EX-99.2

Published on October 21, 2015

Special Investor Presentation October 21, 2015 Acquisition of Exhibit 99.2

Forward-looking Statements This presentation contains statements which constitute forward-looking statements within the meaning of Section 27A of the Securities Act, as amended; Section 21E of the Securities Exchange Act of 1934; and the Private Securities Litigation Reform Act of 1995. The words “may”, “would”, “could”, “will”, “expect”, “estimate”, “anticipate”, “believe”, “intend”, “plan”, “goal”, and similar expressions and variations thereof are intended to specifically identify forward-looking statements. All statements that are not statements of historical fact are forward-looking statements. Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. The risks that might cause such differences are identified in our filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise the forward looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events.

Transaction Background NeoGenomics’ long-standing Vision and Strategy: Vision: to become America’s premier cancer testing laboratory Key Strategic Elements High-quality and low-cost provider. Growth by market share gains as “one-stop-shop” for cancer genetic testing. Innovate aggressively to advance precision medicine Diversify product line and enter BioPharma market. Communicated desire to accelerate achievement of Vision and Strategies through M&A. Clarient is a transformational acquisition for NEO – creates ability to transform NEO quickly into industry leader. We’ve been in a strategic dialogue with GE for almost a year, and are extremely pleased with the outcome.

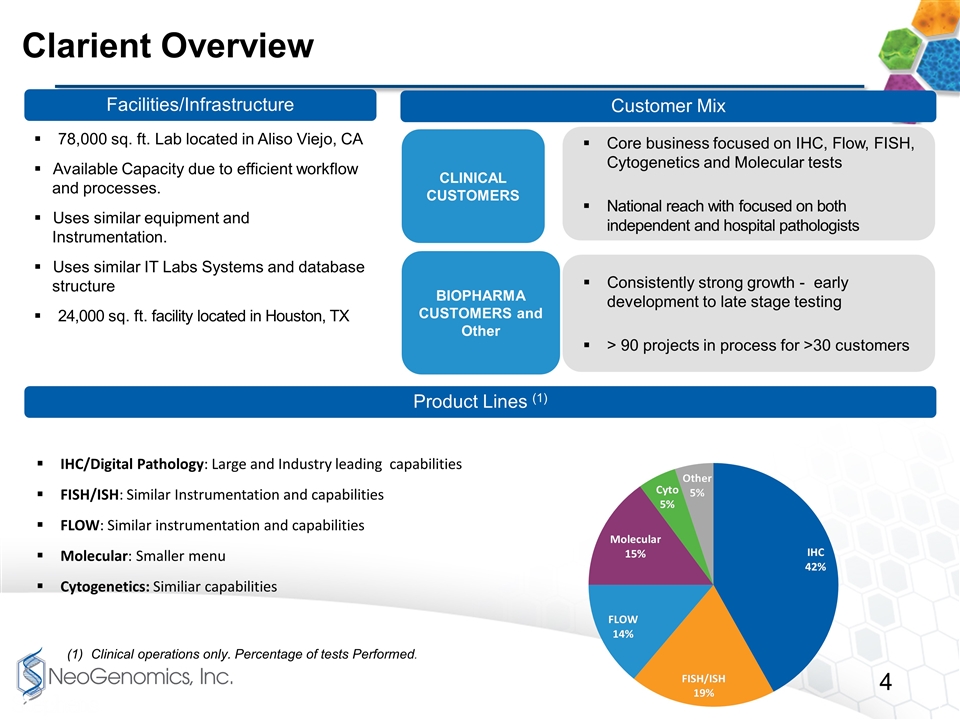

Core business focused on IHC, Flow, FISH, Cytogenetics and Molecular tests National reach with focused on both independent and hospital pathologists Consistently strong growth - early development to late stage testing > 90 projects in process for >30 customers Clarient Overview IHC/Digital Pathology: Large and Industry leading capabilities FISH/ISH: Similar Instrumentation and capabilities FLOW: Similar instrumentation and capabilities Molecular: Smaller menu Cytogenetics: Similiar capabilities Facilities/Infrastructure Customer Mix Product Lines (1) 78,000 sq. ft. Lab located in Aliso Viejo, CA Available Capacity due to efficient workflow and processes. Uses similar equipment and Instrumentation. Uses similar IT Labs Systems and database structure 24,000 sq. ft. facility located in Houston, TX Clinical operations only. Percentage of tests Performed. CLINICAL CUSTOMERS BIOPHARMA CUSTOMERS and Other

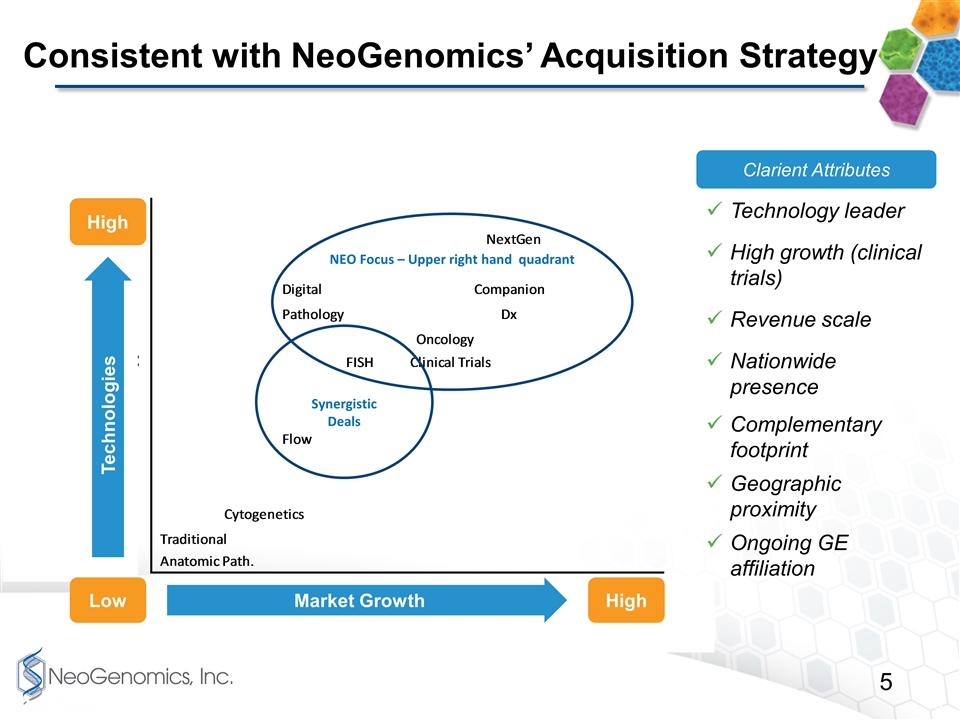

Consistent with NeoGenomics’ Acquisition Strategy NEO Focus – Upper right hand quadrant Synergistic Deals High High Low Market Growth Technologies Clarient Attributes Technology leader High growth (clinical trials) Revenue scale Nationwide presence Complementary footprint Geographic proximity Ongoing GE affiliation

Strategic Rationale Opportunity to be the low-cost provider in each key laboratory discipline. Ability to better balance clinical product portfolio and reduce risk profile from concentration in any one particular product line. Enhance capability to develop a meaningful business in clinical trials. Create greater economies of scale in Administrative/Corporate functions, including Information Technology, Regulatory, Billing, Compliance, etc. Ability to leverage and optimize the Sales and Marketing function across a broader revenue base, and to provide better geographic coverage. Ability to leverage innovation efforts/new product development across broader client base. Create greater ability to serve Managed Care organizations and Large Buyers in a more significant way. Ability to provide better “one-stop-shop” capability and service to existing and new clients.

Key Benefits Synergy potential of $20mm - $30mm/year within 3-5 year Laboratory, Purchasing, Cross-selling, etc. East Coast/West Coast labs Combine Irvine and Aliso Viejo Low cost position in every testing discipline FISH, Flow, Cytogenetics, IHC, Digital Pathology, Molecular Leadership in hematological and solid tumor cancers One-stop-shop for clients with broad geographical coverage Significant clinical trials business Combined business approximates $25mm revenue Potential to be a leading consolidator going forward GE as significant long-term Investor Collaboration in Bioinformatics in Precision Oncology

Clinical Trials - BioPharma A rapidly growing part of Clarient’s business and a fantastic opportunity . . . Over $20mm/yr in current business Strong relationships with several leading Pharmaceutical firms PDL1 22C3 – FDA Approved companion diagnostic for Keytruda Continued push into Companion Dx and personalized medicine Approved vendor with top firms On several firms advisory boards Solid pipeline and future growth opportunities

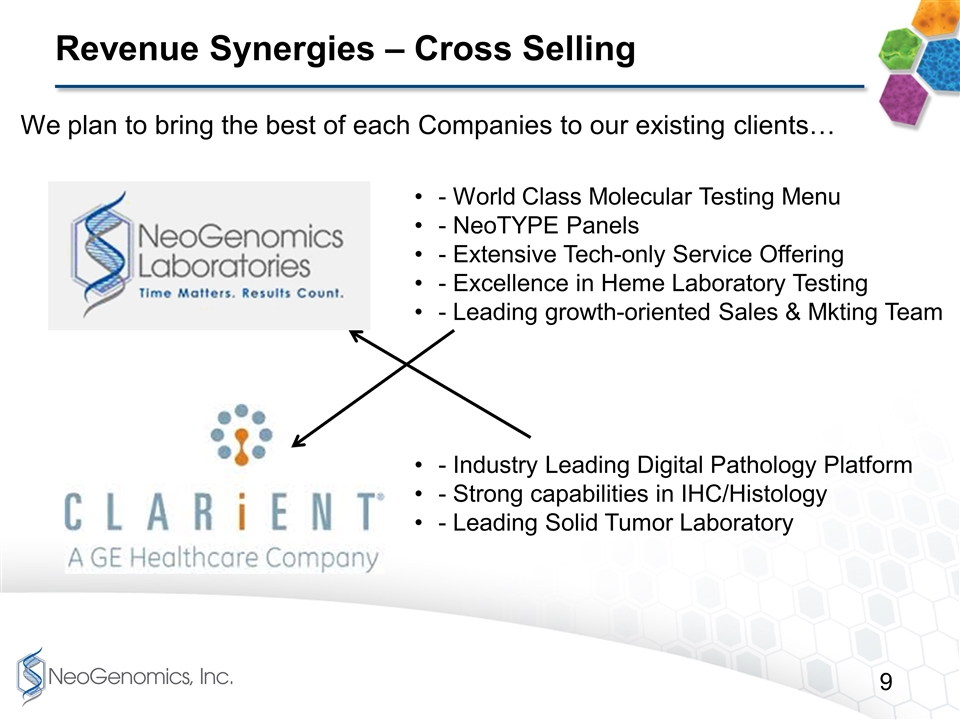

Revenue Synergies – Cross Selling - World Class Molecular Testing Menu - NeoTYPE Panels - Extensive Tech-only Service Offering - Excellence in Heme Laboratory Testing - Leading growth-oriented Sales & Mkting Team - Industry Leading Digital Pathology Platform - Strong capabilities in IHC/Histology - Leading Solid Tumor Laboratory We plan to bring the best of each Companies to our existing clients…

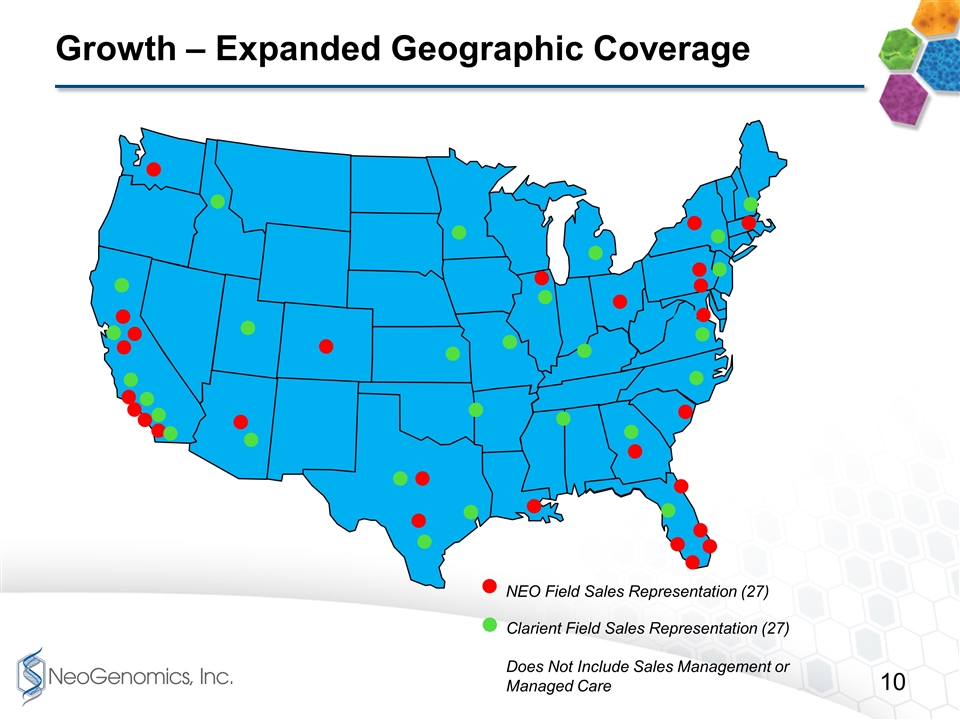

Growth – Expanded Geographic Coverage NEO Field Sales Representation (27) Clarient Field Sales Representation (27) Does Not Include Sales Management or Managed Care

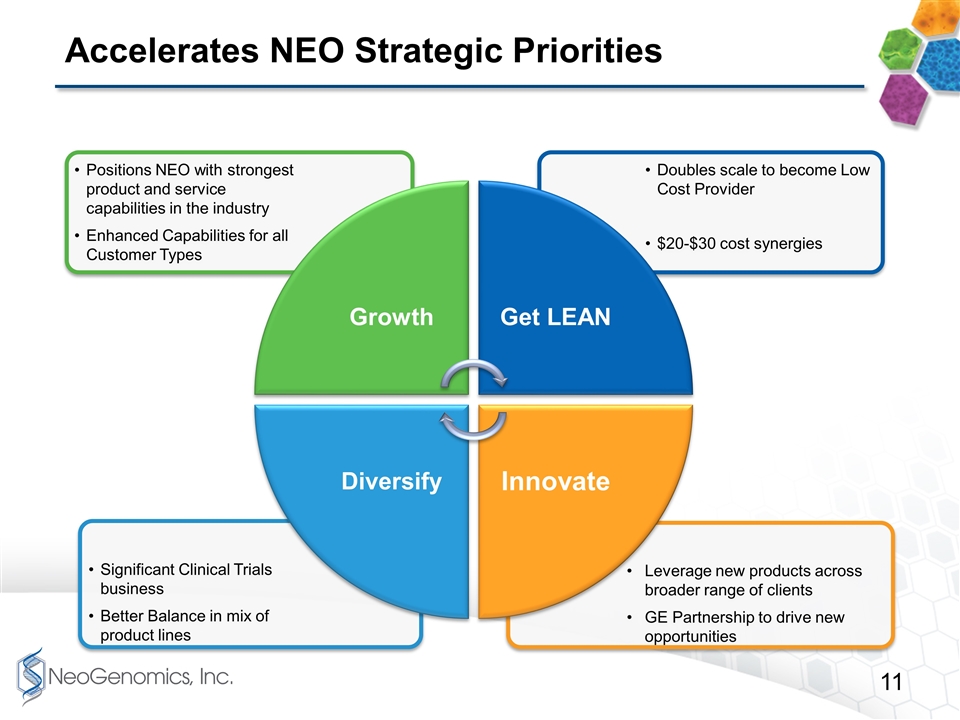

Accelerates NEO Strategic Priorities Leverage new products across broader range of clients GE Partnership to drive new opportunities Significant Clinical Trials business Better Balance in mix of product lines Doubles scale to become Low Cost Provider $20-$30 cost synergies Positions NEO with strongest product and service capabilities in the industry Enhanced Capabilities for all Customer Types Growth Get LEAN Innovate Diversify

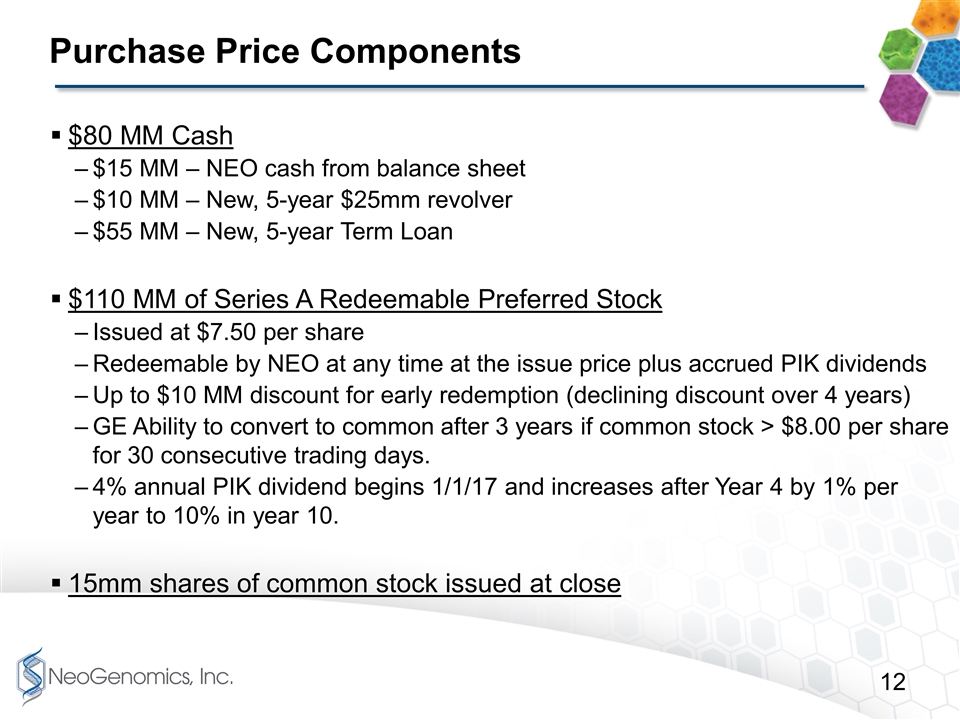

Purchase Price Components $80 MM Cash $15 MM – NEO cash from balance sheet $10 MM – New, 5-year $25mm revolver $55 MM – New, 5-year Term Loan $110 MM of Series A Redeemable Preferred Stock Issued at $7.50 per share Redeemable by NEO at any time at the issue price plus accrued PIK dividends Up to $10 MM discount for early redemption (declining discount over 4 years) GE Ability to convert to common after 3 years if common stock > $8.00 per share for 30 consecutive trading days. 4% annual PIK dividend begins 1/1/17 and increases after Year 4 by 1% per year to 10% in year 10. 15mm shares of common stock issued at close

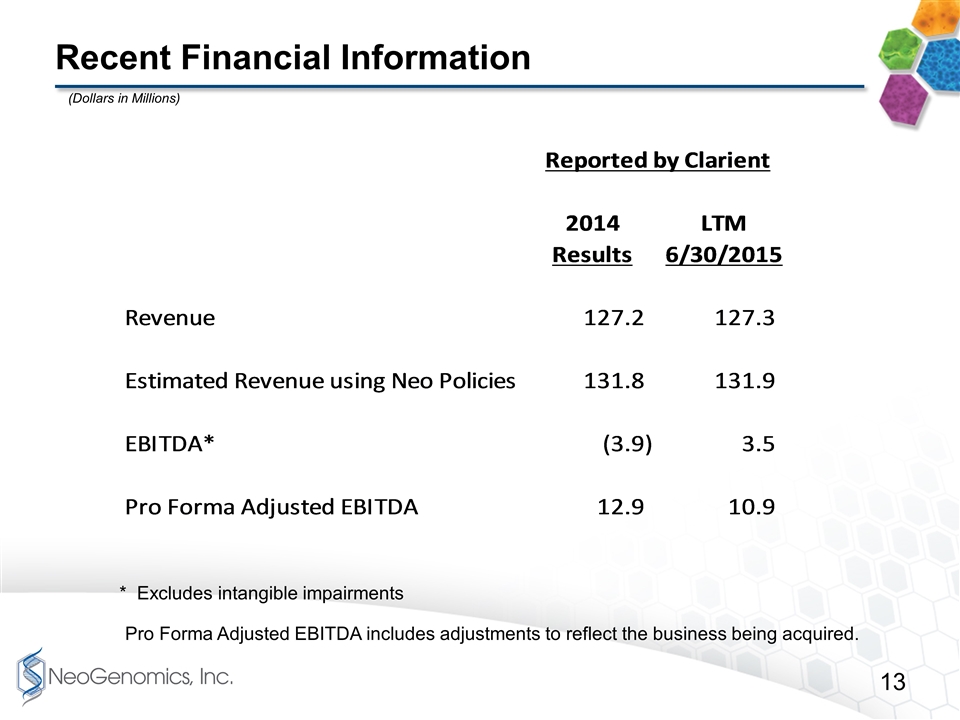

Recent Financial Information * Excludes intangible impairments Pro Forma Adjusted EBITDA includes adjustments to reflect the business being acquired. (Dollars in Millions)

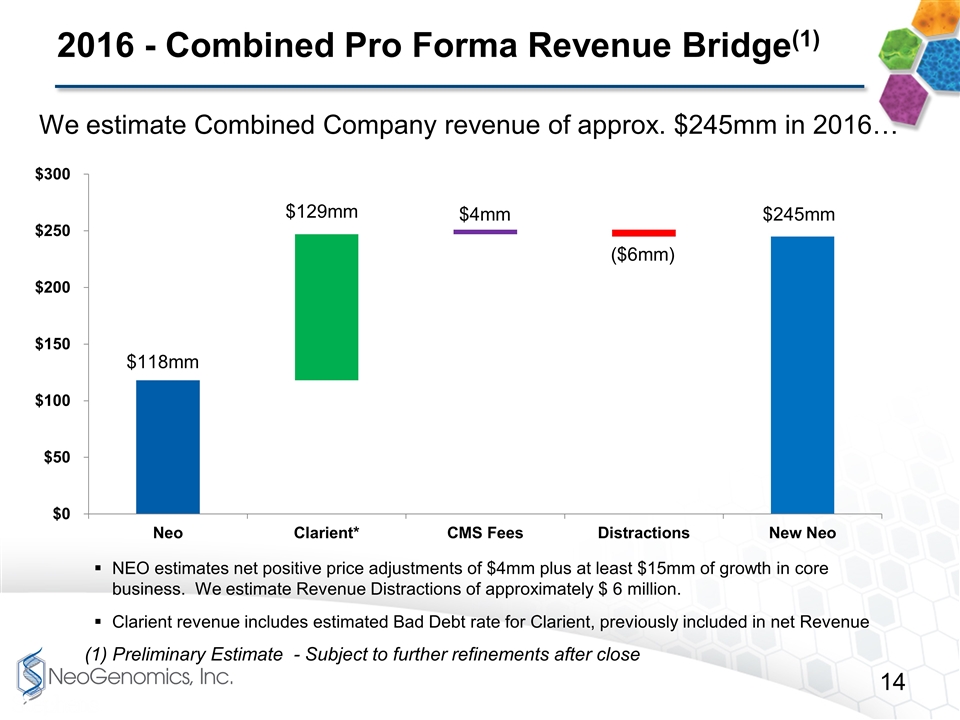

2016 - Combined Pro Forma Revenue Bridge(1) (1) Preliminary Estimate - Subject to further refinements after close We estimate Combined Company revenue of approx. $245mm in 2016… NEO estimates net positive price adjustments of $4mm plus at least $15mm of growth in core business. We estimate Revenue Distractions of approximately $ 6 million. Clarient revenue includes estimated Bad Debt rate for Clarient, previously included in net Revenue $4mm $245mm

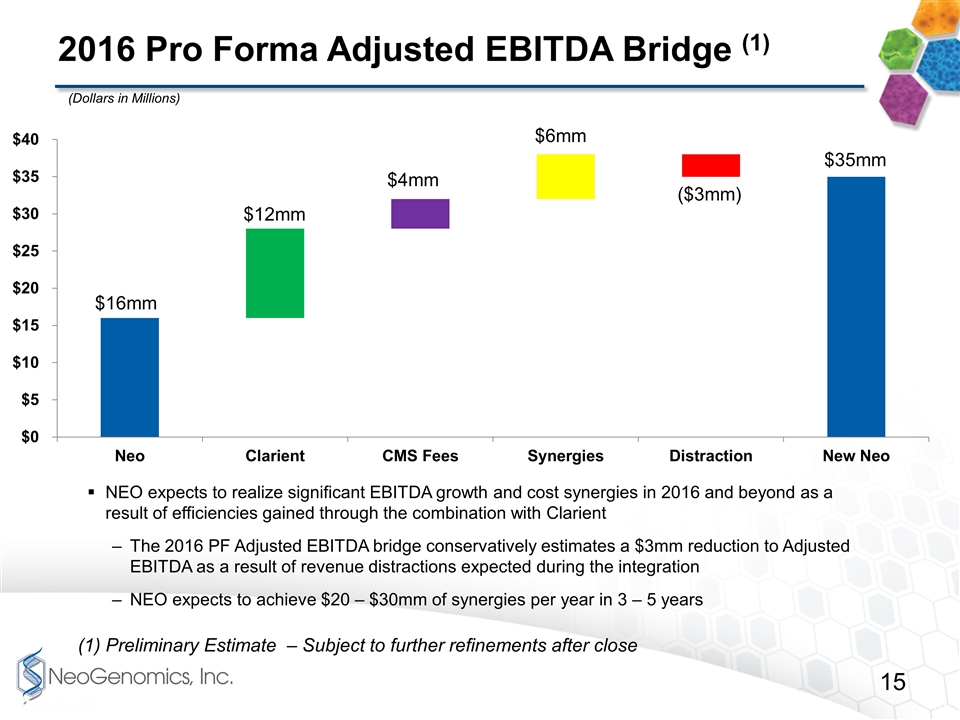

2016 Pro Forma Adjusted EBITDA Bridge (1) NEO expects to realize significant EBITDA growth and cost synergies in 2016 and beyond as a result of efficiencies gained through the combination with Clarient The 2016 PF Adjusted EBITDA bridge conservatively estimates a $3mm reduction to Adjusted EBITDA as a result of revenue distractions expected during the integration NEO expects to achieve $20 – $30mm of synergies per year in 3 – 5 years (Dollars in Millions) (1) Preliminary Estimate – Subject to further refinements after close

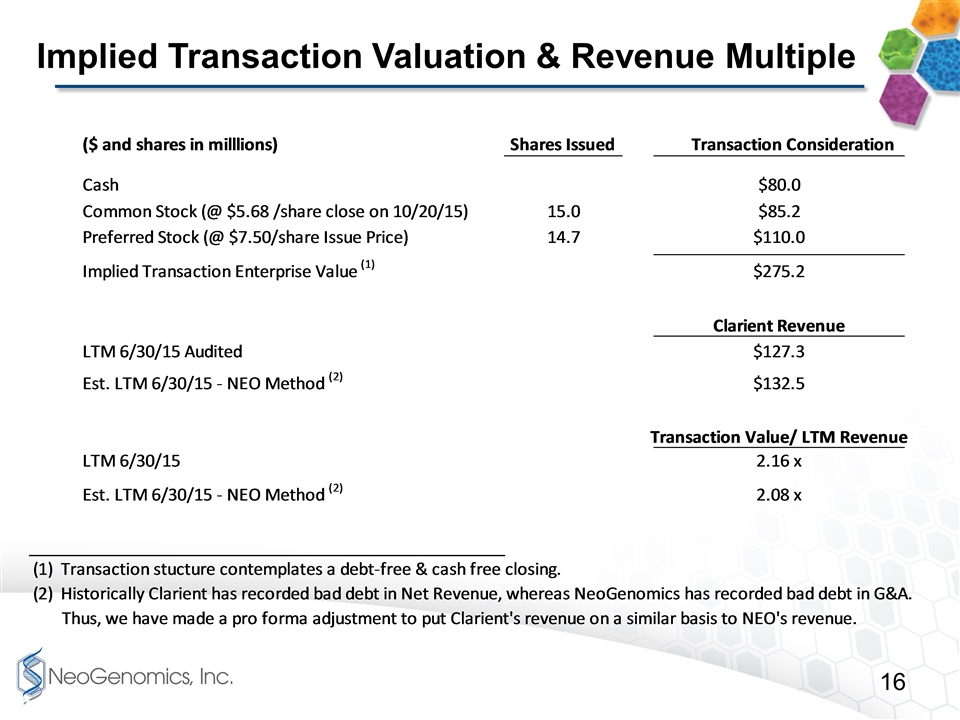

Implied Transaction Valuation & Revenue Multiple

NeoGenomics Emerging Vision and Goals Leadership Goals: Leading specialized, high-growth, high-technology, “precision medicine” testing and information company. Financial Performance Goals: Consistent and sustainable double-digit revenue growth. Clinical Trials > 15% of revenue. Adjusted EBITDA margin of 20-25% of revenue. Competencies: Outstanding Scientific, Medical and Informatics expertise. Wide-ranging health-care system partnerships. Disciplined process management and quality systems. Entrepreneurial, values-driven culture.

Appendix 20 Appendix

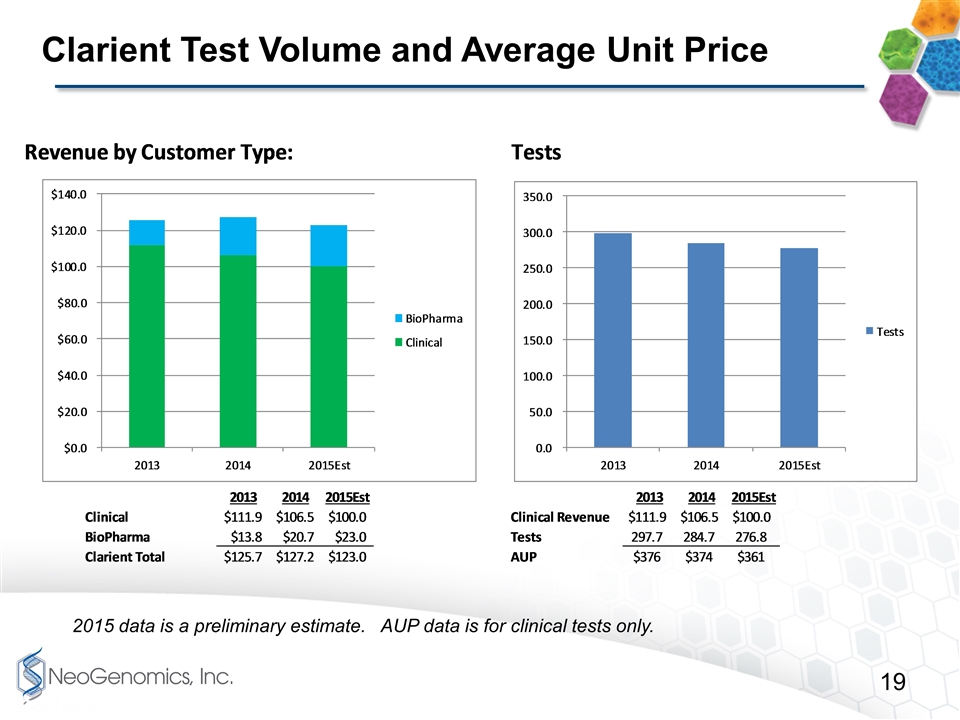

Clarient Test Volume and Average Unit Price 2015 data is a preliminary estimate. AUP data is for clinical tests only.

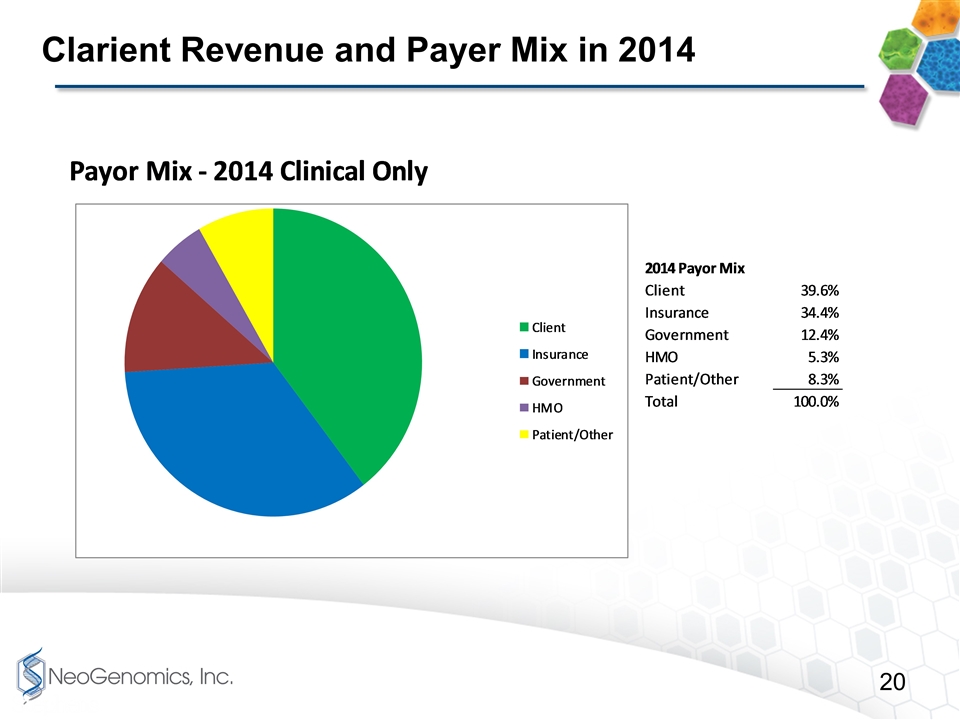

Clarient Revenue and Payer Mix in 2014