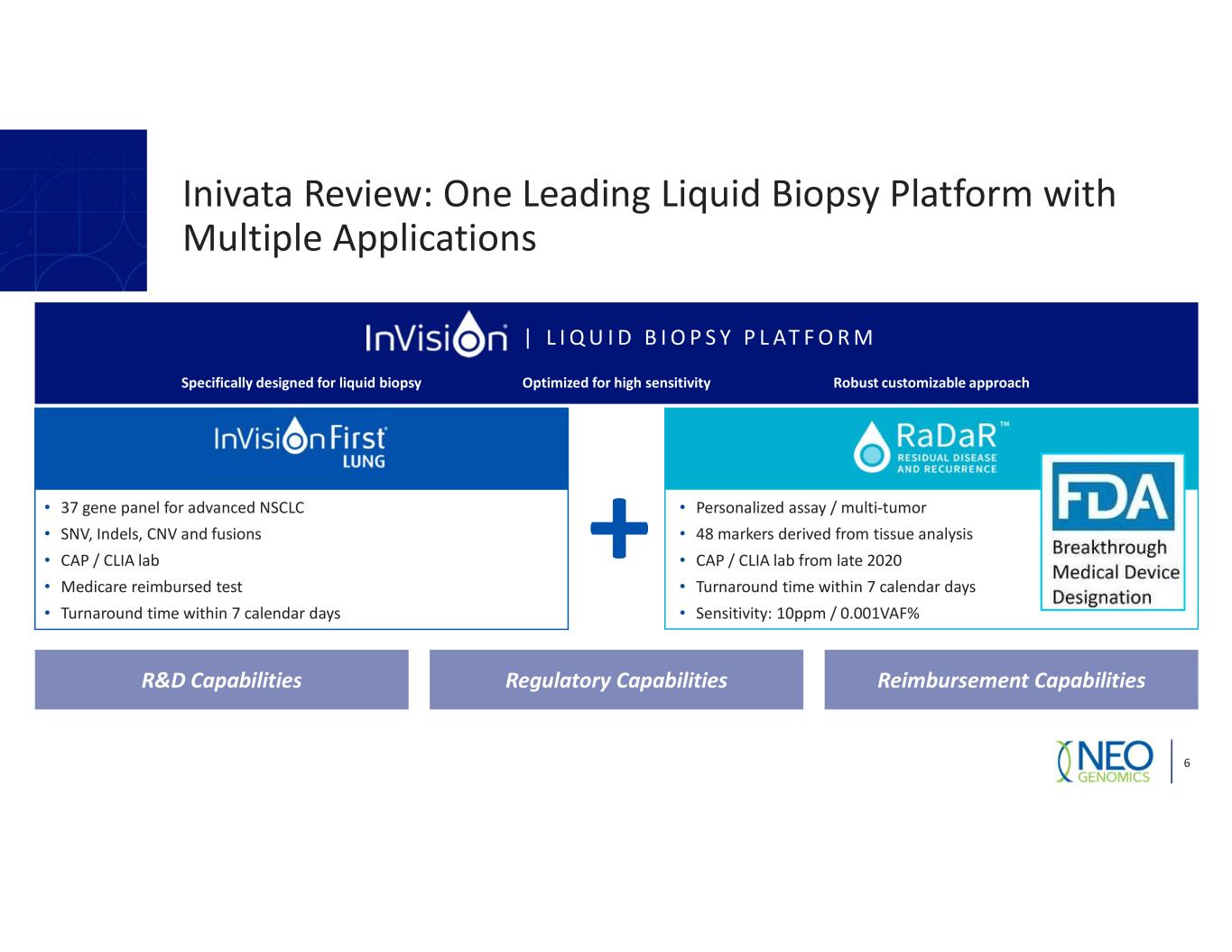

Inivata Review: One Leading Liquid Biopsy Platform with Multiple Applications | L I Q U I D B I O P S Y P L AT F O R M Specifically designed for liquid biopsy Optimized for high sensitivity Robust customizable approach R&D Capabilities Regulatory Capabilities Reimbursement Capabilities • 37 gene panel for advanced NSCLC • SNV, Indels, CNV and fusions • CAP / CLIA lab • Medicare reimbursed test • Turnaround time within 7 calendar days • Personalized assay / multi-tumor • 48 markers derived from tissue analysis • CAP / CLIA lab from late 2020 • Turnaround time within 7 calendar days • Sensitivity: 10ppm / 0.001VAF% 6

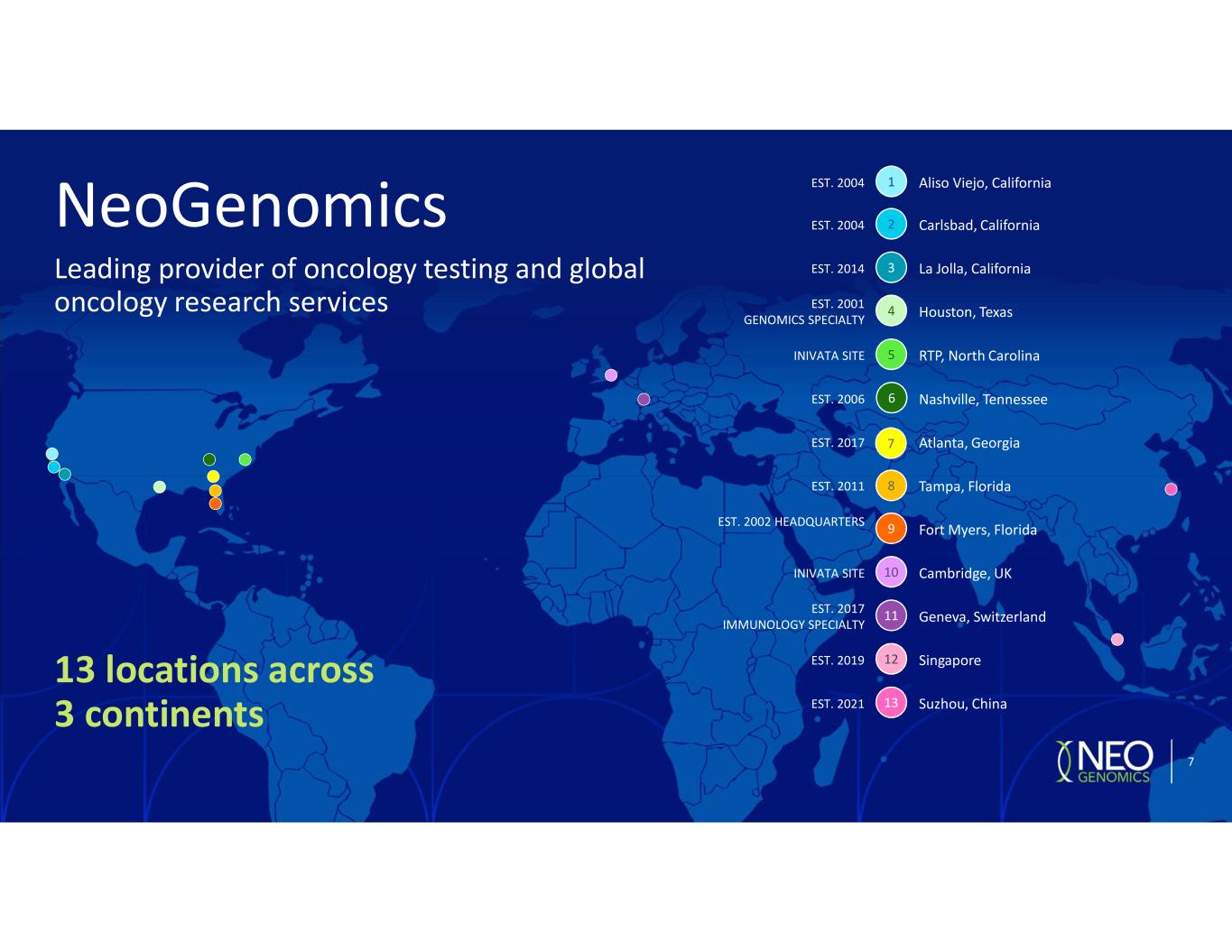

13 locations across 3 continents Leading provider of oncology testing and global oncology research services NeoGenomics 2 3 4 5 9 10 11 12 13 6 7 8 1 7 Carlsbad, California Houston, Texas La Jolla, California Fort Myers, Florida Tampa, Florida Atlanta, Georgia Nashville, Tennessee RTP, North Carolina Cambridge, UK Geneva, Switzerland Singapore Suzhou, China EST. 2004 EST. 2014 EST. 2001 GENOMICS SPECIALTY EST. 2002 HEADQUARTERS EST. 2017 IMMUNOLOGY SPECIALTY EST. 2019 EST. 2021 INIVATA SITE INIVATA SITE Aliso Viejo, CaliforniaEST. 2004 EST. 2006 EST. 2017 EST. 2011

Oncology Testing Market Tailwinds Estimated 6% to 8% annual market growth with upside potential Demographics − An aging population is resulting in higher cancer incidence − Increased cancer survival rates leading to more follow-on testing Precision Medicine & Drug Development − Proliferation and complexity of therapeutic options driving more testing − Burgeoning oncology drug pipeline underlying current Pharma Services demand and likely to drive demand for future clinical testing − New platforms and tests (NGS, TMB, MSI, liquid biopsy, etc.) creating more test options for diagnosis, prognosis, and therapy selection Upside Potential: Emerging Opportunities − Promising minimal residual disease tests in development such as strategic partner Inivata’s RaDaR assay could create a compelling recurrence monitoring opportunity − We expect to develop a number of innovative value-add data offerings in our growing Informatics division 8

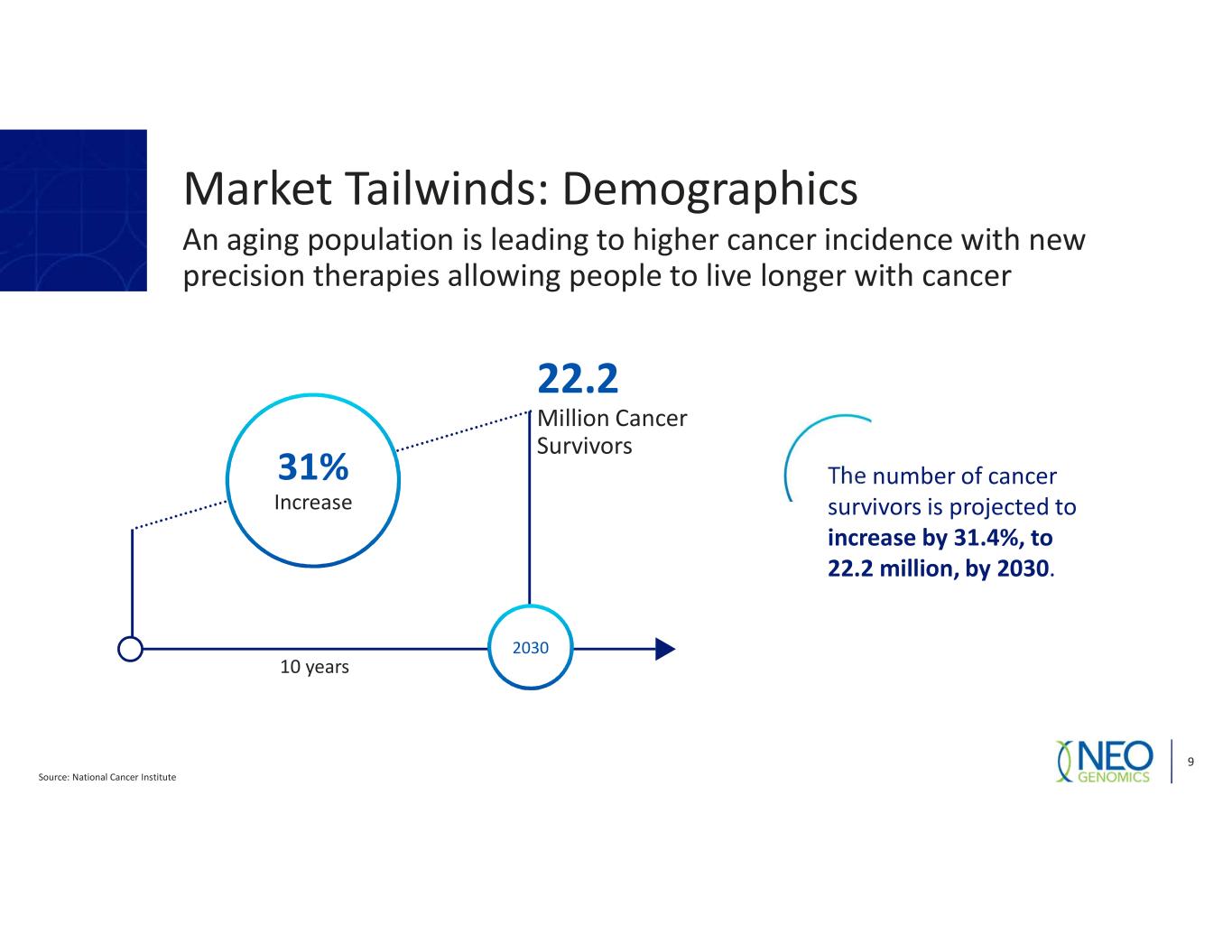

Market Tailwinds: Demographics An aging population is leading to higher cancer incidence with new precision therapies allowing people to live longer with cancer Source: National Cancer Institute 9 2030 22.2 Million Cancer Survivors 10 years 31% Increase The number of cancer survivors is projected to increase by 31.4%, to 22.2 million, by 2030.

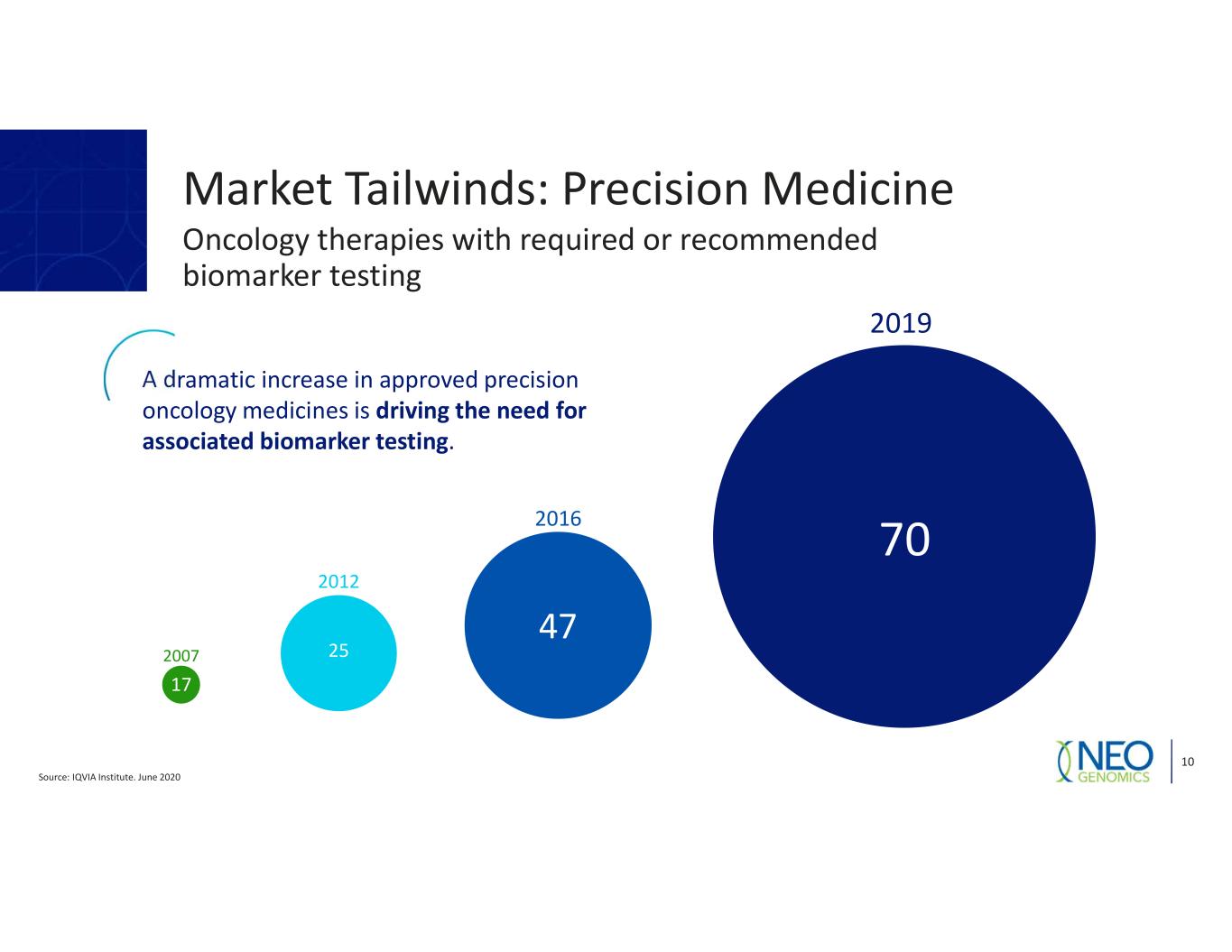

Source: IQVIA Institute. June 2020 10 2007 2012 2016 2019 70 47 25 17 A dramatic increase in approved precision oncology medicines is driving the need for associated biomarker testing. Market Tailwinds: Precision Medicine Oncology therapies with required or recommended biomarker testing

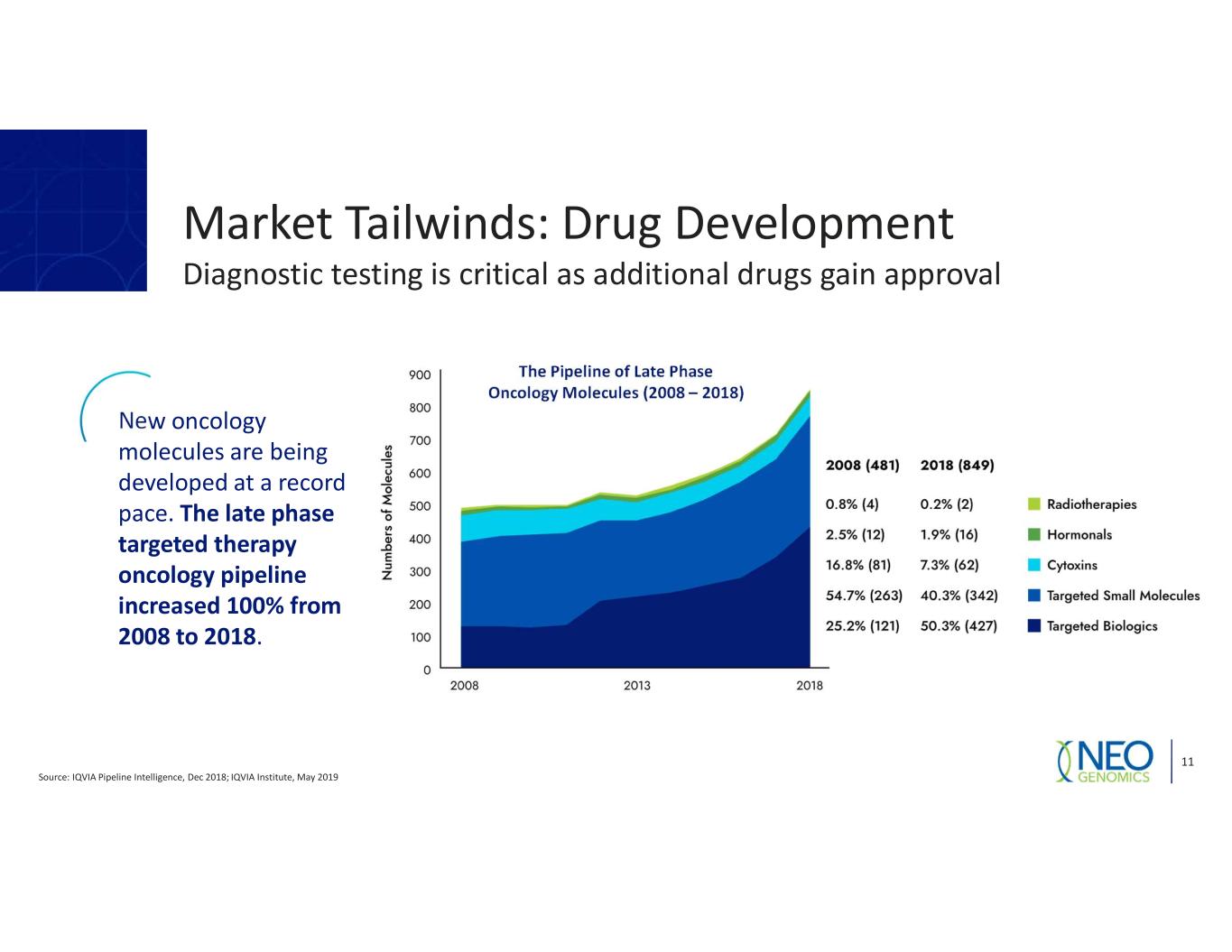

Market Tailwinds: Drug Development Diagnostic testing is critical as additional drugs gain approval Source: IQVIA Pipeline Intelligence, Dec 2018; IQVIA Institute, May 2019 11 New oncology molecules are being developed at a record pace. The late phase targeted therapy oncology pipeline increased 100% from 2008 to 2018. The Pipeline of Late Phase Oncology Molecules (2008 – 2018)

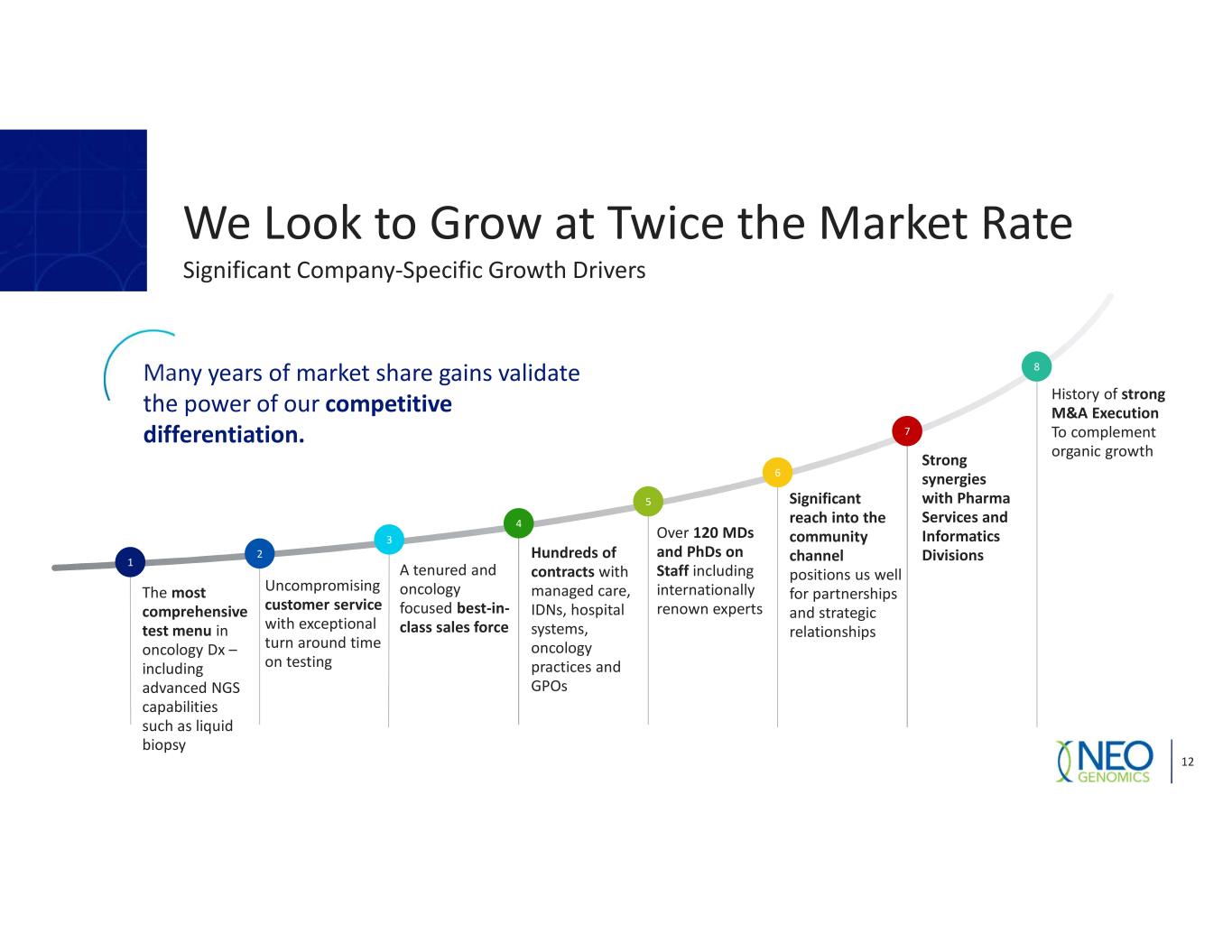

We Look to Grow at Twice the Market Rate 12 Significant Company-Specific Growth Drivers 1 The most comprehensive test menu in oncology Dx – including advanced NGS capabilities such as liquid biopsy 2 Uncompromising customer service with exceptional turn around time on testing 3 4 5 Over 120 MDs and PhDs on Staff including internationally renown experts 6 7 8Many years of market share gains validate the power of our competitive differentiation. Strong synergies with Pharma Services and Informatics Divisions A tenured and oncology focused best-in- class sales force Hundreds of contracts with managed care, IDNs, hospital systems, oncology practices and GPOs History of strong M&A Execution To complement organic growth Significant reach into the community channel positions us well for partnerships and strategic relationships

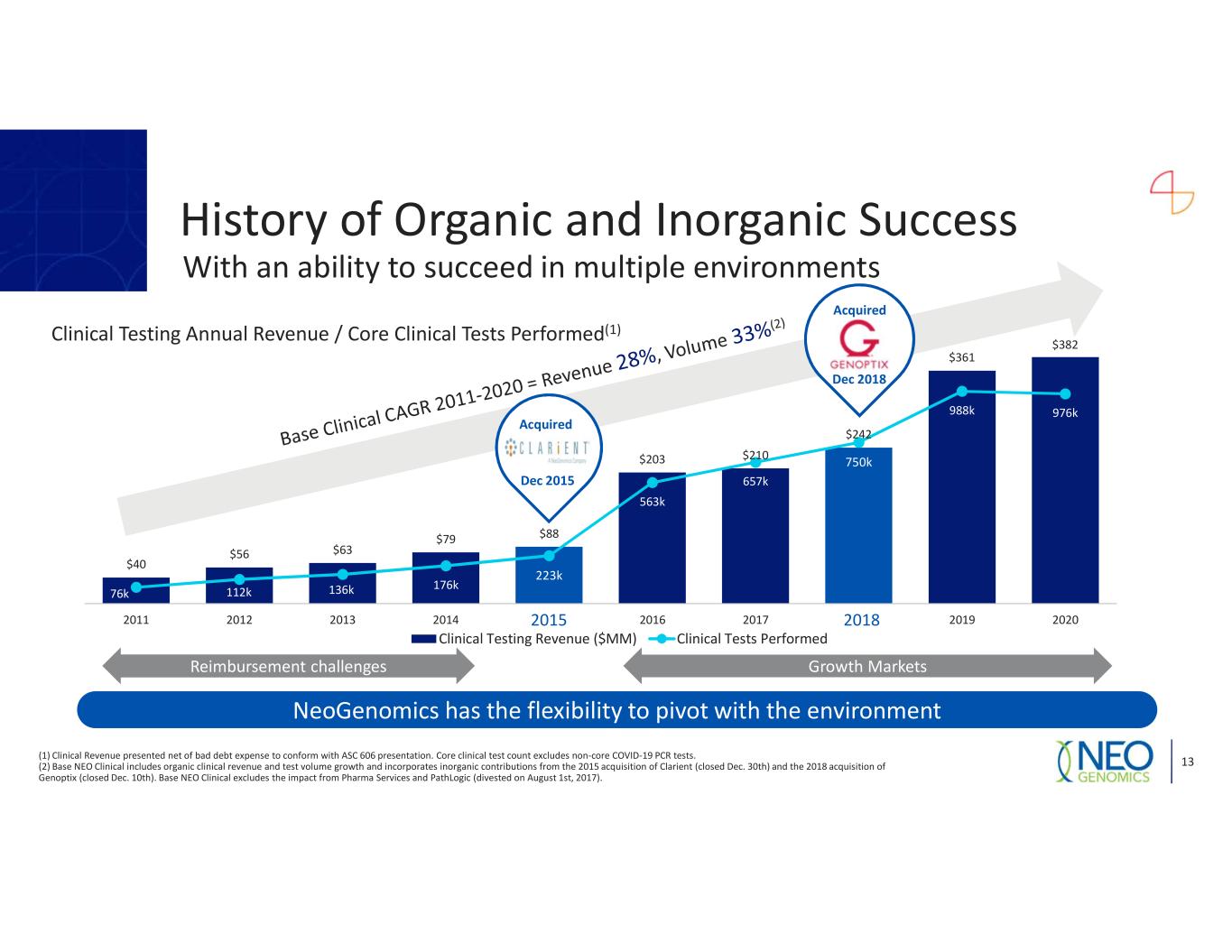

$40 $56 $63 $79 $88 $203 $210 $242 $361 $382 76k 112k 136k 176k 223k 563k 657k 750k 988k 976k 0 200 400 600 800 1,000 1,200 0 50 100 150 200 250 300 350 400 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Clinical Testing Revenue ($MM) Clinical Tests Performed Clinical Testing Annual Revenue / Core Clinical Tests Performed(1) 82 Acquired Growth MarketsReimbursement challenges NeoGenomics has the flexibility to pivot with the environment History of Organic and Inorganic Success With an ability to succeed in multiple environments 13 Acquired Dec 2015 (1) Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. Core clinical test count excludes non-core COVID-19 PCR tests. (2) Base NEO Clinical includes organic clinical revenue and test volume growth and incorporates inorganic contributions from the 2015 acquisition of Clarient (closed Dec. 30th) and the 2018 acquisition of Genoptix (closed Dec. 10th). Base NEO Clinical excludes the impact from Pharma Services and PathLogic (divested on August 1st, 2017). Dec 2018

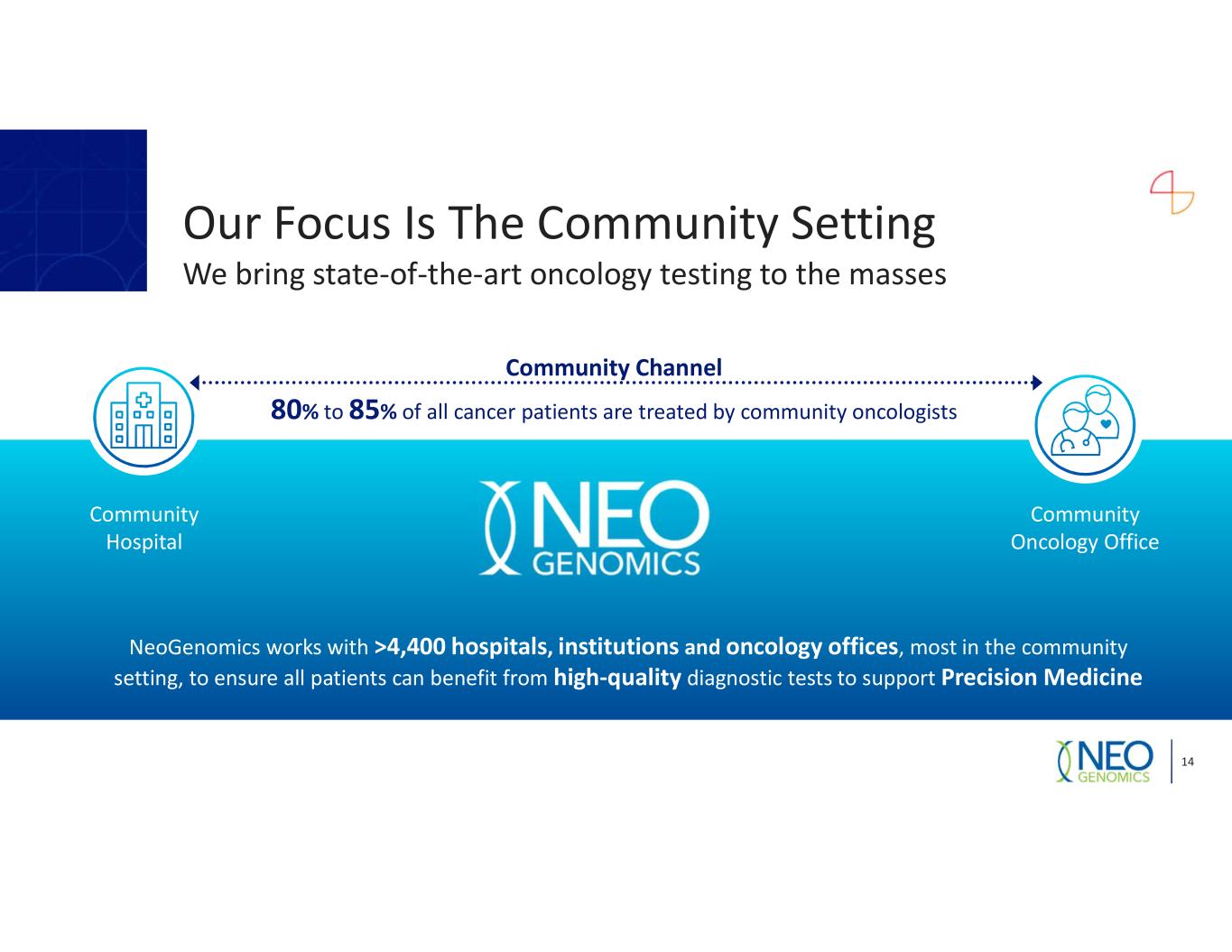

Our Focus Is The Community Setting We bring state-of-the-art oncology testing to the masses 14 NeoGenomics works with >4,400 hospitals, institutions and oncology offices, most in the community setting, to ensure all patients can benefit from high-quality diagnostic tests to support Precision Medicine Community Hospital Community Oncology Office Community Channel 80% to 85% of all cancer patients are treated by community oncologists

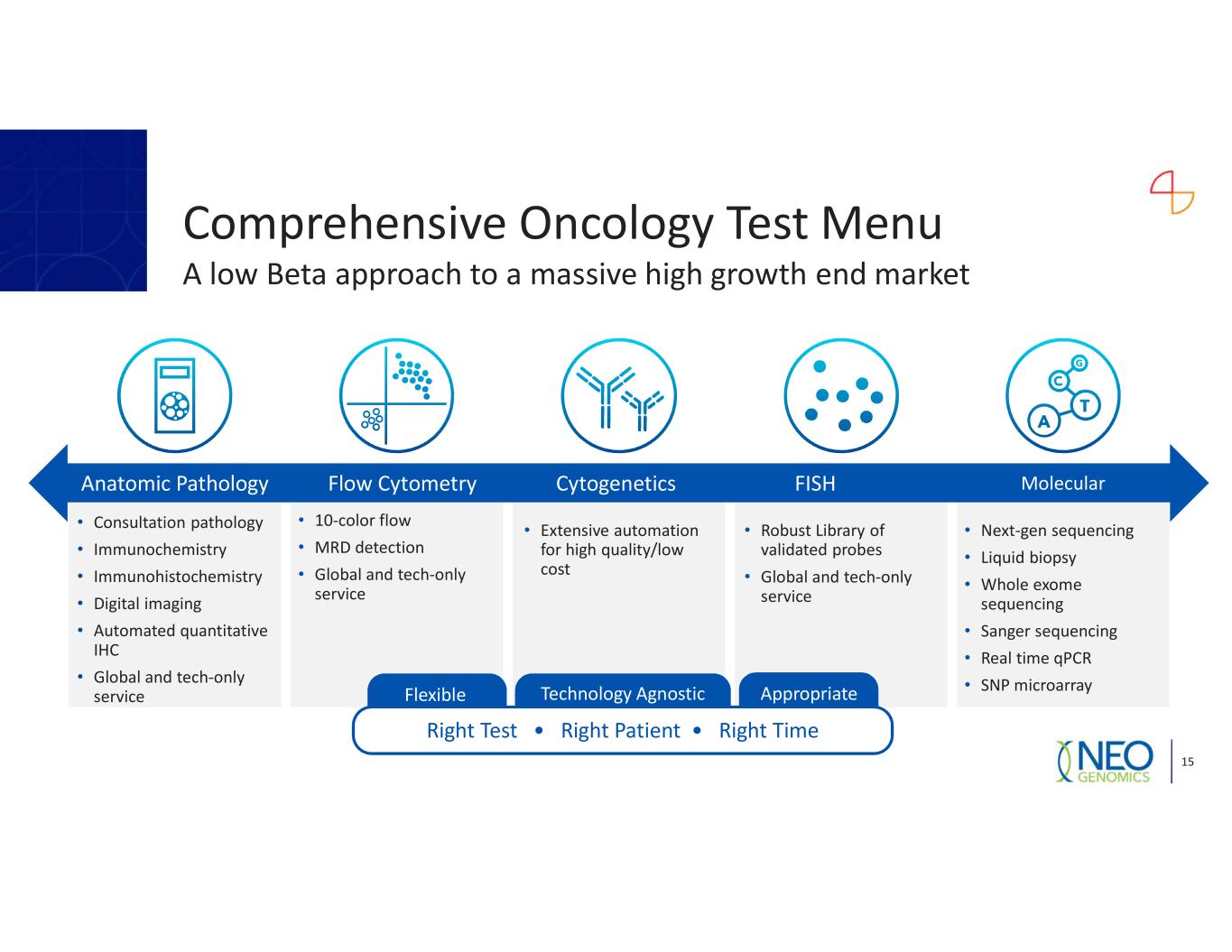

Comprehensive Oncology Test Menu A low Beta approach to a massive high growth end market 15 • Consultation pathology • Immunochemistry • Immunohistochemistry • Digital imaging • Automated quantitative IHC • Global and tech-only service • 10-color flow • MRD detection • Global and tech-only service • Extensive automation for high quality/low cost • Robust Library of validated probes • Global and tech-only service FISH • Next-gen sequencing • Liquid biopsy • Whole exome sequencing • Sanger sequencing • Real time qPCR • SNP microarray MolecularAnatomic Pathology Flow Cytometry Cytogenetics Right Test • Right Patient • Right Time Flexible AppropriateTechnology Agnostic

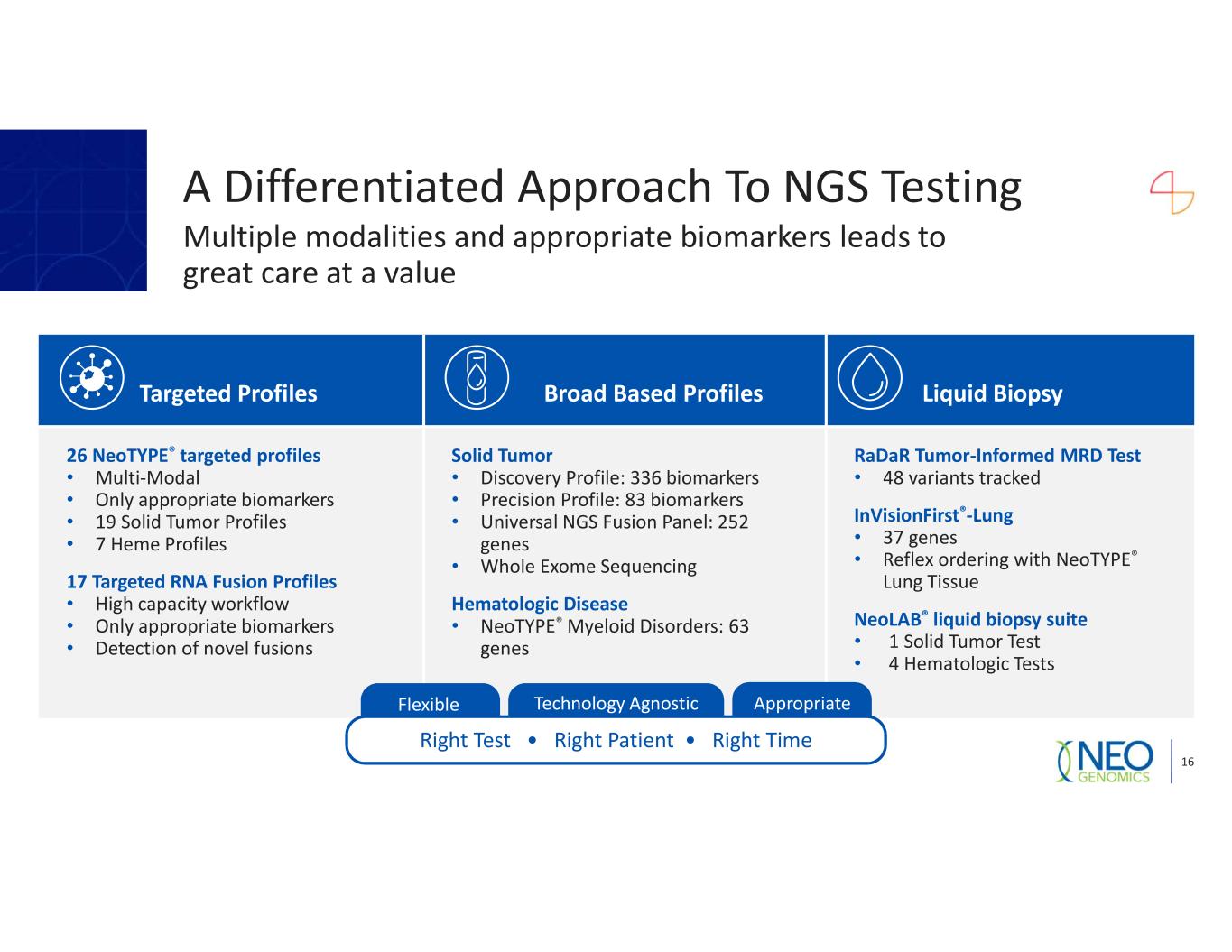

Targeted Profiles Broad Based Profiles Liquid Biopsy 26 NeoTYPE® targeted profiles • Multi-Modal • Only appropriate biomarkers • 19 Solid Tumor Profiles • 7 Heme Profiles 17 Targeted RNA Fusion Profiles • High capacity workflow • Only appropriate biomarkers • Detection of novel fusions Solid Tumor • Discovery Profile: 336 biomarkers • Precision Profile: 83 biomarkers • Universal NGS Fusion Panel: 252 genes • Whole Exome Sequencing Hematologic Disease • NeoTYPE® Myeloid Disorders: 63 genes RaDaR Tumor-Informed MRD Test • 48 variants tracked InVisionFirst®-Lung • 37 genes • Reflex ordering with NeoTYPE® Lung Tissue NeoLAB® liquid biopsy suite • 1 Solid Tumor Test • 4 Hematologic Tests 16 Right Test • Right Patient • Right Time Flexible AppropriateTechnology Agnostic A Differentiated Approach To NGS Testing Multiple modalities and appropriate biomarkers leads to great care at a value

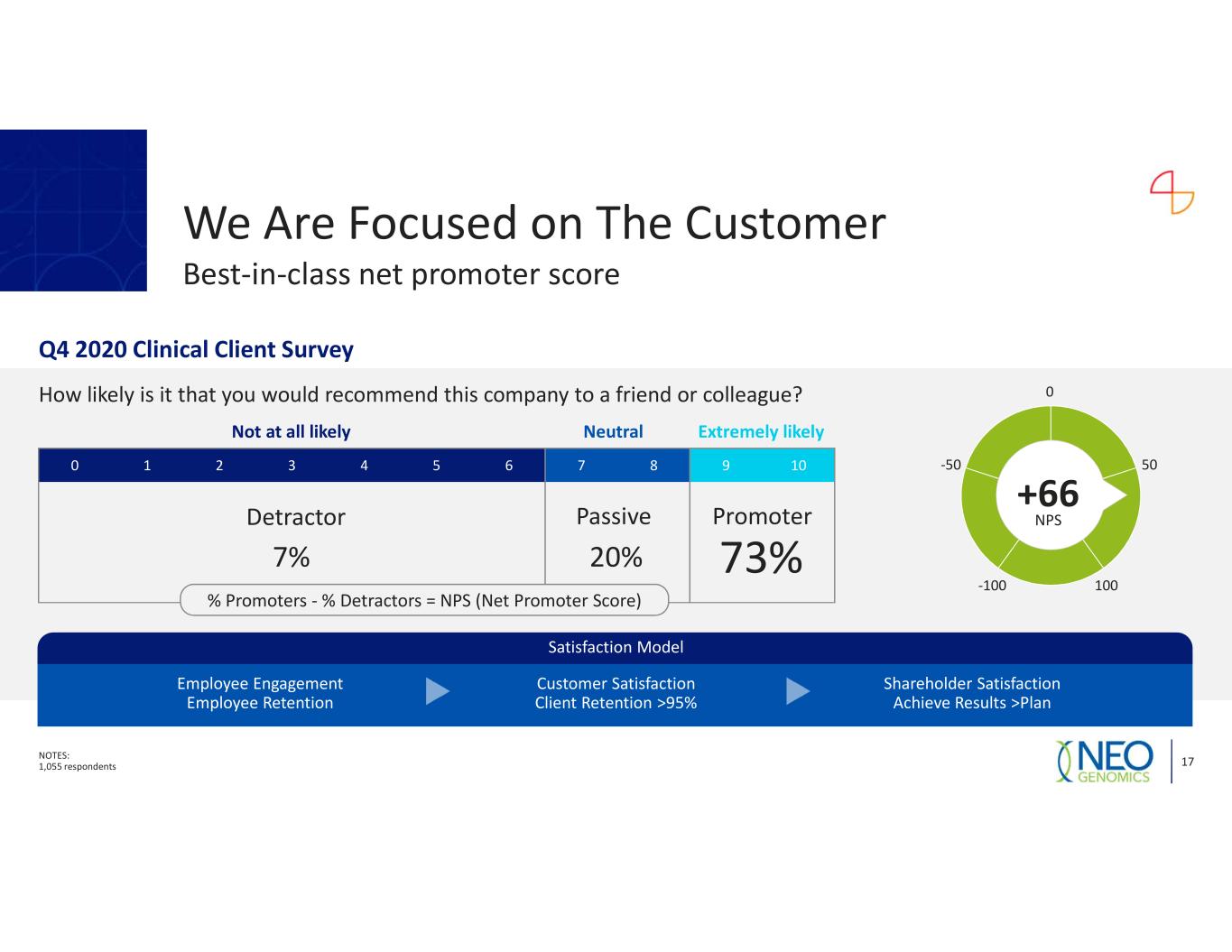

We Are Focused on The Customer NOTES: 1,055 respondents 17 Best-in-class net promoter score Q4 2020 Clinical Client Survey How likely is it that you would recommend this company to a friend or colleague? 0 1 2 3 4 5 6 7 8 9 10 Not at all likely Neutral Extremely likely Detractor Passive Promoter 7% 20% 73% 0 50 100-100 -50 +66 NPS Satisfaction Model Employee Engagement Employee Retention Customer Satisfaction Client Retention >95% Shareholder Satisfaction Achieve Results >Plan % Promoters - % Detractors = NPS (Net Promoter Score)

Clinical Reference Labs with Oncology Divisions Niche Oncology Players High R&D investment and limited test menus 18 Diversified Focus Leading Share in U.S. Clinical Oncology Market Comprehensive, multi-modality “One Lab” position Large and advanced somatic cancer test menu Significant reach into all customer segments National footprint and extensive payer contracts Outstanding client service and partnership models Synergistic Pharma, Clinical and Informatics businesses Pure Play Oncology Diagnostic Lab Comprehensive Test Menu + Sustainable Growth Competing Through Focus, Scale and Scope We enjoy a unique position in the clinical market /

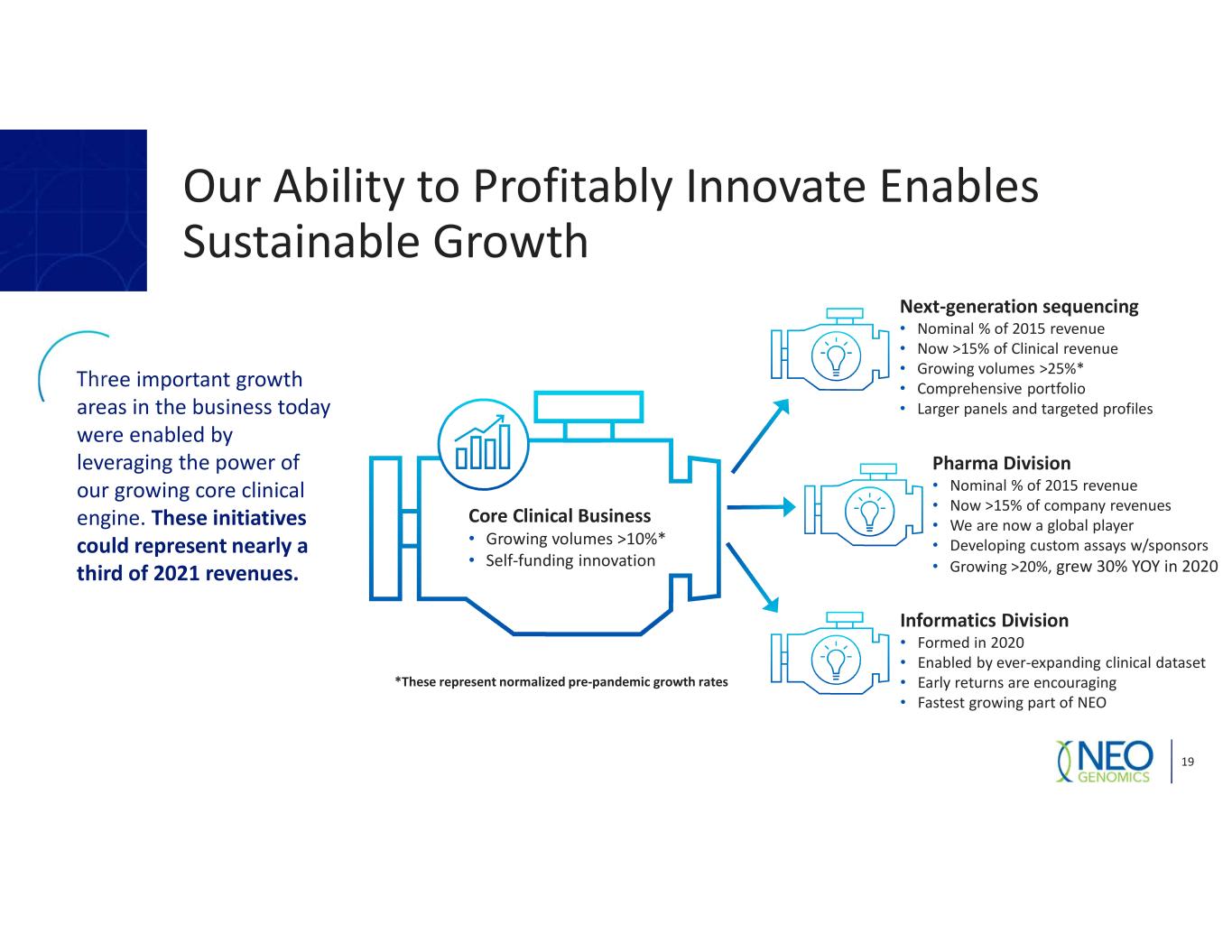

Our Ability to Profitably Innovate Enables Sustainable Growth 19 Core Clinical Business • Growing volumes >10%* • Self-funding innovation Three important growth areas in the business today were enabled by leveraging the power of our growing core clinical engine. These initiatives could represent nearly a third of 2021 revenues. Next-generation sequencing • Nominal % of 2015 revenue • Now >15% of Clinical revenue • Growing volumes >25%* • Comprehensive portfolio • Larger panels and targeted profiles Pharma Division • Nominal % of 2015 revenue • Now >15% of company revenues • We are now a global player • Developing custom assays w/sponsors • Growing >20%, grew 30% YOY in 2020 Informatics Division • Formed in 2020 • Enabled by ever-expanding clinical dataset • Early returns are encouraging • Fastest growing part of NEO *These represent normalized pre-pandemic growth rates

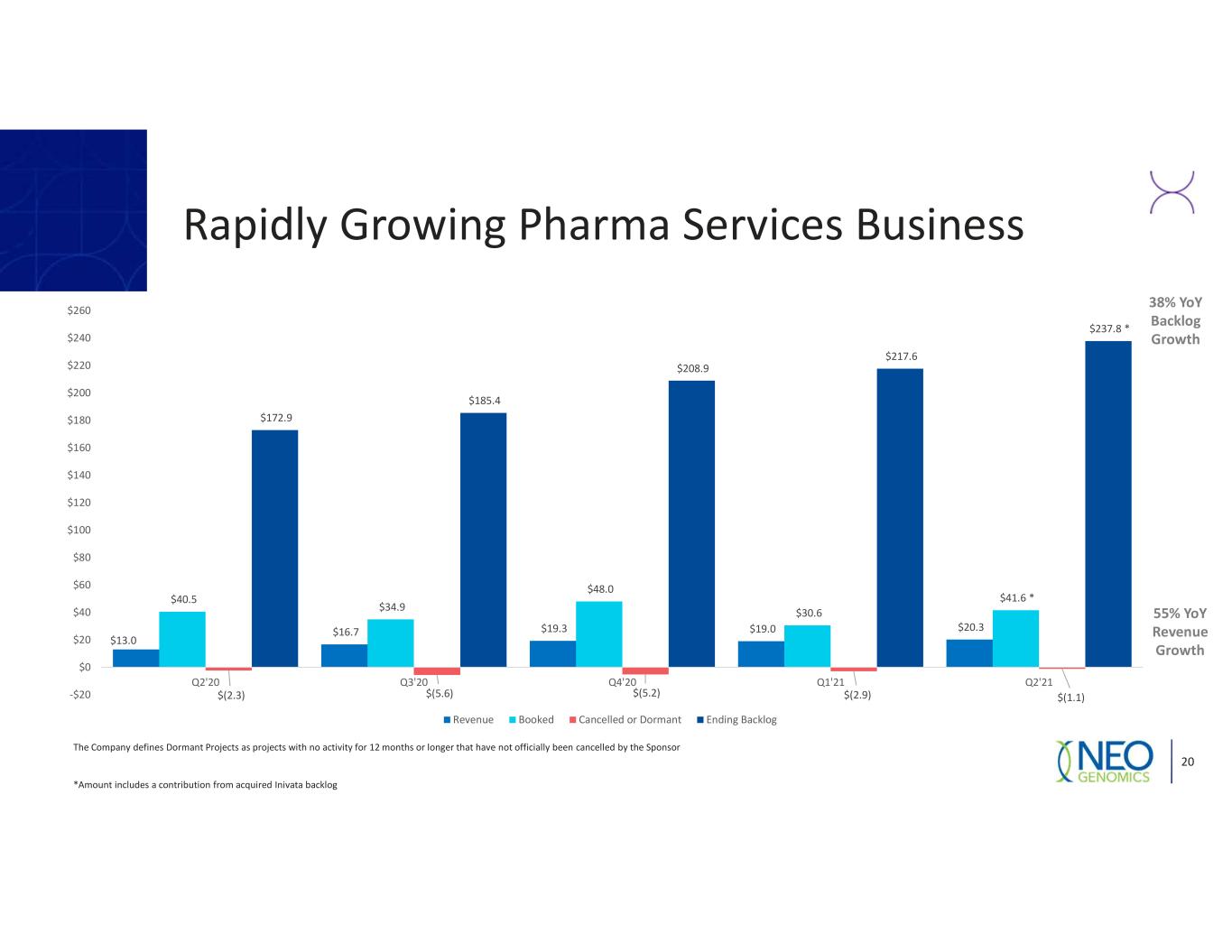

Rapidly Growing Pharma Services Business The Company defines Dormant Projects as projects with no activity for 12 months or longer that have not officially been cancelled by the Sponsor *Amount includes a contribution from acquired Inivata backlog 20 $13.0 $16.7 $19.3 $19.0 $20.3 $40.5 $34.9 $48.0 $30.6 $41.6 * $(2.3) $(5.6) $(5.2) $(2.9) $(1.1) $172.9 $185.4 $208.9 $217.6 $237.8 * -$20 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 $260 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Revenue Booked Cancelled or Dormant Ending Backlog 38% YoY Backlog Growth 55% YoY Revenue Growth

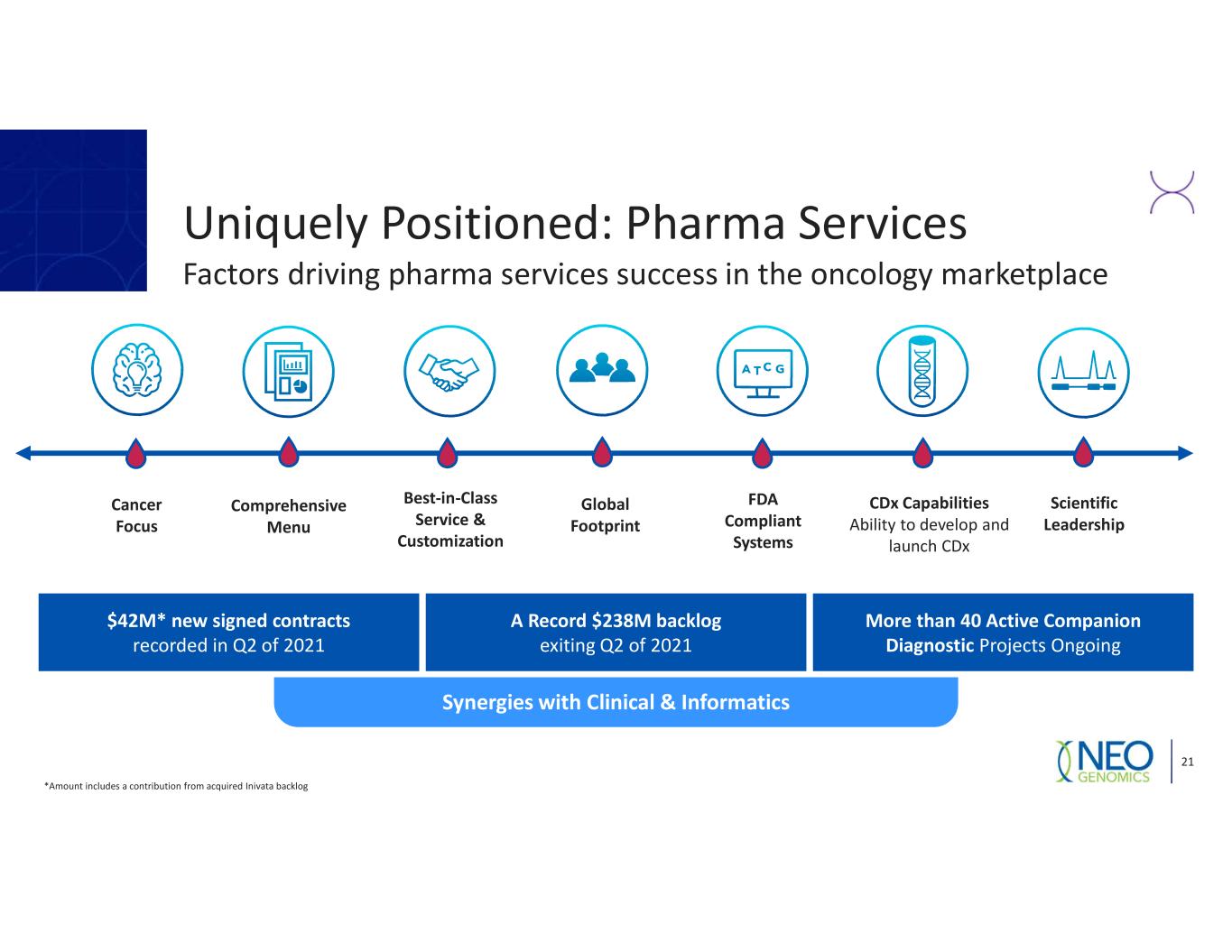

Uniquely Positioned: Pharma Services Factors driving pharma services success in the oncology marketplace 21 $42M* new signed contracts recorded in Q2 of 2021 Synergies with Clinical & Informatics More than 40 Active Companion Diagnostic Projects Ongoing A Record $238M backlog exiting Q2 of 2021 Comprehensive Menu Scientific Leadership CDx Capabilities Ability to develop and launch CDx Best-in-Class Service & Customization Cancer Focus Global Footprint FDA Compliant Systems *Amount includes a contribution from acquired Inivata backlog

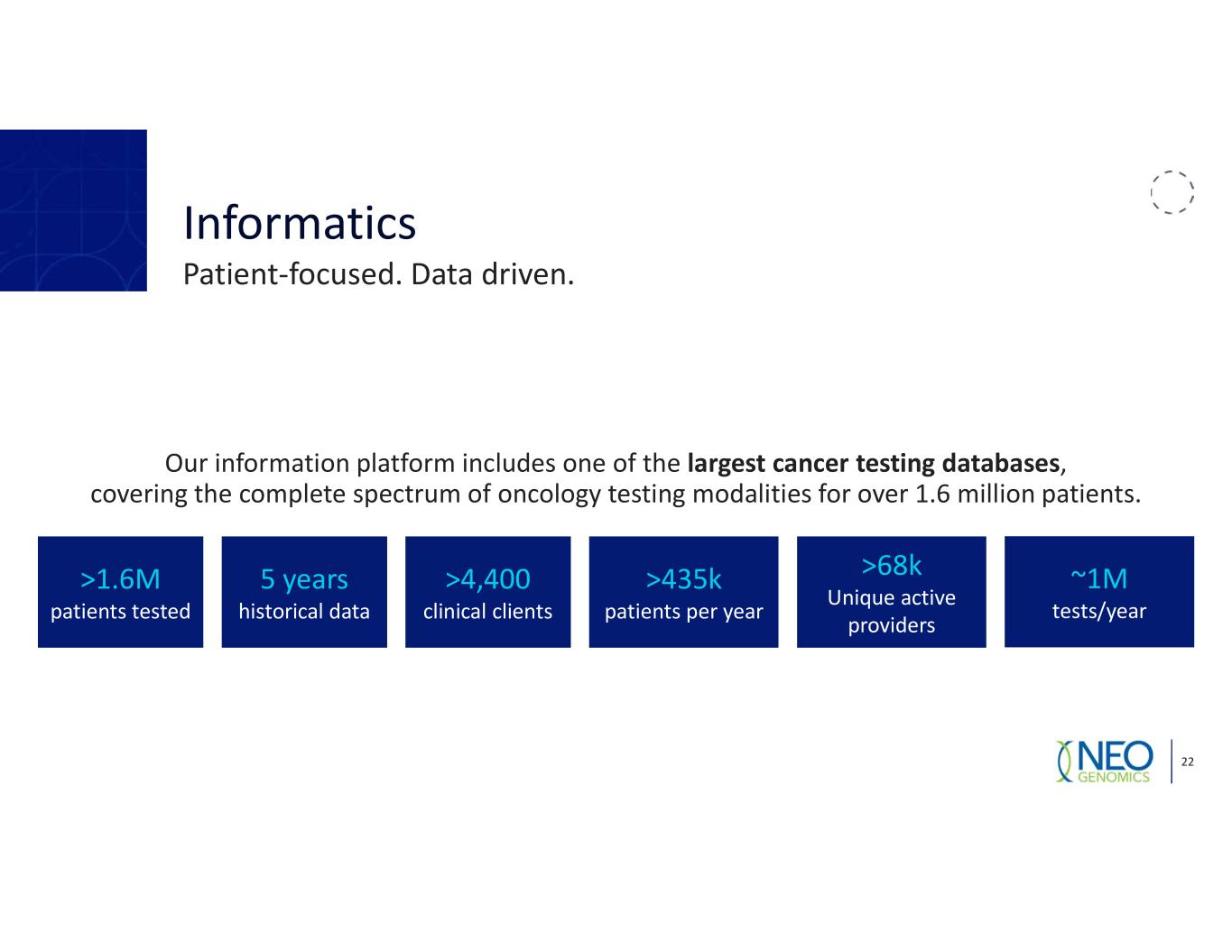

Informatics Patient-focused. Data driven. 22 Our information platform includes one of the largest cancer testing databases, covering the complete spectrum of oncology testing modalities for over 1.6 million patients. >1.6M patients tested 5 years historical data >4,400 clinical clients >435k patients per year >68k Unique active providers ~1M tests/year

Informatics Primary offerings today 23 Diagnostic lab alerts and commercial analytics Clinical trial matching and provider outreach Trapelo Health Clinical Decision Support

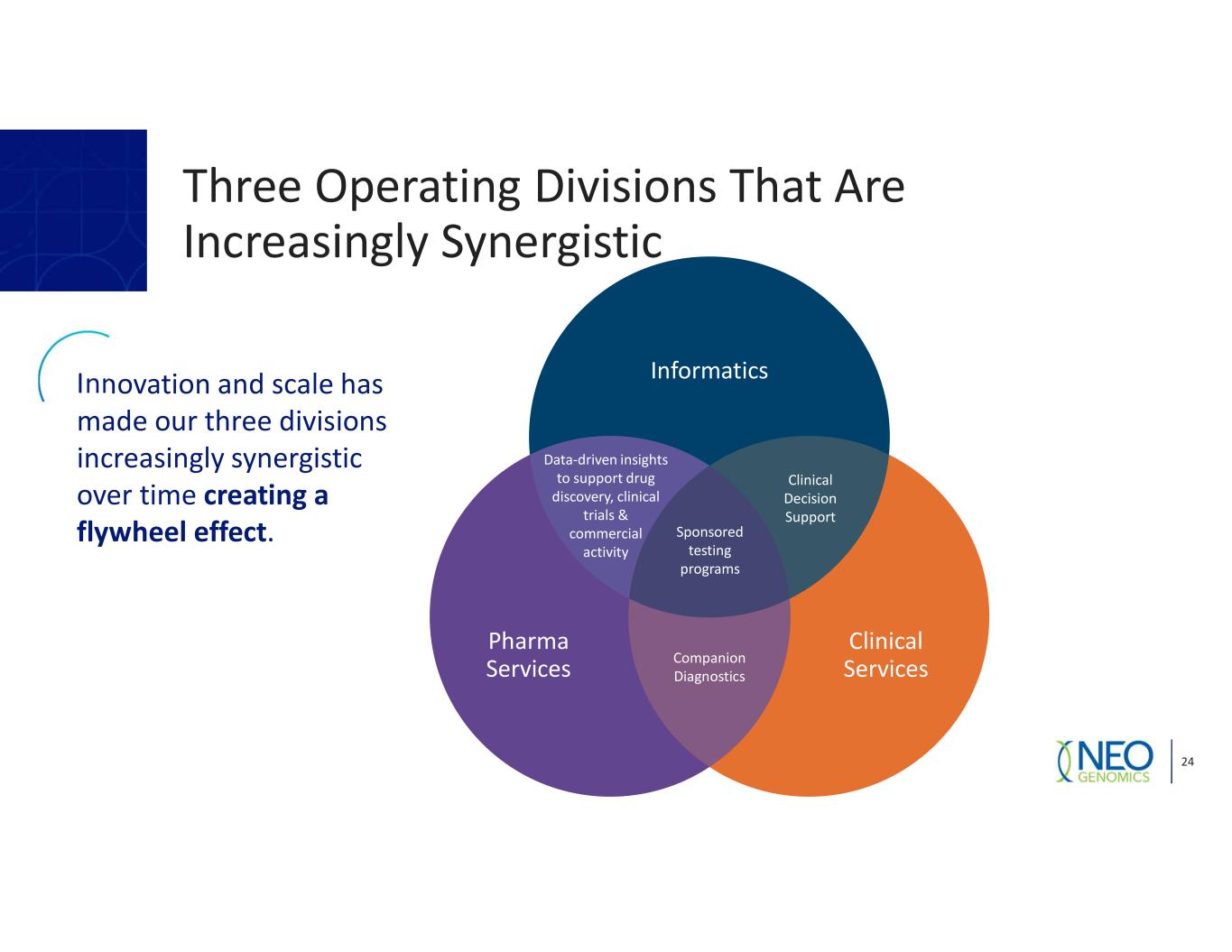

Three Operating Divisions That Are Increasingly Synergistic 24 Innovation and scale has made our three divisions increasingly synergistic over time creating a flywheel effect. Data-driven insights to support drug discovery, clinical trials & commercial activity Clinical Decision Support Sponsored testing programs Clinical Services Pharma Services Informatics Companion Diagnostics

Leading Oncology Diagnostics Company 25 Guided By Science And Passion For Patient Care We are a leader in the field of diagnostic testing with a significant share of patient test volume in the US Our extensive patient database allows us to optimize the pairing of patients with clinical trials We act as a collaborative partner to pathologists, oncologists and biopharma to deliver best-in-class services for all By helping the community oncology field, we improve lives Our work is founded in science, driven by data, and upheld to the highest standards We are oncology experts focused on developing foundational and innovative oncology laboratory diagnostic services When you invest in NeoGenomics, you invest in all of oncology

Appendix

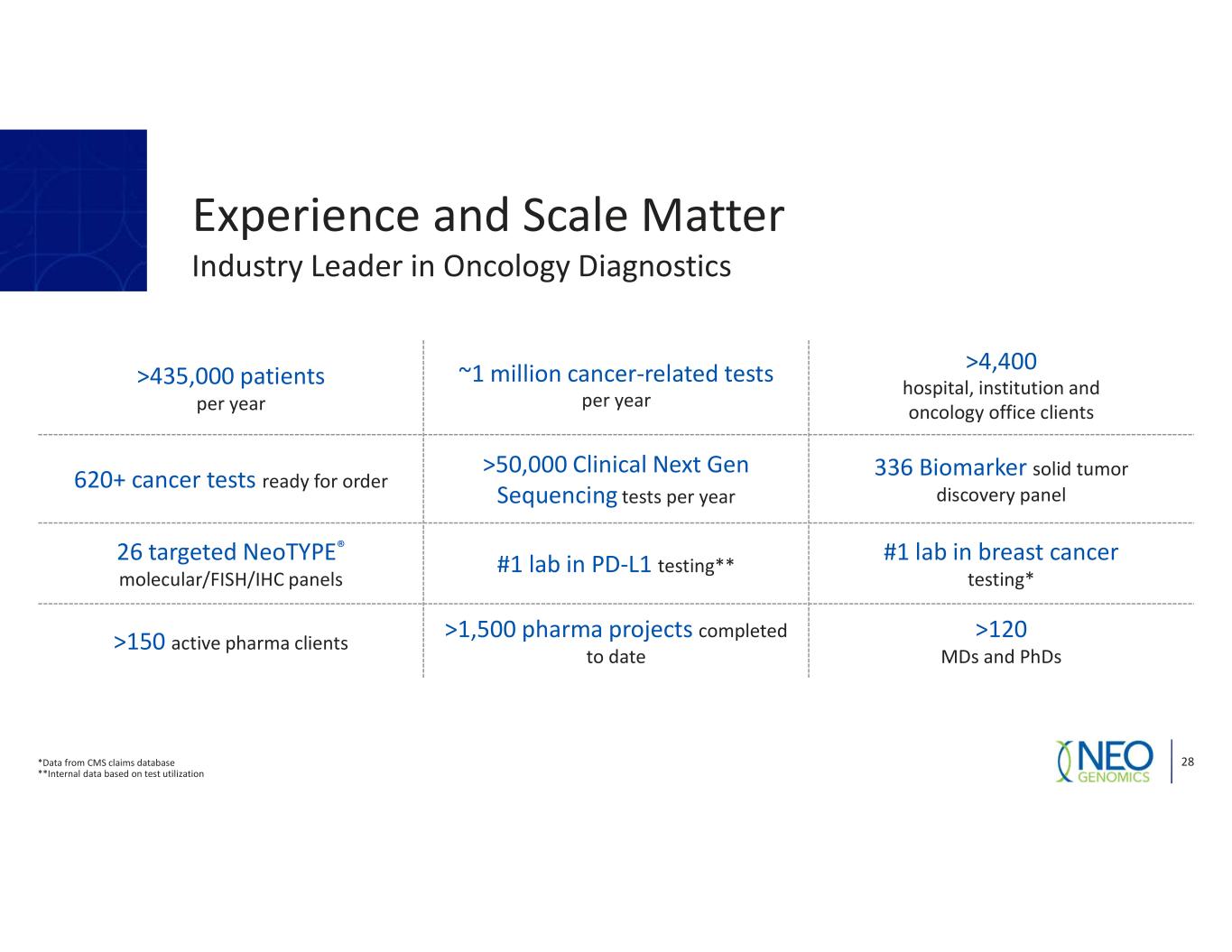

28 Experience and Scale Matter >435,000 patients per year ~1 million cancer-related tests per year >4,400 hospital, institution and oncology office clients 620+ cancer tests ready for order >50,000 Clinical Next Gen Sequencing tests per year 336 Biomarker solid tumor discovery panel 26 targeted NeoTYPE® molecular/FISH/IHC panels #1 lab in PD-L1 testing** #1 lab in breast cancer testing* >150 active pharma clients >1,500 pharma projects completed to date >120 MDs and PhDs *Data from CMS claims database **Internal data based on test utilization Industry Leader in Oncology Diagnostics

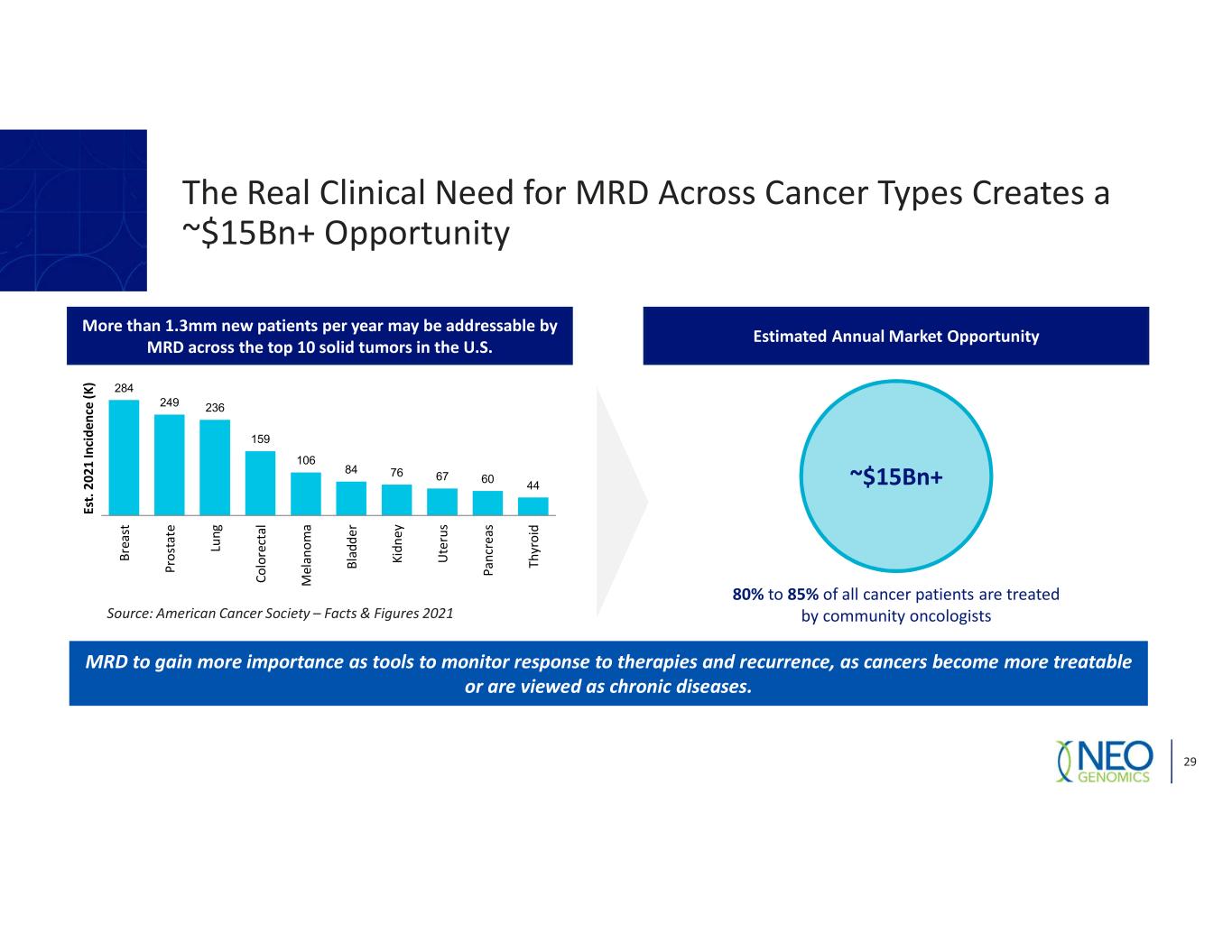

Estimated Annual Market Opportunity ~$15Bn+ 284 249 236 159 106 84 76 67 60 44 Br ea st Pr os ta te Lu ng Co lo re ct al M el an om a Bl ad de r Ki dn ey U te ru s Pa nc re as Th yr oi d Es t. 20 21 In ci de nc e (K ) More than 1.3mm new patients per year may be addressable by MRD across the top 10 solid tumors in the U.S. MRD to gain more importance as tools to monitor response to therapies and recurrence, as cancers become more treatable or are viewed as chronic diseases. The Real Clinical Need for MRD Across Cancer Types Creates a ~$15Bn+ Opportunity 29 80% to 85% of all cancer patients are treated by community oncologistsSource: American Cancer Society – Facts & Figures 2021

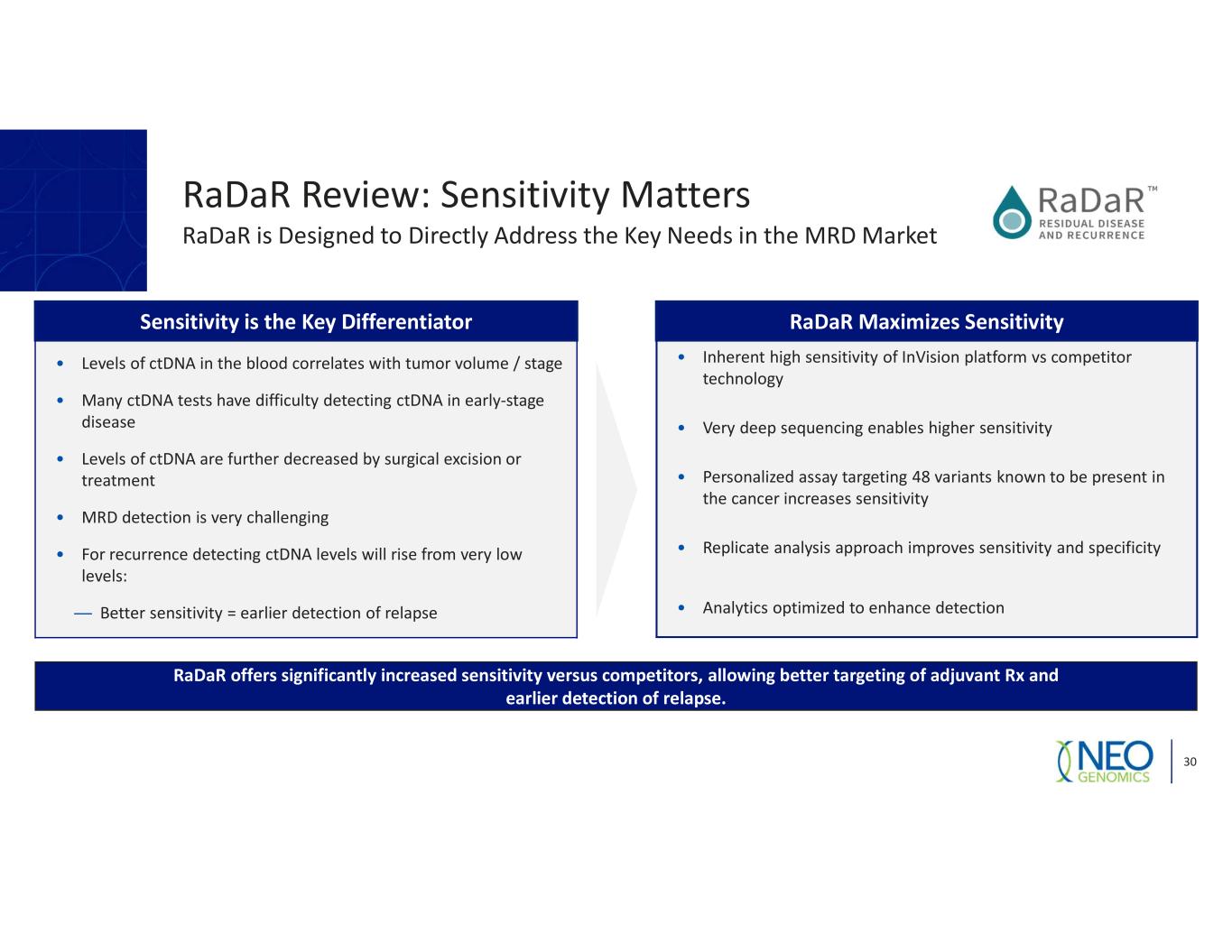

RaDaR Review: Sensitivity Matters RaDaR is Designed to Directly Address the Key Needs in the MRD Market • Inherent high sensitivity of InVision platform vs competitor technology • Very deep sequencing enables higher sensitivity • Personalized assay targeting 48 variants known to be present in the cancer increases sensitivity • Replicate analysis approach improves sensitivity and specificity • Analytics optimized to enhance detection • Levels of ctDNA in the blood correlates with tumor volume / stage • Many ctDNA tests have difficulty detecting ctDNA in early-stage disease • Levels of ctDNA are further decreased by surgical excision or treatment • MRD detection is very challenging • For recurrence detecting ctDNA levels will rise from very low levels: — Better sensitivity = earlier detection of relapse RaDaR offers significantly increased sensitivity versus competitors, allowing better targeting of adjuvant Rx and earlier detection of relapse. Sensitivity is the Key Differentiator RaDaR Maximizes Sensitivity 30

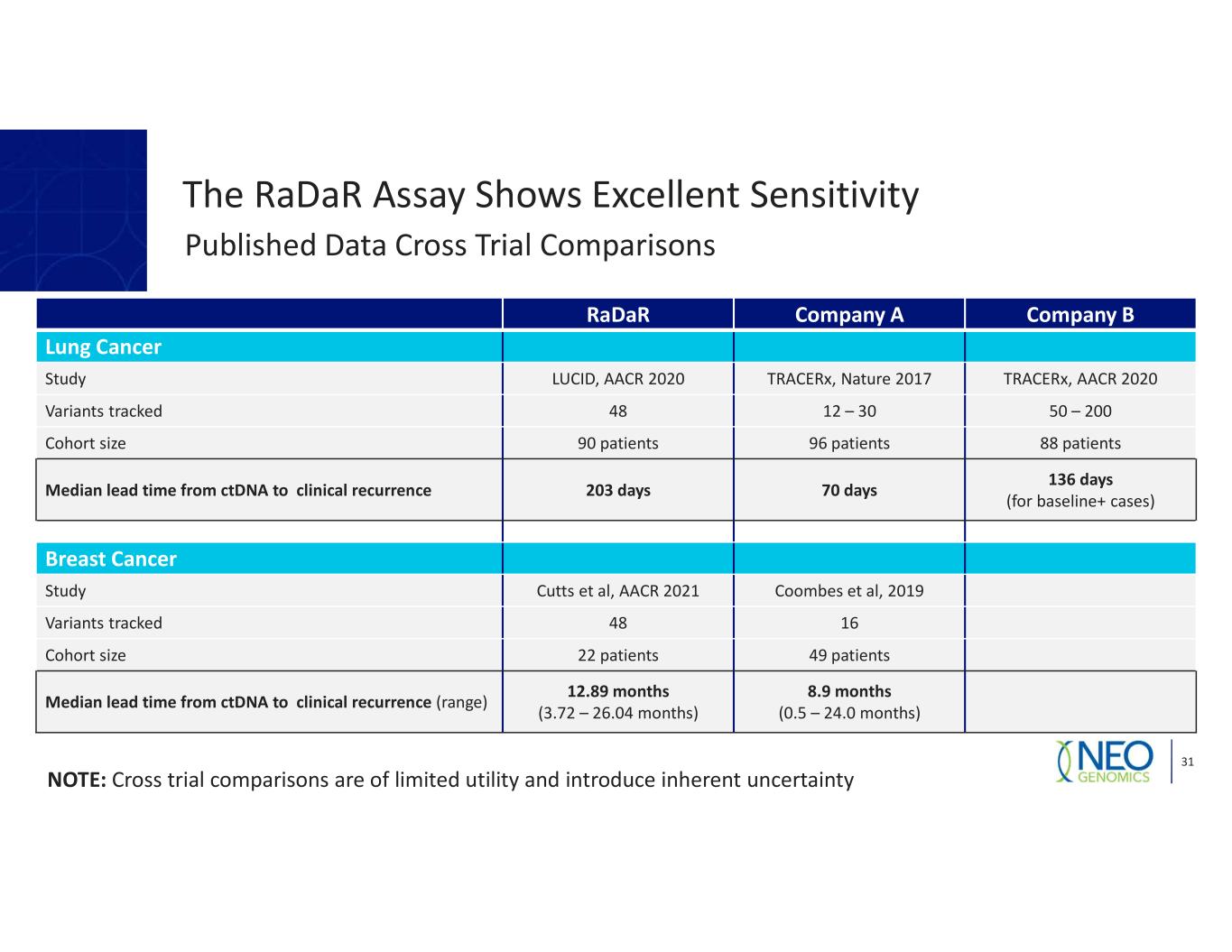

The RaDaR Assay Shows Excellent Sensitivity 31 RaDaR Company A Company B Lung Cancer Study LUCID, AACR 2020 TRACERx, Nature 2017 TRACERx, AACR 2020 Variants tracked 48 12 – 30 50 – 200 Cohort size 90 patients 96 patients 88 patients Median lead time from ctDNA to clinical recurrence 203 days 70 days 136 days (for baseline+ cases) Breast Cancer Study Cutts et al, AACR 2021 Coombes et al, 2019 Variants tracked 48 16 Cohort size 22 patients 49 patients Median lead time from ctDNA to clinical recurrence (range) 12.89 months (3.72 – 26.04 months) 8.9 months (0.5 – 24.0 months) NOTE: Cross trial comparisons are of limited utility and introduce inherent uncertainty Published Data Cross Trial Comparisons

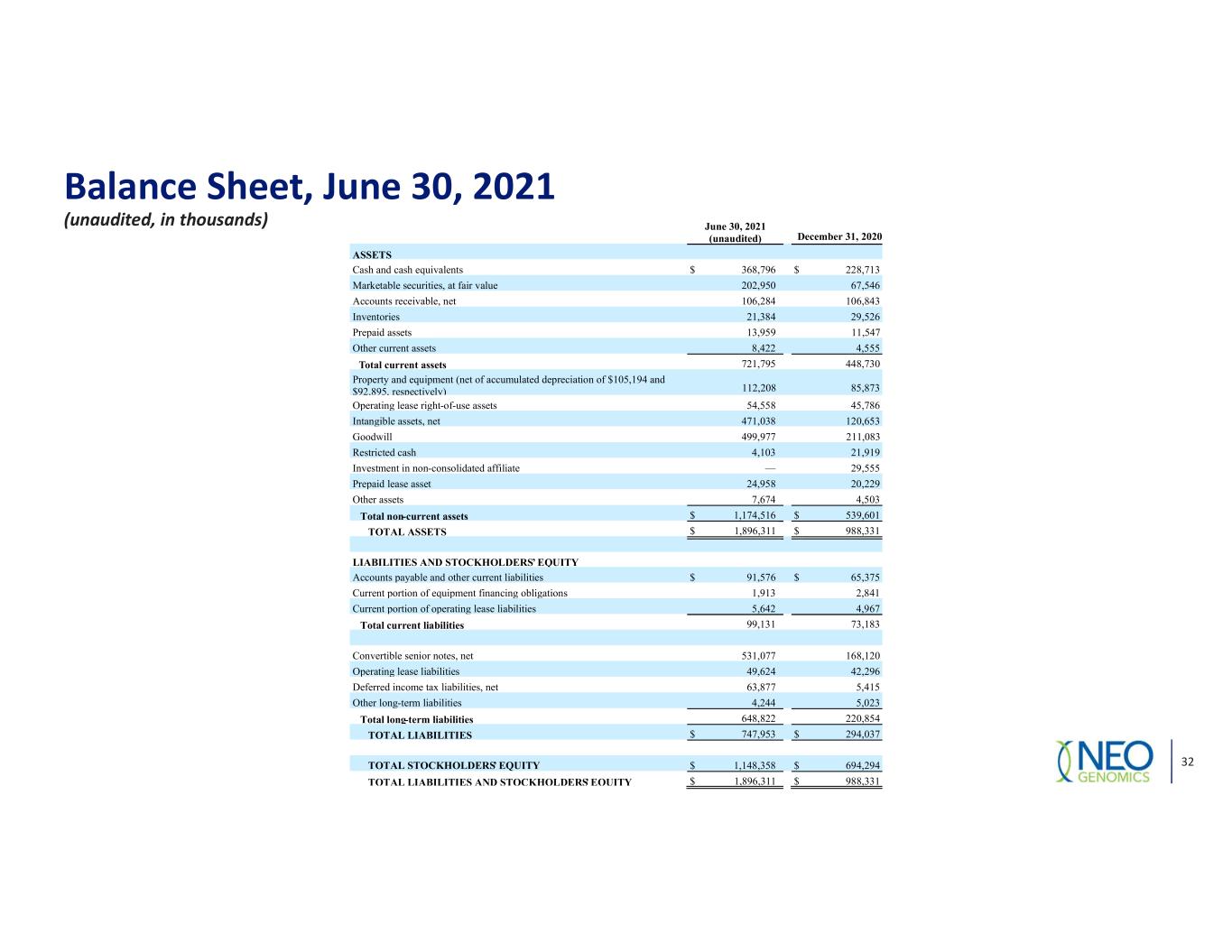

Balance Sheet, June 30, 2021 (unaudited, in thousands) 32 June 30, 2021 (unaudited) December 31, 2020 ASSETS Cash and cash equivalents $ 368,796 $ 228,713 Marketable securities, at fair value 202,950 67,546 Accounts receivable, net 106,284 106,843 Inventories 21,384 29,526 Prepaid assets 13,959 11,547 Other current assets 8,422 4,555 Total current assets 721,795 448,730 Property and equipment (net of accumulated depreciation of $105,194 and $92,895, respectively) 112,208 85,873 Operating lease right-of-use assets 54,558 45,786 Intangible assets, net 471,038 120,653 Goodwill 499,977 211,083 Restricted cash 4,103 21,919 Investment in non-consolidated affiliate — 29,555 Prepaid lease asset 24,958 20,229 Other assets 7,674 4,503 Total non-current assets $ 1,174,516 $ 539,601 TOTAL ASSETS $ 1,896,311 $ 988,331 LIABILITIES AND STOCKHOLDERS’ EQUITY Accounts payable and other current liabilities $ 91,576 $ 65,375 Current portion of equipment financing obligations 1,913 2,841 Current portion of operating lease liabilities 5,642 4,967 Total current liabilities 99,131 73,183 Convertible senior notes, net 531,077 168,120 Operating lease liabilities 49,624 42,296 Deferred income tax liabilities, net 63,877 5,415 Other long-term liabilities 4,244 5,023 Total long-term liabilities 648,822 220,854 TOTAL LIABILITIES $ 747,953 $ 294,037 TOTAL STOCKHOLDERS’ EQUITY $ 1,148,358 $ 694,294 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 1,896,311 $ 988,331

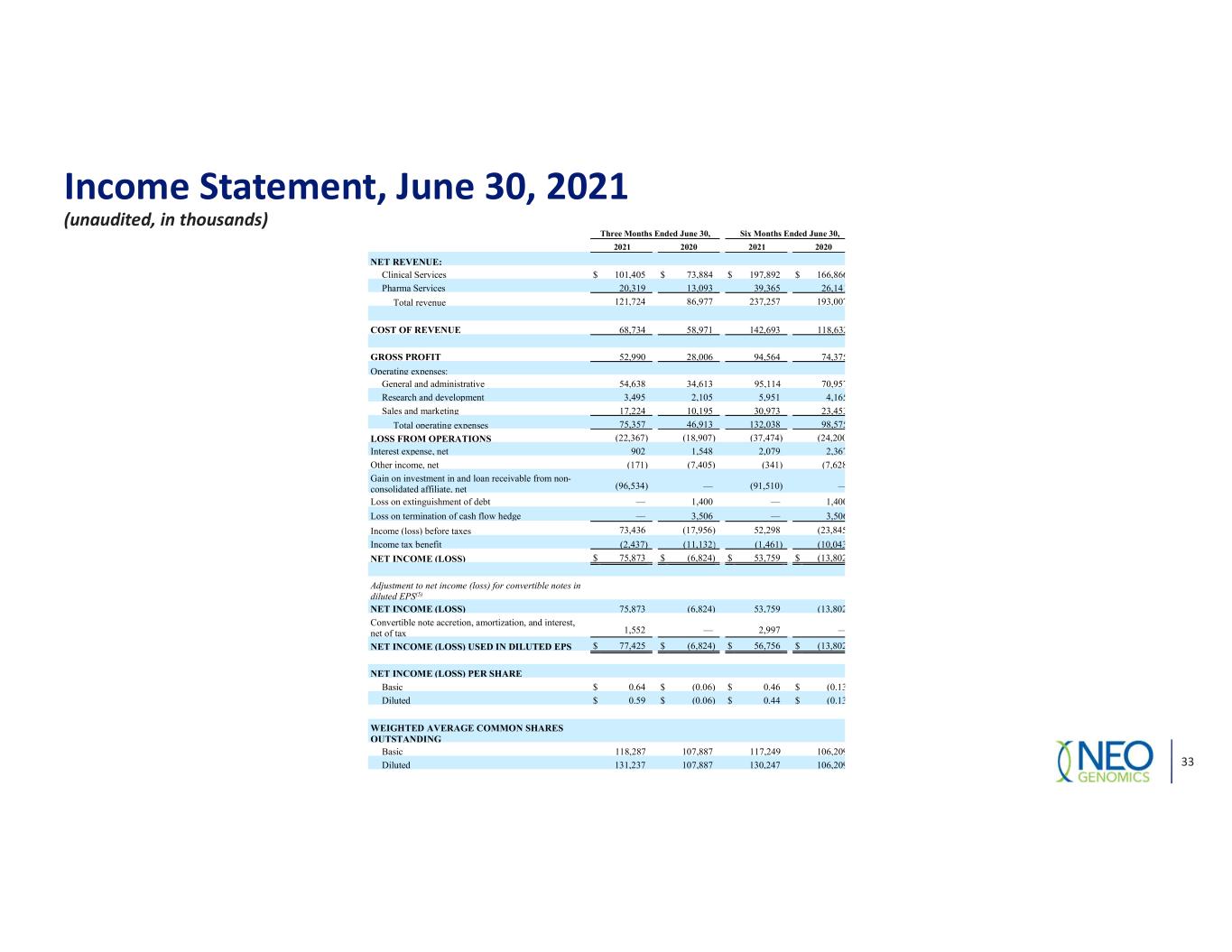

Income Statement, June 30, 2021 (unaudited, in thousands) 33 Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 NET REVENUE: Clinical Services $ 101,405 $ 73,884 $ 197,892 $ 166,866 Pharma Services 20,319 13,093 39,365 26,141 Total revenue 121,724 86,977 237,257 193,007 COST OF REVENUE 68,734 58,971 142,693 118,632 GROSS PROFIT 52,990 28,006 94,564 74,375 Operating expenses: General and administrative 54,638 34,613 95,114 70,957 Research and development 3,495 2,105 5,951 4,165 Sales and marketing 17,224 10,195 30,973 23,453 Total operating expenses 75,357 46,913 132,038 98,575 LOSS FROM OPERATIONS (22,367) (18,907) (37,474) (24,200) Interest expense, net 902 1,548 2,079 2,367 Other income, net (171) (7,405) (341) (7,628) Gain on investment in and loan receivable from non- consolidated affiliate, net (96,534) — (91,510) — Loss on extinguishment of debt — 1,400 — 1,400 Loss on termination of cash flow hedge — 3,506 — 3,506 Income (loss) before taxes 73,436 (17,956) 52,298 (23,845) Income tax benefit (2,437) (11,132) (1,461) (10,043) NET INCOME (LOSS) $ 75,873 $ (6,824) $ 53,759 $ (13,802) Adjustment to net income (loss) for convertible notes in diluted EPS(5) NET INCOME (LOSS) 75,873 (6,824) 53,759 (13,802) Convertible note accretion, amortization, and interest, net of tax 1,552 — 2,997 — NET INCOME (LOSS) USED IN DILUTED EPS $ 77,425 $ (6,824) $ 56,756 $ (13,802) NET INCOME (LOSS) PER SHARE Basic $ 0.64 $ (0.06) $ 0.46 $ (0.13) Diluted $ 0.59 $ (0.06) $ 0.44 $ (0.13) WEIGHTED AVERAGE COMMON SHARES OUTSTANDING Basic 118,287 107,887 117,249 106,209 Diluted 131,237 107,887 130,247 106,209

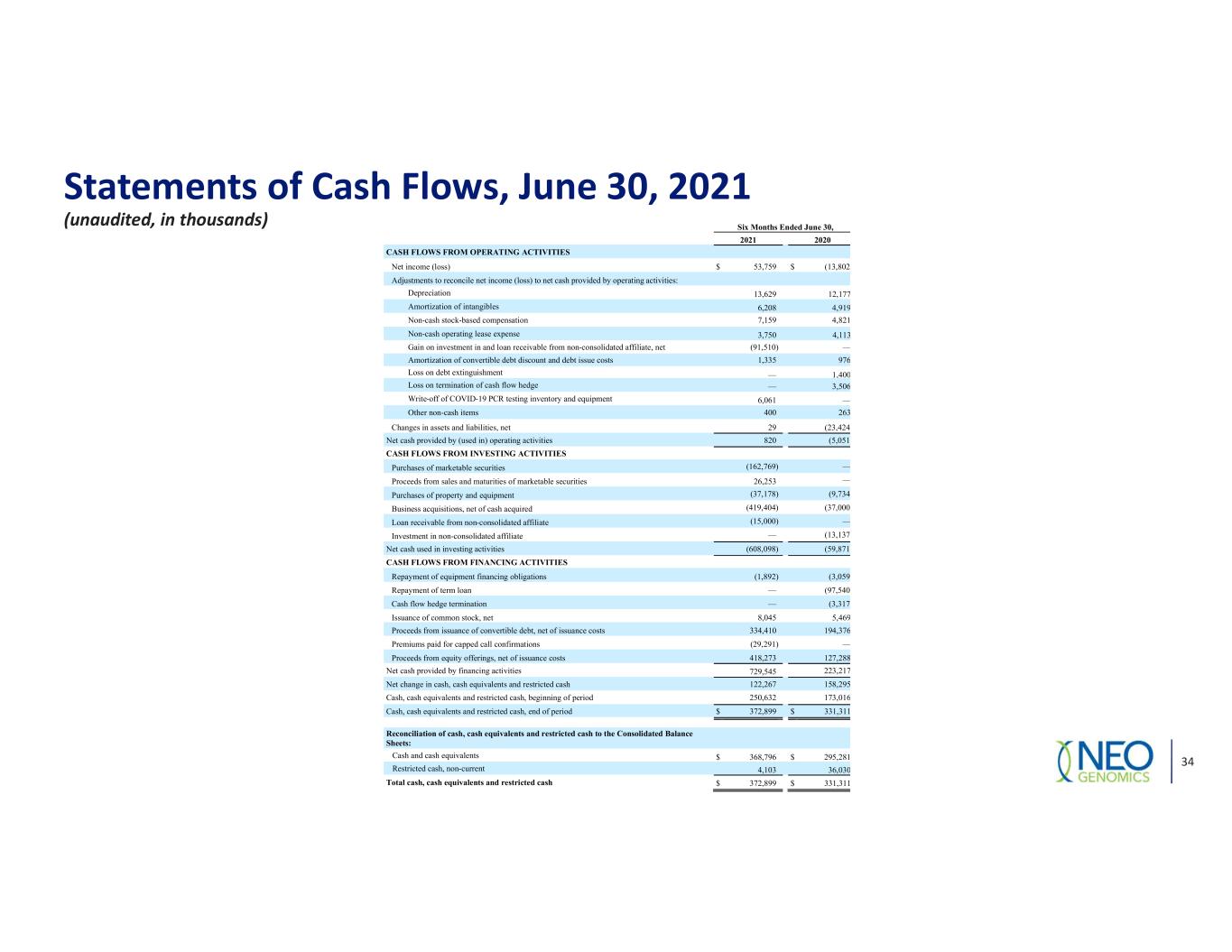

Statements of Cash Flows, June 30, 2021 (unaudited, in thousands) 34 Six Months Ended June 30, 2021 2020 CASH FLOWS FROM OPERATING ACTIVITIES Net income (loss) $ 53,759 $ (13,802) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation 13,629 12,177 Amortization of intangibles 6,208 4,919 Non-cash stock-based compensation 7,159 4,821 Non-cash operating lease expense 3,750 4,113 Gain on investment in and loan receivable from non-consolidated affiliate, net (91,510) — Amortization of convertible debt discount and debt issue costs 1,335 976 Loss on debt extinguishment — 1,400 Loss on termination of cash flow hedge — 3,506 Write-off of COVID-19 PCR testing inventory and equipment 6,061 — Other non-cash items 400 263 Changes in assets and liabilities, net 29 (23,424) Net cash provided by (used in) operating activities 820 (5,051) CASH FLOWS FROM INVESTING ACTIVITIES Purchases of marketable securities (162,769) — Proceeds from sales and maturities of marketable securities 26,253 — Purchases of property and equipment (37,178) (9,734) Business acquisitions, net of cash acquired (419,404) (37,000) Loan receivable from non-consolidated affiliate (15,000) — Investment in non-consolidated affiliate — (13,137) Net cash used in investing activities (608,098) (59,871) CASH FLOWS FROM FINANCING ACTIVITIES Repayment of equipment financing obligations (1,892) (3,059) Repayment of term loan — (97,540) Cash flow hedge termination — (3,317) Issuance of common stock, net 8,045 5,469 Proceeds from issuance of convertible debt, net of issuance costs 334,410 194,376 Premiums paid for capped call confirmations (29,291) — Proceeds from equity offerings, net of issuance costs 418,273 127,288 Net cash provided by financing activities 729,545 223,217 Net change in cash, cash equivalents and restricted cash 122,267 158,295 Cash, cash equivalents and restricted cash, beginning of period 250,632 173,016 Cash, cash equivalents and restricted cash, end of period $ 372,899 $ 331,311 Reconciliation of cash, cash equivalents and restricted cash to the Consolidated Balance Sheets: Cash and cash equivalents $ 368,796 $ 295,281 Restricted cash, non-current 4,103 36,030 Total cash, cash equivalents and restricted cash $ 372,899 $ 331,311

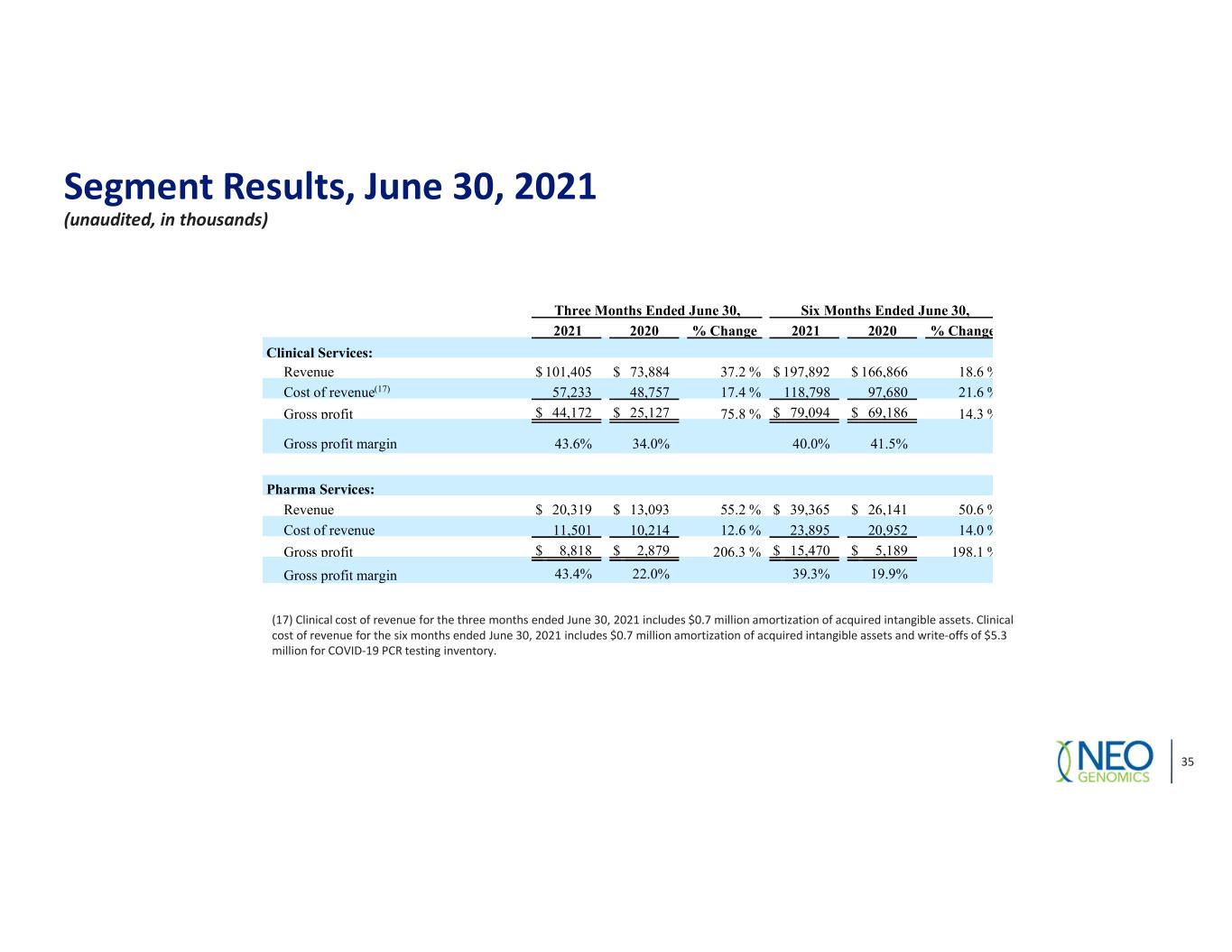

Segment Results, June 30, 2021 (unaudited, in thousands) 35 (17) Clinical cost of revenue for the three months ended June 30, 2021 includes $0.7 million amortization of acquired intangible assets. Clinical cost of revenue for the six months ended June 30, 2021 includes $0.7 million amortization of acquired intangible assets and write-offs of $5.3 million for COVID-19 PCR testing inventory. Three Months Ended June 30, Six Months Ended June 30, 2021 2020 % Change 2021 2020 % Change Clinical Services: Revenue $ 101,405 $ 73,884 37.2 % $ 197,892 $ 166,866 18.6 % Cost of revenue(17) 57,233 48,757 17.4 % 118,798 97,680 21.6 % Gross profit $ 44,172 $ 25,127 75.8 % $ 79,094 $ 69,186 14.3 % Gross profit margin 43.6% 34.0% 40.0% 41.5% Pharma Services: Revenue $ 20,319 $ 13,093 55.2 % $ 39,365 $ 26,141 50.6 % Cost of revenue 11,501 10,214 12.6 % 23,895 20,952 14.0 % Gross profit $ 8,818 $ 2,879 206.3 % $ 15,470 $ 5,189 198.1 % Gross profit margin 43.4% 22.0% 39.3% 19.9%

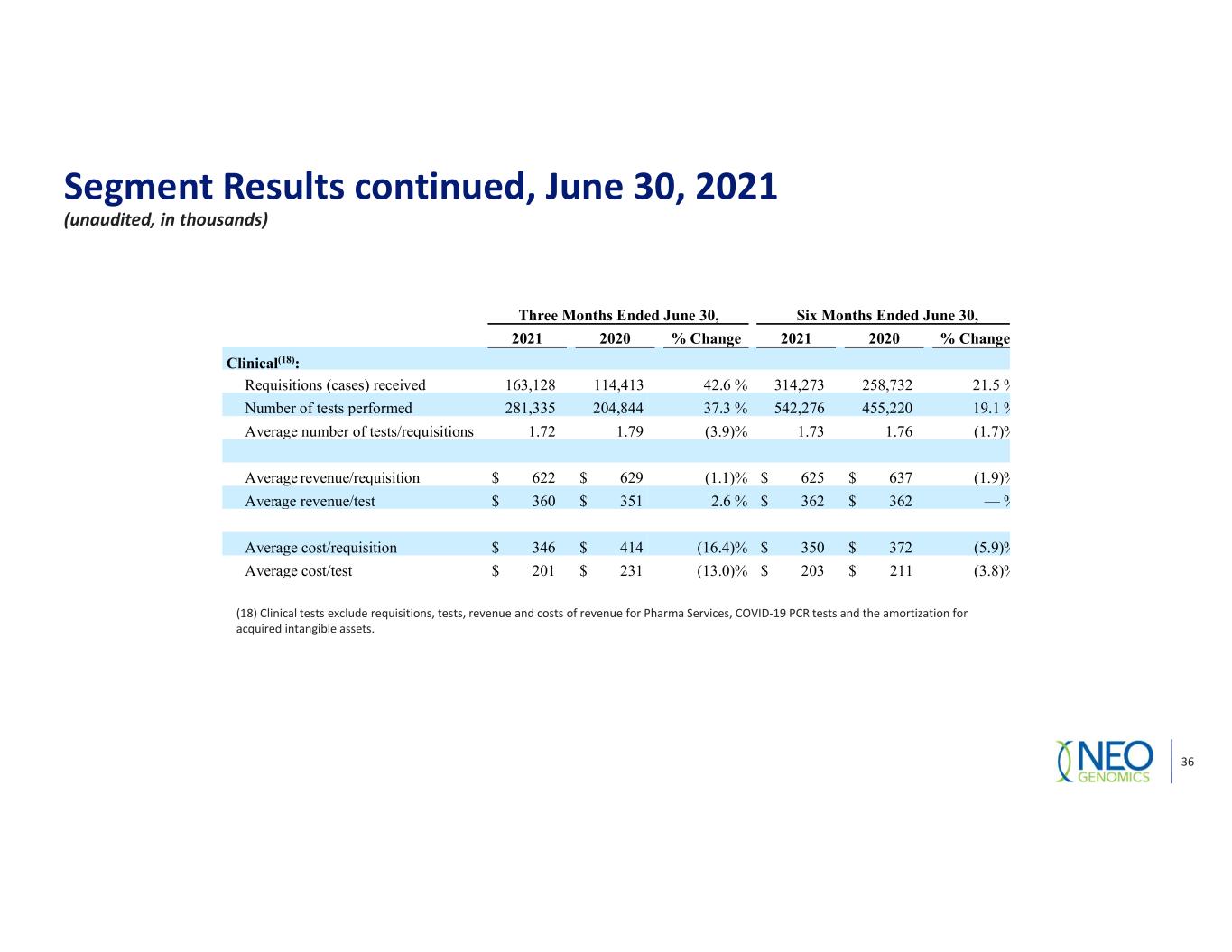

Segment Results continued, June 30, 2021 (unaudited, in thousands) 36 (18) Clinical tests exclude requisitions, tests, revenue and costs of revenue for Pharma Services, COVID-19 PCR tests and the amortization for acquired intangible assets. Three Months Ended June 30, Six Months Ended June 30, 2021 2020 % Change 2021 2020 % Change Clinical(18): Requisitions (cases) received 163,128 114,413 42.6 % 314,273 258,732 21.5 % Number of tests performed 281,335 204,844 37.3 % 542,276 455,220 19.1 % Average number of tests/requisitions 1.72 1.79 (3.9)% 1.73 1.76 (1.7)% Average revenue/requisition $ 622 $ 629 (1.1)% $ 625 $ 637 (1.9)% Average revenue/test $ 360 $ 351 2.6 % $ 362 $ 362 — % Average cost/requisition $ 346 $ 414 (16.4)% $ 350 $ 372 (5.9)% Average cost/test $ 201 $ 231 (13.0)% $ 203 $ 211 (3.8)%

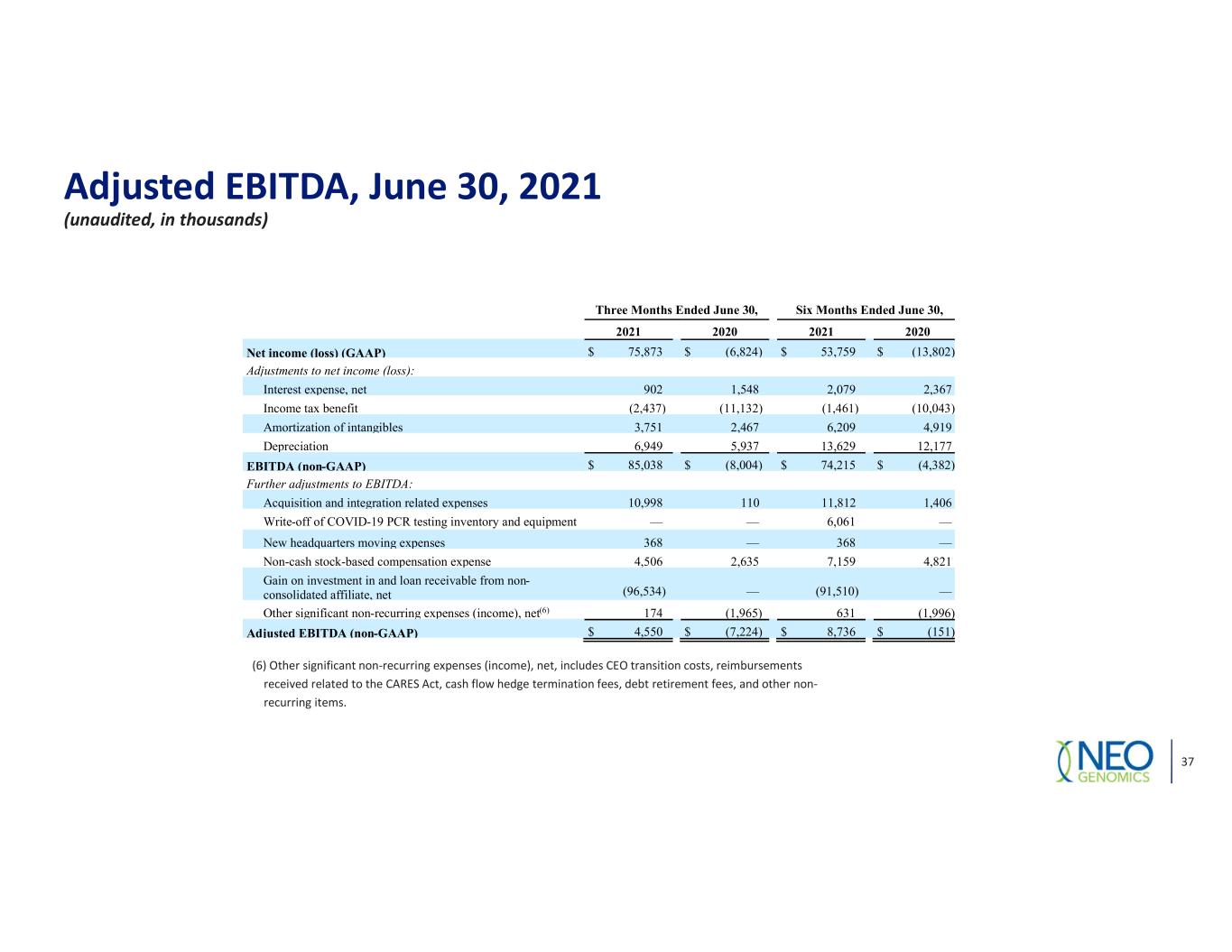

Adjusted EBITDA, June 30, 2021 (unaudited, in thousands) 37 Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Net income (loss) (GAAP) $ 75,873 $ (6,824) $ 53,759 $ (13,802) Adjustments to net income (loss): Interest expense, net 902 1,548 2,079 2,367 Income tax benefit (2,437) (11,132) (1,461) (10,043) Amortization of intangibles 3,751 2,467 6,209 4,919 Depreciation 6,949 5,937 13,629 12,177 EBITDA (non-GAAP) $ 85,038 $ (8,004) $ 74,215 $ (4,382) Further adjustments to EBITDA: Acquisition and integration related expenses 10,998 110 11,812 1,406 Write-off of COVID-19 PCR testing inventory and equipment — — 6,061 — New headquarters moving expenses 368 — 368 — Non-cash stock-based compensation expense 4,506 2,635 7,159 4,821 Gain on investment in and loan receivable from non- consolidated affiliate, net (96,534) — (91,510) — Other significant non-recurring expenses (income), net(6) 174 (1,965) 631 (1,996) Adjusted EBITDA (non-GAAP) $ 4,550 $ (7,224) $ 8,736 $ (151) (6) Other significant non-recurring expenses (income), net, includes CEO transition costs, reimbursements received related to the CARES Act, cash flow hedge termination fees, debt retirement fees, and other non- recurring items.